Are you navigating the complexities of contractor tax liabilities? Understanding this topic is crucial for both freelancers and businesses that hire them. In this article, we'll break down what contractor tax liability entails and how it impacts your financial responsibilities. So, grab a cup of coffee and dive in to discover the essential insights you need to stay compliant and informed!

Contractor's Full Name and Contact Information

A contractor's full name and contact information are essential for tax liability confirmation in the construction industry. Complete identification includes relevant details such as the contractor's full legal name (e.g., John Smith), company name (if applicable, like Smith Construction LLC), phone number (e.g., (555) 123-4567), email address (e.g., john.smith@email.com), and physical address (e.g., 123 Main Street, Cityville, CA 90210). Accurate information ensures seamless communication with tax authorities, minimizes confusion, and ensures timely correspondence regarding tax obligations. Proper documentation aids in verifying that the contractor complies with local, state, and federal tax regulations.

Detailed Project Description and Terms

A contractor tax liability confirmation document typically provides critical information about the scope and specifics of a project. The detailed project description outlines the nature of the work, deadlines, and deliverables. Key components include project title, such as "Residential Renovation Project," which identifies the specific type of work being performed. Important timelines must be noted, such as start dates (e.g., January 10, 2024) and completion dates (e.g., March 15, 2024). Terms of the agreement should specify payment schedules, which could include initial deposits (e.g., 30% upfront), milestone payments, and final payments upon project completion. Additionally, tax obligations should be explicitly mentioned, referencing pertinent regulations from entities like the IRS (Internal Revenue Service) for tax classification under 1099 forms if applicable. Including a section on contractor responsibilities ensures clarity on deliverables, compliance with local building codes, and insurance requirements. Moreover, documenting communication expectations, such as weekly progress reports and onsite meetings, fosters accountability throughout the project's duration. This comprehensive outline safeguards both contractor and client interests, ensuring a clear understanding of all aspects involved in the contractual agreement.

Specific Tax Responsibilities and Obligations

Contractors must adhere to specific tax responsibilities and obligations mandated by the Internal Revenue Service (IRS) and state tax authorities. These obligations include accurately reporting income received throughout the calendar year, such as payments from clients exceeding $600, which typically necessitate the issuance of IRS Form 1099-MISC by clients. Contractors are also required to pay self-employment taxes, which encompass Social Security and Medicare contributions, totaling approximately 15.3% on net earnings. Additionally, estimated quarterly tax payments are essential, as contractors must remit these payments to avoid penalties, ensuring compliance with IRS guidelines, specifically for those earning more than $1,000 in a tax year. Keeping meticulous records of business expenses, including materials, equipment, and travel costs, is crucial for maximizing deductions and minimizing taxable income. Familiarity with local and state tax regulations is equally important, as each jurisdiction may impose varying sales taxes or business licenses that contractors must comply with to maintain operational legitimacy.

Payment Terms and Timeline

Contractor tax liability confirmation forms an essential part of financial transparency in construction projects. Clear payment terms structured in accordance with federal and state tax regulations are vital for ensuring both parties understand their financial obligations, typically outlined in contracts. A comprehensive timeline specifies crucial milestones like payment intervals, which may include upfront deposits, progress payments tied to project phases, and final payments upon completion. It is important to include specific dates (for instance, payment within 14 days of invoicing) to avoid confusion. Additionally, terms relating to late payment penalties should also be included to enforce accountability. This clarity protects both the contractor and client from tax liabilities, promoting healthy financial practices throughout the project duration.

Signatures and Date of Agreement

Contractor tax liability confirmation requires precise documentation to ensure compliance and transparency. The agreement must clearly include sections for signatures from all involved parties, such as the contractor and the contracting entity, typically a company or government agency. Essential dates should be present, indicating when the agreement was executed, which is crucial for tax purposes. Specific clauses denoting responsibilities regarding tax liability should be articulated, often mandated by local tax laws or regulations. Proper formatting and identification of all parties, including addresses and contact information, enhance the validity of the document. A notarized signature may also be beneficial for added legal verification.

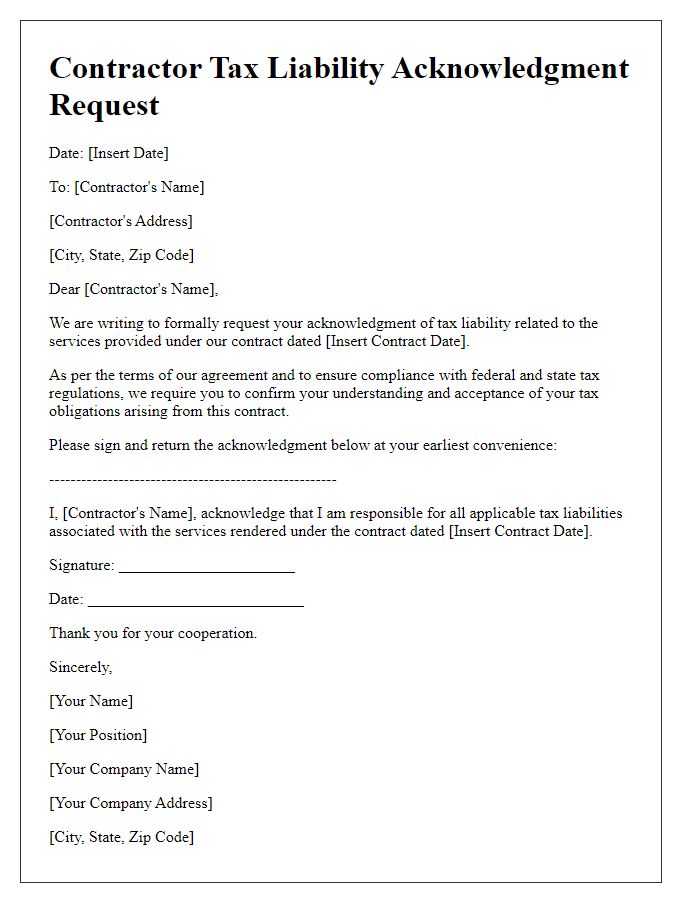

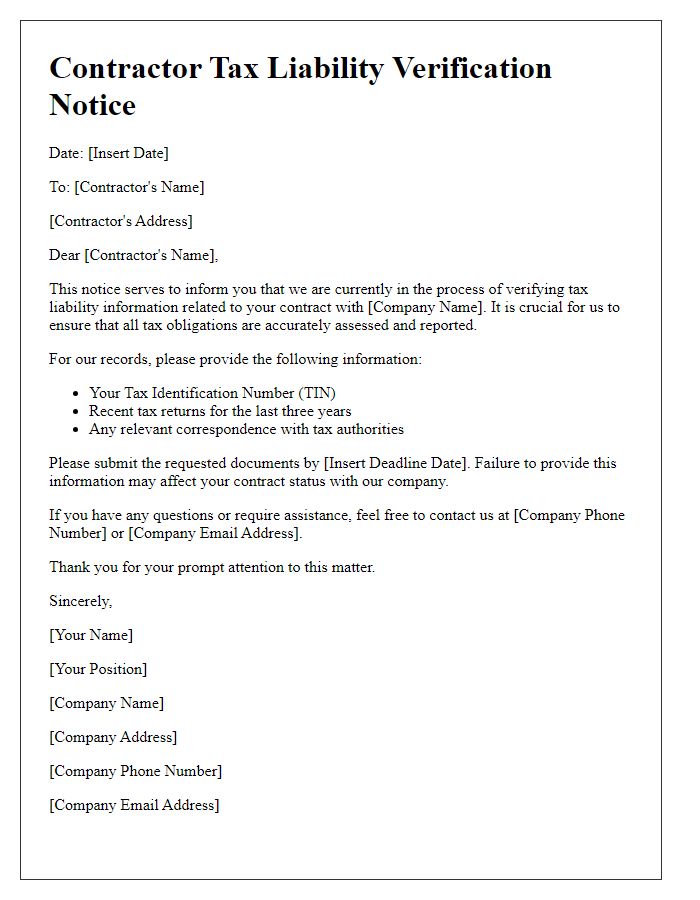

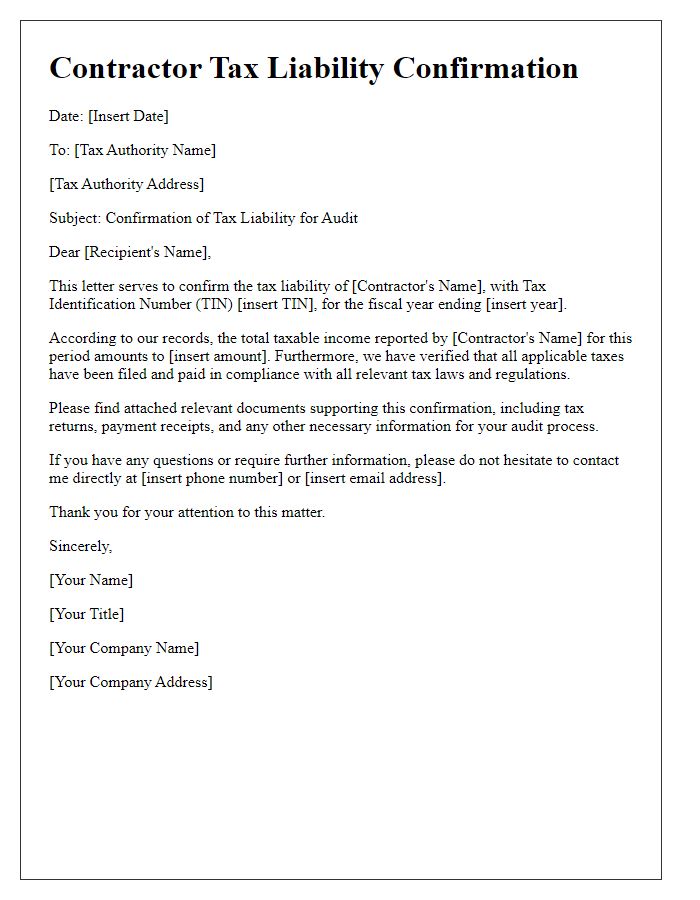

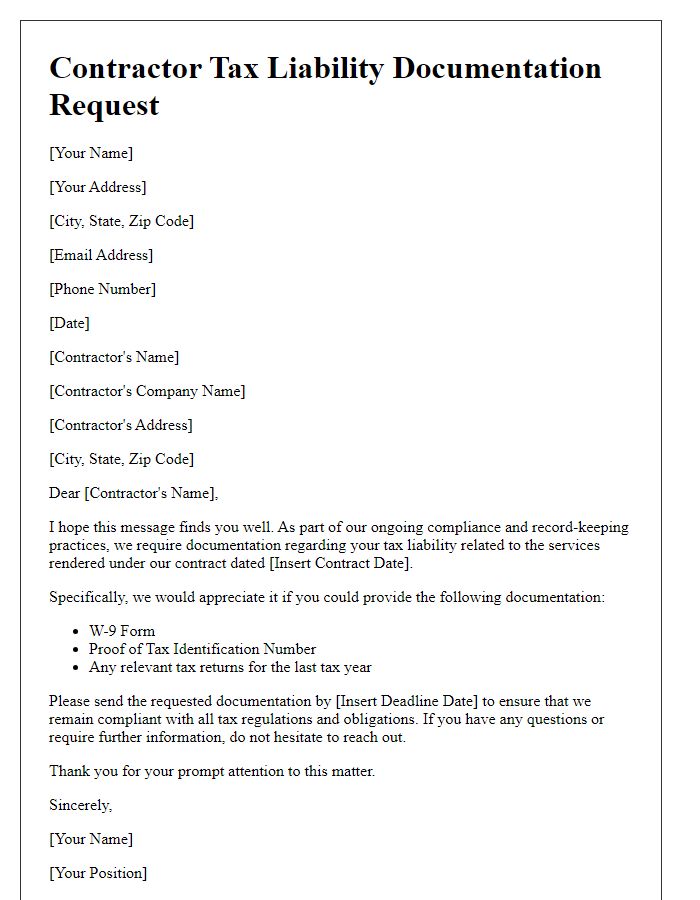

Letter Template For Contractor Tax Liability Confirmation Samples

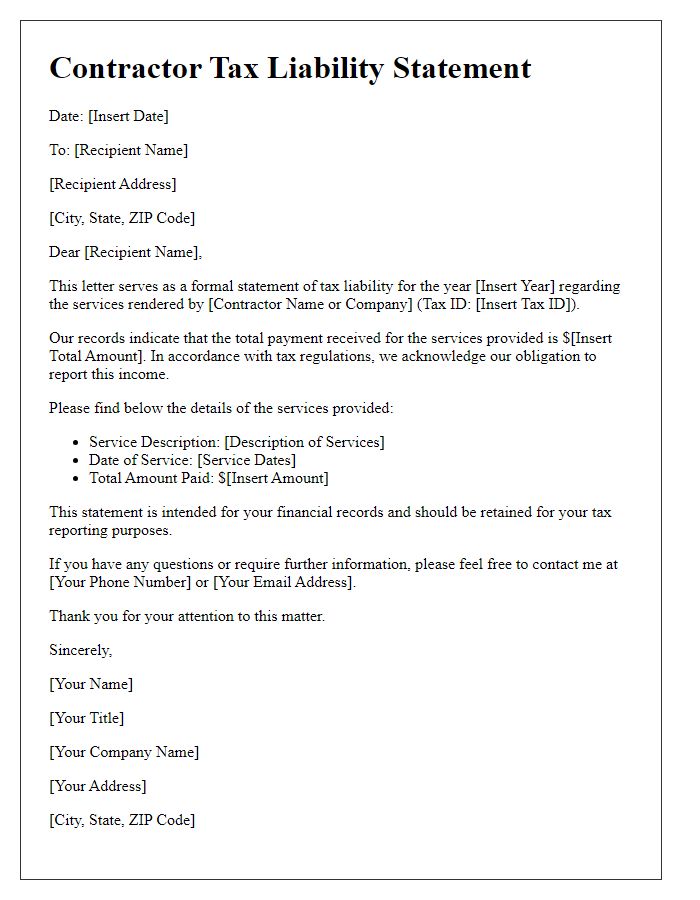

Letter template of contractor tax liability statement for financial records

Comments