If you've ever experienced the hassle of a credit freeze, you know it can be a bit daunting to lift it. Whether it's for applying for a new loan or simply needing access to your credit report, understanding the process can make all the difference. In this article, we'll walk you through a simple letter template that will help you efficiently lift your credit freeze. So, grab a cup of coffee and let's dive in to make this task a breeze!

Personal Identification Information

Lifting a credit freeze involves providing personal identification information to ensure security and proper identification. Key documents include Social Security Number (typically nine digits), full legal name (first, middle, last), date of birth (format MM/DD/YYYY), and current residential address (street, city, state, ZIP code). Additional identifiers could comprise phone numbers (home, mobile) and email addresses. Institutions like Equifax, TransUnion, or Experian may also request a unique PIN or password generated during the credit freeze process to authorize the lifting. Timely submission ensures smoother processing for individuals seeking access to their credit reports for new applications or financial transactions.

Credit Bureau Details

Lifting a credit freeze can provide access to credit reports, allowing individuals to secure loans or mortgages. Credit bureaus like Equifax, Experian, and TransUnion maintain these reports. The process typically involves contacting the specific bureau by phone or online portal, requiring a personal identification number (PIN) or password created during the freeze process. Additionally, individuals need to provide personal information such as full name, social security number, and date of birth, along with any specific details regarding their freeze request. Timely lifting of such freezes, generally within minutes to a day, supports financial transactions and credit applications.

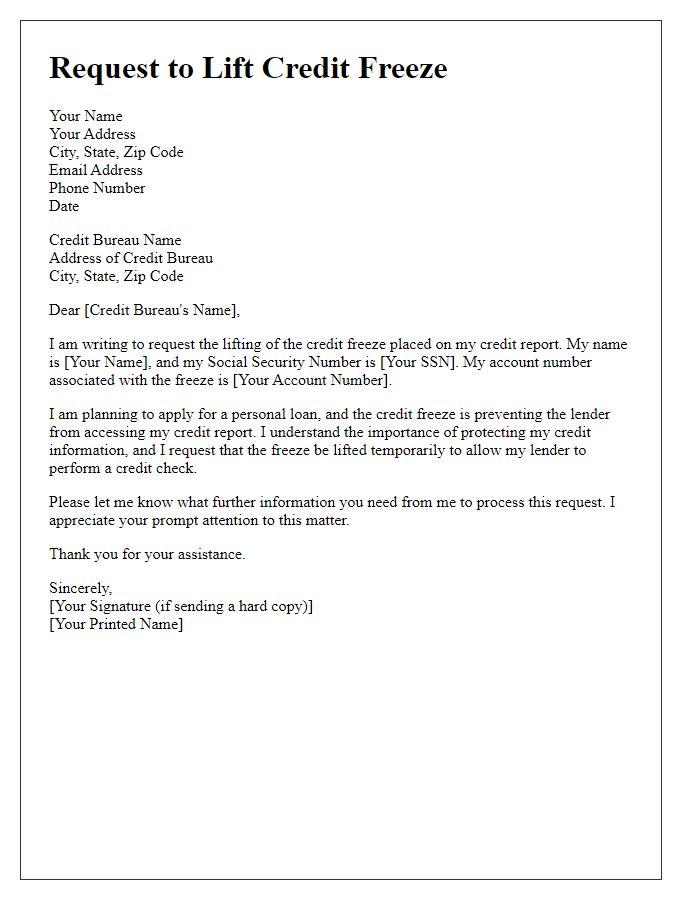

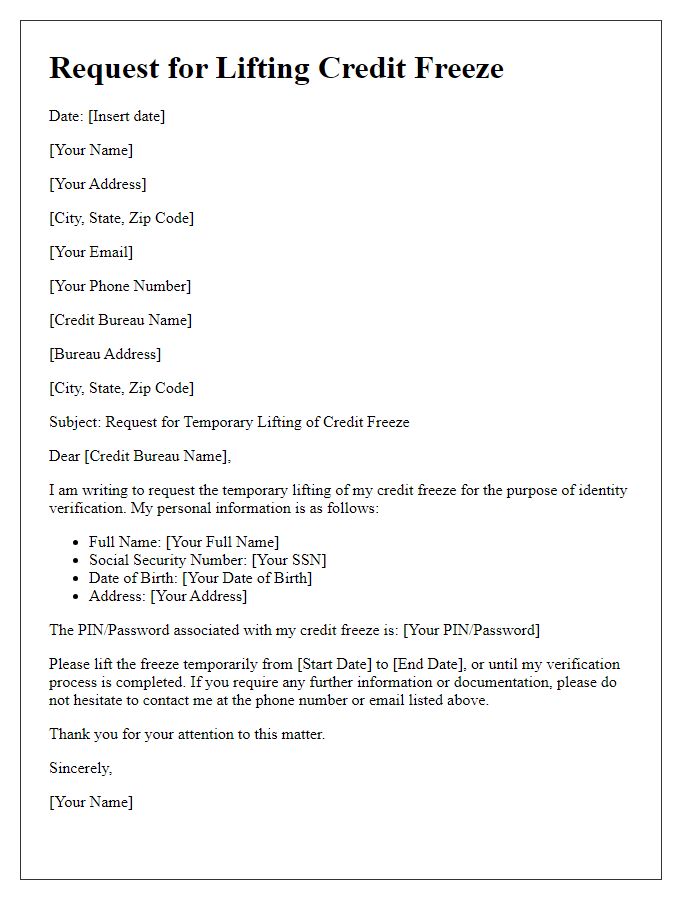

Request Statement for Lifting Freeze

To lift a credit freeze, individuals must submit a request to credit bureaus such as Equifax, Experian, or TransUnion. Each bureau requires specific identifying information: full name, address, Social Security number, and date of birth. Additionally, individuals must provide a unique PIN or password obtained when the freeze was initially established. This process is critical for financial security as it permits authorized access to credit reports, facilitating loan approvals or new credit accounts. Fees associated with lifting a credit freeze may vary by state and bureau, though many jurisdictions allow one free access per year. Speed of processing typically ranges from immediate online requests to several days for mailed forms, highlighting the importance of advance planning for time-sensitive financial needs.

Contact Information and Signature

A credit freeze can significantly impact an individual's ability to access new credit accounts. To lift a credit freeze, individuals must contact the three major credit bureaus: Experian, Equifax, and TransUnion, each maintaining unique protocols. Personal identification details such as Social Security number, date of birth, and current address are crucial for verification. The process often requires a PIN or password created during the initial freeze setup, ensuring that only the account holder has the authority to lift the freeze. It is important to note that processing times may vary, with some requests being fulfilled instantly online, while others may take several days via mail. Proper adherence to each bureau's specific requirements can facilitate a smoother lifting process.

Supporting Documentation

To lift a credit freeze, the process requires specific supporting documentation. Individuals must provide personal identification such as a government-issued photo ID, like a driver's license or passport, ensuring proof of identity. Additionally, a Social Security number (SSN) or card may be required to verify personal data. In certain situations, recent utility bills or bank statements that display the person's name and address can further substantiate the request. Furthermore, unique PIN codes or passwords received during the initial freeze process, usually issued by credit bureaus such as Experian, TransUnion, or Equifax, are essential to facilitate the lifting procedure. This documentation guarantees secure and timely access to credit reports, allowing individuals to obtain loans or credit cards without delay.

Letter Template For Lifting Credit Freeze Samples

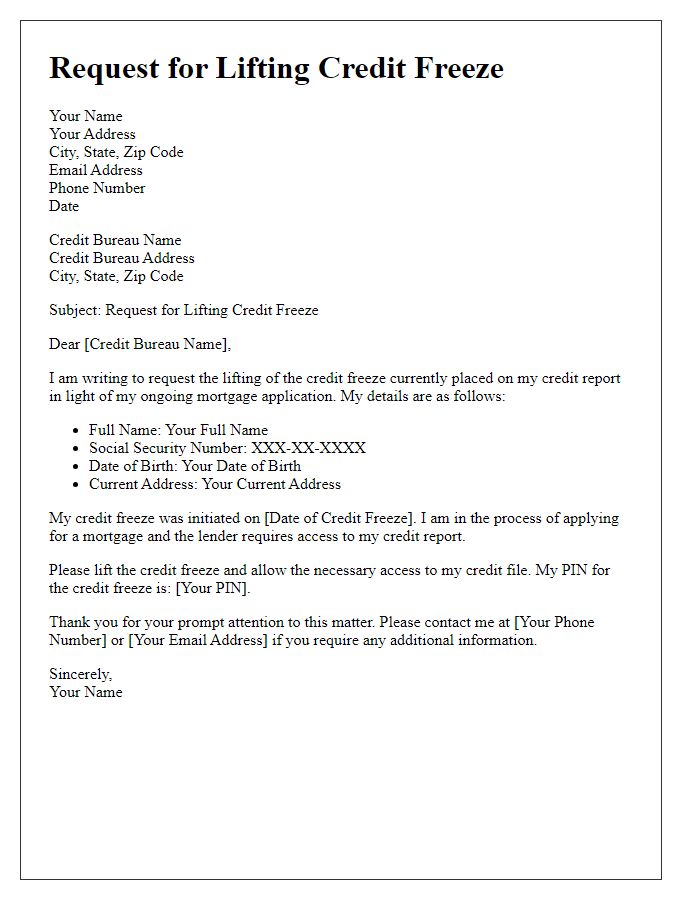

Letter template of request for lifting credit freeze due to mortgage application.

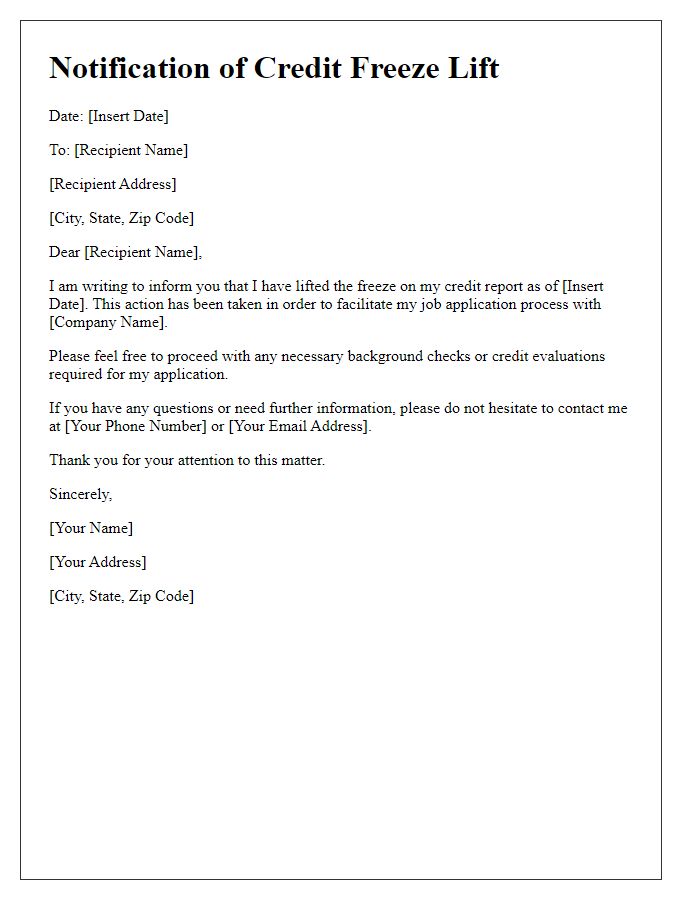

Letter template of notification for lifting credit freeze for job application.

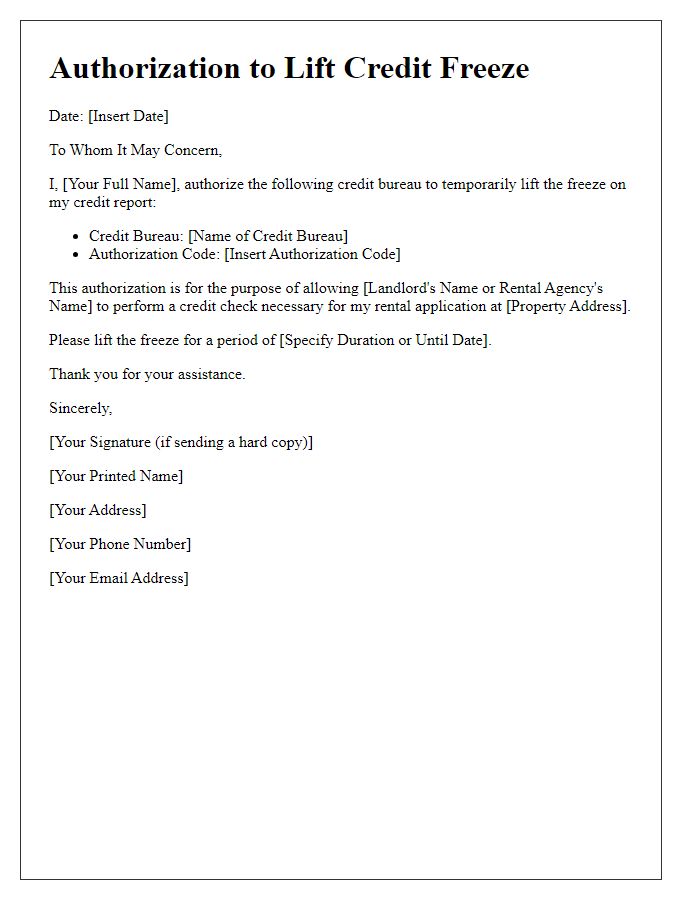

Letter template of authorization to lift credit freeze for rental approval.

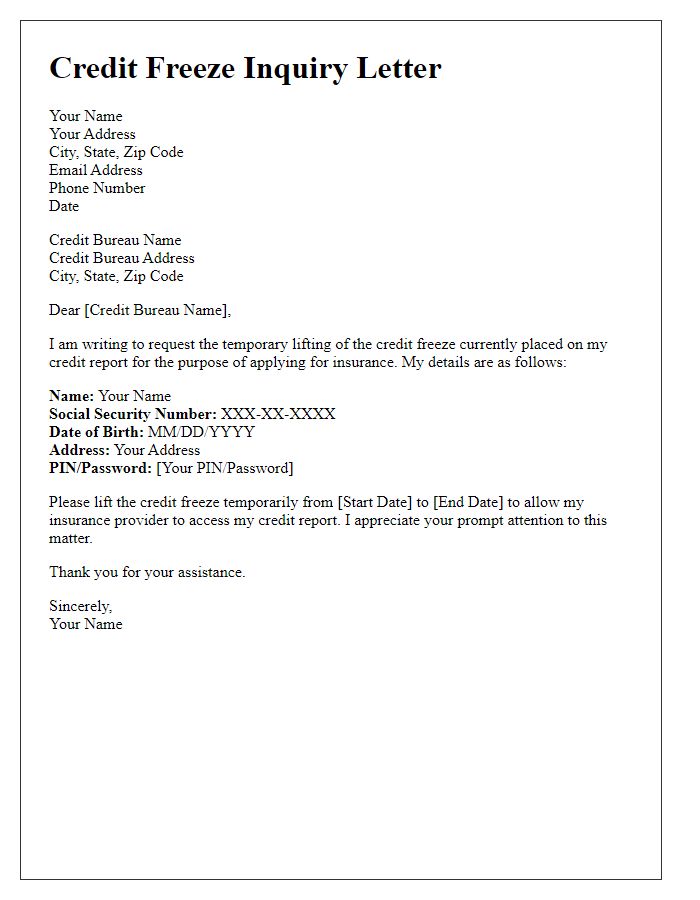

Letter template of inquiry for lifting credit freeze for insurance purposes.

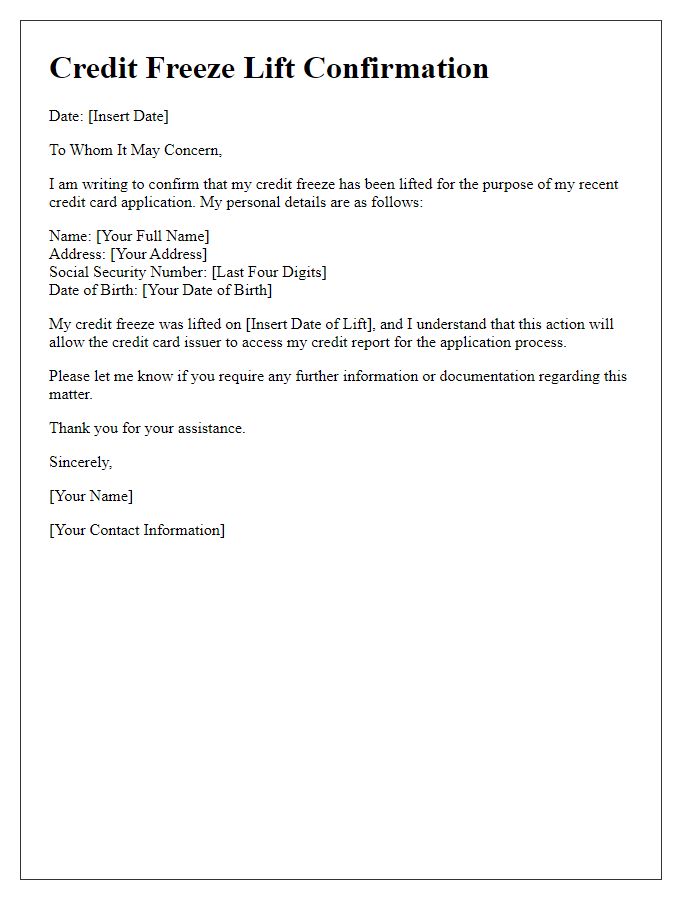

Letter template of confirmation for lifting credit freeze for credit card application.

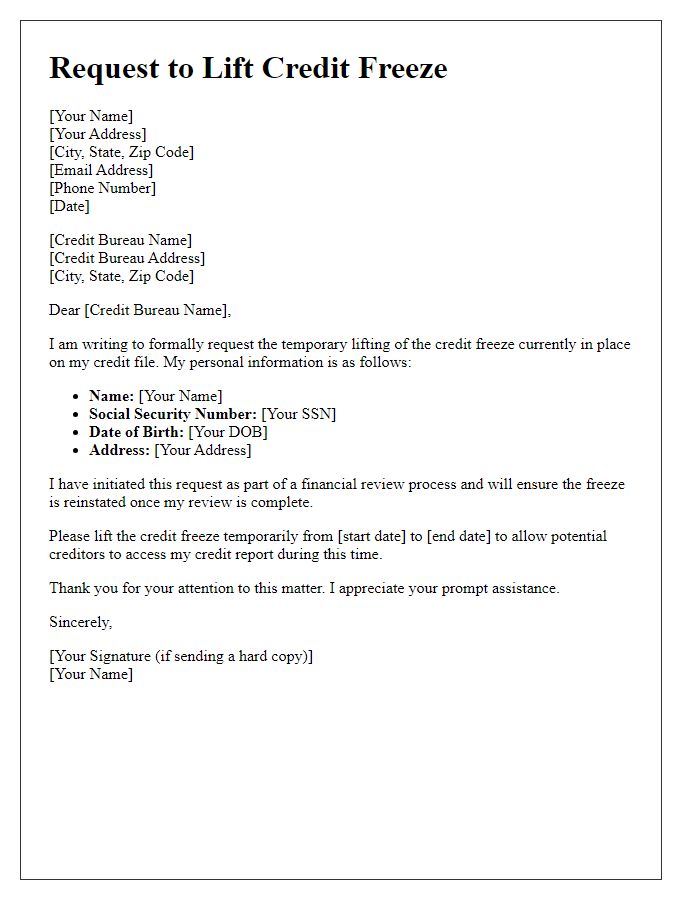

Letter template of formal request to lift credit freeze for financial review.

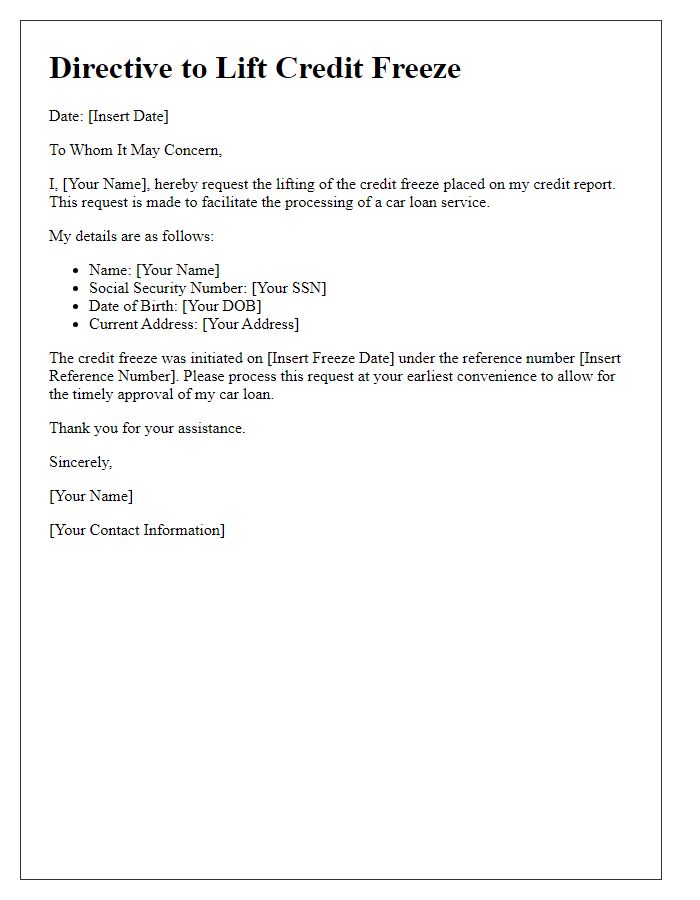

Letter template of directive for lifting credit freeze for a car loan service.

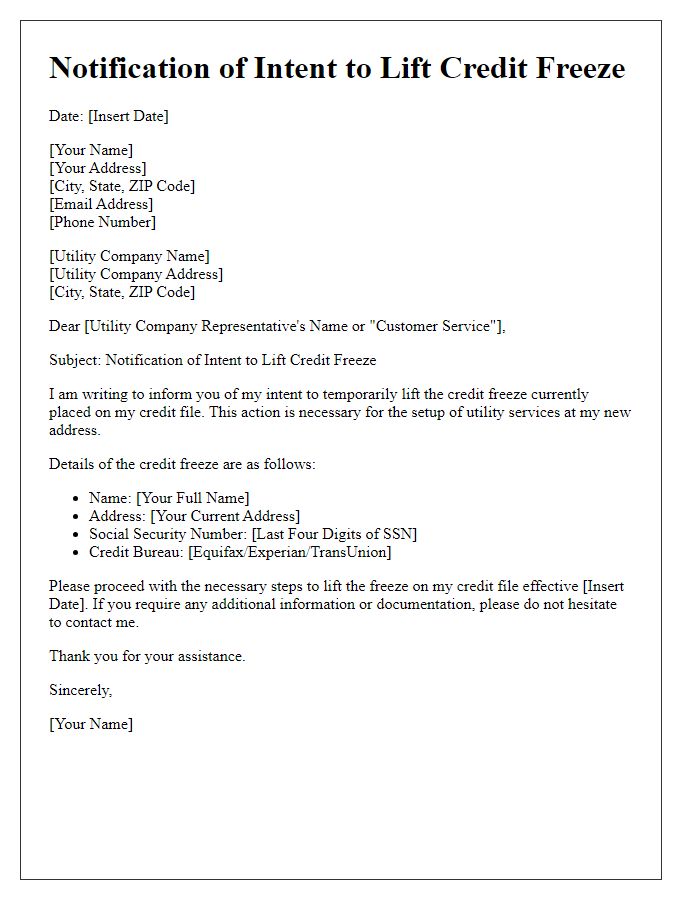

Letter template of notification of intent to lift credit freeze for utility service setup.

Comments