Are you looking to ensure that your correspondence adheres to credit laws? Crafting a letter that complies with these regulations is crucial for both protecting your rights and maintaining financial integrity. In this article, we will guide you through the essential elements of a letter template that meets legal standards while effectively communicating your needs. So, let's dive in and explore how you can confidently address your credit-related concerns!

Clear Subject Line

Request for Compliance with Credit Laws Regulations in Financial Institutions Subject: Compliance Request with Credit Laws The Fair Credit Reporting Act (FCRA) establishes crucial guidelines for handling consumer credit information across various financial institutions. Individuals seeking credit report access, such as mortgage loans or personal loans, must ensure their rights are protected under this federal law. According to the Consumer Financial Protection Bureau (CFPB), consumers are entitled to receive a free credit report annually from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Additionally, the Equal Credit Opportunity Act (ECOA) mandates that all credit applicants be judged fairly, without discrimination based on gender, race, or marital status. Notably, non-compliance with these legal stipulations can result in significant penalties for lenders as outlined in Title VII of the Civil Rights Act of 1964, which serves to protect against credit discrimination. Financial institutions must also be aware of the Fair Debt Collection Practices Act (FDCPA), which regulates the behavior of debt collectors to ensure respectful treatment of consumers. Compliance with all these regulations is essential for maintaining legal standards and fostering trust within the lending community.

Proper Salutation

Compliance with credit laws requires a keen understanding of regulations affecting credit reporting agencies, such as the Fair Credit Reporting Act (FCRA) enacted in 1970. Proper salutations in formal correspondence ensure respectful communication, particularly in professional settings like financial institutions and credit bureaus. Greetings addressing the recipient by their title, such as "Dear Mr. Smith" or "Dear Ms. Johnson," enhance the professionalism of the document. Including appropriate titles signifies acknowledgment of the recipient's position and fosters a favorable impression regarding the transaction or inquiry being addressed. Proper formatting and respectful salutations are crucial components in maintaining compliance and fostering positive relationships in credit law contexts.

Explanation of Compliance

Compliance with credit laws, such as the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA), ensures that financial institutions practice responsible lending. Accurate reporting of credit information--including payment history, outstanding debts, and credit inquiries--is crucial to maintaining fairness. Institutions must provide consumers with access to their credit reports, usually through platforms like Experian or Equifax, enabling individuals to dispute inaccuracies that could affect their credit scores. Additionally, the adherence to regulations set forth by the Consumer Financial Protection Bureau (CFPB) protects against discriminatory practices based on race, gender, or marital status when issuing credit. Regular audits and training sessions for staff help reinforce compliance standards and promote transparency in the credit application process.

Reference to Specific Credit Laws

Consumers must understand their rights under the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA), which govern access to credit information and prohibit discriminatory lending practices. Under the FCRA, individuals have the right to request their credit reports annually from major agencies such as Equifax, Experian, and TransUnion. The ECOA ensures that credit applications are evaluated without regard to race, color, religion, national origin, sex, marital status, or age. In 2023, the Consumer Financial Protection Bureau (CFPB) emphasized the importance of transparency in credit scoring and reporting, mandating clearer disclosures from lenders. Compliance with these regulations is crucial for maintaining fair credit access and protecting consumer rights in financial transactions.

Contact Information for Further Assistance

Consumers seeking assistance regarding credit law compliance can contact their local Attorney General's office. States such as California and New York have specific consumer protection divisions, which provide resources and guidance. The Federal Trade Commission (FTC), a crucial regulatory body, oversees credit reporting practices, and consumers can reach them at 1-877-FTC-HELP (1-877-382-4357). Additionally, the Consumer Financial Protection Bureau (CFPB) offers detailed information about credit laws and consumer rights on their website, www.consumerfinance.gov, as well as a helpline at 1-855-411-2372 for direct support. Local credit counseling agencies also play vital roles, providing personalized advice and assistance in navigating credit issues.

Letter Template For Comply With Credit Laws Request Samples

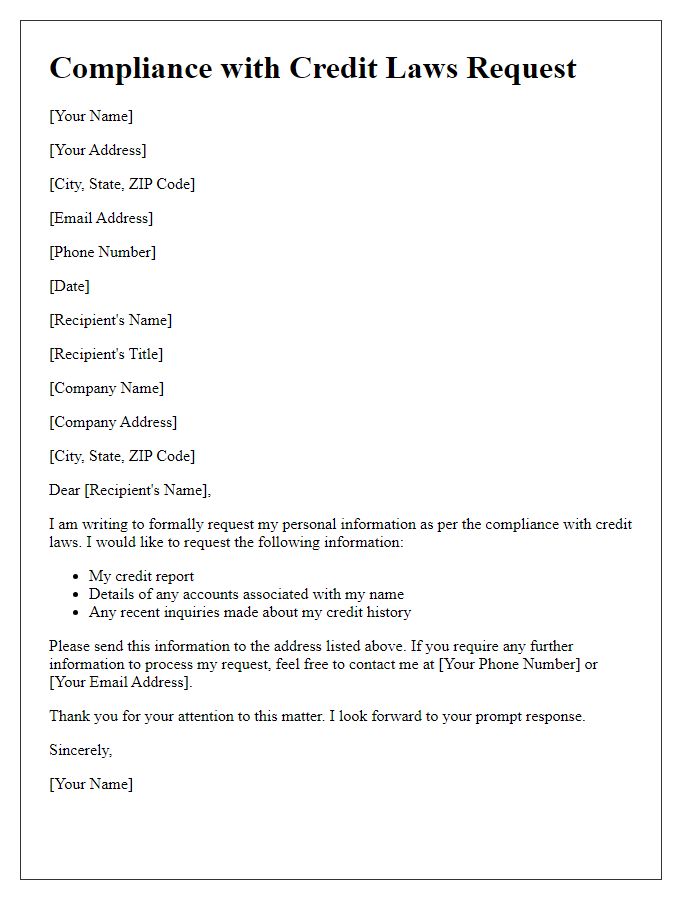

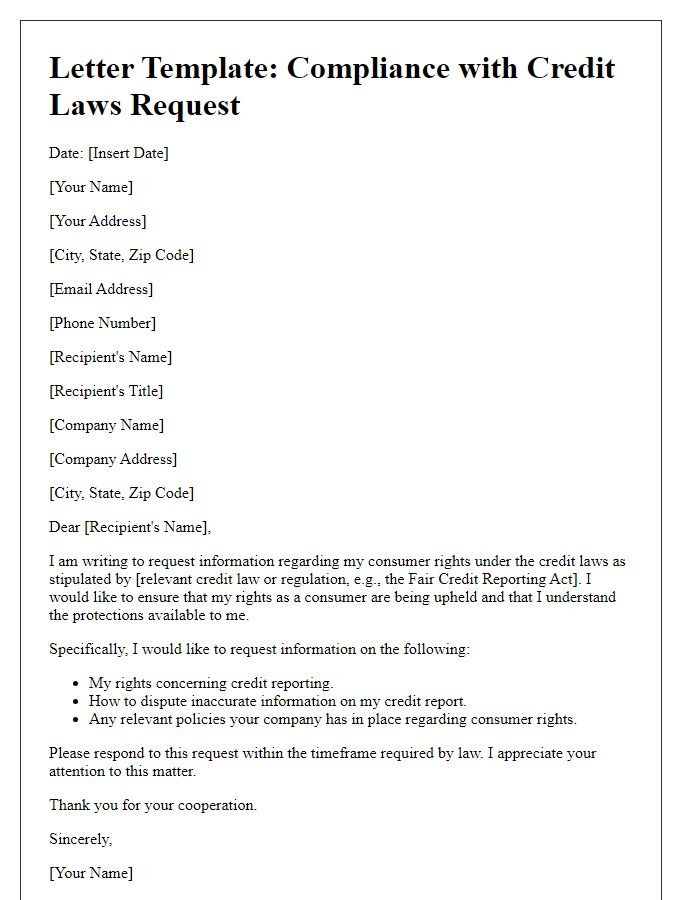

Letter template of compliance with credit laws request for personal information.

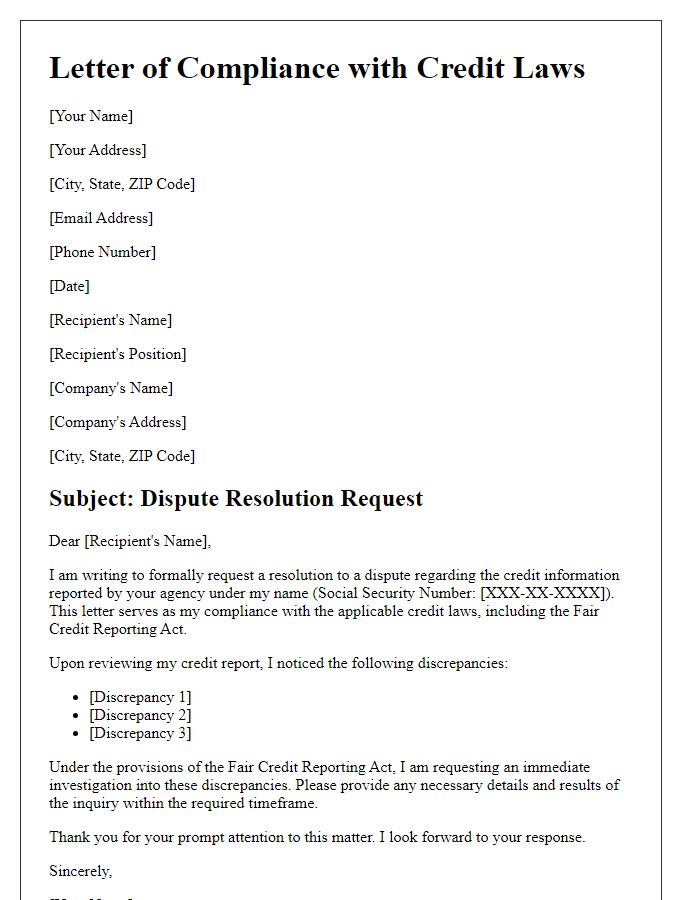

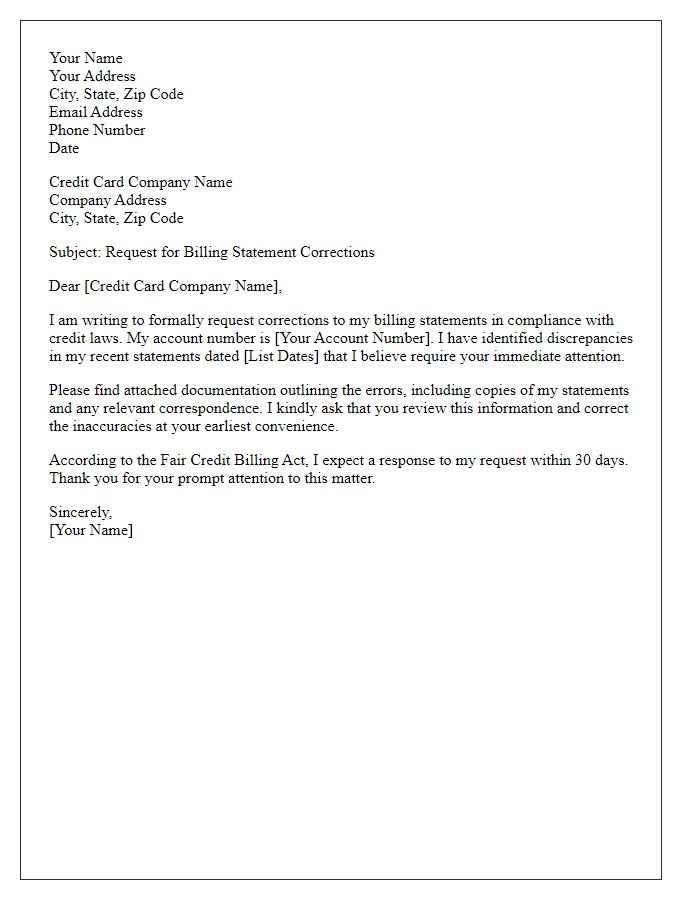

Letter template of compliance with credit laws request for dispute resolution.

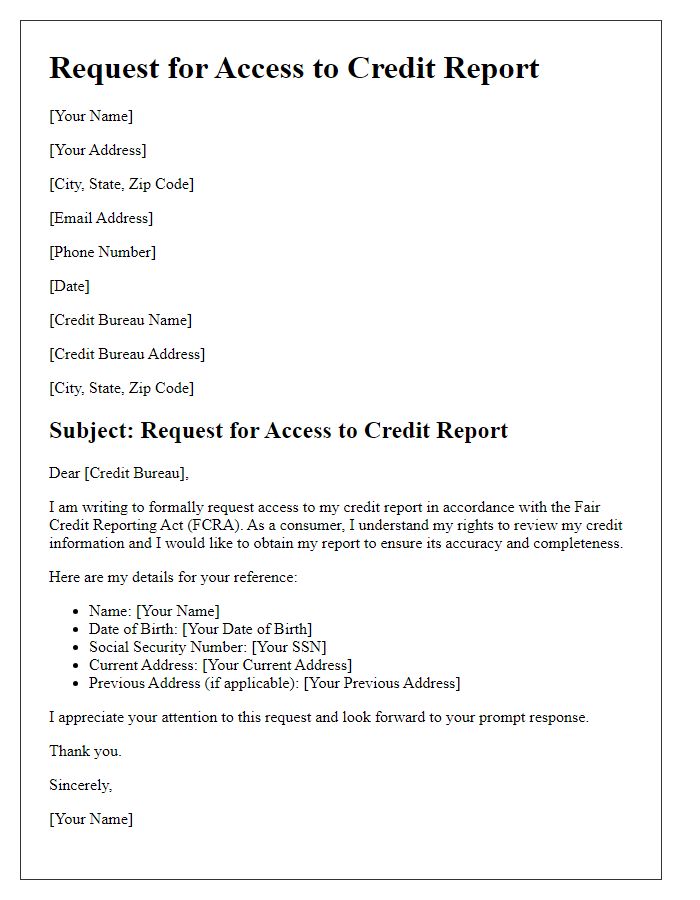

Letter template of compliance with credit laws request for credit report access.

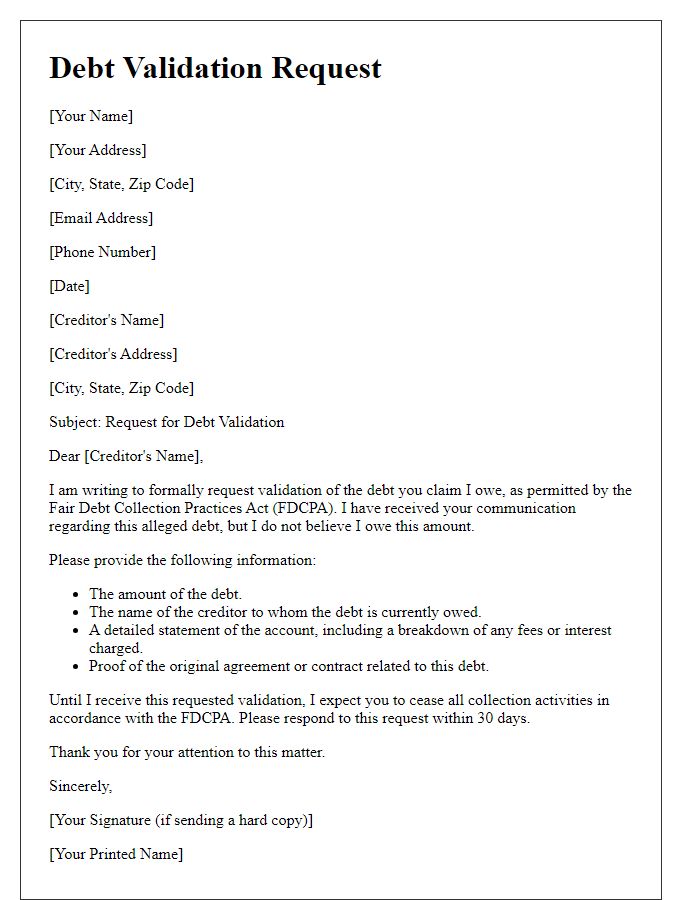

Letter template of compliance with credit laws request for debt validation.

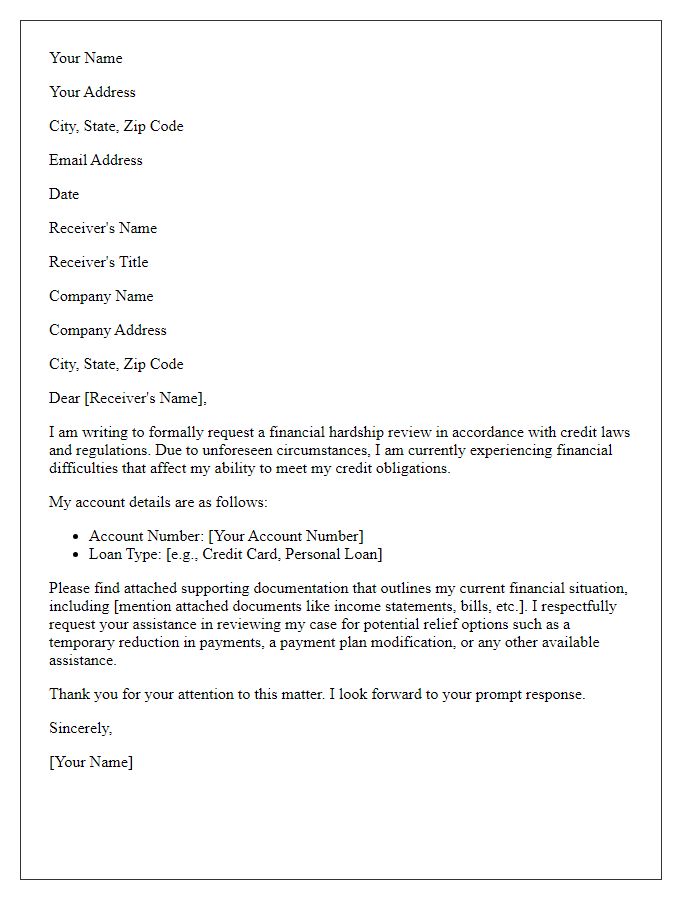

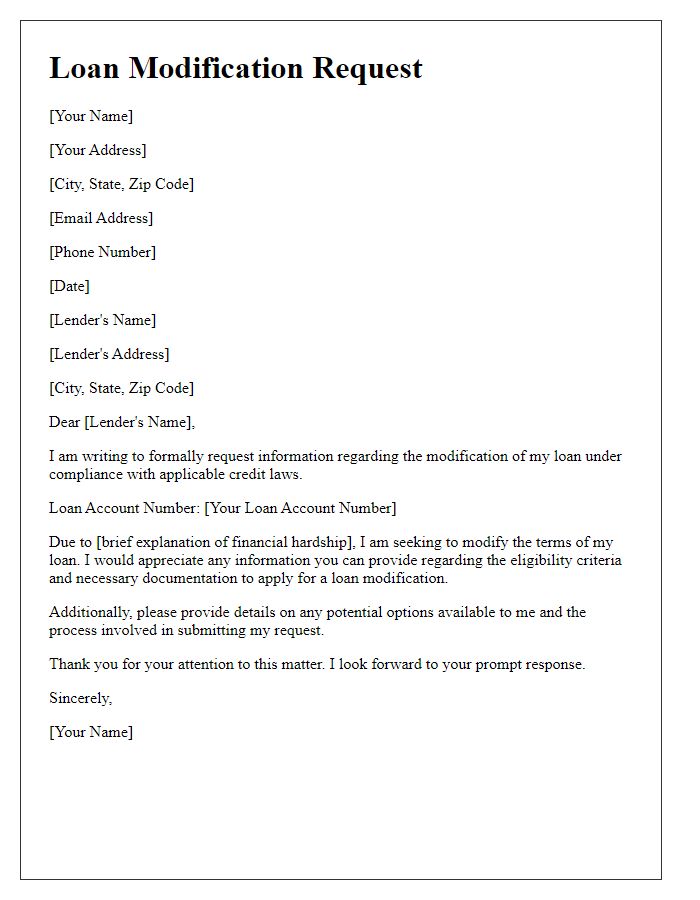

Letter template of compliance with credit laws request for financial hardship review.

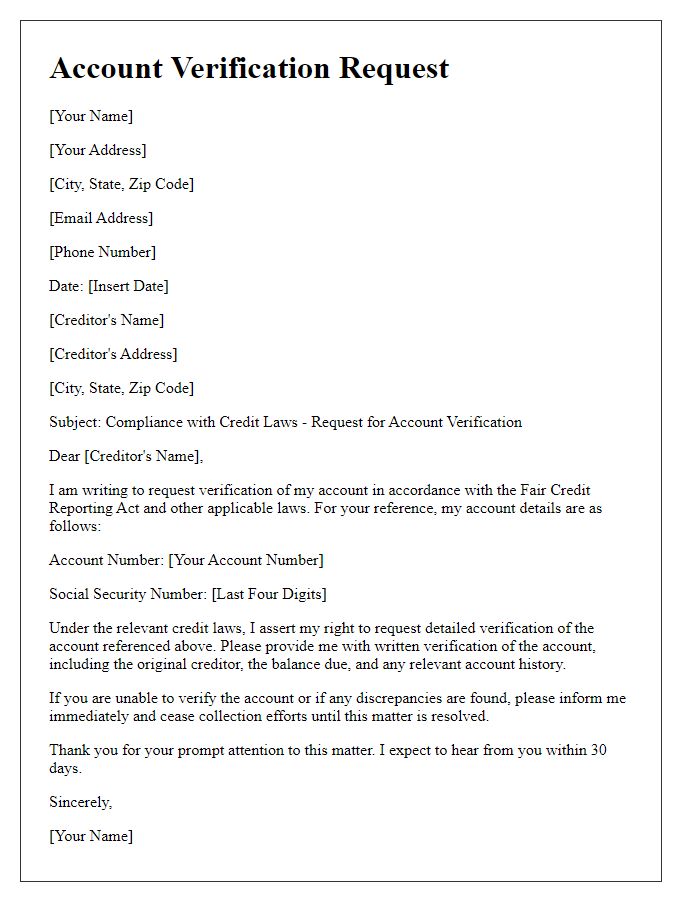

Letter template of compliance with credit laws request for account verification.

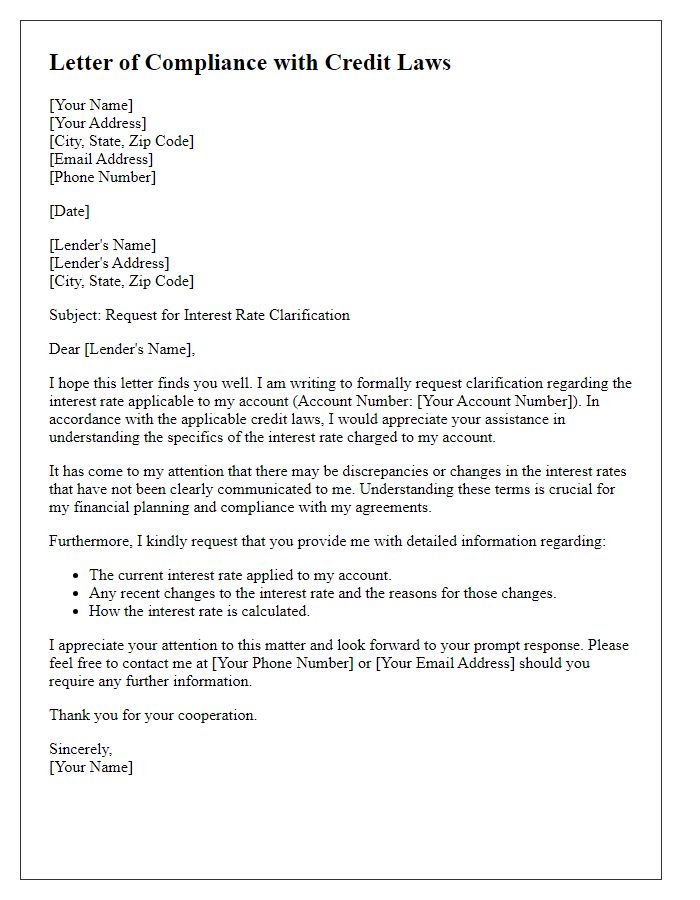

Letter template of compliance with credit laws request for interest rate clarification.

Letter template of compliance with credit laws request for consumer rights information.

Letter template of compliance with credit laws request for loan modification details.

Comments