Have you ever found yourself puzzled by a duplicate charge on your bank statement? It can be frustrating to navigate the process of disputing such errors, especially when your hard-earned money is at stake. Fortunately, drafting a clear and effective letter for duplicate charge reversal can significantly ease the burden. Dive into our guide to learn the essential steps and tips for writing your own letter, ensuring you get back what's rightfully yours!

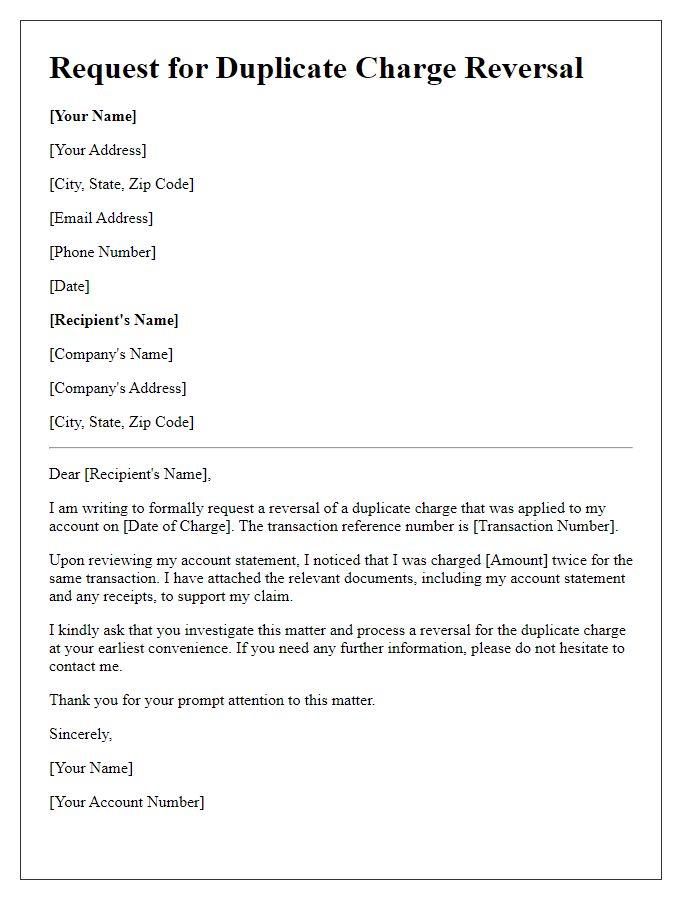

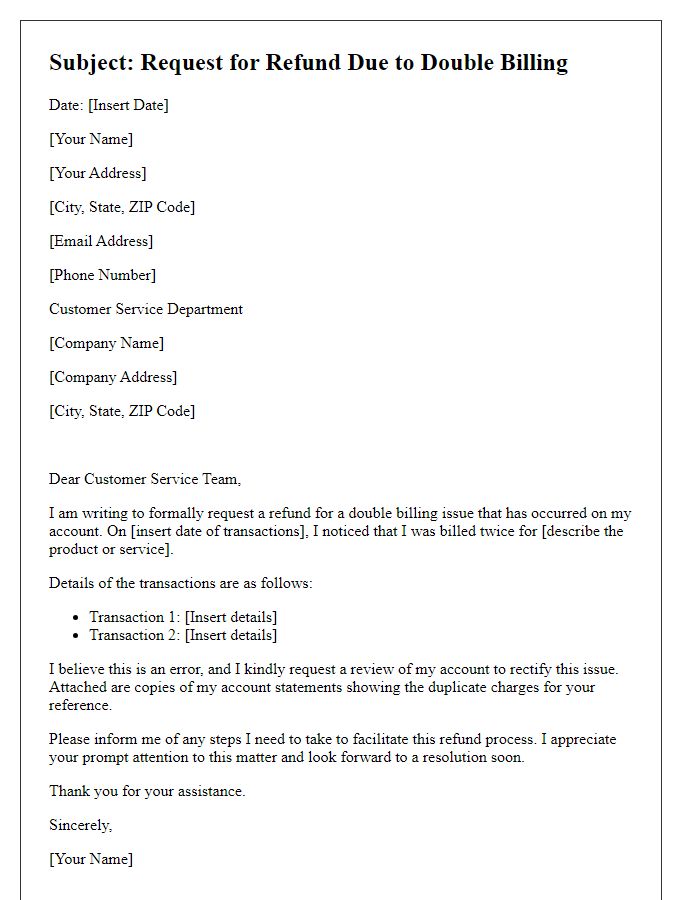

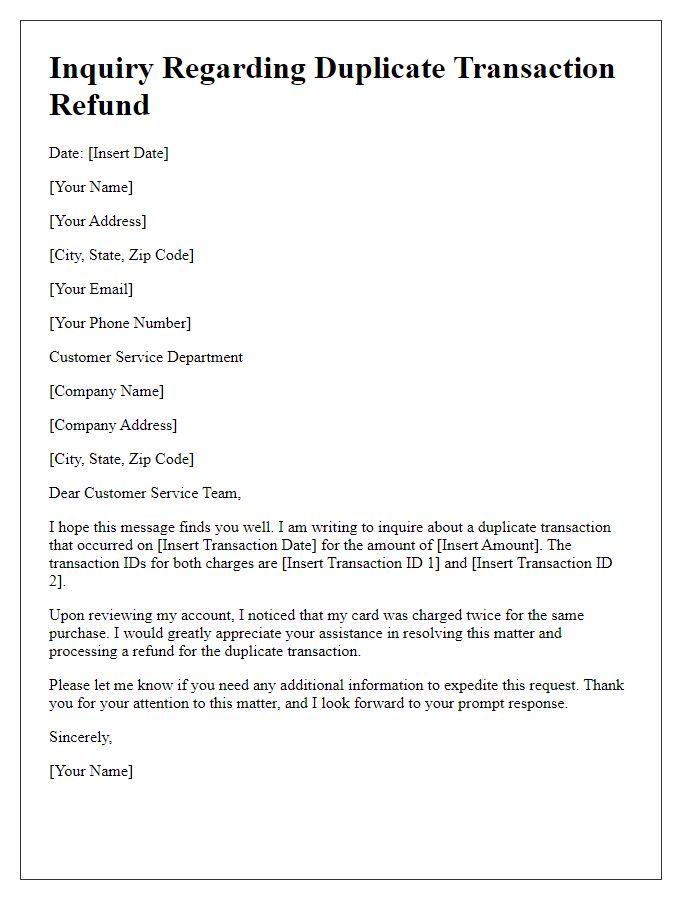

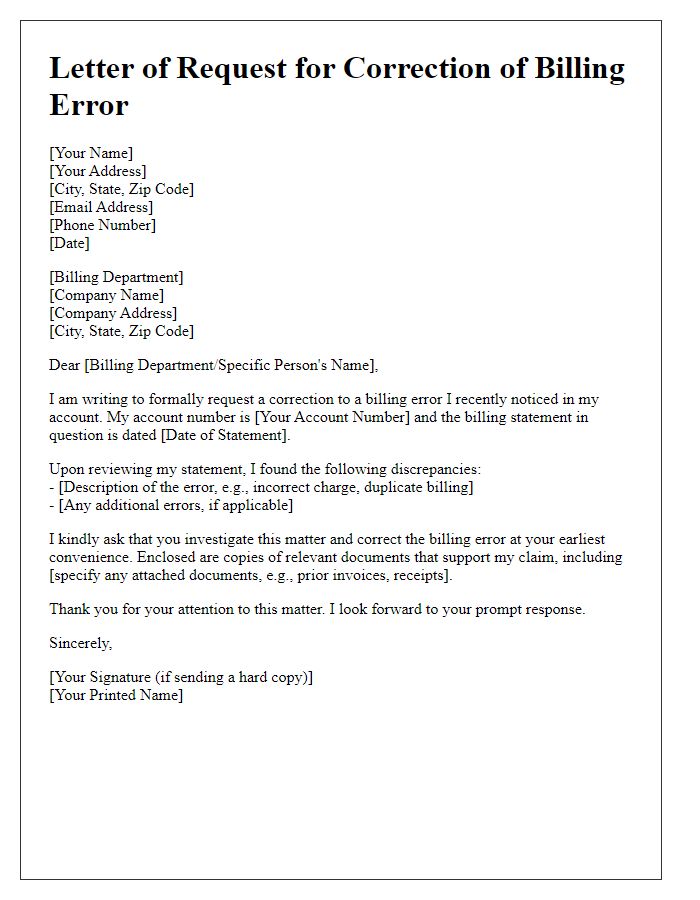

Subject line: Clear and concise mentioning the duplicate charge.

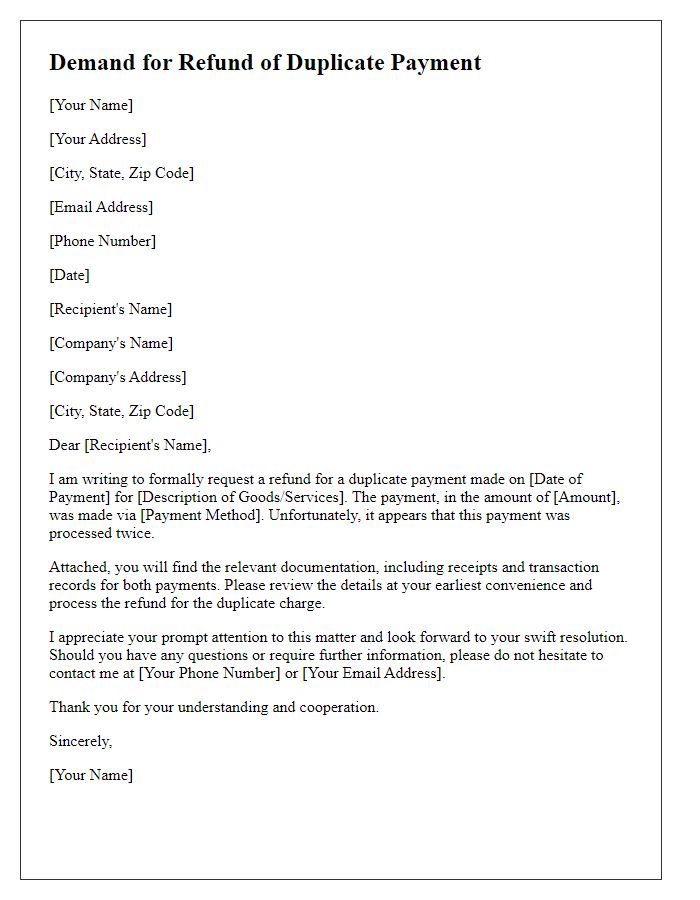

Duplicate charges on credit card statements can cause frustration for consumers and may indicate errors in billing practices. Customers who notice multiple transactions for the same purchase (often within a short timeframe) should take immediate action. This discrepancy can occur in various scenarios, such as online purchases, subscription renewals, or service fees, impacting bank account balances significantly. Filing a dispute with the credit card company typically involves detailing the transaction date, vendor name, and amount in question. Documentation supporting the claim, such as receipts or email confirmations, can expedite the resolution process. Prompt communication with customer service representatives can lead to a quicker reversal of these erroneous charges.

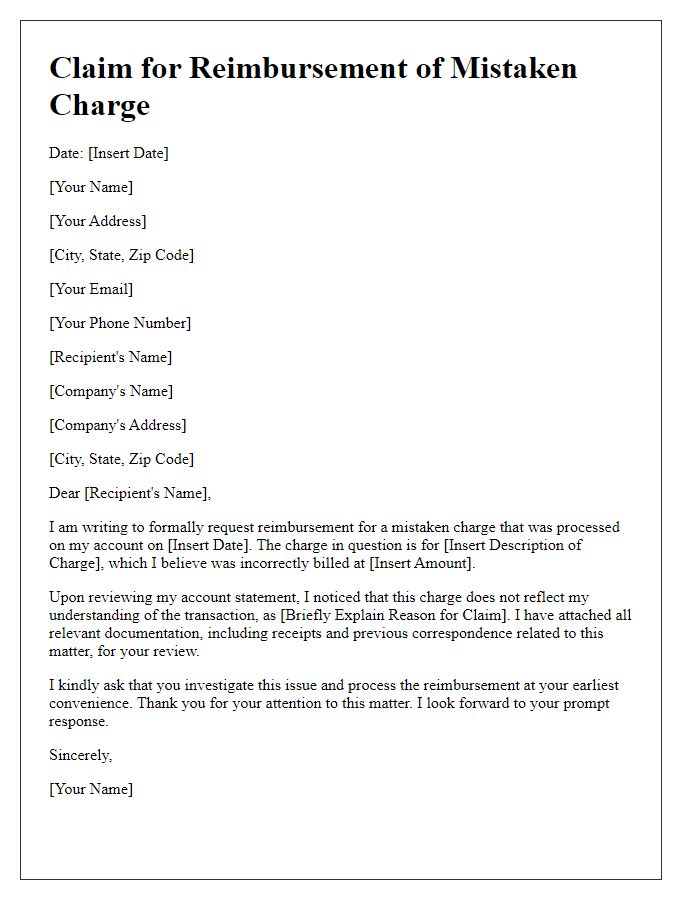

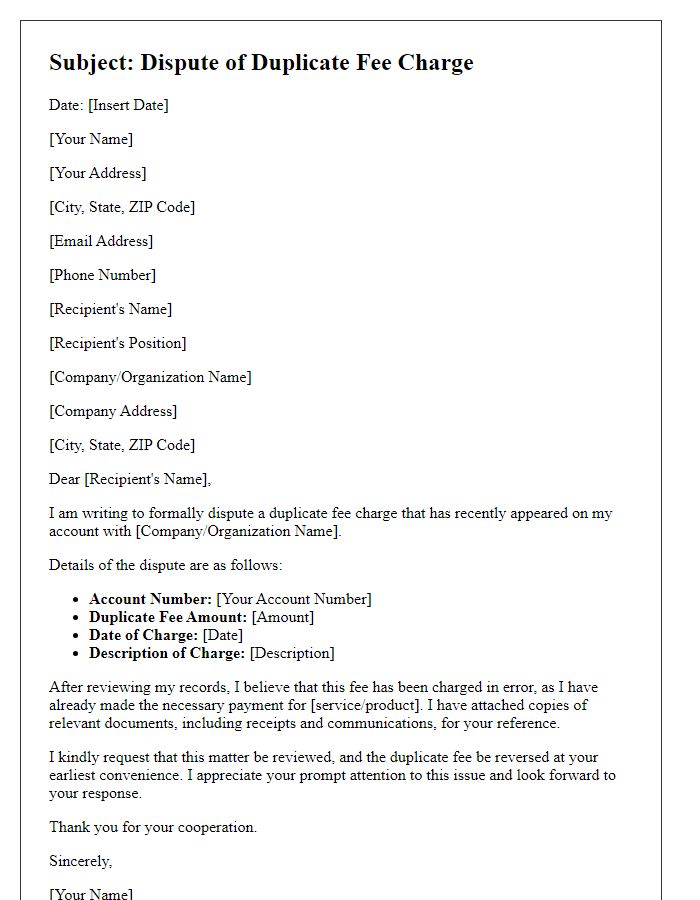

Account information: Include relevant account details and transaction ID.

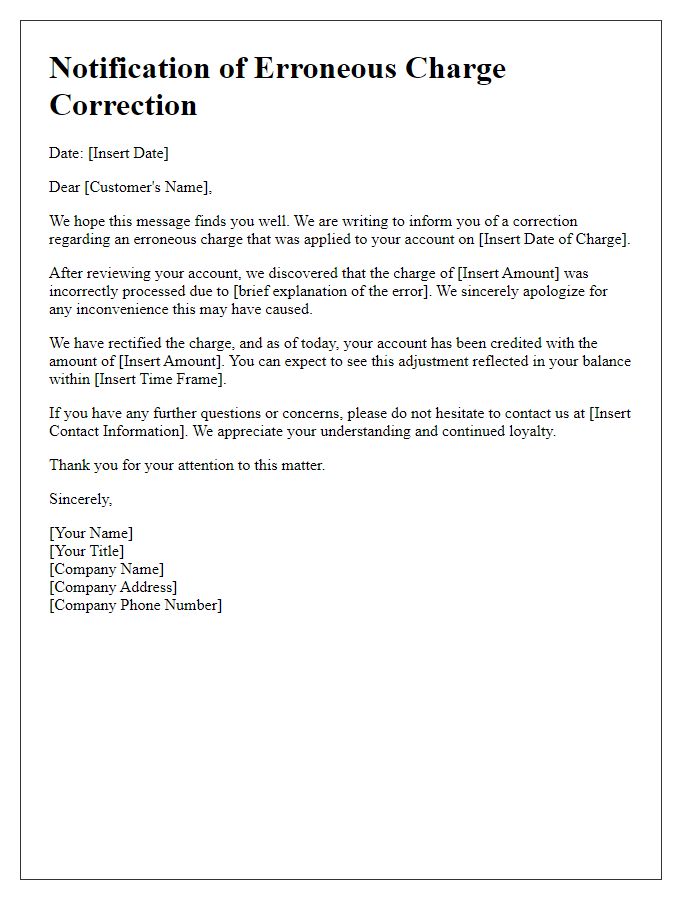

A duplicate charge reversal involves notifying a financial institution about a transaction that was charged more than once. For effective resolution, include account information such as bank account number, credit card number (last four digits for security), and the transaction ID (a unique identifier assigned by the bank or merchant). Document the date of the duplicated transaction, the amount charged, and any relevant merchant names or locations. Provide clear evidence, such as transaction history or receipts, to support the claim of the duplicate charge. This detailed information ensures the financial institution can quickly identify the issue and expedite the reversal process.

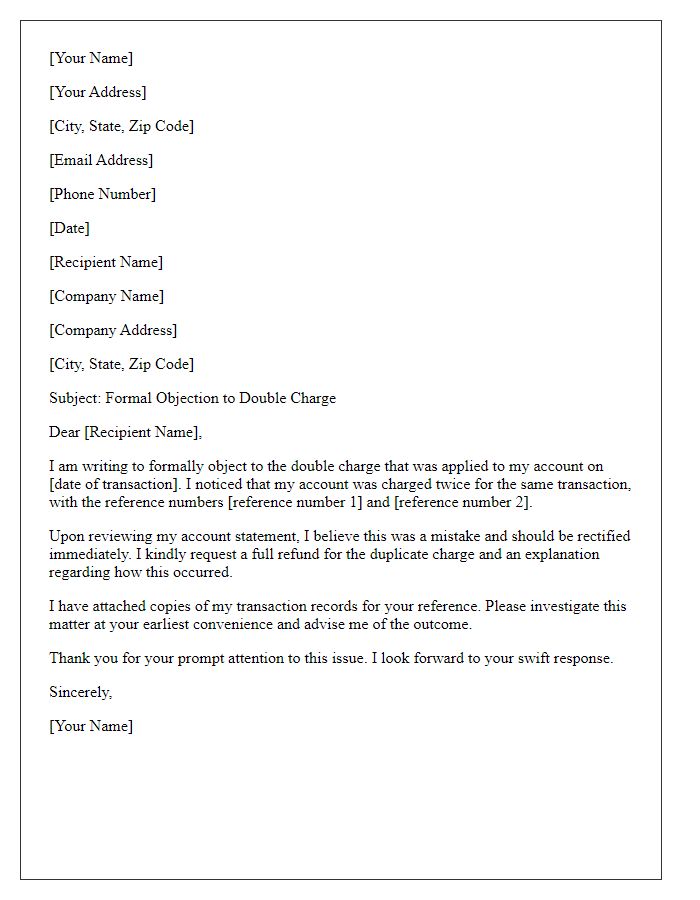

Explanation: Briefly explain the duplicate charge issue.

Customers occasionally encounter duplicate charge issues when processing payments, leading to unauthorized double billing on their credit or debit cards. For instance, an individual may make a purchase of $50 at a retail store, only to find two identical charges reflected in their bank statement. Such duplications arise from various reasons, including software glitches in point-of-sale systems, internet connectivity issues during online transactions, or user error during payment confirmation. Immediate action is needed to reverse these duplicate charges to restore proper account balance and maintain customer trust in financial services. Promptly addressing this problem benefits both customers and businesses, ensuring a seamless shopping experience and accurate financial tracking.

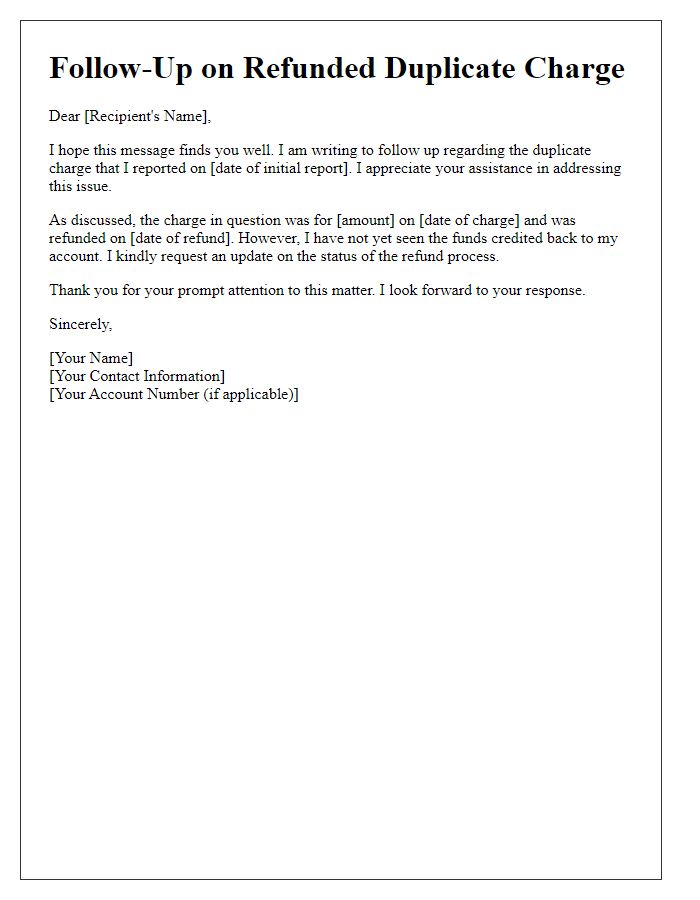

Request: Politely request reversal or refund of the duplicate charge.

A duplicate charge occurs when the same transaction is processed multiple times, resulting in an incorrect increase in the total amount deducted from a customer's account. This can happen due to various reasons, including system errors or user mistakes during online transactions. For instance, on August 10, 2023, a customer may accidentally click the 'submit payment' button twice while paying for a service worth $150. The doubling of this amount can lead to significant financial inconvenience. Requesting a reversal or refund requires providing details of the transaction, such as the date, amount, and transaction ID, to facilitate quick resolution. Clear communication with customer service representatives from the financial institution or service provider is essential to ensure an expeditious return of the excess funds.

Contact information: Provide your contact details for follow-up.

Duplicate charges on credit card statements can cause financial strain on consumers. For instance, if a customer at Apple Store (located in Cupertino, California) is accidentally charged twice for a single purchase of a new iPhone (average cost around $999), the individual may face an unexpected outflow of funds from their bank account. To initiate a reversal, providing personal contact information, such as a valid email address (e.g., name@example.com) and a phone number (e.g., (123) 456-7890), ensures effective communication with customer service representatives. Additionally, having transaction details, including the purchase date (e.g., March 15, 2023) and the order number (e.g., #ABC123456), expedites the investigation process for prompt resolution of the duplicate charge issue.

Comments