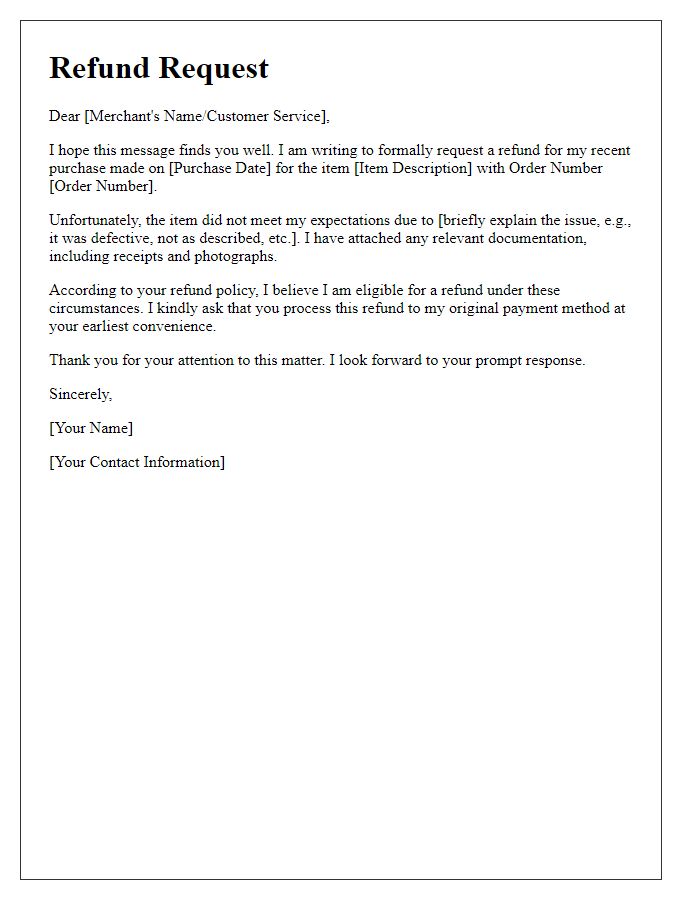

Are you facing the frustration of a credit card dispute and don't know where to start? Writing a clear and effective letter can make all the difference in resolving conflicts with your credit cards. In this article, we'll guide you through the essential components of a successful dispute letter that gets results. So, grab your pen and let's dive into the details that can simplify your credit card resolution process!

Cardholder Information

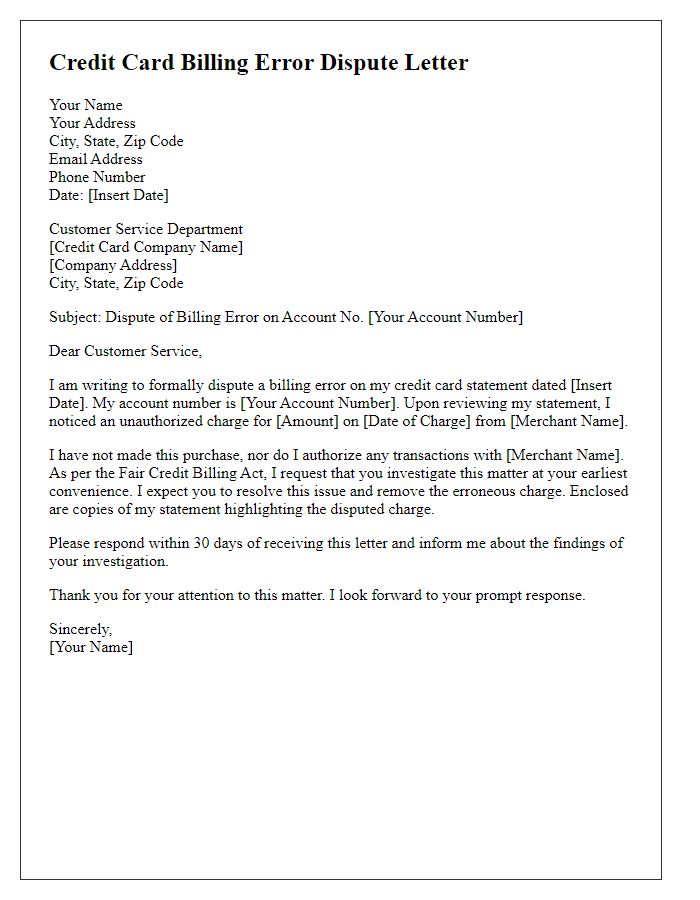

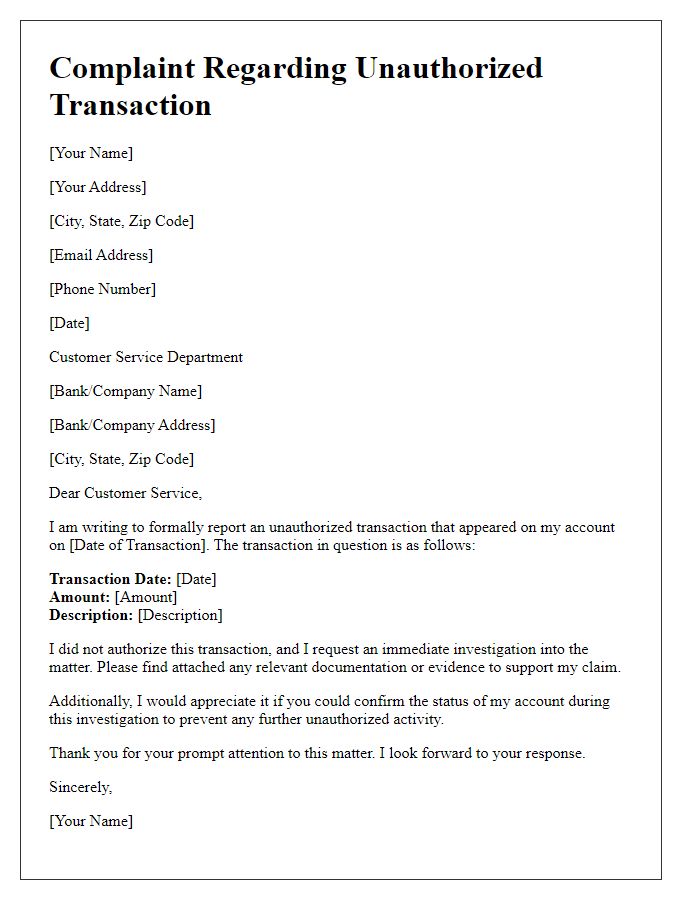

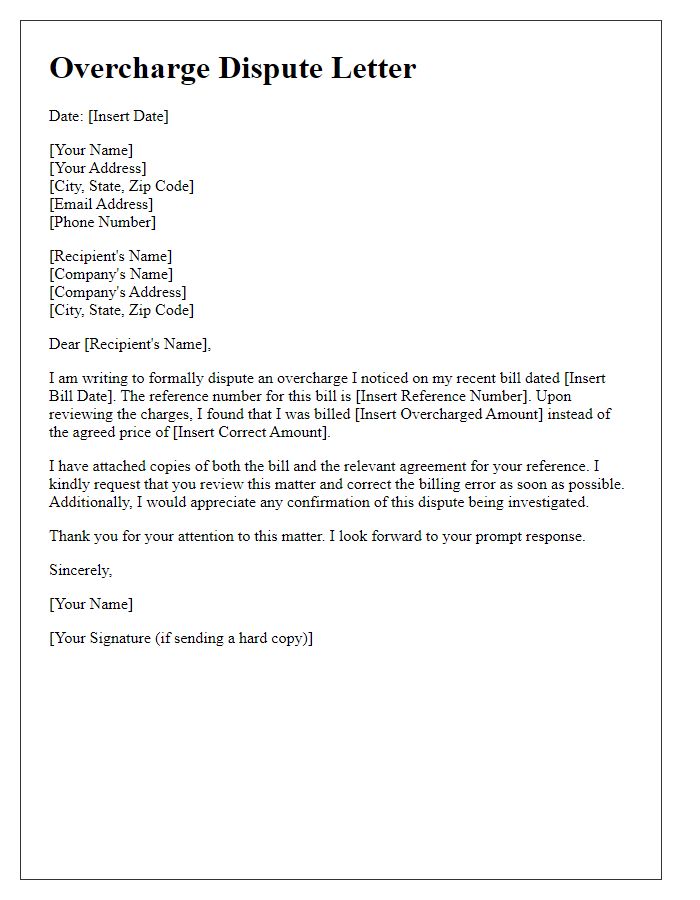

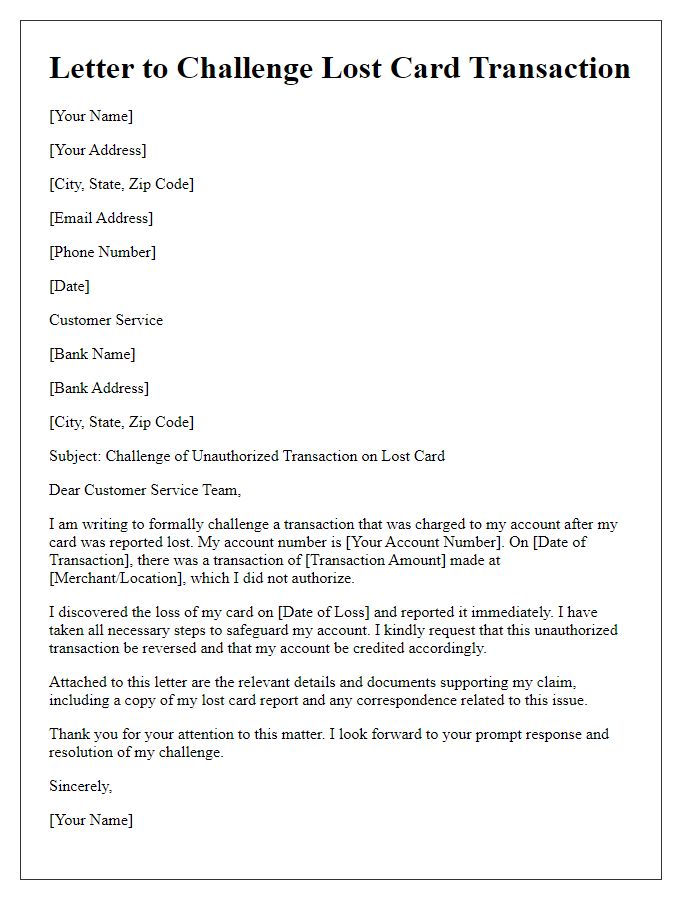

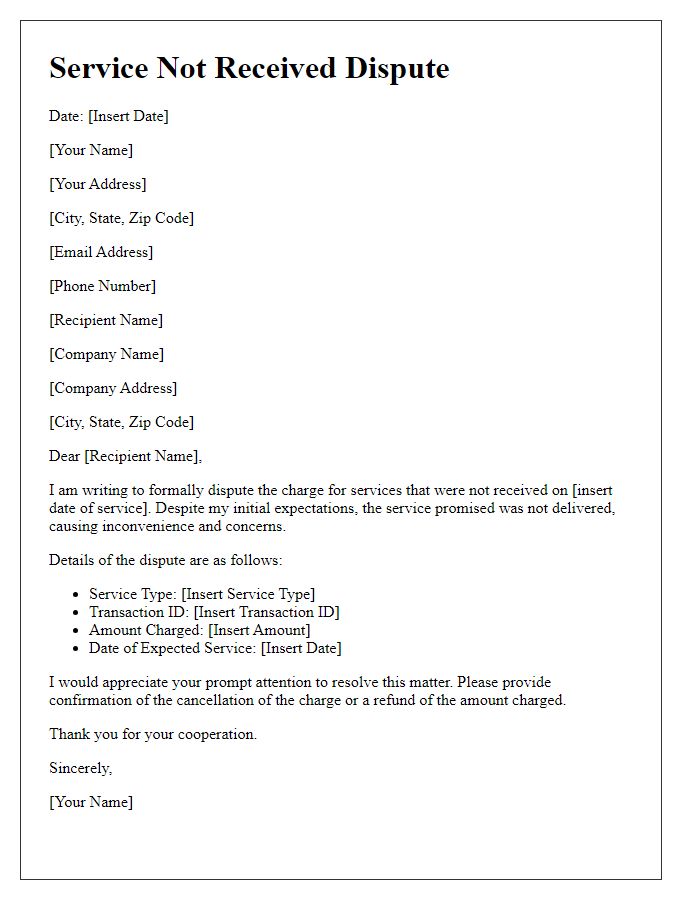

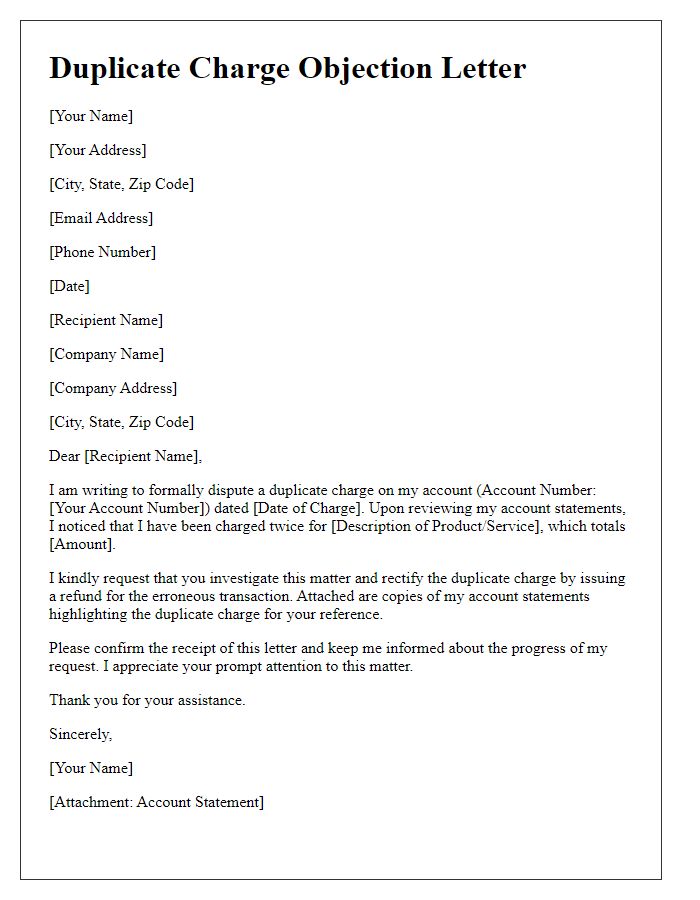

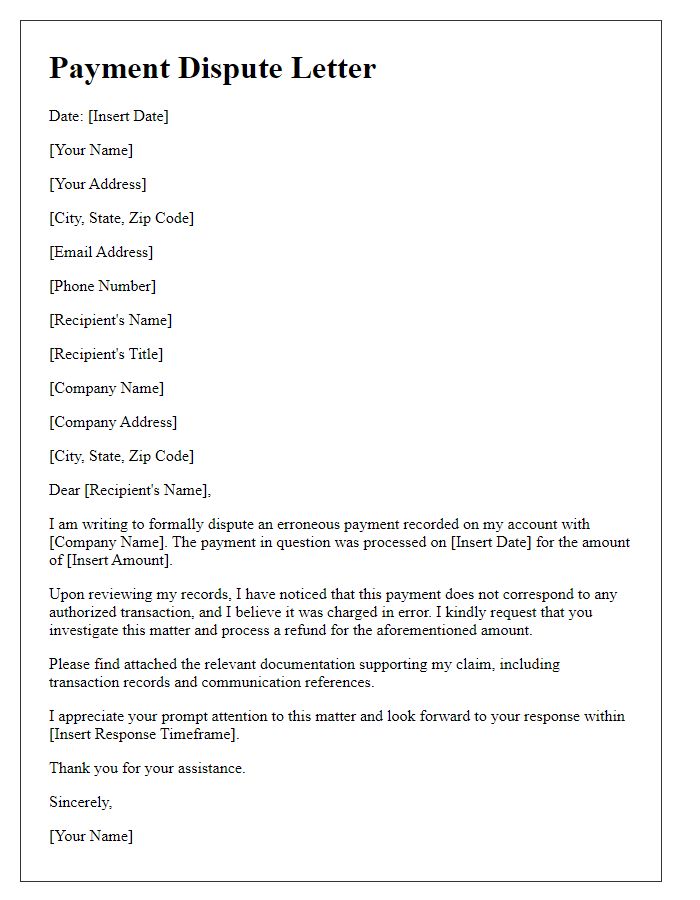

A credit card dispute resolution process involves the cardholder's essential details, including the individual's name, address, and account number associated with the credit card. The account number typically consists of 16 digits, unique to the cardholder's financial institution. Contact information, such as a valid phone number and email address, is crucial for timely communication regarding the dispute. The statement date and transaction date serve as critical reference points in the process, allowing the credit card issuer to pinpoint the specific charge under investigation. In addition, the nature of the dispute--whether it's an unauthorized charge, a billing error, or a service not rendered--should be clearly stated to facilitate an efficient resolution. Supporting documentation, such as receipts or correspondence with merchants, may strengthen the cardholder's claim during the dispute investigation.

Transaction Details

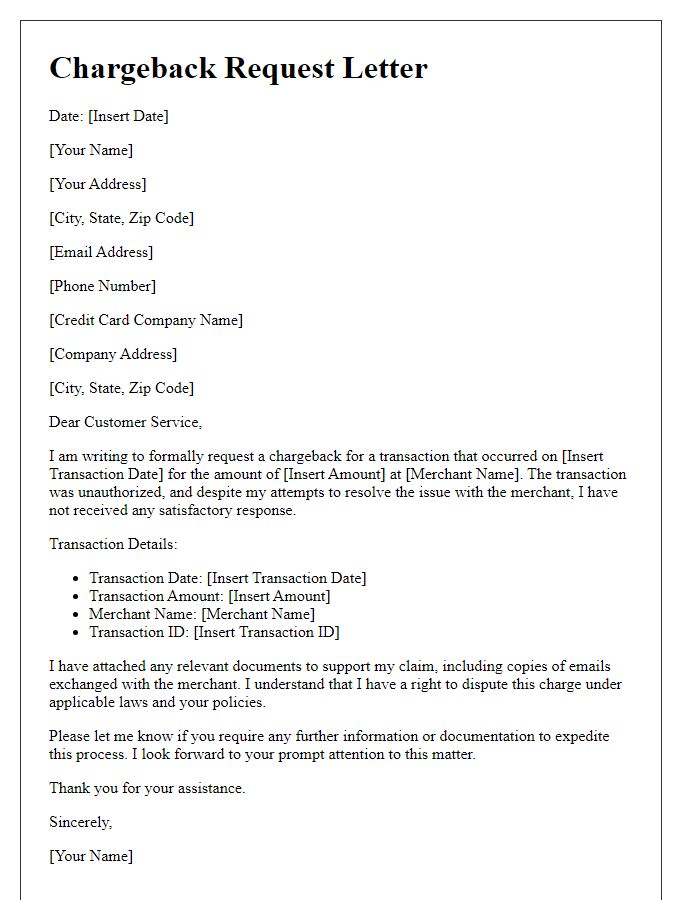

When disputing a credit card transaction, it is essential to detail the specific transaction in question accurately. For example, a transaction dated March 15, 2023, at the electronics retailer Best Buy located at 123 Example St, Anytown, USA, for the amount of $350.47 should be clearly outlined. This purchase may involve a product that was defective, prompting a request for a refund or reversal. Documentation such as receipts, correspondences with the retailer, and photographs of the product can bolster the dispute. Additionally, providing the credit card number (last four digits), the account statement showing the transaction, and the specific reason for the dispute will facilitate a smoother resolution process.

Dispute Reason

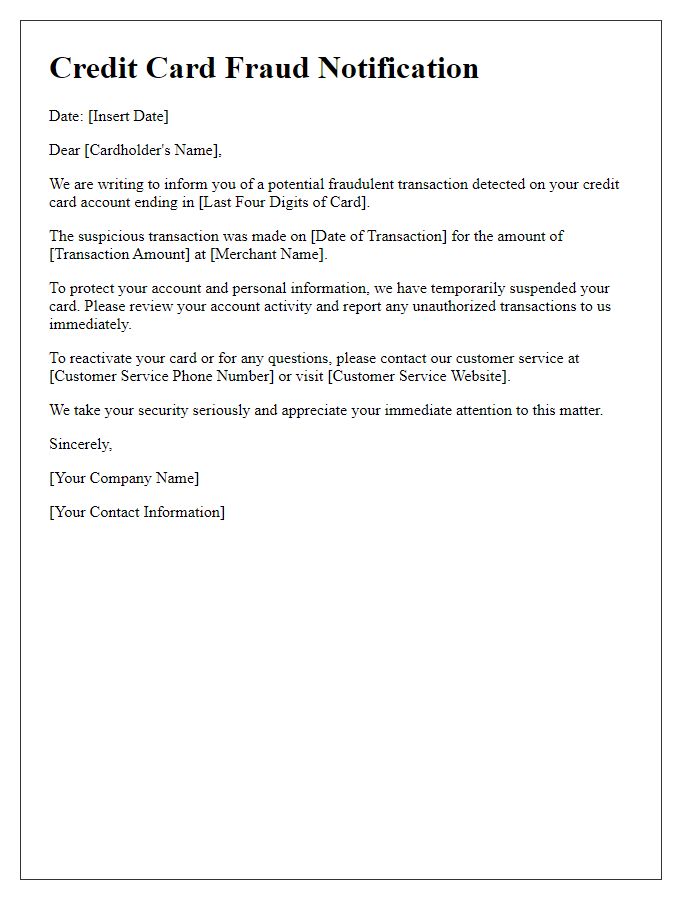

A credit card dispute involves a disagreement between the cardholder and the financial institution regarding unauthorized transactions or incorrect charges. Common situations include fraudulent activity, billing errors, or services not rendered. The cardholder usually communicates the issue to the bank or credit card provider, often with supporting documentation. Timely reporting is crucial; regulations like the Fair Credit Billing Act in the United States provide a window of 60 days for disputing charges. Clear identification of the transaction in question, including transaction date, amount, and merchant details, is essential for resolution. Typically, banks are obligated to investigate the dispute within a specific timeframe, often 30 days, ensuring the resolution process is transparent and fair.

Supporting Documentation

Credit card dispute resolution requires comprehensive supporting documentation to ensure a thorough review. Essential items include billing statements detailing transactions, copies of receipts highlighting purchase discrepancies, and any correspondence linked to the dispute, such as emails or letters from the merchant. Additionally, a timeline of events, especially key dates like the transaction date and date of dispute initiation, enhances clarity. Providing evidence such as photographs or screenshots that support your claim can also be invaluable. It is important to submit all documentation to the credit card issuer, ensuring adherence to their specified guidelines, and maintain copies for personal records in case further follow-up is necessary.

Contact Information

A credit card dispute resolution process often requires clear and concise contact information for both parties involved in the transaction. Cardholders should ensure their full name, account number, and billing address are up to date for accurate communication. Merchants involved in the dispute should provide their business name, merchant identification number (MID), and contact details for customer service. Additionally, both parties should include transaction dates, amounts, and any reference numbers related to the disputed charge for efficient resolution. Keeping all correspondence organized aids in a smoother dispute process.

Comments