Have you ever experienced the stress of a missed payment and its ripple effects? Understanding how this can impact your finances and credit score is crucial for maintaining your financial health. It's not just about the immediate consequences; the long-term repercussions can be significant as well. Join us as we delve deeper into the topic and explore actionable steps you can take to regain control over your financial situation.

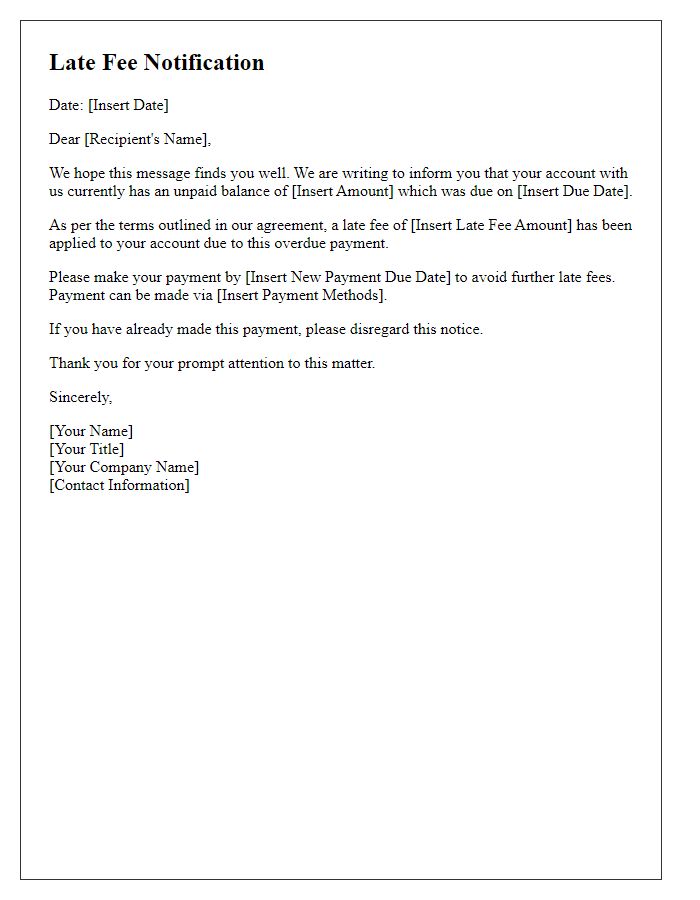

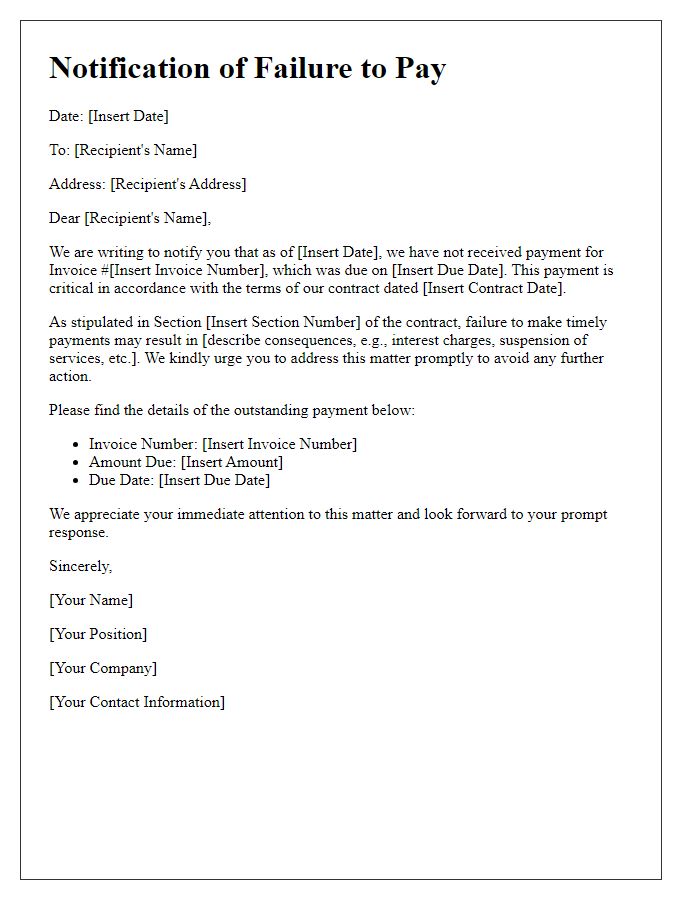

Precise account details and reference numbers.

Missed payments can lead to significant negative impacts, such as late fees or interest rate increases, which can escalate financial burdens. For instance, an account balance of $1,500 may incur a late fee of $50 after a missed payment due date of March 15, 2023. Additionally, a reference number like 123456789 helps in tracking the account for further billing inquiries. The lender (e.g., XYZ Financial Services) may also report the delinquency to credit bureaus, potentially lowering the credit score by 30 points over a period of six months. Continued missed payments can result in collections activity, which can hinder future financial opportunities, such as obtaining loans or credit cards.

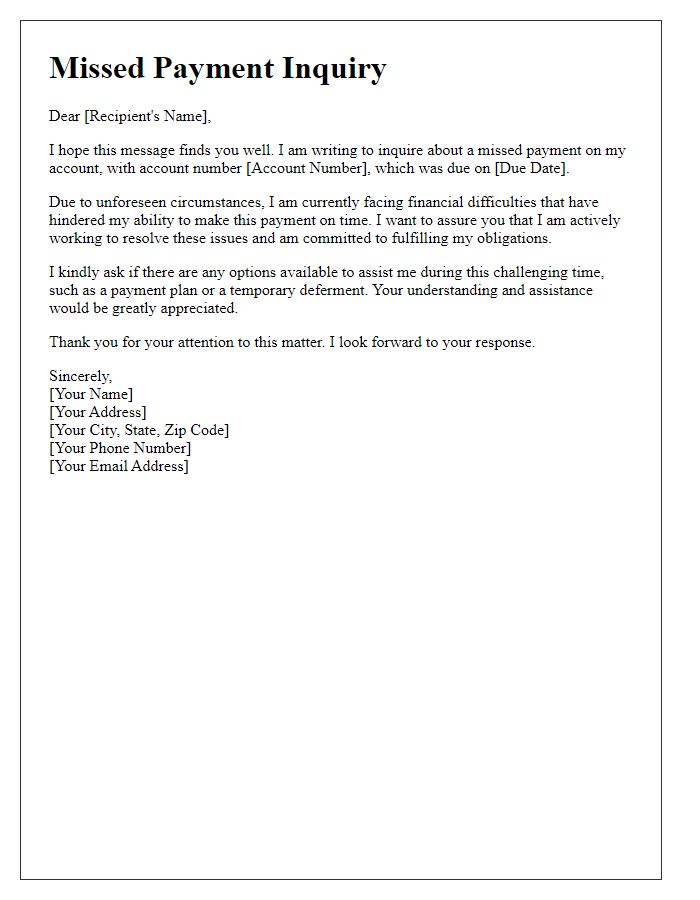

Clear description of the missed payment situation.

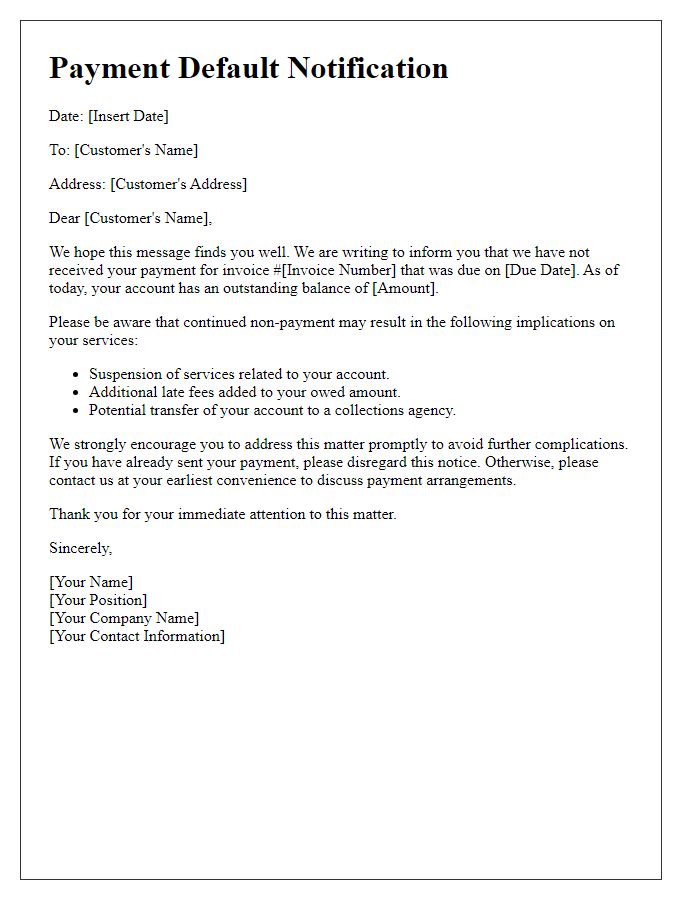

A missed payment situation can severely impact one's financial health and credit score. For instance, failing to make a monthly mortgage payment of $1,500 on time can lead to immediate penalties, such as late fees (often $50 to $100) and accrued interest on the remaining balance, further inflating total debt. If this situation continues for more than 30 days, lenders may report the missed payment to credit bureaus (like Experian, TransUnion, and Equifax), resulting in a potential drop in credit score of 100 points or more. This decline can hinder future borrowing opportunities, such as obtaining a car loan or a credit card, where higher interest rates may apply due to the perceived risk. Additionally, landlords and service providers may view the missed payment as a red flag, influence rental applications or service agreements negatively. Consequently, timely payments are crucial to maintain financial stability and a positive credit profile.

Impact on credit score or financial status.

Missed payments can significantly disrupt an individual's financial health and creditworthiness, leading to a decline in credit scores. Payment history accounts for approximately 35% of the FICO credit score calculation, meaning a single missed payment can lower scores by 50 points or more, depending on the individual's previous credit history. This negative impact persists for up to seven years on credit reports, affecting loan eligibility and interest rates on future borrowing. Additionally, late fees from creditors can compound financial burdens, straining budgets and potentially leading to chronic delinquency. Such repercussions can limit access to essential financial products like mortgages, car loans, and credit cards, ultimately hampering long-term financial stability.

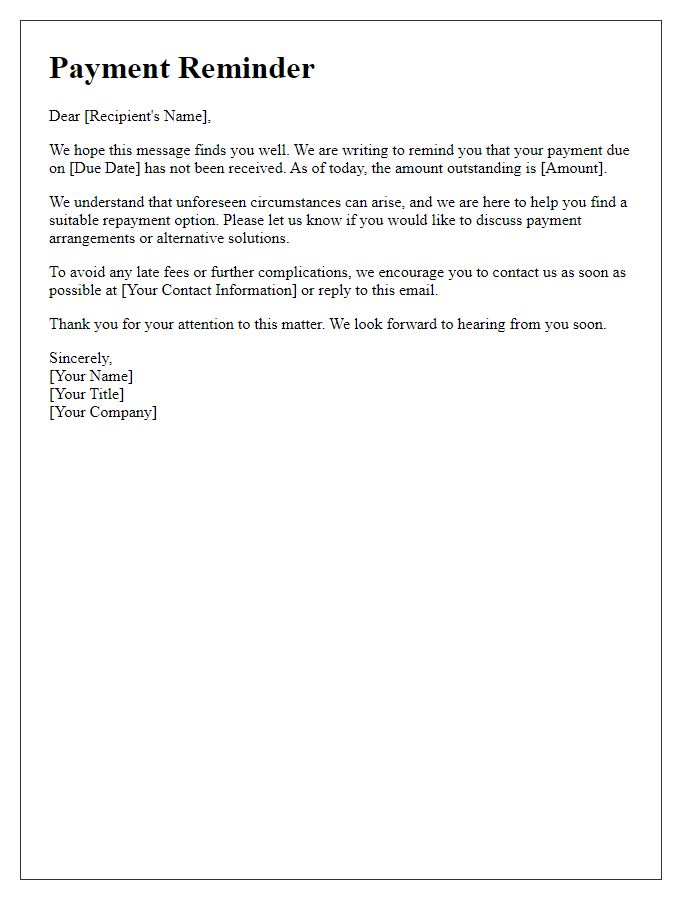

Requested resolution or action steps.

Late payments can significantly affect a business's cash flow, particularly for small businesses relying on timely client payments. A missed payment may lead to delayed project timelines, increased operational costs, or even strain relationships with vendors and suppliers. Clients, such as ABC Corporation, have been reminded multiple times regarding their invoice due on April 15, 2023, which has not been settled. To mitigate these impacts, immediate payment processing is requested, along with clear communication on the cause of the delay. Future steps might include setting up automated reminders for payment due dates and implementing stricter payment terms in contracts to ensure timely payments.

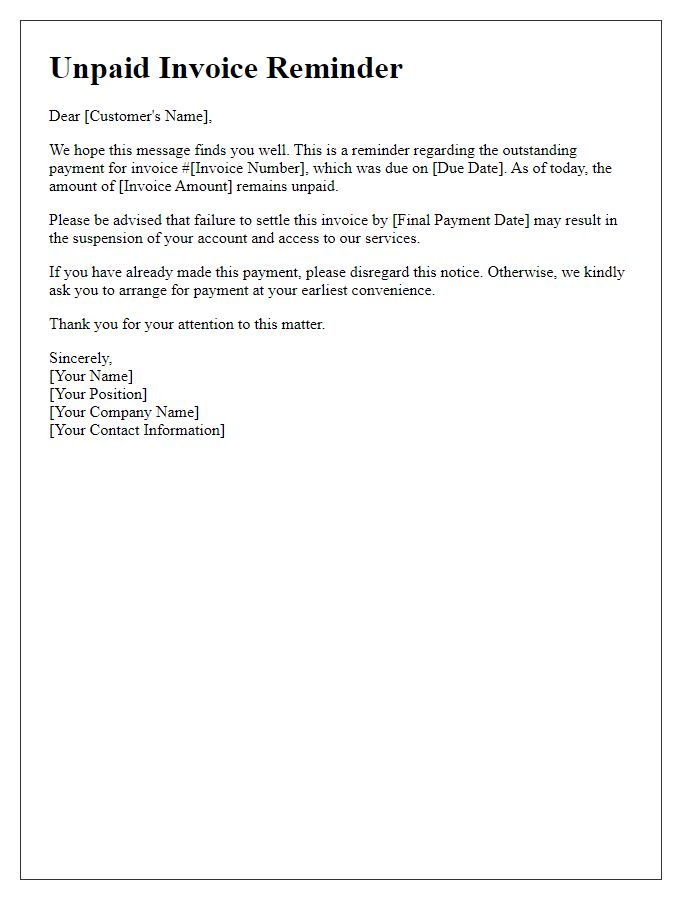

Contact information for further communication.

Missed payments can lead to negative consequences for consumers' credit scores, financial stability, and future borrowing capabilities. Late payment histories can remain on credit reports for up to seven years, affecting future loan applications, mortgage approvals, interest rates, and overall financial health. Immediate communication regarding missed payments is crucial for resolving issues, outlining payment plans, or avoiding further penalties. Service providers or lenders often provide specific contact information, such as dedicated customer service lines or email addresses, to facilitate effective communication and mitigate the impact of missed payments on a consumer's financial trajectory.

Comments