Are you looking to close a joint credit account but unsure where to start? Whether it's due to a life change or simply wanting to streamline your finances, navigating this process doesn't have to be complicated. In this article, we'll walk you through the essential steps and provide a handy letter template to make your task easier. So, let's dive in and help you take control of your credit!

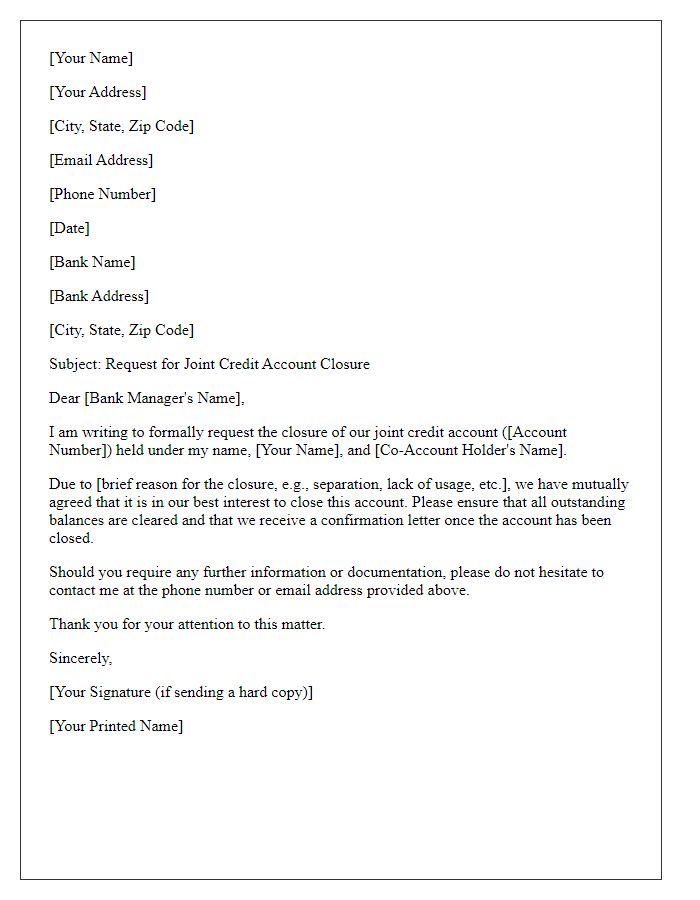

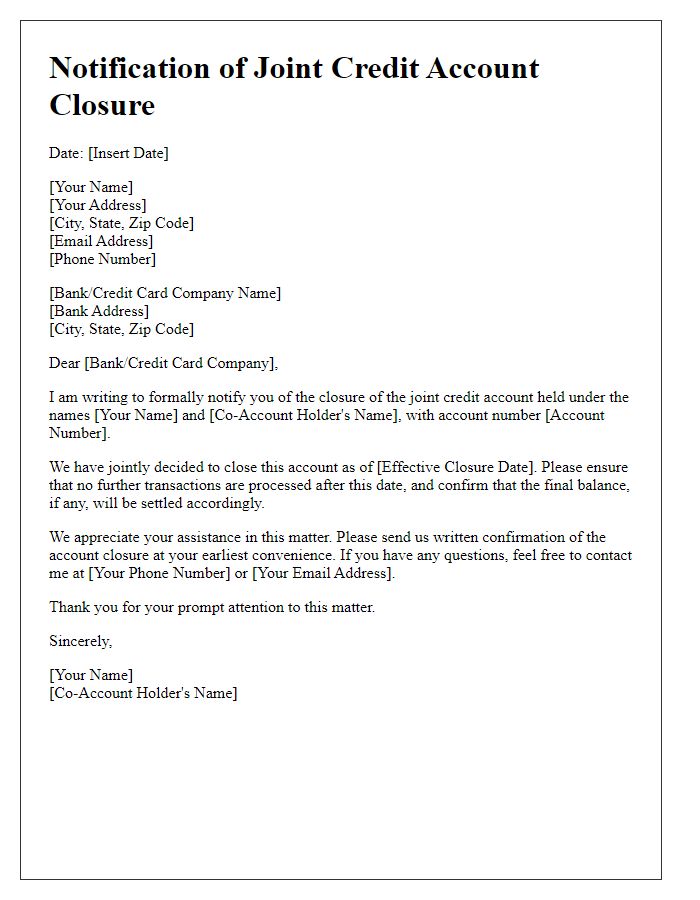

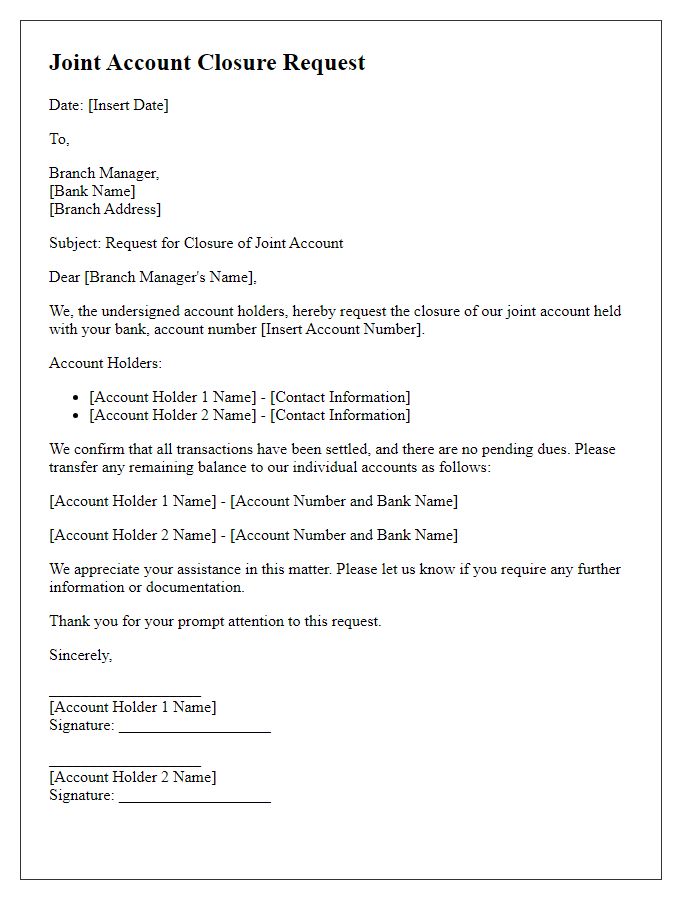

Account Information and Joint Account Holder Details

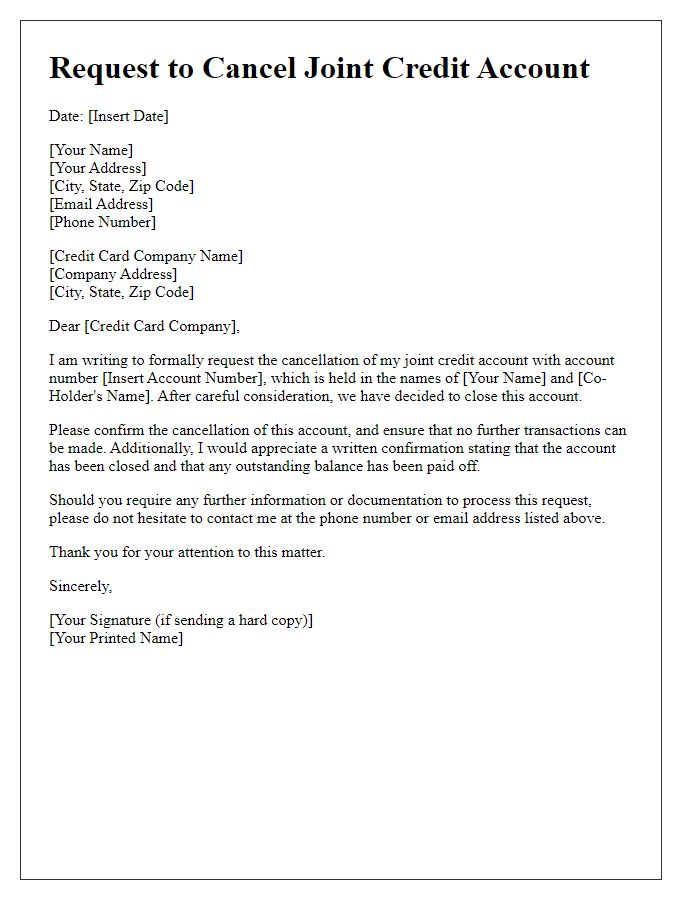

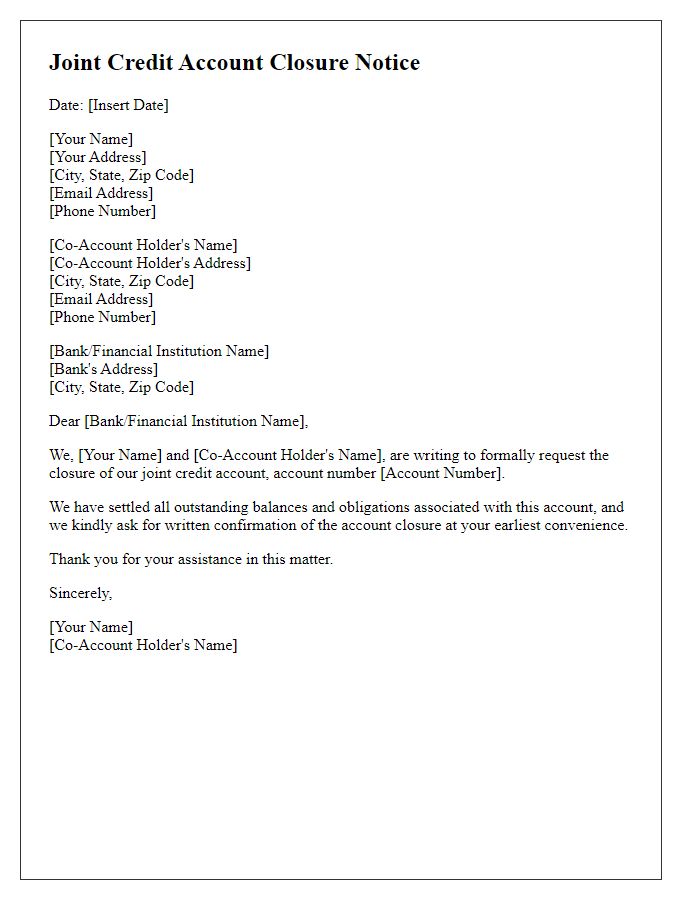

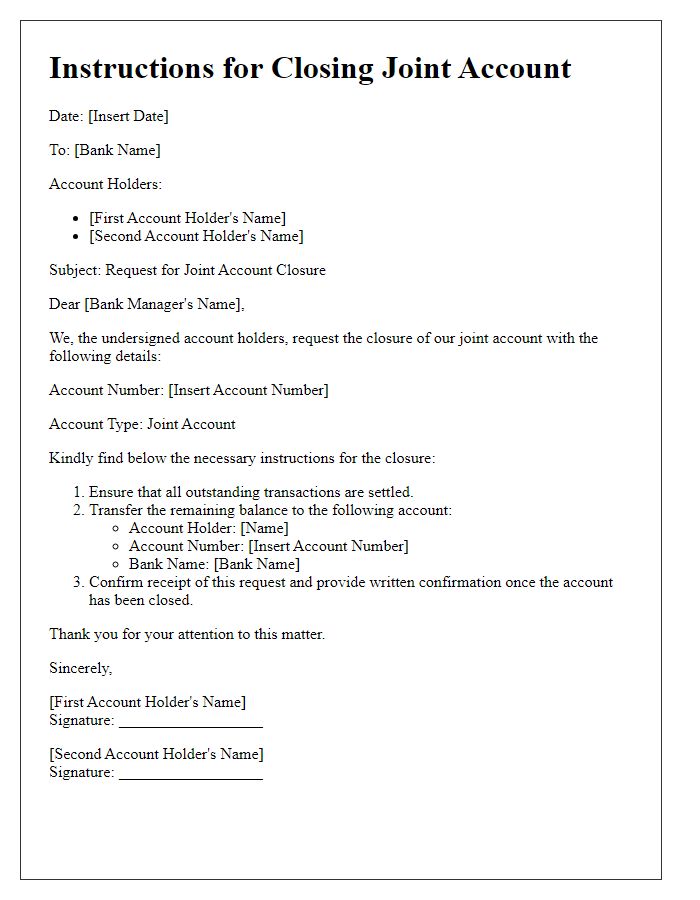

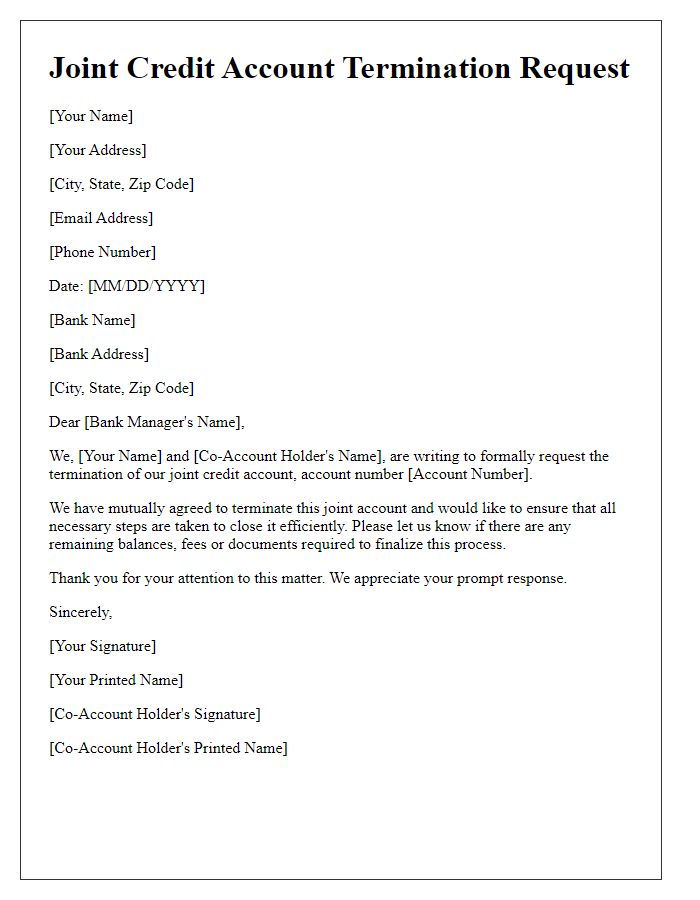

Closing a joint credit account involves a series of important steps and considerations. Joint account details, such as the account number (often consisting of 12-16 digits), need to be accurately documented. Both account holders must be informed of their financial responsibilities, including any outstanding balance, which may vary depending on recent transactions or payments made. Communication with the credit issuer, which could be a major bank like Wells Fargo or Bank of America, is essential to initiate the closure process. All applicable terms and conditions of the account must be reviewed, especially regarding fees or penalties for early closure. Finally, obtaining written confirmation of account closure is crucial to ensure that both parties' credit scores are not adversely affected by lingering balances or miscommunications post-closure.

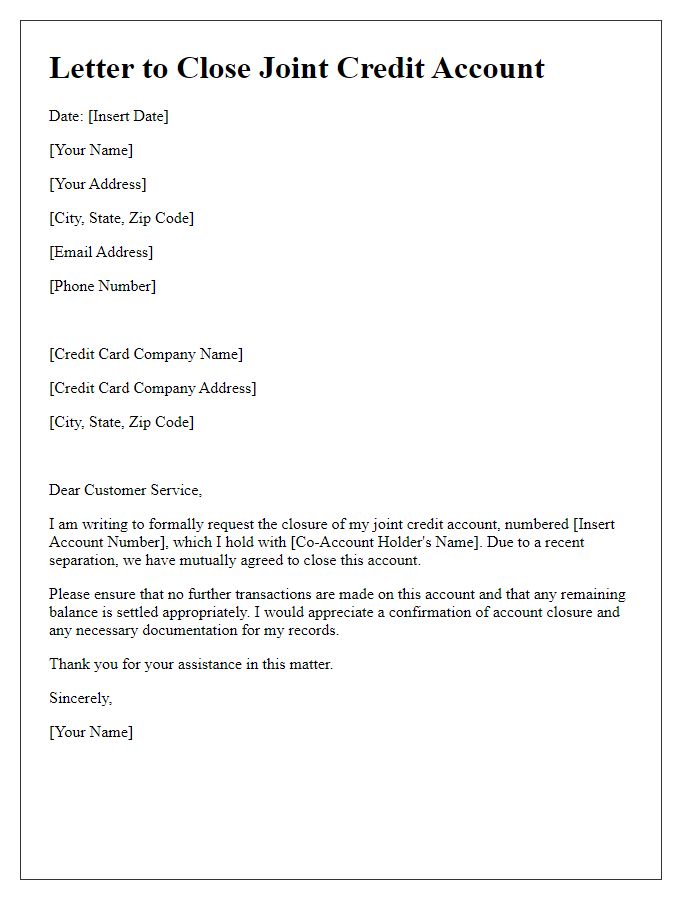

Reason for Closure

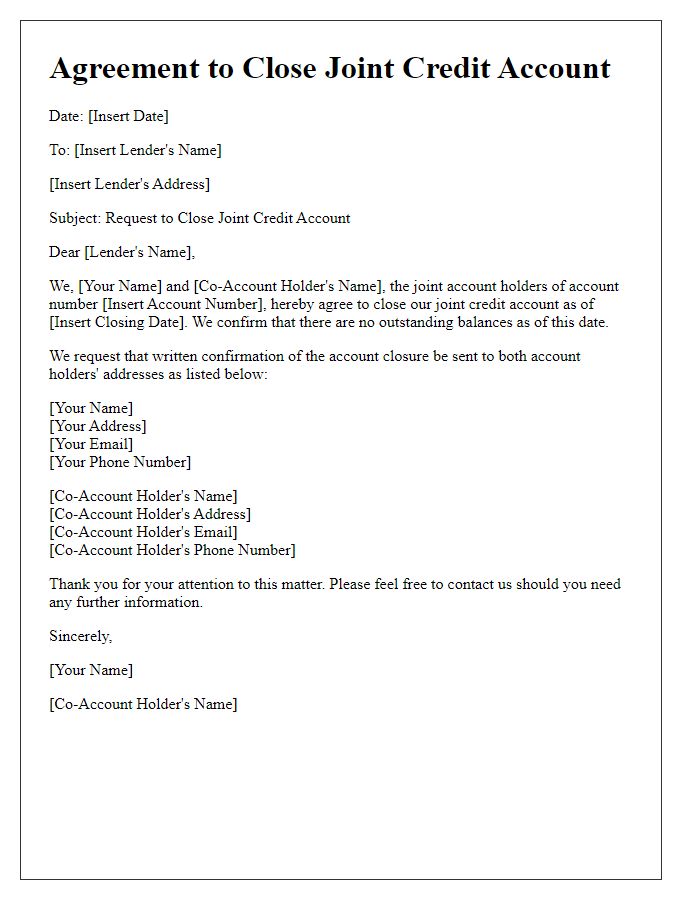

Closing a joint credit account can impact both account holders' credit scores, especially if the account has a significant balance or payment history. Reasons for closure often include changes in financial circumstances, personal disputes, or a desire to manage individual credit more effectively. Communication is vital in these situations to ensure clarity and mitigate potential negative effects on credit ratings. The specific closure process involves verifying identities and following the lender's guidelines, which may differ across institutions. Proper documentation, such as a formal request for closure, can help facilitate the process smoothly, ensuring both parties are informed and protected from future liabilities.

Authorization and Consents

The process of closing a joint credit account involves careful consideration of authorization and consent from all account holders. Providing individuals their rights, all parties must acknowledge the decision to dissolve the credit account. It is essential to include account specifics, such as the account number associated with the joint credit account, as well as the date of closure. Additionally, consent forms should be signed, verifying that all parties agree to this action, ensuring there are no outstanding balances or disputes. Documentation should specify the implications on credit scores and the responsibilities of each party post-closure. Contact details of involved financial institutions may be included for further communication or clarification.

Request for Confirmation and Final Statement

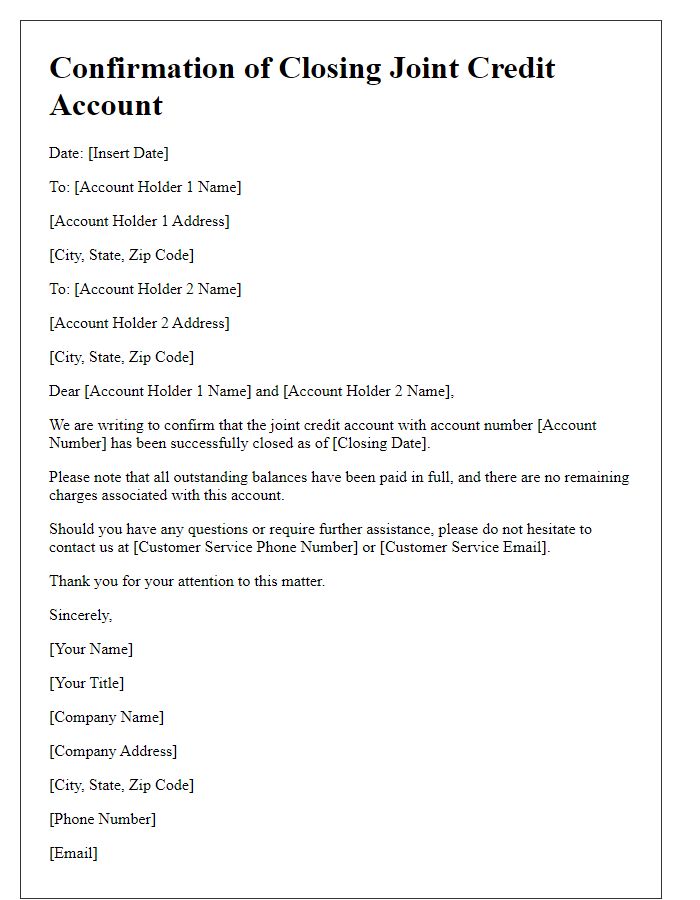

Closing a joint credit account involves ensuring that both parties are on the same page regarding any remaining balances and responsibilities. It typically requires a formal request to the credit card issuer or financial institution for confirmation of account closure. In this context, essential details such as account number, names of joint account holders, and the current outstanding balance should be included. The request should emphasize the need for a final statement highlighting no remaining liabilities and the closure date. Proper documentation helps prevent future disputes concerning any transactions that could occur post-closure. This process is crucial for both parties to protect their financial interests and maintain clear communication.

Contact Information for Follow-up

To efficiently close a joint credit account, it is essential to provide relevant contact information for follow-up. Include details such as the primary account holder's full name (John Doe), joint account holder's name (Jane Smith), account number (1234-5678-9012-3456), and the issuing bank's name (ABC Bank). Mention the customer service phone number (1-800-123-4567) for inquiries regarding the account closure process. Additionally, provide email contact (support@abcbank.com) for written correspondence and clarification. Documenting these details ensures smooth communication during the account closure process and provides avenues for any needed follow-up or dispute resolution.

Comments