Have you ever found yourself in a situation where a transaction just doesn't seem right? It's not uncommon for mistakes to happen, whether it's a billing error or an incorrect charge on your account. When that happens, knowing how to craft a clear and effective correction request letter can make all the difference in resolving the issue swiftly. So let's dive into some useful tips and templates that'll help you get your transaction corrected with ease!

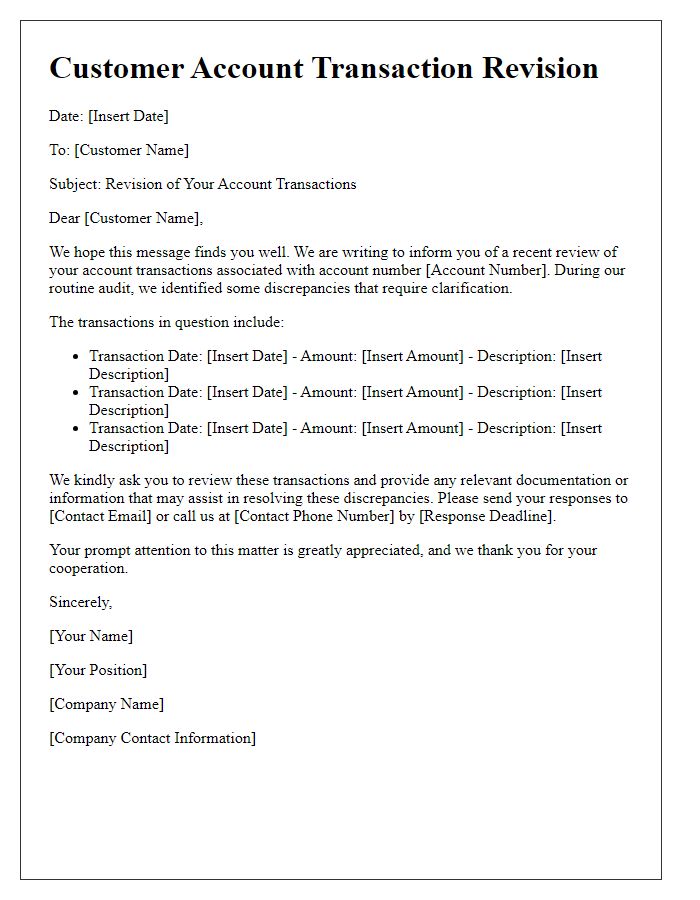

Clear Subject Line

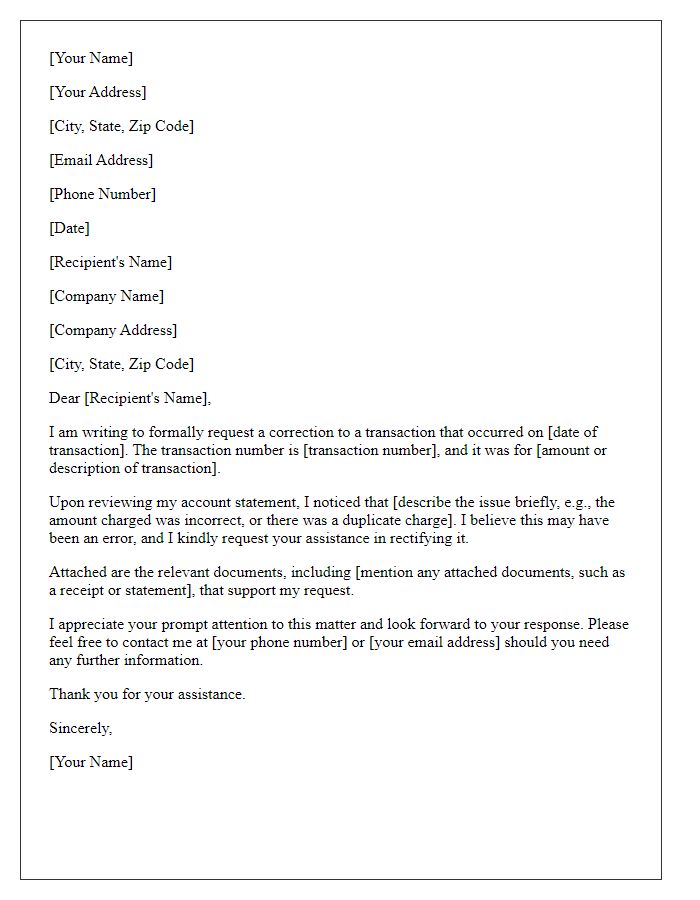

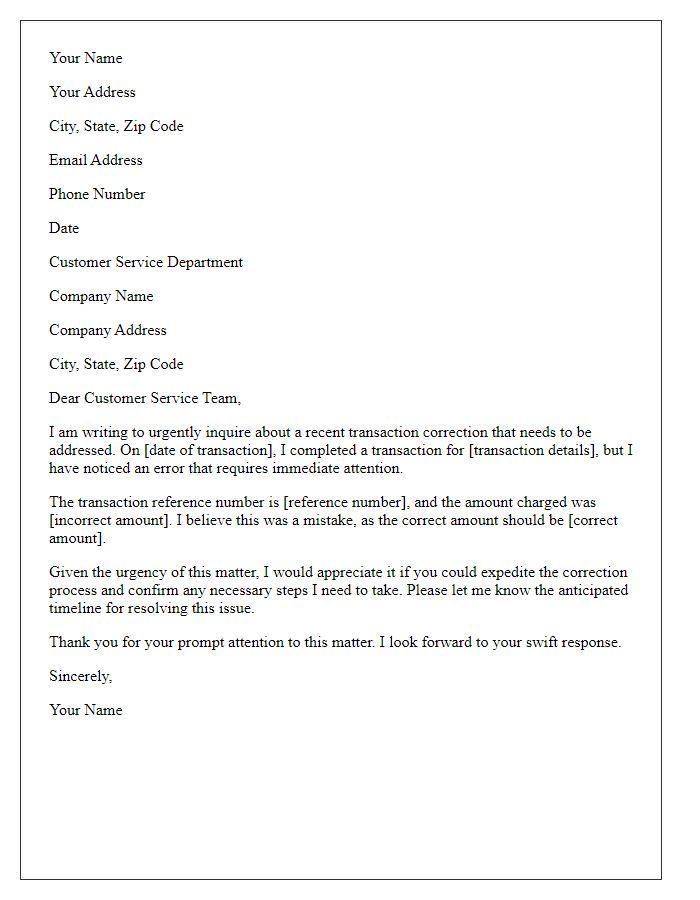

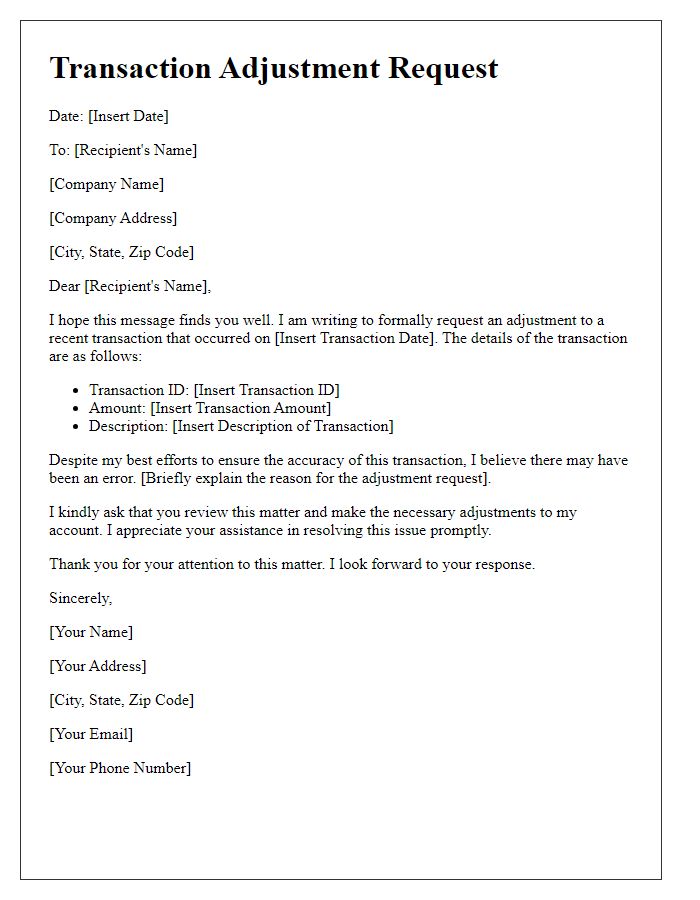

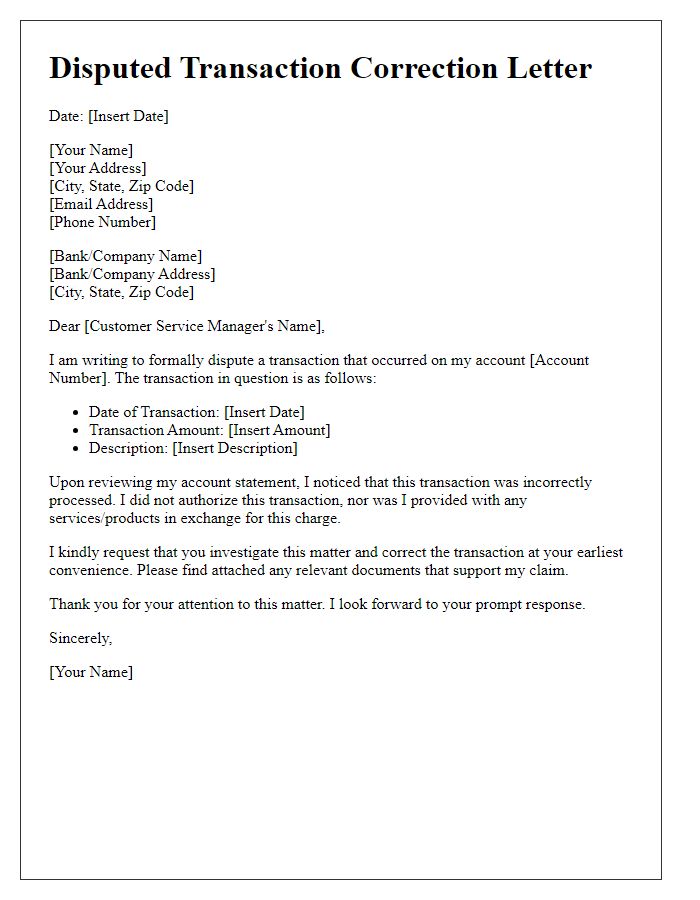

Transaction correction requests require precision and clarity to highlight the issue effectively. Accurate categorization of the transaction allows for streamlined processing by financial institutions. Noteworthy details such as transaction date, amount, and transaction ID (a unique identifier assigned to each transaction) can expedite the review process. Including the merchant name and location (the point of sale or online platform where the transaction occurred) may also provide context that aids in resolving discrepancies. Furthermore, a brief explanation of the correction needed can help clarify the situation, ensuring prompt attention from customer service representatives. These elements collectively contribute to an efficient and effective transaction correction request.

Correct Contact Information

Inaccurate contact information can lead to significant issues in financial transactions, particularly in banking systems, like those utilized by Chase Bank or Bank of America. Incorrect email addresses or phone numbers may result in missed notifications regarding transaction statuses or alerts about fraudulent activities. For instance, email addresses missing the '@' symbol can prevent receipt of essential communication, while outdated phone numbers (such as those no longer in service) can hinder verification processes during account access. Accurate contact information not only facilitates seamless communication but also enhances security protocols by ensuring that alerts are delivered to the rightful account holder.

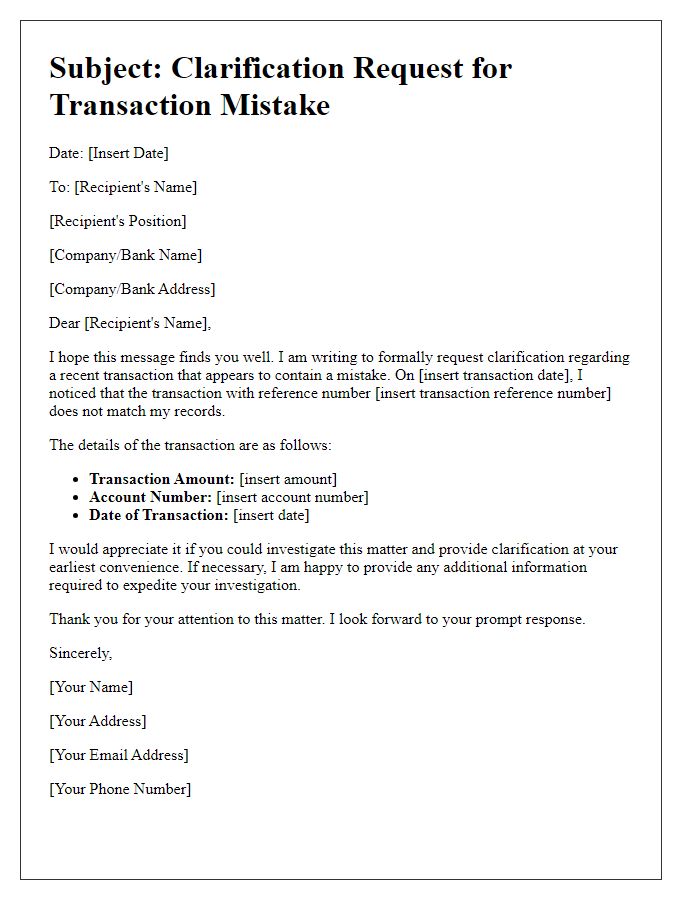

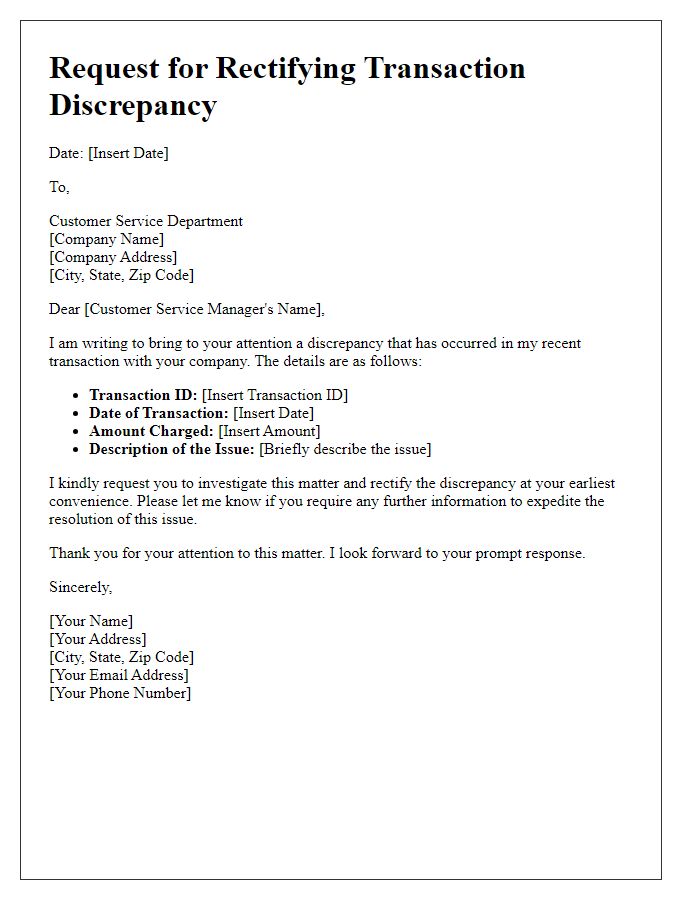

Detailed Transaction Description

Incorrect transactions can lead to significant discrepancies in financial records, such as those seen in bank statements or e-commerce platforms. A transaction description should include key details like transaction ID, date, amount (in USD or other currencies), merchant name (e.g., Amazon, Walmart), and the type of transaction (purchase, refund, etc.). For instance, a purchase made on March 15, 2023, for $150 at Best Buy could contain the item details such as 'Samsung Galaxy Buds Pro', which may aid in identifying the error. Additionally, references to prior communications regarding the transaction (via email or ticket number) may provide context for the correction request and facilitate quicker resolution.

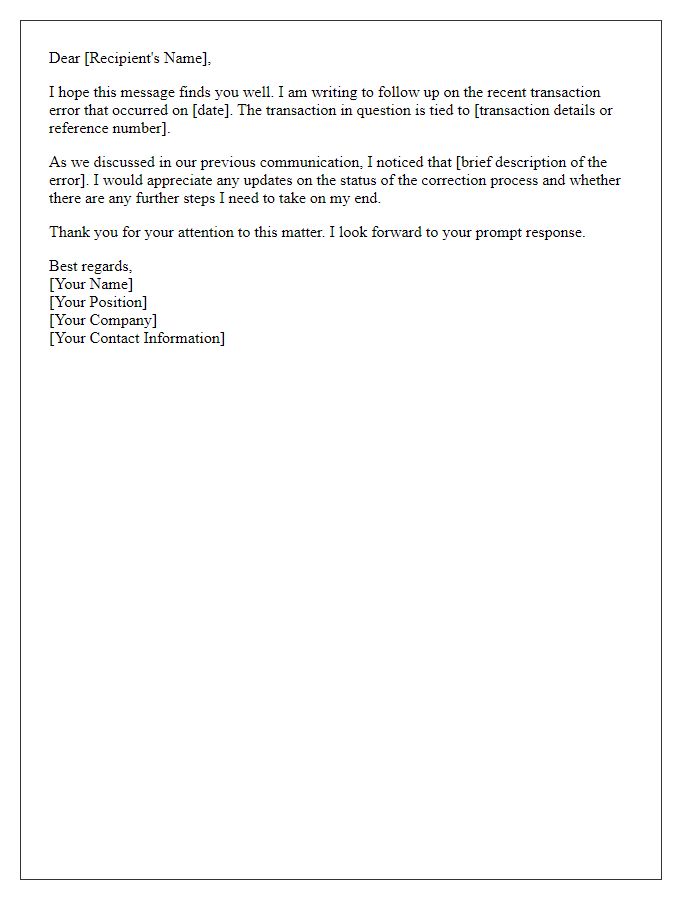

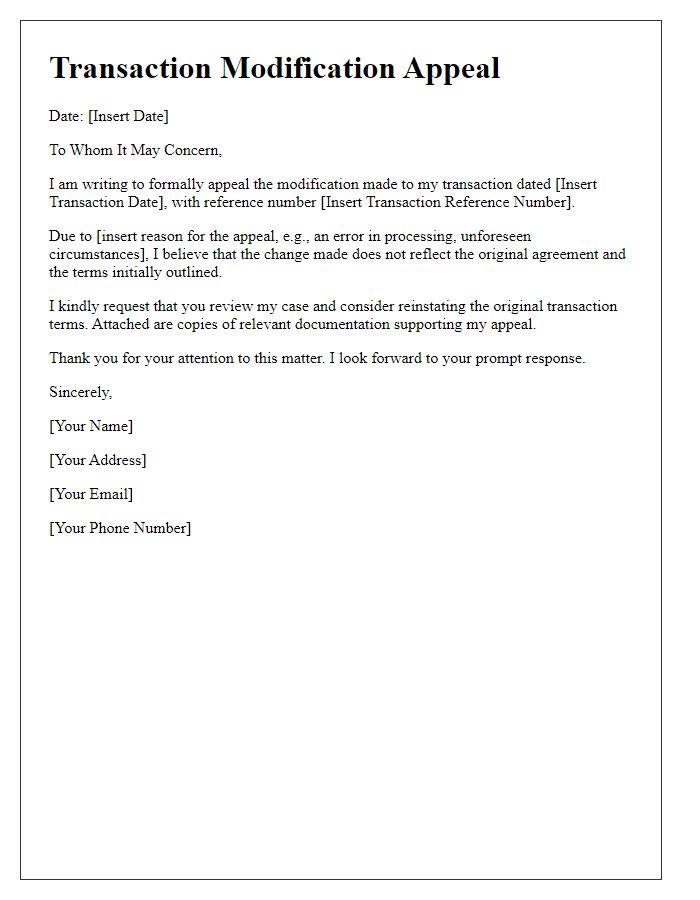

Specific Correction Request

A specific correction request for a transaction may arise due to issues such as duplicate payments sourced from credit cards or incorrect amounts charged to bank accounts. These discrepancies often occur within financial institutions like Chase Bank or Wells Fargo. Essential details such as the transaction date, reference number, and the invoice amount should be accurately provided. Timely notifications, typically within 30 days from the transaction date, are crucial for resolution. Ensuring communication through official channels, such as customer service hotlines or secure online messaging within banking apps, helps facilitate effective corrections. In addition, maintaining a record of related documents, such as receipts or confirmation emails, serves as critical evidence to support the correction request.

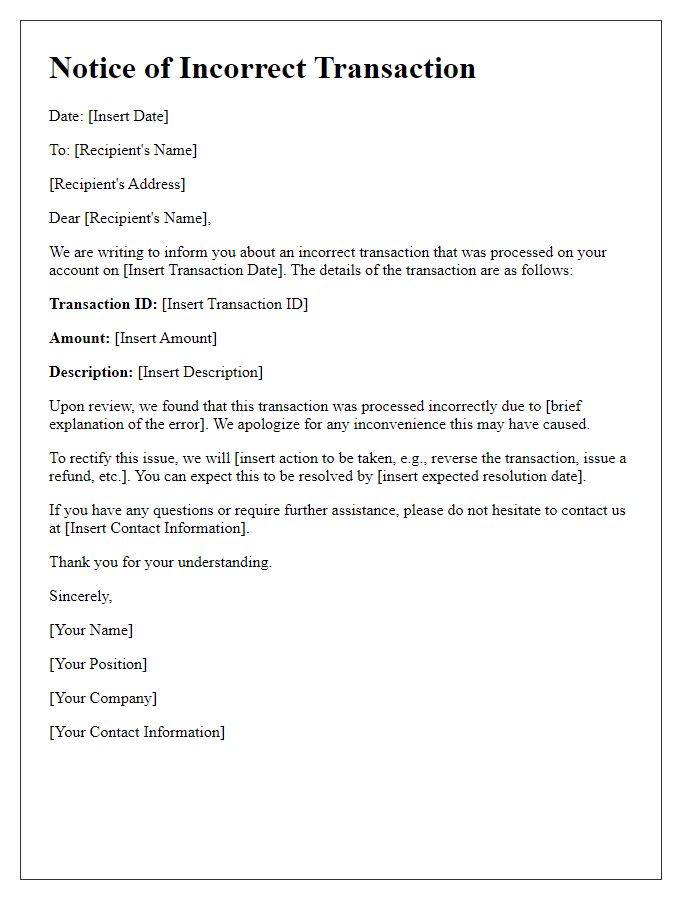

Polite Closing and Signature

A transaction correction request can arise from a variety of errors in financial dealings, such as overcharges, duplicates, or incorrect amounts. This type of request often necessitates a thorough review of transaction details including, but not limited to, transaction dates, invoice numbers, and the amounts involved. For effective communication, it's essential to maintain professionalism and clarity in the closing remarks. A polite closing may include expressions of appreciation for the recipient's assistance, along with a respectful sign-off, which conveys your gratitude and sets a positive tone for the request's resolution.

Comments