Are you concerned about the accuracy of your credit report? You're not alone! Many individuals face the challenge of ensuring their credit history reflects their true financial status, particularly when urgent updates are needed. If you're looking for a reliable template to navigate this process efficiently, keep reading to discover how you can swiftly address your credit report concerns.

Personal Information

An urgent credit report update, particularly regarding personal information such as name, address, or Social Security number discrepancies, is crucial for maintaining financial integrity. Discrepancies in personal information can lead to identity theft or erroneous credit score calculations that affect loan approvals. For instance, a mistake in the address of a borrower living in San Francisco (California) could delay mortgage processing for housing valued at over $1 million. Timely notification to credit reporting agencies like Experian or TransUnion ensures accurate representation of one's financial history, contributing to better interest rates and credit opportunities.

Credit Report Details

A credit report update is crucial for maintaining accurate financial records, impacting borrowers' ability to secure loans and credit. The report contains critical information such as the individual's credit score, payment history on accounts (such as mortgages, credit cards, and student loans), and any public records (such as bankruptcies or liens) that could influence lending decisions. Errors can lead to lower scores, affecting interest rates, credit limits, and overall financial health. Consumers are encouraged to review these reports regularly for discrepancies, ensuring timely correction of any inaccuracies through communication with credit bureaus like Experian or Equifax, which typically house such reports. The Fair Credit Reporting Act (FCRA) governs these updates, providing regulations for timely reporting and consumer rights in disputing errors.

Issue Description

Urgent credit report updates are crucial for maintaining accurate financial profiles, particularly for individuals seeking loans or mortgages. Errors in credit reports can arise from events such as identity theft, clerical mistakes, or outdated information that may significantly impact credit scores. Timely corrections are essential, as inaccuracies can lead to higher interest rates, rejections from lenders, or adverse effects on personal finance. Monitoring agencies like Equifax, Experian, or TransUnion provide platforms for consumers to access, dispute, and update credit reports efficiently, ensuring that financial histories reflect true creditworthiness.

Request for Update

A request for an urgent credit report update is crucial for assessing financial health. Credit scores, numerical representations of creditworthiness ranging from 300 to 850, are often influenced by new information such as timely payments or increased credit inquiries. Events like bankruptcy filings or late payments can severely impact scores, making it essential to request updates promptly. Organizations like credit bureaus, including Experian, Equifax, and TransUnion, maintain these reports. Inaccurate information may lead to lower approval rates for loans or mortgages, affecting consumers' ability to secure homes or vehicles. Further delays could hinder critical financial decisions, emphasizing the importance of timely updates to credit reports.

Supporting Documentation

Experiencing an urgent need for a credit report update may arise from significant changes in financial status, such as identity theft or sudden increase in credit limit. Supporting documentation plays a critical role in this process. Essential documents may include a government-issued identification card, recent bank statements showcasing account activity, and proof of address (like utility bills dated within the last three months). Additionally, any relevant police reports in the case of identity theft can substantiate claims. Timely submission of these documents can significantly expedite the credit report modification process, ensuring accuracy and integrity of personal financial information.

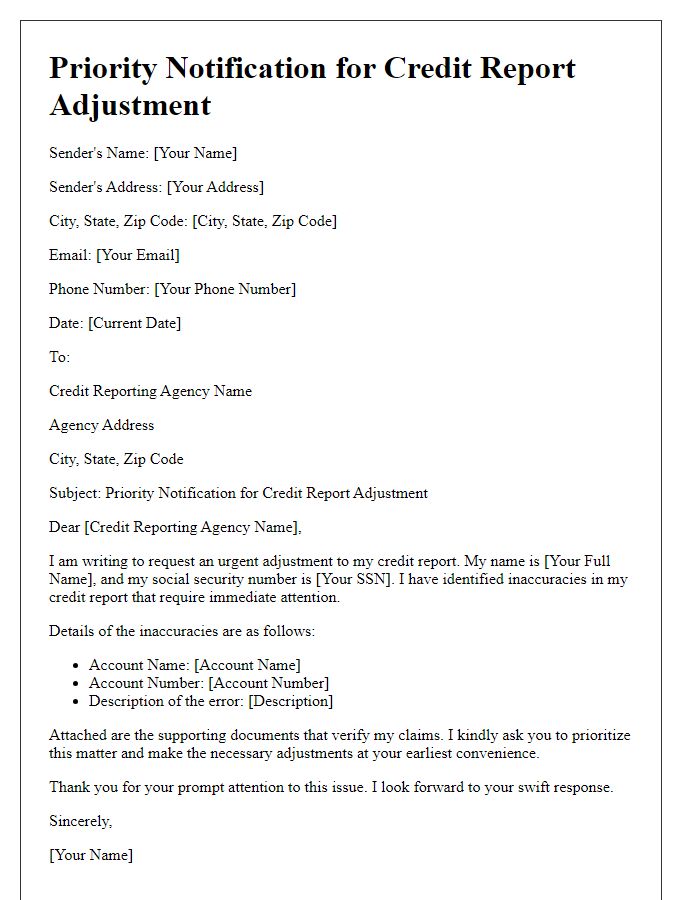

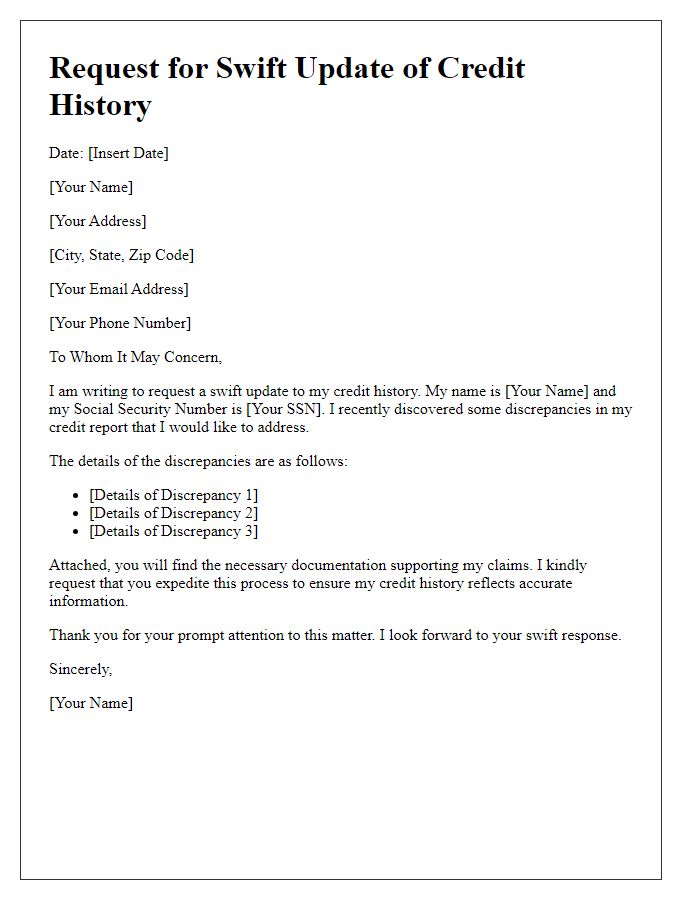

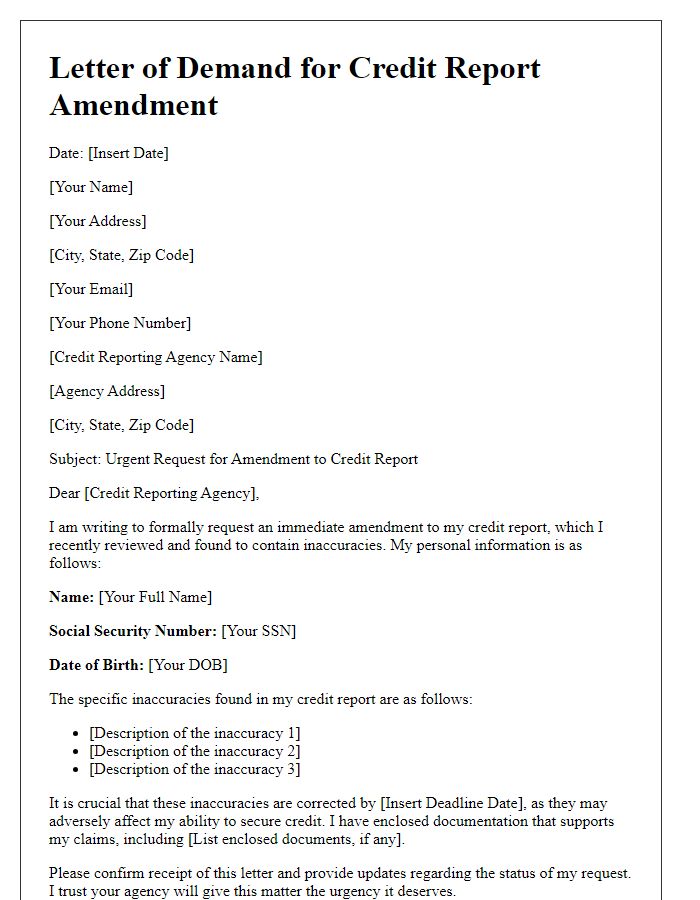

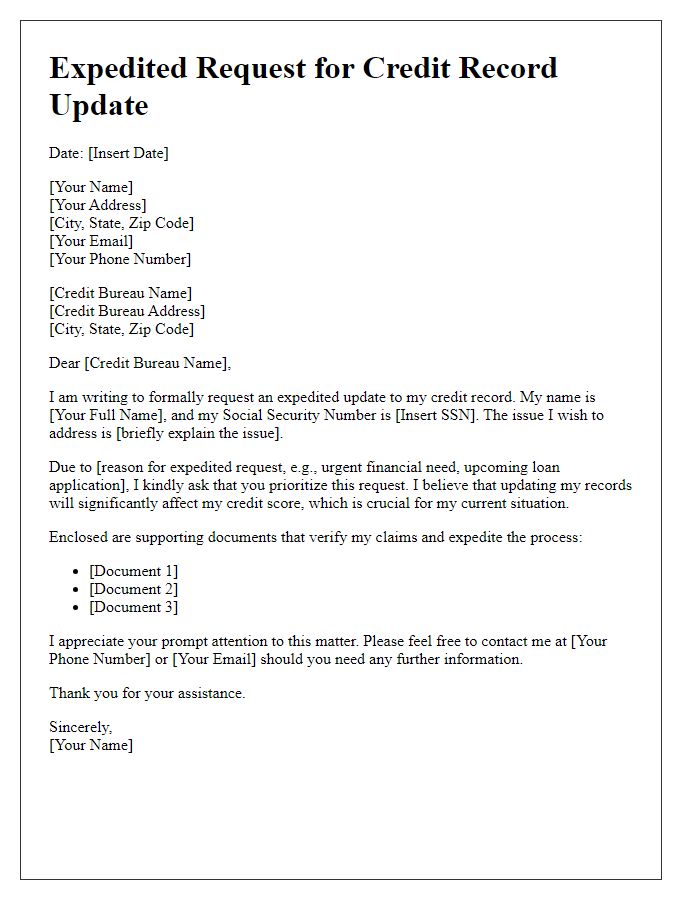

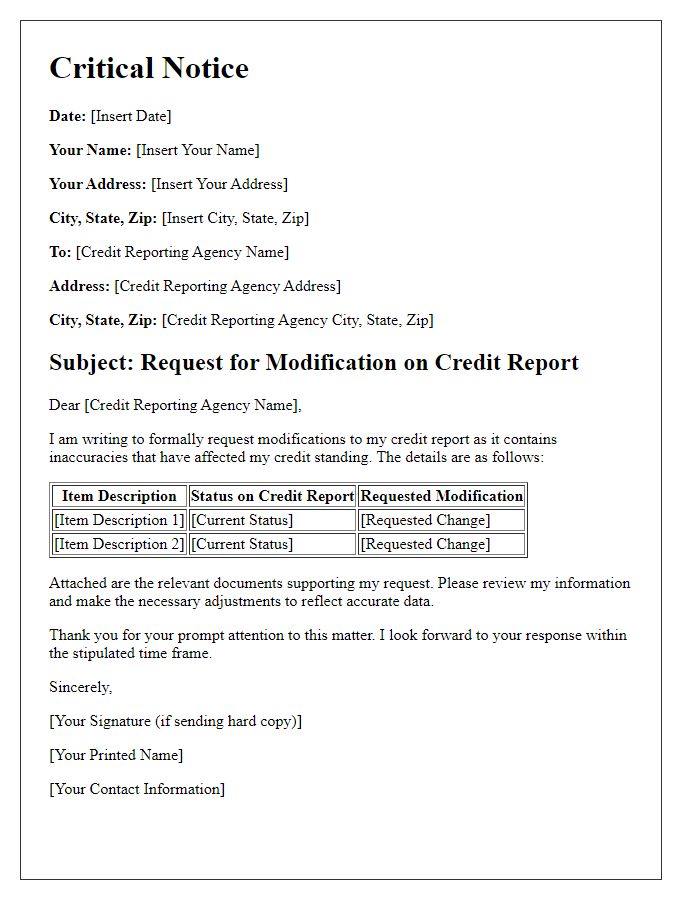

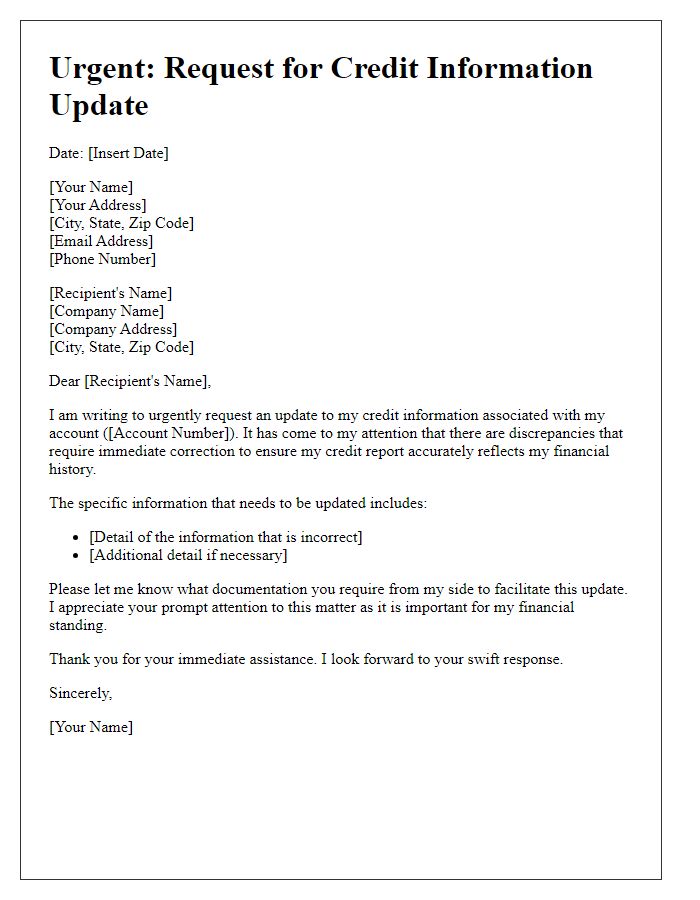

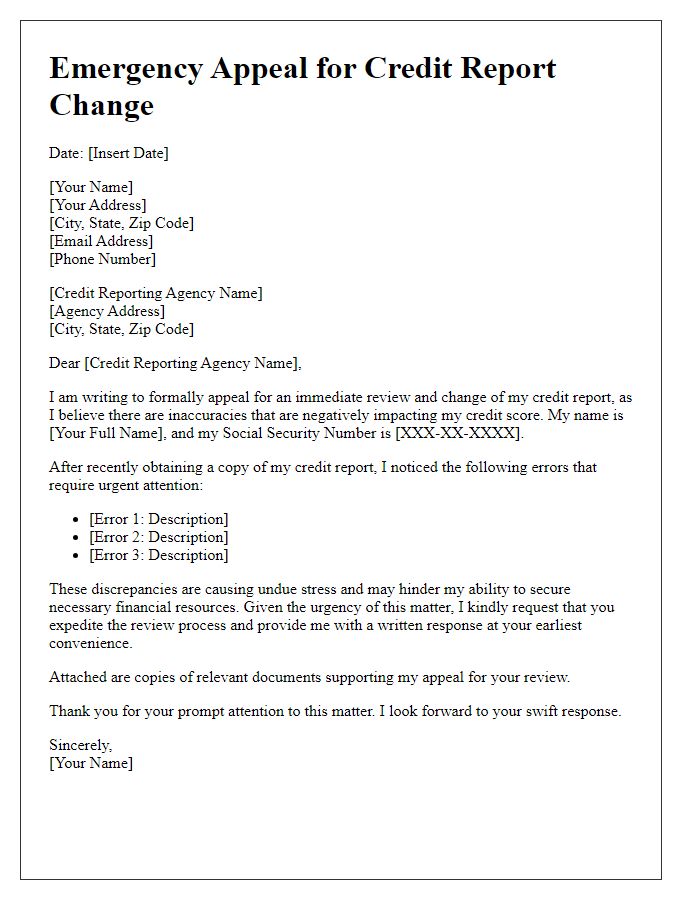

Letter Template For Urgent Credit Report Update Samples

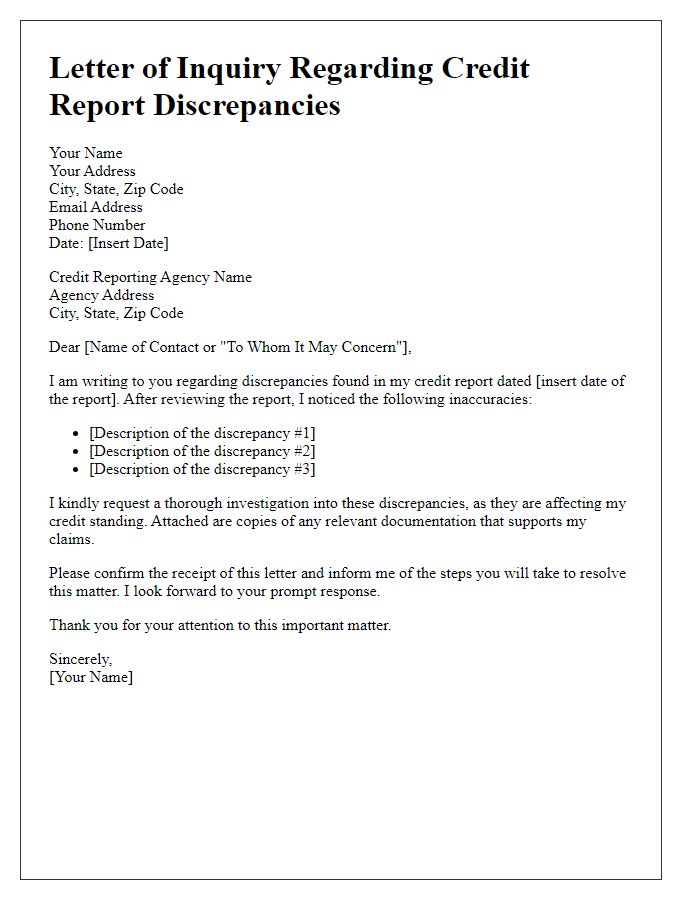

Letter template of pressing inquiry regarding credit report discrepancies

Comments