Are you feeling overwhelmed by unexpected debt amounts? It's crucial to address any discrepancies promptly to avoid unnecessary stress. In this article, we'll provide you with a straightforward letter template that will help you communicate effectively with creditors about correcting those incorrect debt figures. So, let's dive in and ensure you have the right tools to take control of your financial situation!

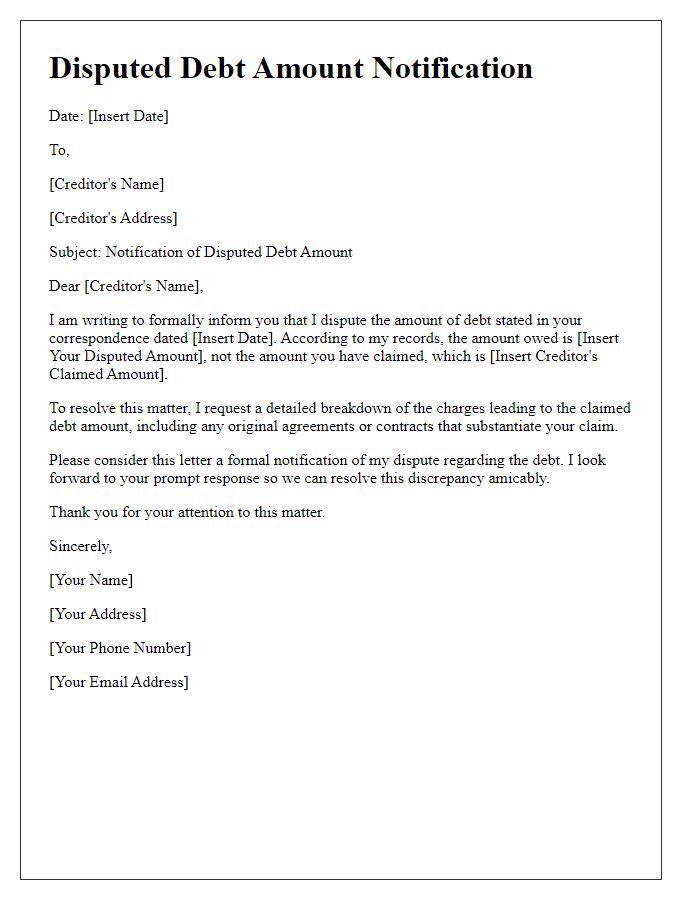

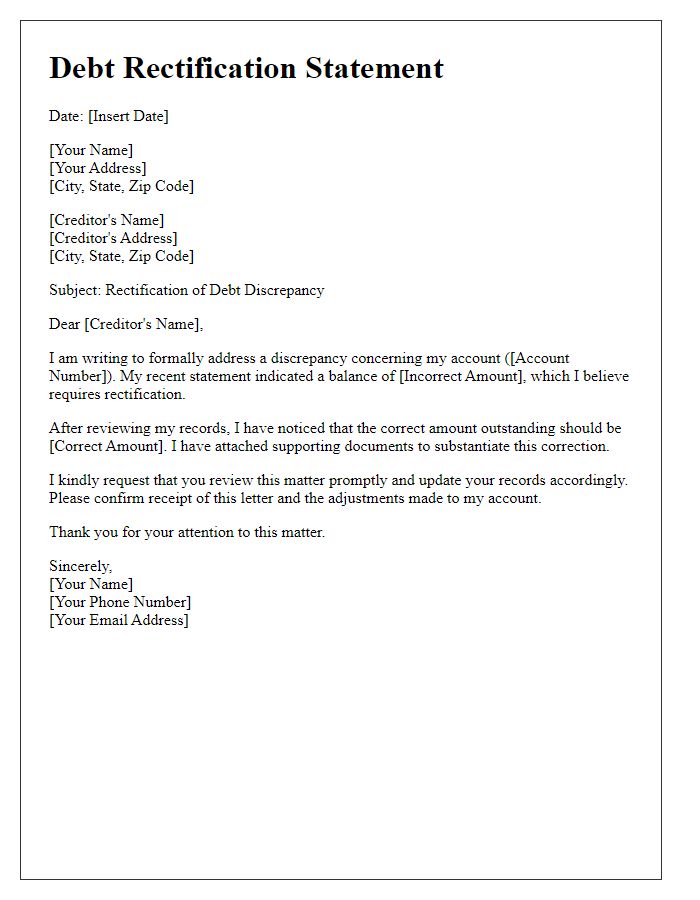

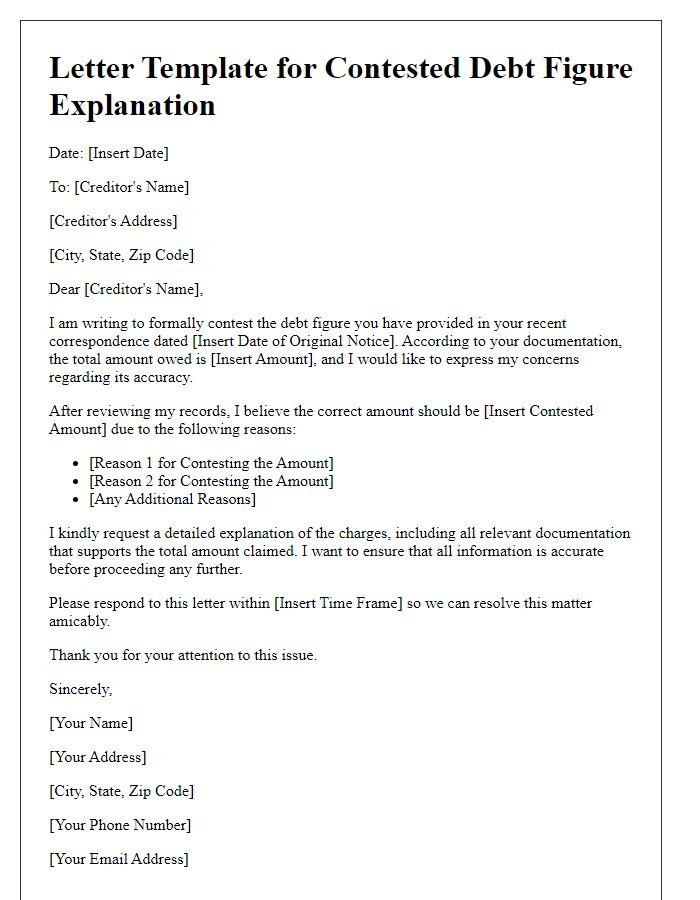

Creditor's contact information.

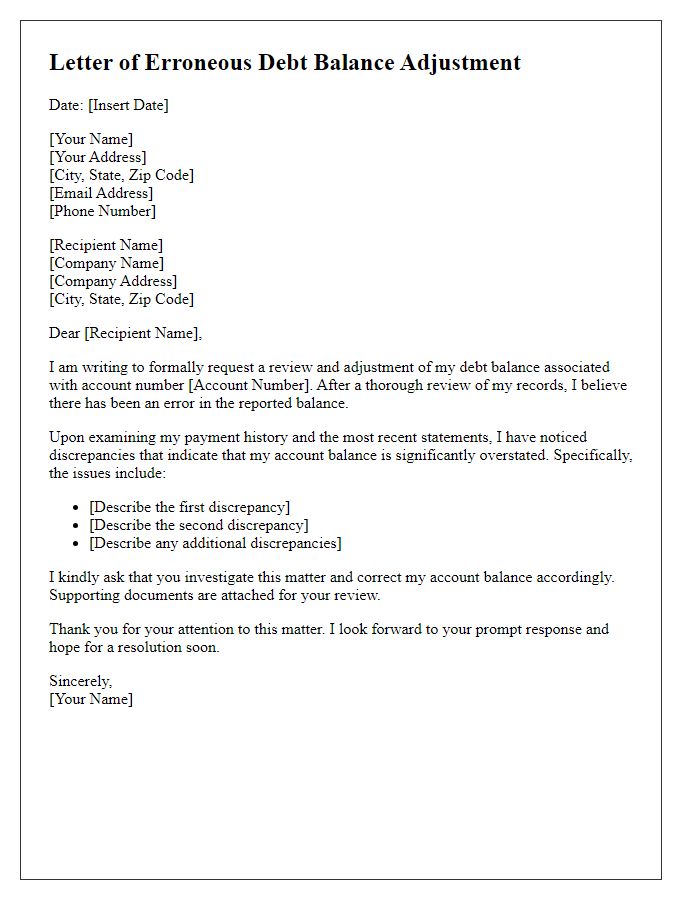

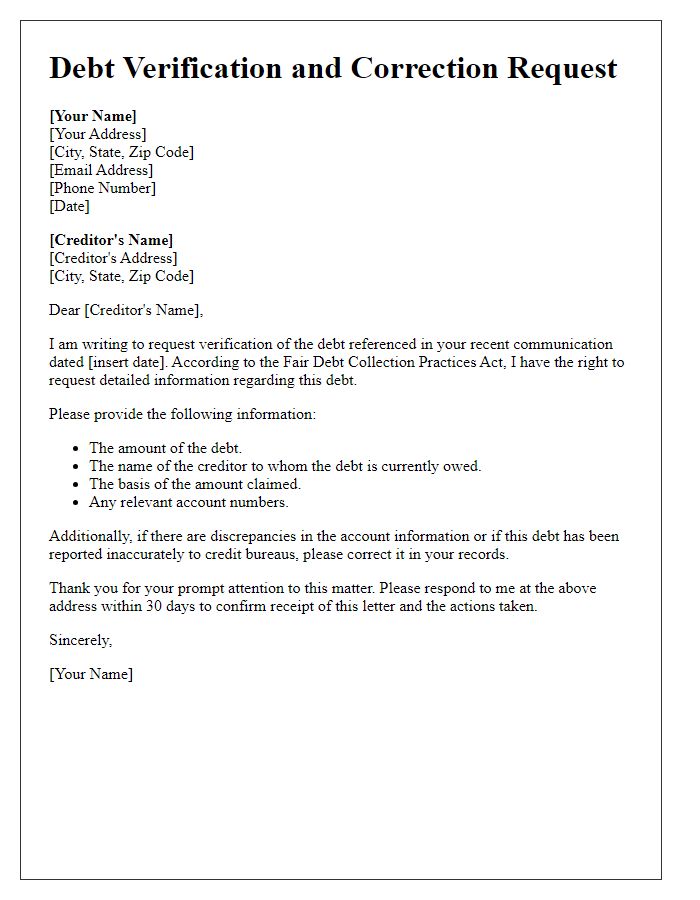

Resolving inaccuracies regarding debt amounts involves contacting the creditor directly. It's essential to gather all pertinent information related to the debt, including the account number, original amount owed, and any documentation that supports the claim of incorrectness. The creditor's contact information typically includes the official name of the lending institution (such as Bank of America or Experian), phone number (often found on monthly statements), email address, and physical mailing address (usually located on the creditor's website or billing statements). Clear communication with the creditor is crucial to rectify the discrepancy, so ensure all details are accurate and coherent while providing the necessary proof.

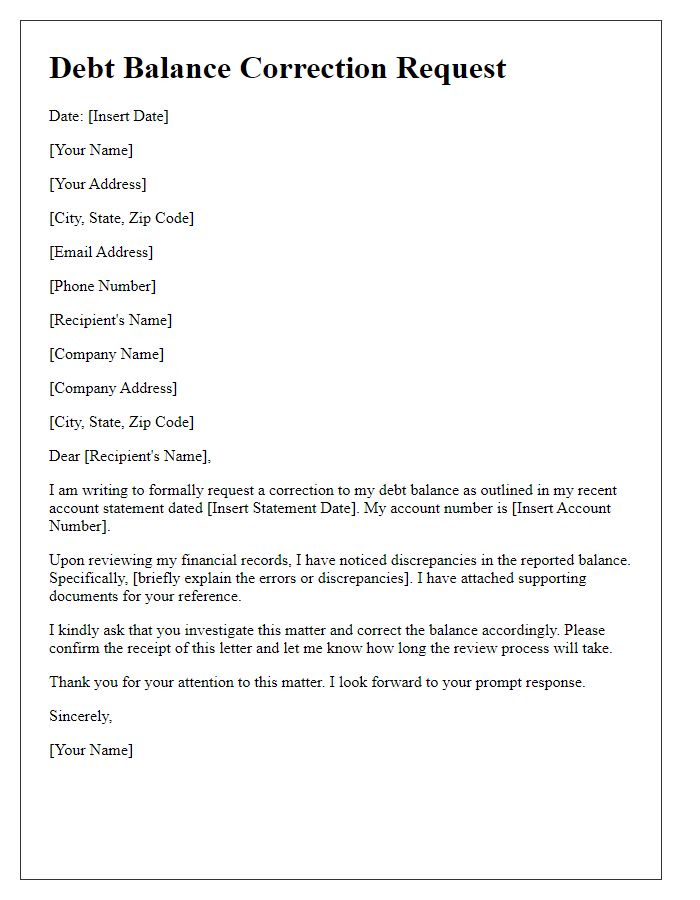

Accurate account details.

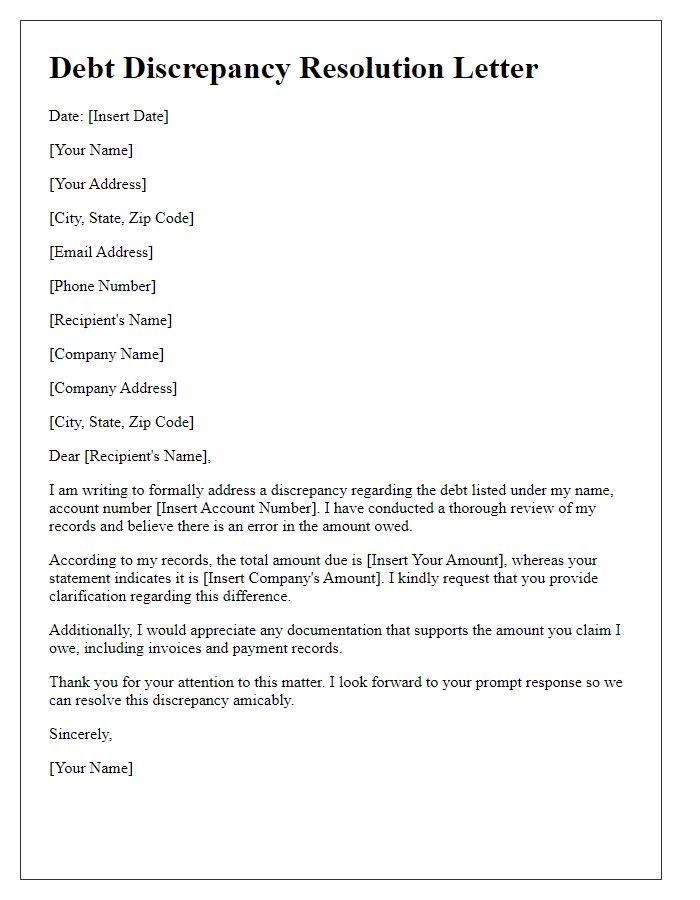

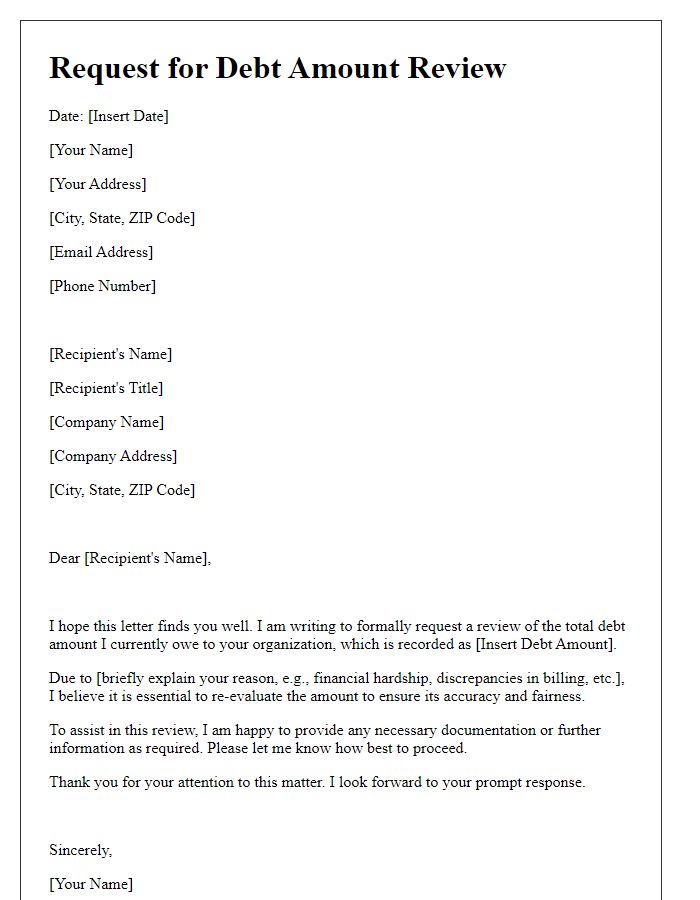

Inaccurate debt amounts can lead to significant financial distress for individuals. For example, a consumer might receive a notice claiming a debt of $15,000 from a third-party collections agency, when the actual outstanding amount is only $6,500. Ensuring accurate account details is crucial, as discrepancies in figures can result from clerical errors, wrongful reporting, or miscommunication among various financial institutions. It is essential to review documentation, including account statements from banks or credit providers, and to cross-reference these figures with original loan agreements to clarify true debt obligations. Addressing these inaccuracies promptly helps prevent potential damage to credit scores and legal complications.

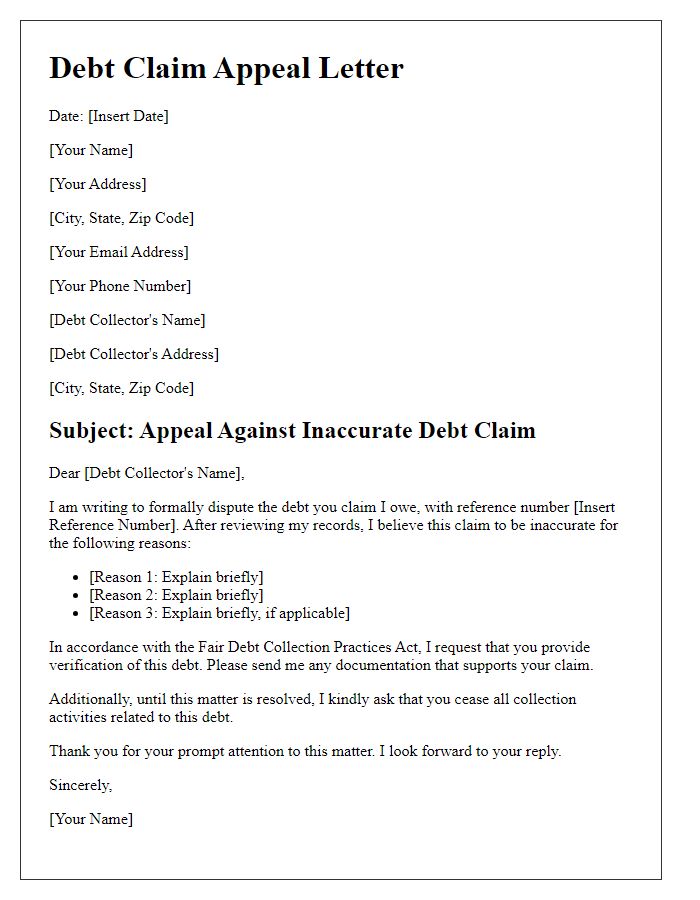

Description of the error.

A common issue with credit reports is the incorrect debt amount reported by financial institutions, which can mislead consumers regarding their creditworthiness. For instance, a debt of $1,500 may be inaccurately recorded as $2,500, significantly affecting an individual's credit score. Errors can arise from various sources, including clerical mistakes, outdated information, or miscommunication between lenders and reporting agencies. Such discrepancies can lead to difficulties in securing loans or opening credit accounts. Individuals reviewing their reports should meticulously verify each entry, particularly focusing on the amounts listed, to ensure accuracy before addressing the reporting agency with detailed evidence to rectify the situation.

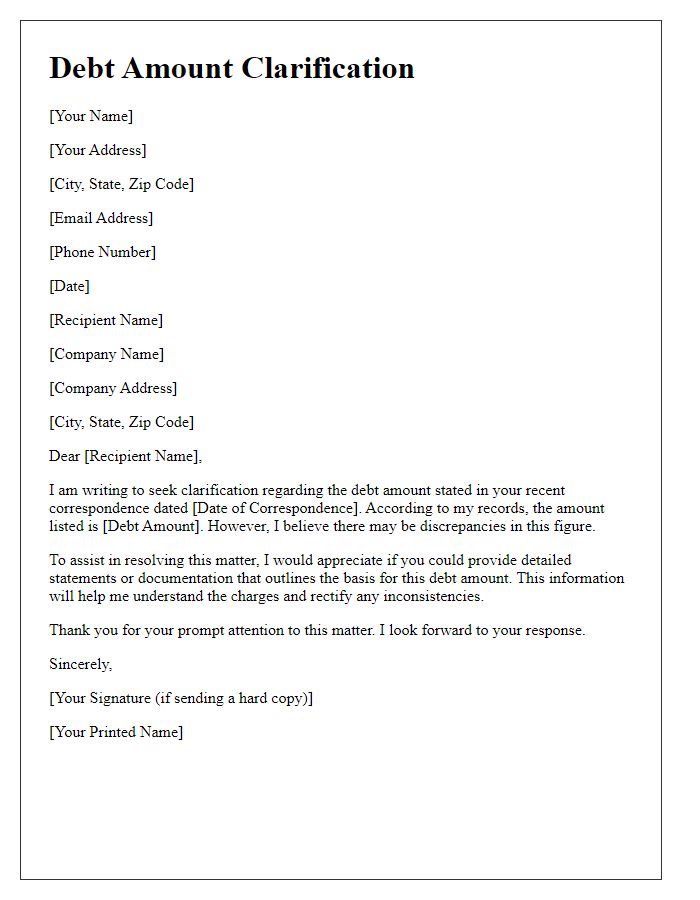

Correct debt amount with proof.

In a formal communication regarding discrepancies in debt amounts, it is crucial to reference the specific debt, detailing the originally stated figure and the corrected amount. For instance, a mortgage debt from XYZ Bank, originally listed at $15,000, requires correction to the actual figure of $12,000, supported by documentation such as bank statements or payment confirmations. This ensures transparency and provides the creditor with a basis for adjusting records. Including relevant account numbers and dates of transactions reinforces the legitimacy of the claim, facilitating a prompt and accurate resolution to the matter.

Request for confirmation of correction.

Incorrect debt amount can lead to significant discrepancies in financial records, causing confusion for both creditors and debtors. Disputes can arise when the reported amount differs from the actual balance due, highlighting the importance of accurate record-keeping. In situations where mistaken amounts are reported, it is crucial to seek confirmation from relevant financial institutions or collection agencies regarding the corrected figures. Providing supporting documentation, such as recent statements (dated within the last 30 days), can expedite the verification process. Proper resolution of discrepancies not only restores accurate financial standing but also preserves the integrity of one's credit history.

Comments