Are you ready to take control of your financial future and rebuild your credit history? It might seem daunting, but with the right approach, you can pave the way toward a healthier credit profile. One effective strategy is to write a heartfelt letter to your creditors, expressing your intentions and outlining your plan for improvement. If you're interested in learning more about how to craft the perfect letter for reestablishing your positive credit history, keep reading!

Personal information verification

Reestablishing a positive credit history requires careful attention to detail and clear communication. A personal information verification process is essential to ensure that your identity and credit profile align accurately. Individuals seeking to improve their credit standing must gather pertinent documents such as social security numbers, recent pay stubs, and proof of address (e.g., utility bills dated within the last three months). It is crucial to submit these documents to credit bureaus like Experian, TransUnion, and Equifax for thorough verification. Each bureau employs specific identification protocols, often requiring submission through secure online portals or certified mail. Maintaining up-to-date records and promptly addressing any discrepancies can significantly enhance one's credit score over time, paving the way for favorable loan terms and lower interest rates in future financial endeavors.

Explanation of recent financial challenges

Recent financial challenges, including job loss and unexpected medical expenses, have significantly impacted the credit history of affected individuals. During this period, the unemployment rate reached a staggering 14.7% in April 2020, highlighting the widespread nature of financial hardship. Medical bills, often exceeding thousands of dollars, contributed to the inability to meet payment obligations. The combination of these events resulted in missed payments on accounts, which tarnished credit scores. Restoring positive credit history necessitates demonstrating improved financial stability through consistent payment of existing debts, maintaining low credit utilization rates, and proactively addressing outstanding obligations, ultimately fostering a path toward recovery and better financial management.

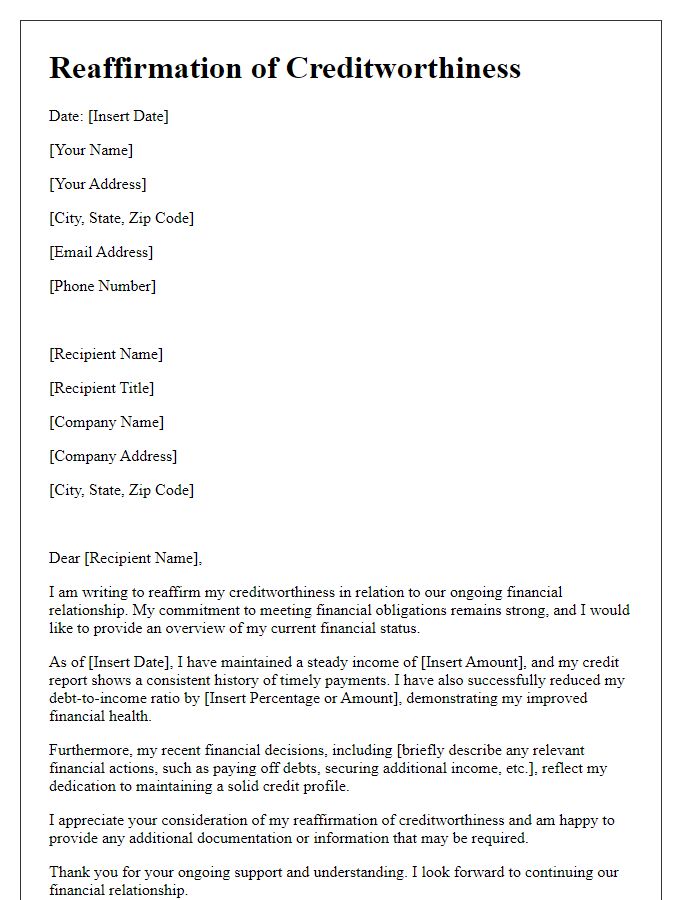

Outline of current financial stability

Reestablishing positive credit history involves showcasing current financial stability through detailed analysis. Recent credit score, typically ranging from 300 to 850, indicates strong reliability. Consistent bill payments, including utilities, mortgages, and credit lines, demonstrate a commitment to financial responsibility; for example, a recent analysis might show a 100% payment rate over the last year. Active savings accounts, shown by balances exceeding three months' worth of expenses, reflect disciplined budgeting, thus improving financial health. Employment history, ideally uninterrupted over the last two years, strengthens reliability in income. Regularly monitored credit utilization, kept below 30% of available credit, fosters positive credit behavior, making future credit applications more favorable. Additionally, community engagement, such as financial literacy workshops, illustrates a proactive approach to sustained financial knowledge and stability.

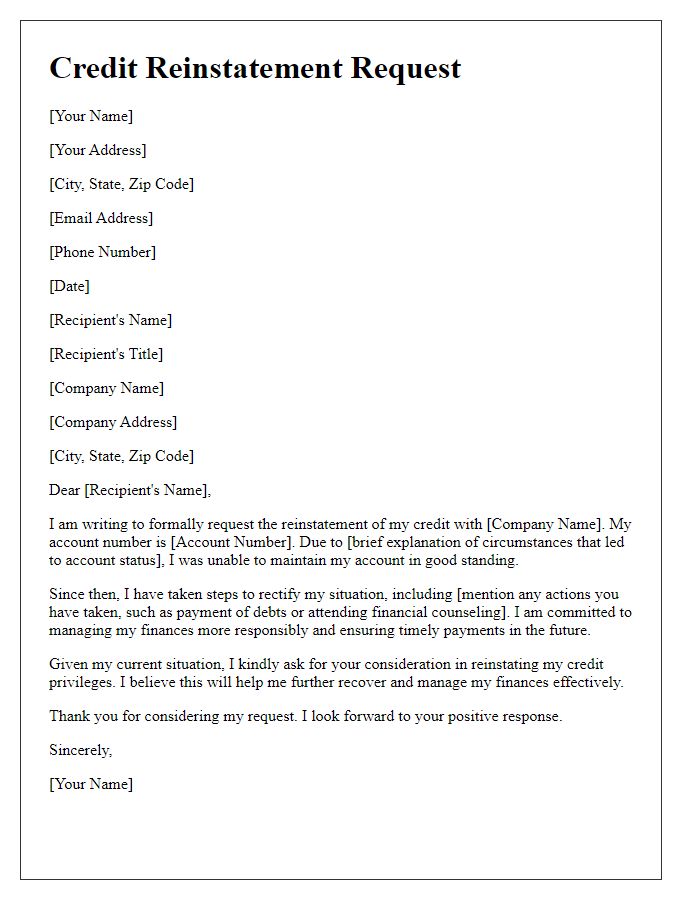

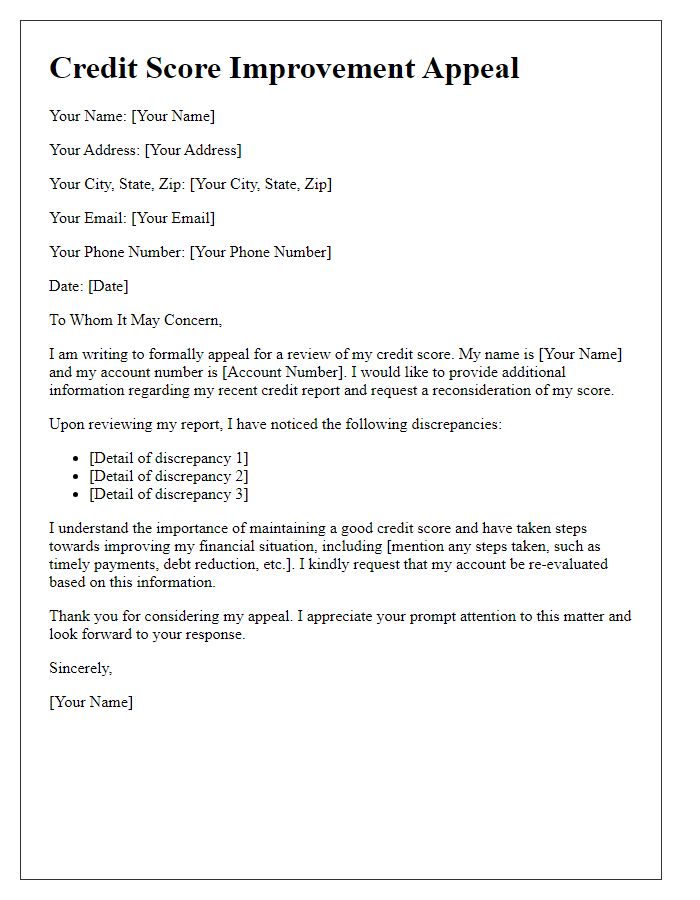

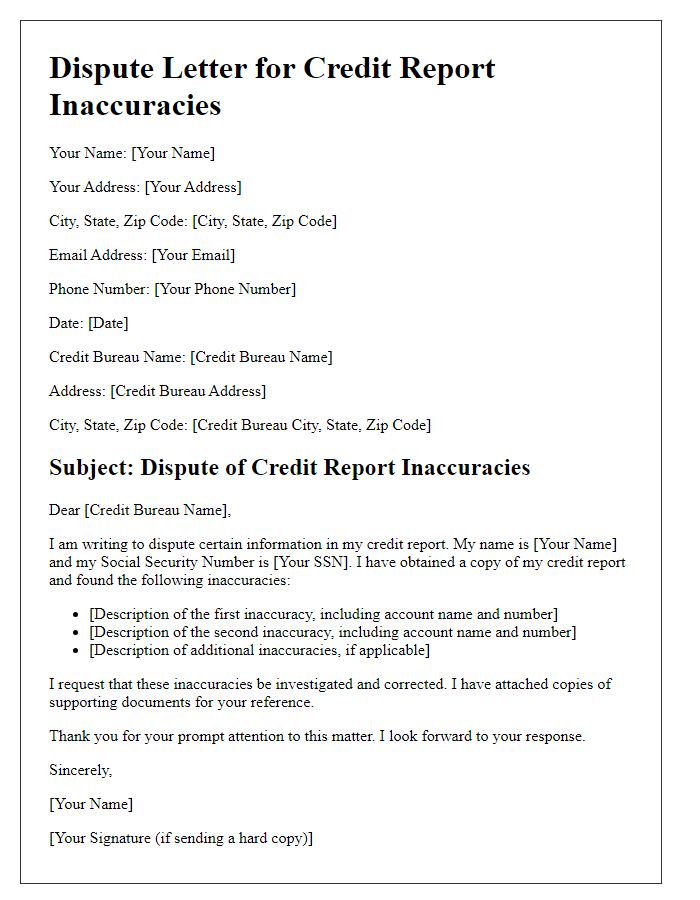

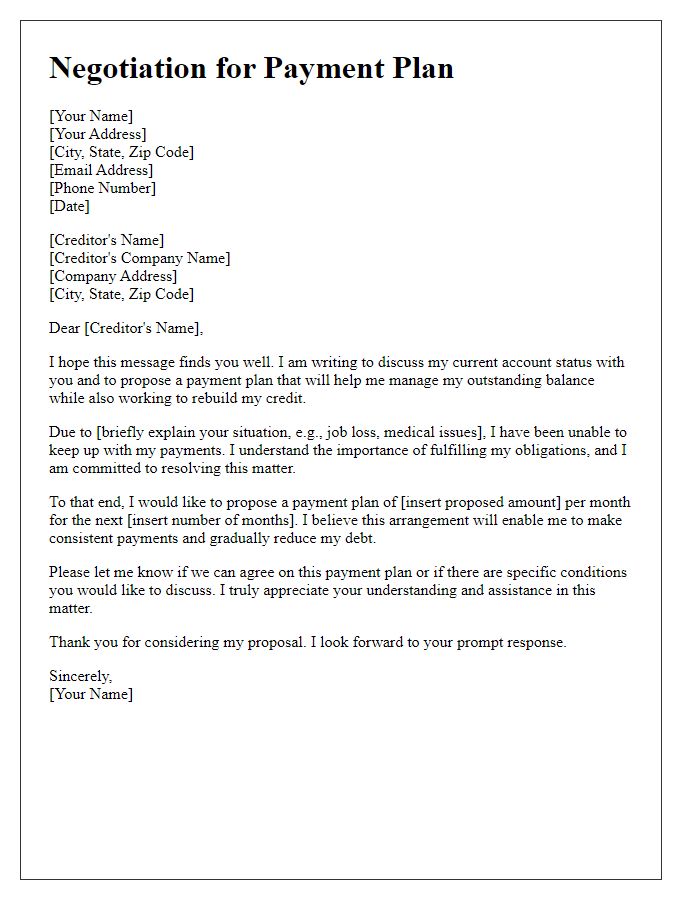

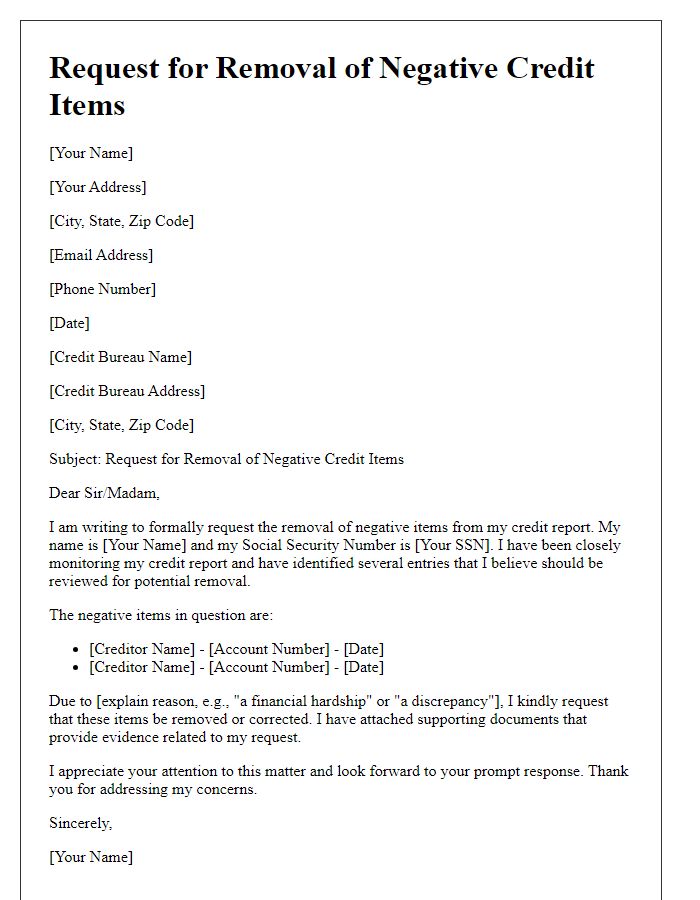

Request for positive credit reporting

Establishing a positive credit history is crucial for securing loans and favorable interest rates. Credit reports, maintained by agencies such as Experian, TransUnion, and Equifax, compile an individual's credit behavior, including payment history, credit utilization, and length of credit accounts. A positive credit report often results from consistent on-time payments, low credit card balances relative to limits, and a diverse array of credit types, such as installment loans and revolving credit accounts. Individuals with a negative credit history can improve their standing by engaging with creditors to request positive reporting, setting up payment plans, and disputing inaccuracies in credit reports. Persistent efforts can lead to a significant rise in credit scores, enabling access to better financial opportunities in the future.

Expression of commitment to future financial responsibility

Establishing a positive credit history requires diligent financial management and responsibility. A commitment to future financial responsibility can be demonstrated by making timely payments on loans and credit cards, which significantly contributes to a good credit score. Regular monitoring of credit reports from agencies like Experian, TransUnion, and Equifax helps identify inaccuracies and rectify them promptly. Maintaining a low credit utilization ratio (ideally below 30% of total available credit) is essential in showcasing responsible credit usage. Engaging in credit-building activities, such as secured credit cards or credit-builder loans, can further enhance creditworthiness. In the long term, consistently adhering to these practices not only fosters trust with lenders but also opens doors to better interest rates and terms on future borrowing.

Comments