Hey there! If you're feeling the stress of financial hardship and need to reach out to your creditors, don't worry; you're not alone in this. Crafting a thoughtful letter can make a huge difference in how your situation is understood and handled. In our upcoming article, we'll share a simple, effective template that can help you communicate your challenges professionally. So, keep reading to discover how to take the first step towards easing your financial burden!

Personal Information and Contact Details

Financial hardship notifications highlight essential personal information and their implications for the financial situation. Relevant details include full name, which identifies the individual in financial records. Address, including street, city, state, and postcode, serves as the official location for correspondence. Email address, vital for digital communication, aids in swift responses. Phone number provides an immediate line for discussion and clarification. Date of notification marks the urgency and context of the communication. Providing accurate details helps creditors understand the situation comprehensively and facilitates potential repayment solutions.

Explanation of Financial Hardship

Financial hardship affects many households, typically due to unforeseen circumstances such as sudden job loss, significant medical expenses, or unexpected home repairs. Individuals facing this issue often struggle to cover essential bills, including mortgage payments, utility costs, and minimum credit card payments. For instance, a survey from the U.S. Bureau of Labor Statistics shows that the unemployment rate can spike to over 14% during economic downturns, leading to severe income instability. Furthermore, rising healthcare costs have contributed to an increasing number of bankruptcies, with estimates suggesting that medical debt affects approximately 1 in 5 Americans. Creditors are often alerted to these challenges when debtors communicate their situations, which can lead to options such as deferred payments or modified settlement plans. Notifying creditors about financial hardship is a crucial step in managing sustainable repayment strategies and avoiding further financial distress.

Current Financial Situation Summary

Individuals facing financial hardship often experience significant stress and anxiety due to unexpected circumstances. Events such as job loss, medical emergencies, or unforeseen expenses can drastically alter one's financial landscape. In these situations, maintaining communication with creditors becomes crucial. A comprehensive summary detailing the current financial situation must include key components like total monthly income (which may have decreased due to reduced hours or unemployment), essential expenses (such as rent or mortgage payments, utility bills, and groceries), and any outstanding debts (including credit card balances and personal loans). Providing specific numbers and dates can enhance credibility, helping creditors understand the challenges faced. This proactive approach fosters empathy and may increase the chances of negotiating flexible payment terms or temporary relief.

Request for Specific Assistance or Modification

Financial hardship can lead to significant challenges in meeting payment obligations, particularly with creditors such as credit card companies and lenders. Situations involving unexpected events like job loss, medical emergencies, or natural disasters may require assistance or modifications to existing payment plans. Affected individuals typically must provide documentation, such as bank statements or termination letters, to demonstrate their current financial situation. When submitting requests to creditors, clarity and specificity in outlining the desired modifications--like reduced payments or extended repayment periods--are critical for potential approval. Timing also plays a crucial role, as contacting creditors promptly after experiencing financial strain can increase the likelihood of finding an agreeable solution.

Documentation and Supporting Evidence

Financial hardship notifications to creditors necessitate comprehensive documentation and supporting evidence. Essential documents include recent pay stubs reflecting income levels, bank statements detailing monthly expenditures, tax returns from the past two years, and any notices of reduced work hours or layoffs from employers. Additional records such as medical bills highlighting unforeseen expenses, eviction notices documenting housing instability, and any supporting letters from social services can strengthen the case. Detailed charts showcasing monthly cash flow, identifying sources of income versus necessary expenses, can also aid in presenting a clear picture of the financial distress being faced.

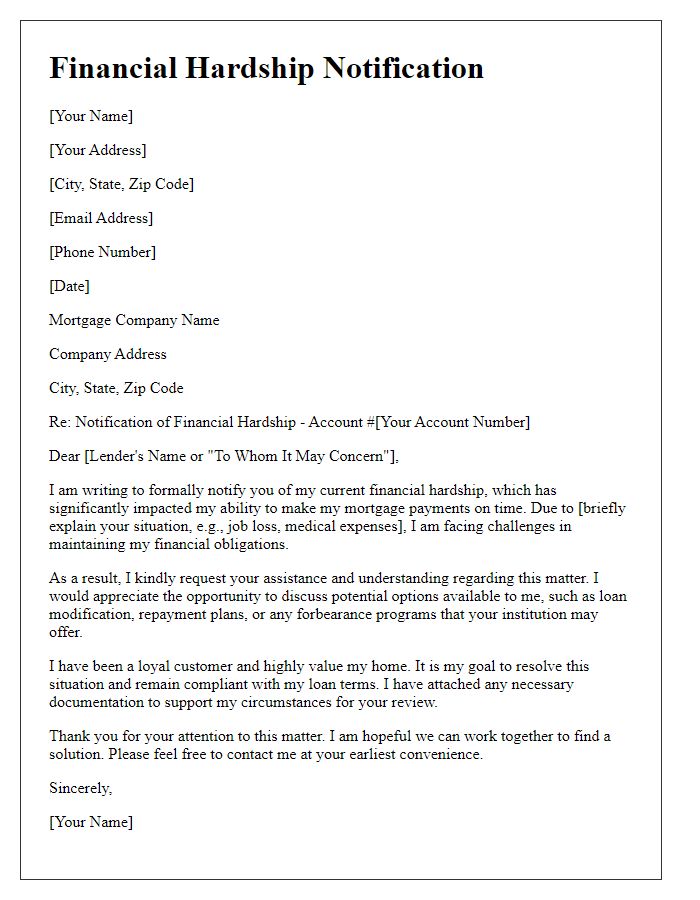

Letter Template For Financial Hardship Notification To Creditors Samples

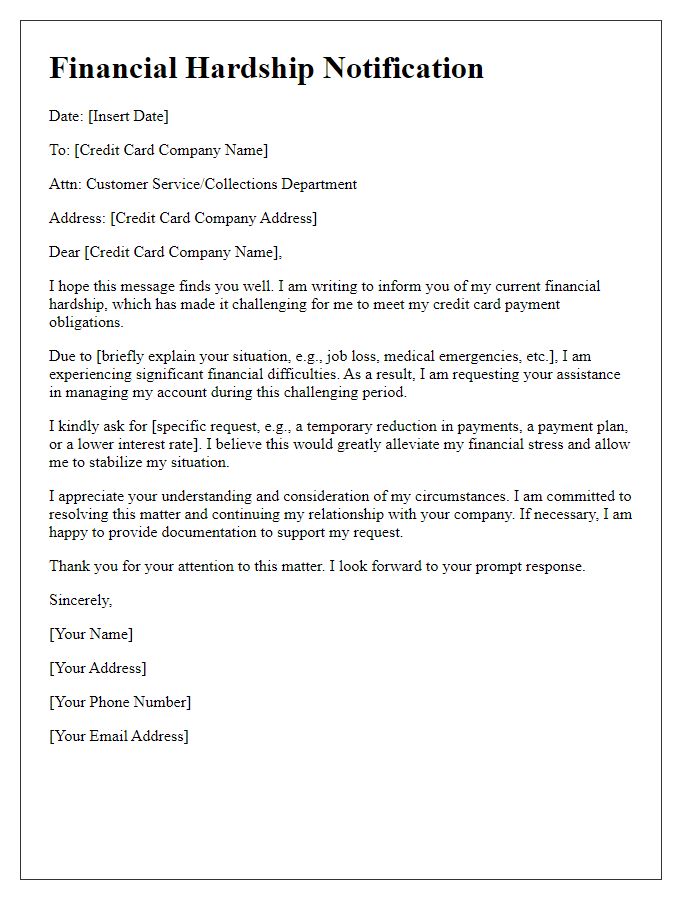

Letter template of financial hardship notification for credit card companies

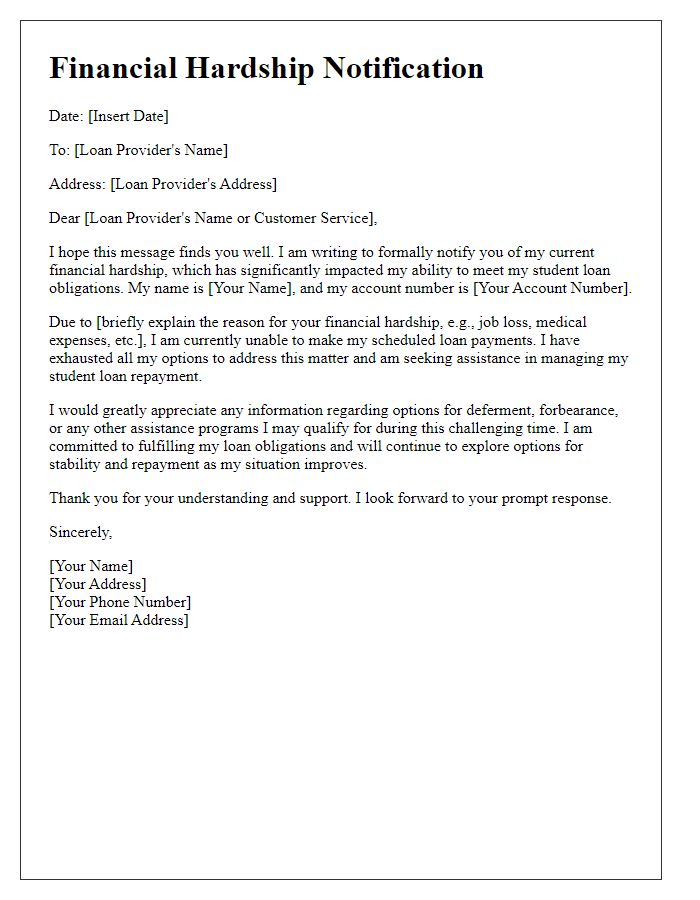

Letter template of financial hardship notification for student loan providers

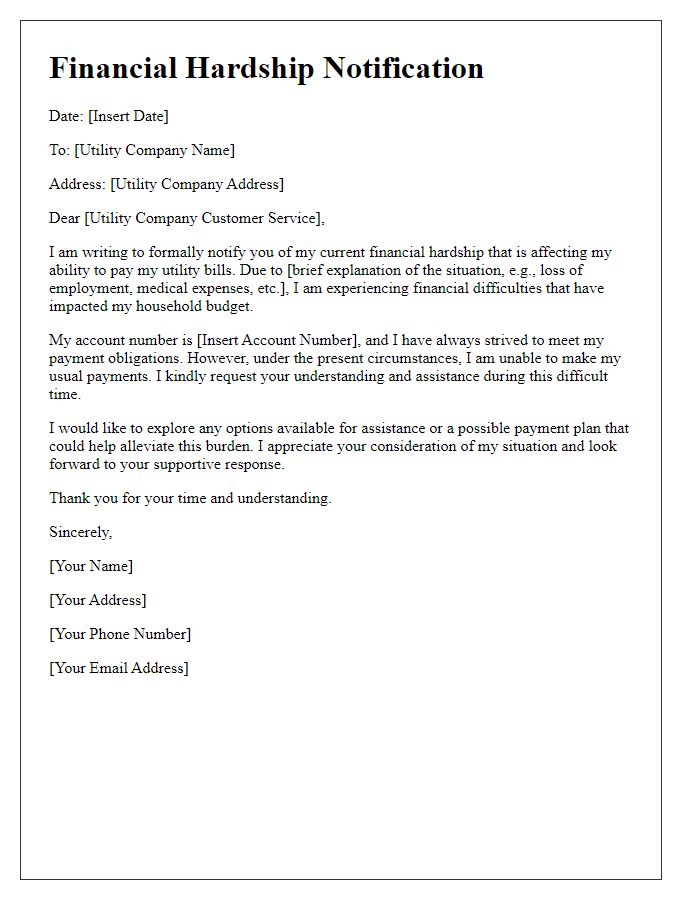

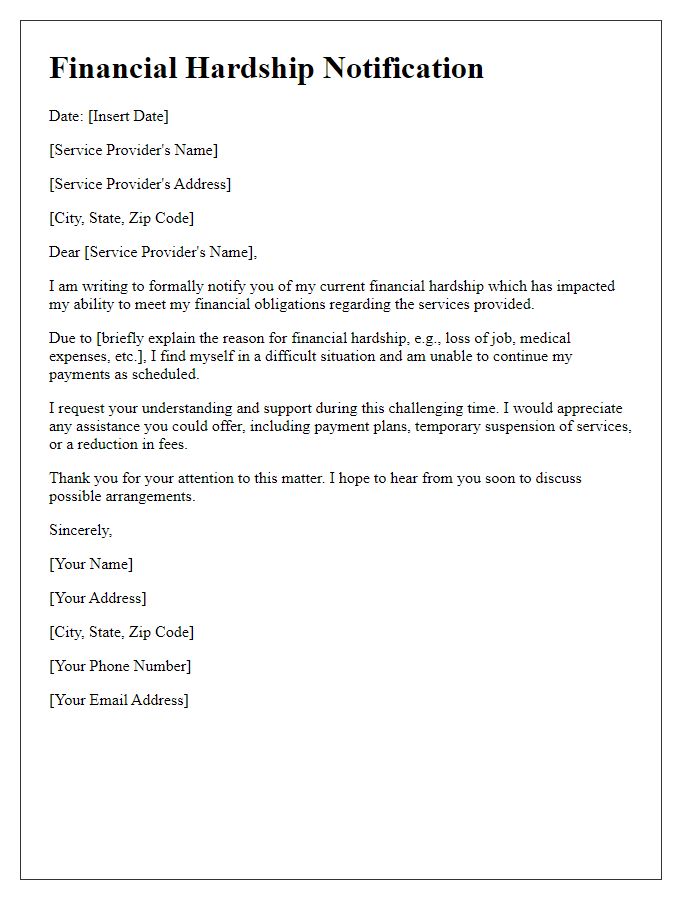

Letter template of financial hardship notification for utility companies

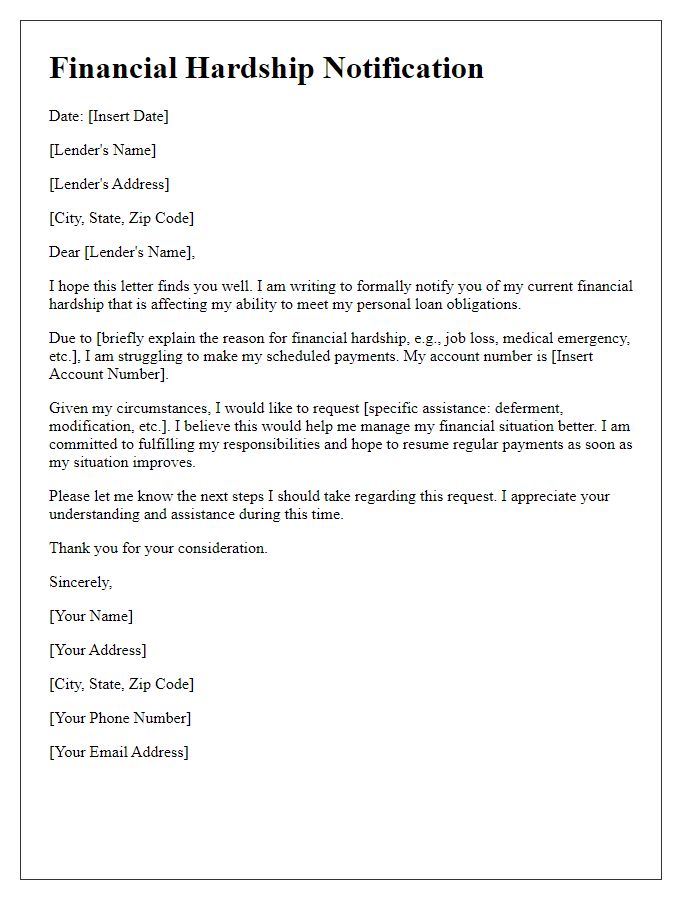

Letter template of financial hardship notification for personal loan lenders

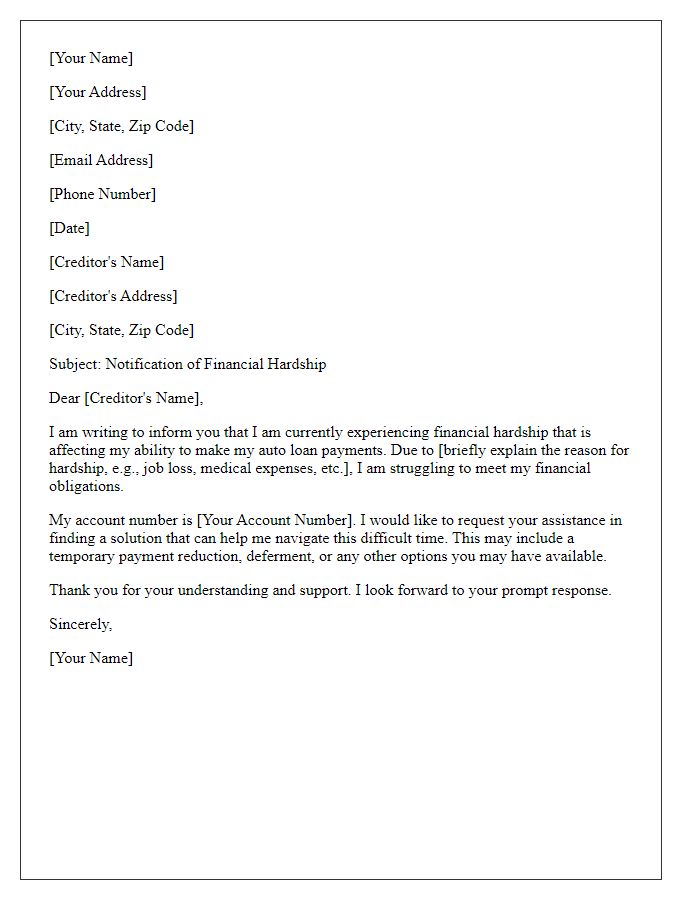

Letter template of financial hardship notification for auto loan creditors

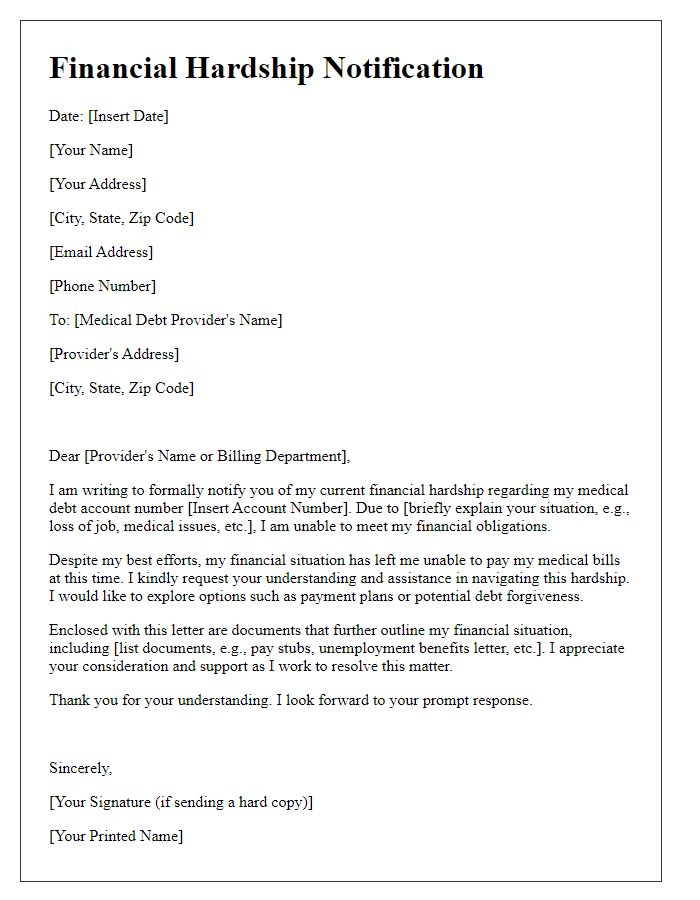

Letter template of financial hardship notification for medical debt providers

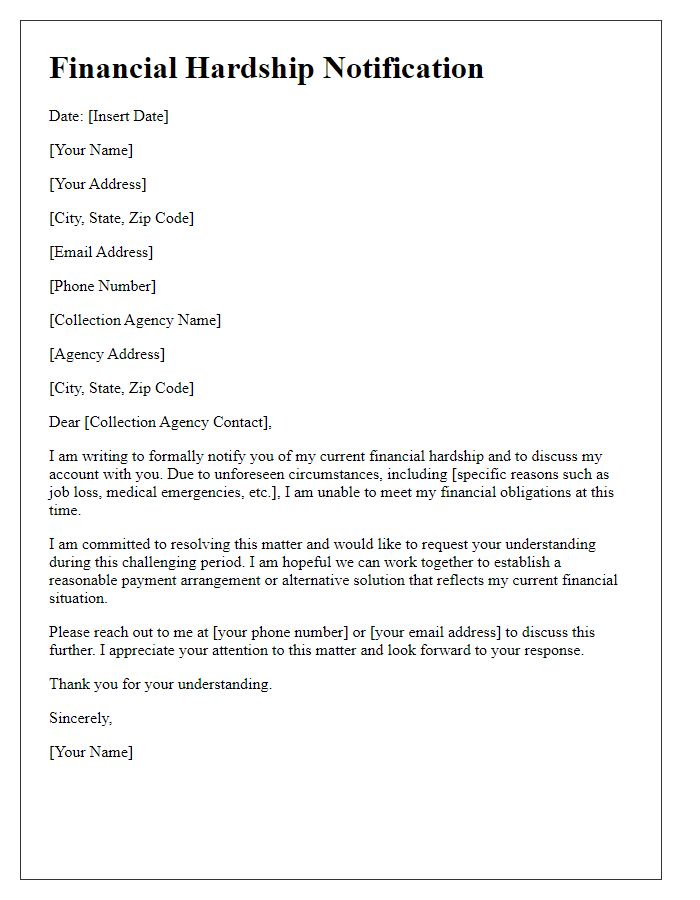

Letter template of financial hardship notification for collection agencies

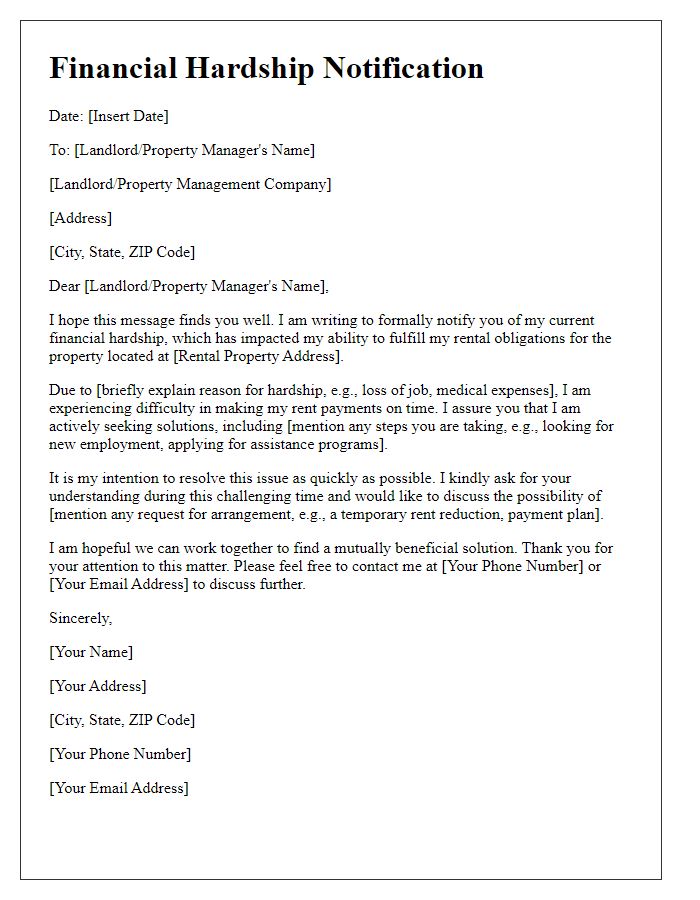

Letter template of financial hardship notification for rental agreements

Comments