Are you navigating the world of payment instruments, and wondering how to effectively disclose information related to them? Understanding the intricacies of payment options can feel overwhelming, but it's essential for both businesses and consumers alike. In this article, we will break down the importance of payment instrument disclosures and provide you with a handy template to simplify the process. So, grab a cup of coffee and join us as we explore the ins and outs of payment transparency!

Clarity of Terms

Clear and concise payment instrument disclosures enable consumers to understand the terms associated with their financial transactions. Crucial details include annual percentage rates (APRs), which vary by lender and can significantly impact repayment amounts. Additionally, the due dates for payments, typically on a monthly basis, must be explicitly stated to avoid late fees. Key fees, such as late payment penalties or transaction fees, should also be outlined to prevent unexpected charges. Moreover, the consequences of defaulting, including potential impacts on credit scores and legal repercussions, need careful clarification. Understanding these terms foster informed consumer decisions regarding credit cards, loans, and other financial products, ultimately promoting financial literacy.

Confidentiality Measures

Payment instrument disclosures commonly address crucial aspects of security and confidentiality. Payment instruments, including credit cards and electronic wallets, often require strict confidentiality measures to ensure sensitive information, such as card numbers and expiration dates, remains protected. Encryption technologies such as AES (Advanced Encryption Standard) play a vital role in securing data during transmission. Organizations, such as banks and financial institutions, implement policies to limit access to authorized personnel only, reducing the risk of data breaches. Compliance with regulations like GDPR (General Data Protection Regulation) mandates that individuals' personal information is handled with utmost care and transparency. Furthermore, regular training for staff on the importance of safeguarding payment information contributes to a culture of security awareness within the organization.

Regulatory Compliance

Payment instrument disclosures ensure regulatory compliance across various financial transactions. These disclosures include important details such as fees, interest rates, and terms of use associated with payment instruments like credit cards, debit cards, and digital wallets. For instance, the Truth in Lending Act (TILA) mandates clear presentation of annual percentage rates (APRs), which is crucial for consumer awareness. The Dodd-Frank Wall Street Reform and Consumer Protection Act also influences these disclosures, ensuring transparency regarding fees, conditions, and consumer rights. Accurate disclosures are vital for organizations operating in jurisdictions like the United States, where regulatory bodies like the Consumer Financial Protection Bureau (CFPB) enforce guidelines to protect consumers from misleading practices. Compliance with these guidelines establishes trust and fosters a fair marketplace.

Payment Method Details

The Payment Method Details section provides crucial insights into methods of monetary transactions that facilitate exchanges between parties. Accepted payment methods include credit cards (Visa, MasterCard, American Express) which offer consumer protection and rewards points. Mobile payment options such as Apple Pay and Google Wallet allow for contactless transactions, increasing convenience and security. Bank transfers can include wire transfers and ACH payments, ensuring direct, reliable transactions, particularly for larger amounts. Additionally, e-wallets like PayPal and Venmo provide fast, streamlined options for online purchases or peer-to-peer payments. Understanding these payment methods ensures informed decisions in any financial transaction.

Contact Information

Payment instrument disclosure ensures transparency in financial transactions involving tools such as credit cards, debit cards, or digital wallets. Clear contact information for customer support is crucial for resolving issues or inquiries related to payments. Typically, this includes a dedicated phone number, which might be available during business hours, and an email address for written correspondence, ensuring accessibility. Additionally, a physical address for the company can provide a sense of security and legitimacy regarding the payment services offered. Ensuring this information is readily available enhances customer confidence and satisfaction.

Letter Template For Payment Instrument Disclosure Samples

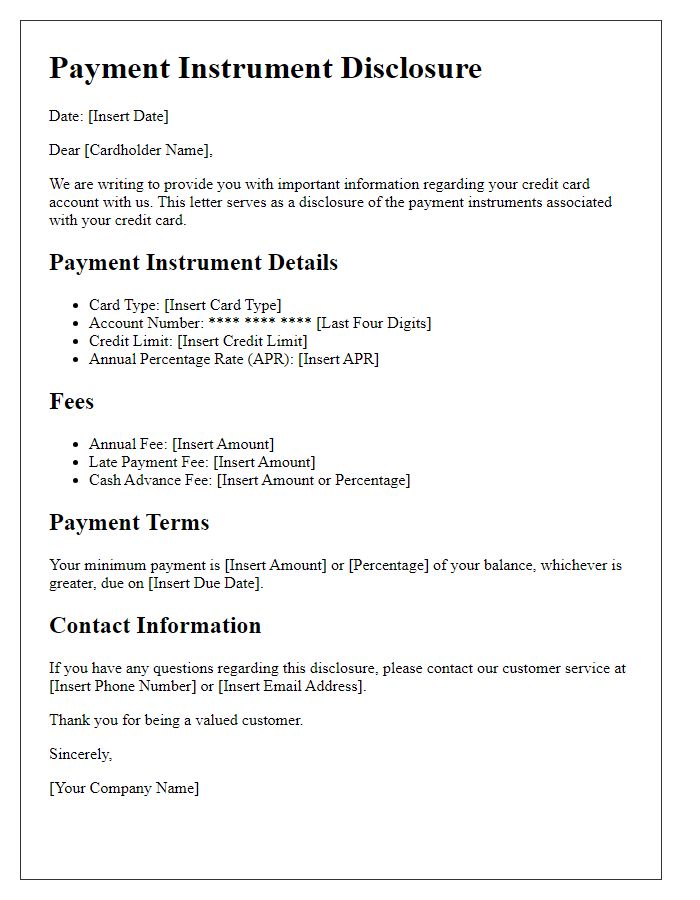

Letter template of Payment Instrument Disclosure for Credit Card Holders

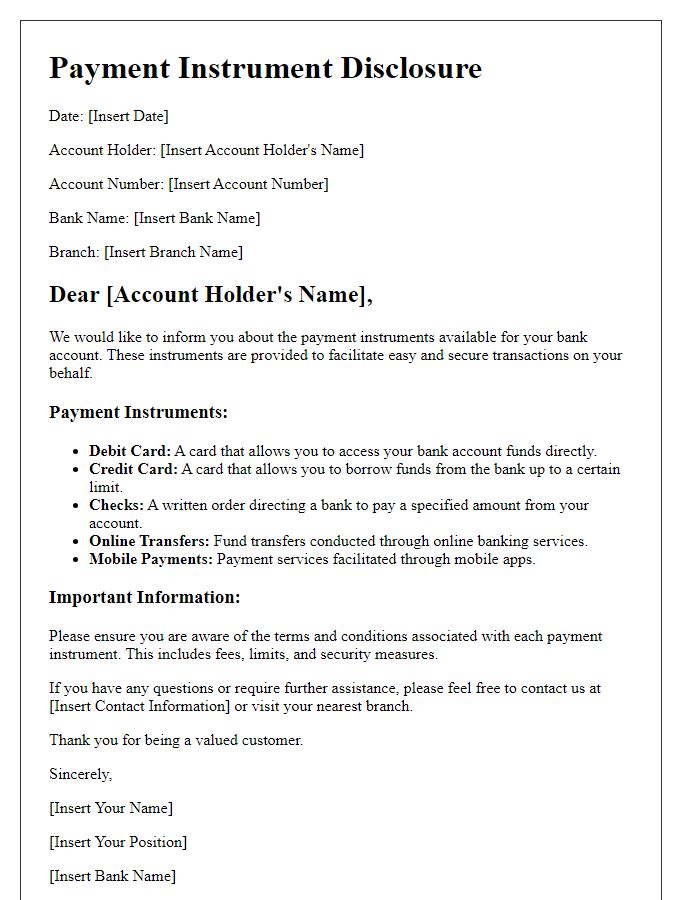

Letter template of Payment Instrument Disclosure for Bank Account Holders

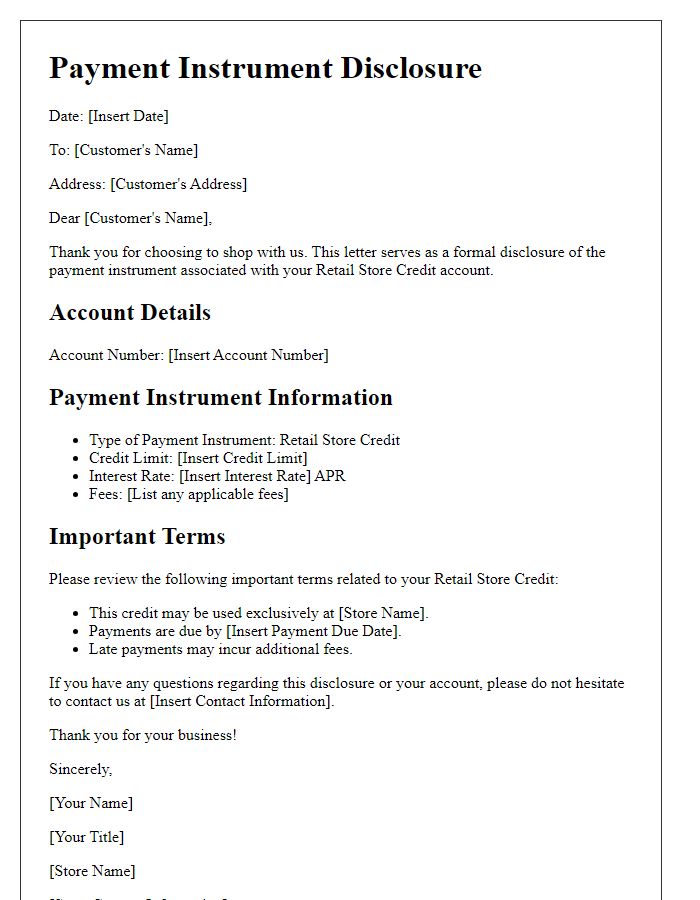

Letter template of Payment Instrument Disclosure for Retail Store Credit

Letter template of Payment Instrument Disclosure for Online Payment Services

Letter template of Payment Instrument Disclosure for Subscription Services

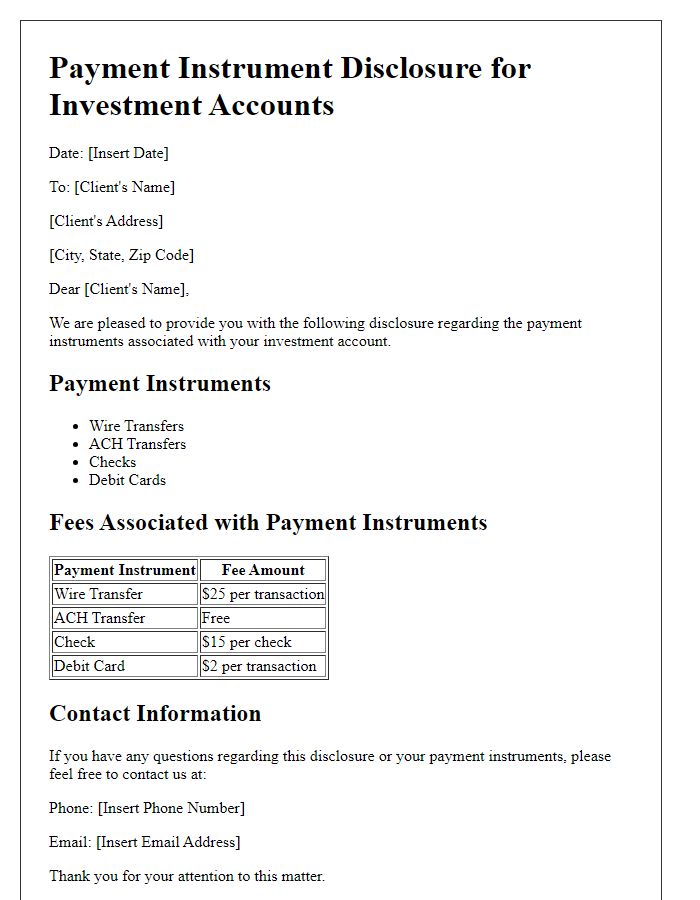

Letter template of Payment Instrument Disclosure for Investment Accounts

Comments