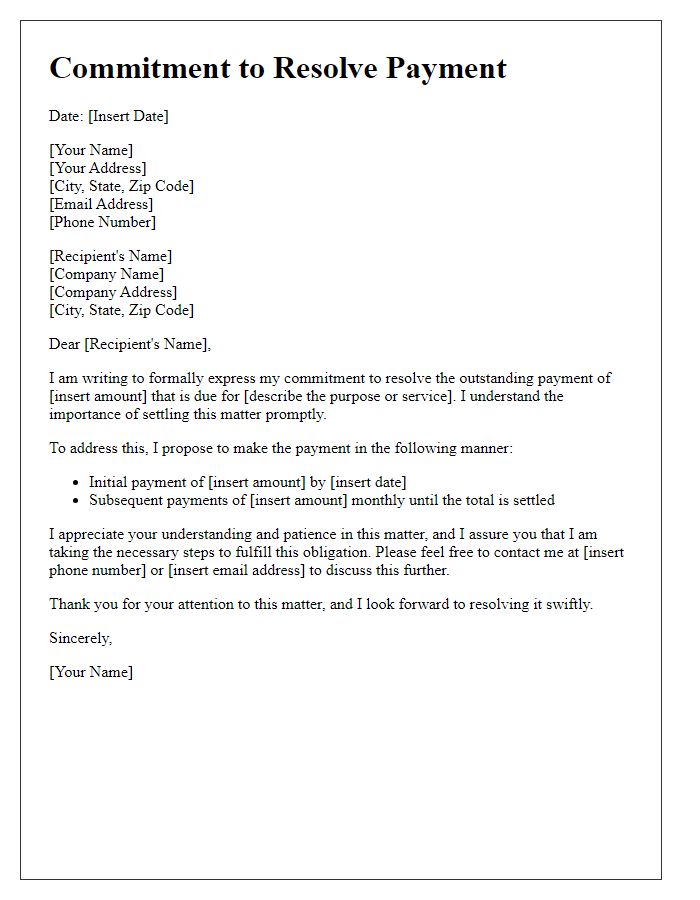

Are you feeling uncertain about how to express your commitment to addressing a payment? Writing a letter to acknowledge your intentions can provide clarity and confidence for both you and the recipient. In this article, we'll share a simple yet effective template that captures your sincerity while also laying out your payment plan. So, let's dive in and help you craft the perfect letter that resonates!

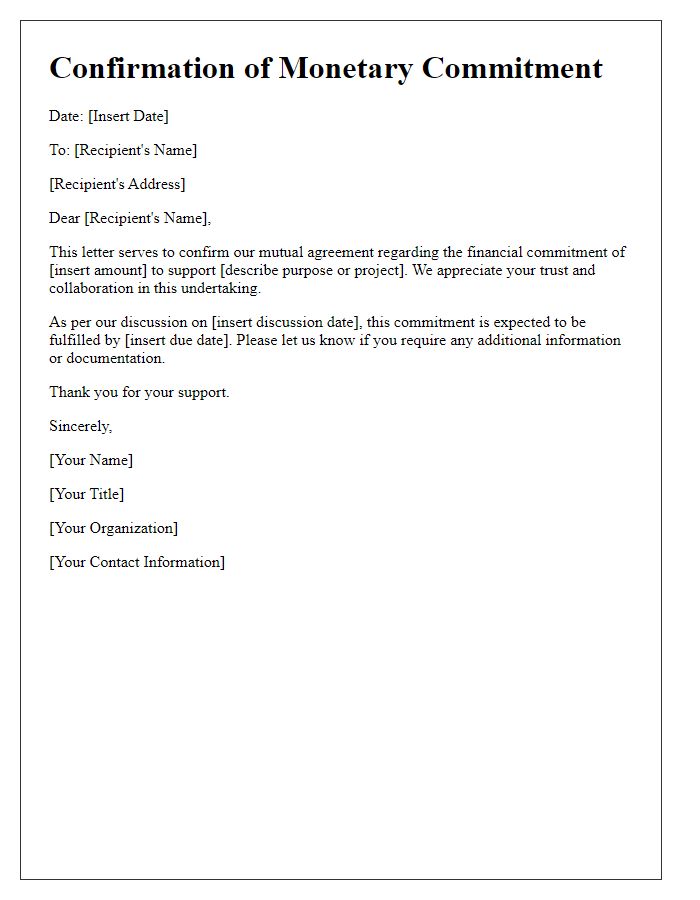

Company Information

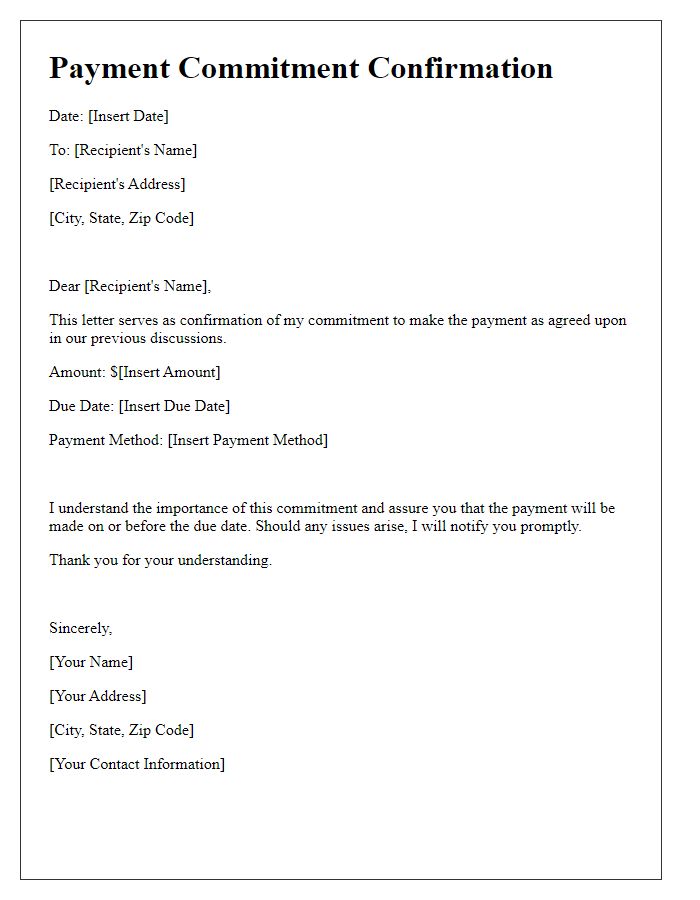

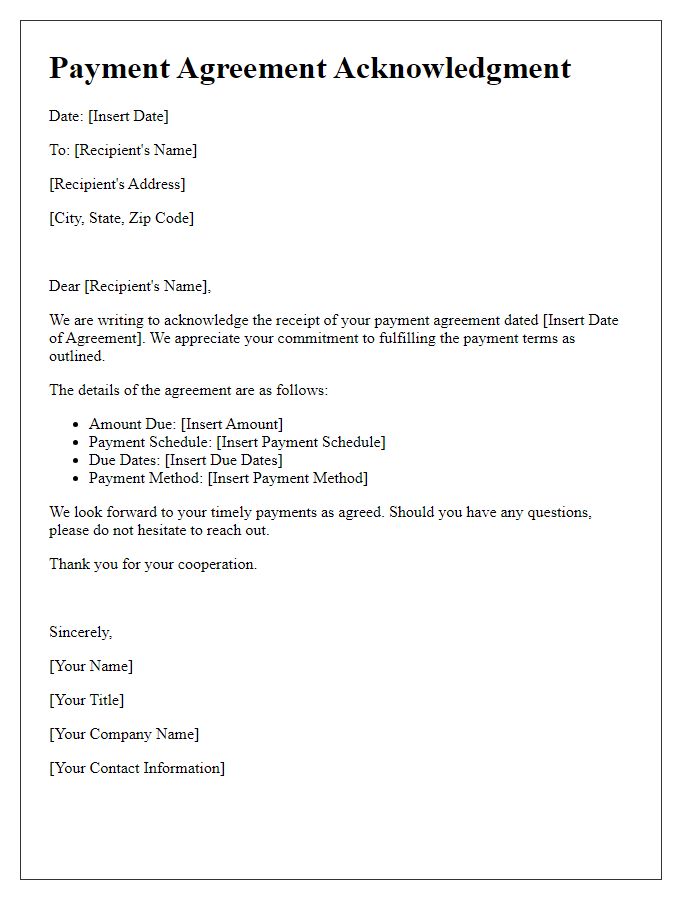

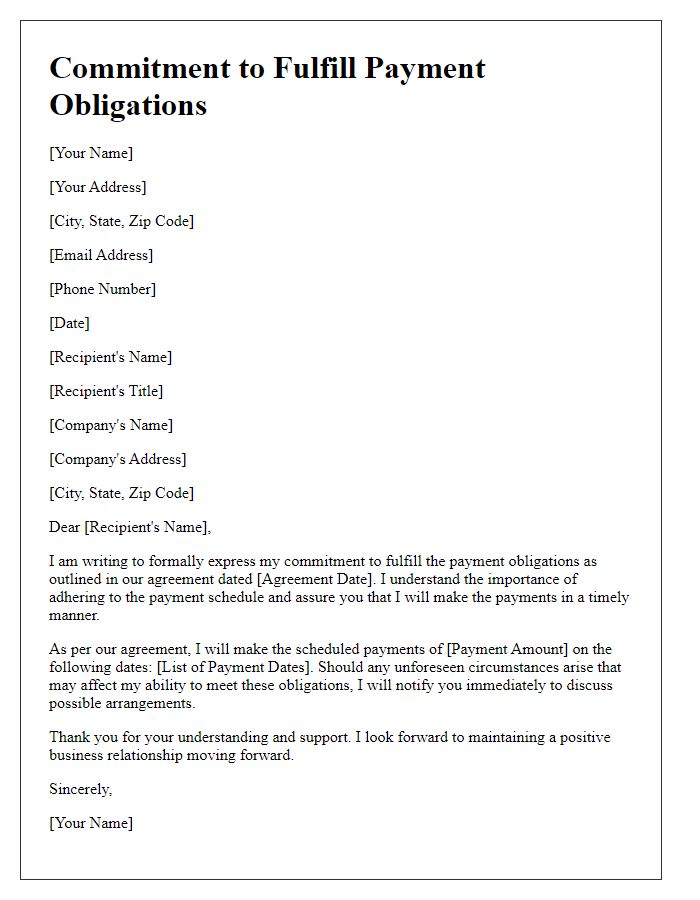

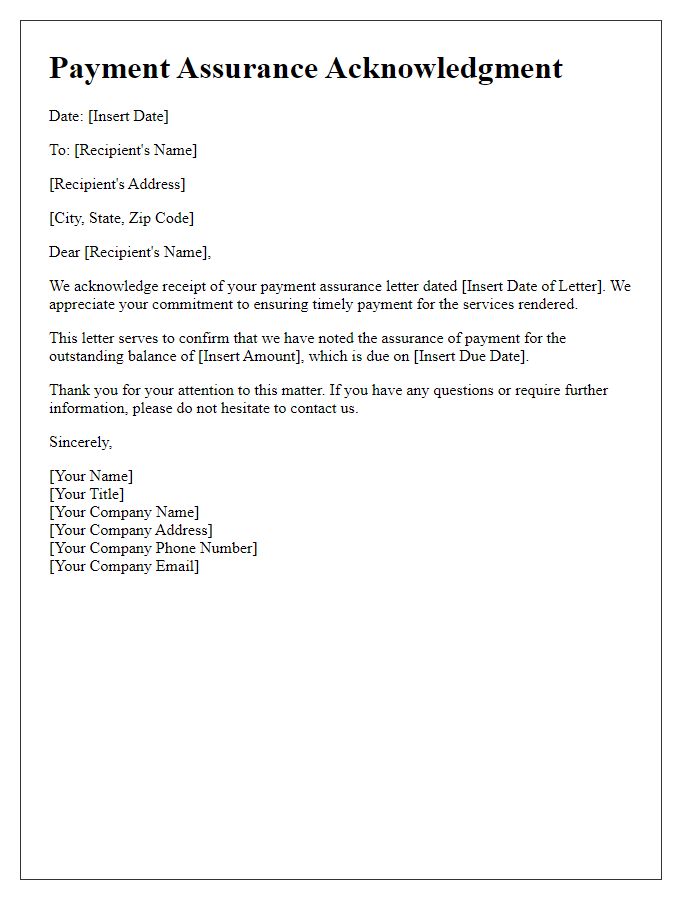

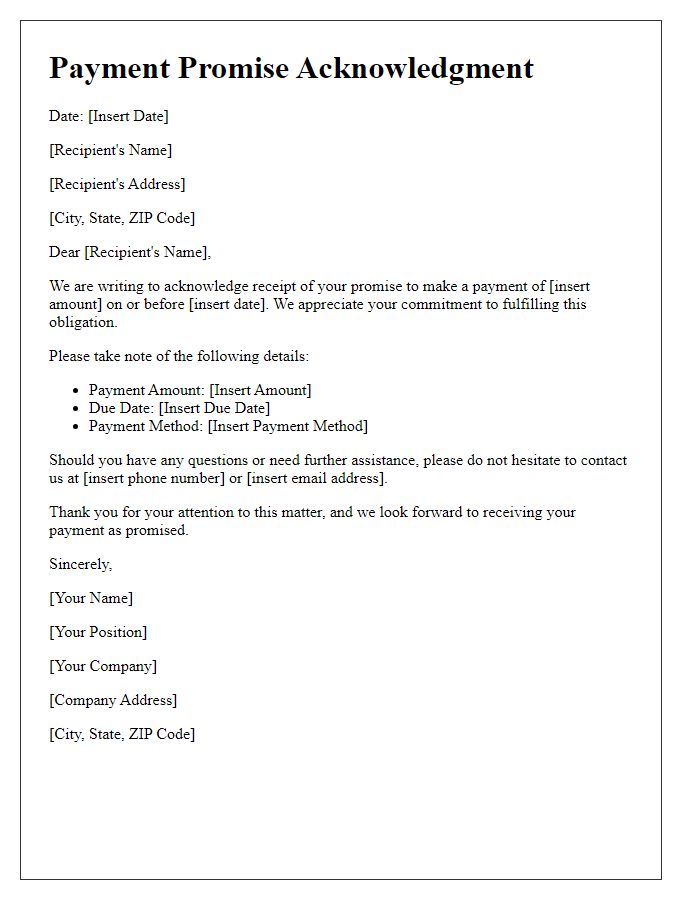

A commitment to pay acknowledgment ensures that the involved parties understand their financial responsibilities. It outlines the payment agreement between a company and its clients or partners. Clear statements of payment terms, including amounts, due dates, and accepted payment methods, build transparency. An organized format should feature the company's name, contact details, and relevant payment references. This documentation can serve as a crucial legal record in case of future disputes while fostering trust and understanding in business relationships. Implementing a structured acknowledgment can also streamline financial processes, promoting timely payments and enhancing cash flow management.

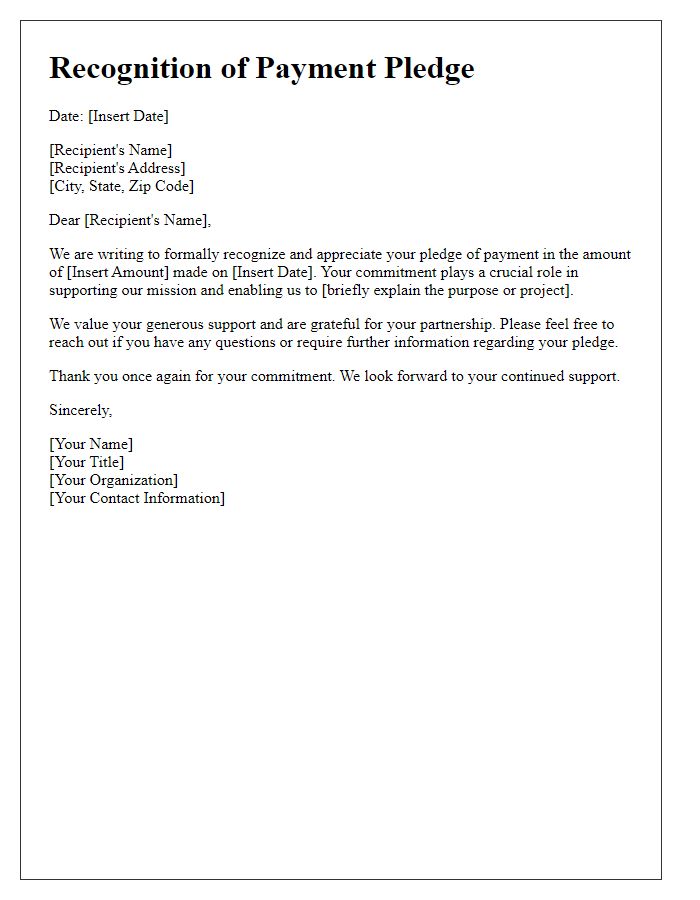

Payment Details

Acknowledgment of payment commitment is crucial for maintaining transparency in financial transactions. Companies frequently create documents to ensure all terms are clear. Important details such as total amount owed (like $1,500), due date (for instance, October 31, 2023), payment method (credit card or bank transfer), and payment plan structure can enhance understanding. Additionally, mentioning the name of the creditor (such as XYZ Corp) and financial reference numbers can streamline future communications. A clear outline of consequences for late payments can also guide both parties in their responsibilities.

Acknowledgment Statement

In a financial context, an acknowledgment statement serves as a formal document confirming the commitment to pay a specific amount owed. This statement often includes key details such as the total debt amount, payment due dates, and the consequences of defaulting. Legal references may be included, referencing local laws governing financial obligations. For instance, a debt of $5,000 with a repayment timeline of six months requires the debtor to adhere to a structured payment plan, which may feature monthly installments of $833.34. All parties involved may sign the acknowledgment to confirm their agreement to the outlined terms, ensuring clarity and preventing future disputes.

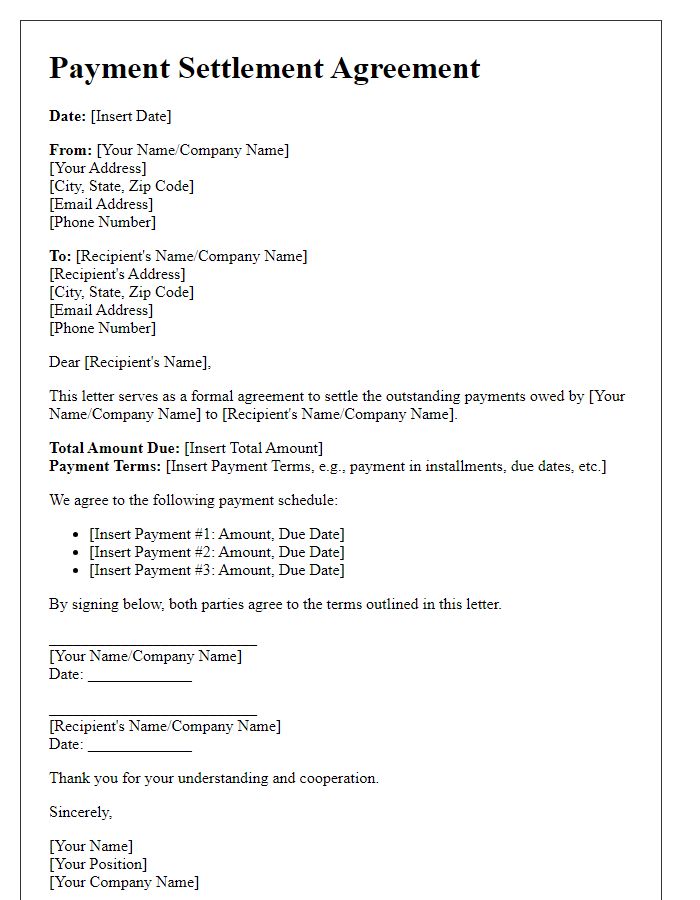

Contact Information

The commitment to pay acknowledgment is crucial for maintaining financial transparency. Individuals or entities can ensure accurate record-keeping through proper documentation. Contact information includes essential details such as the name of the paying party, mailing address, phone number, and email. This information aids communication regarding payment schedules, amounts due, and to address any discrepancies. Additionally, the acknowledgment should specify the payment method, such as bank transfer, check, or credit card, and include the payment timeline, often specifying due dates or installment plans. Clear contact details ensure streamlined correspondence, fostering trust between involved parties in financial agreements.

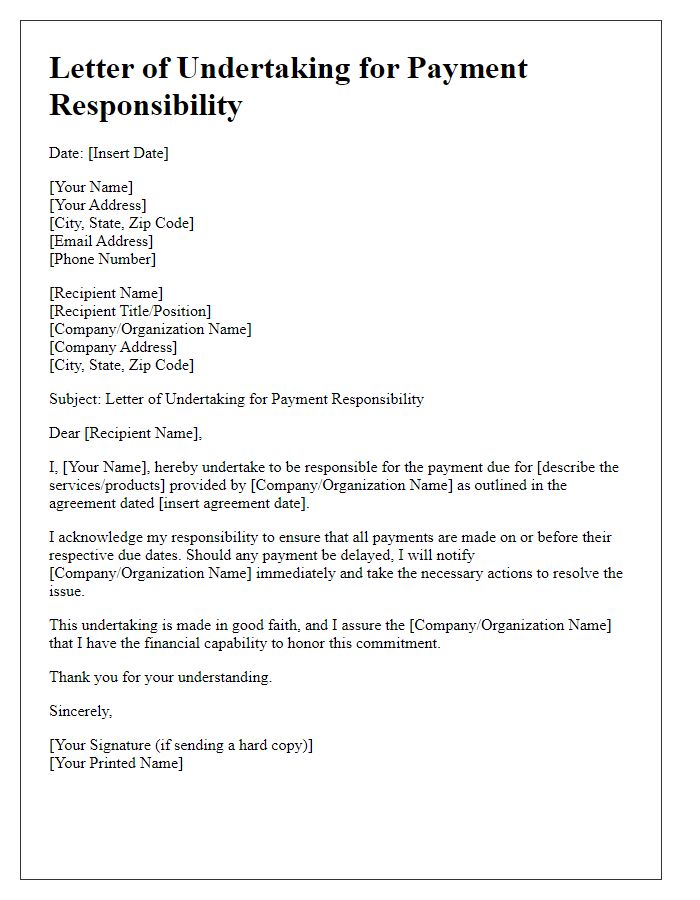

Terms and Conditions

Acknowledgment of payment commitment refers to a formal document that outlines the agreement between parties regarding the payment terms for services or products. This document often includes specific details such as the payment amount, due dates, and applicable interest rates in cases of late payments. Payment commitments ensure clarity in transactions, especially in businesses across various sectors like real estate, construction, and retail. Terms and Conditions (often abbreviated as T&Cs) define the rules and guidelines applicable to a contract or agreement, ensuring all parties understand their rights and obligations. These conditions can cover areas like liability limitations, dispute resolution processes, and confidentiality agreements, aiming to protect both the provider and receiver in a contractual relationship.

Comments