Are you curious about how your credit report impacts your financial health? Understanding the nuances of your credit report can empower you to make informed decisions and improve your credit score. In this article, we'll break down the critical elements of your credit report and explain how a personalized analysis can reveal hidden opportunities for better financial management. So, let's dive in and discover how you can take control of your credit journey!

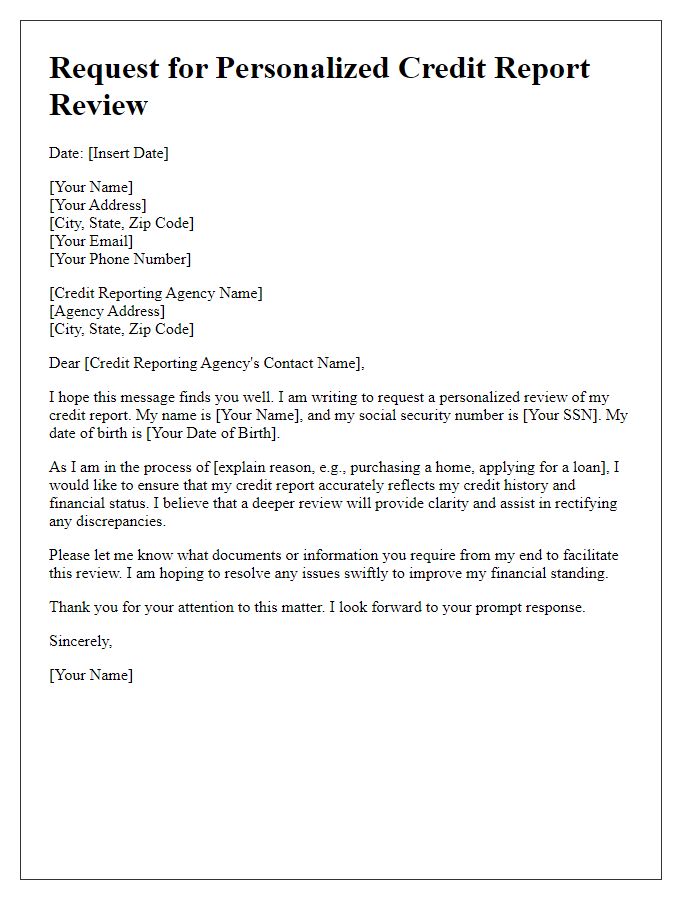

Clear and concise language

Personalized credit report analysis provides essential insights into financial health. Comprehensive reviews highlight crucial factors, such as payment history (35% of the credit score), credit utilization (30%), and length of credit history (15%). Analyzing specific accounts, including credit cards and loans, allows identification of areas for improvement. Factors like late payments or high balances can significantly impact the overall score. Understanding these elements can empower individuals to make informed decisions regarding debt repayment strategies, increasing creditworthiness. Additionally, awareness of credit inquiries, which account for 10% of the score, is vital for maintaining a healthy credit profile. Regular monitoring of credit reports from major bureaus like Experian, TransUnion, and Equifax is advisable for accurate financial planning.

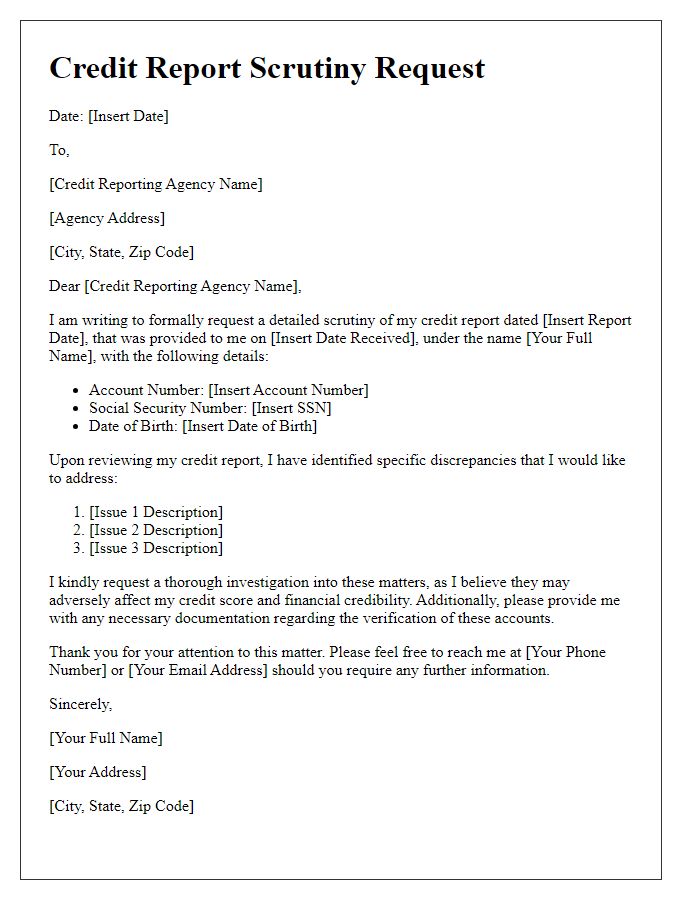

Personalization and customization

Personalized credit report analysis provides insights into individual financial health, focusing on specific credit behaviors and patterns. Credit scores, typically ranging from 300 to 850, reflect an individual's creditworthiness and are influenced by factors such as payment history (accounting for 35% of the score), amounts owed (30%), length of credit history (15%), types of credit in use (10%), and new credit inquiries (10%). Detailed examination of these elements can reveal areas for improvement, such as reducing credit utilization ratios (ideally below 30%) or addressing missed payments, which can stay on credit reports for up to seven years. Customized recommendations based on unique financial goals, like securing a mortgage in a particular city, such as Austin, Texas, can enhance understanding and foster proactive credit management.

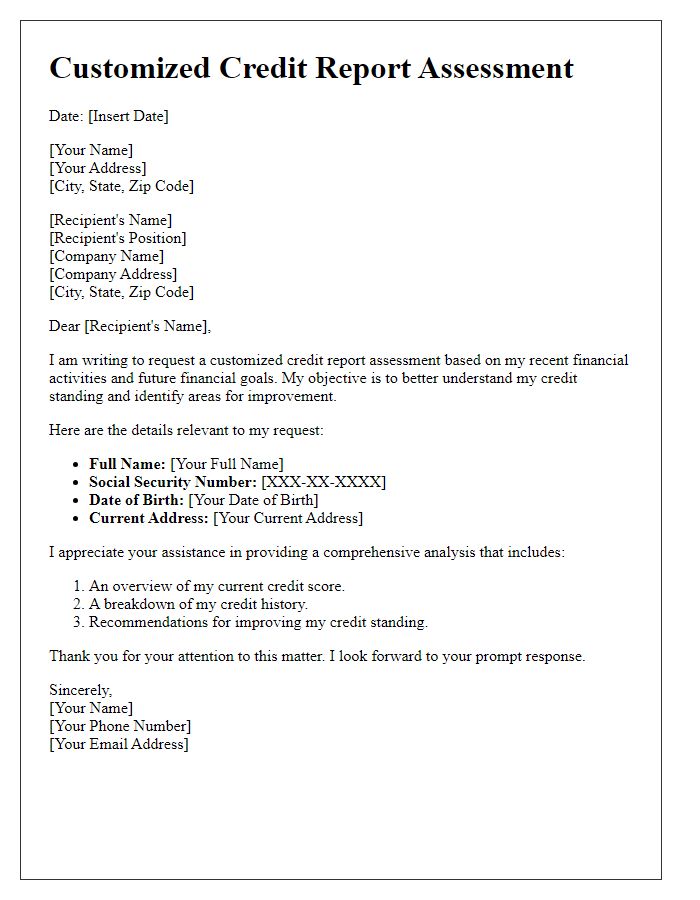

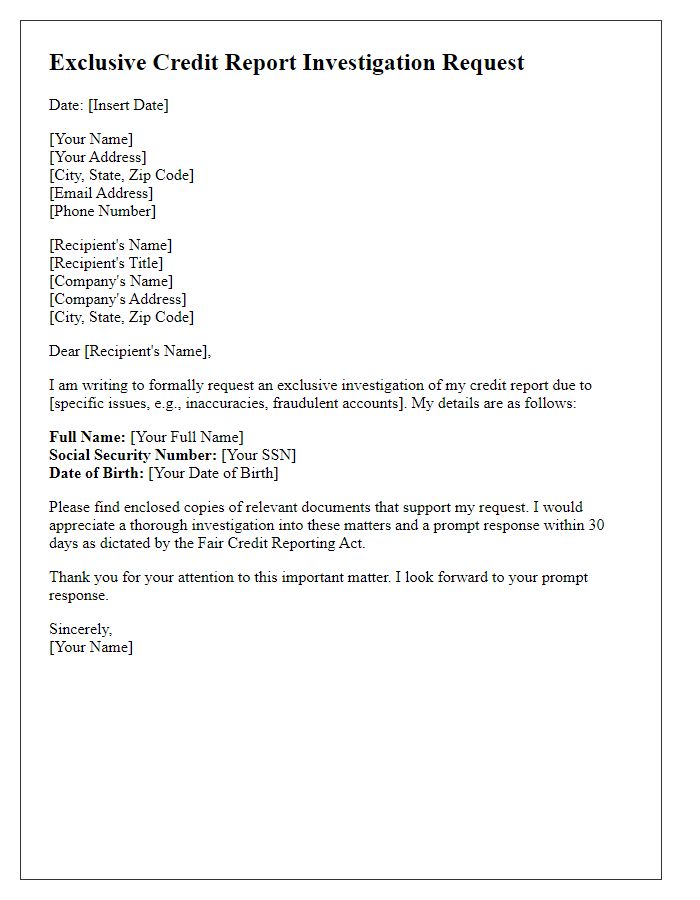

Accurate and relevant data presentation

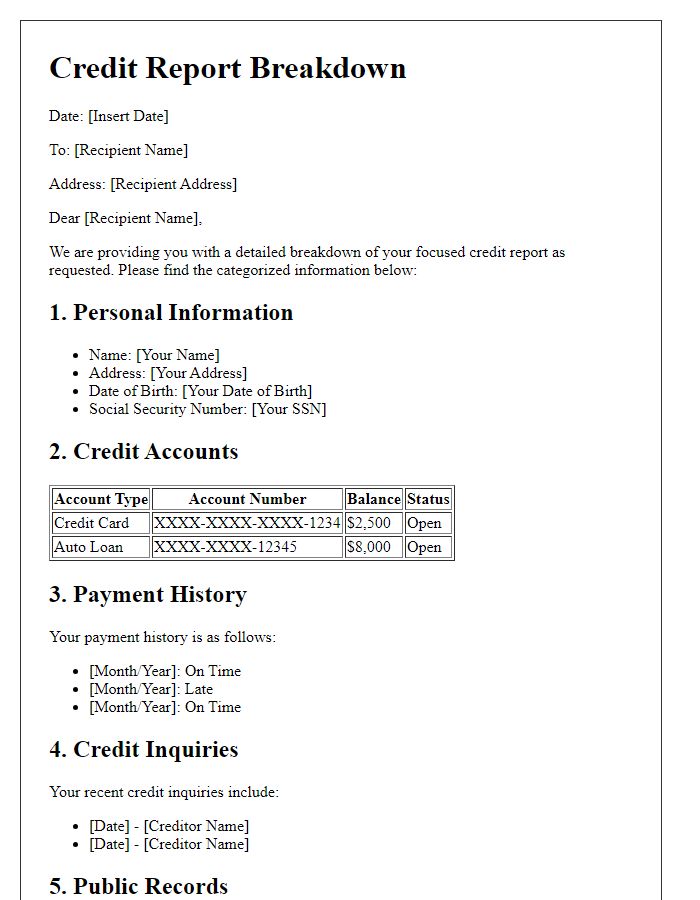

Accurate presentation of personalized credit reports provides invaluable insights regarding financial health. Comprehensive reports from agencies like Experian and TransUnion detail credit scores, payment history, and outstanding debts. The FICO score, a crucial metric, ranges from 300 to 850, categorizing creditworthiness among consumers. Payment history accounts for 35% of the score, highlighting the importance of on-time payments. Additionally, credit utilization ratio (ideally below 30%) shows how much available credit is being used. Negative marks, such as late payments or collections, stay on reports for up to seven years, impacting future borrowing. Regular analysis of these reports enables individuals to identify discrepancies, establish credit recovery strategies, and improve their financial prospects.

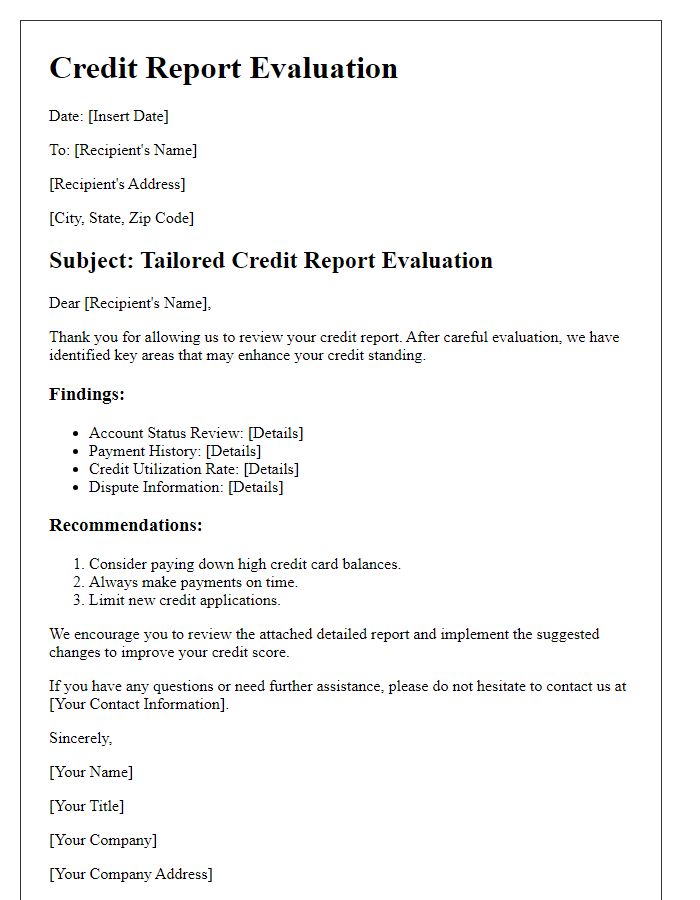

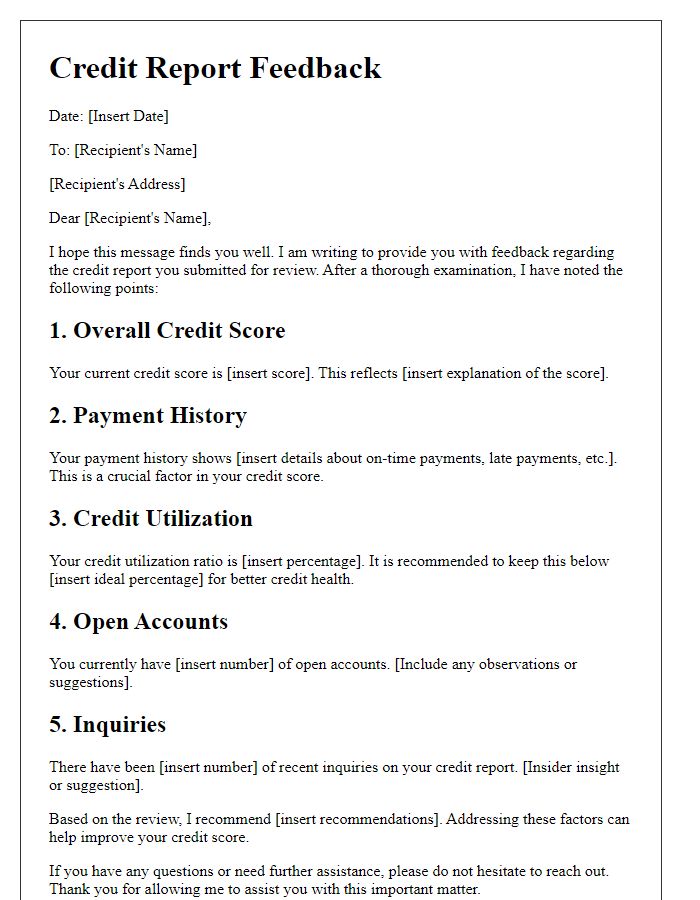

Actionable insights and recommendations

A personalized credit report analysis provides valuable insights for individuals managing their financial health. The report evaluates credit scores, which range from 300 (poor) to 850 (excellent), highlighting factors like payment history, credit utilization ratio, and length of credit history. For example, a high credit utilization ratio (above 30%) can negatively impact a score, while on-time payments contribute positively. Additionally, the analysis identifies common negative marks, such as late payments or collections, which require attention. Recommendations may include strategies like reducing credit card balances, disputing inaccuracies, or diversifying credit accounts to improve creditworthiness. The significance of regular monitoring through services like Experian, Equifax, or TransUnion can enhance awareness of changes and promote proactive measures.

Compliant with privacy and legal standards

A personalized credit report analysis provides consumers with insights into their creditworthiness as assessed by major credit bureaus, including Experian, TransUnion, and Equifax. This analysis typically includes detailed information such as credit score ranges, significant credit accounts (e.g., loans, credit cards), and payment history with respect to timeframes (30, 60, 90 days past due). Key components like credit utilization ratio (the percentage of available credit being used) are crucial, as high percentages can indicate potential risk to lenders. Understanding inquiries (both hard and soft) is vital since recent hard inquiries can impact credit scores for several months. Overall, a comprehensive analysis ensures consumers can effectively monitor their financial health while remaining compliant with the Fair Credit Reporting Act (FCRA), ensuring personal information is protected and only disclosed with consent.

Comments