Are you feeling a bit overwhelmed by the process of making credit card payments online? You're not aloneânavigating the digital payment landscape can be tricky! But don't worry; we've put together a comprehensive guide that breaks it down into simple steps. Stick around to unlock all the tips and tricks for mastering your online credit card payments!

Clear Payment Instructions

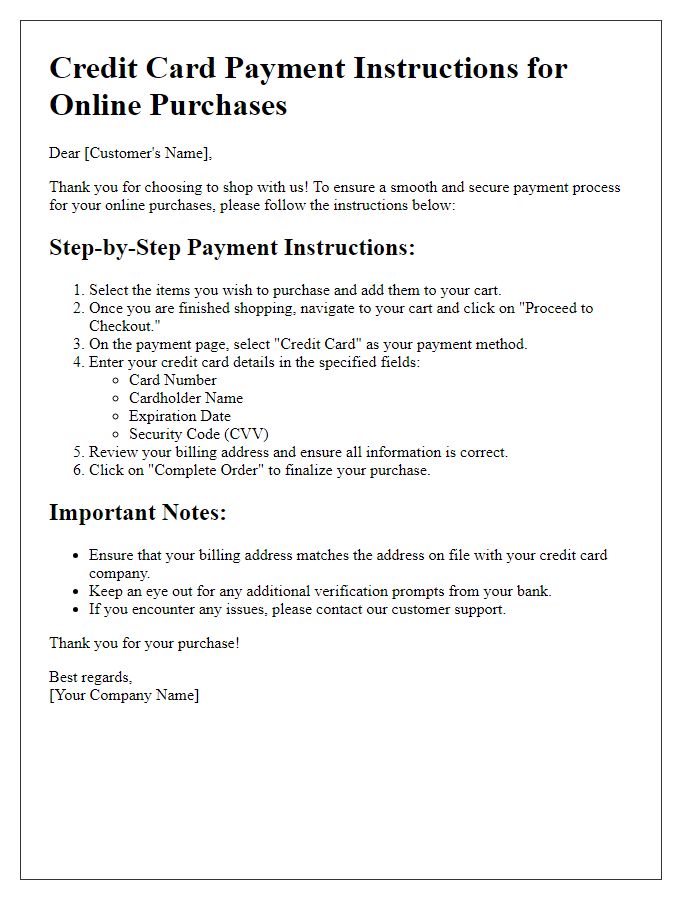

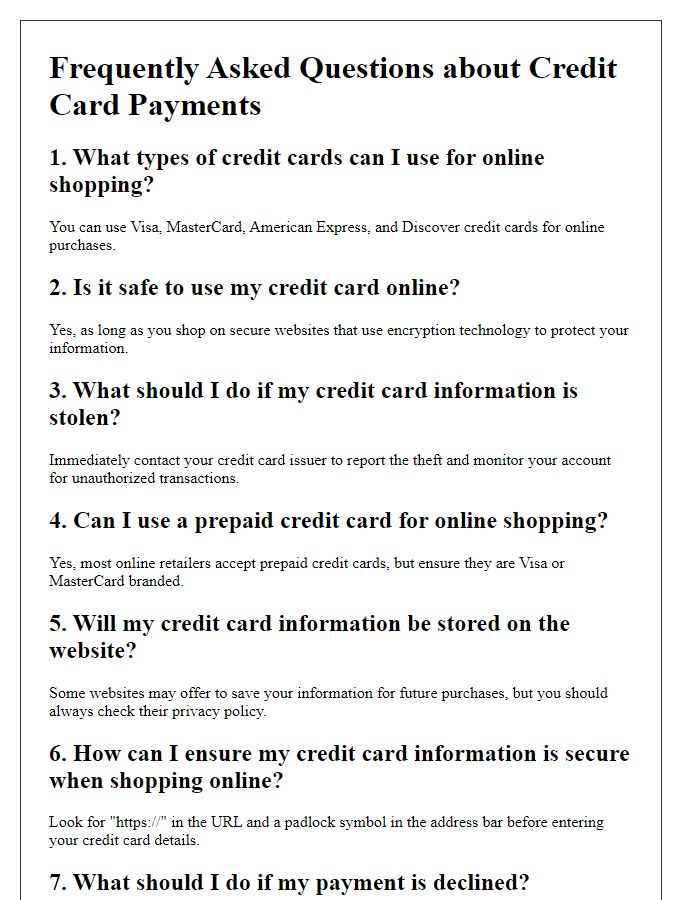

Online credit card payments require precise steps to ensure security and accuracy. Initially, users must access the designated payment portal, commonly found on the merchant's website, such as Amazon or PayPal. Upon clicking the payment option, users are prompted to input card details, including the 16-digit card number, expiration date (valid for two to five years depending on the card issuer), and the CVV (three-digit security code located on the back of the card). The website may also request the billing address associated with the credit card, which helps in verifying the transaction. After entering the information, users press the "Submit" or "Pay Now" button to initiate the transaction. Following submission, a confirmation page with transaction details appears, confirming successful payment or indicating necessary corrections if errors occur. Safeguards, such as SSL encryption, protect sensitive data during this process. Users should always ensure they are on secure websites, indicated by "https://" in the URL, to protect against potential fraud and data breaches.

Secure Payment URL

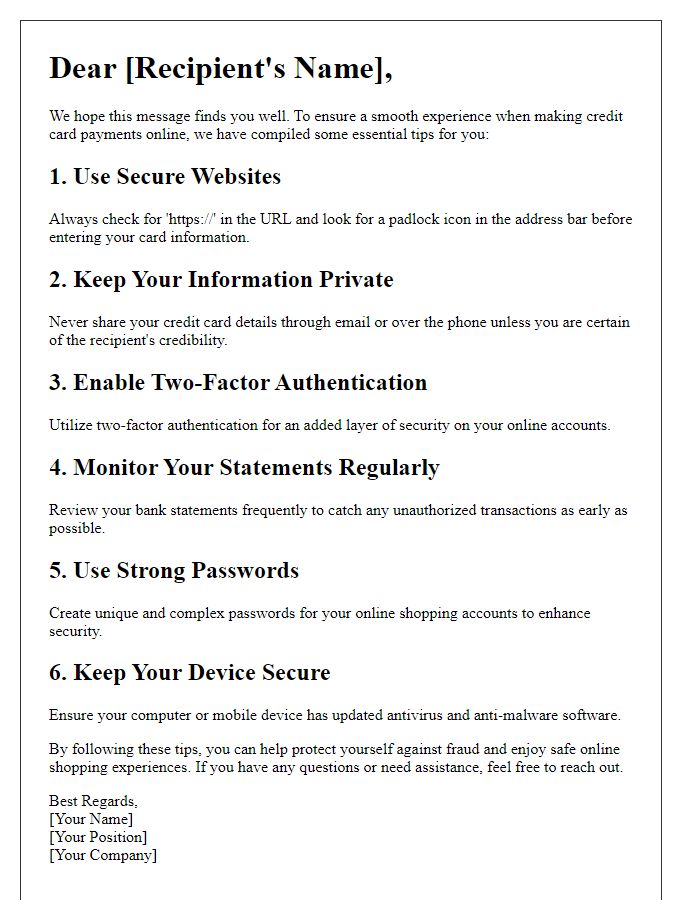

Navigating secure online credit card payments necessitates an understanding of key components such as Secure Payment URLs (Uniform Resource Locators). These encrypted URLs facilitate transactions, ensuring that sensitive information like card numbers, expiration dates, and CVV codes are transmitted safely. Utilizing protocols like HTTPS (Hyper Text Transfer Protocol Secure) reinforces data protection, safeguarding against interception during transfer. Payment gateways like PayPal and Stripe employ these Secure Payment URLs to provide a reliable shopping experience for users while complying with regulations like PCI DSS (Payment Card Industry Data Security Standard). Trusting these systems, customers can confidently complete purchases knowing their financial information remains confidential.

Contact Information for Support

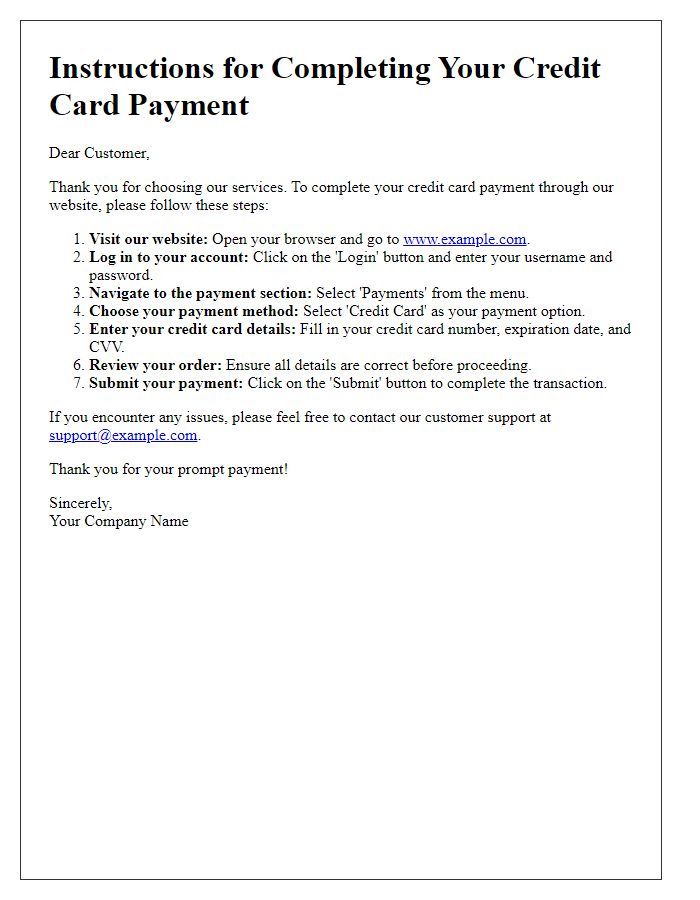

Navigating online credit card payments can sometimes be challenging for users, especially when dealing with platforms like PayPal or Stripe. Users may need to access customer support for issues related to transaction failures or billing discrepancies. Important contact information typically includes dedicated support email addresses, such as support@example.com, and helplines, 1-800-555-0199, which are often available 24/7. In addition, many companies have live chat features through their websites or mobile apps, allowing instant assistance during peak hours, generally from 8 AM to 10 PM EST. Social media channels, including Twitter @CompanySupport, may also provide quick responses to inquiries or concerns regarding online payment processes.

Privacy and Security Assurance

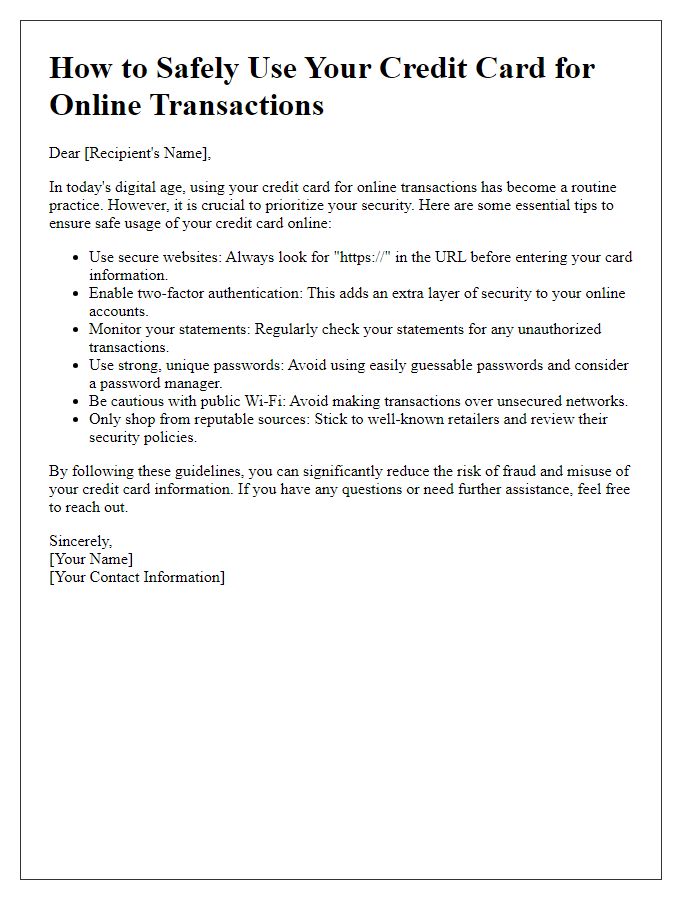

Ensuring privacy and security during online credit card transactions is paramount for users. Various encryption technologies, such as Secure Socket Layer (SSL), safeguard sensitive information, making it nearly impossible for unauthorized parties to intercept data. Compliance with Payment Card Industry Data Security Standards (PCI DSS) further reinforces safety, mandating rigorous security measures for merchants processing payment card transactions. Additionally, multi-factor authentication (MFA) enhances account protection, requiring users to verify their identity through multiple steps. Users should monitor bank statements regularly for any unauthorized charges, emphasizing proactive vigilance in safeguarding personal financial data. Utilizing virtual credit card numbers offers an added layer of security, limiting exposure of actual card details during online purchases.

Payment Confirmation Details

Payment confirmation serves as a crucial element in the online transaction process, especially for credit card users. Upon completion of an online purchase, such as an electronic device from a major retailer like Amazon or eBay, the payment confirmation page details essential information including transaction ID (usually a unique 10-20 digit code), date of payment, and total amount charged. Additionally, it often specifies the billing address associated with the credit card, ensuring accuracy and security. Users typically receive an email confirmation, providing a digital record of the transaction for future reference. This document is invaluable for tracking expenses, managing budgets, and addressing any disputes that may arise regarding the payment.

Letter Template For Credit Card Online Payment Guide Samples

Letter template of credit card payment instructions for online purchases.

Letter template of directions for completing credit card payments via the website.

Letter template of how to safely use your credit card for online transactions.

Comments