Are you tired of chasing overdue invoices and feeling the strain of unpaid debts on your business? Fret not, as a well-structured letter can be your key to effective commercial debt recovery. By clearly communicating your expectations and outlining the consequences of non-payment, you can encourage prompt action from your clients while maintaining a professional tone. Keep reading to discover a comprehensive template that will help you reclaim what's rightfully yours!

Debtor Identification Information

Commercial debt recovery processes often begin with detailed debtor identification information. Accurate identification includes the debtor's full legal name, registered business address, and contact information such as phone numbers and email addresses. This information can help locate businesses such as Corporation XYZ, founded in 2010, situated at 123 Main Street, New York City. Additionally, including the debtor's Tax Identification Number (TIN) is crucial for verifying their legitimacy and streamlining the recovery process. A comprehensive understanding of the debtor's financial status, including outstanding invoices and payment history, enhances the effectiveness of collection strategies, particularly when pursuing debts exceeding $10,000. Timely communication and documentation of this information can significantly influence recovery success rates.

Outstanding Debt Details

Outstanding debts can harm the financial stability of businesses, impacting cash flow and operational capacity. For instance, an overdue account with a balance of $5,000 that has gone unpaid for over 90 days can significantly strain resources. Legal jurisdictions such as the United States have specific regulations, like the Fair Debt Collection Practices Act (FDCPA), that govern debt recovery efforts. Engaging a commercial debt recovery agency may be necessary, with fees ranging from 20% to 40% depending on the amount recovered. Moreover, prompt communication with the debtors--including sending formal demand letters--can help facilitate the recovery process and reduce prolonged financial losses.

Payment Instructions and Deadline

Commercial debt recovery involves specific payment processes and deadlines that are critical for ensuring timely resolution of outstanding debts. Companies typically issue formal notices outlining payment instructions, including bank account details for wire transfers, acceptable payment methods (such as credit cards or checks), and necessary references for identifying accounts. Deadlines for payment often range from 7 to 30 days from the invoice date to maintain cash flow and legal standing. It is essential to highlight potential late fees or penalties associated with overdue payments, which may be stated in the original contract or terms of service. Clear communication regarding these details can significantly improve recovery rates and reduce disputes between creditors and debtors.

Legal Consequences for Non-Payment

Businesses face significant risks when it comes to commercial debt recovery, especially regarding non-payment. Outstanding invoices exceeding 30 days can lead to potential legal action, including collection lawsuits or court orders. The consequences of non-payment can further escalate to penalties, interest charges, and even damage to credit ratings. In jurisdictions like California (USA), strict regulations govern collections to protect consumers, whereas, in the UK, businesses follow protocols under the Late Payment of Commercial Debts Act. Engaging a collection agency may become necessary, impacting both the financial health and reputation of the debtor. Prompt resolution of debts is crucial to avoiding these legal pitfalls and maintaining positive business relationships.

Contact Information for Resolution

In commercial debt recovery, providing clear contact information significantly enhances the chances of successful resolution. Essential details include the company name (XYZ Corporation), a designated contact person (Jane Smith, Accounts Receivable Manager), phone number (123-456-7890), and email address (jane.smith@xyzcorp.com). Including the business address (456 Business Park, Suite 300, Cityville, ST 78901) establishes legitimacy and facilitates correspondence. Clarity in communication can lead to discussions that address outstanding invoices or payment terms effectively. Prompt response to inquiries showcases a proactive approach, which can strengthen relationships and promote timely resolutions.

Letter Template For Commercial Debt Recovery Samples

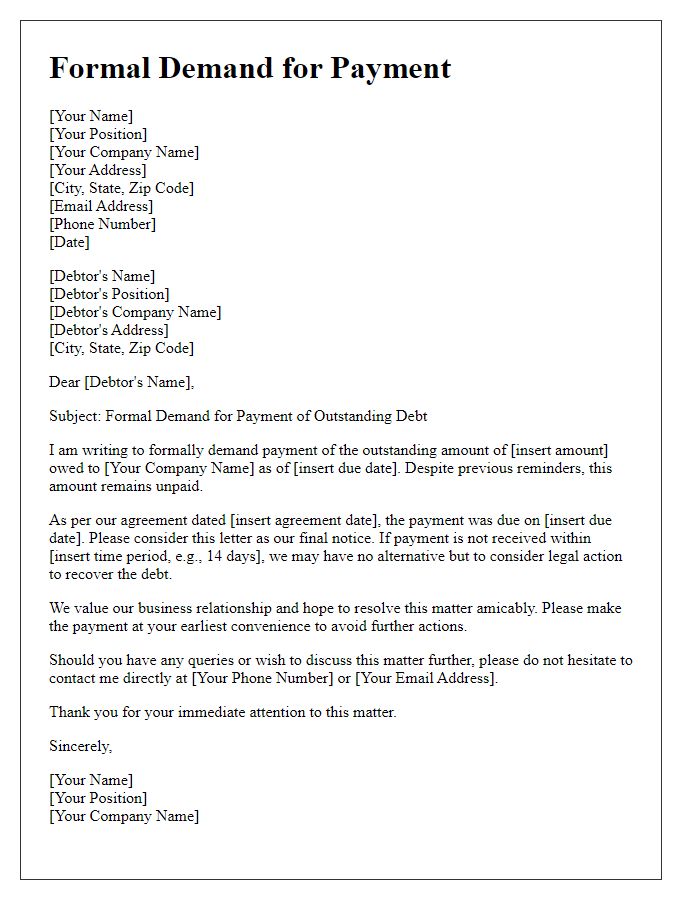

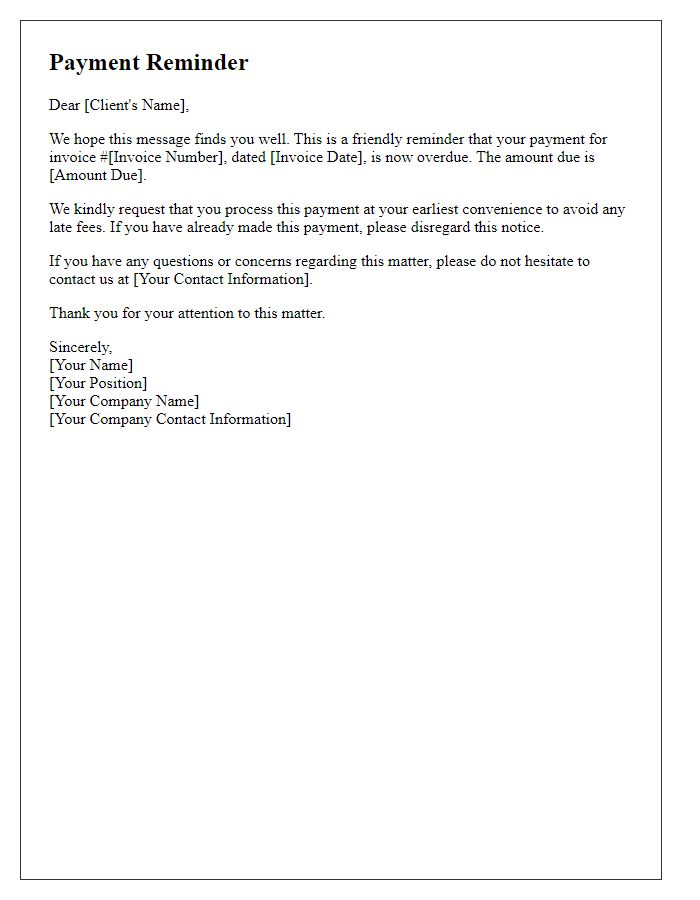

Letter template of formal demand for payment in commercial debt recovery

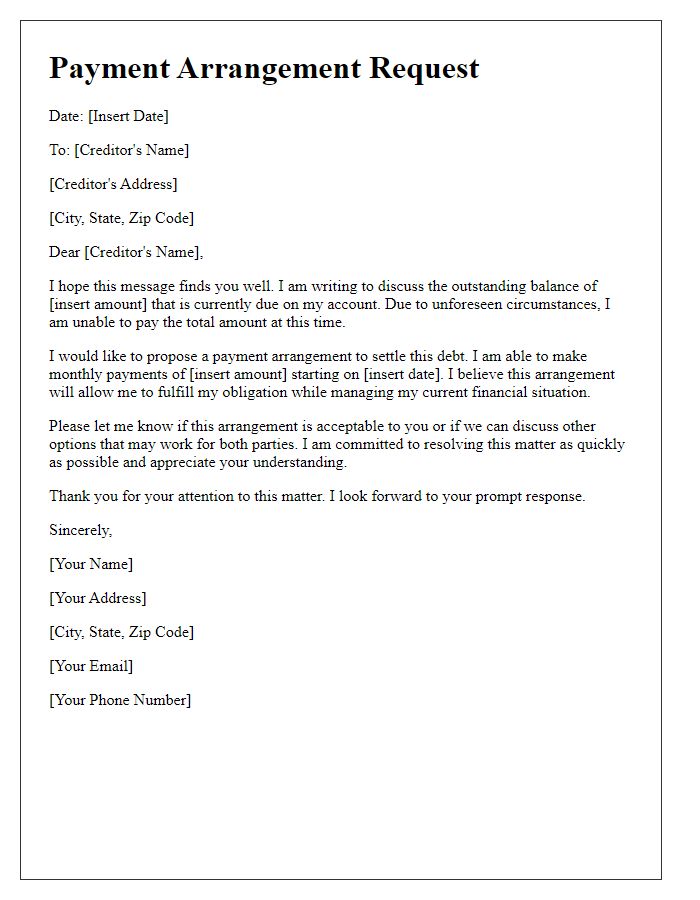

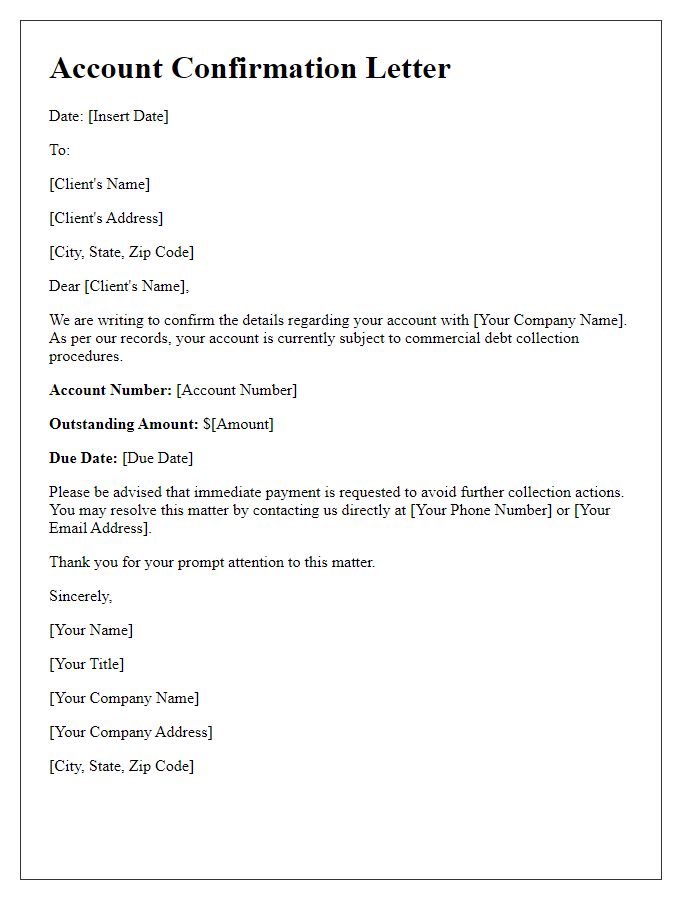

Letter template of payment arrangement request for commercial debt recovery

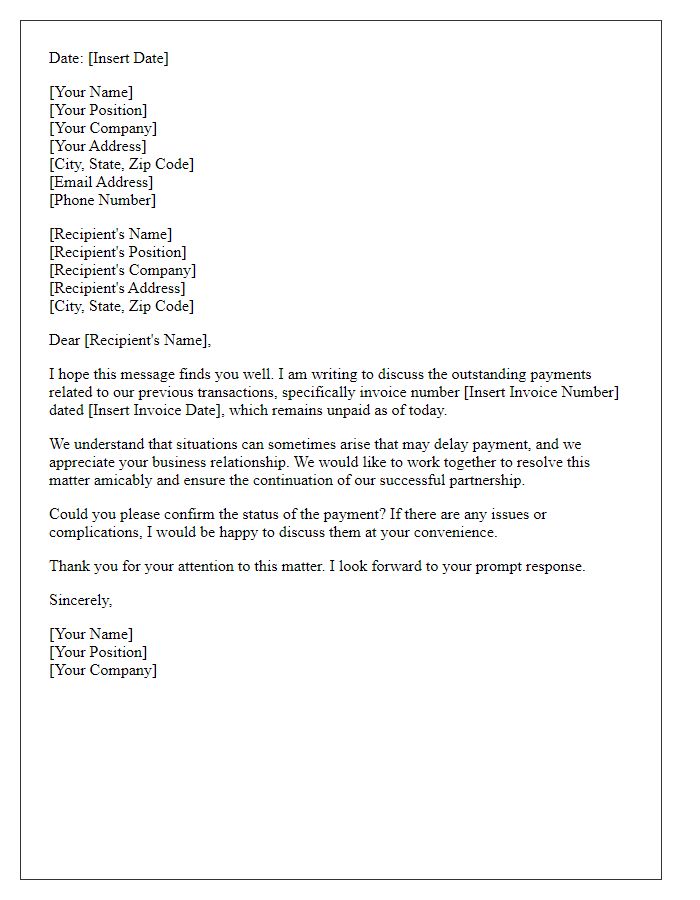

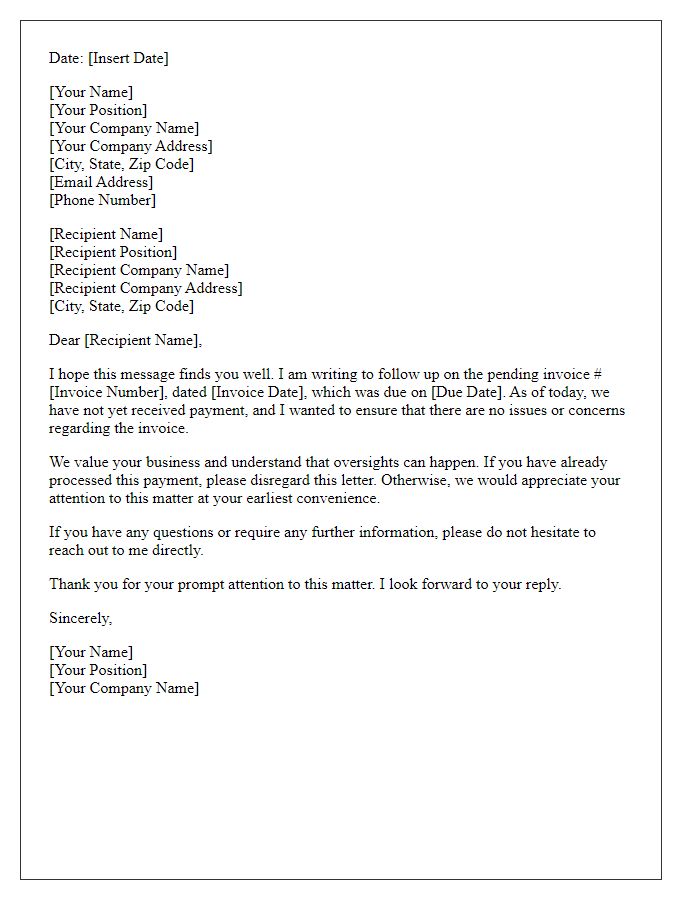

Letter template of conciliatory approach for outstanding commercial payments

Comments