Hey there! So, you've been thinking about checking your TransUnion credit score, and that's a fantastic move toward financial empowerment. Understanding your credit score is crucial for making informed decisions about loans, mortgages, and overall financial health. In this article, we'll guide you step-by-step on how to check your score and what it means for your financial future. Stick around to discover tips and advice that can help you navigate the world of credit scores more confidently!

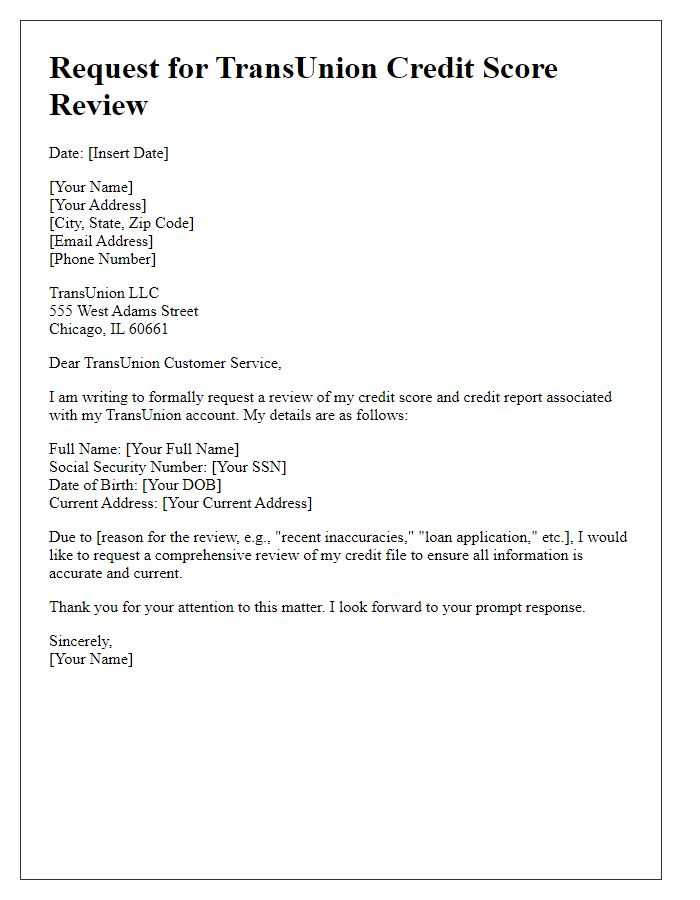

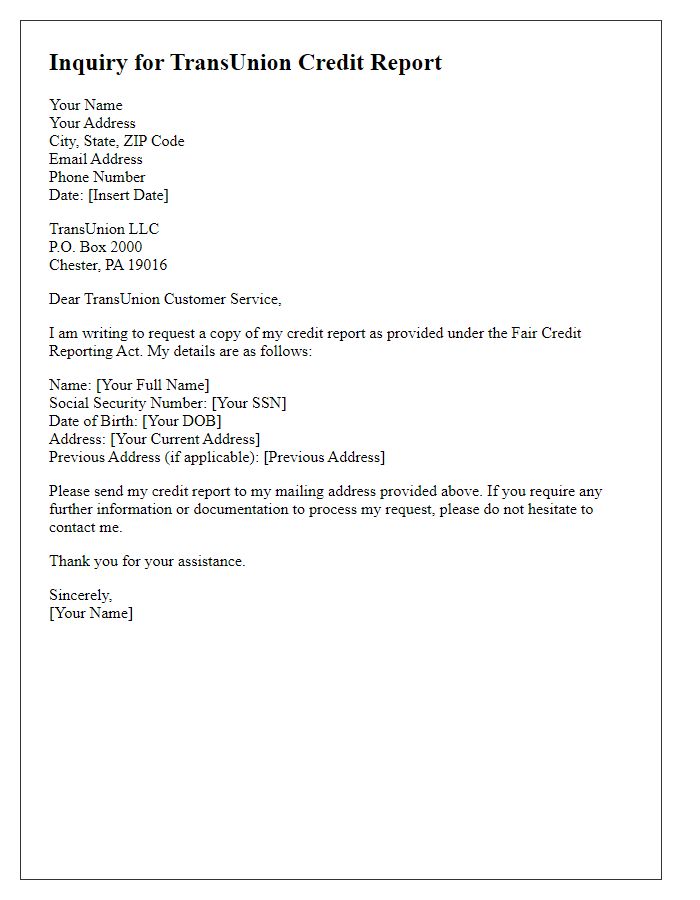

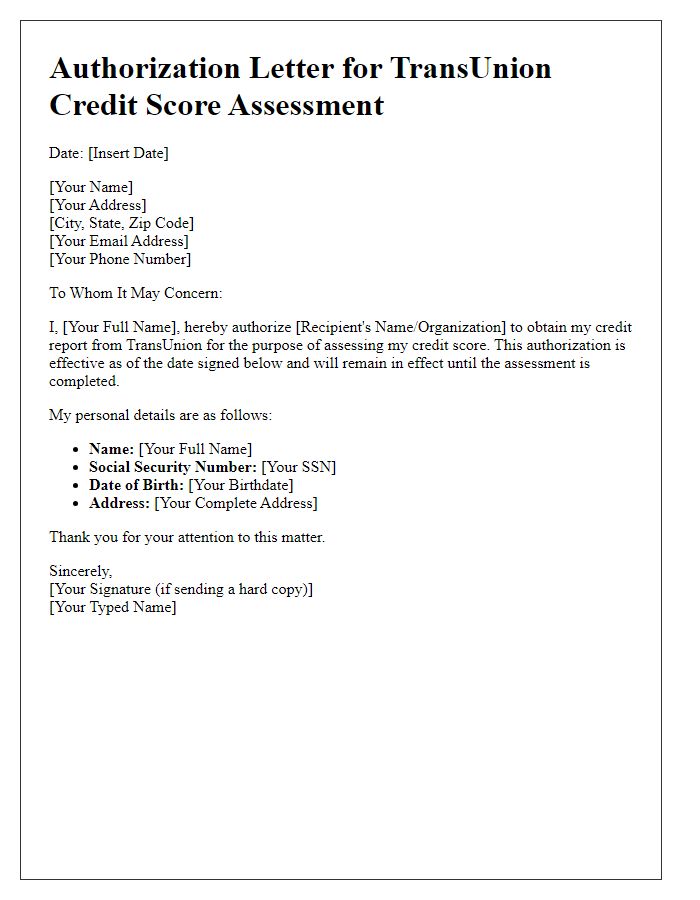

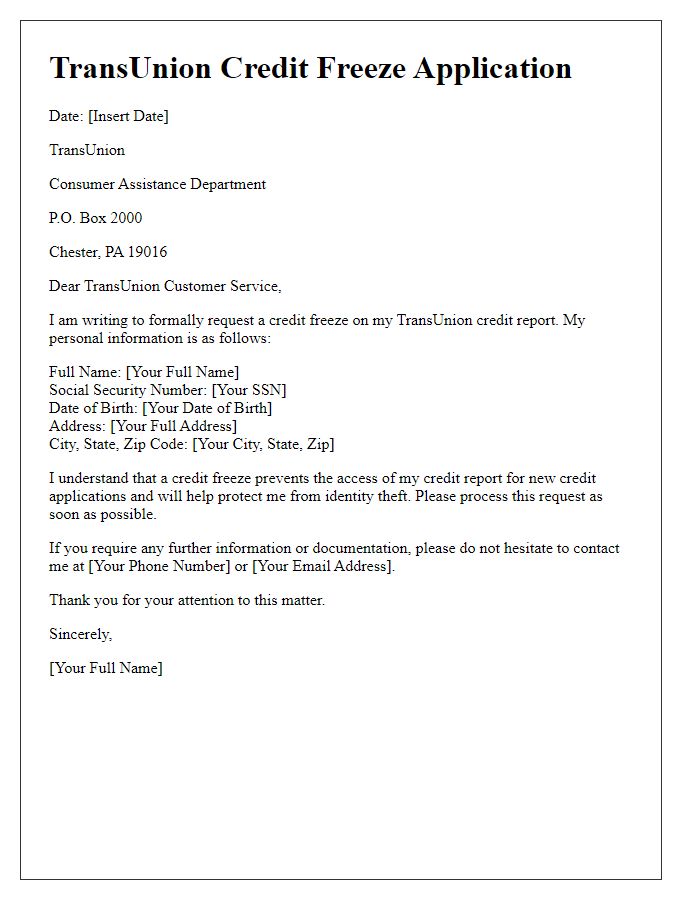

Personal Information

Checking a credit score is an important step for individuals looking to understand their financial health, particularly through TransUnion, a major consumer credit reporting agency in North America. Gathering personal information is essential, including full name, address (current and previous if relevant), date of birth, and Social Security number. Additionally, it is beneficial to provide details on employment history, such as employer's name and duration of employment. Potential users should also include information on any outstanding debts or loans, ensuring accuracy to avoid delays in credit score evaluation. Understanding the credit score process through TransUnion can give insights into financial standing and creditworthiness, influencing future borrowing opportunities and interest rates.

Purpose of the Request

A credit score check, particularly through TransUnion, is a vital process for individuals looking to understand their financial standing and eligibility for loans. The request often stems from significant life events such as purchasing a home, seeking an auto loan, or applying for credit cards. It highlights financial health indicators through a three-digit number (ranging from 300 to 850) that lenders use to evaluate creditworthiness. Regular monitoring helps identify potential discrepancies in reports, allowing for timely corrections. Accessing TransUnion's services offers insights into one's credit history, including payment history, credit utilization, and types of credit accounts, crucial for making informed financial decisions.

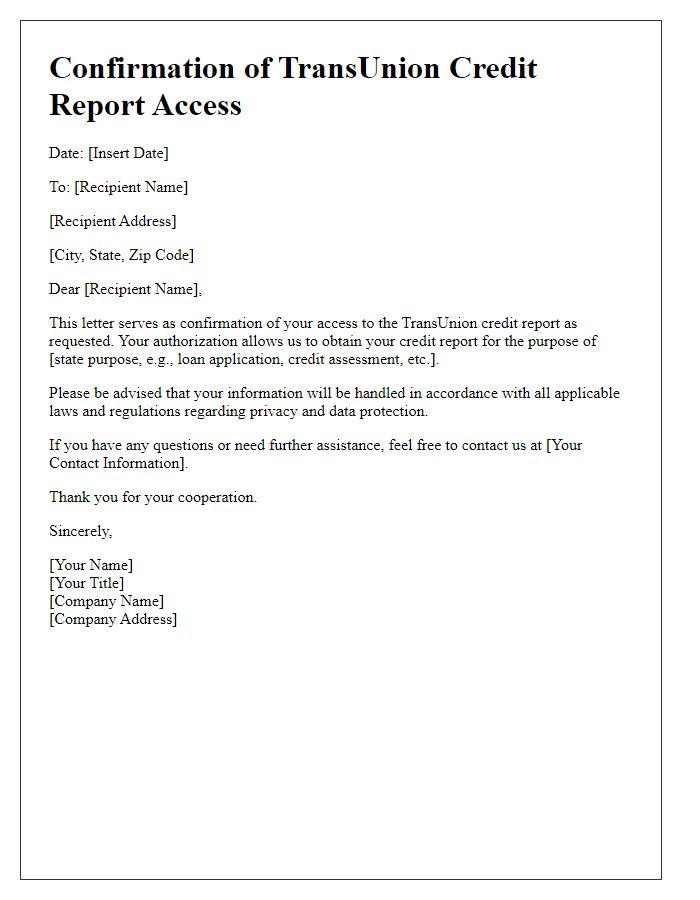

Authorization for Credit Inquiry

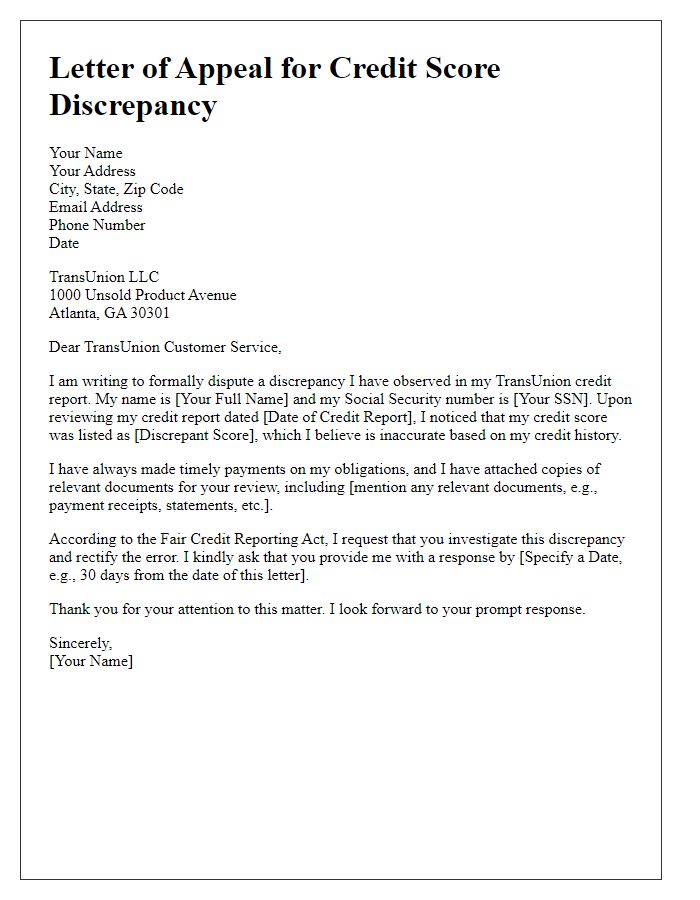

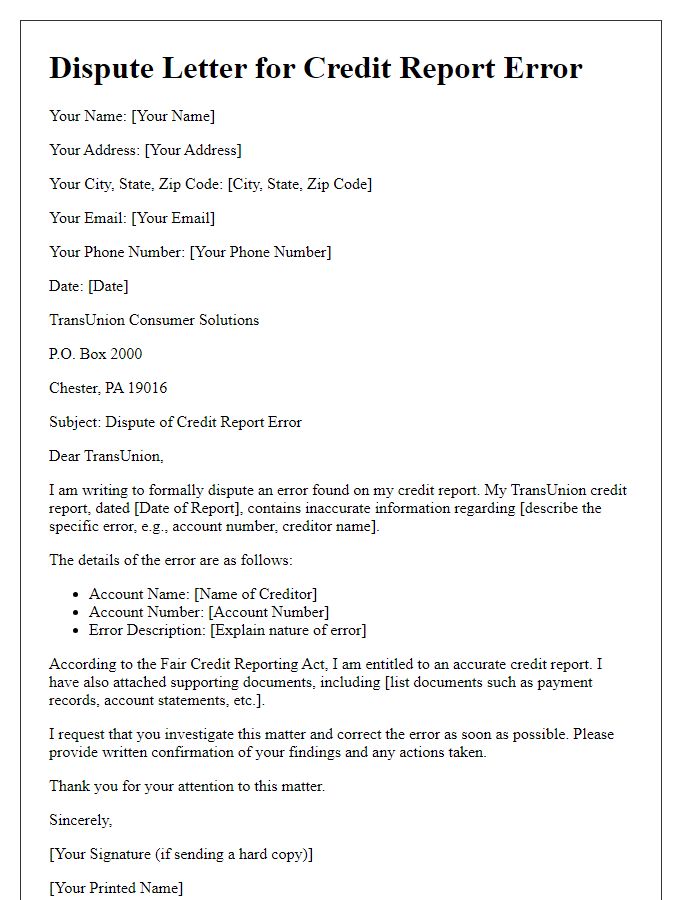

Authorization for a credit inquiry allows a credit reporting agency, like TransUnion, to assess an individual's credit history and score. This process typically involves the evaluation of various factors including payment history, credit utilization, and length of credit history. Individuals seeking to check their credit score may submit a formal request that includes personal identification details such as Social Security number, full name, and current address. Acknowledgment of this inquiry is crucial as it can influence future credit applications and loan approvals, especially when considering the impact on credit rating that results from multiple inquiries within a short period.

Specific Credit Check Details

TransUnion provides comprehensive credit reports that detail an individual's credit history and overall creditworthiness. A specific credit check can include numerous factors: payment history (reflecting punctuality with loan and credit card payments), credit utilization ratio (the amount of credit used in relation to the total credit limit), length of credit history (the age of credit accounts), types of credit accounts (such as revolving credit or installment loans), and recent inquiries (which indicate how many times credit has been accessed). Understanding these elements is crucial for assessing one's credit score-- a numerical representation ranging typically from 300 to 850-- and can impact loan approval rates, interest rates, or eligibility for certain financial services. By reviewing one's TransUnion credit report regularly, individuals ensure accuracy, identify potential issues, and take proactive steps toward improving their credit score.

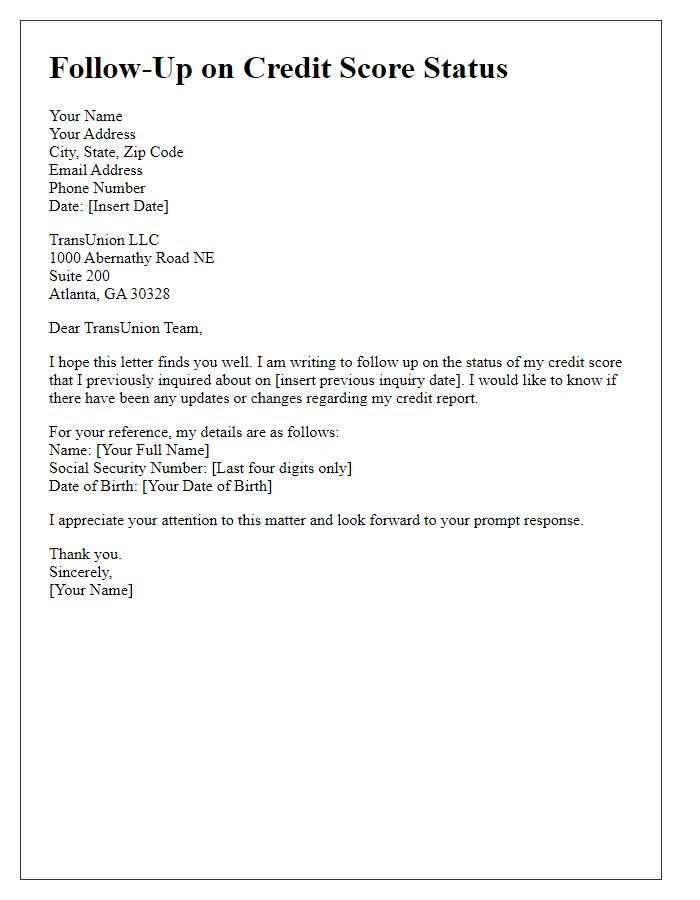

Contact Information for Response

TransUnion, a major credit reporting agency, is essential for monitoring individual credit scores and reports. Providing accurate contact information ensures timely responses regarding credit inquiries. Essential details include the individual's full name, current address (preferably including city, state, and ZIP code), and telephone number for immediate communication. Additionally, including an email address can facilitate digital correspondence, especially for those seeking faster responses. Clarity in this contact information enhances the efficiency of the credit score inquiries, ensuring individuals receive essential updates and information relevant to their financial health.

Comments