Have you ever found yourself wondering what to do with that outdated credit account still lingering on your financial records? It can be confusing and, at times, a little overwhelming, but closing these accounts is often a smart move for your financial health. In this article, we'll guide you through the process of drafting a letter to close your outdated credit accounts, ensuring you maintain a good credit score while decluttering your financial life. Ready to simplify your financial situation? Let's dive in!

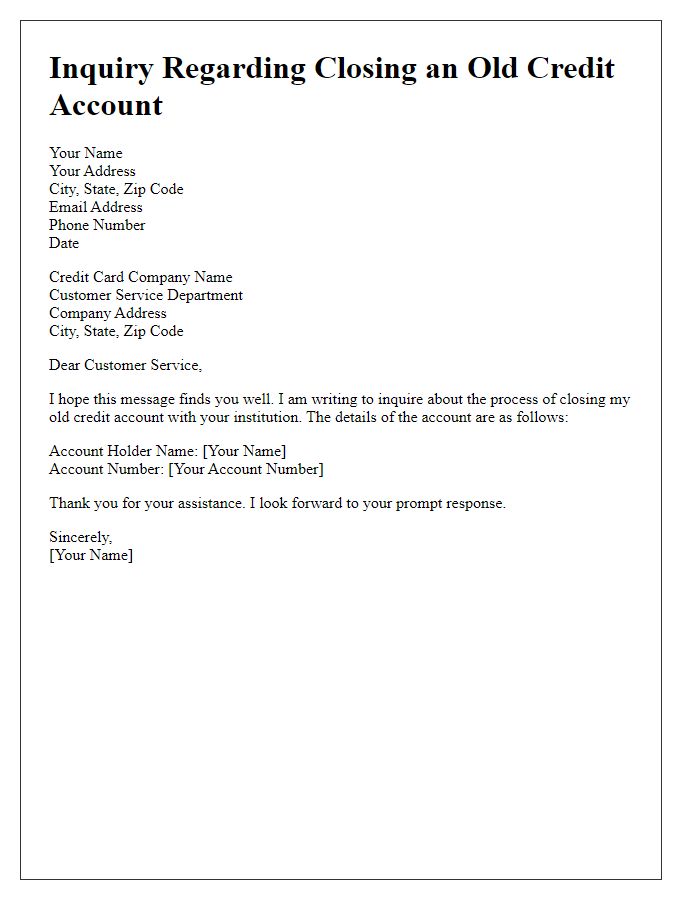

Account Holder Information

Outdated credit accounts can negatively impact one's credit score and financial standing. Timely closure of these inactive accounts is essential. Account holder information includes the individual's name, associated account number, and last known address. Specific details such as the date of account opening and the total outstanding balance at closure can provide clarity. A proper closure process helps ensure that the credit reporting agencies reflect accurate financial history, paving the way for better credit opportunities in the future. Regular monitoring of credit reports after closure is advisable to confirm the account's status.

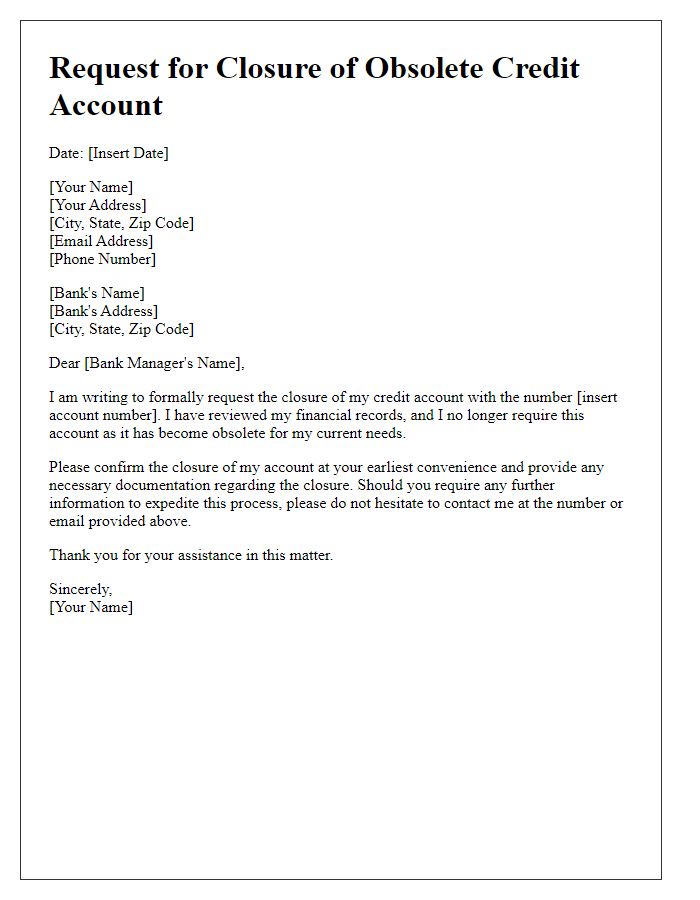

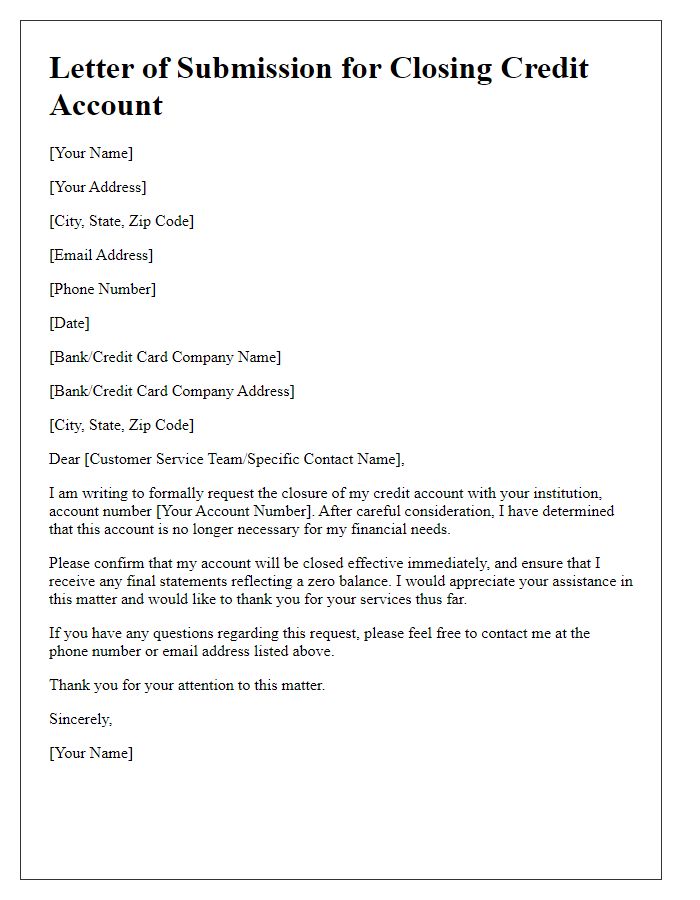

Account Details and Closure Request

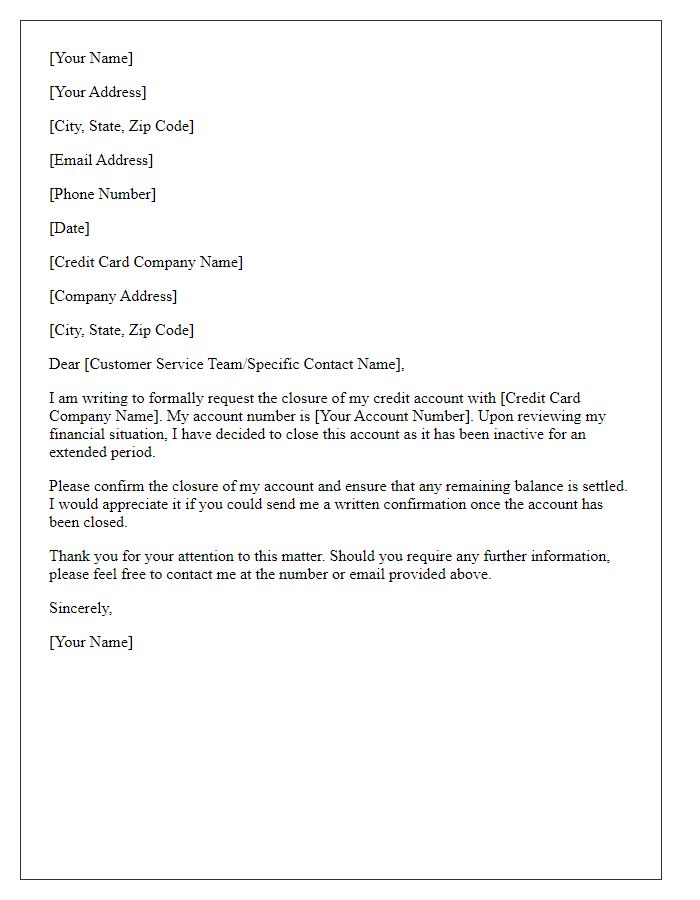

Outdated credit accounts can negatively impact an individual's credit score, particularly if they remain active despite inactivity. Closure requests should include specific account information such as the account number, institution name (e.g., Chase Bank, Capital One), and the request date. Consumers must also mention the reasons for the closure, such as reducing credit utilization or addressing identity theft concerns. A formal tone, along with a clear request for written confirmation of the account closure, is essential. Tracking the correspondence and confirming the effective closure date will help maintain accurate financial records.

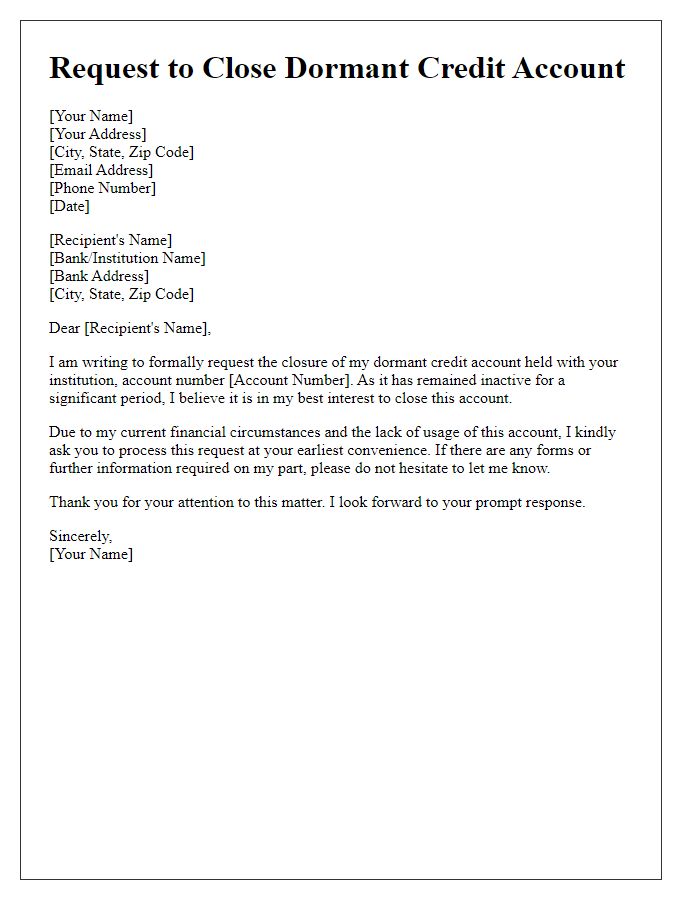

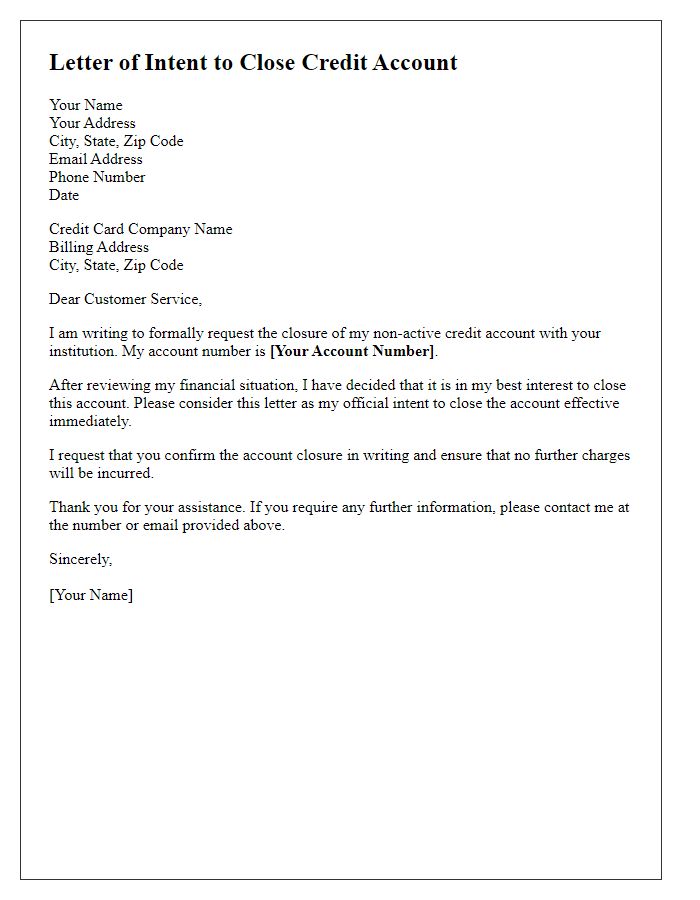

Intent to Close Account

A proactive approach to managing finances includes addressing outdated credit accounts, which may affect credit scores and financial health. Credit accounts, particularly credit cards issued by major banks like Citibank or Chase, must be evaluated regularly for relevance. Communicating with the credit provider regarding the intent to close an account can be necessary to prevent unwanted annual fees or identity theft. A written notice of intent should include specific details such as the account number, the account holder's name, and a request for confirmation of closure. Additionally, it is advisable to check the impact of closure on credit utilization ratio, as closing long-standing accounts may inadvertently decrease overall credit history length. Moving forward, maintaining an updated record of active accounts can enhance financial management practices.

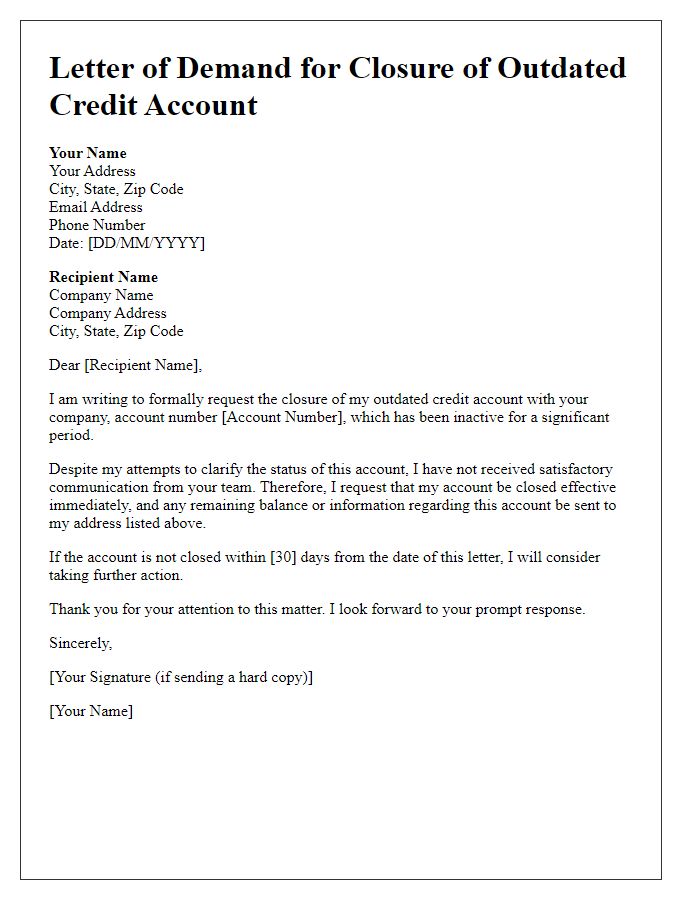

Reason for Closure

An outdated credit account closure can significantly impact financial health, particularly if the account is no longer actively used. Accounts, such as those from major credit issuers like Visa or MasterCard, may become inactive after several months of non-usage, typically defined as six to twelve months. This inactivity can lead to a decline in the overall credit score, as credit utilization ratios shift with fewer accounts contributing positively. Furthermore, closing older accounts removes the history associated with them, which is crucial for demonstrating responsible credit management over time. Additionally, specific reasons for closure, such as a lack of competitive rewards programs or high annual fees, can further justify the decision. Always consider the long-term implications of closing credit accounts, as they can vary significantly based on individual credit history and overall financial strategy.

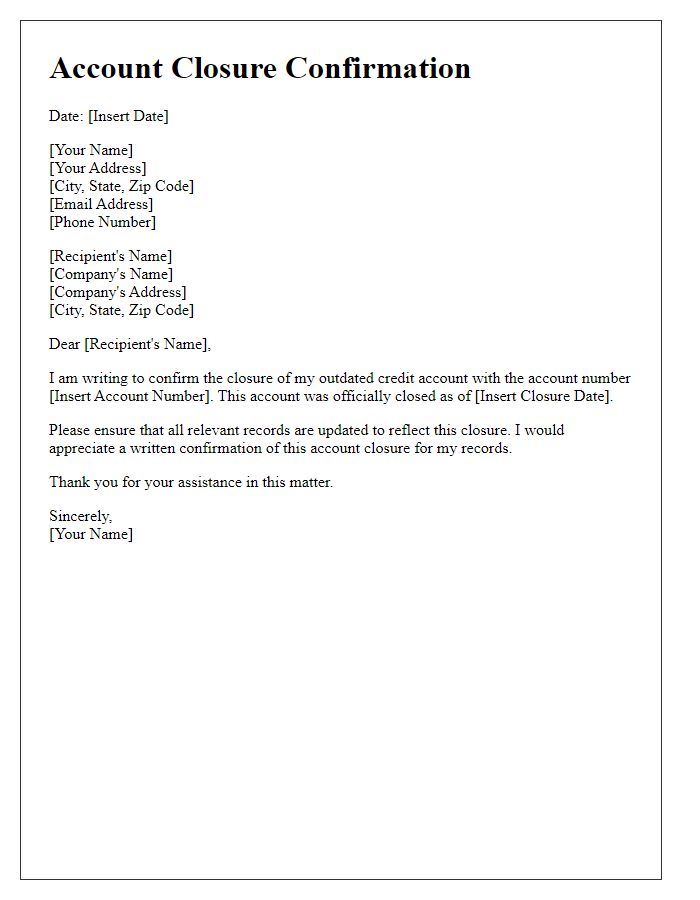

Request for Confirmation

Outdated credit accounts can impact credit scores and financial health significantly. These accounts, often inactive for several years, may appear on credit reports and confuse lenders. Requesting confirmation for closure of such accounts ensures clarity in financial records. In many cases, accounts opened before 2015, particularly with high-interest rates, may need closure to streamline finances. Sending a formal request to credit issuers, especially major companies like Capital One or Discover, confirms account status and helps prevent identity theft. Maintaining updated credit reports, checked through services like AnnualCreditReport.com, is essential for overall financial well-being.

Letter Template For Outdated Credit Account Closure Samples

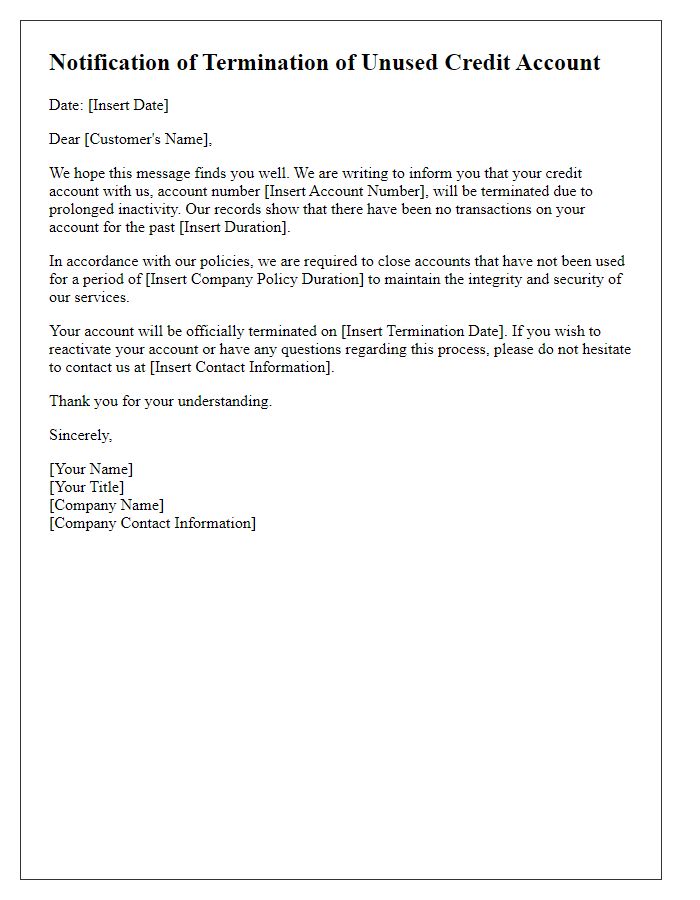

Letter template of notification for termination of unused credit account

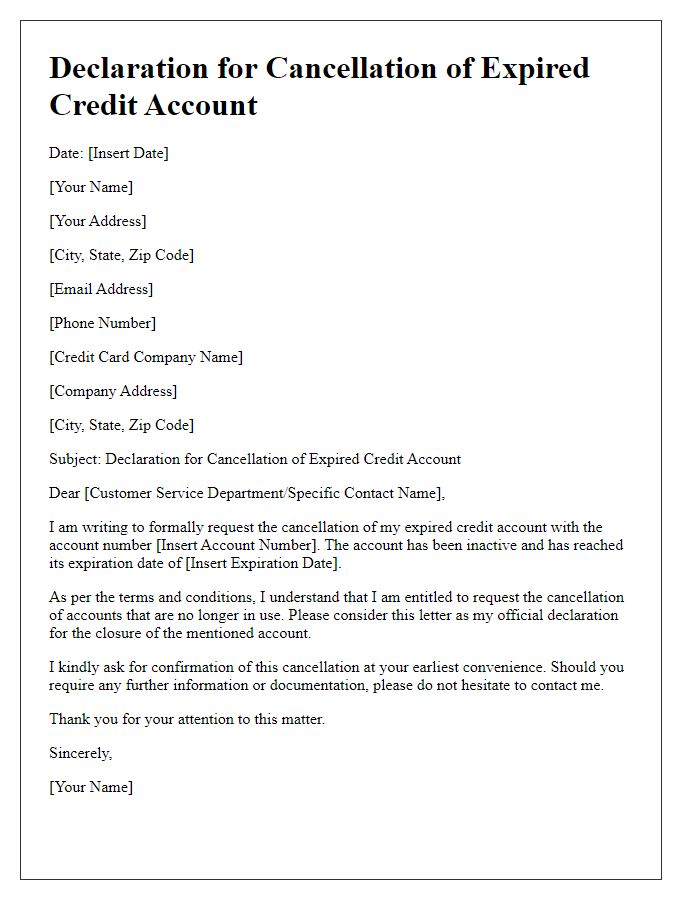

Letter template of declaration for cancellation of expired credit account

Comments