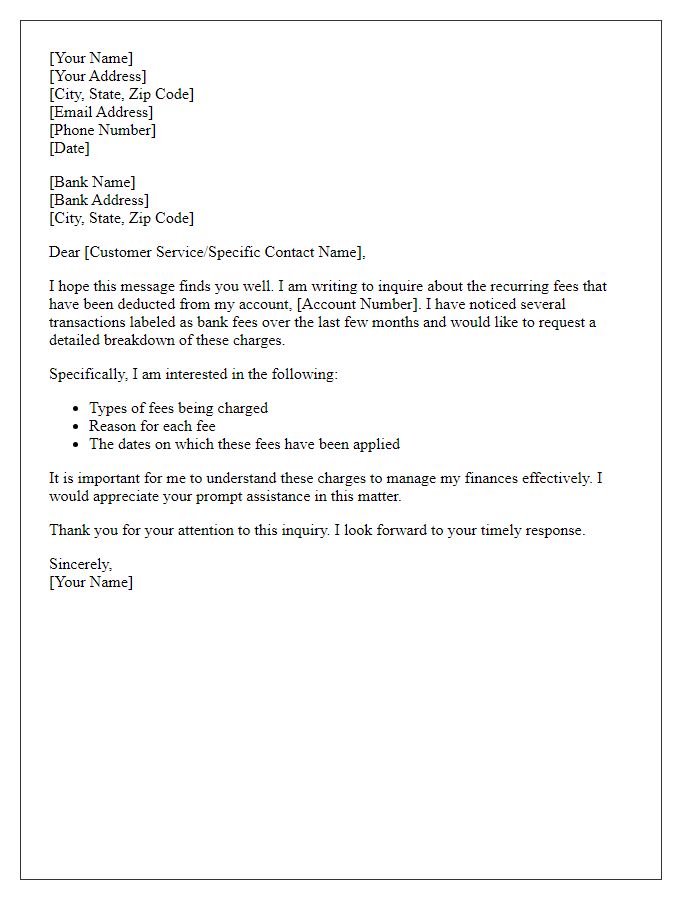

Are you feeling frustrated by unexpected bank fees? You're not alone! Many customers find themselves grappling with hidden charges that can significantly impact their finances. In this article, we'll guide you through the process of writing an effective complaint letter to your bank, helping you reclaim your hard-earned money. Read on to discover our essential tips and a handy letter template to get you started!

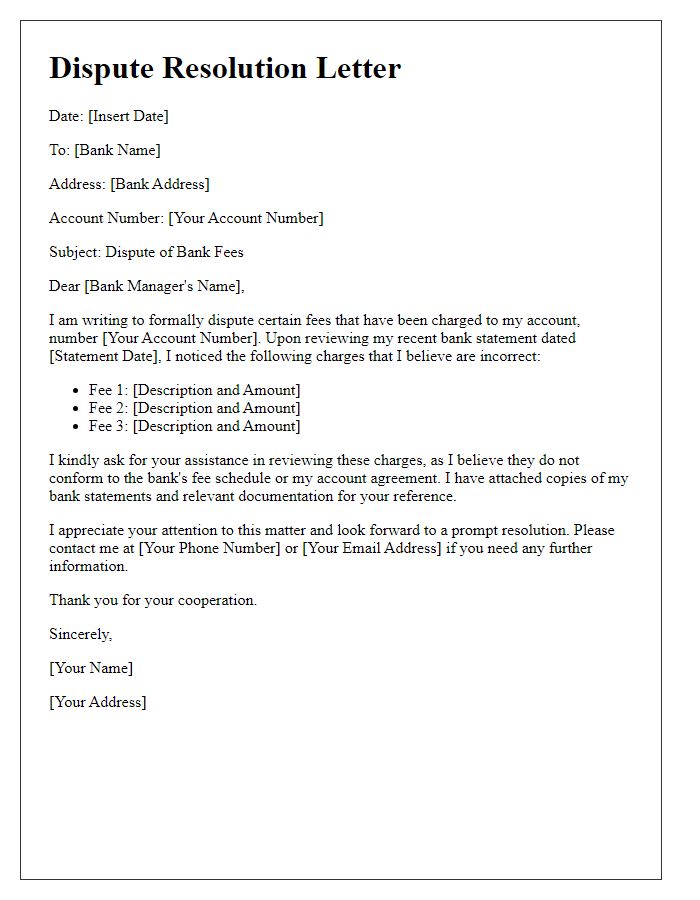

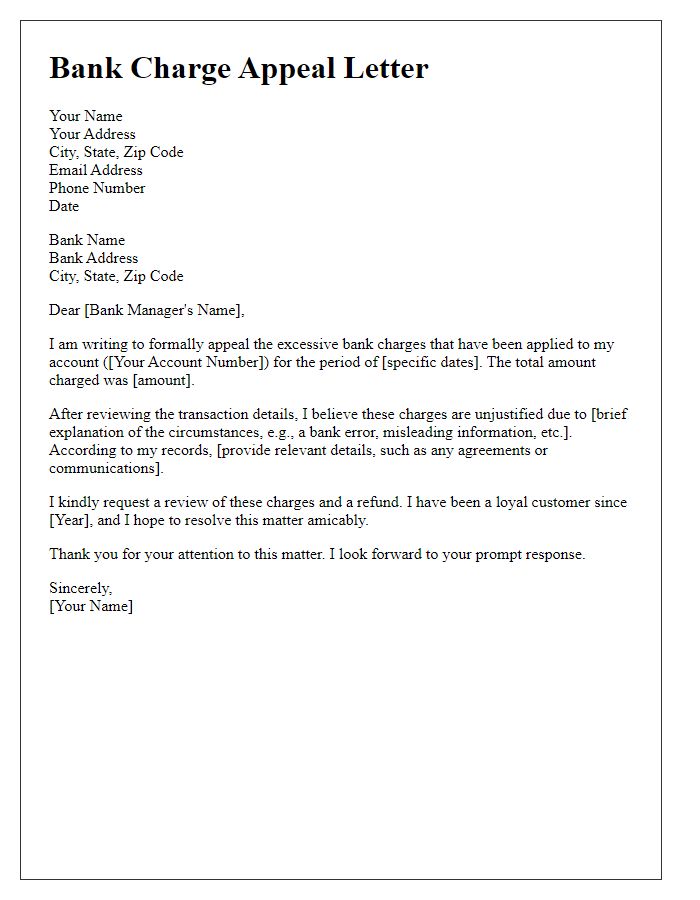

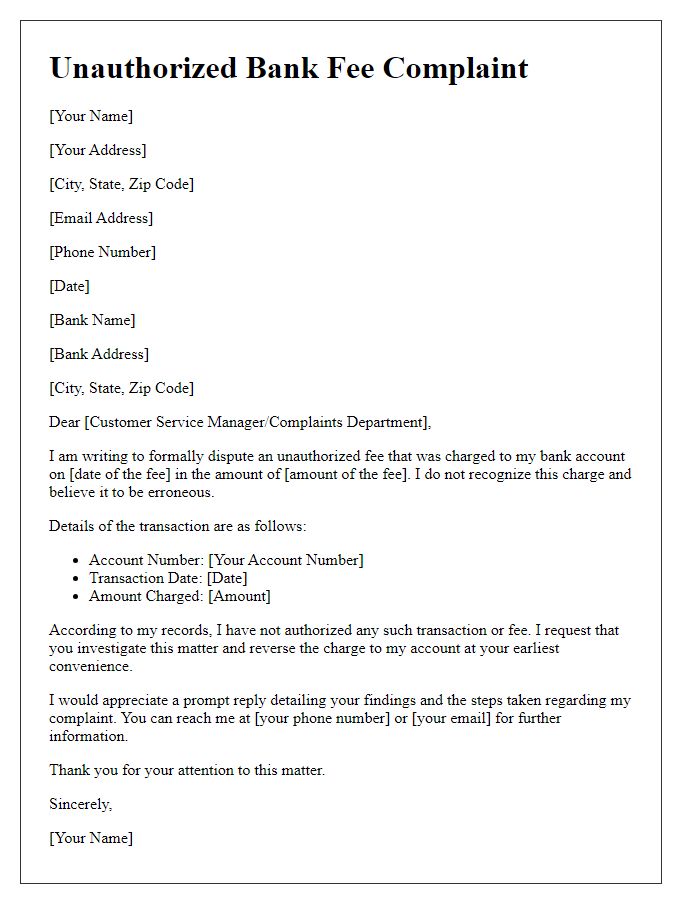

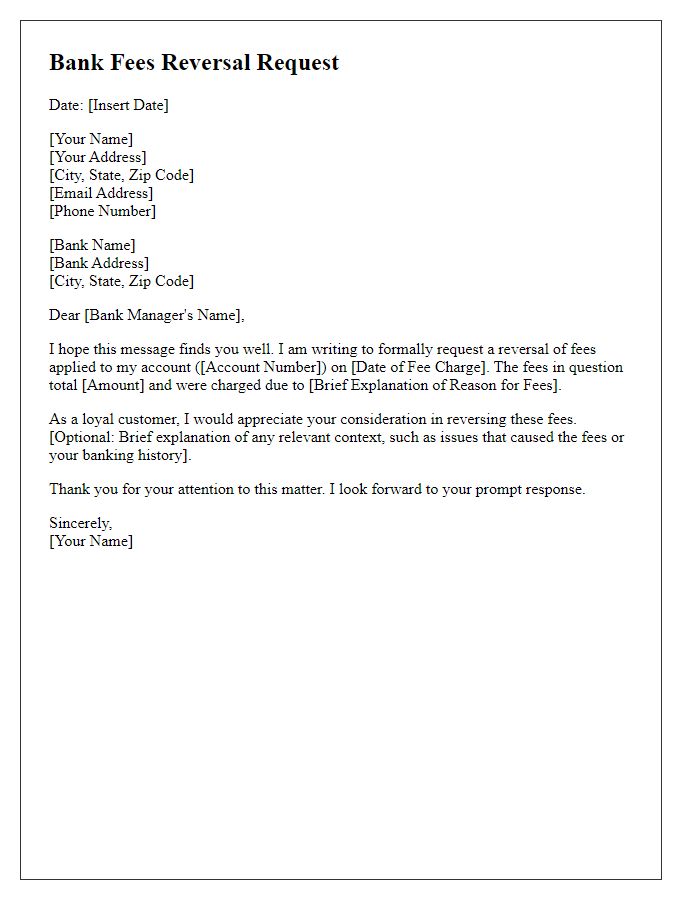

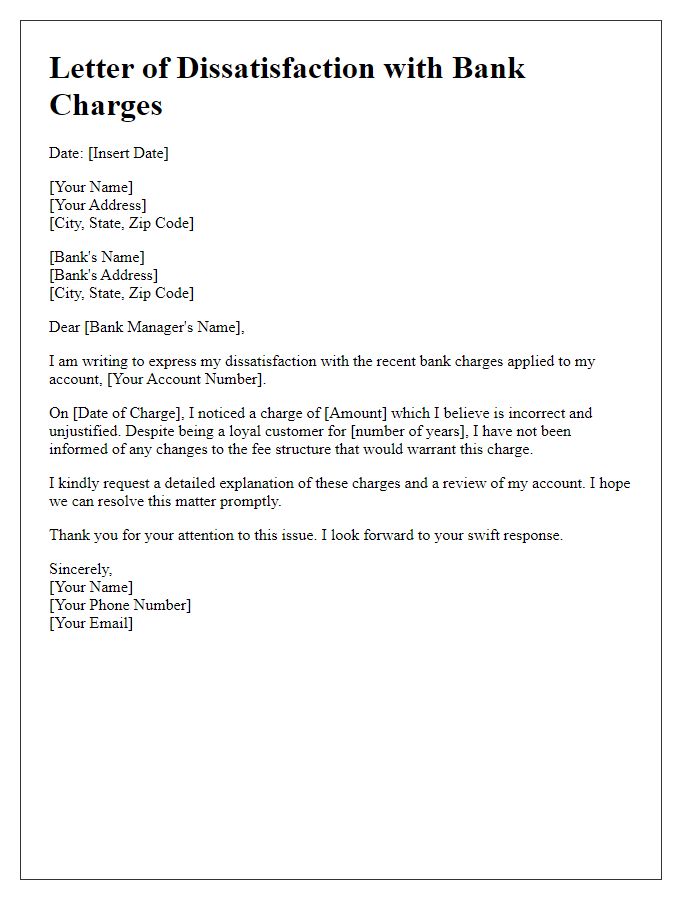

Account Information

Clients often experience frustration regarding unexpected bank fees impacting their Account Information, particularly checking or savings accounts. Common fees include maintenance charges that may reach $12 monthly if account balances fall below a specified threshold (e.g., $1,500). Additionally, overdraft fees can accumulate rapidly, often exceeding $35 per transaction. These fees vary by financial institution, such as JPMorgan Chase or Bank of America, and can significantly affect personal finances. It is essential for clients to review their account statements thoroughly to identify unauthorized charges or discrepancies that may warrant a formal complaint to the bank. Prompt resolution can help restore trust and ensure a fair banking experience.

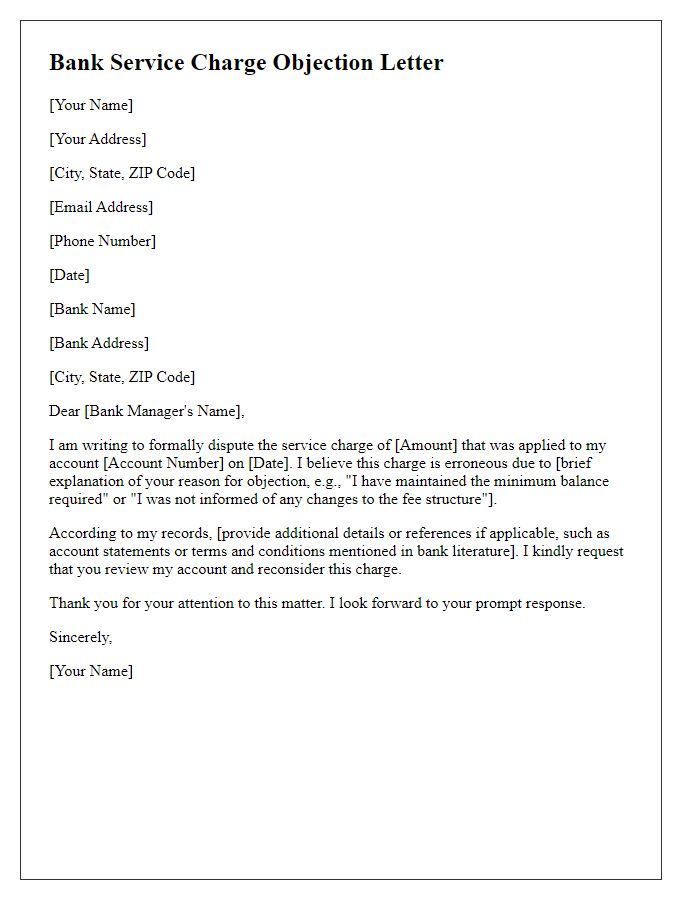

Fee Details

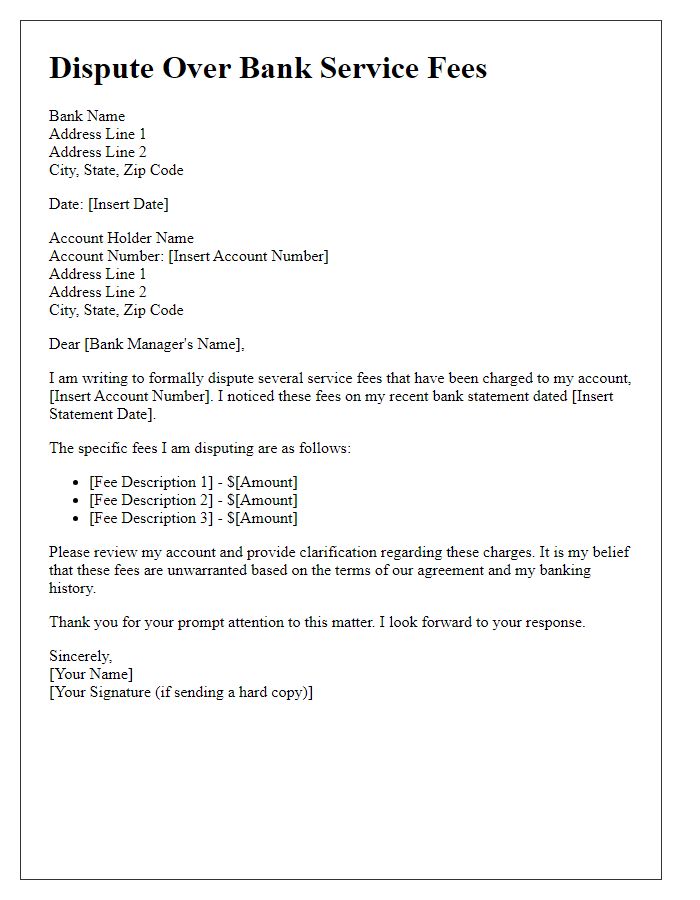

Numerous banking institutions impose various fees which can significantly impact account holders. Monthly maintenance fees, often ranging from $5 to $30 depending on account type and balance, typically cover administrative expenses. Insufficient funds fees, which can reach up to $35 per occurrence, penalize account holders for overdrafts or negative balances. ATM fees can add to this burden, commonly amounting to $2 to $5 for out-of-network transactions. Additionally, wire transfer fees usually vary between $15 and $50 for domestic transfers and can spike to upwards of $100 for international transactions. Such fees may cause frustration among customers, prompting complaints focused on transparency and fairness of these charges.

Reason for Dispute

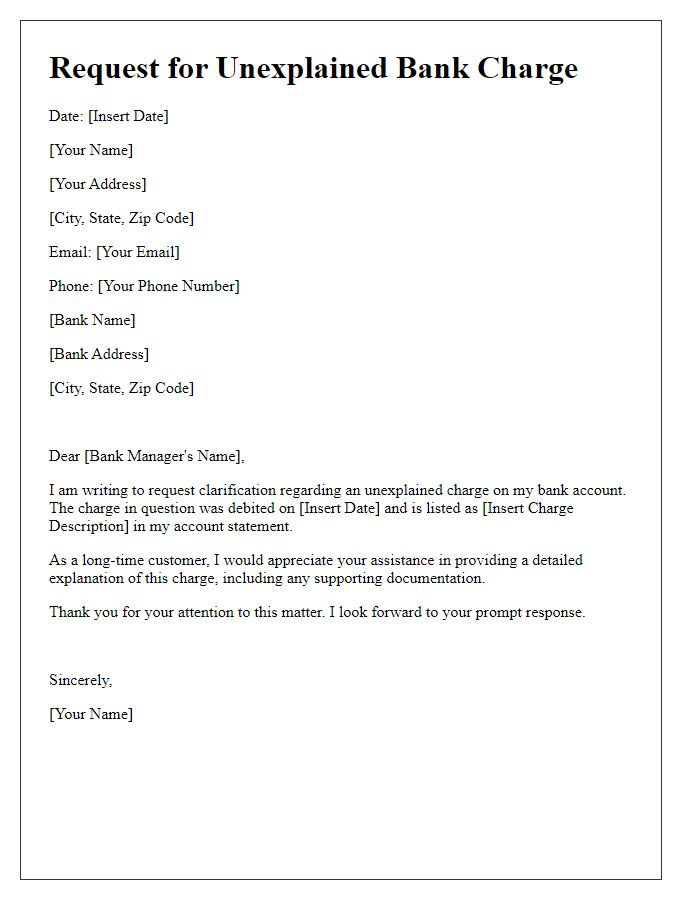

Bank fee discrepancies can arise from various factors, including unauthorized transactions, unexpected charges, or miscommunication regarding account terms. Affected consumers often notice fees, such as monthly maintenance fees or overdraft fees, that deviate from their understanding of account stipulations. These charges, often ranging from $5 to $35, can accumulate over time, leading to significant financial strain, especially for low-income individuals. Addressing these issues directly with the bank, through formal complaints or dispute resolutions, can potentially resolve misunderstandings and restore trust. Consumers must keep supporting evidence, such as bank statements and correspondence, to substantiate their claims during the dispute process.

Requested Action

Unexpected bank fees can significantly impact personal finances, especially those associated with checking accounts, savings accounts, or credit cards. For example, overdraft fees can reach up to $35 per occurrence, while monthly maintenance fees can accumulate to $15 if minimum balance requirements are not met. The financial burden can be particularly felt by low-income households, where even a single fee can disrupt budgeting. Additionally, failure to address erroneous fees can damage customer relationships, leading to a loss of trust in the banking institution, such as Chase Bank or Bank of America, known for high-profile customer service disputes. Clear communication and timely resolution are essential in restoring customer confidence and preventing further financial strain.

Supporting Documentation

Bank fees can significantly impact account holders, often resulting in unexpected financial strain. Documentation supporting complaints regarding bank fees, such as monthly statements and transaction records, plays a crucial role in resolution efforts. For example, a statement from September 2023 indicating multiple overdraft fees (often $35 each) due to insufficient balance alerts can illustrate the issue. Including evidence, like communication logs with customer service representatives from institutions like Wells Fargo or Bank of America, adds weight to disputes. Tracking recurring charges, such as maintenance fees (averaging $12 monthly), can highlight unfair practices. Thorough documentation can expedite the complaint process while ensuring transparency for both parties involved.

Comments