Are you tired of high credit card interest rates eating away at your hard-earned money? You're not aloneâmany consumers face the challenge of managing steep rates that can feel overwhelming. Fortunately, there are steps you can take to request a lower interest rate from your credit card issuer, potentially saving you significant cash in the long run. Ready to learn how to craft a compelling letter that could lead to a reprieve from those burdensome fees? Read on for tips and a sample template to get you started!

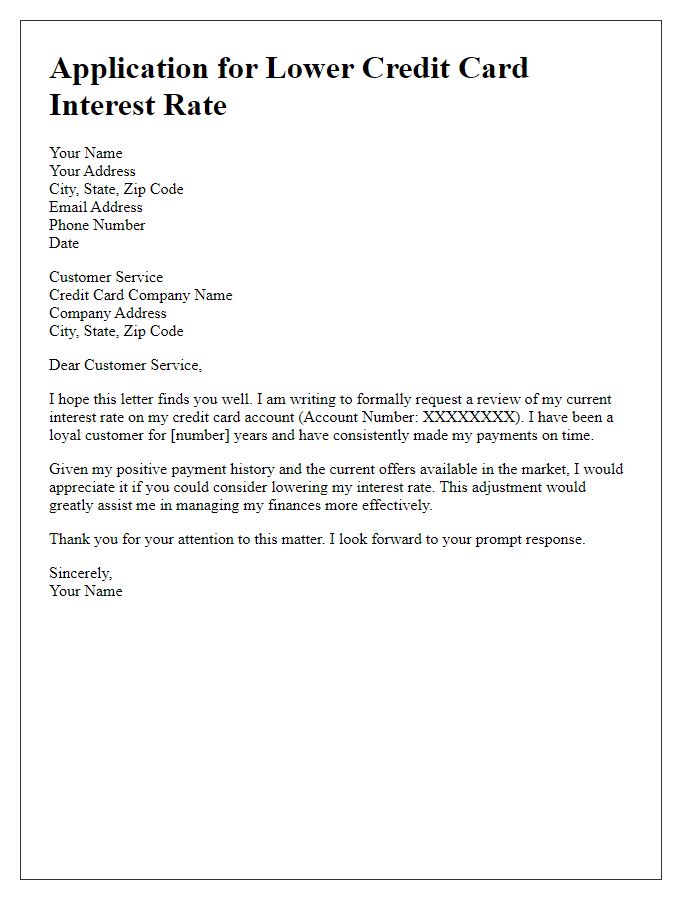

Account Information

Credit card interest rates significantly impact monthly payments and overall debt management. For example, a typical credit card interest rate ranges from 15% to 25%, significantly affecting borrowers over time. Reducing this rate can lower total interest paid, enhancing financial stability. Cardholders often seek to negotiate a lower interest rate based on responsible payment history, current market rates, or competitive offers from other banks. Documenting account information, like payment history over the past year or specific reasons for the request, may strengthen the case for rate reduction. Engaging with customer service representatives at institutions like Capital One or Chase can pave the way for better terms.

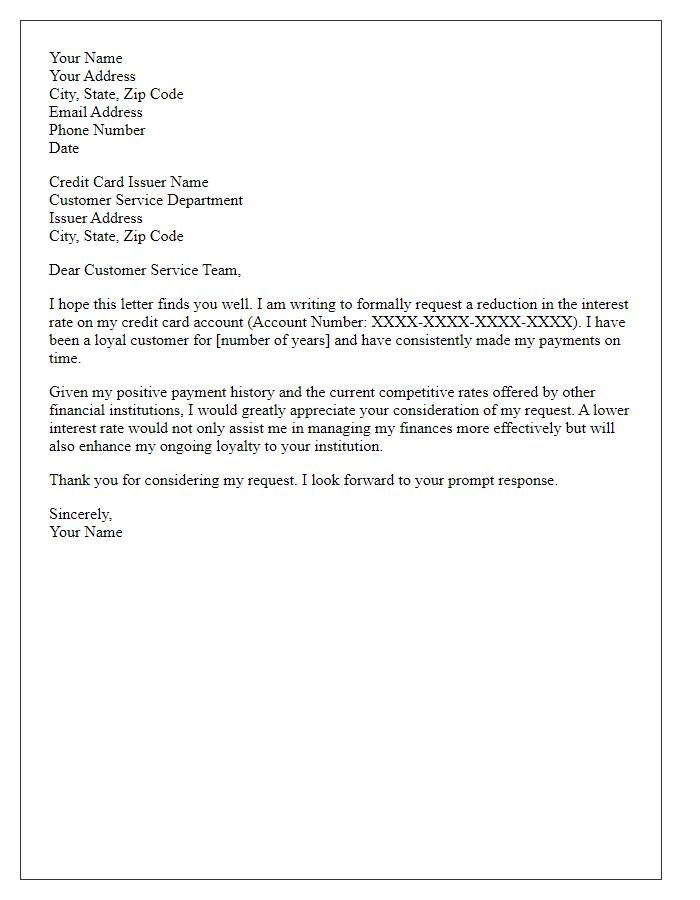

Request for Reduction

Reducing credit card interest rates can significantly ease financial strain for consumers, especially during challenging economic times. Many credit card companies, such as Visa or MasterCard, often review accounts for potential adjustments based on a person's payment history, income changes, and loyalty. For example, a consumer with an account in good standing for more than five years may request a rate reduction, emphasizing responsible usage, timely payments, and overall creditworthiness. Additionally, mentioning competitive offers from other financial institutions can bolster the case, highlighting the current average credit card interest rates around 16% to 24%, prompting the issuer to reconsider terms favorably. Such negotiations, if successful, can ultimately lower monthly payments and reduce total debt incurred over time.

Financial Reasoning

Credit card interest rates significantly impact monthly payments, often leading to financial strain for individuals. High-interest rates, sometimes exceeding 20%, can result in debt accumulation, making it difficult for consumers to manage their finances effectively. Negotiating a reduced interest rate can alleviate these pressures, enabling faster debt repayment. Financial institutions such as banks and credit unions may consider customer loyalty, payment history, and overall credit profile when negotiating terms. For instance, a consistent payment record over 12 months can bolster a request for lower rates, enhancing chances for approval. Additionally, market trends indicating lower national interest rates provide leverage, as consumers seek more favorable conditions and institutions aim to retain competitive advantages in the lending landscape.

Positive Payment History

A credit card interest rate reduction can provide significant savings for responsible borrowers. A positive payment history, marked by on-time payments for over 12 consecutive months, demonstrates financial reliability and creditworthiness. This history not only impacts the individual's credit score, often above 700, but also highlights the consumer's commitment to maintaining a healthy account standing. Financial institutions, such as major banks like Chase or Bank of America, often consider this track record in their evaluations. A lower interest rate can reduce monthly payments and total interest paid over time, making it a strategic advantage for those managing credit effectively.

Call to Action

Credit card interest rates, often exceeding 20% annually, can significantly impact consumer finances. By contacting the credit card issuer directly, consumers may request a reduction, citing payment history and loyalty. Highlighting consistent on-time payments and account longevity can strengthen the case for a rate decrease. Additionally, mentioning competitive offers from other credit card companies can provide leverage. This proactive approach may lead to more favorable terms, potentially saving hundreds of dollars in interest over time. Consumers should be prepared for negotiation and emphasize their commitment to maintaining the account in good standing.

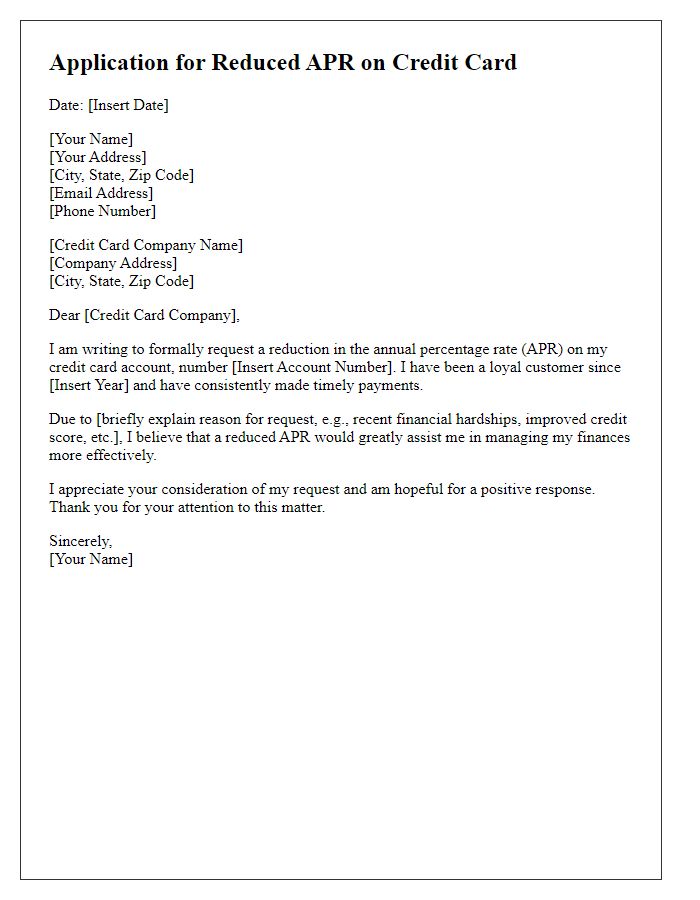

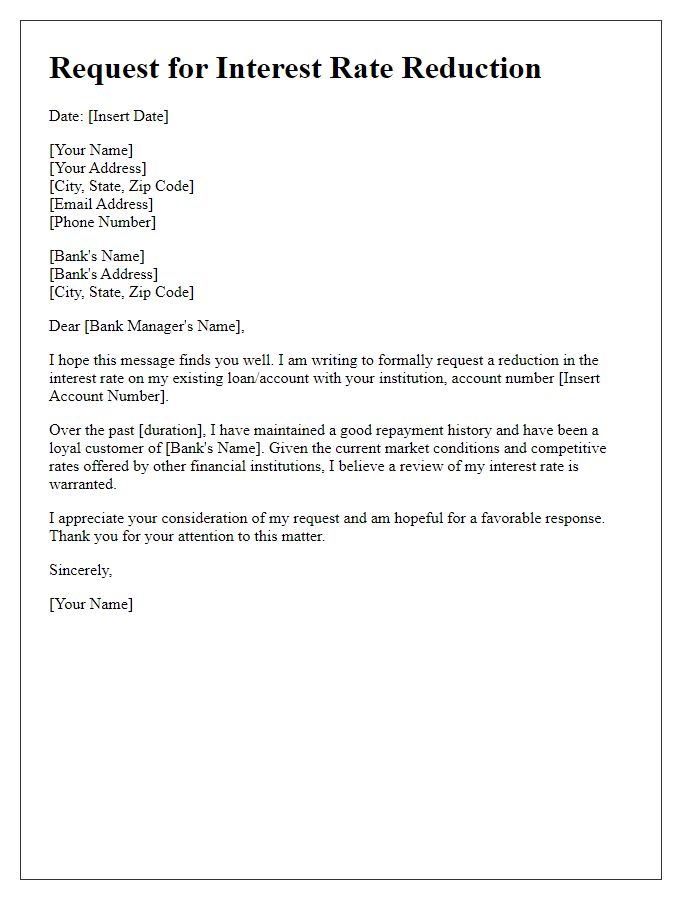

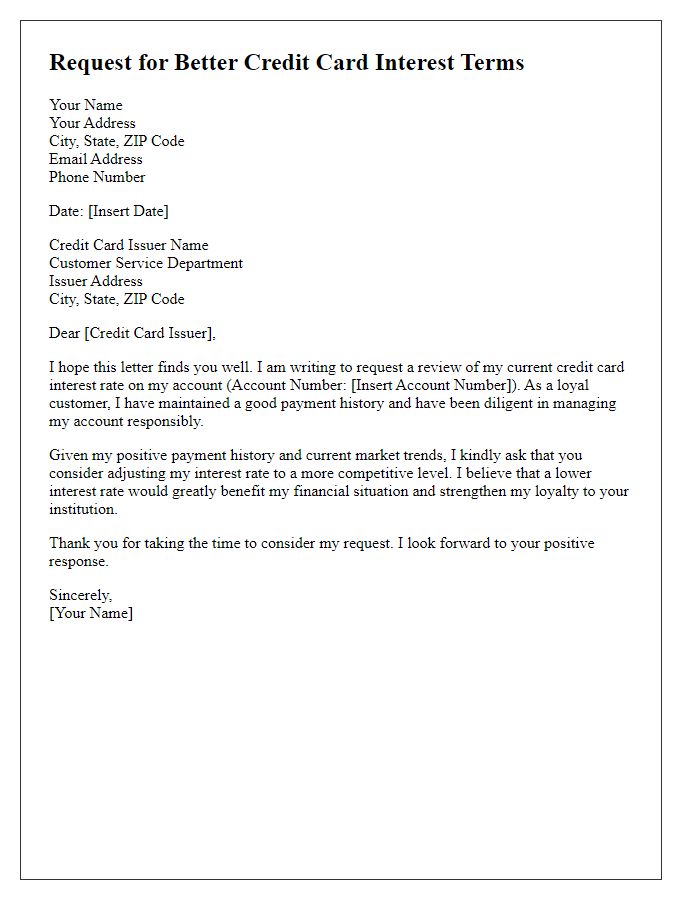

Letter Template For Credit Card Interest Rate Reduction Samples

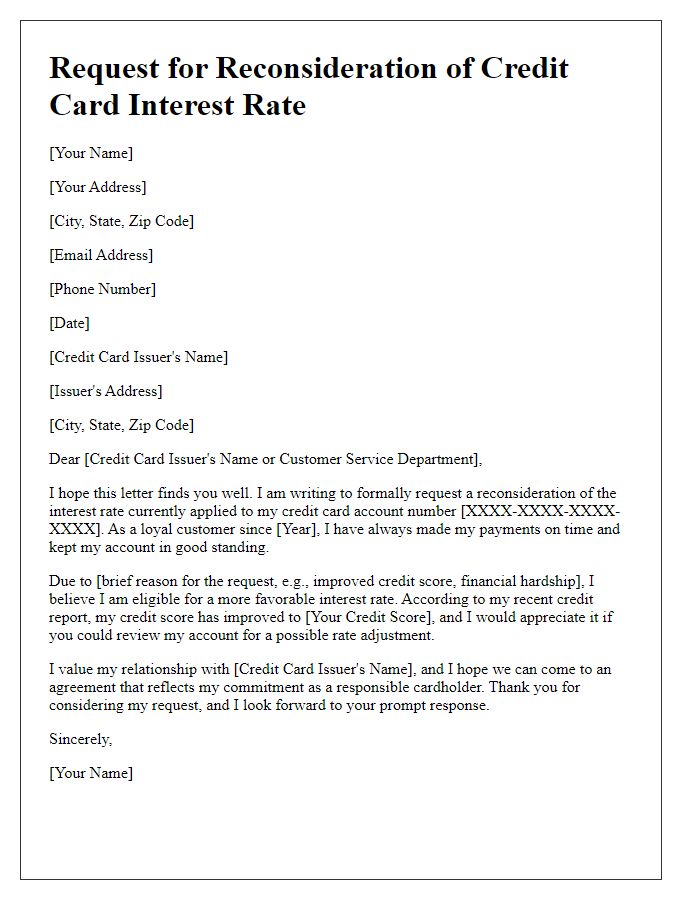

Letter template of request for reconsideration of credit card interest rate

Comments