Are you curious about your credit report but unsure how to request access? It's essential to understand your credit status, especially if you're planning any major financial decisions. In this article, we'll walk you through a simple and effective template for requesting your credit report, ensuring you have all the necessary information at your fingertips. Keep reading to discover how easy it can be to take control of your financial future!

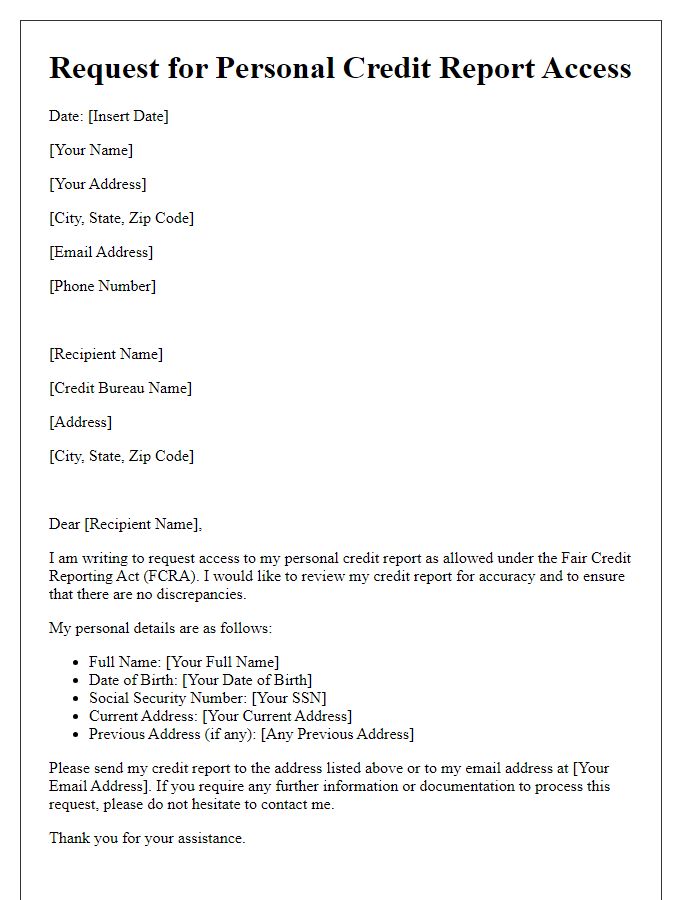

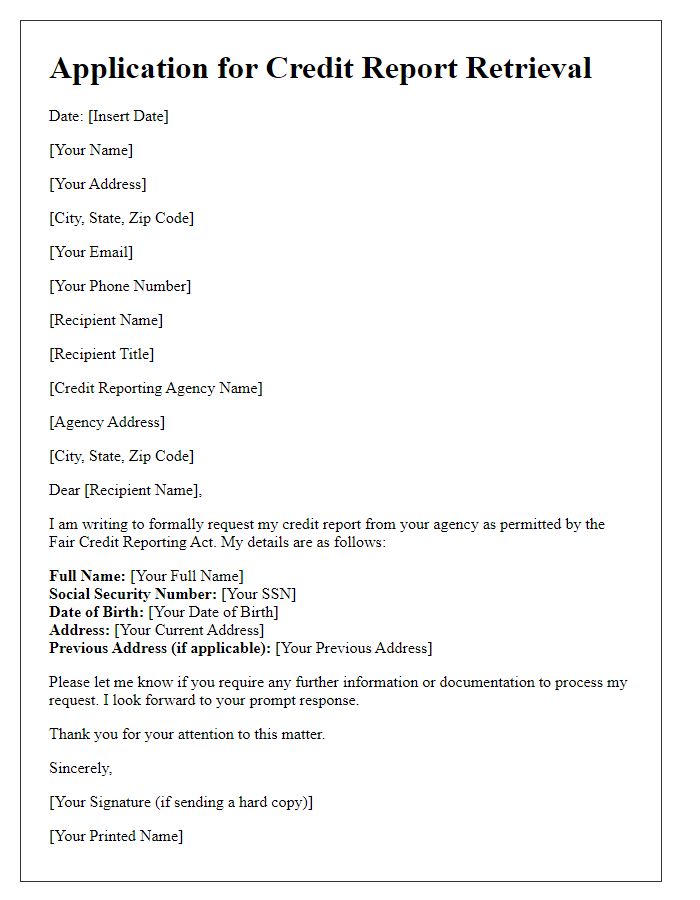

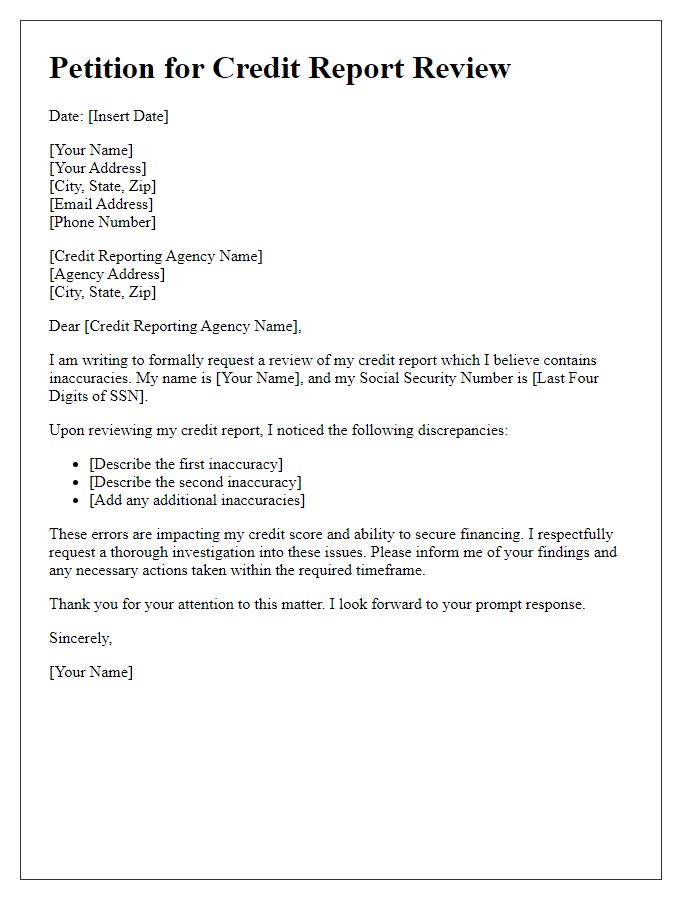

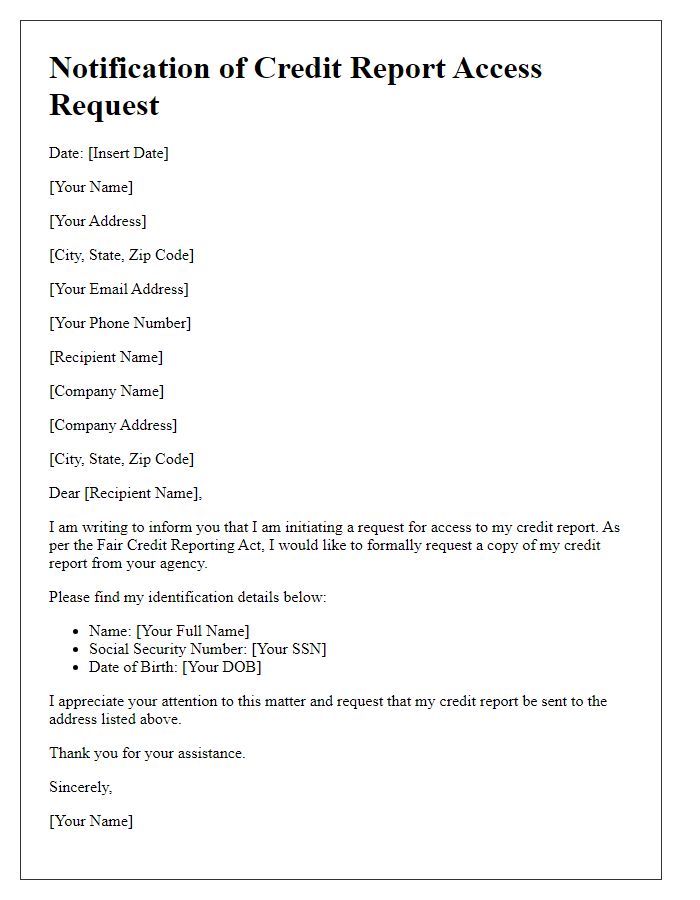

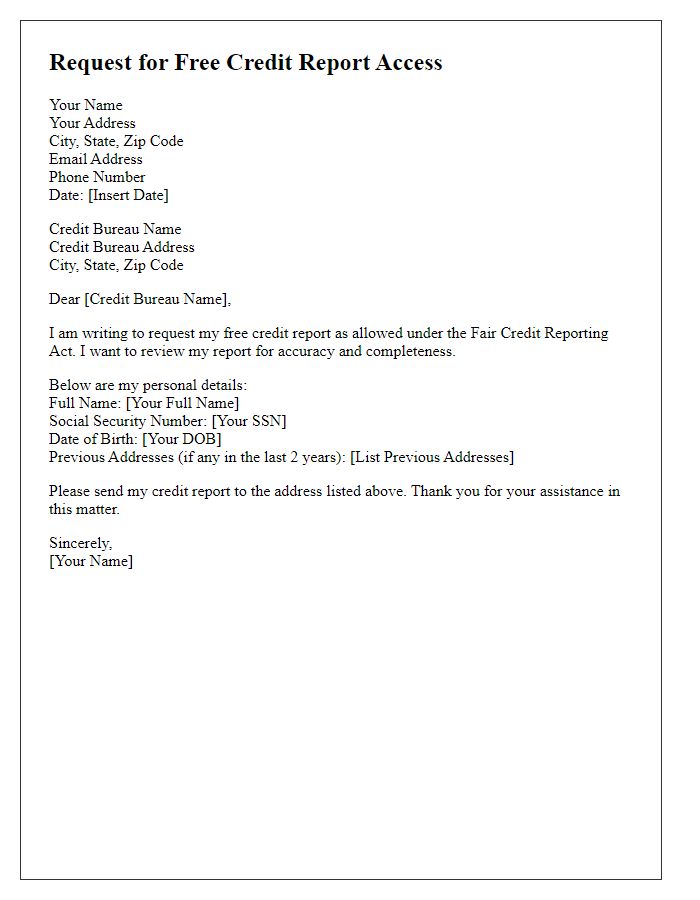

Personal Information

Individuals seeking access to their credit report must include essential personal information to facilitate the request. General details such as full name (including middle initials), date of birth (key for identity verification), residential address (current address including city and zip code for accurate record matching), and Social Security number (usually last four digits are sufficient) are necessary. Additionally, it may be beneficial to specify any previous addresses used in the last five years, along with a phone number for contact purposes. Including this information ensures compliance with regulations set by agencies like the Fair Credit Reporting Act (FCRA), which governs access to credit reports in the United States. Clear identification aids in processing requests efficiently and protects against identity theft.

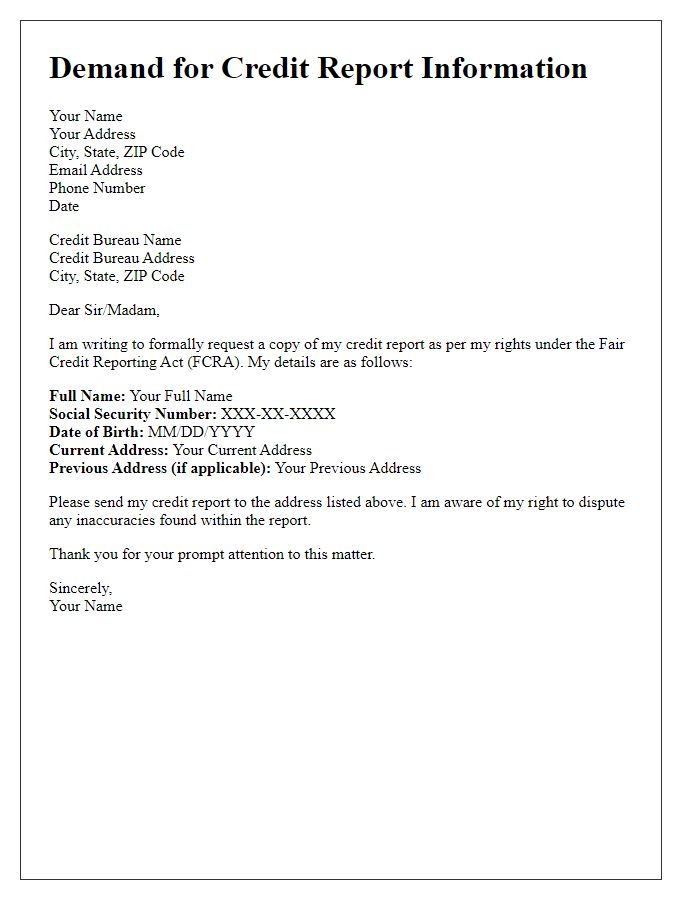

Request Details

Requesting access to a credit report is important for monitoring financial health. Individuals seeking this report can contact credit bureaus like Experian, TransUnion, or Equifax. Federal law mandates consumers entitled to one free credit report annually from each bureau. Personal information needed includes full name, address (including previous addresses if within the last two years), Social Security number, and date of birth. Specific details, such as previous loan applications or credit inquiries, may assist in expediting the process. Accessing this report enables individuals to check for inaccuracies, identify potential fraud, and improve their credit standing.

Reason for Request

Accessing a credit report is crucial for validating your financial history, especially if you are preparing for significant transactions like applying for a mortgage or a car loan. Credit reporting agencies such as Experian, Equifax, and TransUnion maintain detailed records of your credit activity, including accounts, payment history, and outstanding debts. Monitoring your credit report allows you to identify any inaccuracies or fraudulent activities, which can persist for years if not addressed promptly. Additionally, reviewing your credit report supports financial planning by providing insights into your credit score, which directly impacts interest rates and approval chances for loans. Understanding the reason for your request and maintaining your credit health is fundamental in today's financial landscape.

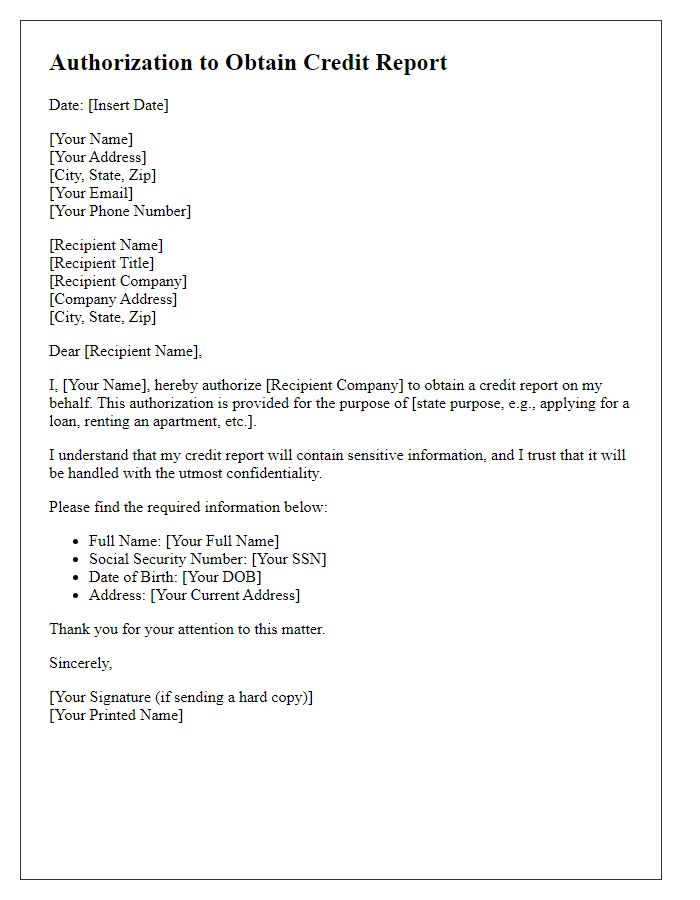

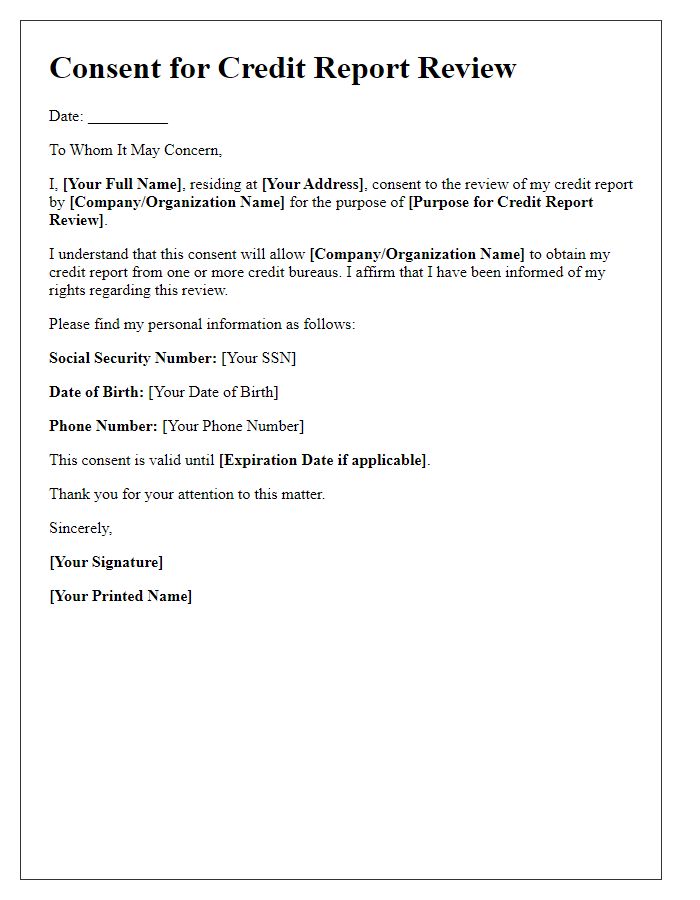

Authorization and Consent

Individuals seeking credit report access must provide explicit authorization and consent to financial institutions. Requests should specify the credit reporting agency (Equifax, Experian, TransUnion) and outline personal details such as Social Security Number (SSN), date of birth, and address. The authorization form must clearly state the purpose (e.g., loan application, rental agreement) and include the signature of the individual granting permission. Data privacy regulations, including the Fair Credit Reporting Act, stipulate the secure handling of personal information throughout this process. Timely access can significantly impact financial decisions and creditworthiness assessment.

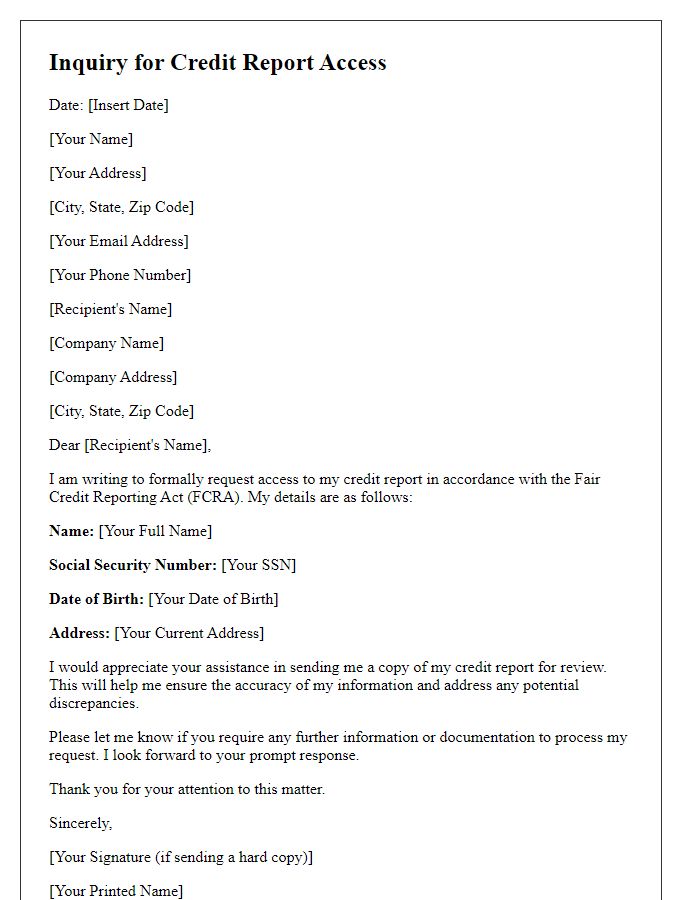

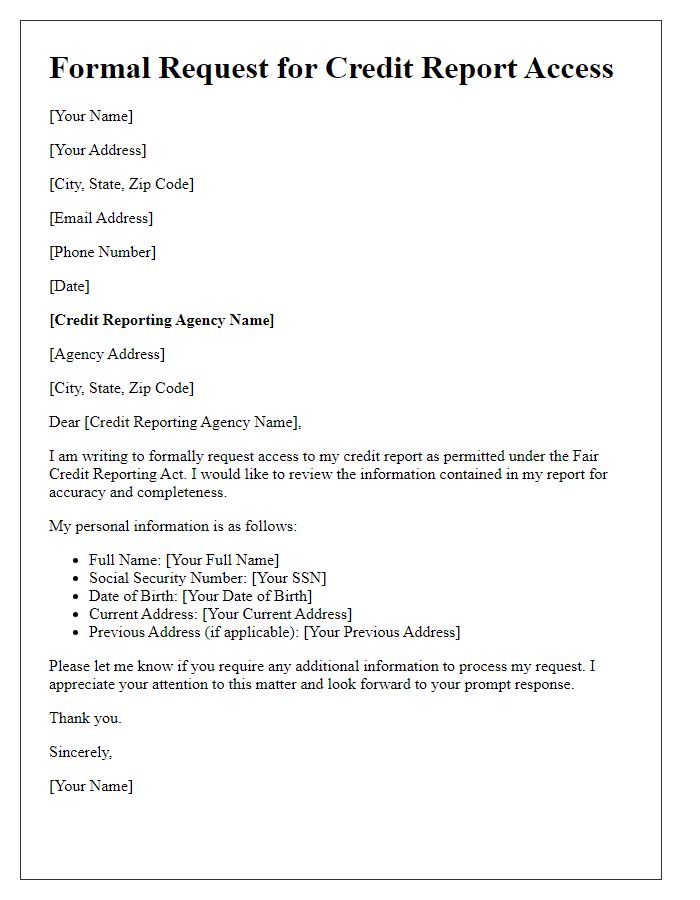

Contact Information

Obtaining a credit report is essential for assessing personal financial health and understanding creditworthiness. Individuals can access their credit reports through major credit bureaus like Equifax, Experian, and TransUnion. Each bureau typically allows one free credit report per year under the Fair Credit Reporting Act (FCRA). When requesting a credit report, it is crucial to provide accurate personal information including full name, social security number (SSN), date of birth, and current address (as well as previous addresses if necessary) to ensure the identification process is seamless. Properly formatted contact information improves communication efficiency with the credit bureau.

Comments