Are you looking to get your credit line reinstated but unsure how to approach it? Writing a well-crafted letter can make all the difference in your request being favorably received. In this article, we'll guide you through the essential components and provide a clear template to help you navigate the process smoothly. So, if you're ready to take the next step towards reinstating your credit line, keep reading to discover our handy template!

Account Information: Clear identification of account number and personal details.

Account information is crucial for processing a request for credit line reinstatement. The account number, typically consisting of 10 to 16 digits, uniquely identifies the customer's credit account. Personal details include the full name of the account holder, which may match identification documents. The inclusion of the primary address, referencing city and state, ensures accurate identification of the customer's residence. Additionally, the date of birth, often formatted as MM/DD/YYYY, may be necessary for verification processes. All these elements help streamline communication, facilitating a quick response from the financial institution regarding the status of the credit line reinstatement request.

Reason for Request: Specific, concise explanation for reinstatement.

Reinstating a credit line can impact financial stability for individuals and businesses. Factors for request may include changes in income, such as job loss (increased unemployment rates reaching 6.2% in 2023), unforeseen medical expenses (average healthcare costs soaring to $12,000 per year), or a positive credit score improvement (e.g., raised from 650 to 750). Economic events like inflation rates (reaching a peak of 9.1% in mid-2022) can strain budgets. Providing a detailed explanation, highlighting responsible repayment history with lenders (e.g., at least 12 months of on-time payments) and demonstrating improved financial management strategies can strengthen a reinstatement request.

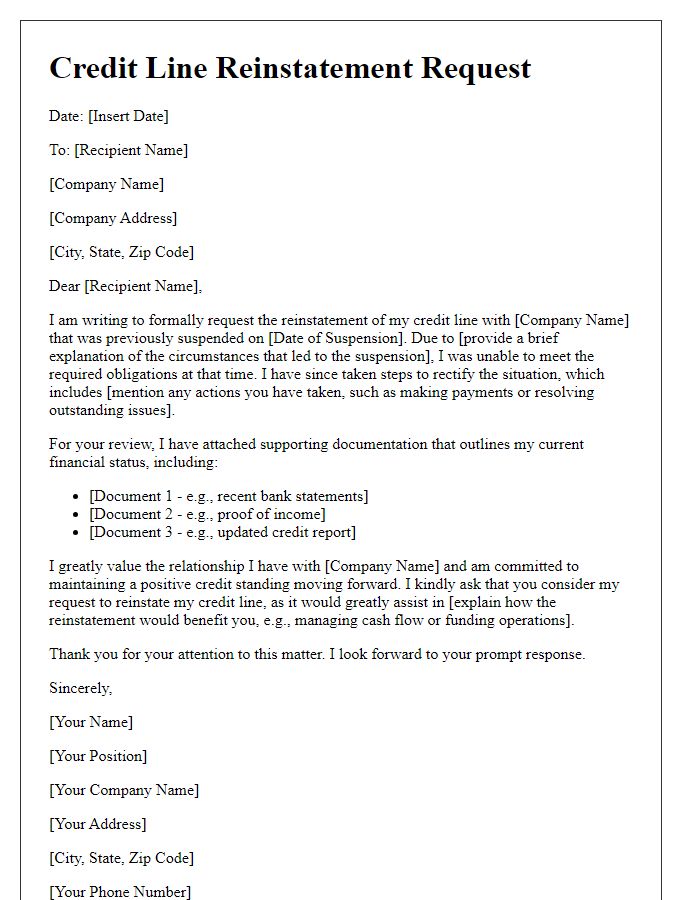

Financial Stability Evidence: Proof of improved creditworthiness, such as income or payment history.

Demonstrating financial stability is crucial when requesting the reinstatement of a credit line, especially for individuals with a history of credit issues. Relevant documents may include recent income statements (reflecting monthly earnings from stable employment), improved payment histories (showing timely payments over the past twelve months), and credit reports indicating a positive change in credit score (ranging from 300 to 850). Additional evidence such as a budget plan or savings account statements can further illustrate responsible financial management. To enhance the appeal, include a narrative outlining specific improvements in financial circumstances, such as reduced debt levels or increased savings, showcasing a commitment to maintaining financial health.

Acknowledgment of Previous Issues: Address any past issues and steps taken to resolve them.

Credit line reinstatement requests frequently involve acknowledging previous issues that affected financial standing. In the context of a personal credit line managed by a major financial institution, such as Bank of America, it is vital to specify any late payments (more than 30 days overdue) or account delinquencies that resulted in the original credit line suspension. Highlighting actions taken to resolve these issues, such as timely payments made in the last six months or participation in financial counseling sessions, can demonstrate improved financial responsibility. Furthermore, providing a detailed account of changes in income or employment status, like a recent promotion at a company such as Amazon, can reinforce the commitment to maintaining a healthy credit profile moving forward. This contextual information helps lenders evaluate the request favorably, considering both past challenges and future potential.

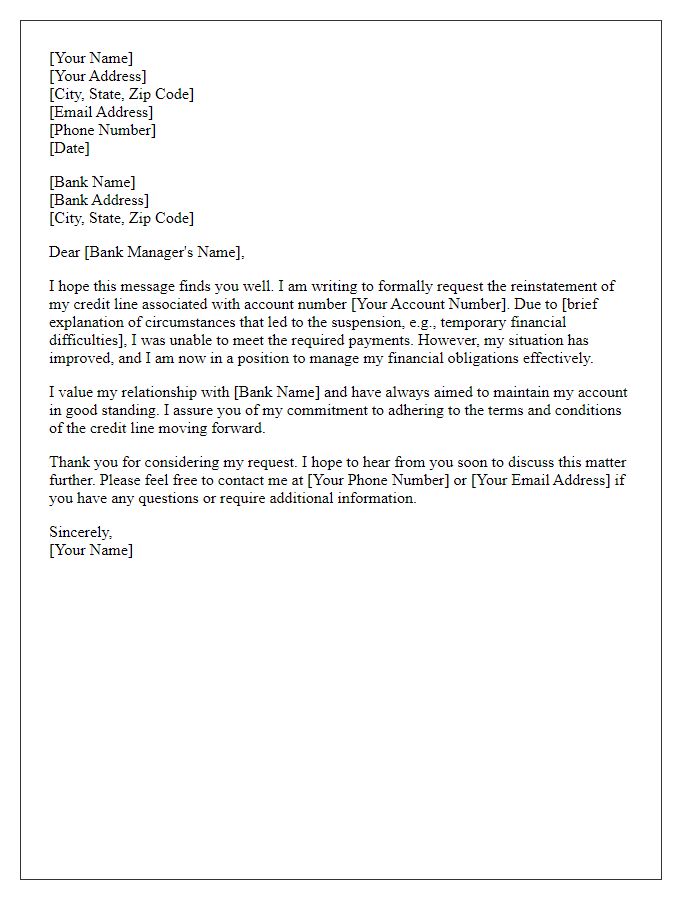

Polite Closing and Contact Information: Express gratitude and provide a way to reach out for further discussion.

In the pursuit of reinstating a credit line, it is essential to express sincere appreciation for the consideration given to the request. This reflects respect toward the financial institution's policies and a willingness to maintain a positive relationship. Including a direct contact number, such as a personal mobile or office phone, ensures that communication remains open for further discussion. An email address can also be provided to facilitate prompt responses. This demonstrates readiness to engage in dialogue, fostering a cooperative atmosphere for addressing any concerns regarding the reinstatement process.

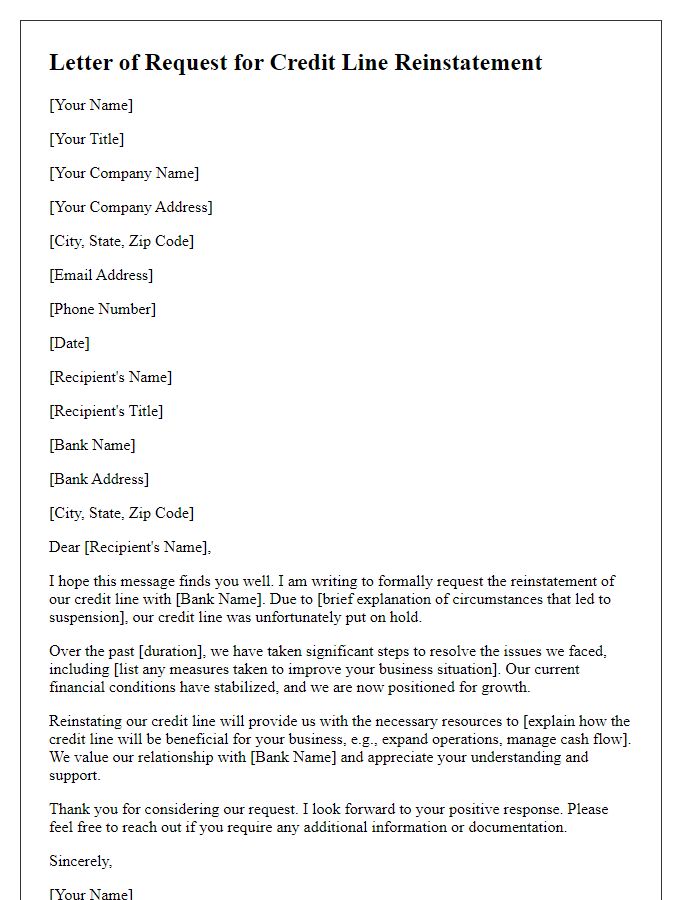

Letter Template For Credit Line Reinstatement Request Samples

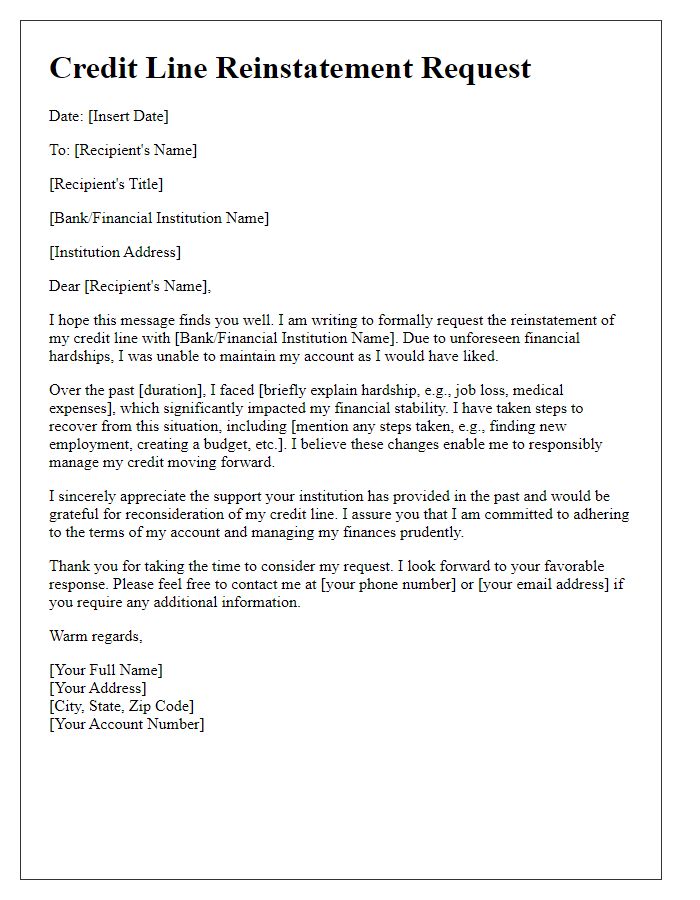

Letter template of credit line reinstatement request after financial hardship

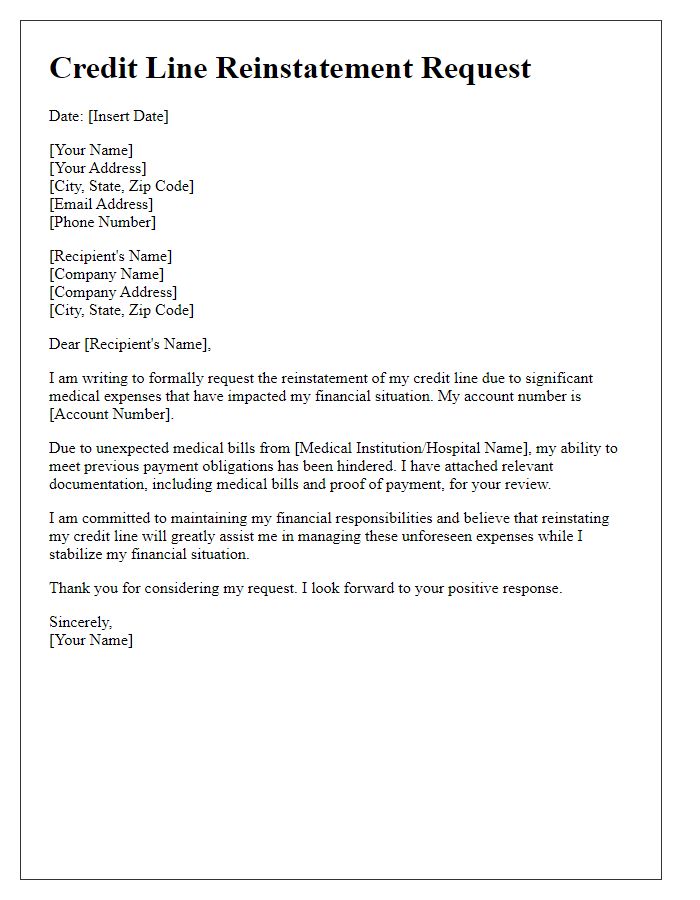

Letter template of credit line reinstatement request for medical expenses

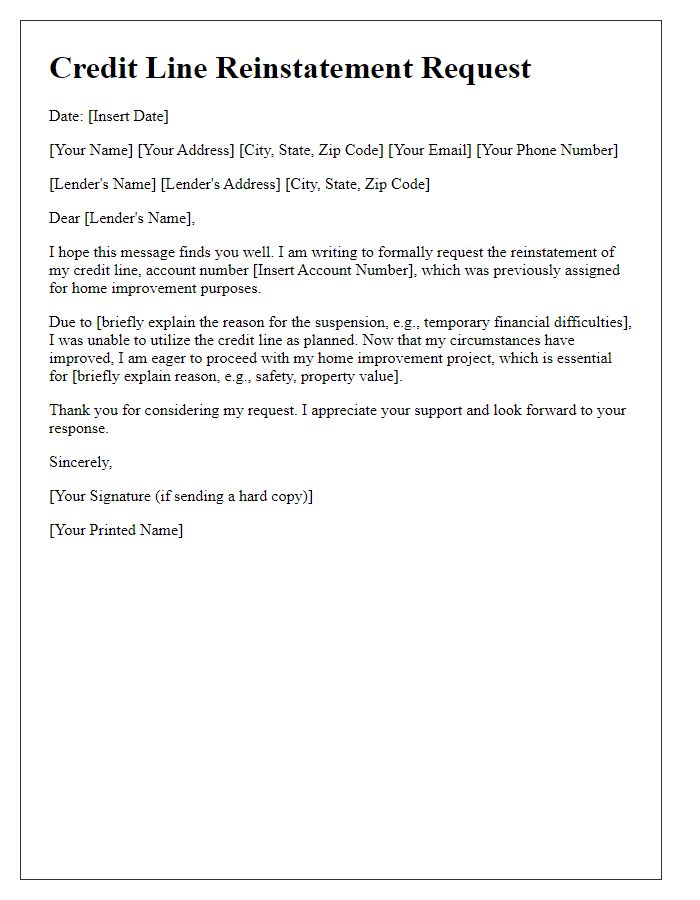

Letter template of credit line reinstatement request for home improvement

Letter template of credit line reinstatement request for educational expenses

Letter template of credit line reinstatement request for travel expenses

Letter template of credit line reinstatement request for debt consolidation

Letter template of credit line reinstatement request citing payment history

Comments