Are you a contractor in need of financial flexibility to keep your projects running smoothly? Navigating supplier credit requests can be a daunting task, but it's essential for managing resources effectively. In this article, we'll break down the key elements of crafting a persuasive letter to your suppliers, ensuring you get the credit you need without any hassle. Join us as we explore this topic further and set the stage for your next successful project!

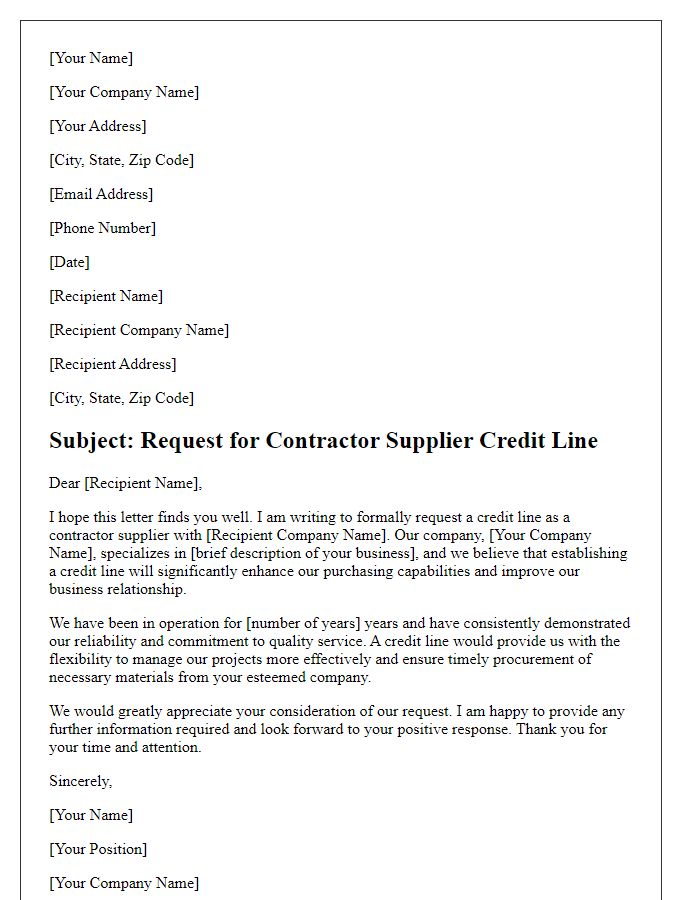

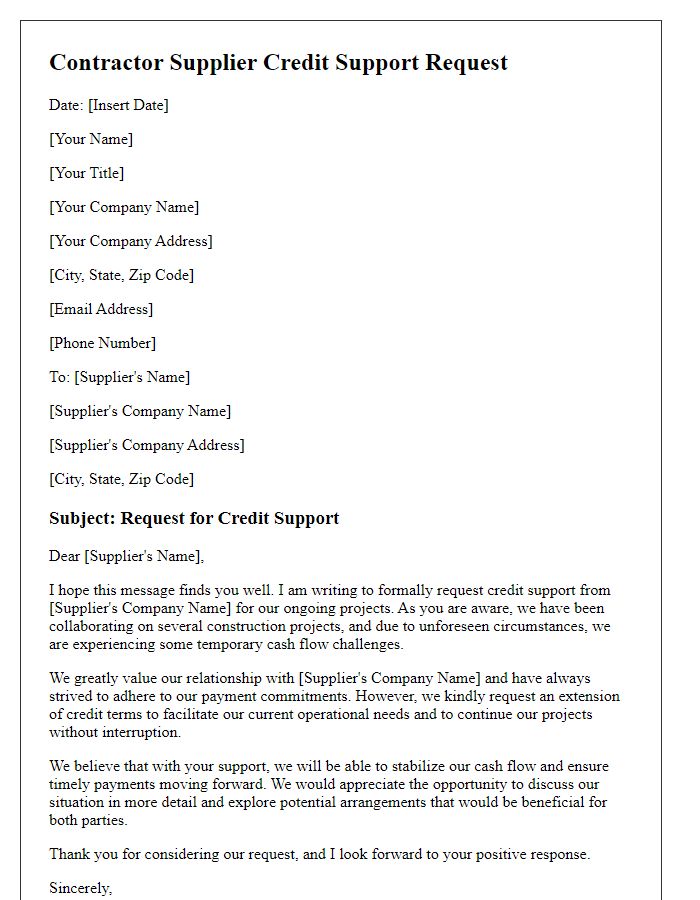

Detailed Business Information

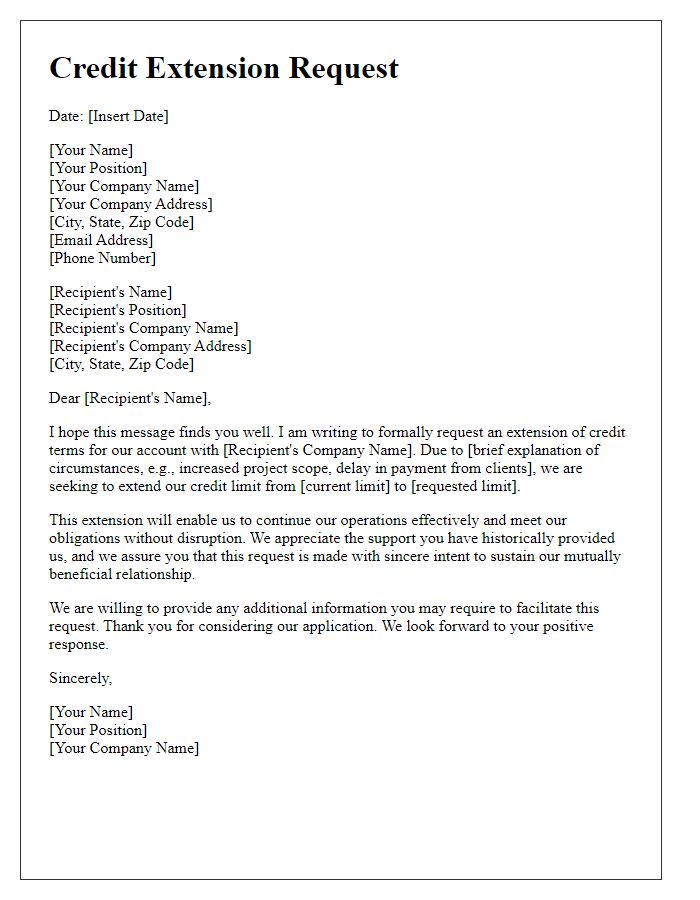

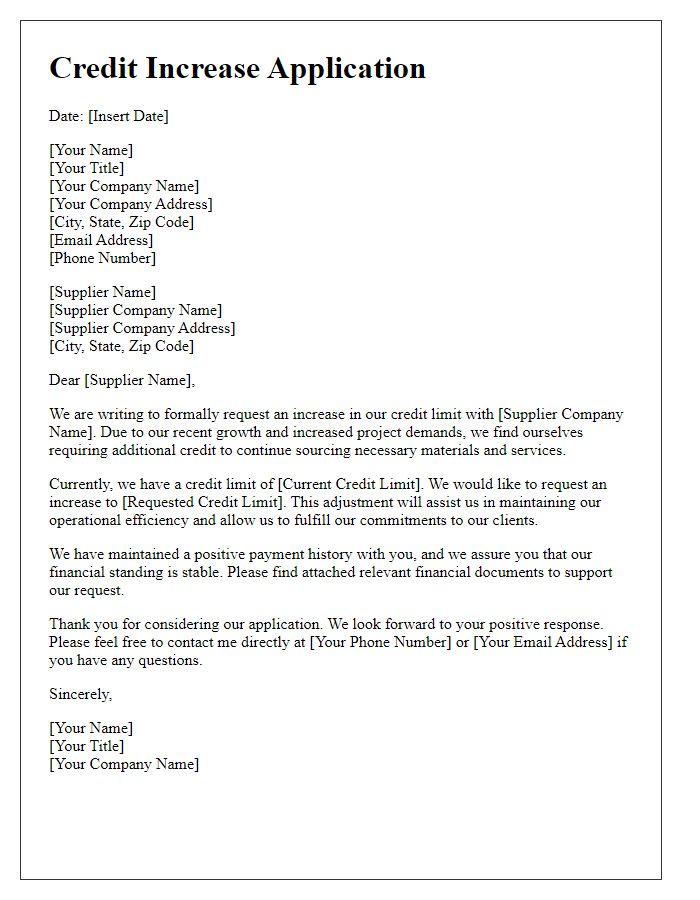

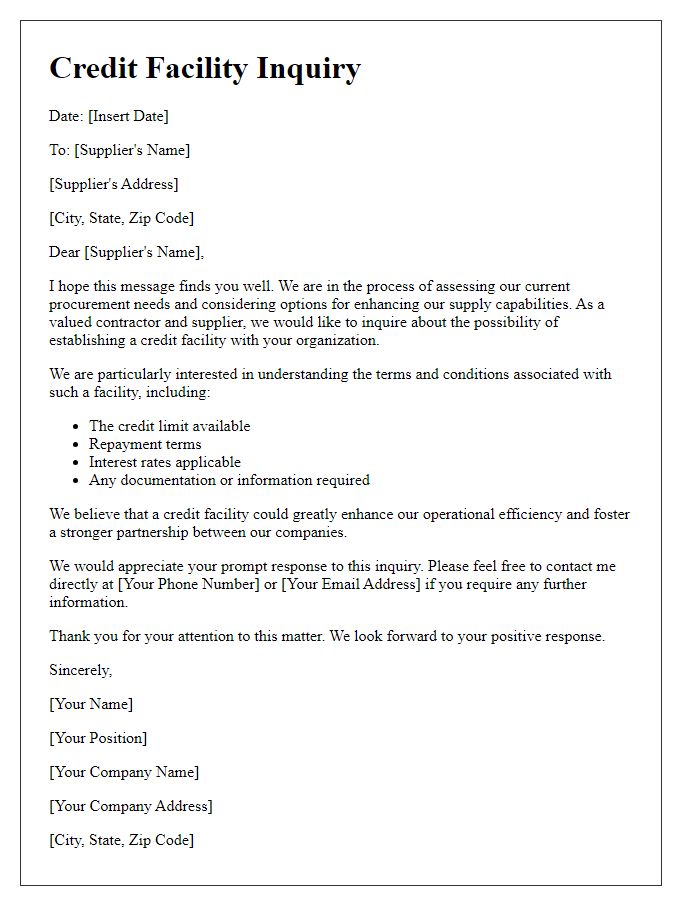

When approaching a contractor supplier for a credit request, it's essential to provide comprehensive business information that establishes credibility and context. Include details such as the business name, registered address, and contact information, which may include a phone number and email address. Highlight the nature of the business operations, which could involve construction projects, renovation works, or specific trades like plumbing or electrical services. Mention the history of collaboration with the supplier, including the duration of the partnership and the volume of past orders, which illustrates reliability and trustworthiness. Specify the type of credit requested, such as a line of credit or a specific amount, and include reasons for this request, possibly due to recent project expansions or cash flow management needs. Emphasize how establishing credit terms will facilitate smoother transactions and strengthen the ongoing business relationship.

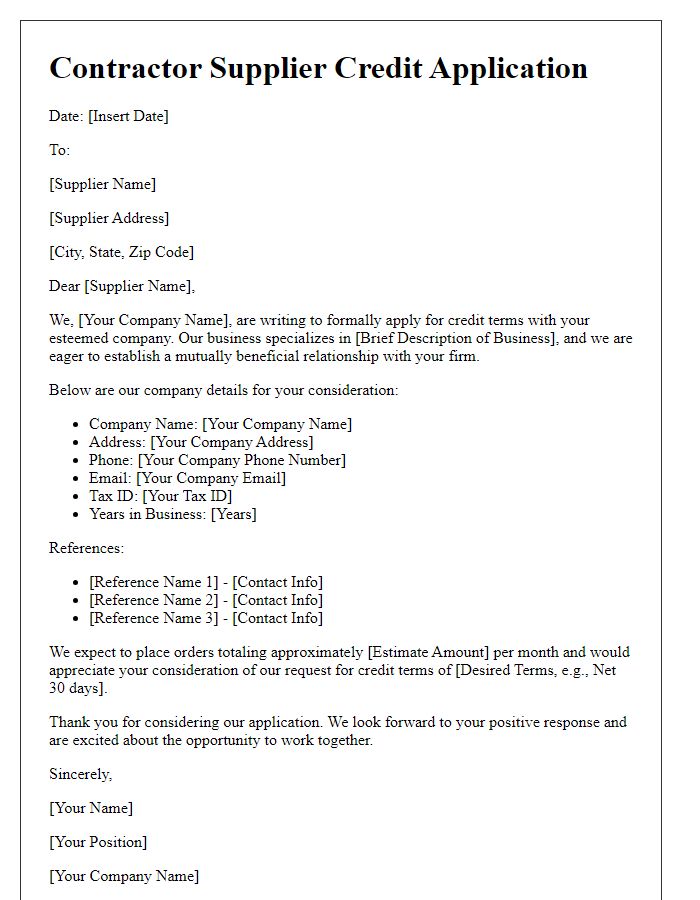

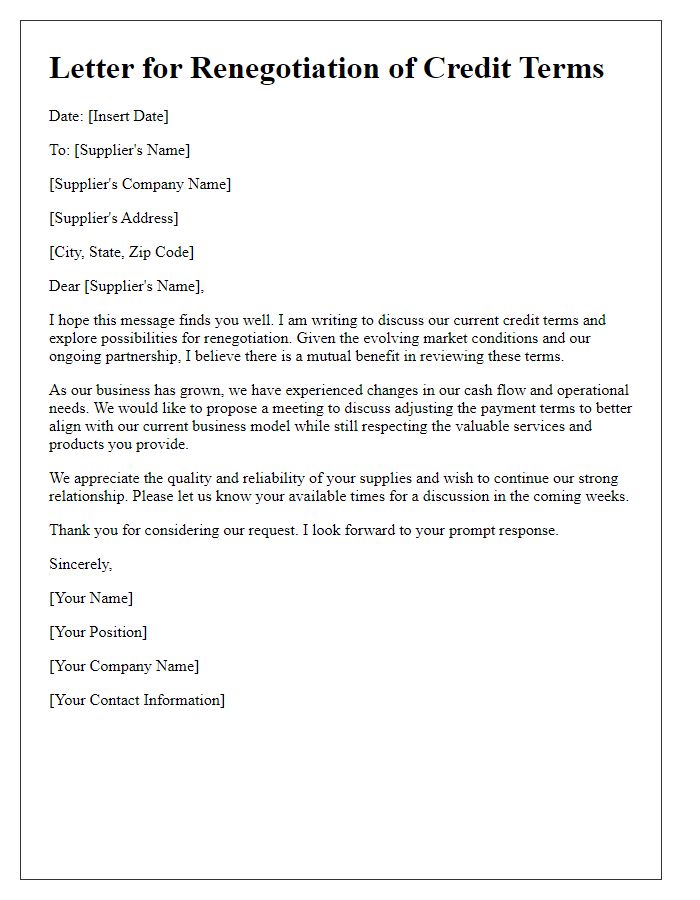

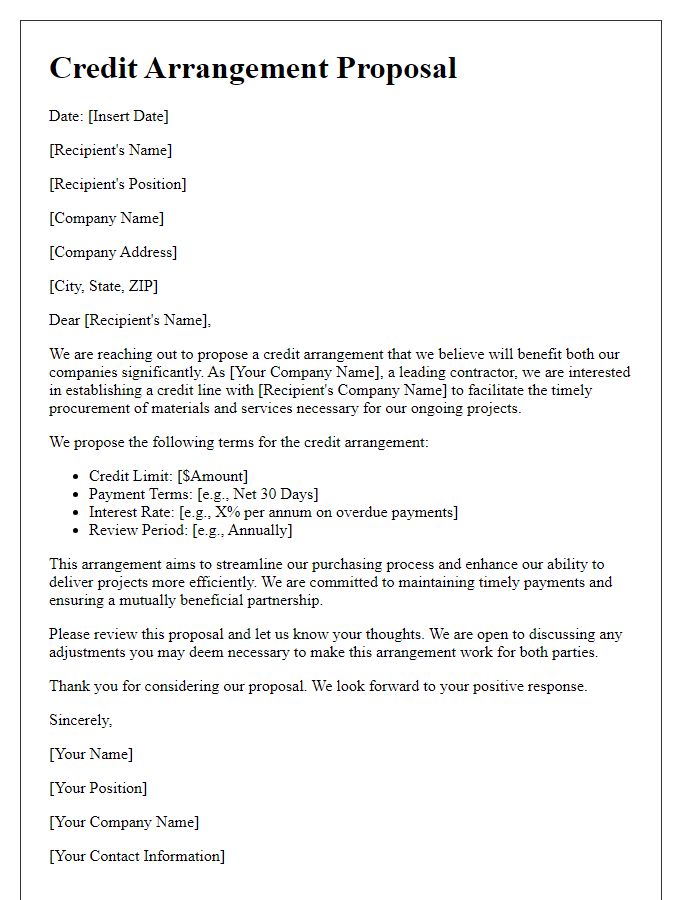

Specific Credit Terms Requested

Contractor suppliers often face challenges in managing cash flow, particularly when waiting for payments from clients. A request for specific credit terms, such as net 30 or net 60, can significantly improve financial flexibility. By establishing these terms, suppliers can better align their accounts receivable and payable, facilitating smoother operations. Credit terms might include a defined grace period before payment is due or discounts for early payments. Clear documentation of the terms would benefit both parties, ensuring mutual understanding and adherence to the agreement. This proactive approach streamlines procurement processes and fosters strong supplier relationships.

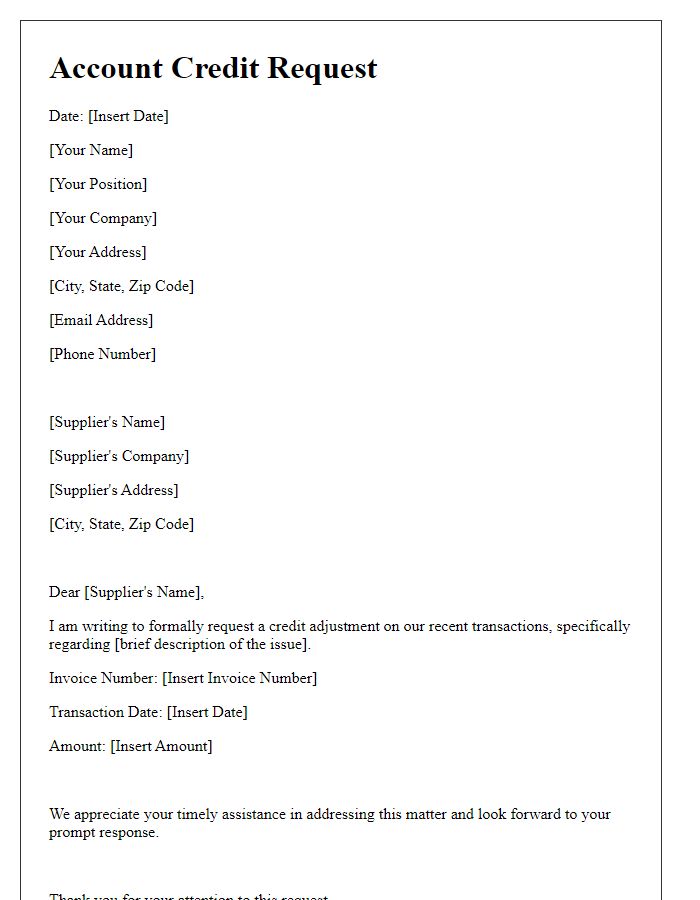

Justification for Credit Request

Contractors often encounter situations that require a credit request when dealing with suppliers. Issues such as overbilling or product defects can prompt such requests. In the construction industry, for instance, a contractor might find that the delivered materials, like concrete or steel beams, do not meet specified quality standards or quantities outlined in their purchase orders. A typical justification for a credit request would include detailed documentation, such as invoices, delivery receipts, and photographs illustrating discrepancies. Ensuring that the request is backed by clear evidence can greatly enhance the chances of approval, ultimately protecting the contractor's financial interests and maintaining good relationships with suppliers.

Financial Statements and Documentation

Contractor suppliers can experience cash flow challenges that necessitate credit requests. Providing financial statements, including balance sheets and income statements, can establish credibility and demonstrate the ability to repay. Essential documentation might include tax returns from the previous two years, current accounts receivable aging reports, and proof of ongoing projects. These details help lenders assess risk and make informed decisions regarding creditworthiness. Accurate cash flow projections for the next quarter can also enhance the request, showcasing the anticipated revenue from upcoming contracts. Compliance with local regulations and industry standards is crucial in fostering trust with potential suppliers.

Contact Information for Follow-up

A contractor's supplier credit request involves detailed contact information for follow-up purposes. Important details include the contractor's name, such as John Doe Construction, along with phone numbers (e.g., 555-123-4567) and email addresses (e.g., john@doeconstruction.com). Additionally, it is crucial to include the supplier's name, such as ABC Materials, along with their contact person, e.g., Jane Smith, to ensure seamless communication. The physical address of the supplier, like 234 Supply Lane, Hometown, ST 12345, should also be provided to facilitate any necessary visits or shipments. Furthermore, including the contract details, specifically the contract number (e.g., 78901), can help in tracking the specific agreement related to the credit request, ensuring an efficient follow-up process.

Letter Template For Contractor Supplier Credit Request Samples

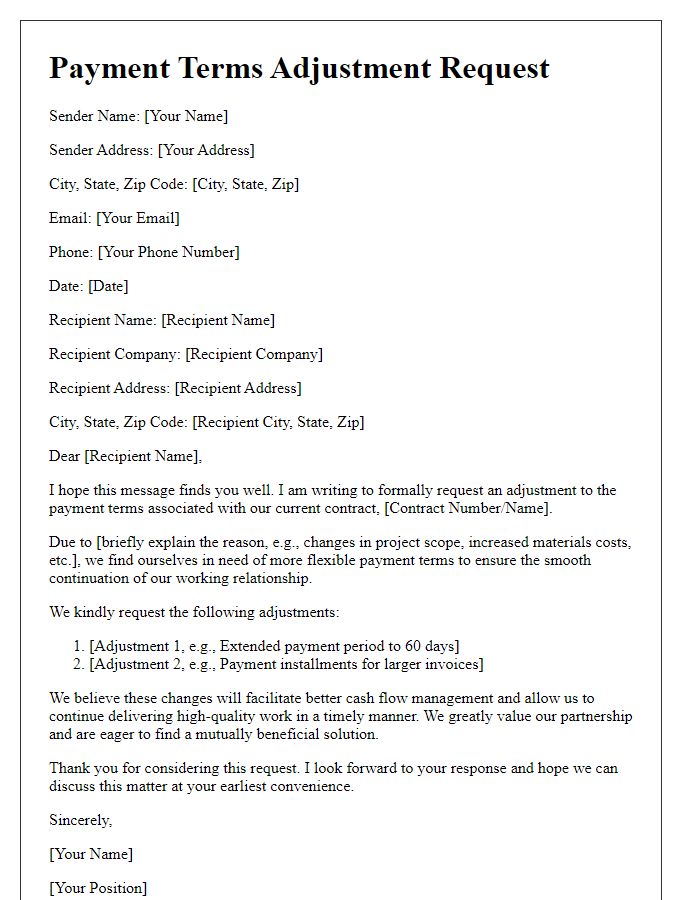

Letter template of contractor supplier payment terms adjustment request.

Comments