When it comes to securing your dream home, understanding the ins and outs of a mortgage loan agreement is vital. This letter template serves as a friendly guide to help you navigate the essential components of your loan contract. We'll break down each section in clear terms, ensuring you're well-informed and confident as you take this significant step. Ready to dive deeper into the world of mortgage agreements? Keep reading!

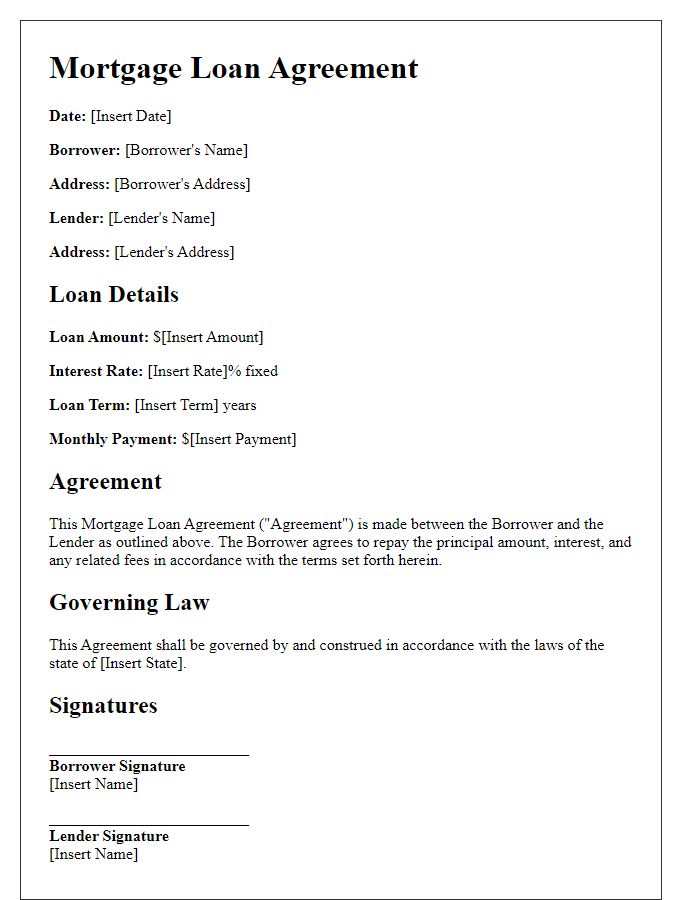

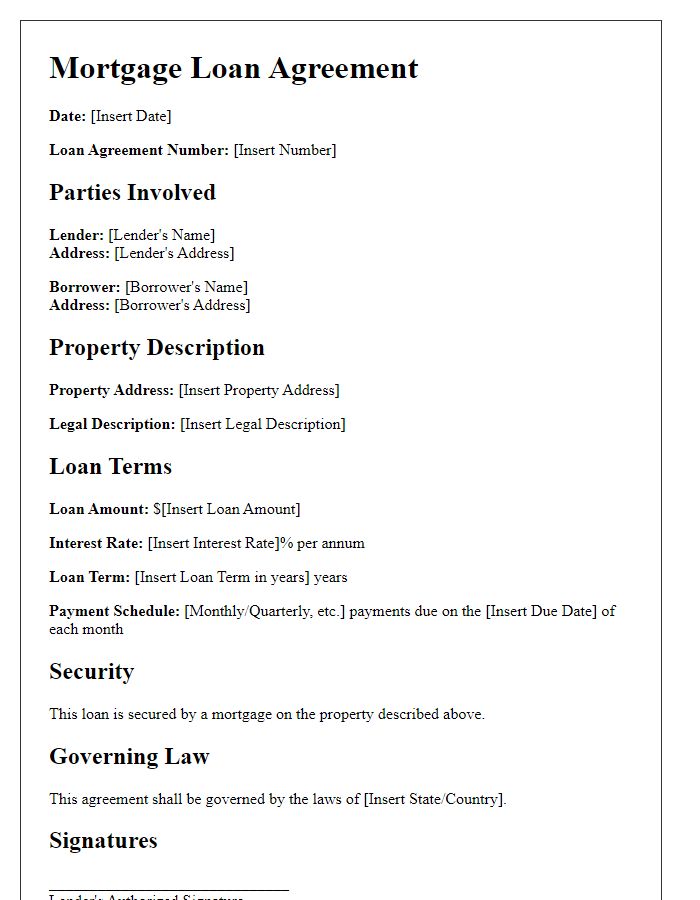

Loan amount and interest rate

A mortgage loan agreement outlines essential financial details for both lenders and borrowers. The loan amount specifies the principal sum provided; for example, a typical loan might be $300,000 for a home purchase. The interest rate, a crucial component of the agreement, represents the cost of borrowing expressed as a percentage; for instance, a rate of 4.5% annually is common in the current market. This percentage determines interest payments over the life of the loan, impacting the total repayment amount significantly. Understanding these aspects is vital for the financial planning of individuals purchasing real estate.

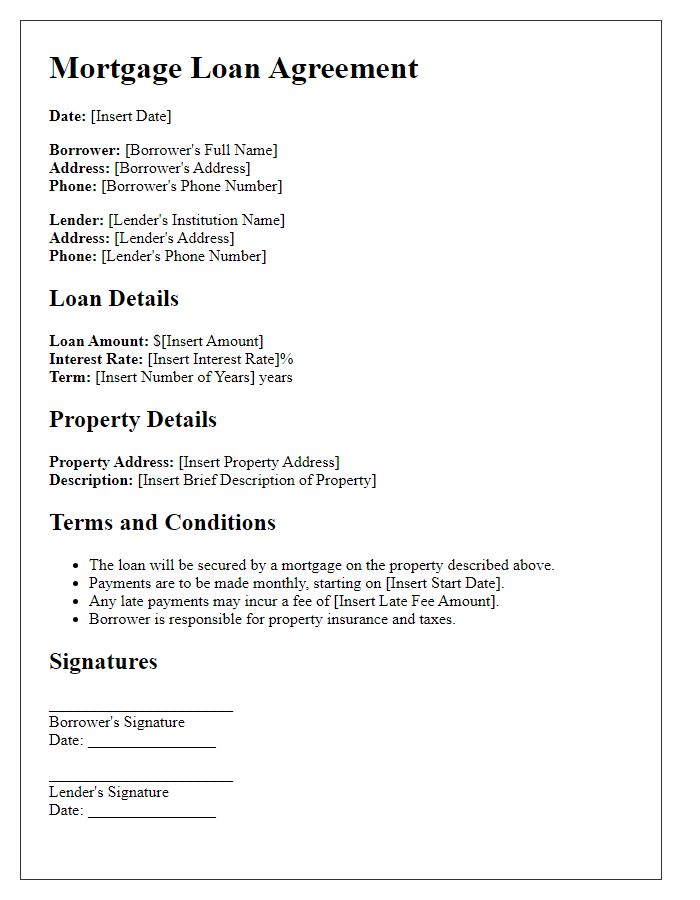

Repayment terms and schedule

Mortgage loan agreements typically specify repayment terms and schedules to ensure clarity and understanding between lenders and borrowers. These agreements outline the loan amount, which can range from tens of thousands to millions, depending on the property value and loan type. They also define the interest rate, which may vary between fixed rates (around 3% to 7% annually) and adjustable rates that can fluctuate based on market conditions. Repayment schedules usually detail monthly payments, spanning 15 to 30 years, allowing borrowers to manage their finances effectively. Moreover, these agreements often include terms regarding prepayment penalties, late payment fees, and amortization methods, determining how each payment affects the loan balance and interest over time. Understanding these terms is essential for making informed decisions about home financing and long-term financial commitments.

Collateral and security details

The mortgage loan agreement outlines the collateral and security provisions essential for securing the loan. The property, located at 123 Maple Street, Springfield, serves as collateral, ensuring lender protection in case of borrower default. The estimated market value of the property is $250,000, which is supported by an appraisal conducted by ABC Appraisals on October 1, 2023. The agreement stipulates that the borrower grants the lender a security interest in the property, allowing for foreclosure rights if the borrower fails to meet repayment obligations. Additional provisions include maintaining property insurance with a minimum coverage of $150,000 to mitigate risks. The borrower must also provide regular updates on property value assessments every two years to ensure adequate collateral coverage throughout the life of the loan.

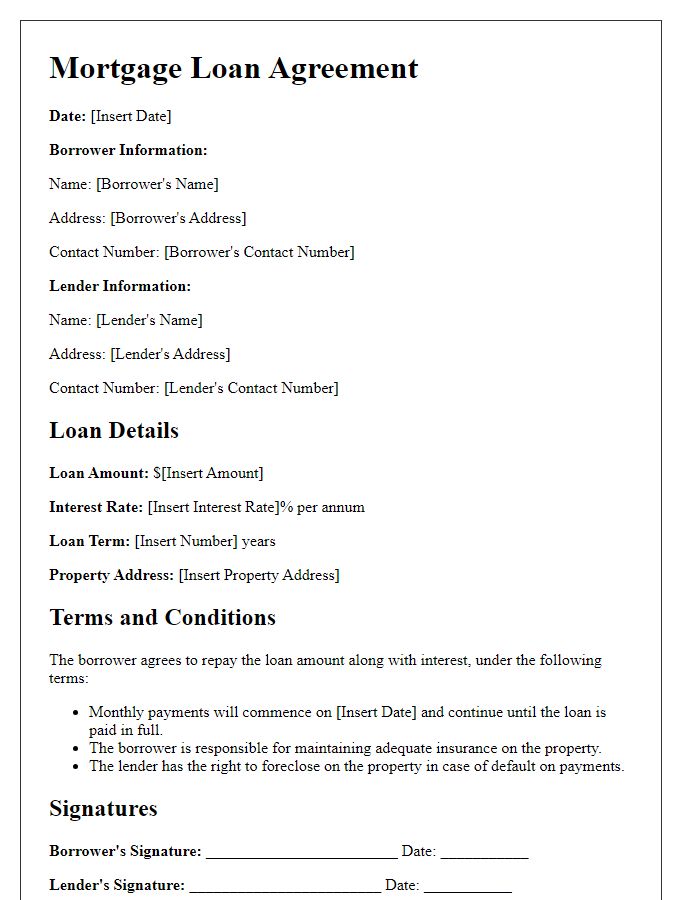

Default and late payment penalties

In a mortgage loan agreement, default and late payment penalties serve as crucial protective measures for lenders. Typically, a borrower may face a late payment penalty if their mortgage payment is not received within a specified grace period, often set at 15 days after the due date. For example, a common penalty could be 5% of the overdue payment amount, which can accumulate monthly, potentially leading to significant financial strain for the borrower. In cases of default, where a borrower fails to make payments for an extended period, such as 90 days, the lender may initiate foreclosure proceedings, typically in accordance with state laws such as those outlined in the Uniform Commercial Code. This legal action can result in the loss of the property, affecting the borrower's credit rating for years. Moreover, the total debt may incur additional fees, including attorney fees, court costs, and other expenses, which can further escalate the financial burden. Consequently, it is imperative for borrowers to fully understand the implications of default and the importance of timely payments to avoid such severe consequences.

Signatory requirements and identification

In a mortgage loan agreement contract, signatory requirements must adhere to specific identification protocols to ensure authenticity and legal compliance. Typically, primary signatories, such as the borrower and co-borrower, are required to present government-issued identification, including driver's licenses or passports, to validate their identities. Notaries public may also be present to witness the signing process as mandated by certain state laws and lender policies to prevent fraud. Additionally, any entities involved, such as corporations or trusts, necessitate documentation proving legal authority, like articles of incorporation or trust agreements. Essential details, including Social Security Numbers (SSNs) and full legal names, must align precisely with identification documents to uphold the agreement's enforceability in jurisdictions like New York or California. Ensuring these requirements can mitigate potential disputes during the loan term, promoting a smoother transaction process.

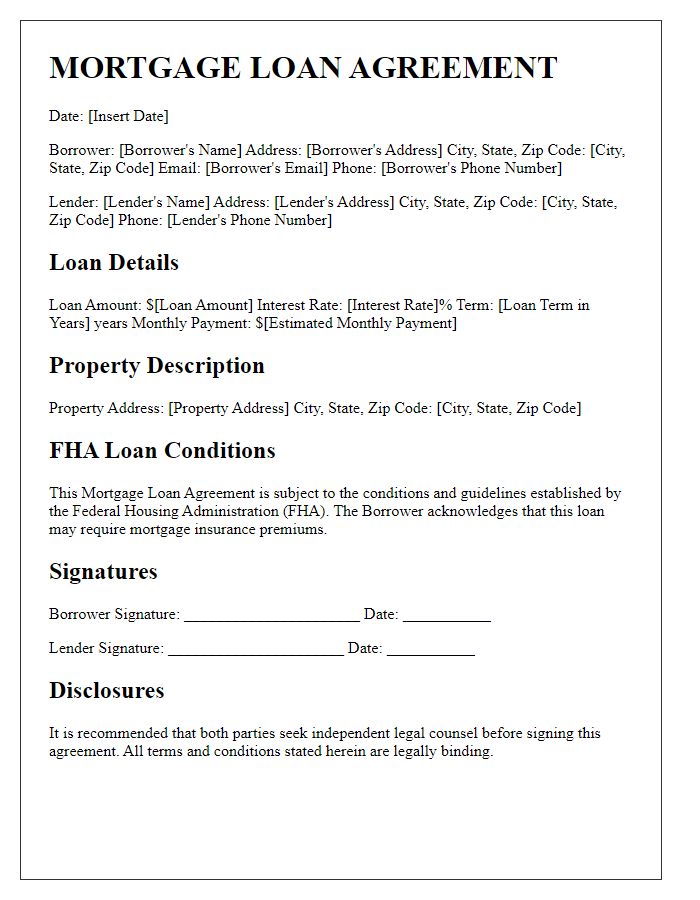

Letter Template For Mortgage Loan Agreement Contract Samples

Letter template of mortgage loan agreement for refinancing existing loans

Letter template of mortgage loan agreement for adjustable-rate mortgages

Comments