Are you considering requesting a salary increase and wondering how it might affect your credit? It's an important topic to consider, as your income can play a significant role in how lenders view your financial stability. A higher salary not only boosts your confidence but can also improve your creditworthiness, making it easier to secure loans with favorable terms. Dive into this article to learn how to craft that perfect salary increase letter and understand its potential impact on your credit score!

Current Salary and Change

A salary increase can significantly impact an individual's credit profile and overall financial health. For example, receiving a promotion that raises the annual income from $50,000 to $65,000 enhances not only disposable income but also reduces the debt-to-income ratio, a crucial factor that credit bureaus evaluate for creditworthiness. An improved ratio, ideally below 30%, signals to lenders that the individual is managing credit responsibly. The increased salary can also result in higher credit limits on revolving credit accounts, contributing to better credit utilization. Additionally, with a stronger financial position, individuals often experience relief in meeting monthly obligations like mortgages and loans, which improves payment history--another key component of a healthy credit score.

Employment Verification

A salary increase can significantly enhance one's creditworthiness, particularly when considering employment verification. Higher income levels demonstrate financial stability, which lenders, such as banks and credit unions, often assess during the loan approval process. Credit scoring models, including FICO, rely on debt-to-income ratios that evaluate an individual's ability to manage existing debts alongside new financial obligations. When employment verification confirms a salary increase--an upward adjustment that may range from 5% to 20%--this positive change can improve credit scores by lowering debt-to-income ratios. Additionally, consistent employment within reputable companies further strengthens the credit profile, reassuring lenders about repayment capabilities, especially for large loans such as mortgages, car financing, or personal loans.

Credit Score Monitoring

Monitoring credit scores can significantly impact financial decision-making. Credit scores, numerical representations of an individual's creditworthiness, range typically from 300 to 850, with higher scores indicating better credit health. A salary increase, such as a raise of $5,000 annually, can improve the debt-to-income ratio, a crucial factor in scoring models. Improved income supports better payment habits on debts such as credit cards, personal loans, or mortgages, which constitute 30% of the credit score. Access to tools like Credit Karma or Experian allows individuals to track changes in their credit scores following financial adjustments, providing insights into spending behaviors and payment histories. Regular monitoring of credit scores promotes awareness, helping consumers make informed decisions regarding future loans or credit applications.

Impact on Debt-to-Income Ratio

A salary increase can significantly improve an individual's debt-to-income (DTI) ratio, a key metric used by lenders to assess creditworthiness. When a person's salary rises, their monthly income increases, allowing them to manage existing debts more effectively. For instance, if an individual's monthly salary increases from $4,000 to $5,000, while maintaining total monthly debt payments of $1,200, the DTI ratio shifts from 30% (1,200/4,000) to 24% (1,200/5,000). This reduction signals a stronger financial standing to potential creditors, improving eligibility for loans, credit cards, or favorable interest rates. A lower DTI indicates better financial management, suggesting reduced financial strain and increased ability to take on additional debt responsibly.

Financial Planning Adjustments

A salary increase significantly impacts financial planning, particularly regarding credit management. Increased income can boost creditworthiness, allowing for better interest rates on loans and credit cards. For instance, a salary rise to $75,000 annually provides additional disposable income, enabling timely bill payments. This consistent payment history can elevate the credit score, which is crucial for obtaining favorable terms on mortgages in competitive markets like San Francisco or New York. Moreover, improved cash flow can facilitate debt repayment strategies, reducing credit utilization ratios. Lower credit utilization below 30% enhances financial stability, promoting a healthier credit profile and increasing access to higher credit limits or new credit opportunities. Adjustments to budgeting are essential to maximize the benefits of the salary increase, ensuring long-term financial security and optimal credit use.

Letter Template For Salary Increase Impact On Credit Samples

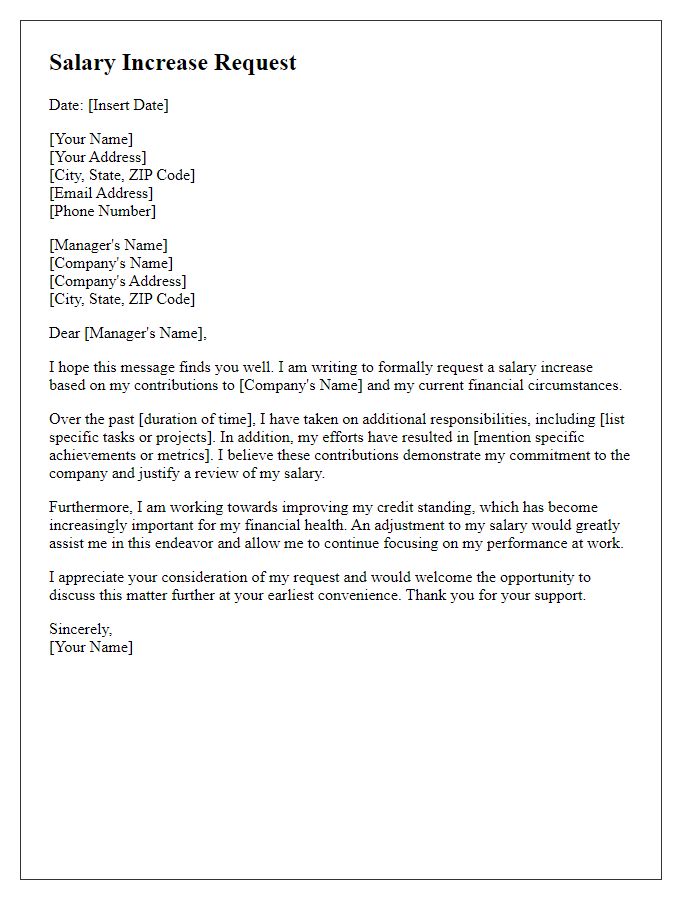

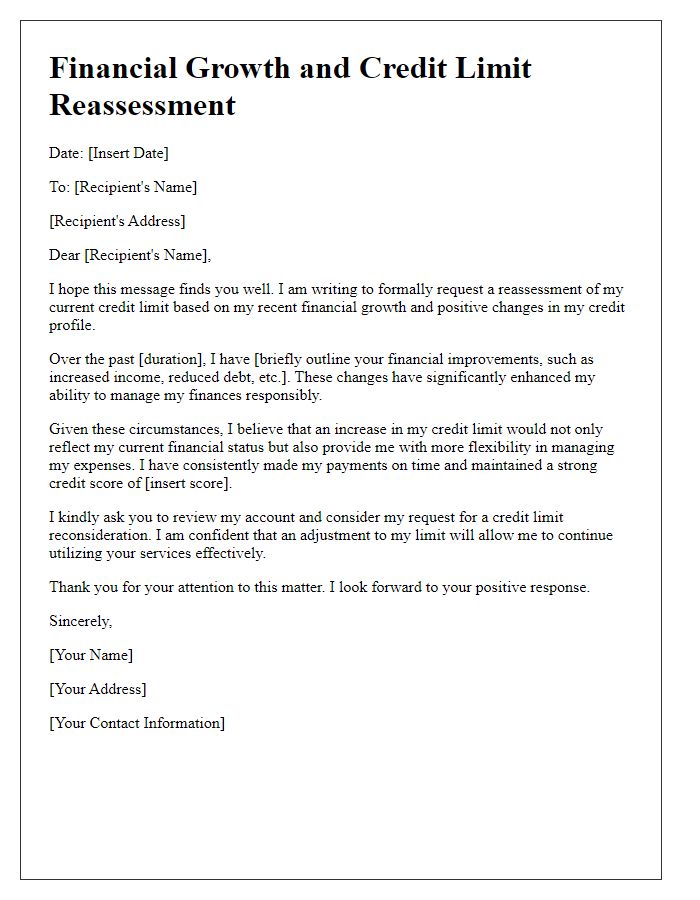

Letter template of salary increase request for improved credit standing.

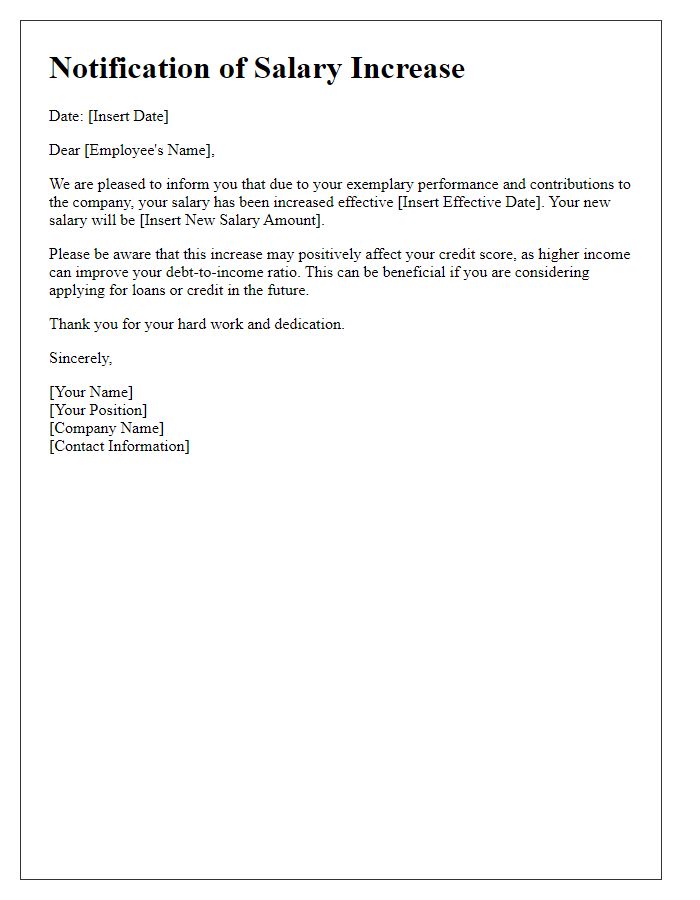

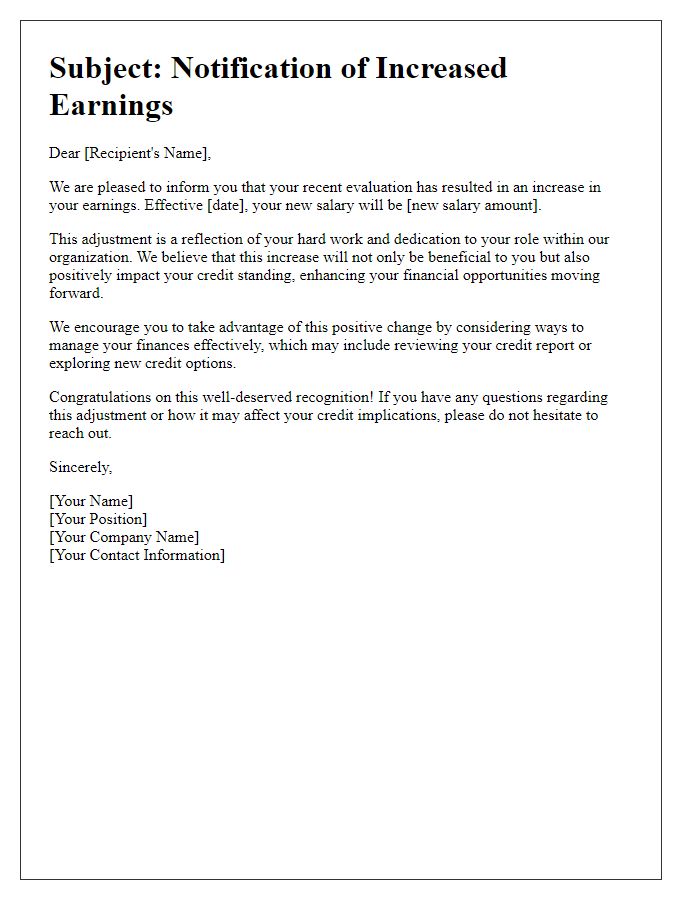

Letter template of notification for salary increase affecting credit score.

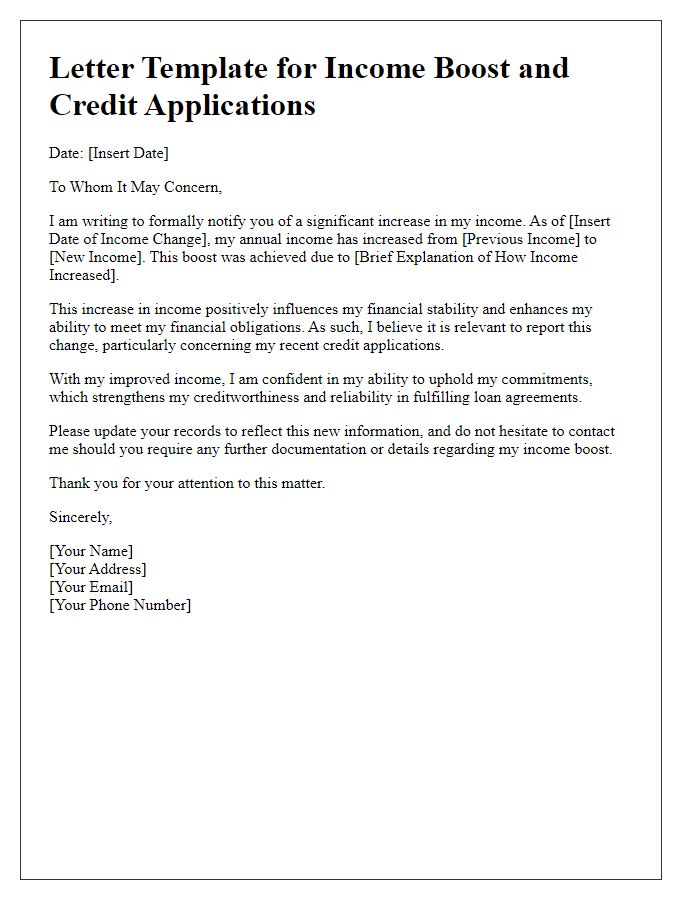

Letter template of income boost and its influence on credit applications.

Letter template of formal salary increase and resultant credit evaluation.

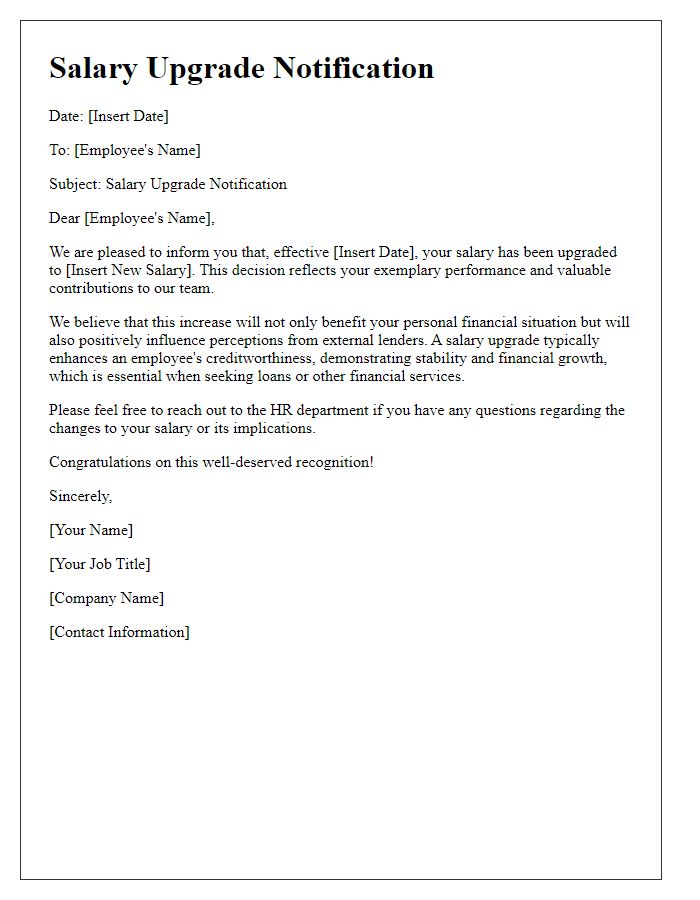

Letter template of salary increment for better credit utilization ratio.

Comments