Hey there! If you're navigating the tricky waters of a payment agreement default, you've come to the right place. Understanding how to approach this situation can save you a lot of stress and maintain your professional relationships. Stick around as we explore some helpful tips and templates that can guide you through the process!

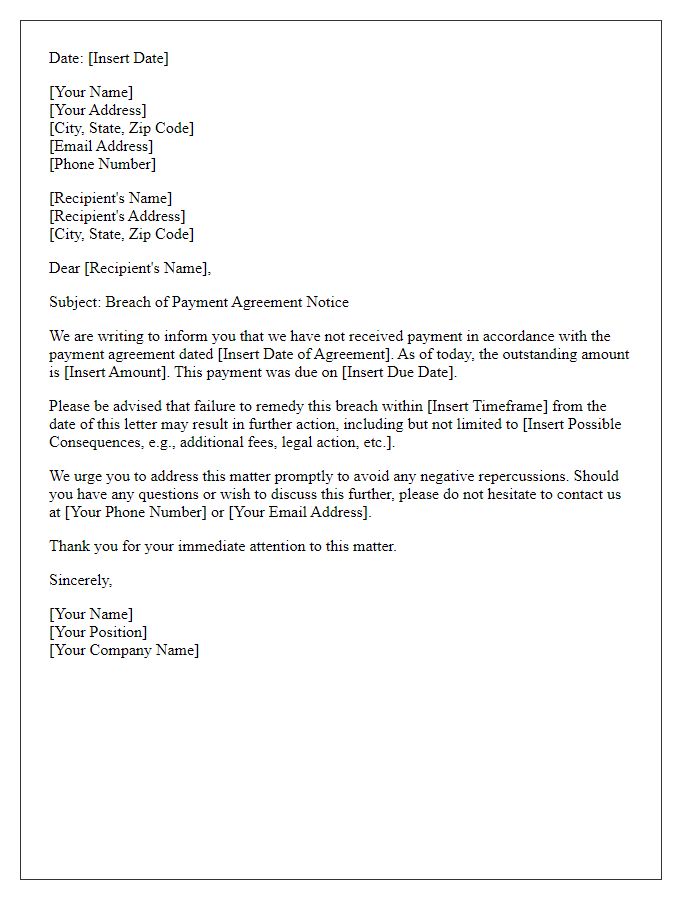

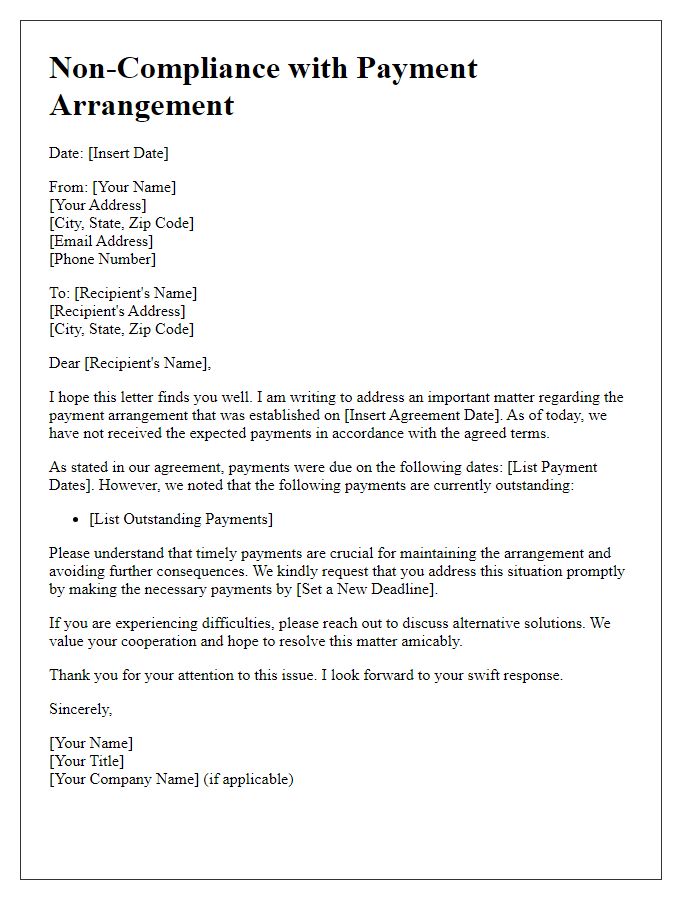

Clear identification of parties involved.

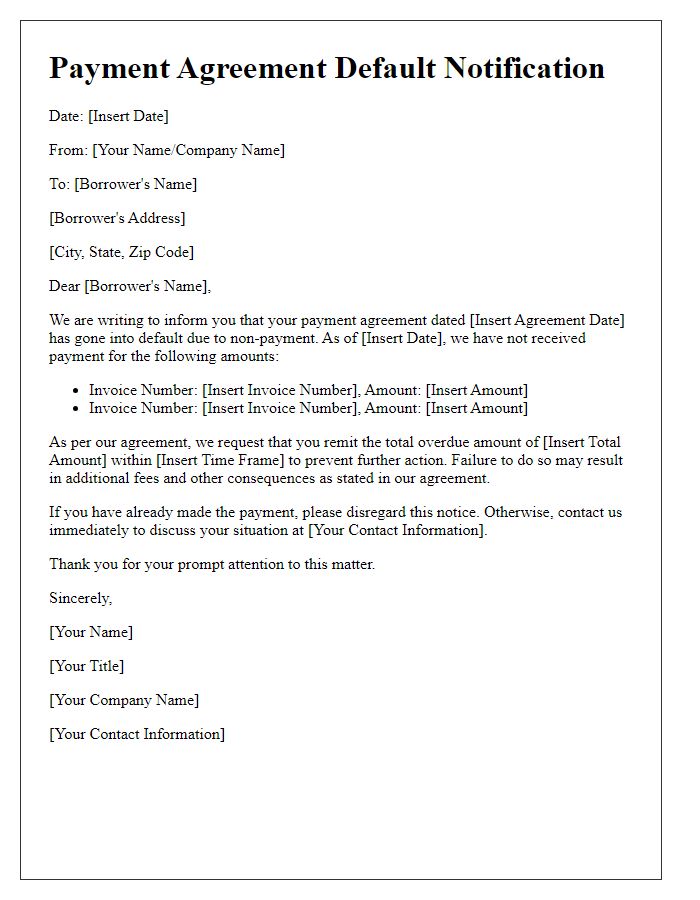

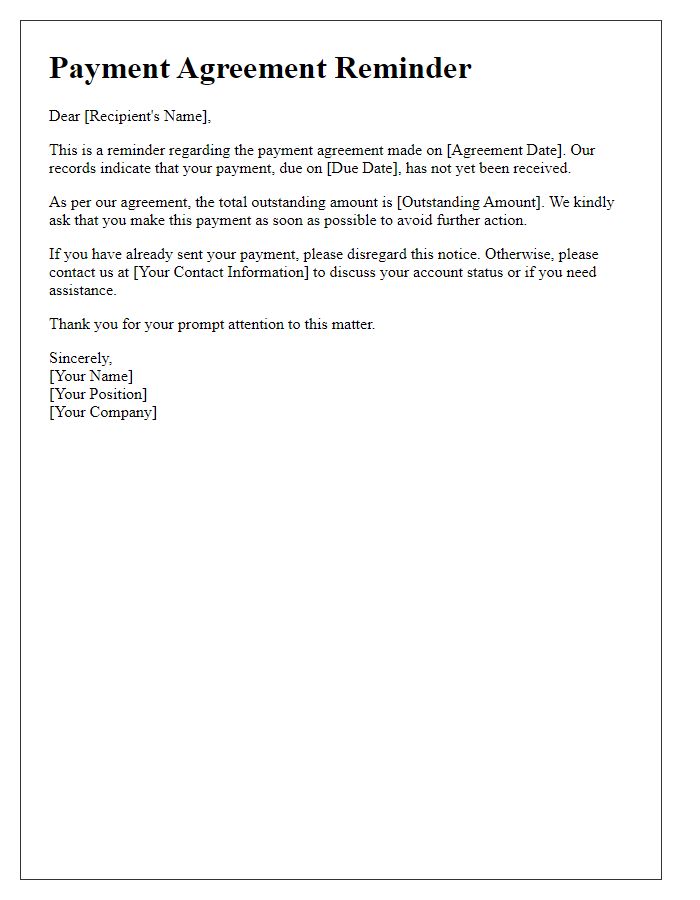

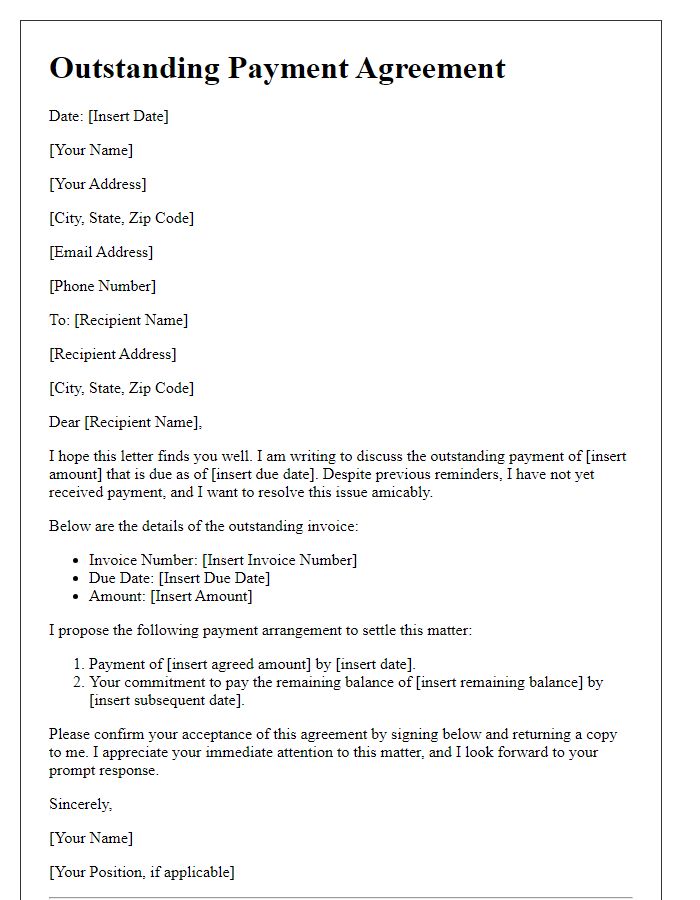

A payment agreement default typically involves two main parties: the debtor, the individual or entity responsible for making payments, and the creditor, the individual or entity entitled to receive those payments. In formal agreements, the debtor's identifying information includes names, addresses, and contact numbers, ensuring clarity in identification. The creditor's details will similarly consist of name, address, and contact information, establishing a clear channel for communication. Precise identification of both parties lays the foundation for the understanding of their obligations, helping to prevent disputes in future transactions related to the payment agreement.

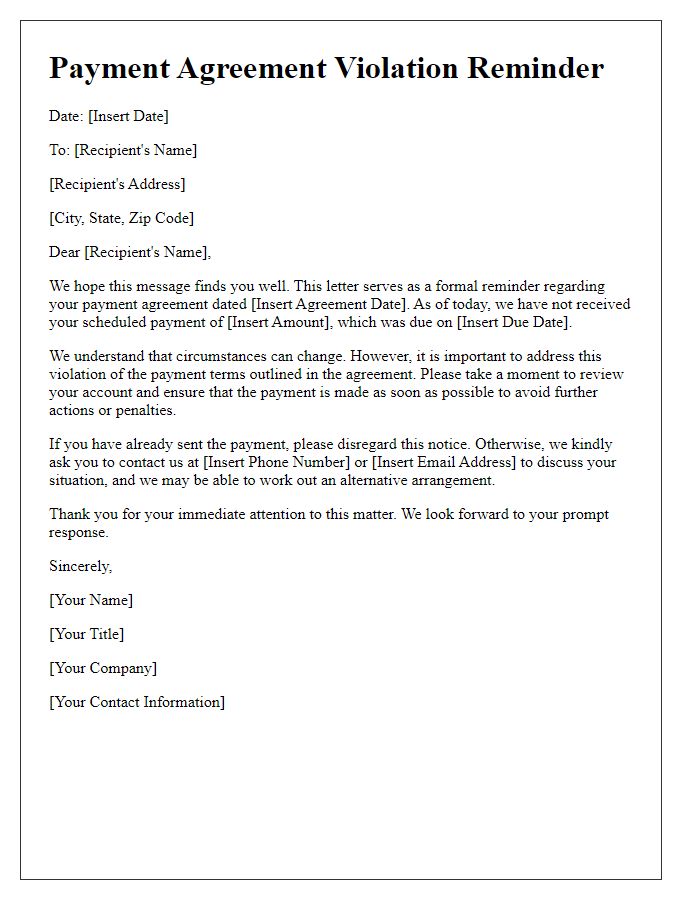

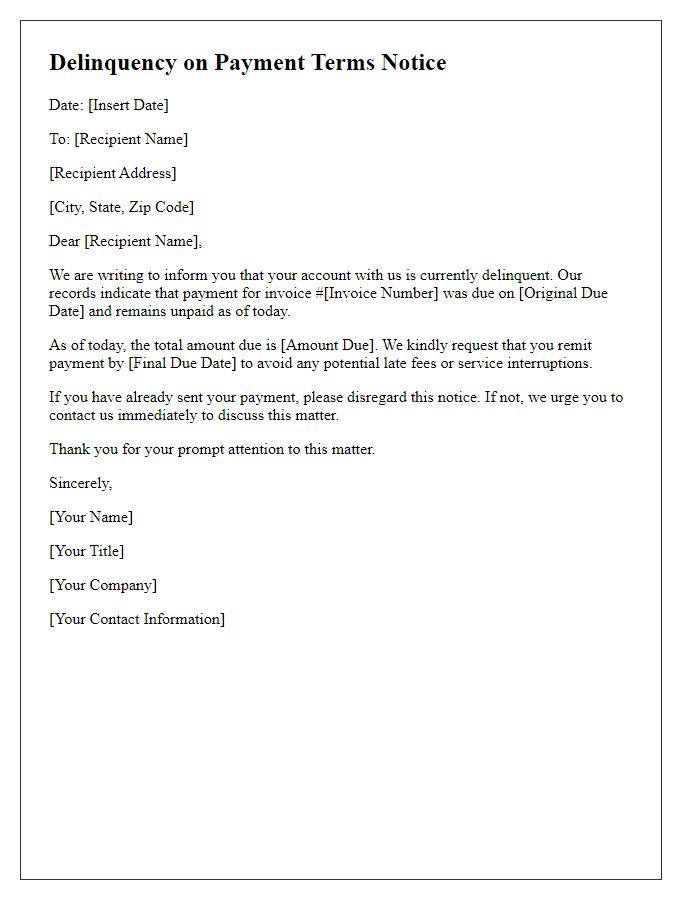

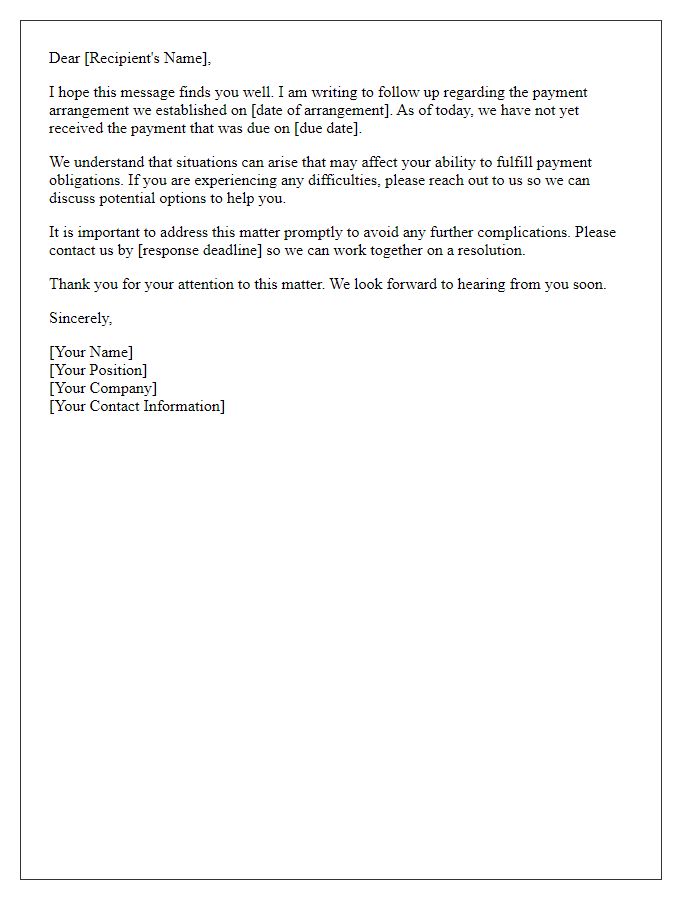

Detailed description of the payment terms.

A payment agreement outlines specific payment terms, clarifying obligations of both parties involved in a financial transaction. This agreement often includes the total amount owed (for instance, $1,000) and details the payment schedule (monthly payments of $200). The due dates for these payments must be specified, such as the first payment due on the 15th of the month. Late fees may be outlined, often a percentage (e.g., 5%) of the overdue amount per month, incentivizing timely payments. The agreement may also stipulate the consequences of default, which can include legal actions or additional interest charges. Both parties must sign, affirming their understanding and acceptance of these terms.

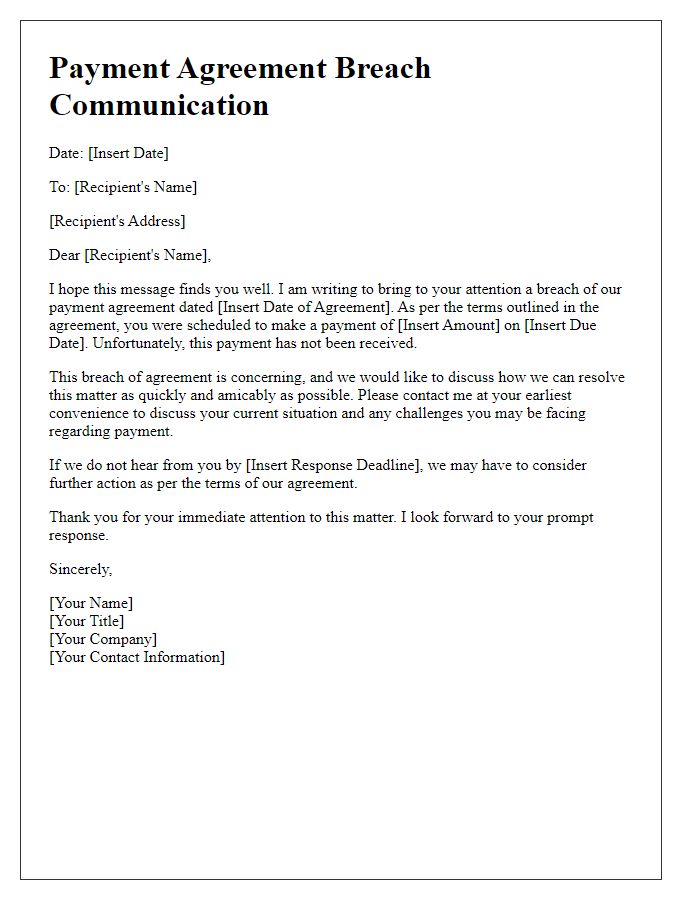

Explanation of the default situation.

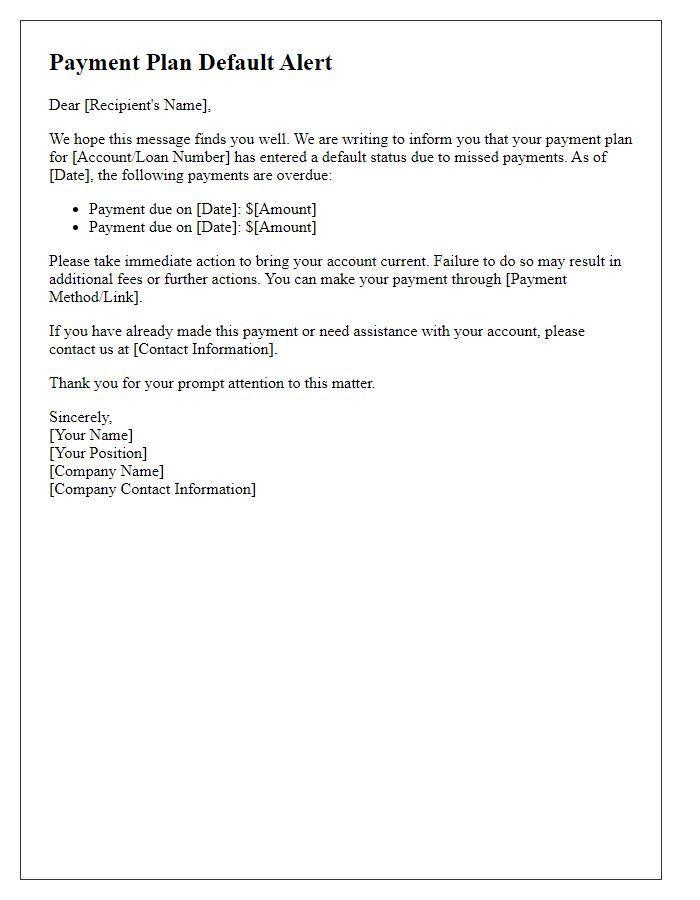

A payment agreement default occurs when an individual or entity fails to adhere to the terms outlined in a financial contract. This can happen when scheduled payments, such as monthly installments, are not made on time, often resulting in late fees or penalties. In many cases, the default arises due to unforeseen circumstances, including job loss, medical emergencies, or economic downturns. When a default situation becomes apparent, it may lead to further actions such as collections processes or legal proceedings. Entities often resort to communication with the debtor to understand their situation and negotiate potential pathways to rectify the default, including revised payment plans or deferments. Such discussions usually focus on restoring compliance with the agreement and avoiding escalated legal repercussions.

Proposed resolution or adjusted payment plan.

Proposed resolutions for payment agreement defaults include a structured adjusted payment plan that accommodates the debtor's current financial situation. This plan typically extends the repayment period, often by six months to a year, depending on the total debt amount and the debtor's ability to pay. Each month, the client might be required to make smaller, manageable payments, potentially reducing the burden from original due amounts. Moreover, incorporating features such as deferred interest charges or temporarily suspending payment obligations for 30 to 90 days could provide additional relief. It is essential for all parties to document these adjustments in a formal agreement, ensuring clarity on revised terms, scheduled dates for payments, and consequences for future defaults.

Consequences of continued default.

Continued default on payment agreements can lead to significant financial and legal repercussions. For instance, lenders may impose late fees, which can accumulate and increase the total amount owed. Additionally, defaulting can result in a negative impact on credit scores, making it more challenging to secure future loans or credit. Legal actions, such as collections or lawsuits, may also be initiated by creditors to recover outstanding debts. Furthermore, assets may be at risk of seizure or repossession, particularly in secured loan agreements where collateral (like property or vehicles) is involved. Maintaining timely payments is crucial to avoid these serious consequences and to ensure financial stability.

Comments