Navigating the world of personal loans can feel overwhelming, especially when it comes to negotiating terms. Whether you're looking to lower your interest rate, extend your repayment period, or adjust your monthly payments, knowing how to effectively communicate your needs is essential. In this article, we'll explore some practical strategies and tips that can empower you during the negotiation process. Let's dive in and discover how you can make the most out of your personal loan situation!

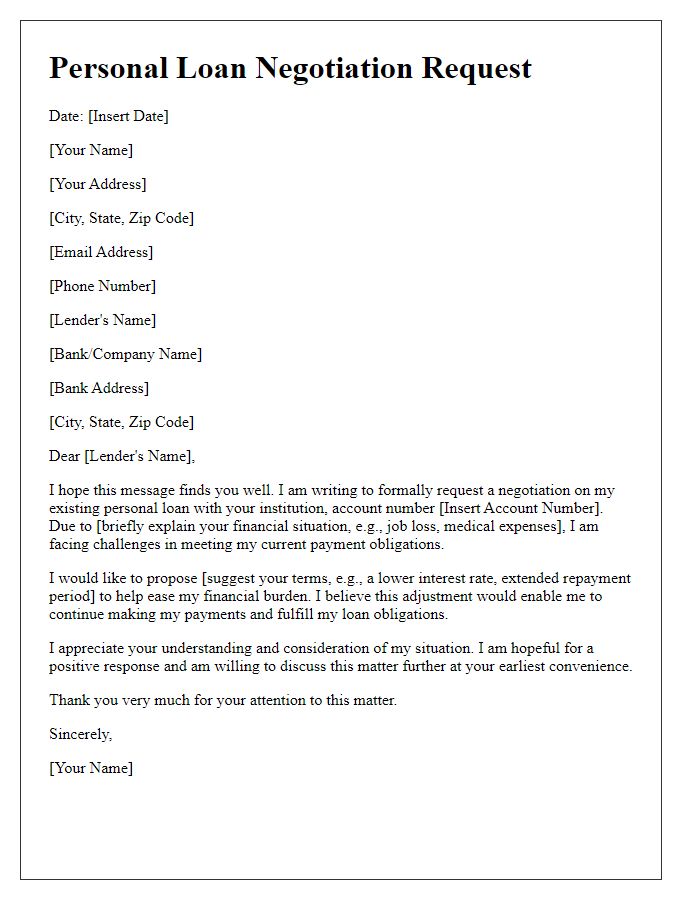

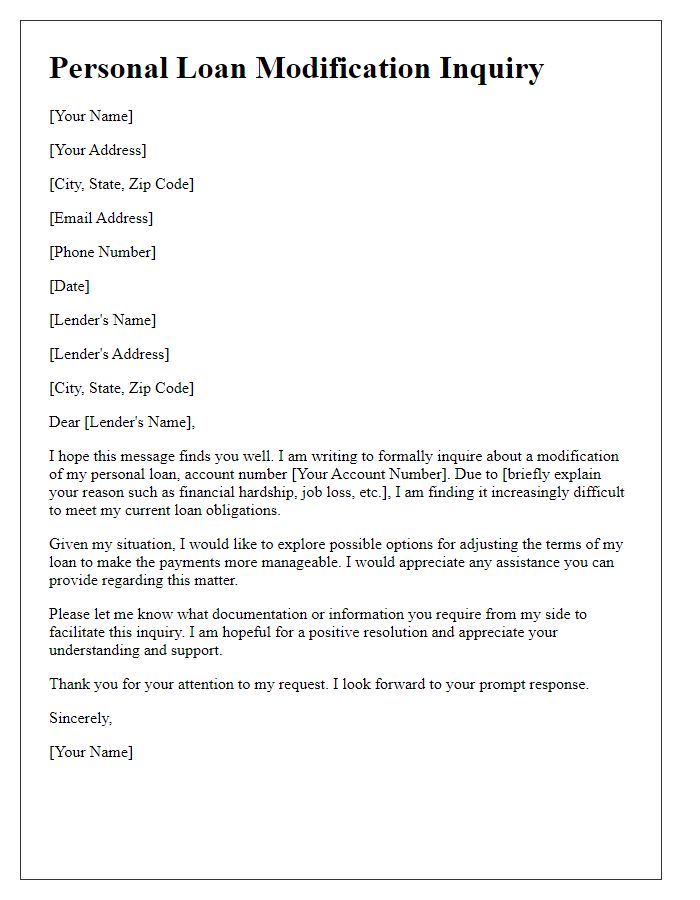

Clear Subject Line

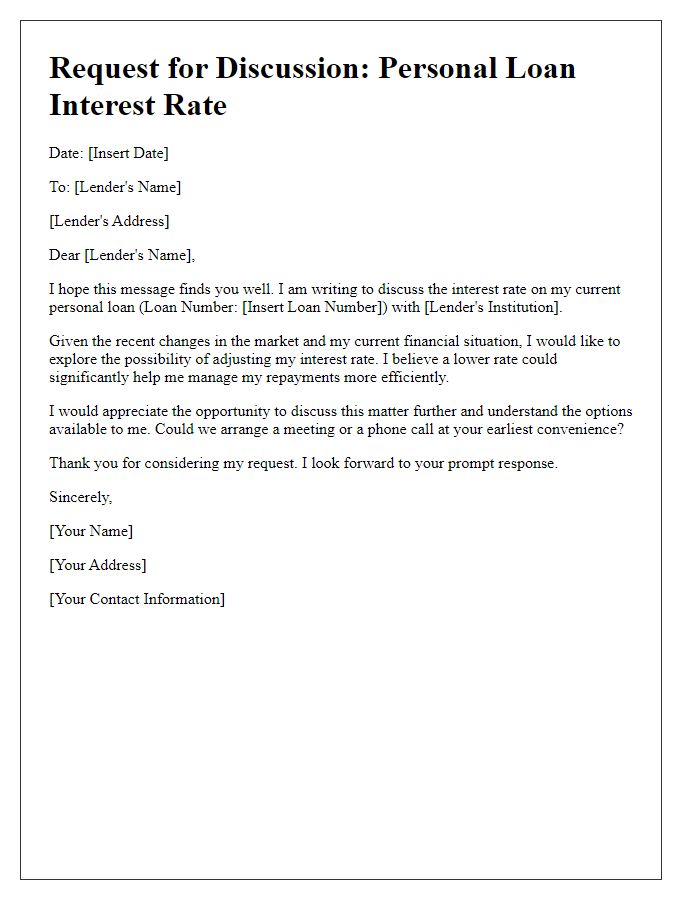

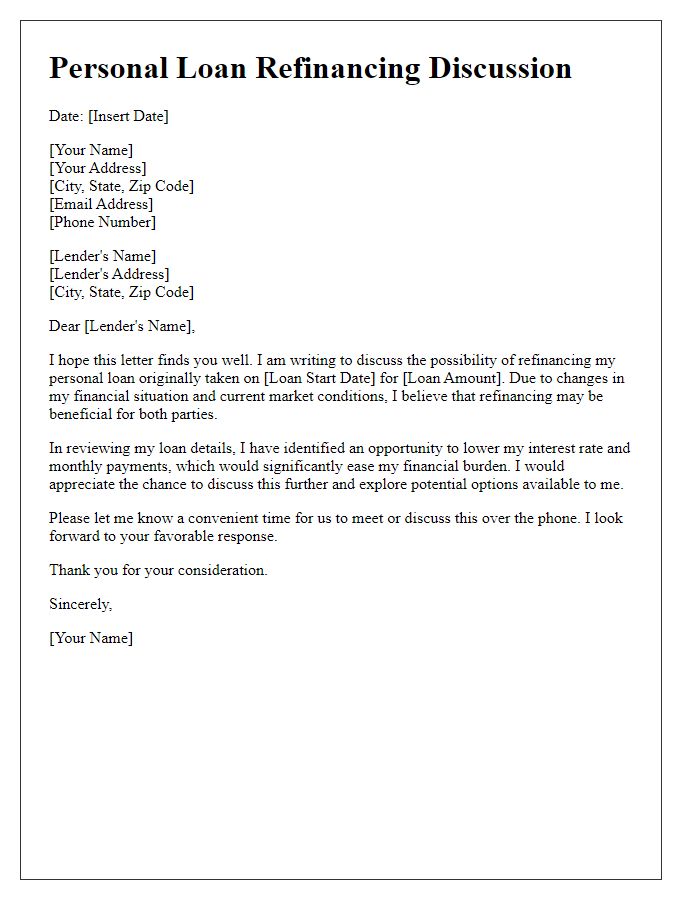

Negotiating a personal loan can yield significant savings on interest rates or payment terms. A well-crafted communication highlights the need for adjustments based on current financial capabilities. Understanding average interest rates (around 10-15% for unsecured loans) empowers the negotiation process. Providing specific examples of competitors can strengthen the case, referencing institutions such as Credit Union A offering rates as low as 7%. Presenting a clear financial situation is vital, including changes in income or unexpected expenses, which can impact repayment capabilities. Documenting positive payment history (average monthly payments made on time for over 12 months) assures lenders of reliability, potentially leading to more favorable loan terms.

Polite Salutation

Personal loans are financial agreements that allow individuals to borrow money for various purposes, often with repayment terms extending from one to five years. Interest rates for personal loans typically range between 6% to 36%, depending on creditworthiness. Many financial institutions, such as banks and credit unions, provide these loans, and monthly payments can vary based on the principal amount borrowed, interest rate, and loan term. Effective negotiation can lead to reduced interest rates or adjusted repayment schedules, ultimately making the loan more manageable for the borrower. Understanding one's credit score, which significantly influences loan terms, is crucial in this negotiation process.

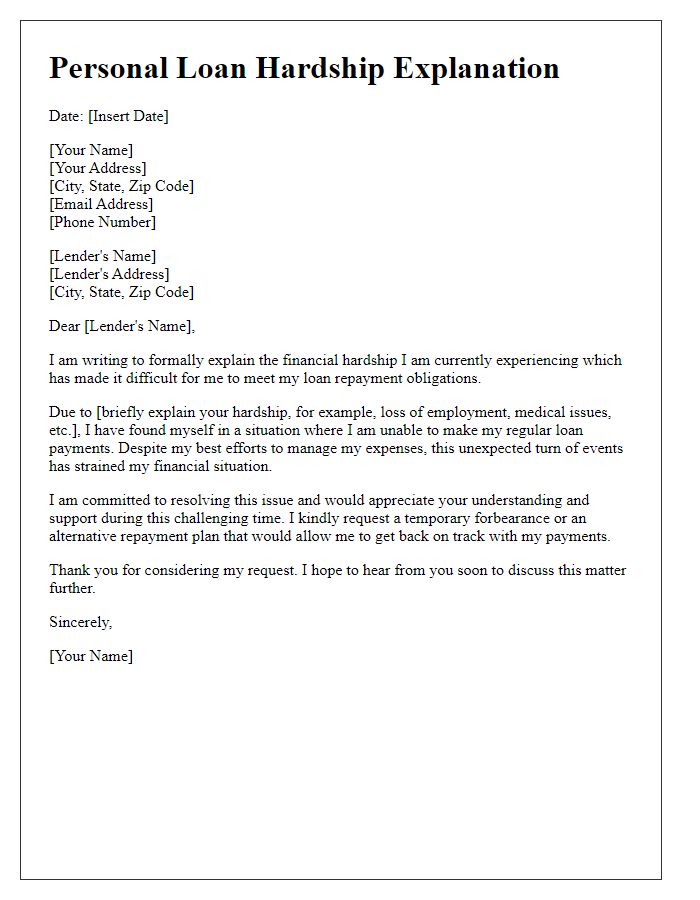

Reason for Negotiation

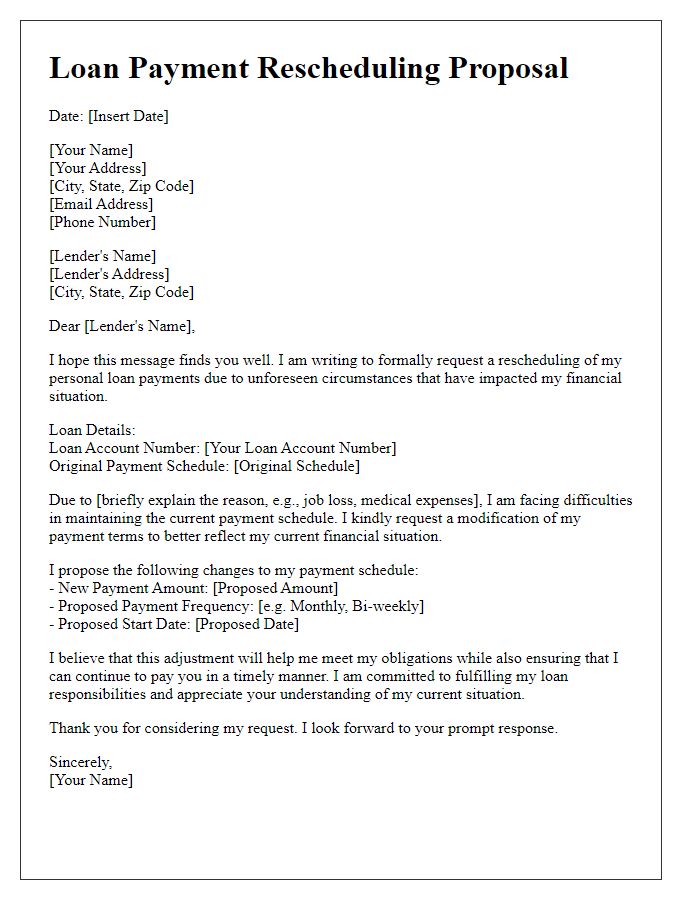

Negotiating personal loans often arises from financial hardships, shifts in personal circumstances, or a desire for better terms. Common reasons include unexpected medical expenses, such as hospital bills averaging $10,000, or job loss affecting monthly income by 30%. Additionally, borrowers may seek to lower interest rates, particularly if prevailing rates drop below 5%, resulting in significant savings over the loan period. Changes in financial goals, such as planning for a home down payment or addressing credit card debt averaging $7,000, can also motivate renegotiation efforts. These reasons underline the importance of open communication with lenders to find a workable solution that accommodates changing financial landscapes.

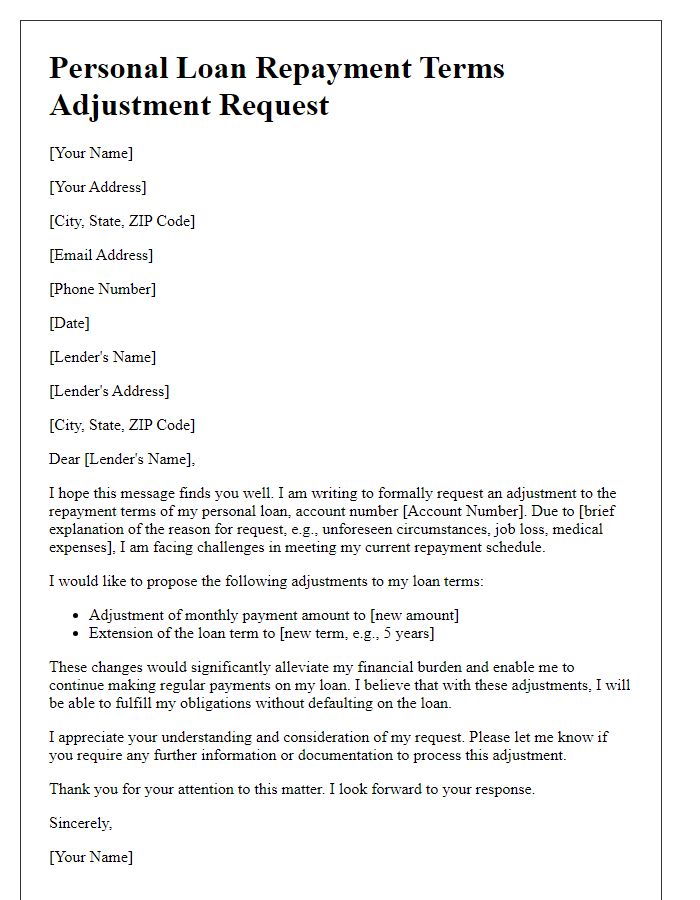

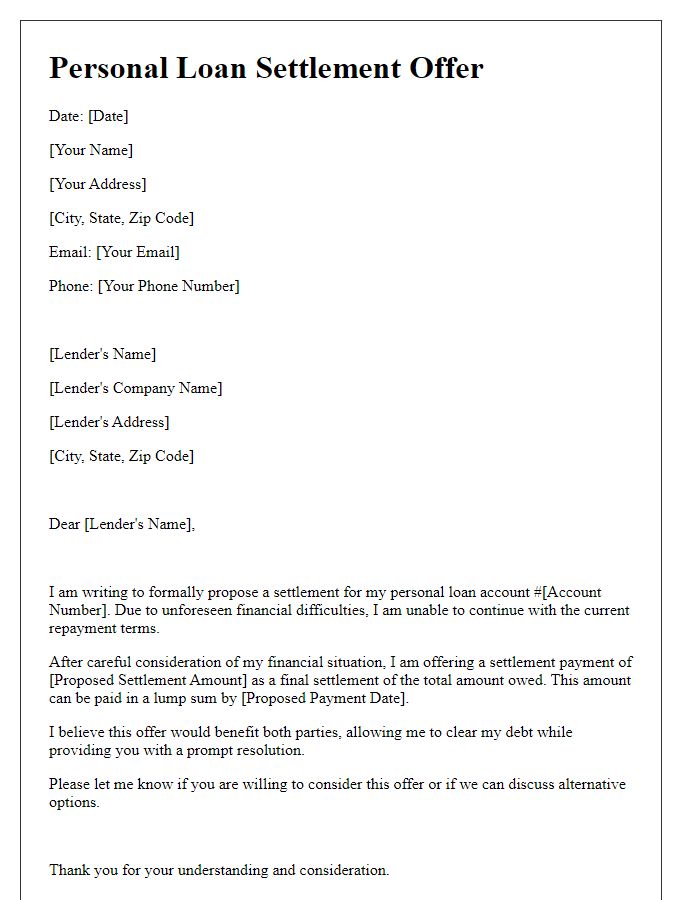

Offer Proposed Terms

In personal loan negotiations, clearly defined proposed terms can significantly impact the agreement's success. Borrowers should consider the interest rate, typically around 5% to 36%, which determines monthly payments and total interest paid over the loan duration. Loan amounts can range from $1,000 to $100,000, depending on personal needs and lender criteria. Repayment periods are often between 2 to 7 years, affecting the overall cost and budgeting plans. Secured versus unsecured loans is essential; secured loans require collateral, potentially reducing interest rates. Establishing a clear payment schedule, including due dates, consequences for late payments, and options for early repayment, provides transparency. Communication about potential fees, such as origination fees (often between 1% to 5% of the loan amount), should occur to avoid surprises. Transparency about financial circumstances, including credit score implications, strengthens the negotiating position and aligns both parties on expectations.

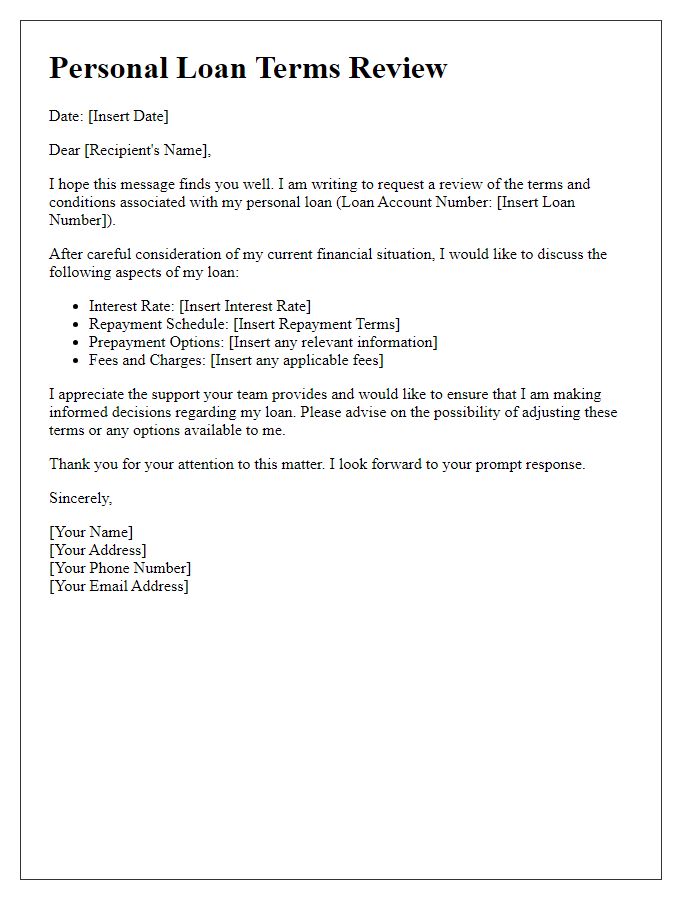

Request for Response

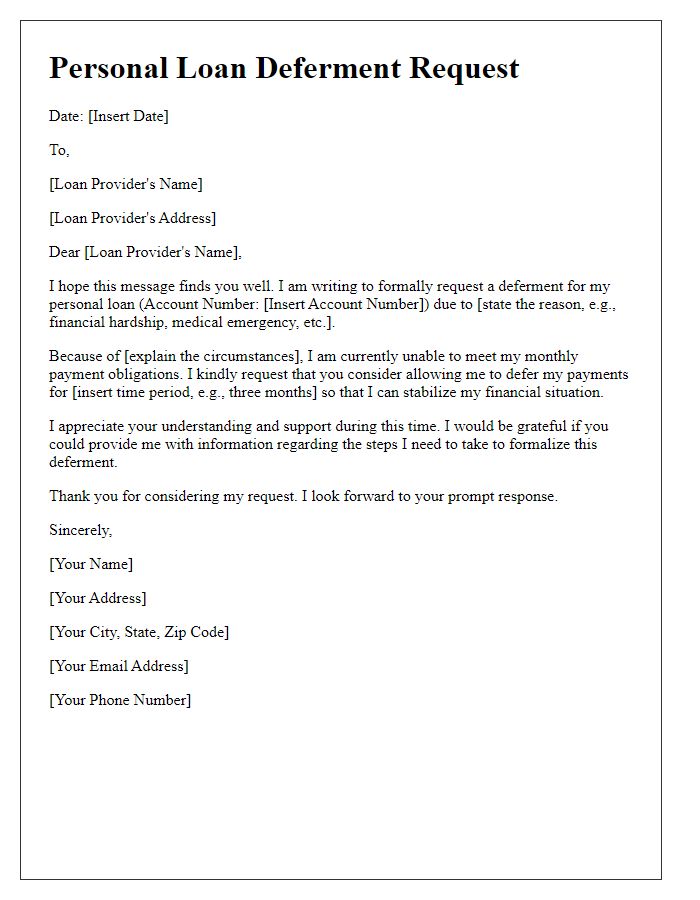

Personal loan negotiations often require clear communication to ensure a mutual understanding between borrowers and lenders. A request for response emphasizes the urgency for acknowledgment or feedback regarding proposed terms or adjustments. Personal loans, typically ranging from $1,000 to $100,000 with varying interest rates and repayment schedules, may warrant discussions about interest rate reductions, extended repayment periods, or temporary suspensions of payments. Lenders in the financial institutions sector often rely on credit scores, which can range from 300 to 850, to evaluate negotiation requests. A timely response can facilitate a smooth resolution process, aiding borrowers in maintaining financial stability while ensuring lenders remain informed about the borrower's intent and situation.

Comments