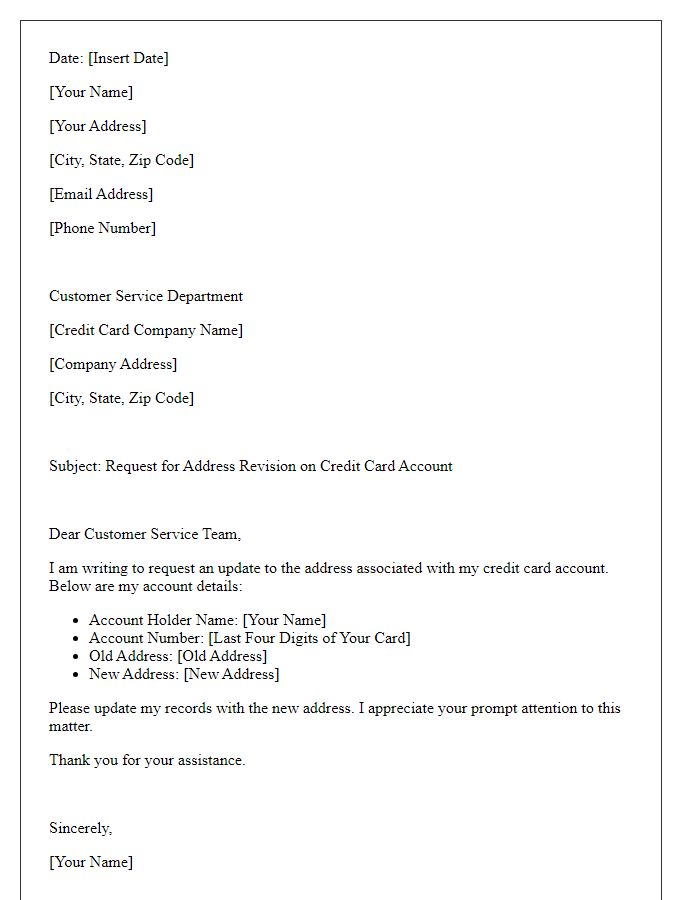

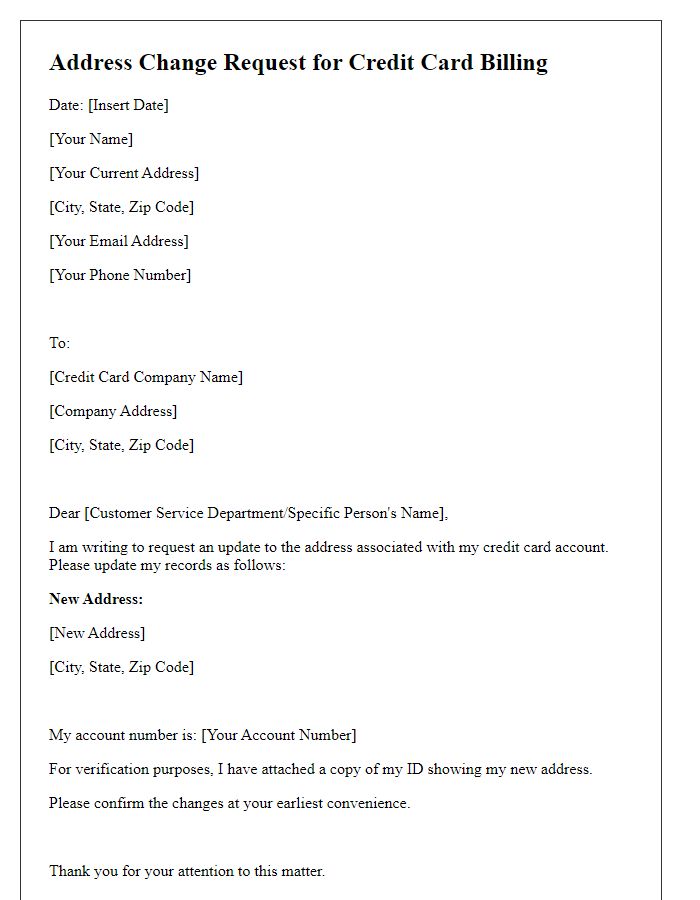

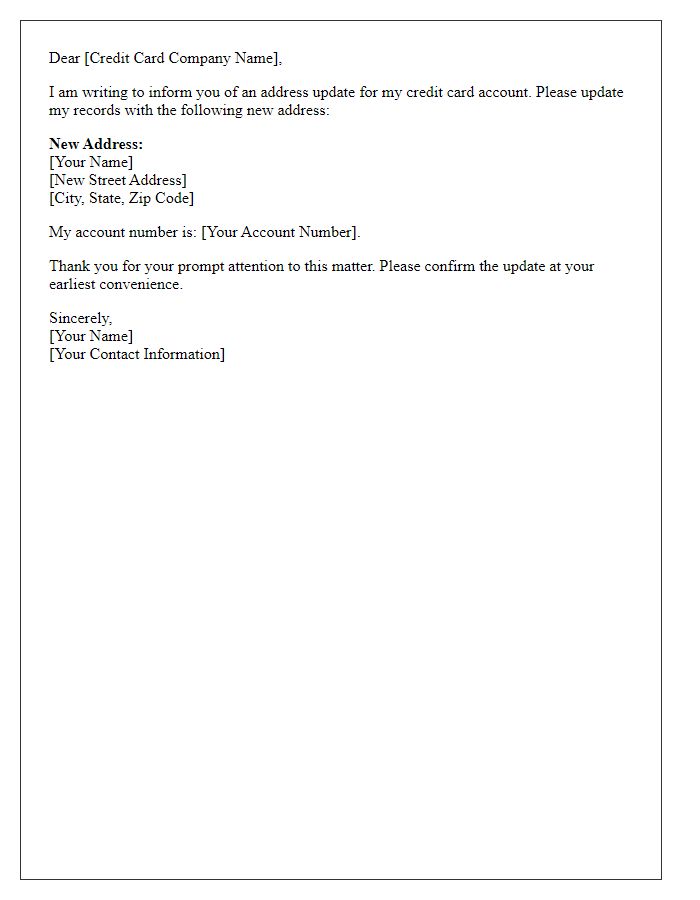

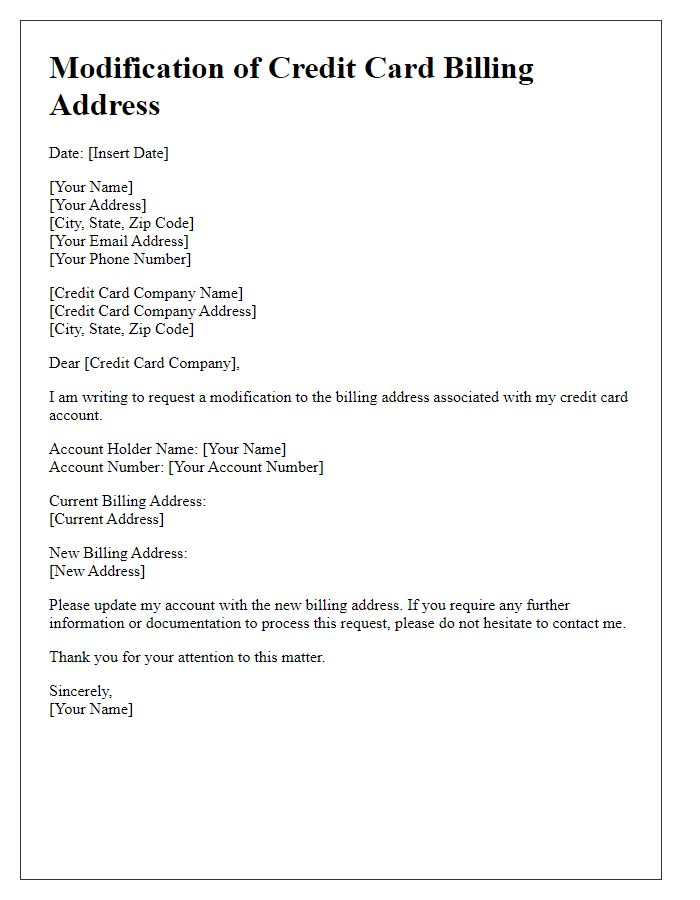

Updating your credit card payment address might seem like a small task, but it's an important one that can make a big difference in keeping your financial information secure. Whether you've moved to a new city or simply need to change your billing address, knowing how to properly communicate this information is essential. In this article, we'll guide you through a simple letter template you can use to ensure your credit card company receives your updated details swiftly and efficiently. So, stay tuned as we dive into the specifics and provide you with all the tips you need to make this process seamless!

Account Number

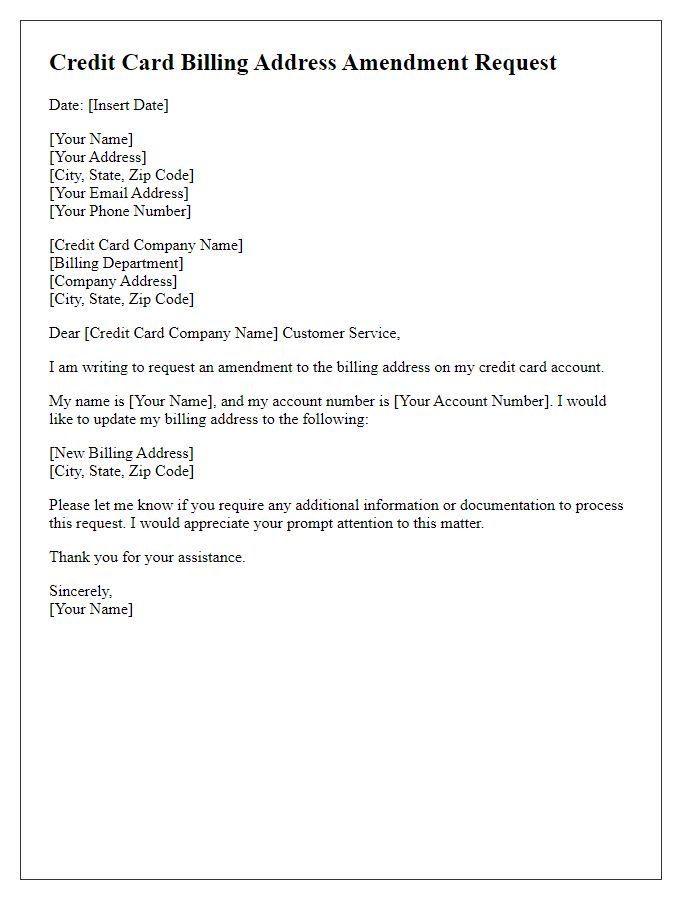

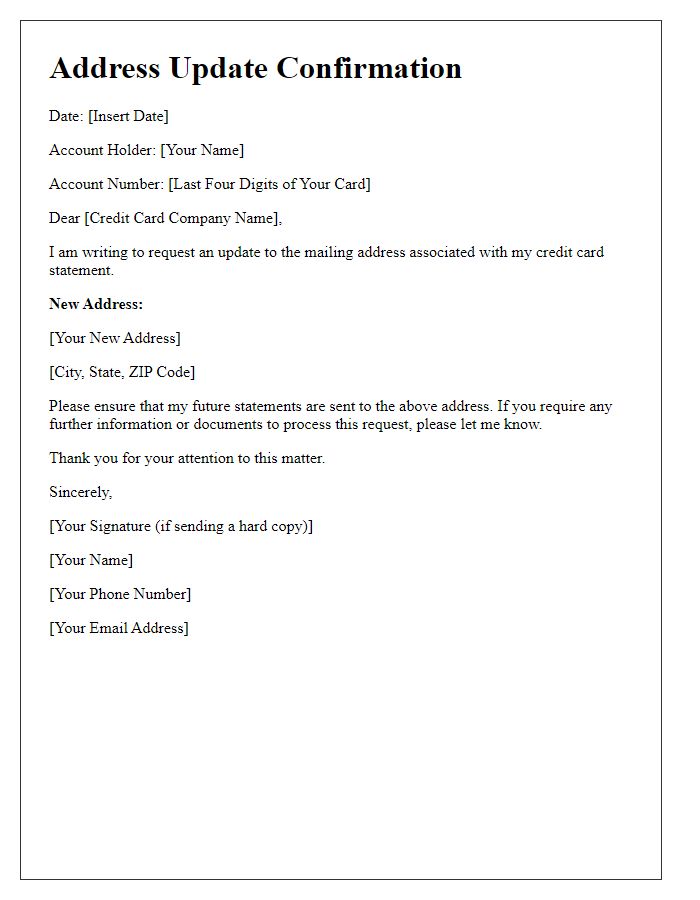

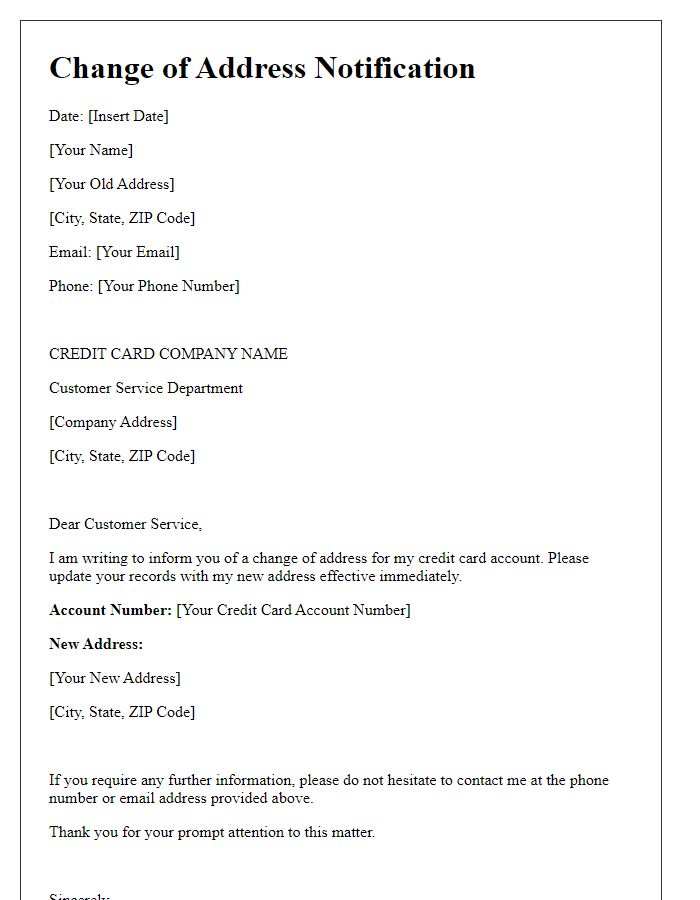

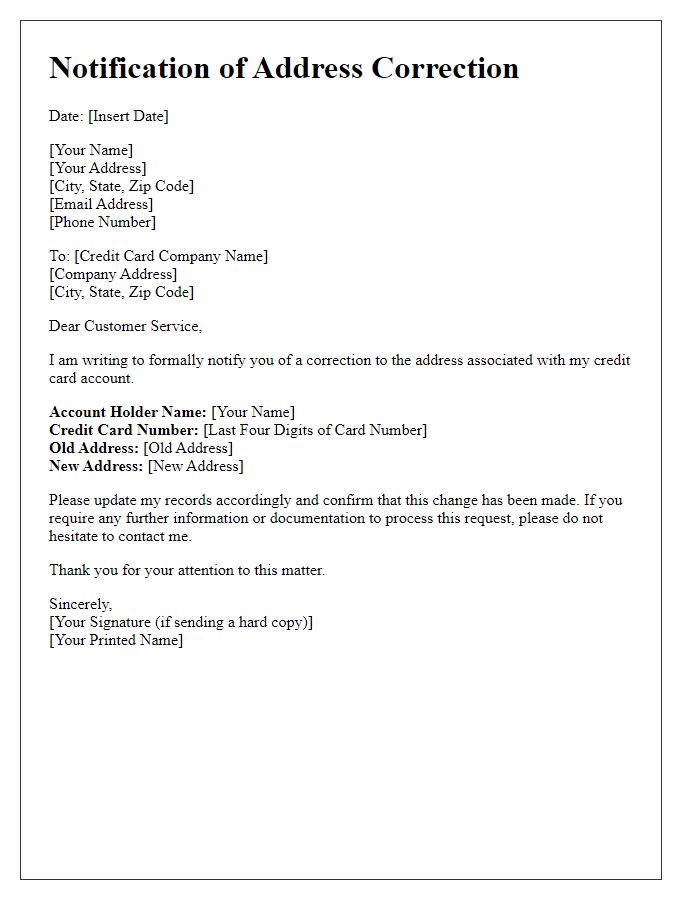

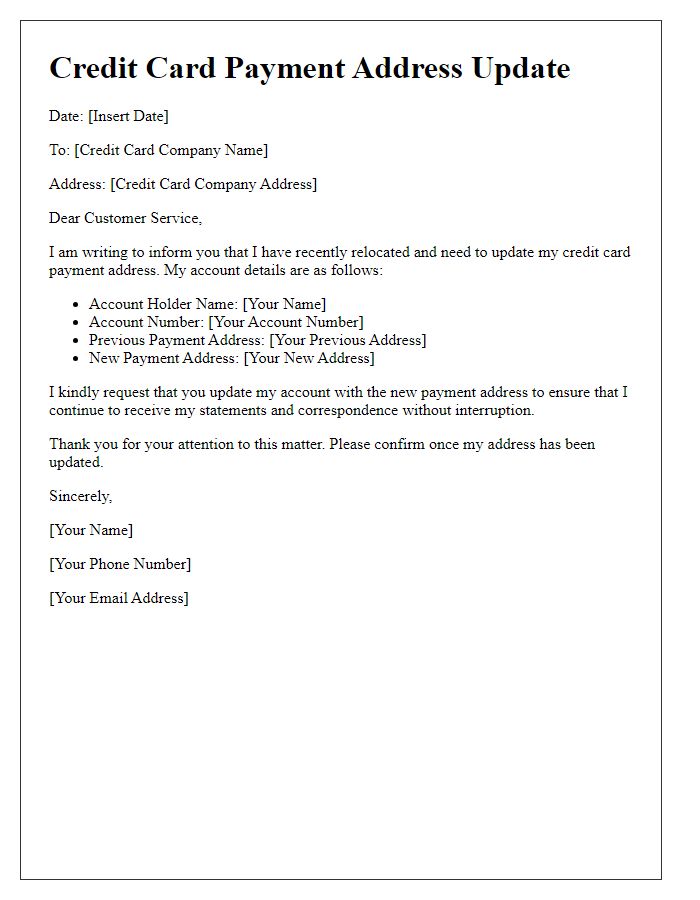

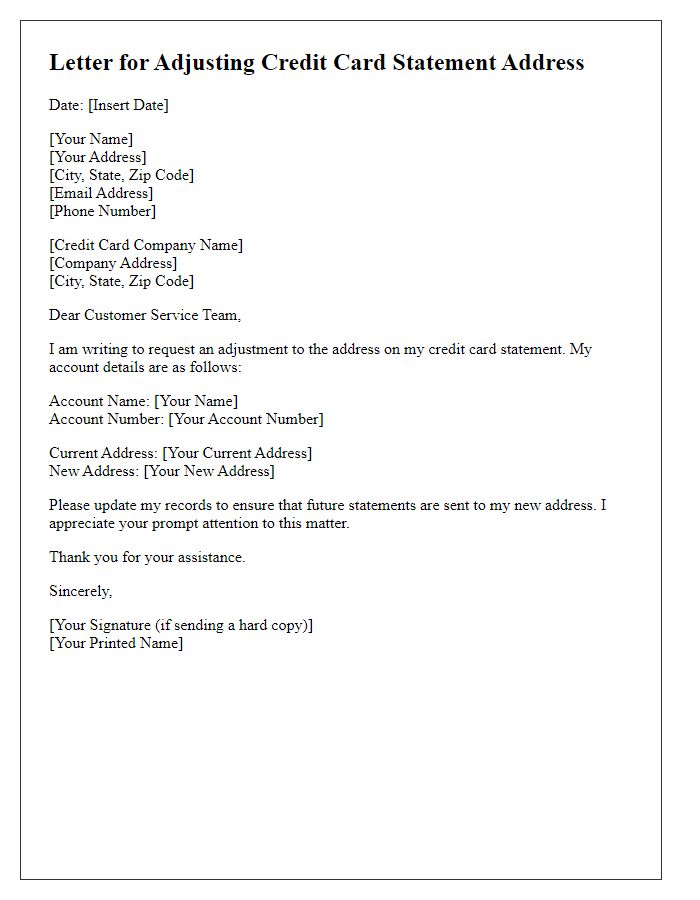

When updating the credit card payment address, ensure to include essential details such as account number (example: 1234-5678-9101-1121), and new or updated address (for instance: 123 Main St, Springfield, IL 62701). Include any reference codes from previous correspondence, any specific request or changes desired, and additional contact information in case further verification is required. Timely submission before the payment due date (often the 15th of each month for many credit cards) can prevent service disruption or late fees.

Current Address

Updating the credit card payment address is crucial for maintaining accurate billing information to prevent service disruptions. This process usually involves submitting an official request to the credit card issuer, such as Visa or Mastercard. The current address, often required for verification, includes essential details like street number, street name, city, state, and zip code, reflecting the accurate location associated with the credit card account. Ensuring that this information matches official documents, like government-issued ID or utility bills, can expedite the address update process. In certain cases, additional information such as contact numbers or previous addresses may also be necessary for identity verification and security purposes.

New Billing Address

Updating billing addresses is essential for maintaining accurate financial records and ensuring timely payments. The billing address, often linked to credit cards issued by financial institutions like Visa or MasterCard, must be current to prevent payment disruptions. Customers may initiate this process due to a change in residence or shifts in financial institutions. This update often requires verification of the new address, which can include recent utility bills or lease agreements. Timely processing can prevent complications during transactions, especially for recurring payments linked to services like subscriptions, insurance, or utility bills. Secure channels should be used to submit such sensitive information to avoid identity theft.

Effective Date

Ensure accuracy when updating the credit card payment address, particularly the associated billing address for the account. The effective date of the address change should always be specified clearly, enabling timely processing of payment transactions. Financial institutions usually process these updates within 1-3 business days, depending on their policies. Always verify the updated address on the next billing statement to confirm successful processing. Additionally, this change may impact any automatic transactions linked to the previous billing address.

Contact Information

Contact information for credit card payment updates must be accurate to ensure proper billing and communication. The cardholder's full name, as registered with the issuer, is essential for identification. The updated mailing address, including street number, street name, city, state, and zip code, provides the necessary location for billing statements and correspondence. A current phone number, preferably a mobile that allows for regular contact, enables the credit card company to reach the holder for verification purposes. An email address, linked to the account, facilitates digital notifications and alerts regarding account activity and payments. All these elements work together to maintain active and secure credit card management.

Comments