Are you feeling a bit puzzled about the recent updates to your credit card terms and conditions? You're not alone! Many cardholders are navigating through the changes, and it's essential to understand how they might affect your spending power and benefits. So, grab a cup of coffee and let's dive deeper into what these updates really mean for youâkeep reading to learn more!

Compliance with Legal Regulations

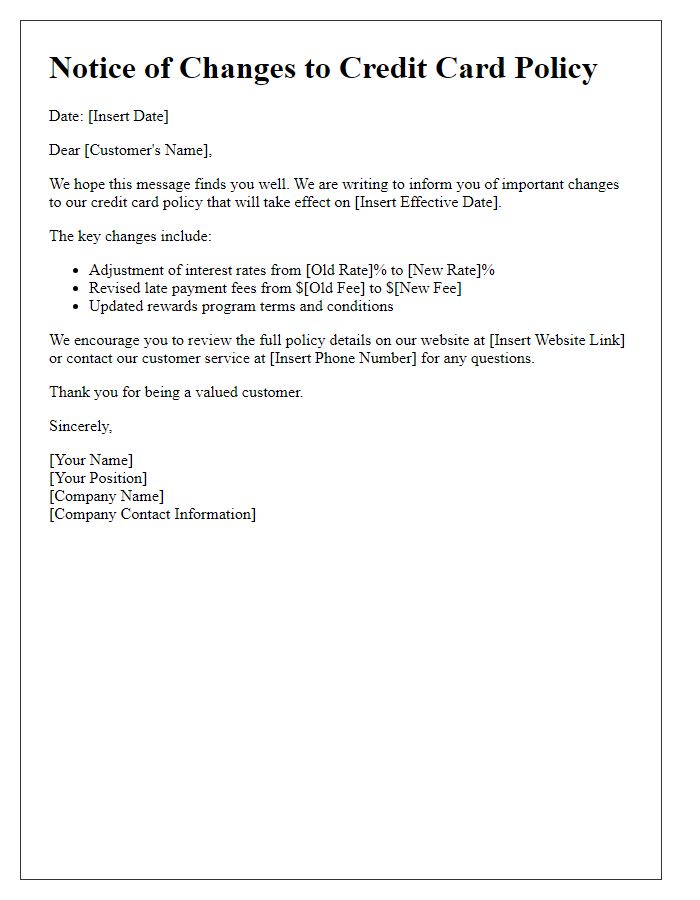

Credit card companies often update their terms and conditions to ensure compliance with evolving legal regulations. These updates may include changes to interest rates, fees, and billing practices, reflecting new federal and state laws. For instance, adjustments to the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) may require clearer disclosures regarding rates and fees. Transparency in advertising practices is another key area, necessitating companies to present accurate information about terms to avoid misleading consumers. Additionally, revisions in consumer protection laws may lead to enhanced privacy policies regarding data security and customer information handling. Regular updates help maintain adherence to regulatory standards, enhancing consumer trust and protecting users from potential legal disputes.

Clarity and Transparency

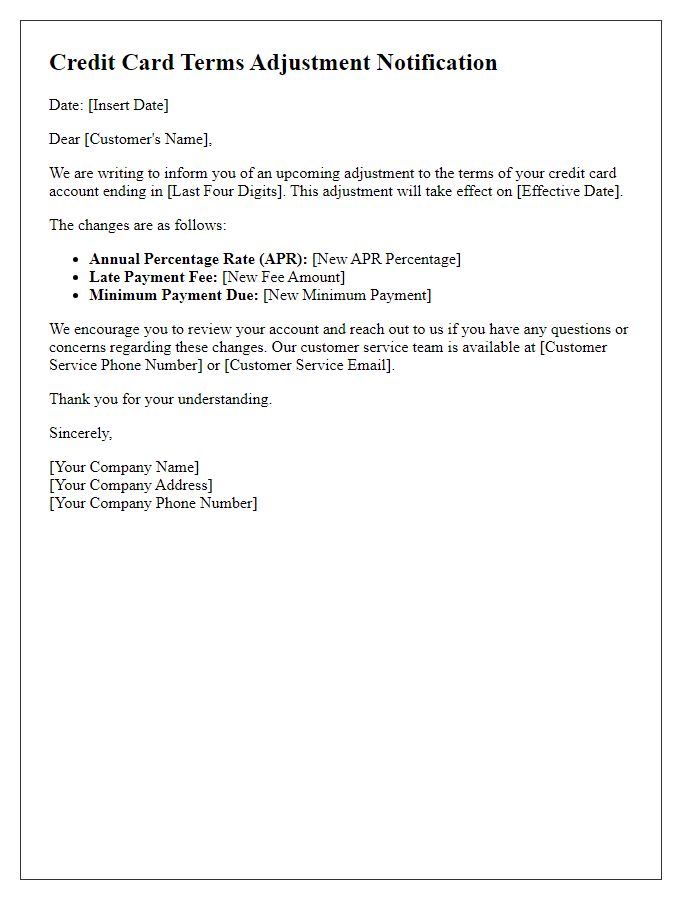

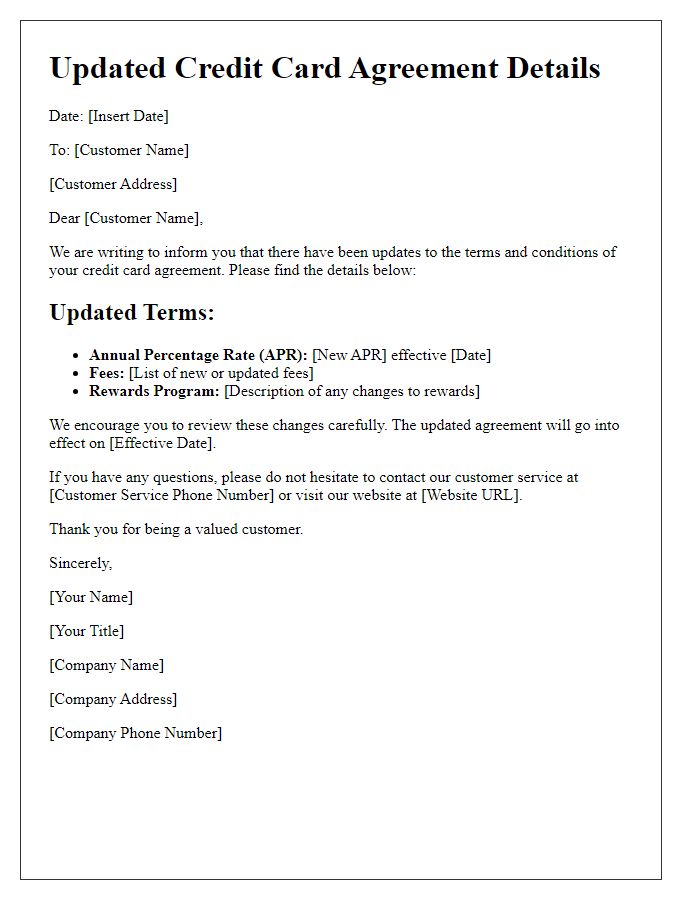

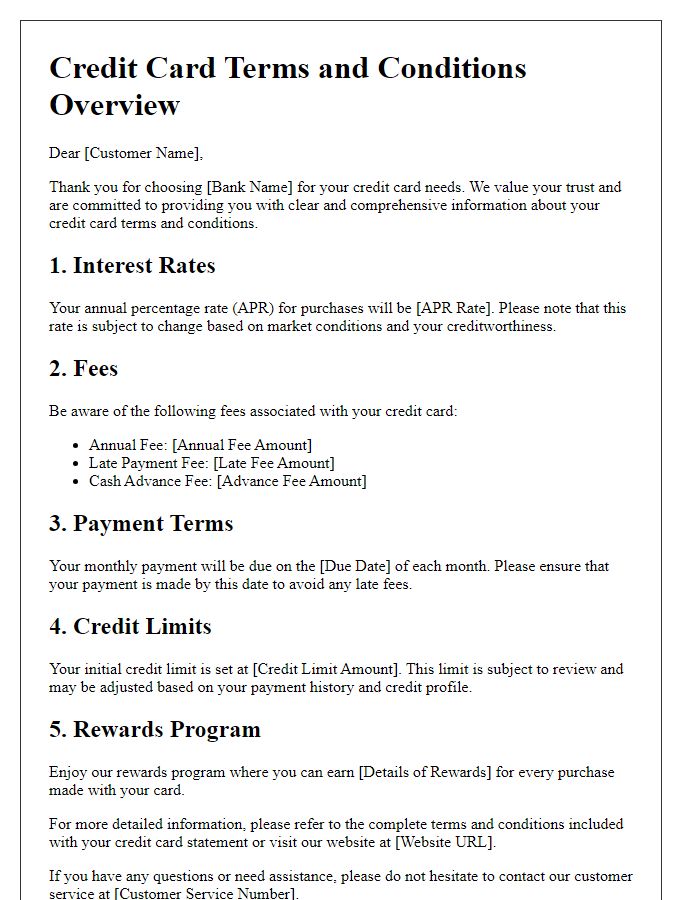

Credit card terms and conditions often undergo periodic updates that enhance clarity and transparency for cardholders. Updated agreements outline key aspects including interest rates (APR) which may vary based on market conditions, late payment fees that can reach up to $39, and the grace period for payments, typically 21-25 days from the statement date. Additionally, changes might include detailed descriptions of reward programs, such as cash back percentages for specific categories like groceries or travel, as well as introductory offers that could include 0% APR for the first 12 months. Providing clear definitions for terms like "minimum payment" and "credit limit" ensures consumers fully understand their obligations. Emphasizing transparency in these documents helps foster trust and facilitates informed financial decisions among cardholders.

Impact on Cardholder Benefits

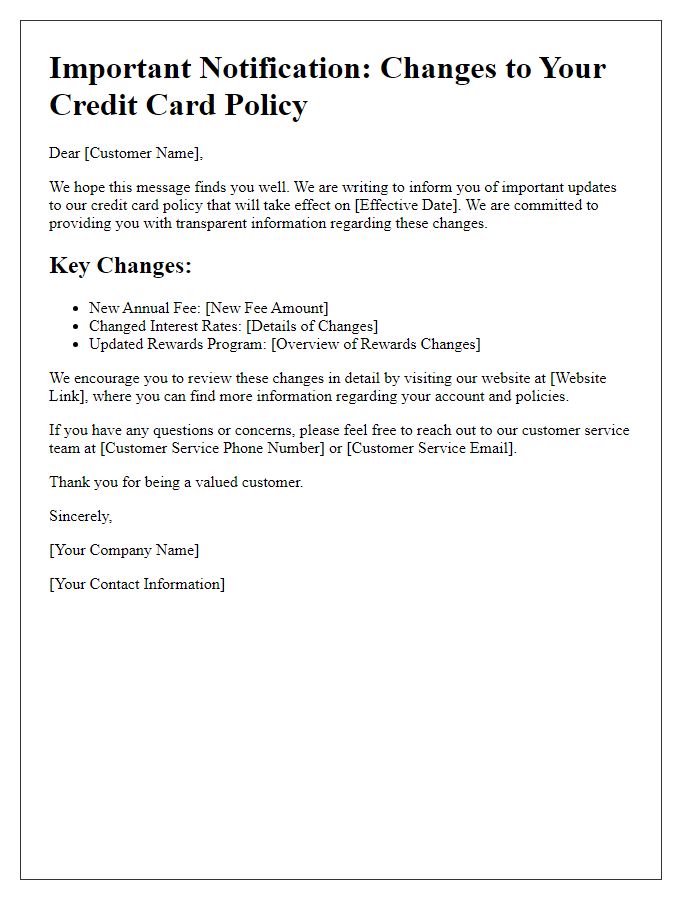

Upcoming updates to credit card terms and conditions may significantly impact cardholder benefits, particularly rewards programs and interest rates. Effective October 15, 2023, cash back on everyday purchases will change from 2% to 1.5%, affecting budget-conscious consumers, especially in retail centers like Shopping Mall A, known for high-frequency spending. Additionally, the annual percentage rate (APR) for late payments may increase from 15% to 18%, influencing cardholders who occasionally miss payment deadlines. Furthermore, travel benefits including rental car insurance and baggage coverage may be restricted, requiring activation through specific travel agencies, potentially affecting plans of frequent travelers using airlines such as Delta and American Airlines. Being aware of these adjustments is essential for maximizing the value of credit card ownership.

Communication Channel Effectiveness

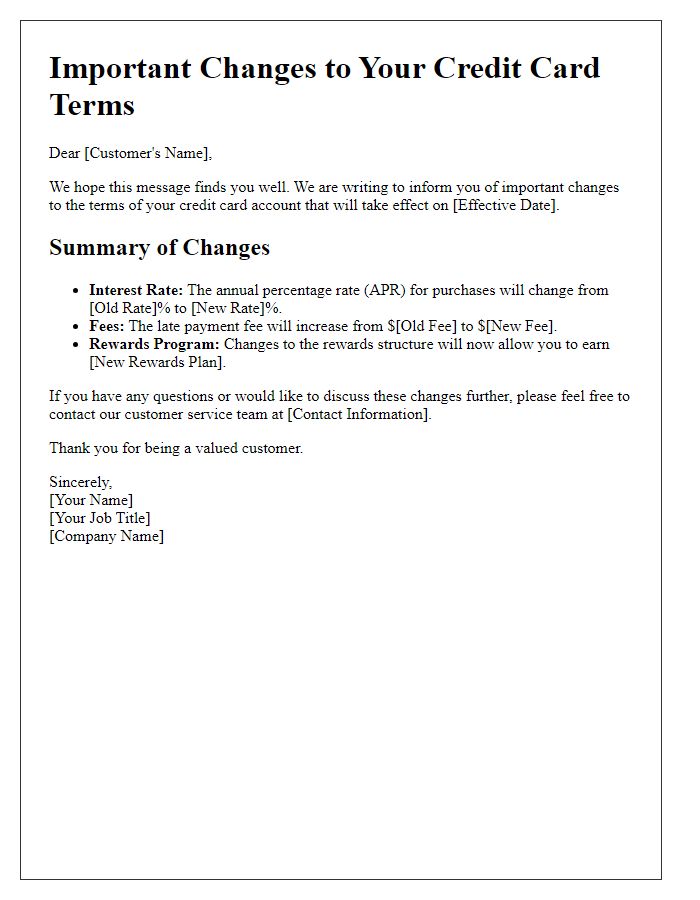

The recent update to credit card terms and conditions highlights significant changes regarding communication channels, ensuring compliance with evolving regulatory standards. Notably, email notifications at least 30 days before any changes, along with secure online portals, enhance customer awareness, promoting transparency. In particular, the inclusion of in-app messaging for mobile banking applications improves user engagement, facilitating real-time updates. Regular mail communications, as a backup option, remain essential for customers without digital access, ensuring inclusivity. The new policy emphasizes timely information dissemination and user-friendly interfaces, catering to the diverse needs of cardholders across various demographics.

Customer Feedback Incorporation

Recent updates to credit card terms and conditions reflect customer feedback, enhancing clarity and usability. Changes include improved language regarding interest rates, now clearly stated in both percentage terms and APR (Annual Percentage Rate), which varies by card type. Additionally, fees related to late payments and foreign transactions have been explicitly outlined, addressing concerns raised during customer surveys. Policies regarding balance transfers have also been refined, providing details on promotional rates and time limits. The objective remains to enhance customer understanding and satisfaction with credit card services, ensuring transparency in financial responsibilities and benefits.

Comments