Are you tired of being held back by an outdated judgment on your record? You're not alone â many individuals face the burden of past mistakes that no longer reflect who they are today. Clearing outdated judgments can open doors to new opportunities and restore your peace of mind. Join us as we explore the process and provide you with a comprehensive guide to help you reclaim your future!

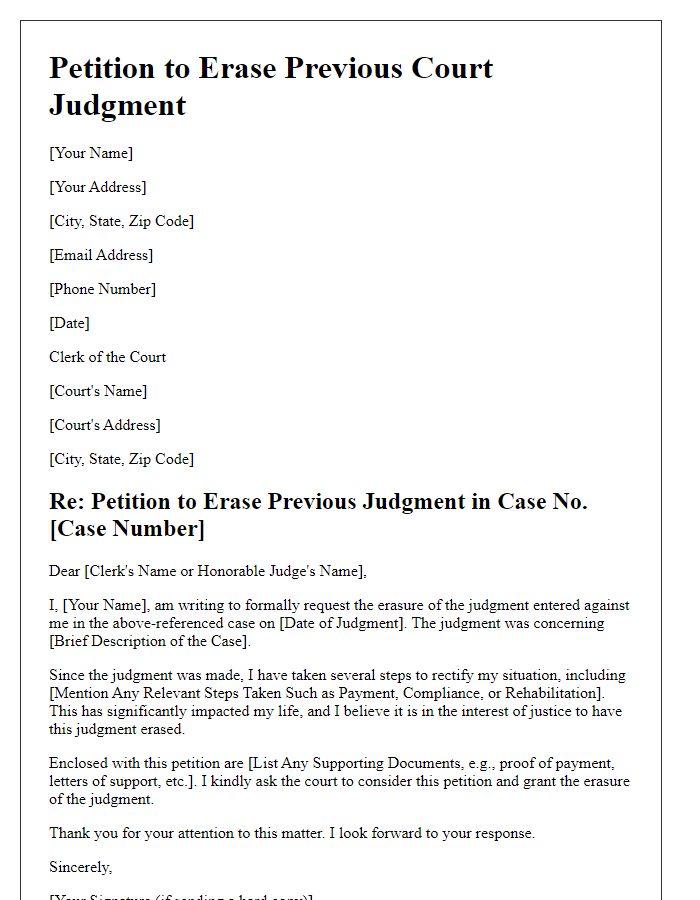

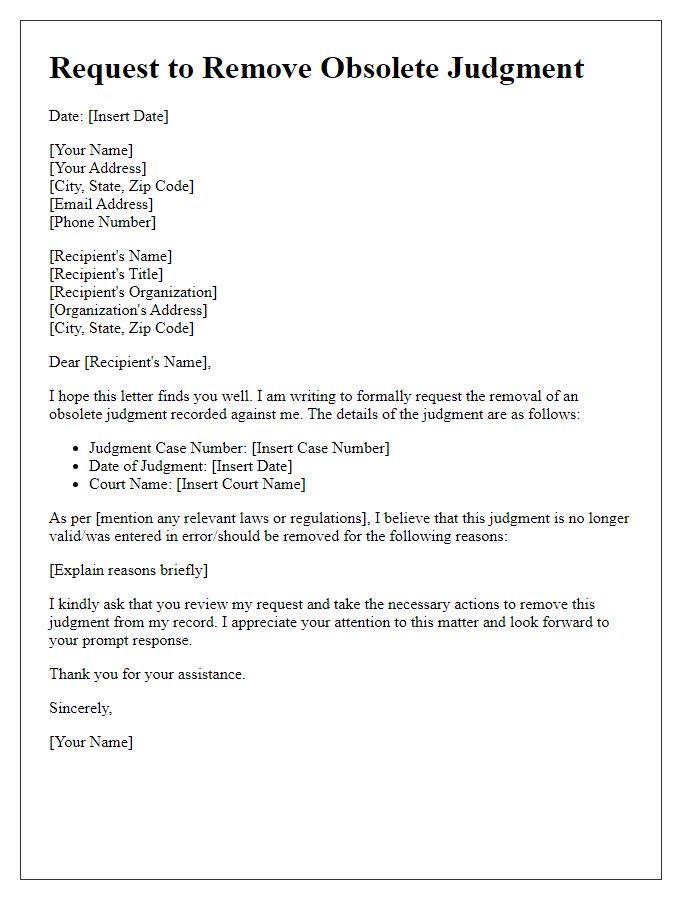

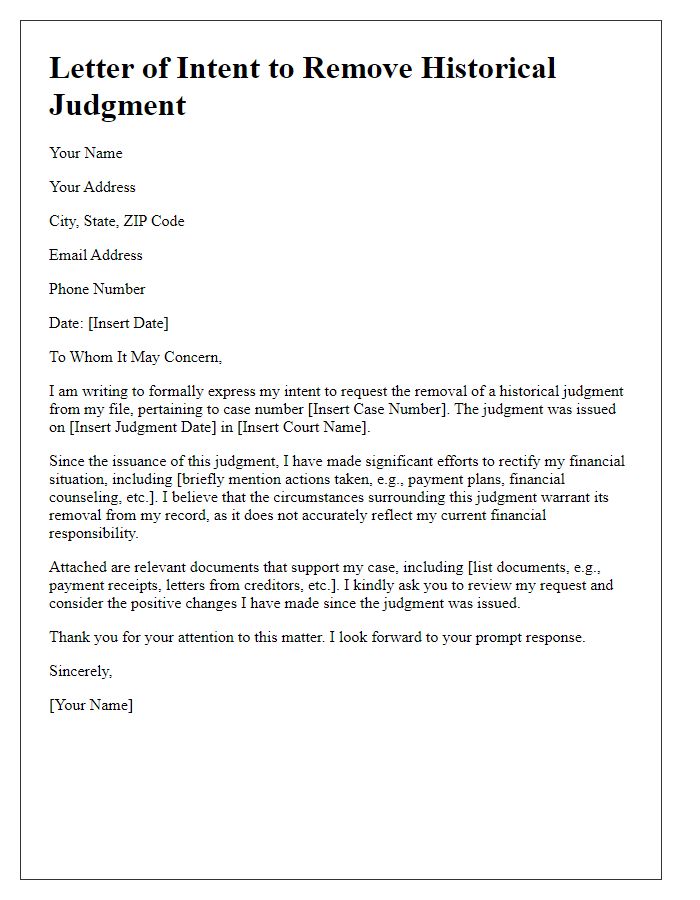

Clear Subject Line

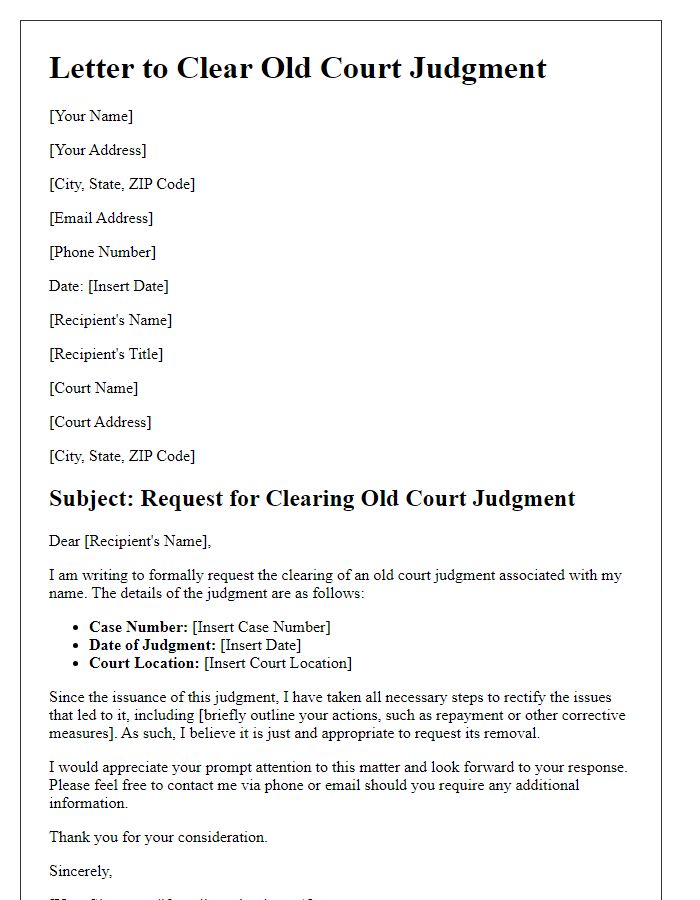

Clearing outdated judgment records can significantly impact an individual's credit report and financial standing. Judgments, typically issued by courts, remain on files for seven years (or longer in some jurisdictions) and can affect loan applications, mortgage approvals, and overall creditworthiness. Addressing outdated records requires submitting a formal request to the relevant credit bureau or court, often necessitating supporting documents such as court orders or proof of payment. Successful removal can improve credit scores, enabling lower interest rates and increased chances of loan approval for significant purchases like homes or vehicles. Understanding local laws and regulations (such as the Fair Credit Reporting Act in the United States) is essential for efficiently navigating this process.

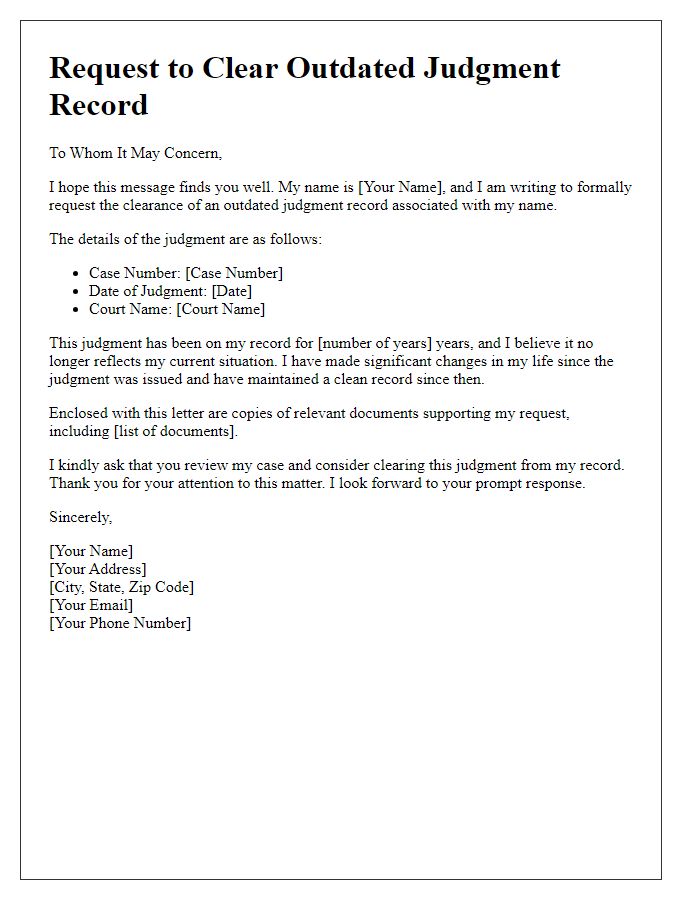

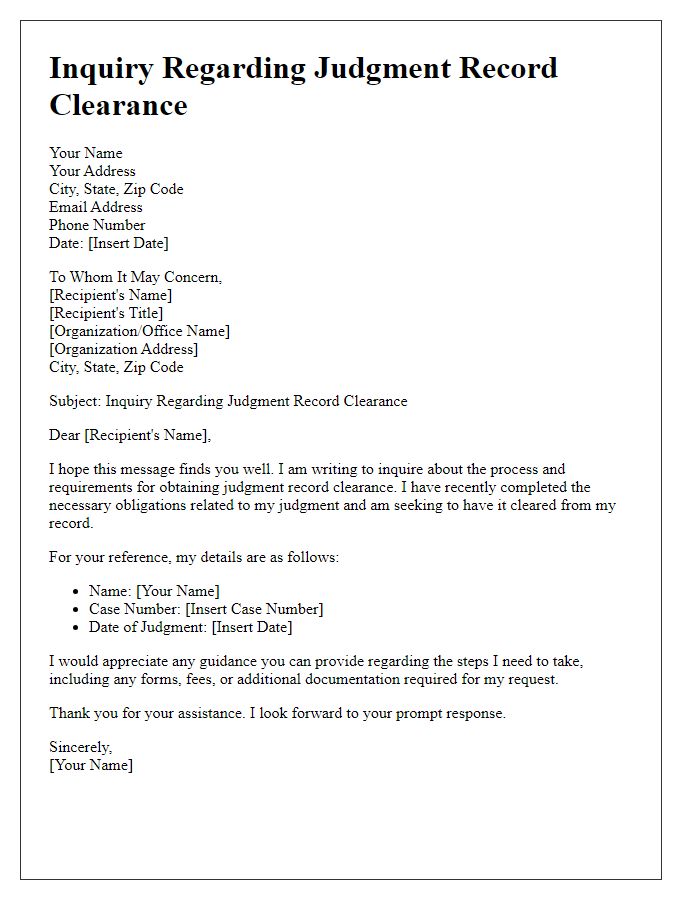

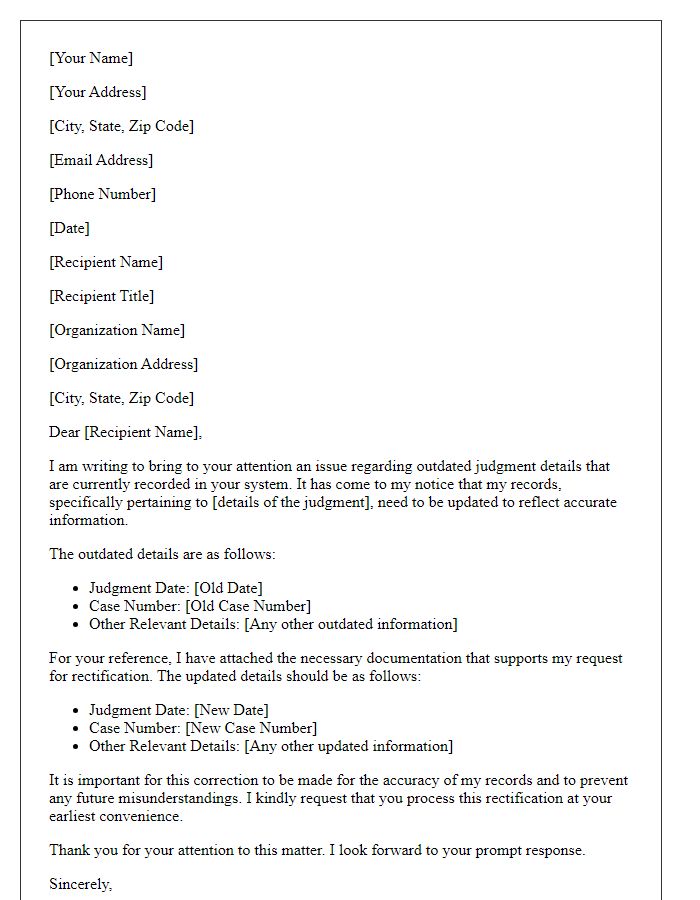

Precise Personal Information

Clearing outdated judgment records is a crucial process for individuals seeking to improve their credit history. A judgment record, often originating from court decisions, can negatively impact personal credit scores, hindering opportunities for loans and employment. In the United States, a judgment typically remains on public record for seven years. To initiate the clearing process, individuals must gather precise personal information including full name, address, date of birth, and Social Security number. Effective communication with credit bureaus, such as Equifax, Experian, and TransUnion, is key. Additionally, filing correct forms with the local courthouse, where the judgment was recorded, requires attention to detail to avoid further delays. Timely follow-up ensures that outdated judgment records are promptly addressed, allowing for more favorable financial prospects.

Specific Judgment Details

An outdated judgment record can significantly impact an individual's credit score, often leading to challenges in securing loans, employment opportunities, or housing. For instance, a judgment entered in a New York court in 2015 might affect an individual's ability to obtain a mortgage from lenders like Wells Fargo or Chase, as many financial institutions assess credit histories before approval. Legal statutes stipulate that judgments can remain on credit reports for seven years, but recent reforms allow for the possibility of early expungement under certain conditions, like payment of the debt or a successful appeal. One crucial aspect involves obtaining official documentation from the court, often requiring individuals to provide their case number and details to the appropriate clerk's office for timely resolution.

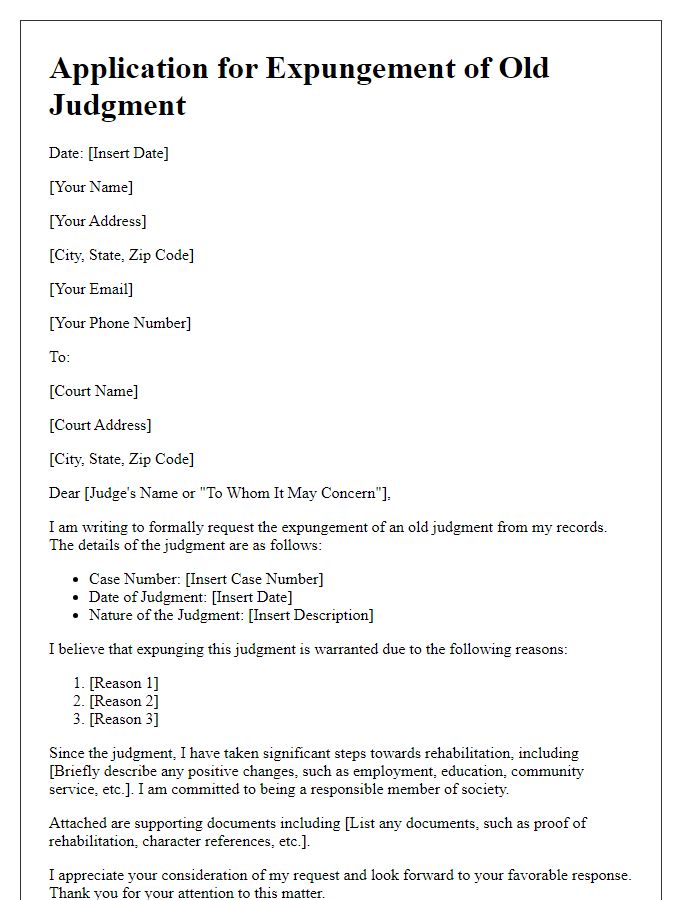

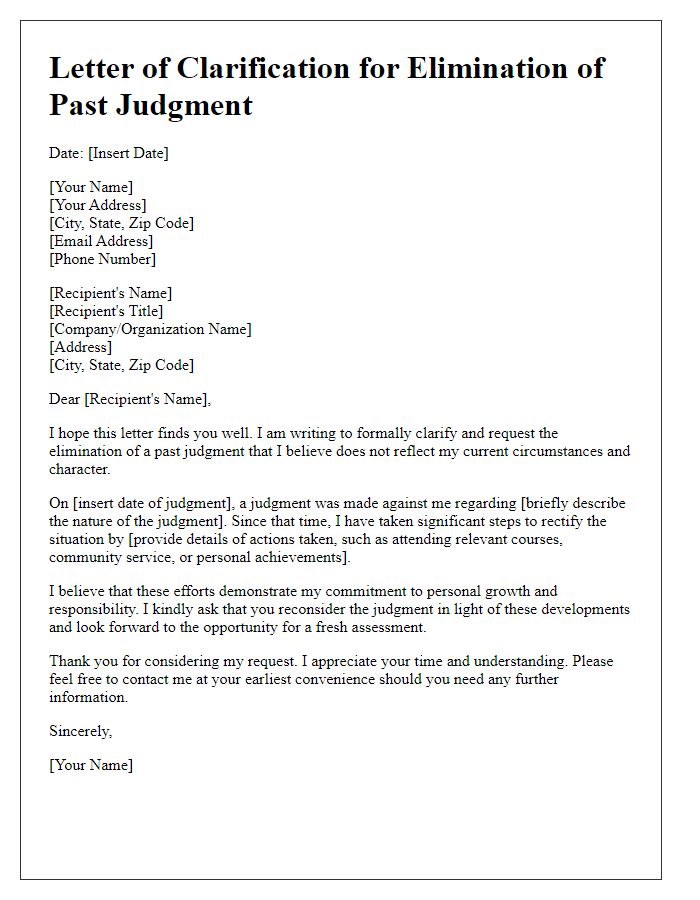

Legal Justification

Outdated judgments can significantly impact an individual's credit score, job prospects, and overall reputation. Legal jurisdictions, such as the United States, have established guidelines under the Fair Credit Reporting Act (FCRA) concerning the reporting timeline for negative items, generally extending to seven years for most debts. Courts, including those in New York and California, may also provide mechanisms for record sealing or expungement, especially when the judgment was satisfied or vacated. Individuals navigating this complex legal landscape often seek to understand the implications of specific case law, such as "Koeppel v. Hertz," which affirmed the possibility of removal under certain conditions. Legal representation is crucial to ensure that motions to dismiss or clear outdated records are effectively pursued, allowing for a fresh start and restoring one's public standing.

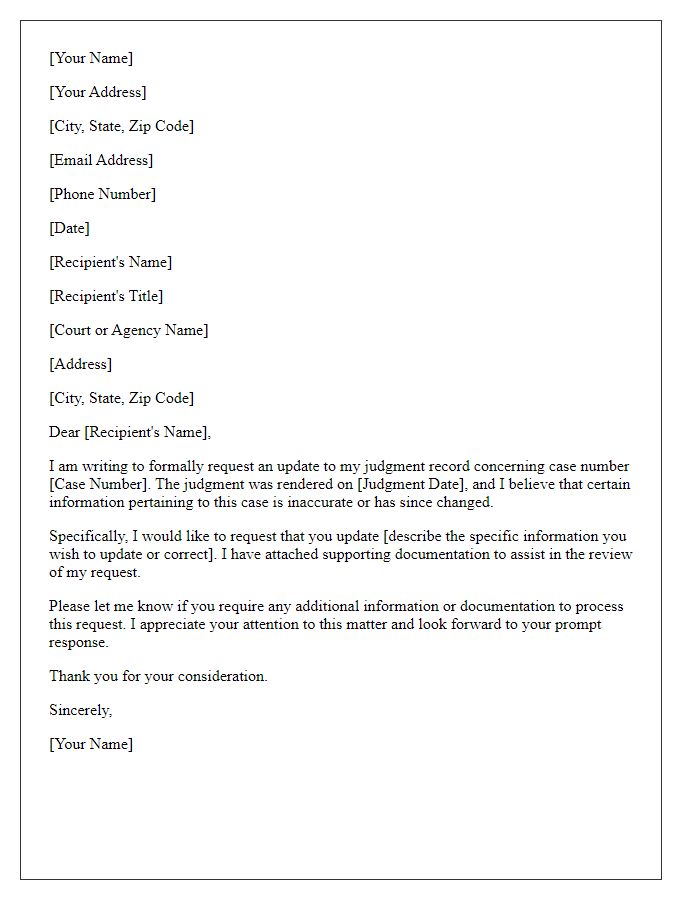

Professional and Polite Tone

In some jurisdictions, an outdated judgment record can hinder individuals' opportunities for employment or housing. A judgment record may remain on a credit report for up to seven years from the date of the final disposition. Individuals desiring to clear this record often need to submit a formal request to the appropriate court or agency. Inclusion of specific case information such as case number, court name, and date of judgment is vital in the request. Supporting documents demonstrating the completion of all obligations tied to the judgment may also strengthen the application. The process can vary by state; thus, consulting local laws and procedures is essential for a successful outcome.

Comments