Are you feeling overwhelmed by credit card debt and unsure where to start? You're not alone, as many people find themselves in similar situations and are looking for effective ways to regain control of their finances. Crafting a well-structured letter to settle your credit card debts can be a crucial step towards achieving financial freedom. To help you navigate this process with confidence, we invite you to read on and discover the best strategies for writing an impactful letter that could transform your financial journey.

Accurate account details

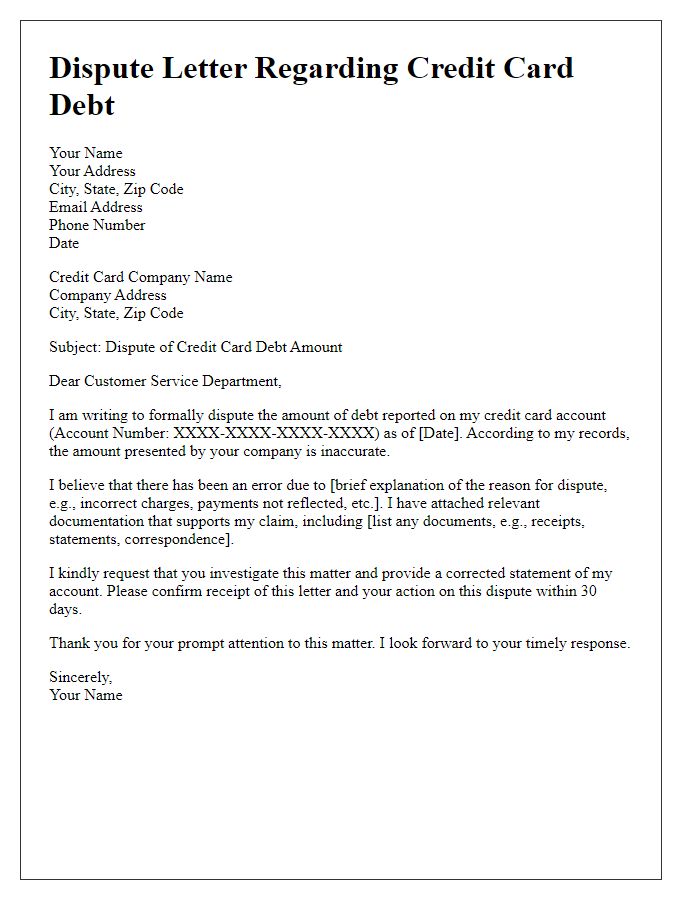

Credit card debt resolution requires accurate account details for effective communication with financial institutions. Key elements include account number (usually 16 digits), creditor name (such as American Express), outstanding balance (monthly statements typically show this amount), and payment history (including missed payments or late fees). Include contact information for customer service (often found on the back of the card), legal disclaimers (pertaining to debt collection laws), and any relevant dates (like last payment date or dispute resolution timeline). Ensuring all details are correct facilitates smooth negotiations and settlements with creditors.

Clear settlement amount

Credit card debt settlement involves negotiating a reduced amount with lenders. For instance, if an individual owes $5,000 on a credit card with a high-interest rate of 21%, they may negotiate a settlement for $3,000. Settlements typically occur after missed payments, which could impact credit scores (typically ranging from 300 to 850) negatively. Successful settlements often require a lump sum payment, which may be funded through personal savings or a loan. Keep in mind, cleared debts may still affect future borrowing capacity, as creditors review past payment behavior. Legal considerations may also arise, particularly around documentation and confirmation of settled amounts through written agreements.

Proposed payment terms

Credit card debt poses significant financial strain, often leading individuals to seek negotiations with creditors for manageable payment terms. Proposed payment terms typically involve a structured repayment plan, often ranging from six months to five years, to settle outstanding balances. Monthly payments can be adjusted based on the debtor's financial situation, aiming for half (or less) of the total debt amount, which may include principal and accrued interest. Additionally, a single lump-sum settlement might be proposed as a negotiated resolution, potentially lowering the total financial obligation. Clear communication should be established with the credit card company, providing detailed financial statements and explaining any hardships (such as job loss or medical emergencies) that prompted the need for restructuring the debt.

Consequences of agreement

Credit card debt settlement can have significant consequences on an individual's financial future. When an agreement is reached, such as paying a lump sum that is less than the total owed, credit card companies may report the account as "settled" rather than "paid in full." This status can remain on a credit report for up to seven years, impacting credit scores (often resulting in a decrease of 100 points or more). Additionally, settling debt can lead to potential tax liabilities, as forgiven debt may be considered taxable income by the Internal Revenue Service (IRS). Future credit opportunities can also be affected, as lenders often view settled accounts unfavorably, leading to higher interest rates or denial of credit applications. Understanding these consequences is crucial for making informed decisions about managing credit card debt effectively.

Contact information for negotiation

Credit card debt settlement involves negotiating directly with credit card companies to reduce the amount owed. The negotiation process typically includes contacting the credit card issuer's debt collections department, where representatives assess financial situations. Providing personal information such as account numbers, balances (often in thousands of dollars), and payment history is essential. It is crucial to communicate the willingness to settle for a lower amount, often a fraction of the total debt (e.g., 40-60% of the original balance). Documenting conversations and agreements is also vital to ensure clarity and prevent discrepancies.

Letter Template For Settling Credit Card Debts Samples

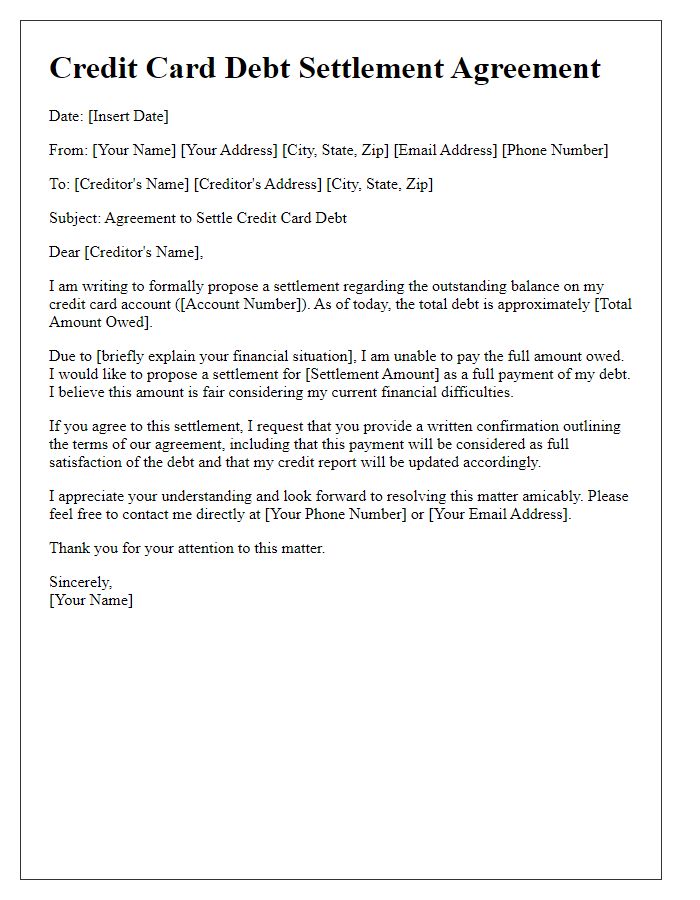

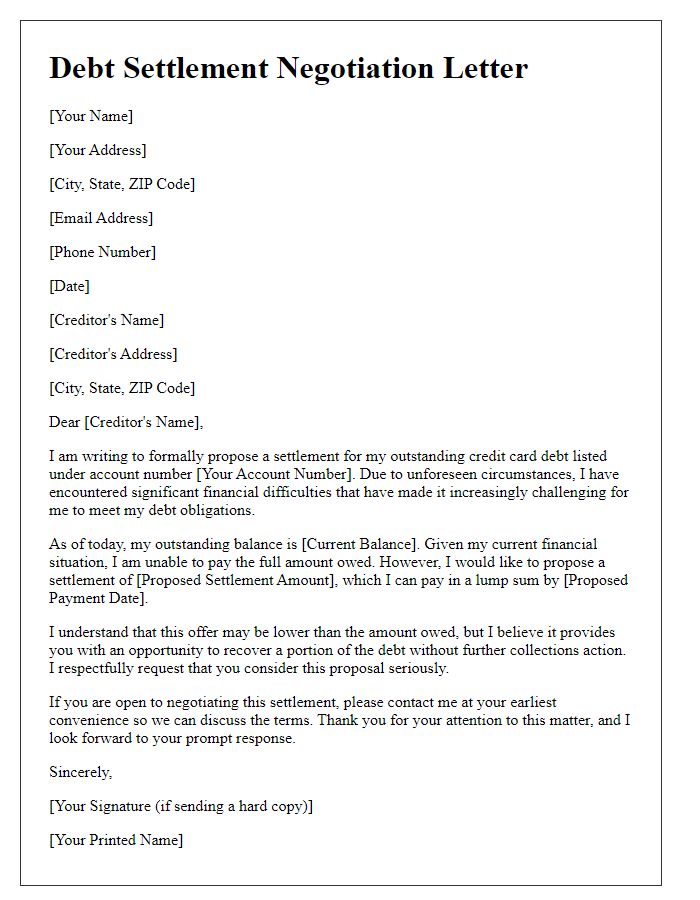

Letter template of agreement to settle credit card debt for less than owed

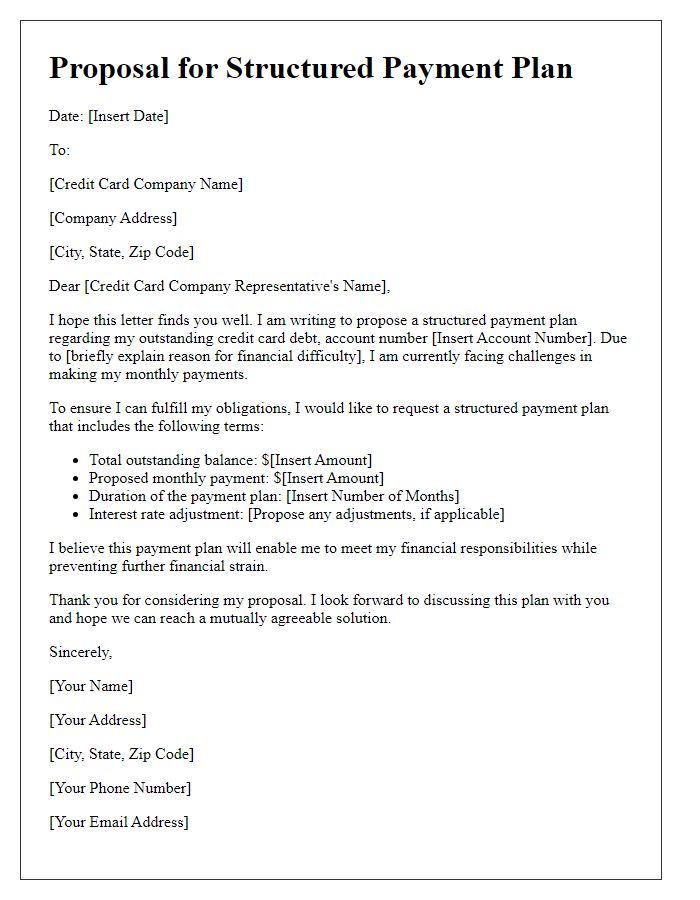

Letter template of proposal for a structured payment plan on credit card debt

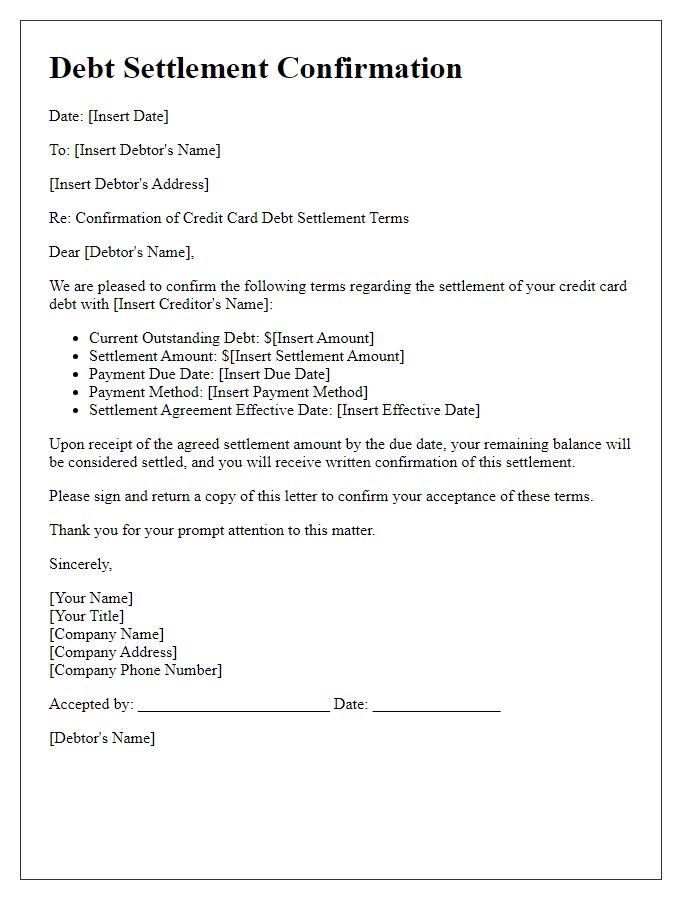

Letter template of acknowledgment of credit card debt settlement agreement

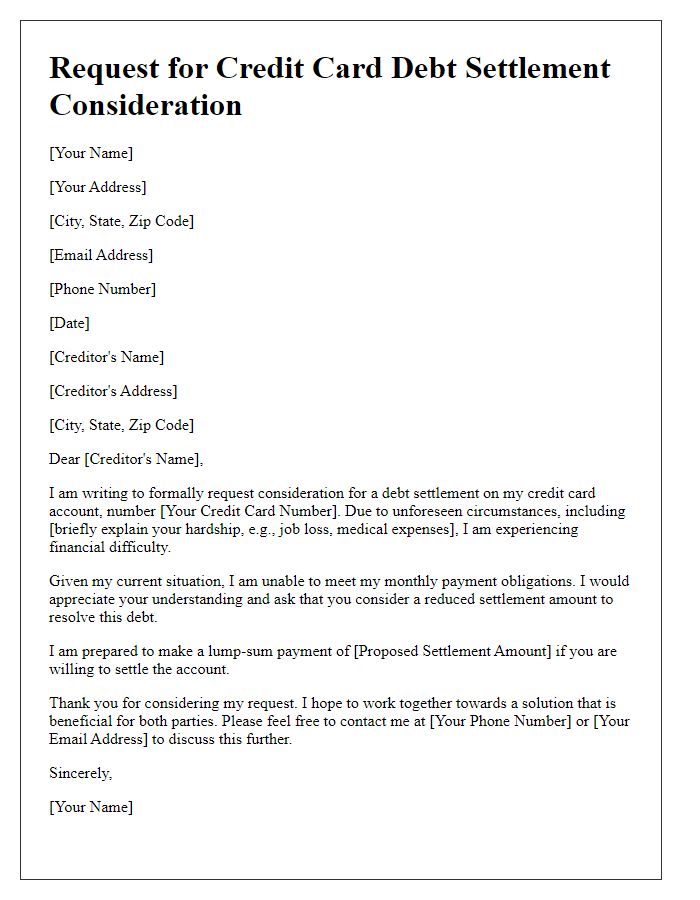

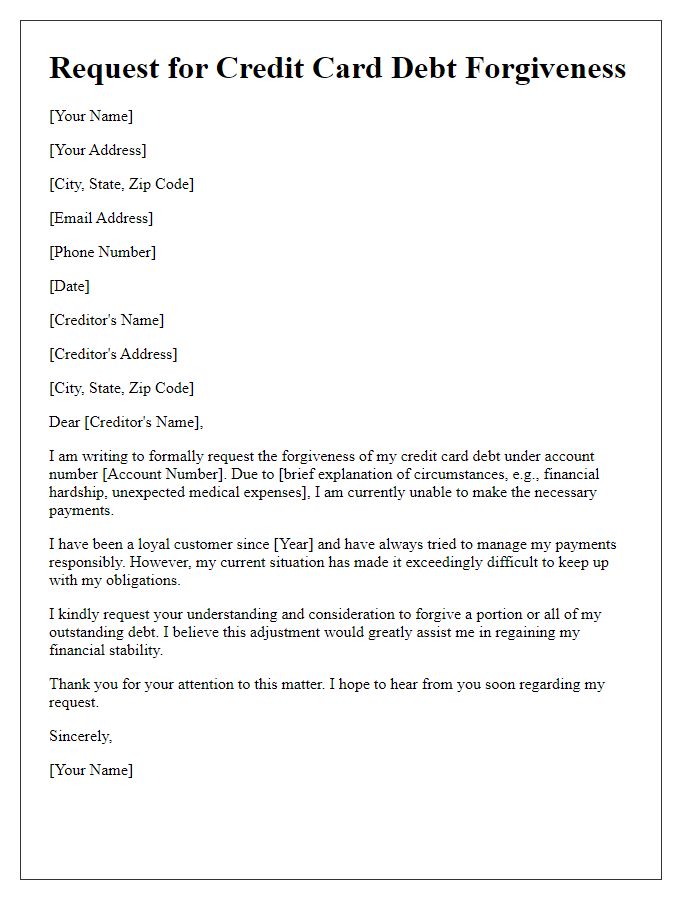

Letter template of hardship request for credit card debt settlement consideration

Comments