Are you feeling overwhelmed by the threat of foreclosure? You're not alone, and there are ways to navigate this challenging situation. In this article, we'll explore practical strategies and resources that can help you prevent foreclosure and secure your home. So, let's dive in and discover some valuable solutions together!

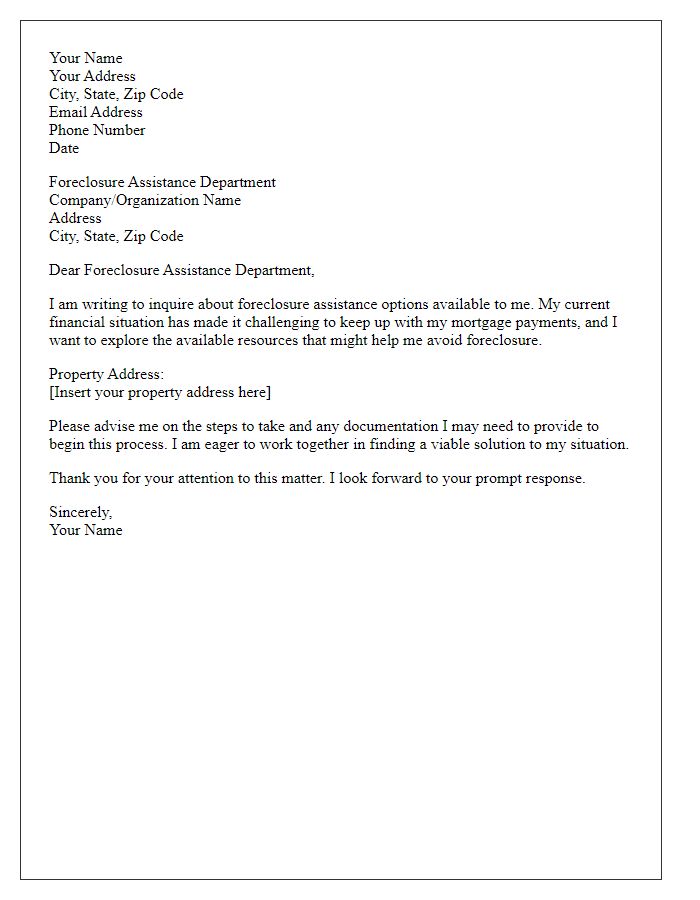

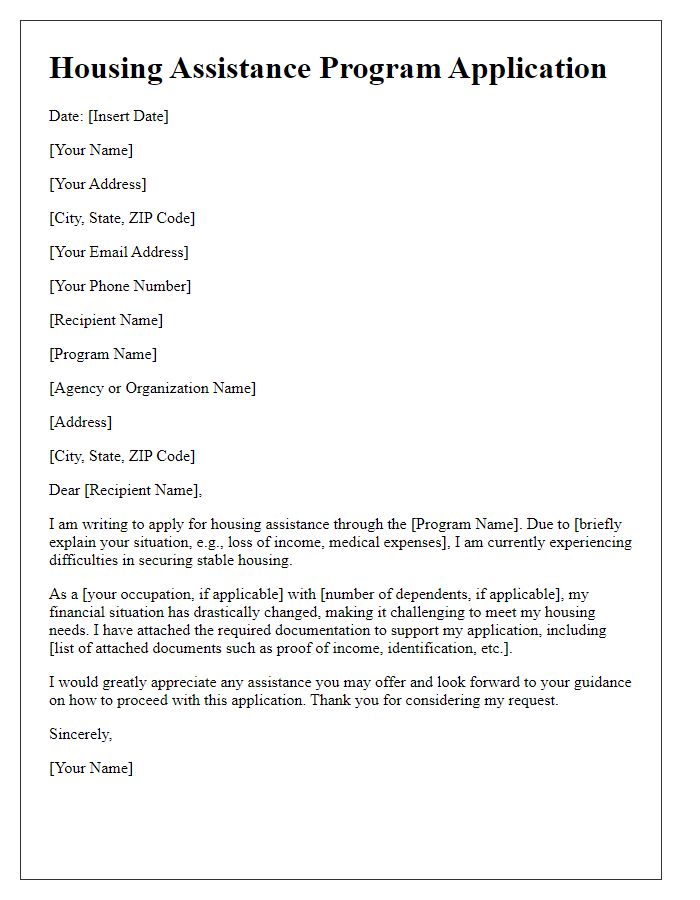

Introduction and Personal Information

Foreclosure prevention discussions are critical for homeowners facing financial difficulties. Personal information such as a homeowner's name, property address including city and ZIP code, and loan account number is vital in identifying the specific case. The introduction should emphasize the urgency of the situation, highlighting the potential loss of the home, and articulate the homeowner's desire for assistance in navigating options like loan modification or repayment plans. Organizations like the Homeownership Preservation Foundation and state housing agencies offer resources for foreclosure prevention, providing valuable support for individuals seeking to retain their homes.

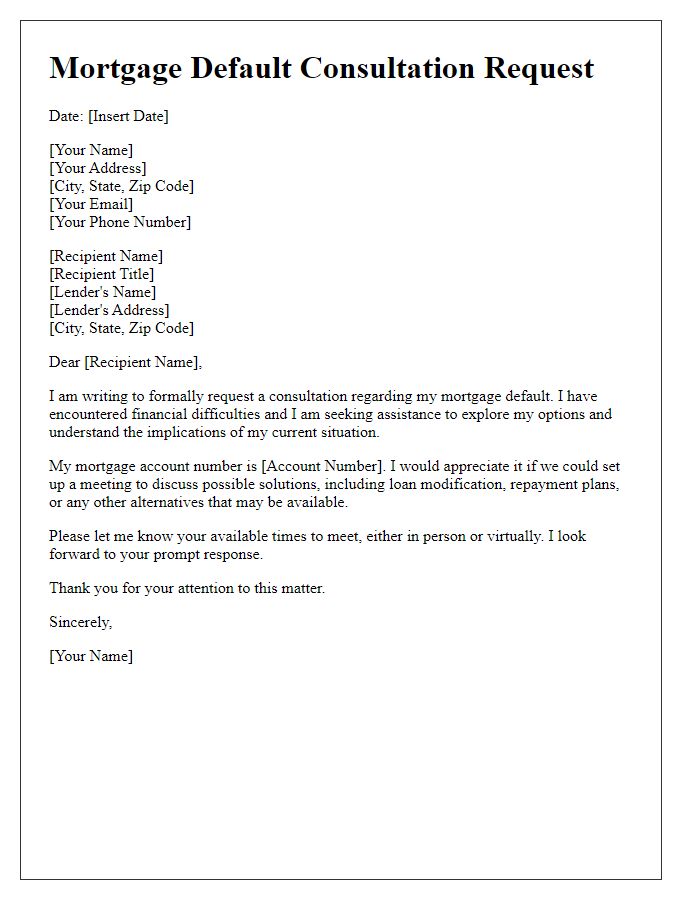

Financial Hardship Explanation

Homeowners facing foreclosure often experience significant financial hardship, impacting their ability to keep up with mortgage payments. Fluctuating job markets, such as the decline of manufacturing jobs in the Midwest or layoffs in tech industries, can lead to sudden income loss. Medical emergencies, resulting in unexpected hospital bills, can also deplete savings, forcing homeowners into difficult financial situations. Expenses associated with child care or education, such as tuition fees for local public schools, can further strain budgets. Mitigating these challenges requires proactive communication with lenders, exploring options like loan modification programs or forbearance agreements, which can temporarily reduce or suspend payments, allowing families to regain financial stability.

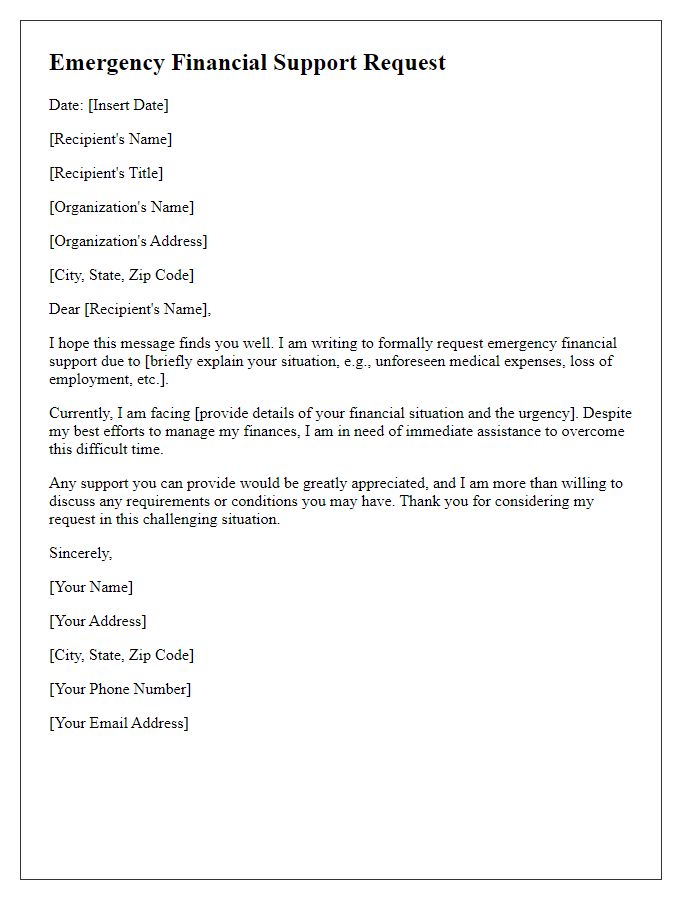

Current Financial Situation and Proposed Plan

Homeowners facing foreclosure may experience significant stress due to financial hardships such as job loss, medical expenses, or divorce. A thorough assessment of their current financial situation can reveal crucial details like monthly income, expenses, and outstanding debts. Effective foreclosure prevention strategies might include options like loan modification (adjusting loan terms), short sale arrangements (selling the property for less than owed), or forbearance agreements (temporary suspension of mortgage payments) to provide relief. Engaging with housing counselors or legal advisors can facilitate discussions with mortgage lenders, ensuring that all available options are explored to retain homeownership and stabilize financial standing.

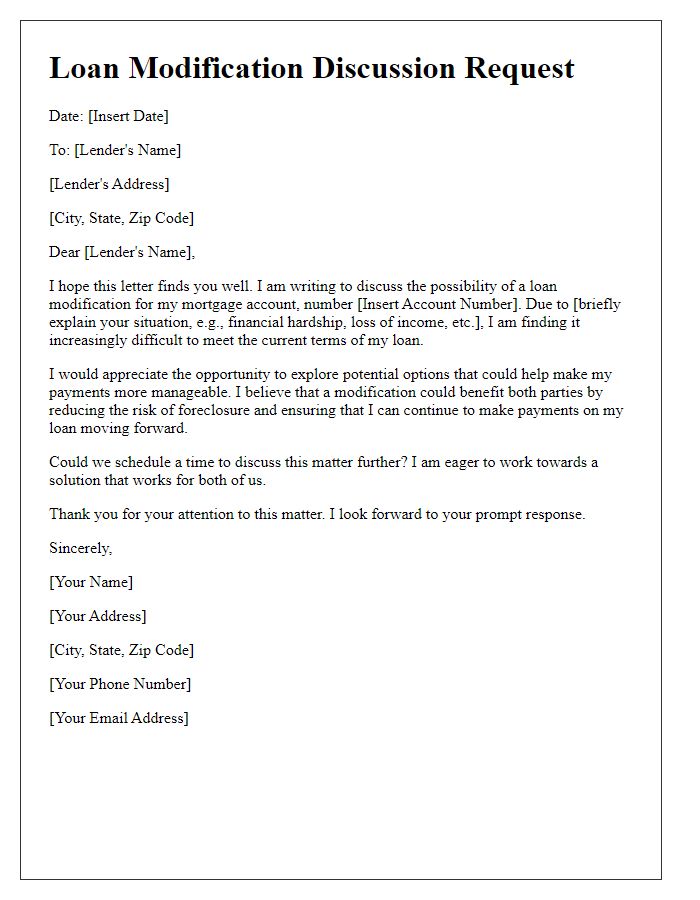

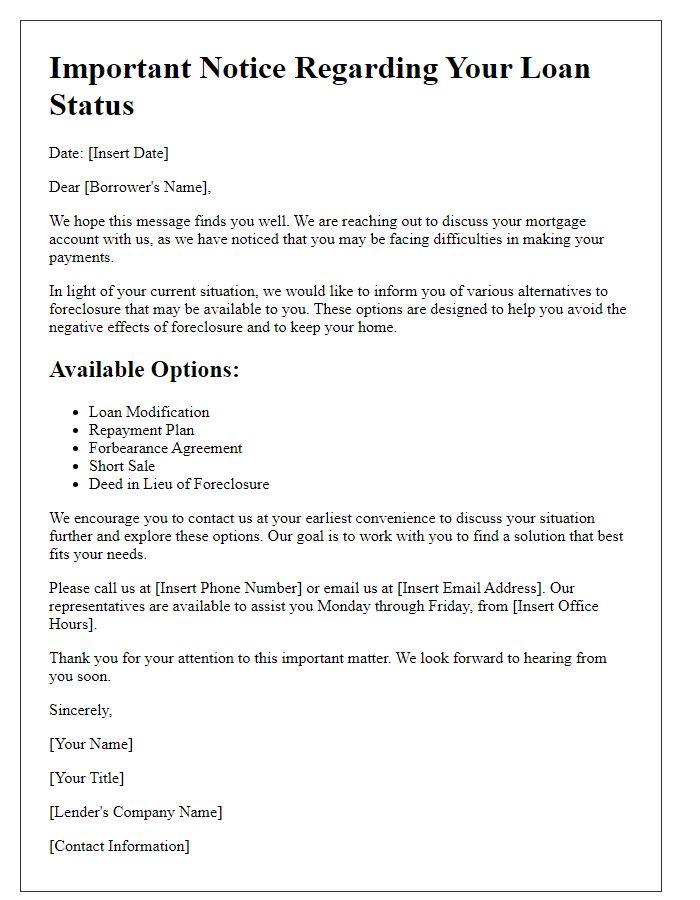

Request for Assistance or Options

Homeowners facing foreclosure often experience significant stress and uncertainty regarding their financial future. A foreclosure typically occurs when mortgage payments are delinquent for an extended period, usually around three to six months, leading banks or lenders, such as Wells Fargo or Bank of America, to initiate legal proceedings. Seeking assistance from local housing counseling agencies, like the National Foundation for Credit Counseling, can provide access to helpful resources, including potential loan modifications or refinancing options tailored to individual financial situations. Additionally, programs like the Home Affordable Modification Program (HAMP) can offer relief by reducing monthly payments or altering loan terms, thus helping homeowners avoid the detrimental effects of foreclosure on their credit scores, which can drop by 100 points or more. Understanding these available options and proactively engaging with lenders can be crucial in preventing foreclosure and securing a stable financial future.

Contact Information and Call to Action

During the foreclosure prevention discussion, providing clear contact information is essential for effective communication. Key points include the name of the organization, such as the Homeowner's Assistance Program, located in California, a dedicated hotline number displaying accessibility, and the website with detailed resources on assistance options. Encourage homeowners facing financial difficulties, such as job loss or medical expenses, to reach out for professional guidance and support. Highlight scheduled workshops in community centers throughout the state for deeper engagement, emphasizing the importance of taking proactive steps to avoid foreclosure through informed decision-making and timely action.

Comments