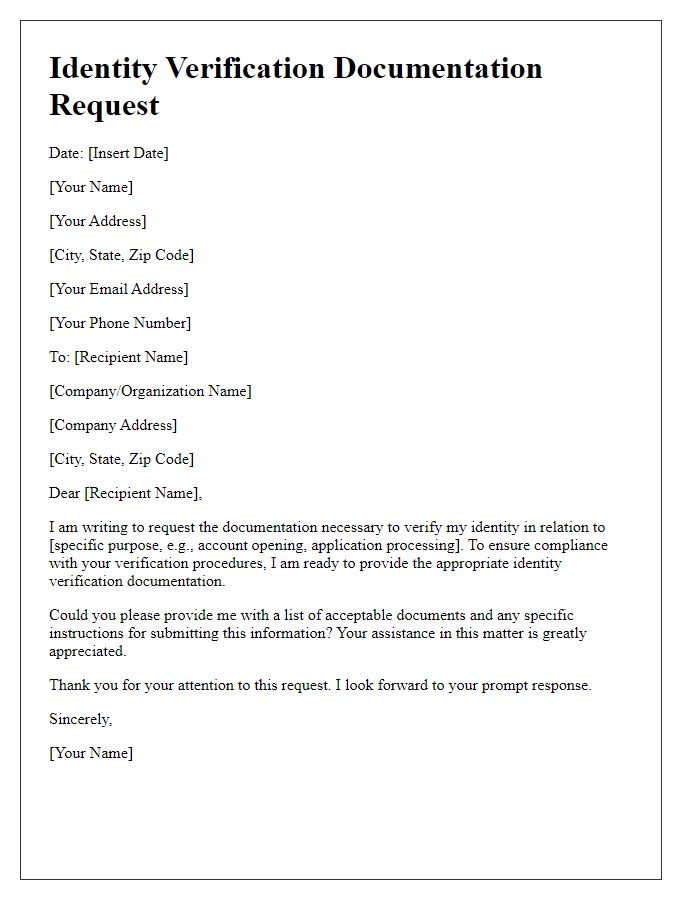

Hey there! If you're looking to verify your account holder's identity, crafting the perfect letter is key to ensuring a smooth process. A well-structured letter not only conveys professionalism but also reassures the recipient about the importance of security and privacy. In the following sections, we'll dive into essential elements to include in your identity verification letter to make it as effective as possible. Stick around to discover tips and templates that will simplify your writing journey!

Account Holder's Full Name and Contact Information

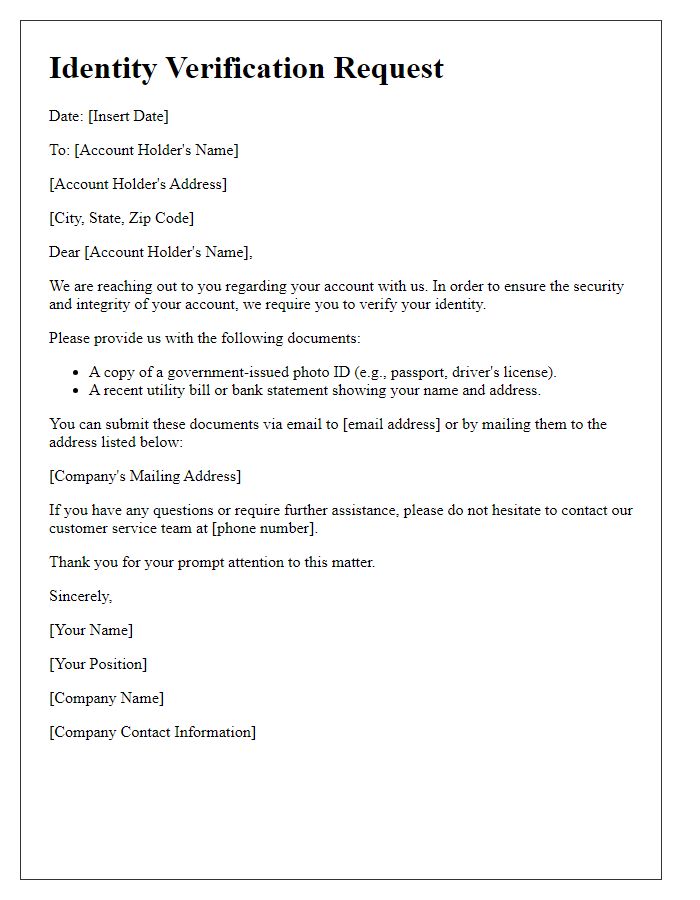

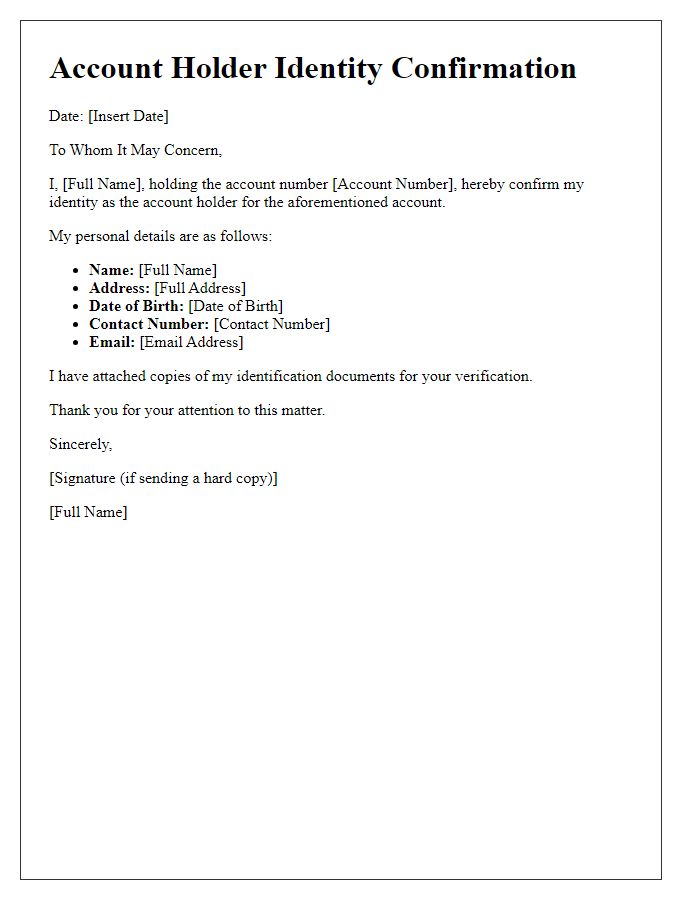

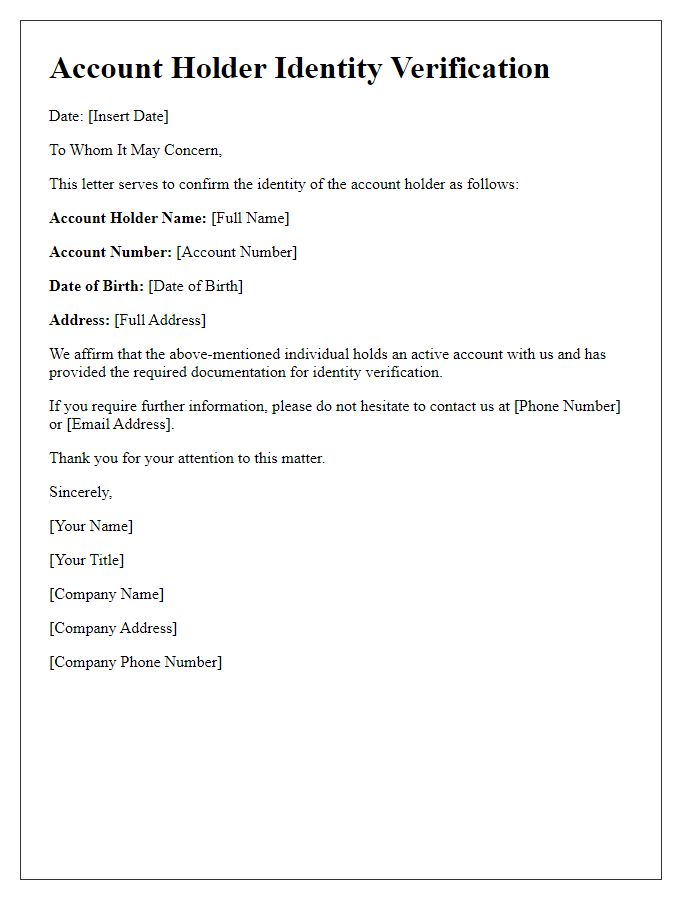

Accurate verification of account holder identity is imperative in financial institutions to prevent fraud. Identity can be verified through documents such as a government-issued photo ID, social security card, or utility bill displaying the account holder's full name, which must match the name on the account. Contact information should include a verified phone number and email address, enabling secure communication. Institutions often utilize multi-factor authentication processes, where the account holder receives a unique code via SMS or email, adding an additional layer of security. To ensure compliance, it is essential to adhere to the guidelines set forth by the Financial Industry Regulatory Authority (FINRA) and the Bank Secrecy Act (BSA).

Account Number and Type

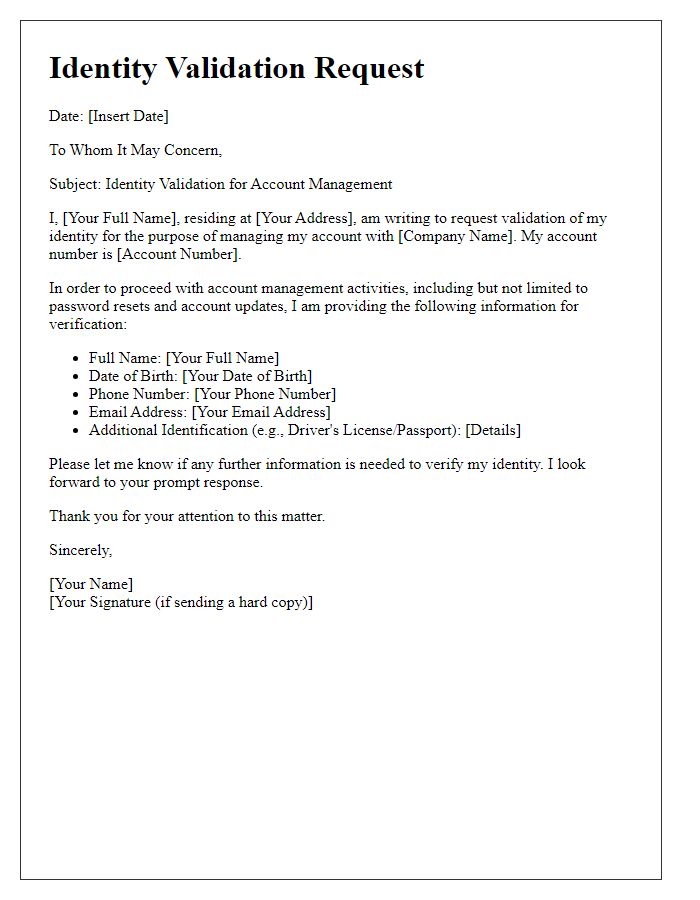

To verify account holder identity, banks require specific information regarding the account. Account number serves as a unique identifier assigned to each customer, facilitating access and management of funds within financial systems. Account type categorizes the account, such as checking, savings, or business, providing insight into the account's intended use and associated features. Additional verification methods may include government-issued identification, such as a driver's license or passport, and security questions linked to the account for enhanced security measures. Institutions typically emphasize accuracy and confidentiality in handling this information to protect customer data during the verification process.

Verification Method (e.g., government ID, utility bill)

Account verification requires submitting appropriate identification documents to ensure security. Common verification methods include presenting a government-issued ID, like a driver's license or passport, which typically includes a photo, name, and address details. Utility bills, dated within the last three months, serve as a residential address proof essential for verifying the account holder's identity. This document should clearly display the account holder's name and address as registered. Other acceptable forms include bank statements or tax documents, which also provide critical information required for identity confirmation. Adhering to these verification protocols protects against fraud and ensures secure account access.

Authorized Signature Verification

The process of verifying an account holder's identity often involves collecting authorized signatures from official documents such as bank forms or government-issued identification. Financial institutions like Citibank and JPMorgan Chase typically require documents that include signature samples, which help confirm the authenticity of the individual's identity. This verification process is essential in maintaining security and preventing fraud. Institutions may employ advanced techniques such as biometric recognition or digital signature analysis to enhance verification accuracy. Each institution often outlines specific requirements, with timeframes ranging from immediate to several weeks, depending on the request complexity.

Security and Confidentiality Statement

Verifying the identity of account holders is essential for maintaining security and confidentiality in financial transactions. This process often includes gathering personal identification information, such as government-issued identification numbers, full names, and addresses. Institutions, like banks and credit unions, implement stringent requirements to ensure compliance with regulations, such as the USA PATRIOT Act, which mandates thorough verification steps. Effective verification not only protects account holders from fraud but also safeguards sensitive financial data, reducing the risk of identity theft. Proper documentation along with secure channels for submission are critical to uphold the trust and integrity of the financial system.

Comments