Have you ever found yourself in a tough spot needing a little financial help, only to face a loan application denial? It can be disheartening, but there's still hope! Crafting a compelling letter for loan application reconsideration can often open doors that seemed shut. If you're curious about how to effectively present your case and increase your chances of approval, read on for some helpful tips!

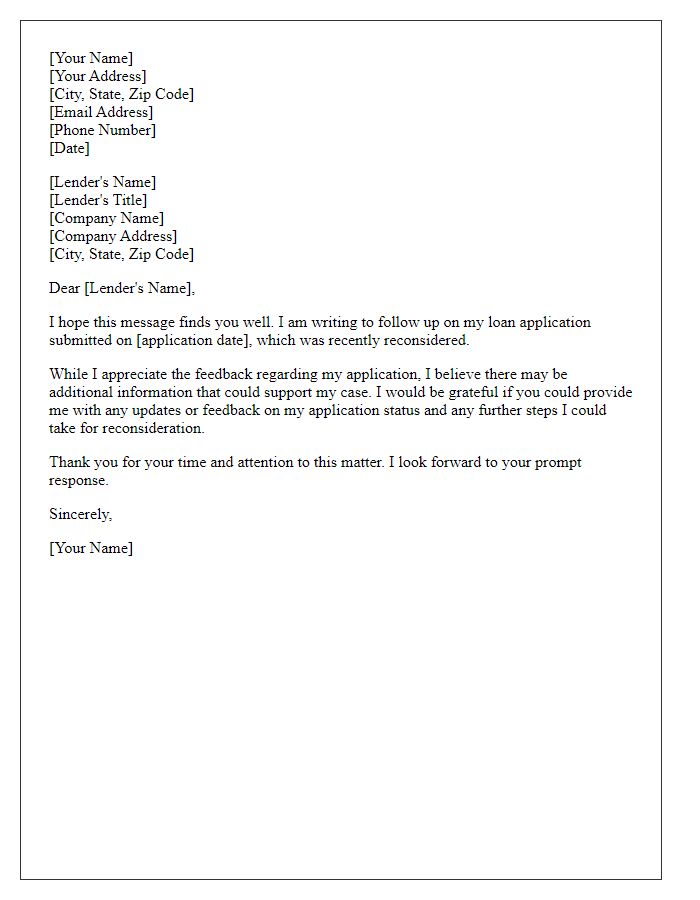

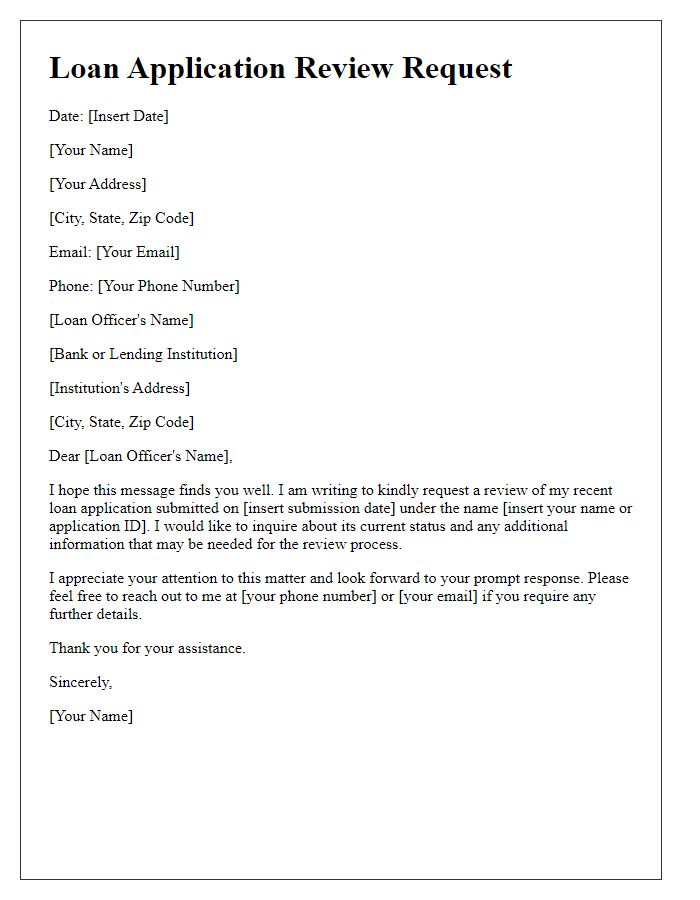

Personal Information

A reconsideration request for a loan application often requires detailing personal information to support the case. This includes full name, residential address (such as 123 Maple Street, Springfield), contact number (like 555-1234), and email address. Additional financial details may also be necessary, such as annual income (for instance, $65,000), current employment status (full-time at ABC Corporation since 2021), credit score (e.g., 720, indicating good credit), and details of existing debts or obligations (like a car loan of $15,000 remaining). Including supporting evidence of financial stability and a clear rationale for the reconsideration, such as recent increases in income or improved financial circumstances since the initial application, can further strengthen the request.

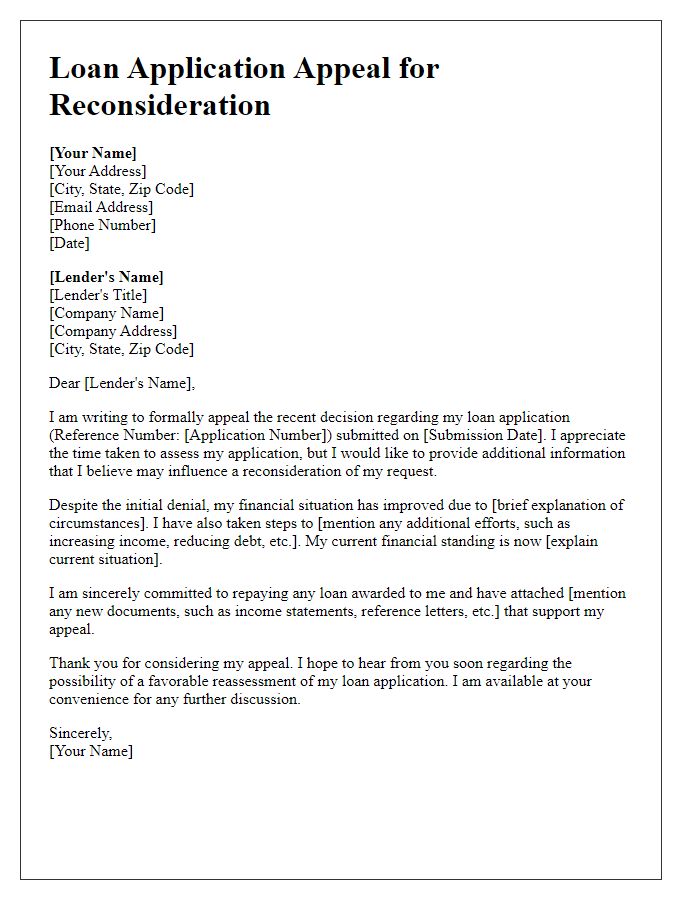

Loan Details

A loan application reconsideration process requires detailed information about the loan itself, such as the loan amount requested (often ranges from $1,000 to $500,000 depending on the lender), the purpose of the loan (such as home purchase, business expansion, or education expenses), and the loan type (conventional, FHA, or VA loans). The applicant typically includes their credit score (ranging from 300 to 850) to illustrate their creditworthiness, along with employment history detailing positions held and income verification (such as pay stubs or tax returns from the past two years). Additional notes may encompass the lender's previous decision rationale and any changes in financial circumstances (like recent raises or debt reduction), enhancing the reconsideration argument for approval. The location can also play a crucial role, as housing markets in cities like San Francisco or New York may have unique considerations influencing loan decisions.

Reason for Reconsideration

A loan application reconsideration can arise from various circumstances that merit reevaluation. Common reasons include improvements in credit score, such as an increase from 620 to 700 due to timely debt repayments and reduced credit card balances. Recent changes in income, such as a new job at a reputable company with an annual salary of $80,000, may also contribute to eligibility reassessment. Furthermore, a lower debt-to-income ratio, now standing at 30%, might be significant enough for lenders to reconsider the application. Additionally, providing proof of assets, such as savings of $15,000 in a high-yield account, can further support the request for reevaluation. Each factor plays a crucial role in demonstrating financial stability and creditworthiness.

Supporting Documentation

A comprehensive loan application reconsideration requires essential supporting documentation to strengthen the case. This documentation includes recent income statements, such as pay stubs (typically covering the last 30 days), which verify a stable financial status. Tax returns from the previous two years demonstrate overall income consistency and reliability. A current credit report, reflecting credit scores and history from agencies like Experian or TransUnion, reveals payment behaviors and existing debts, helping lenders assess creditworthiness. Additionally, bank statements from the last three months provide insights into cash flow and savings, showcasing the applicant's ability to manage funds. Evidence of employment such as an employment verification letter from an employer solidifies job stability, which is crucial for loan approval. All these documents collectively present a clearer financial picture for reconsideration purposes.

Contact Information

The reconsideration of a loan application often requires precise contact information to streamline communication and facilitate a prompt review process. Essential details include the applicant's full name, present address (including city, state, and zip code), and phone number. Additionally, providing a professional email address ensures that correspondence remains efficient and organized. In scenarios where a co-applicant or guarantor is involved, their contact information should also be included to enable a comprehensive evaluation of the application. By ensuring all contact details are accurate and up-to-date, the likelihood of receiving a timely response increases significantly.

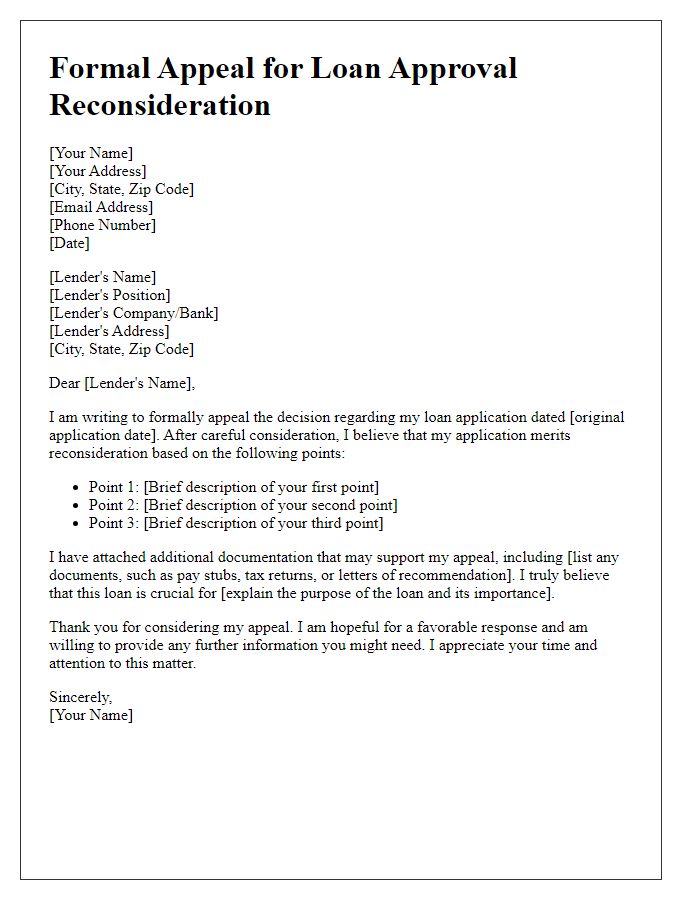

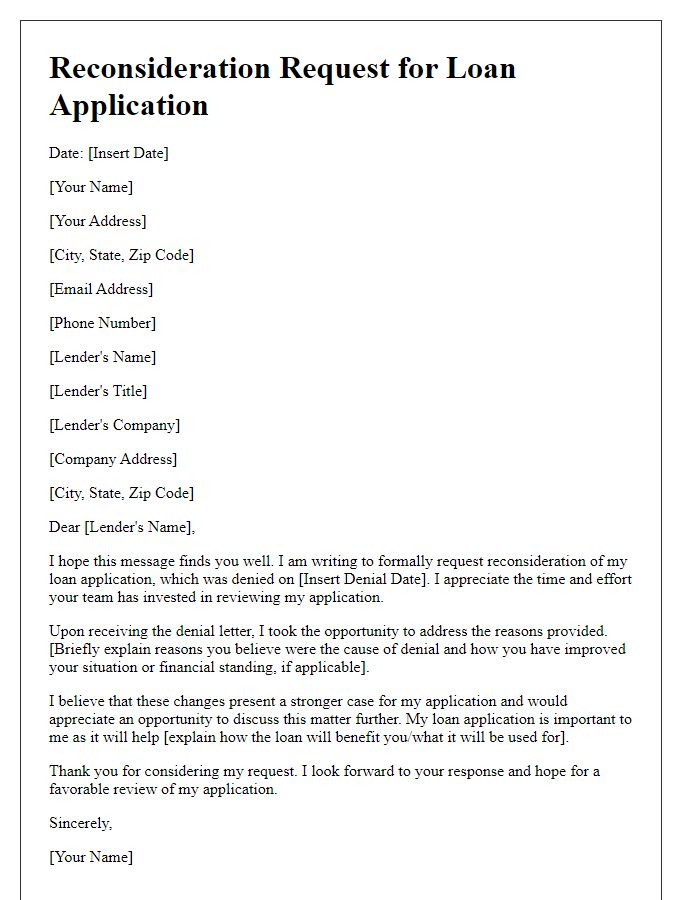

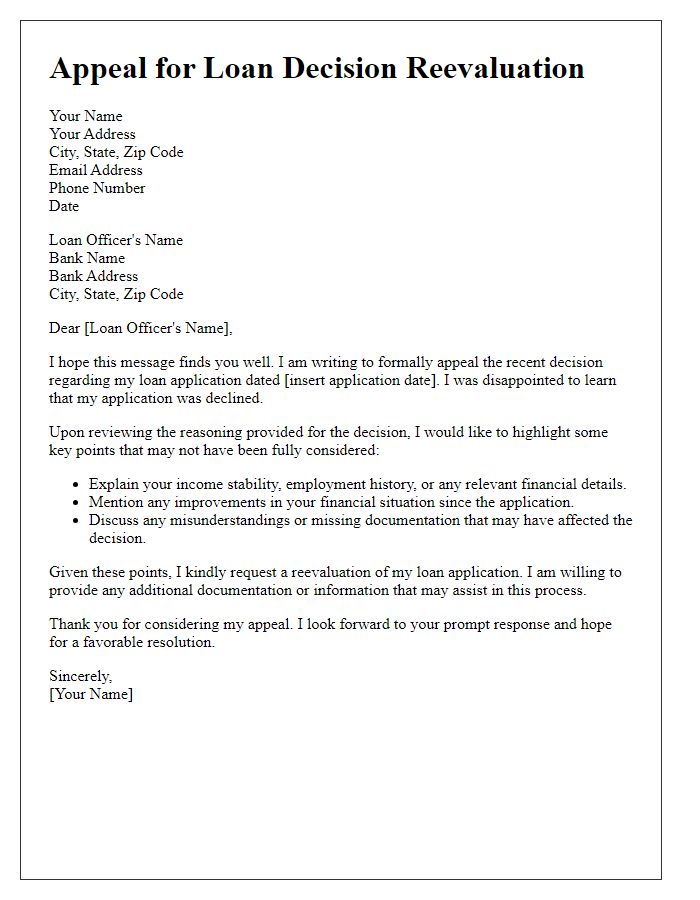

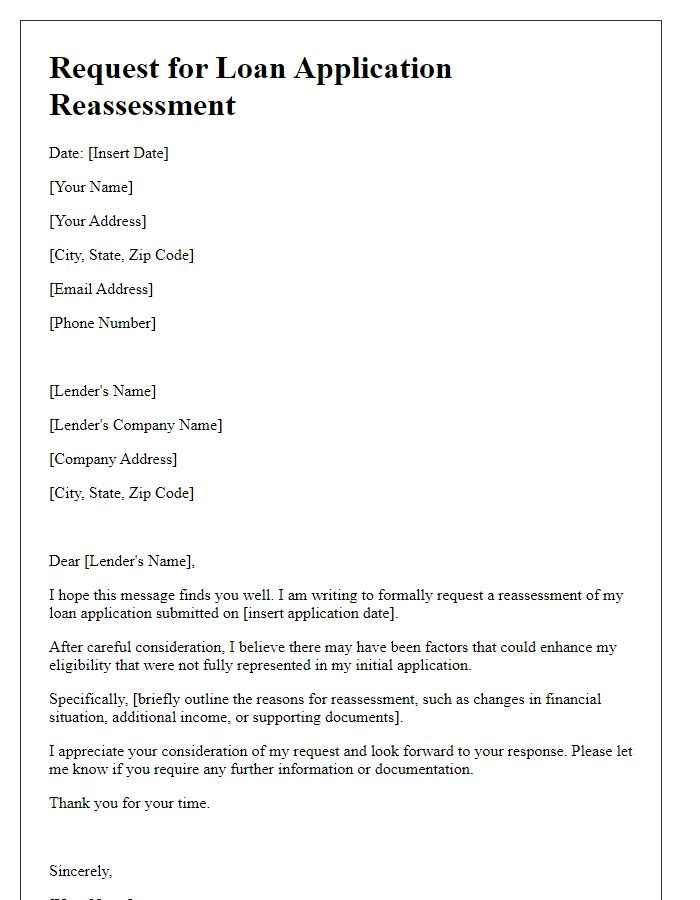

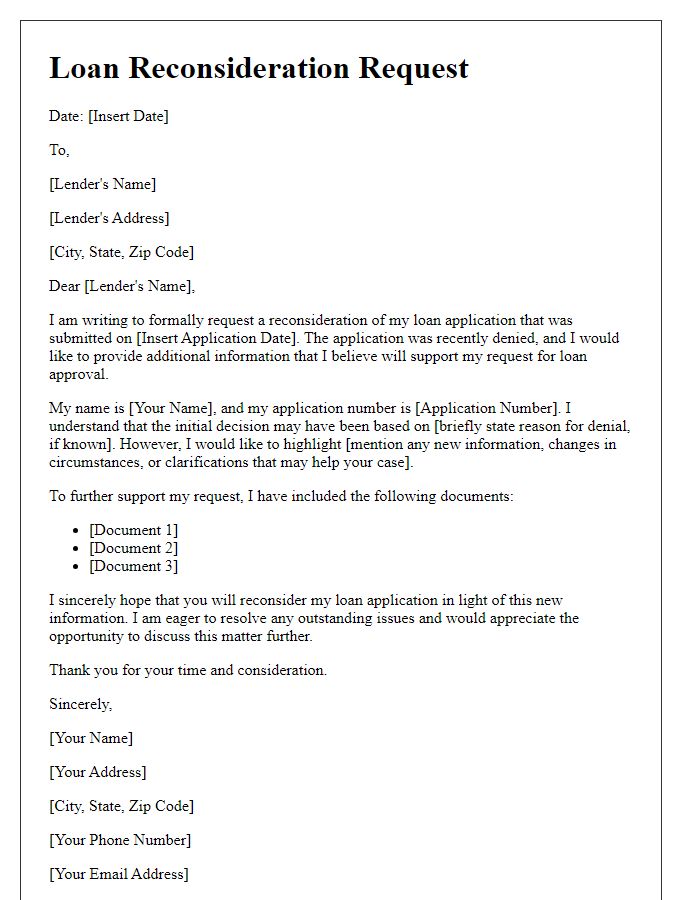

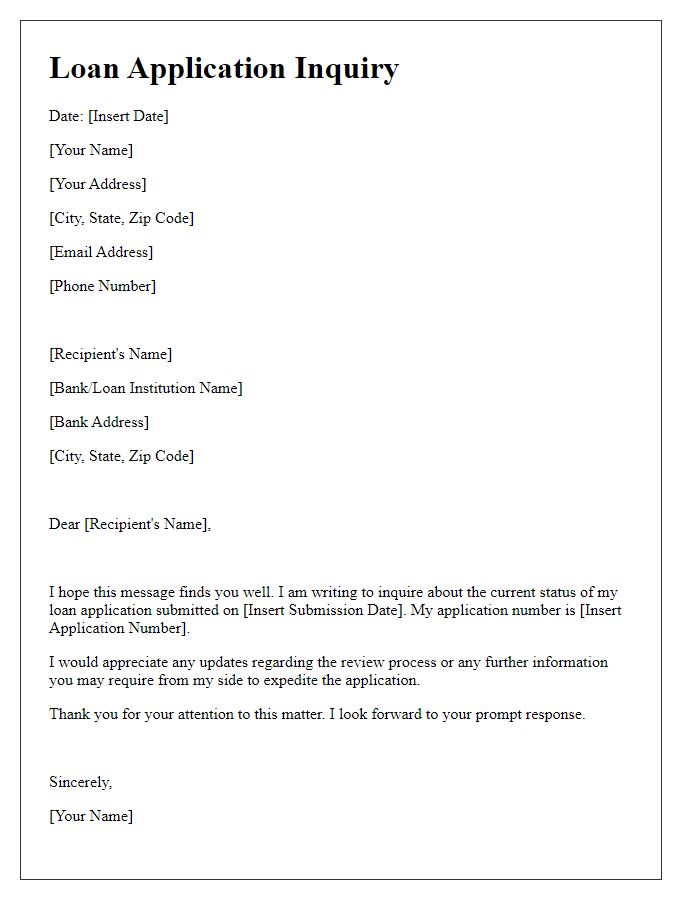

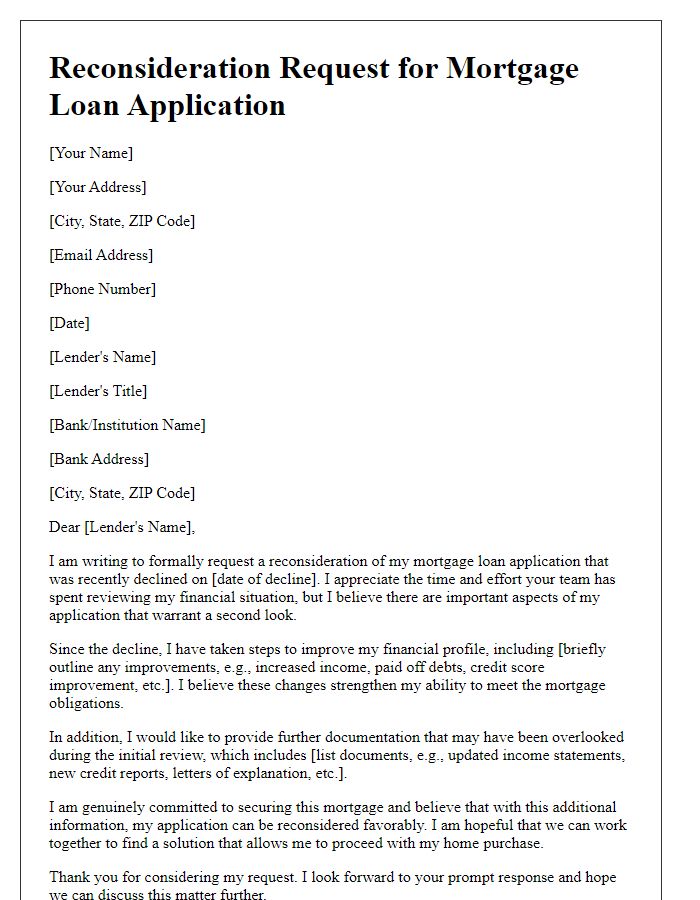

Letter Template For Loan Application Reconsideration Samples

Letter template of follow-up request on loan application reconsideration

Comments