Are you curious about how to maximize your credit card loyalty points? Understanding your rewards can make a significant difference in your spending habits and savings. In this article, we'll break down the essentials of tracking your points, redeeming them wisely, and unlocking exclusive benefits that come with your credit card. Join us as we explore the fascinating world of loyalty points and learn how to make the most of them!

Personalized Greeting

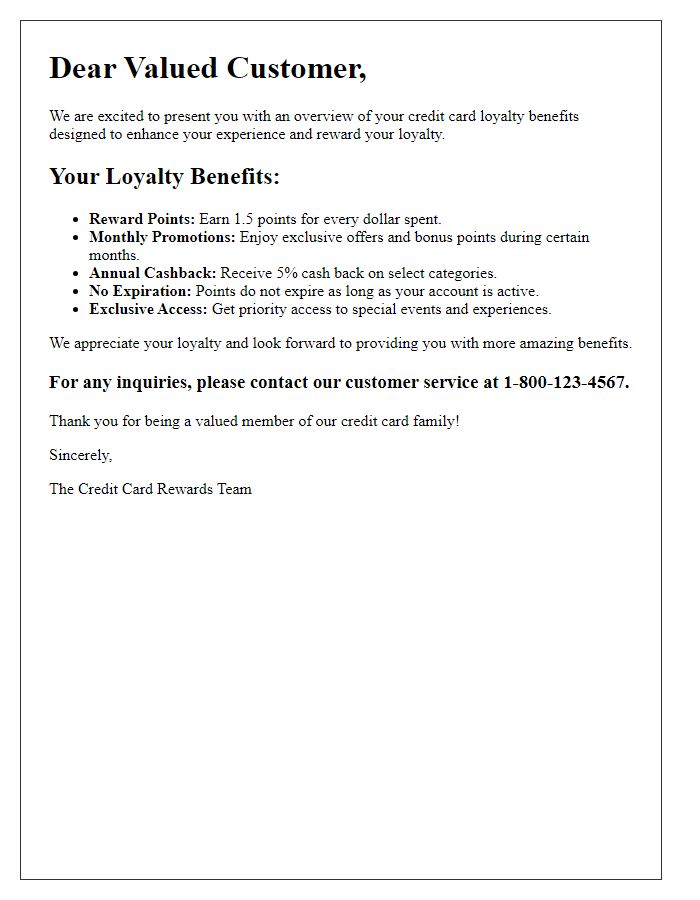

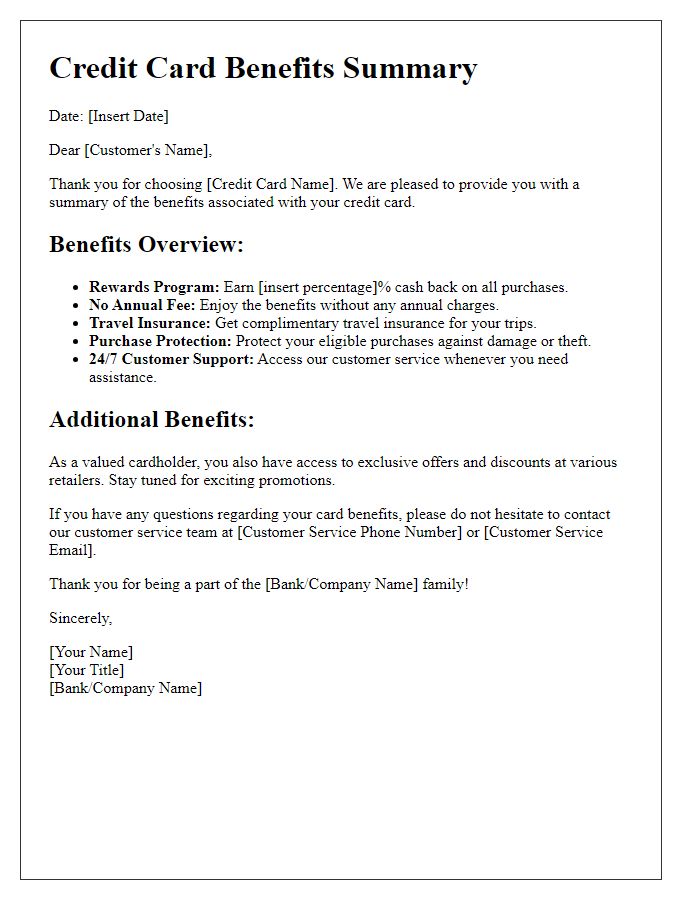

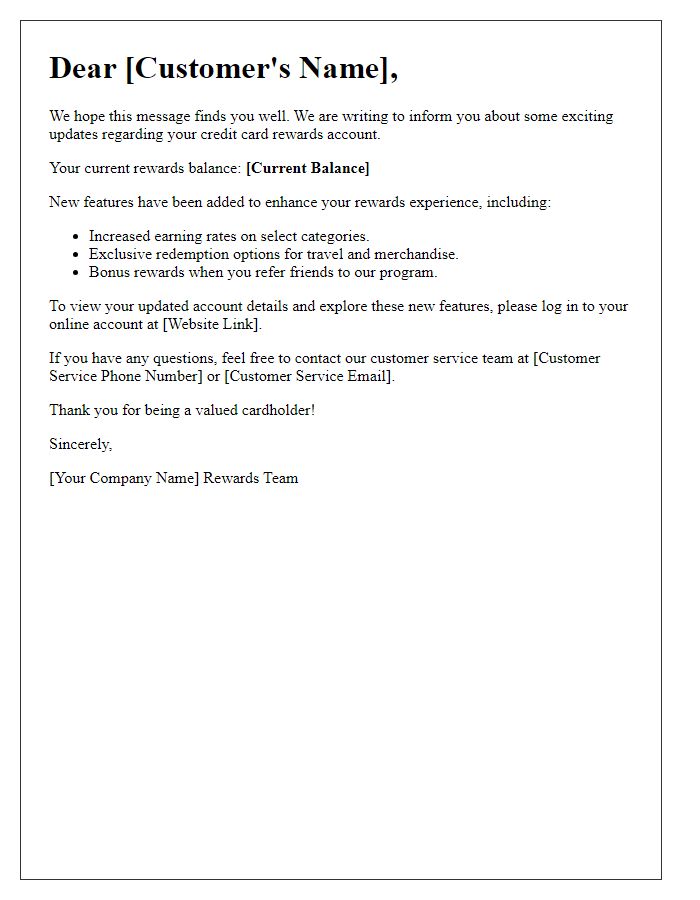

Credit card loyalty programs offer customers various incentives for their spending habits. Rewards points accumulate based on purchases made with cards such as Visa, MasterCard, or American Express. Specific programs may provide bonus points for categories including dining, travel, or online shopping. For example, a card may offer 3 points per dollar on dining and 2 points on travel purchases, greatly enhancing users' ability to redeem points for future rewards. Tracking these points through monthly statements or dedicated apps allows users to maximize benefits accrued. Redemption options may vary, including gift cards, cash back, or travel deals, making the loyalty program appealing to diverse spending patterns.

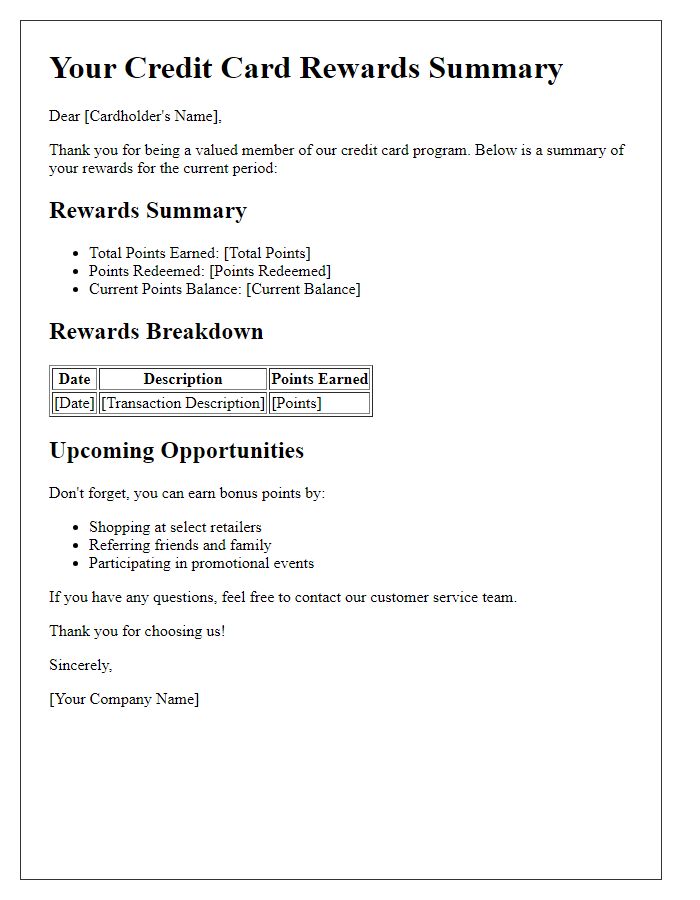

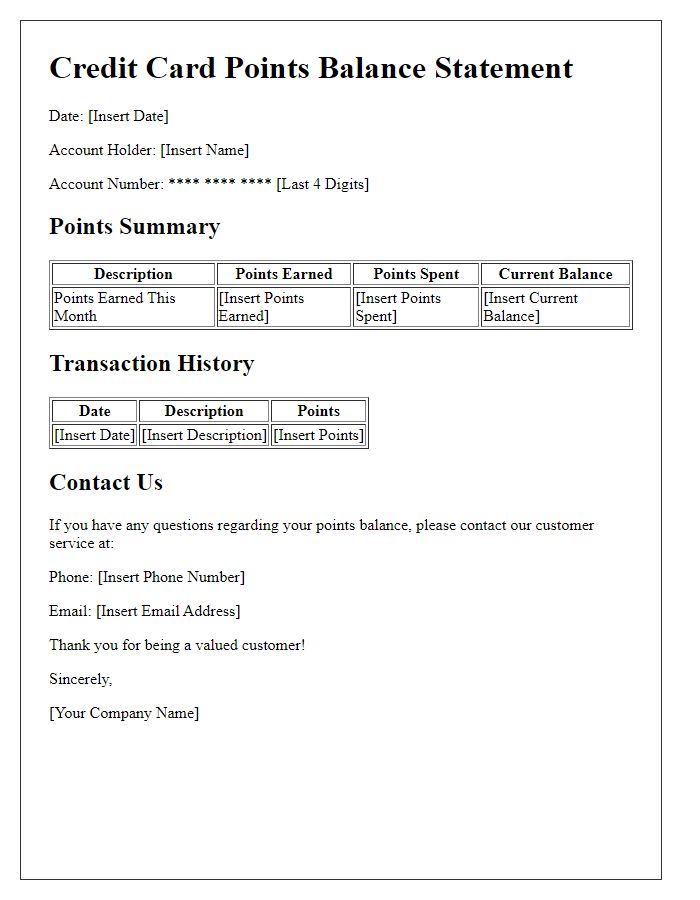

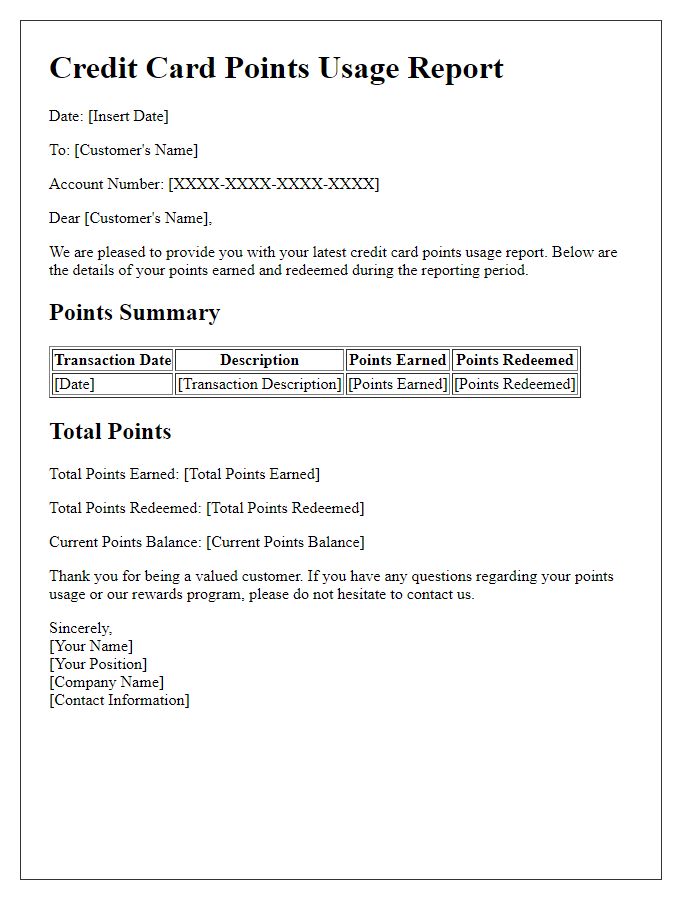

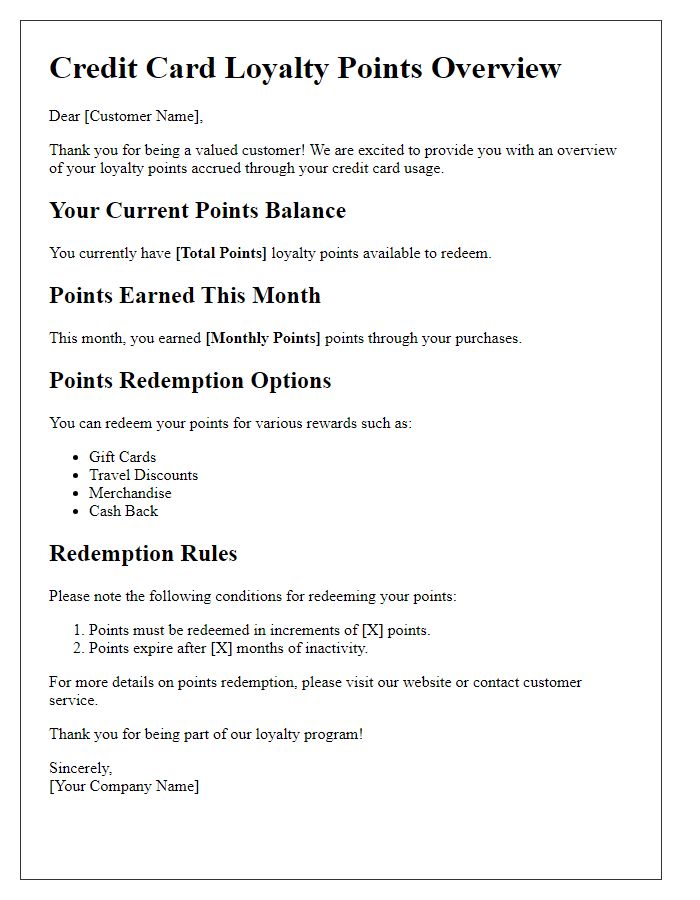

Points Earned Overview

Credit card loyalty programs often reward users with points for purchases, enhancing customer engagement and encouraging spending. Each transaction contributes to a total points accumulation, often categorized by various spending types, such as dining, travel, or groceries, each offering different earning rates. For example, cards like the Chase Sapphire Preferred may provide 2 points per dollar on travel-related expenses, whereas everyday purchases might yield 1 point. Users can redeem these points for exclusive rewards, including travel vouchers, merchandise, or cash back, thereby maximizing their financial benefits. Annual statements provide a comprehensive summary of earned points, making it easier for customers to track their rewards progression and plan future spending strategically.

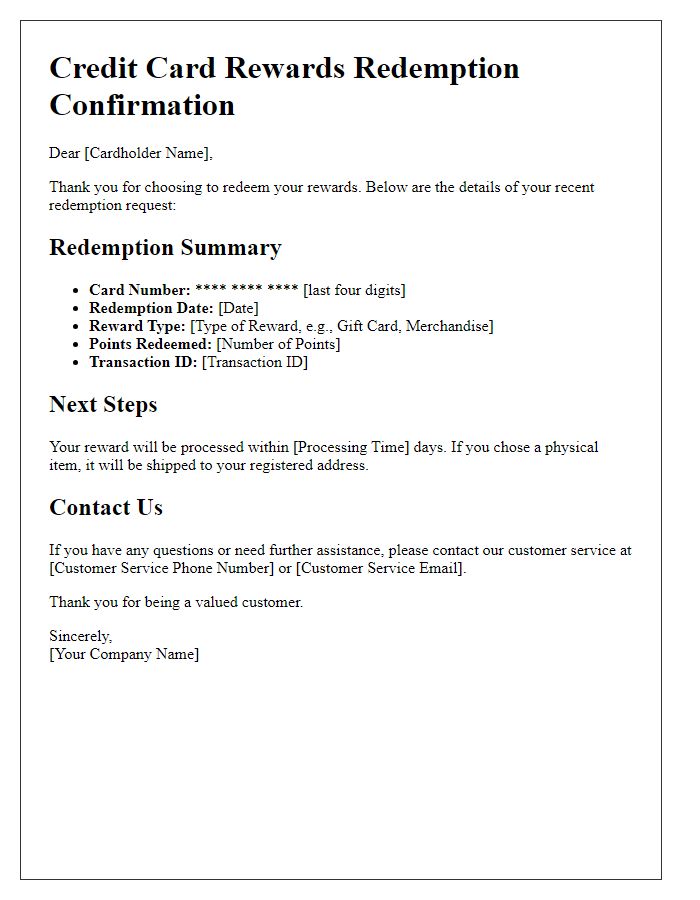

Redemption Options

Loyalty programs associated with credit cards offer various redemption options to enhance customer engagement and reward loyalty. Popular redemption avenues include travel rewards, such as flights and hotel stays, often facilitated through partnerships with airlines like Delta Air Lines and hotel chains like Marriott International. Customers can also redeem points for merchandise, offering items ranging from electronics to lifestyle products, accessible through retail collaborations with companies like Amazon. Additionally, cash back rewards provide financial flexibility, usually applied as statement credits or direct deposits. Exclusive experiences, including concert tickets or dining events, represent another appealing option for discerning members, allowing them unique access to high-demand offerings. This variety ensures that cardholders find meaningful ways to utilize their accumulated points, creating a fulfilling loyalty experience.

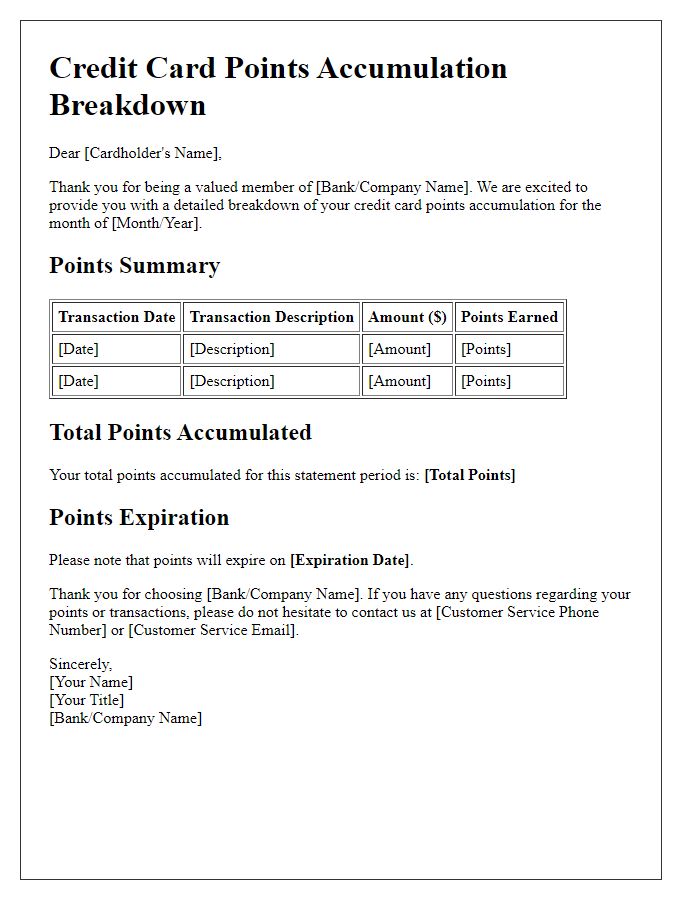

Expiration Date Information

Credit card loyalty points serve as a valuable incentive for consumers, rewarding them for their spending habits. Various financial institutions, such as Chase and American Express, have their own systems in place for managing these points. Typically, loyalty points can expire if there is no qualifying activity within a certain timeframe, often ranging from 12 to 24 months. For example, points accrued during travel bookings or grocery purchases may remain valid as long as there is sustained customer engagement. The expiration dates often differ based on promotional periods or changes in program terms, making it essential for cardholders to regularly check their accounts for relevant announcements and updates. Maintaining awareness of these expiration timelines can help consumers maximize their rewards and avoid the disappointment of losing accumulated benefits.

Contact & Customer Service Information

Credit card loyalty program summaries often include essential contact and customer service information for cardholders. The summary typically lists the loyalty program name, such as Rewards Plus, alongside the total points earned to date, which may exceed 5,000 points. Additionally, it may provide a dedicated customer service number, like 1-800-555-0199, operational 24/7. Email support is also available at support@rewardspoints.com, with a response time of 48 hours. Furthermore, details about redeeming points for travel, merchandise, or cash back can be included, along with popular partner brands like Amazon and Delta Airlines. Lastly, links to the loyalty program's website offer cardholders easy access to check their points balance and explore redemption options.

Comments