Are you feeling frustrated with the banking services that have fallen short of your expectations? Writing a complaint letter can be an effective way to voice your concerns and seek a resolution. In this article, we'll guide you through the essential components of a well-structured complaint letter, ensuring that your message is clear and impactful. Join us as we explore this helpful template and empower yourself to advocate for the service you deserve!

Contact Information and Date

The recent merger between XYZ Bank and ABC Financial Services has resulted in significant changes to account management systems, causing increased customer service wait times (averaging 45 minutes) and access issues to online banking platforms. Numerous customers reported experiencing difficulties with mobile app functionalities, including login errors and transaction delays. Affected customers, numbering in the thousands, voiced concerns regarding unauthorized transactions and slow response rates from support teams working out of the main branch in downtown Citysville. Feedback indicates a pressing need for improved staff training and system robustness to address the ongoing service challenges effectively.

Clear Subject Line

Unresponsive customer service can severely impact the overall banking experience with institutions like Wells Fargo and Bank of America. Long wait times, sometimes exceeding 30 minutes, on customer service calls can lead to frustration among clients. In-branch services may also suffer from delays, with some branches reporting up to an hour wait during peak hours. Additionally, issues like incorrect transaction postings or lack of timely updates regarding account status can exacerbate dissatisfaction, potentially influencing customer retention rates. Immediate attention to these service shortcomings is necessary to uphold industry standards and maintain client trust.

Detailed Description of the Issue

Unresolved banking issues can lead to significant frustration for customers relying on institutions like Chase Bank. Long wait times (averaging over 30 minutes during peak hours) for customer service, particularly during the COVID-19 pandemic, have resulted in increased dissatisfaction among clients. Account discrepancies, such as unauthorized transactions, can lead to loss of trust, especially when customer representatives fail to resolve the issue effectively within three attempts. In addition, delayed processing of fund transfers, which can take up to five business days instead of the promised one day, exacerbates problems for customers needing immediate access to funds. These service failures ultimately compromise customer loyalty and tarnish the bank's reputation.

Account Information and Relevant Details

The dissatisfaction with bank services can significantly impact customer trust and experience, particularly in institutions like Bank of America (established in 1904). Issues such as account discrepancies (errors in account balance or transaction history), long wait times (exceeding 30 minutes during customer service calls), and inadequate online banking features (like lack of two-factor authentication) often lead to frustration among clients. Furthermore, the lack of timely responses to inquiries can exacerbate this situation, especially for urgent matters such as fraudulent charges (which can occur every 36 seconds in the U.S.). Customers expect transparency, efficiency, and security from their banking institutions, and any failures in these areas can lead to formal complaints and potential loss of clientele.

Desired Resolution and Feedback Request

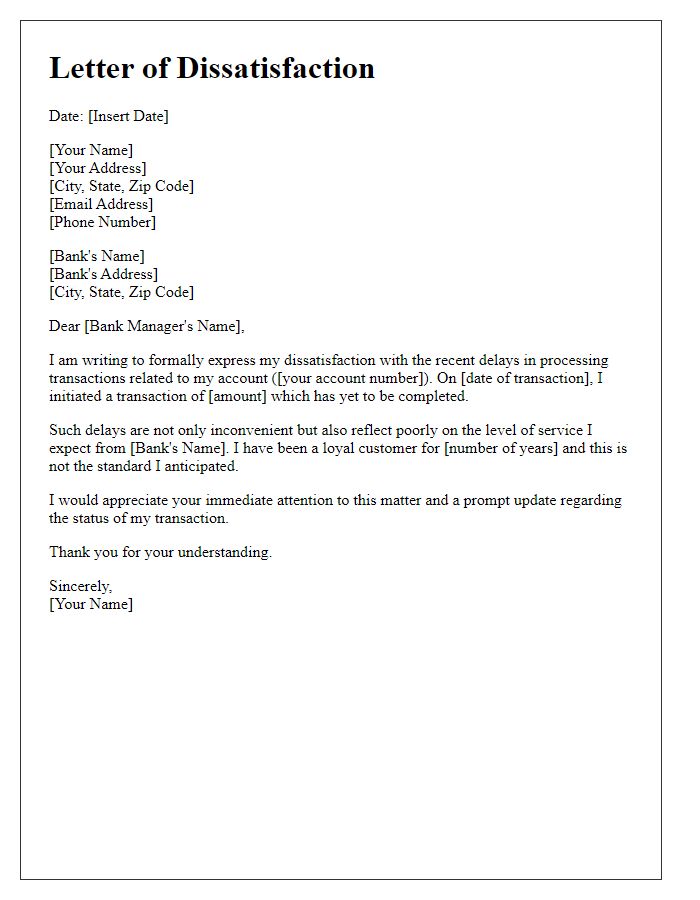

A letter template for a complaint against bank services serves as a structured format for customers to express dissatisfaction with banking operations, customer support, or transaction processes. The desired resolution element clearly outlines the specific outcome sought, such as a refund, service adjustment, or policy change. The feedback request section invites the bank to provide insights on their procedures or resolutions, fostering a dialogue for improvement. This template ensures that communications remain professional, emphasizing clarity and specificity, which are crucial when addressing financial institutions. Proper utilization can lead to constructive responses that enhance overall banking experiences.

Letter Template For Complaint Against Bank Services Samples

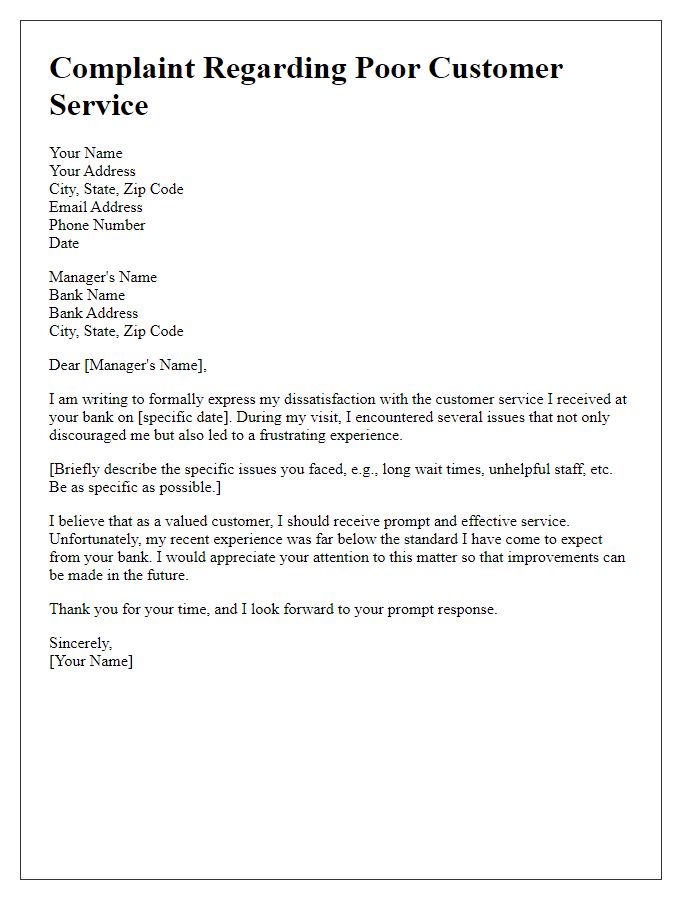

Letter template of complaint regarding poor customer service at the bank.

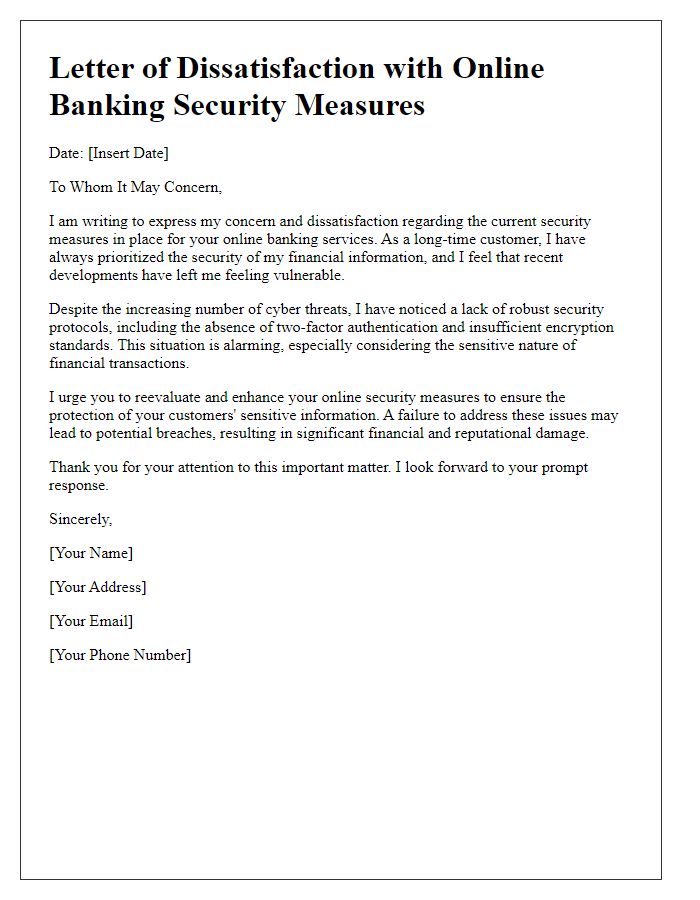

Letter template of dissatisfaction with online banking security measures.

Comments