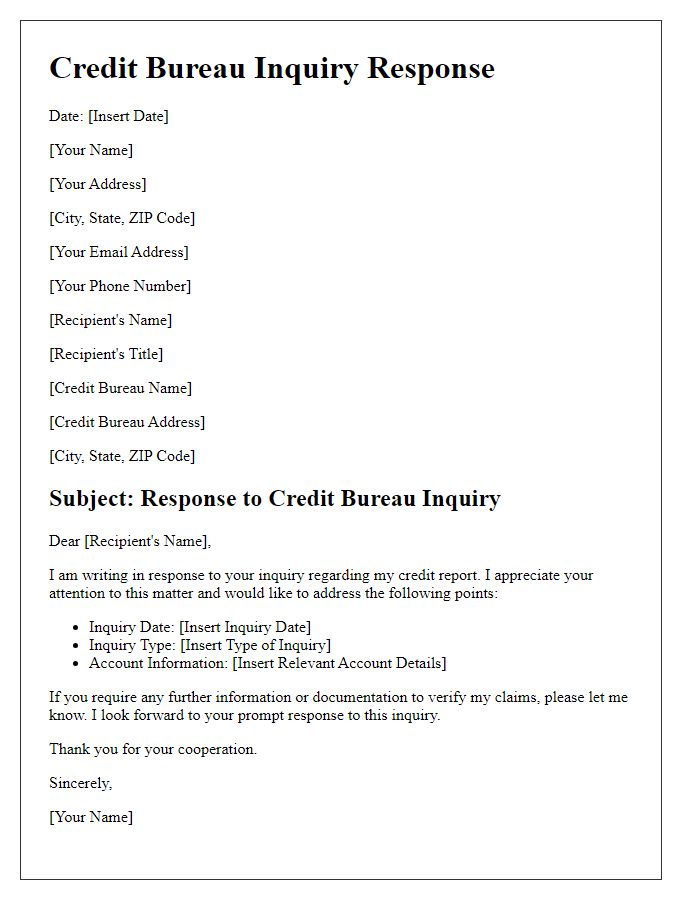

Are you looking to understand how to effectively notify a credit bureau about discrepancies on your credit report? Crafting a well-structured letter is essential to ensure your concerns are addressed promptly. In this article, we'll walk you through a straightforward template that highlights key elements you need to include for a successful notification. So, stick around to discover the best practices for communicating with credit bureaus!

Accurate Personal Information

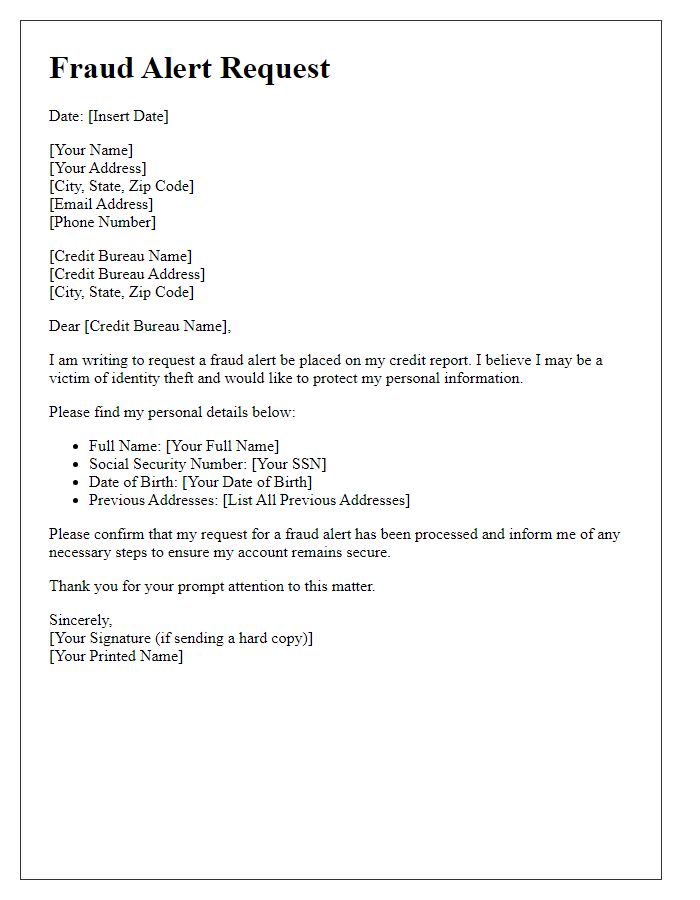

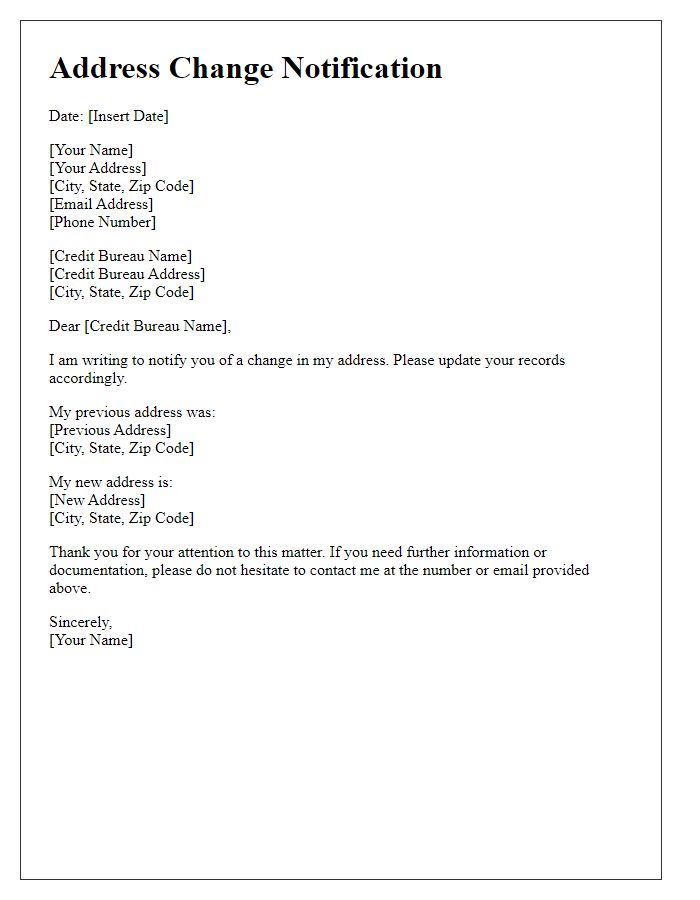

Accurate personal information is crucial for maintaining a healthy credit report with major credit bureaus such as Equifax, TransUnion, and Experian. Errors in name spelling, address history, or Social Security number can lead to a diminished credit score and potential loan rejections. Inaccurate data may arise from identity theft instances or clerical errors during credit reporting. Regularly reviewing credit reports at annualcreditreport.com is recommended for verifying data accuracy. Disputed items can be reported via certified mail, ensuring timely updates to personal information. Maintaining correct information aids in securing favorable interest rates and credit opportunities.

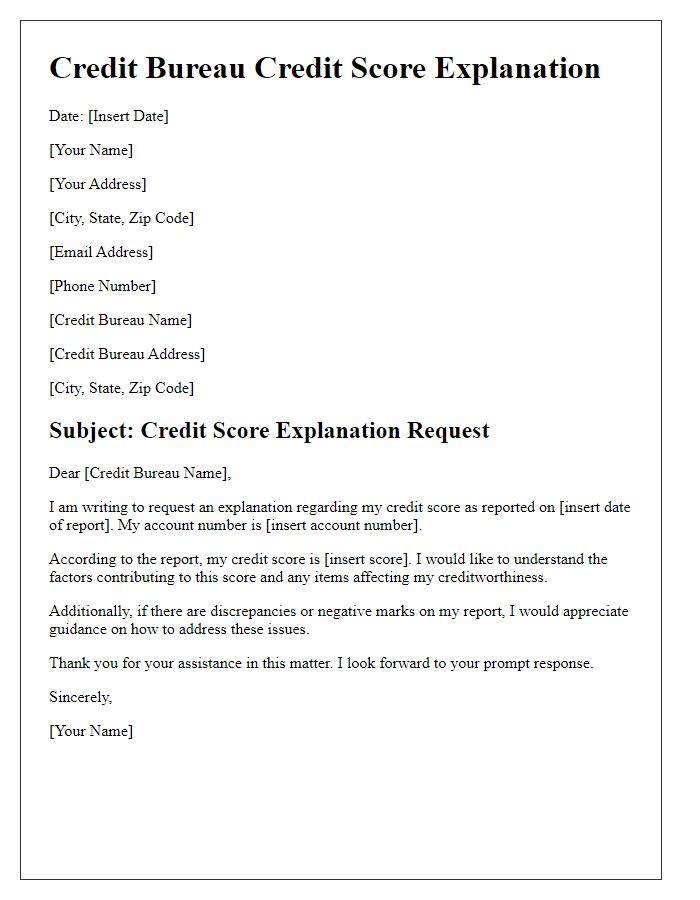

Clear Subject Line

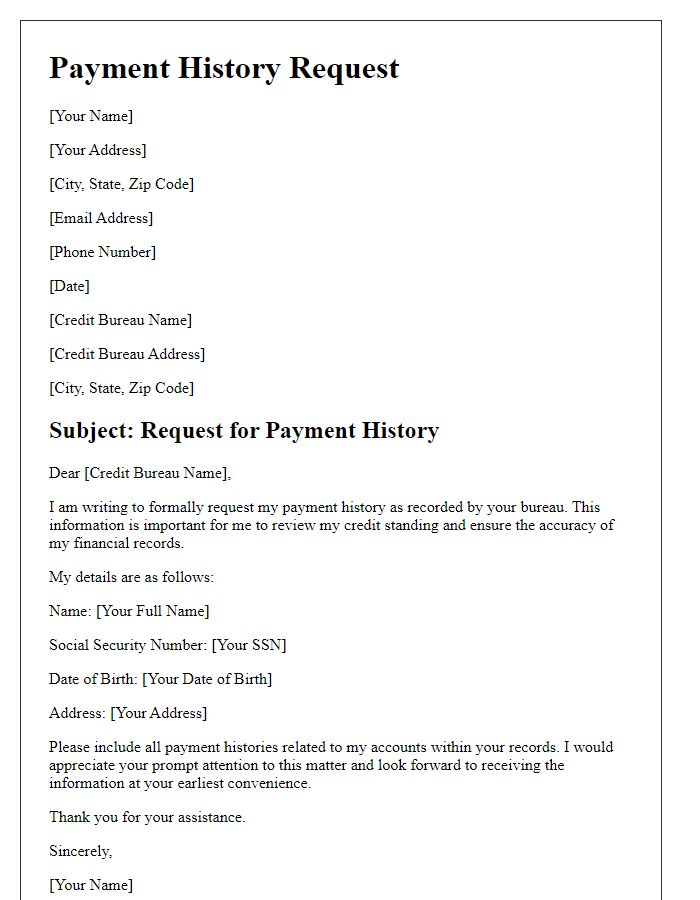

Payment history affects credit scores significantly, especially in the context of FICO scores, which range from 300 to 850. Late payments beyond 30 days can remain on credit reports for up to seven years, impacting loan approval rates and interest rates. Financial institutions like Experian, TransUnion, and Equifax provide credit reports that detail payment behavior. Understanding how missed payments influence creditworthiness is crucial for maintaining a healthy credit profile and can directly affect mortgage applications for properties valued over $200,000. Monitoring credit reports regularly can help identify inaccuracies and mitigate potential risks associated with poor payment history.

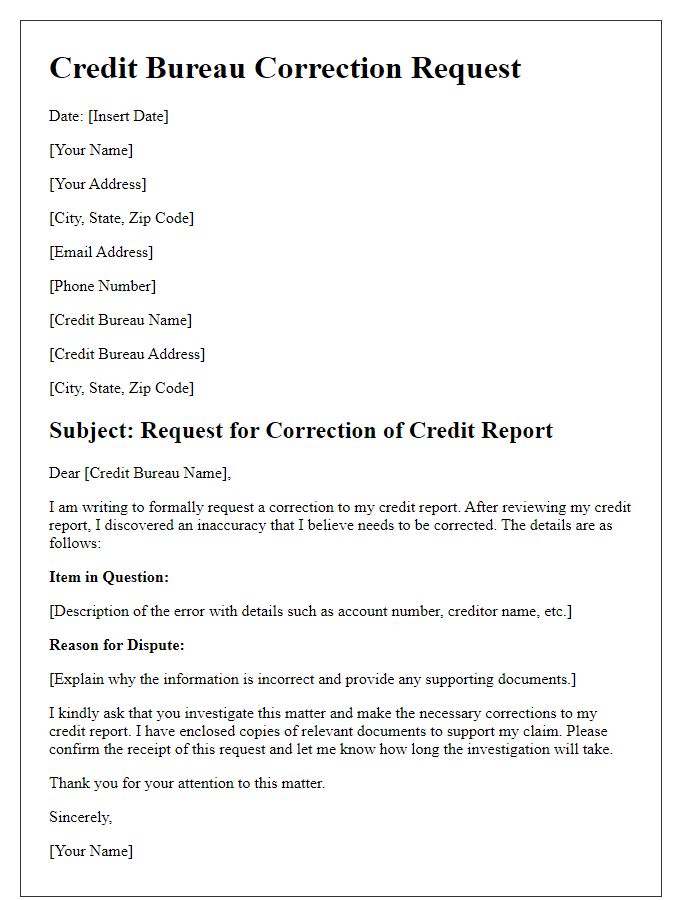

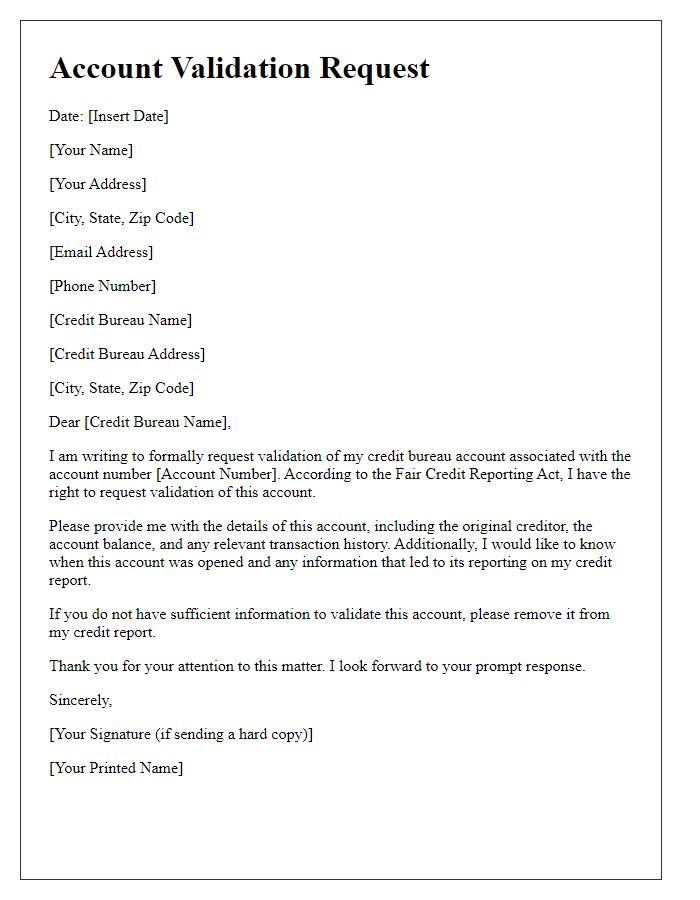

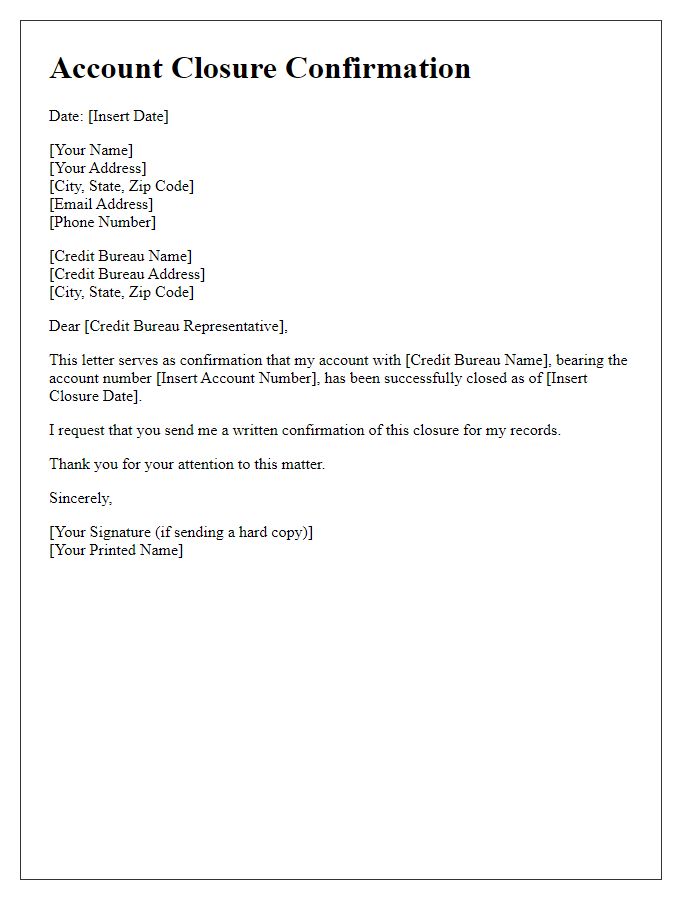

Specific Account Details

Credit bureau notifications require precise account details for clarity. An account number, typically a 10-15 digit identifier, is essential to link the correspondence to the specific financial account. The creditor's name, such as a major bank or credit union, helps identify the institution involved. Date of account opening provides context regarding the account's history, indicating the duration of the credit relationship. Current balance information shows the financial status, crucial for credit reporting. Payment history, documented as a series of on-time or late payments over a specified period, reflects the borrower's reliability. Lastly, reporting dates indicate when the information was last updated, ensuring the accuracy of the current credit report status.

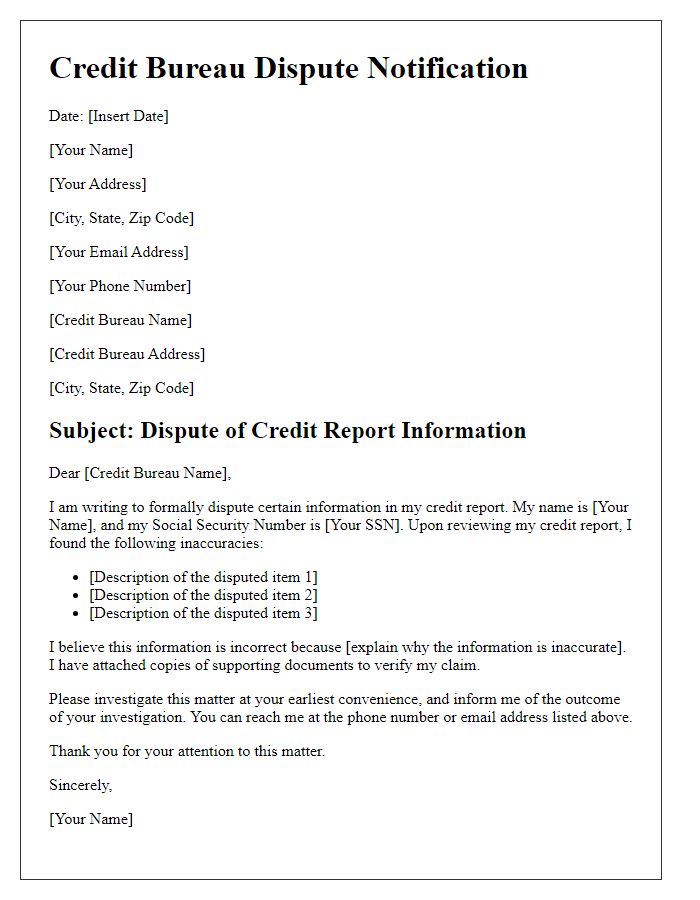

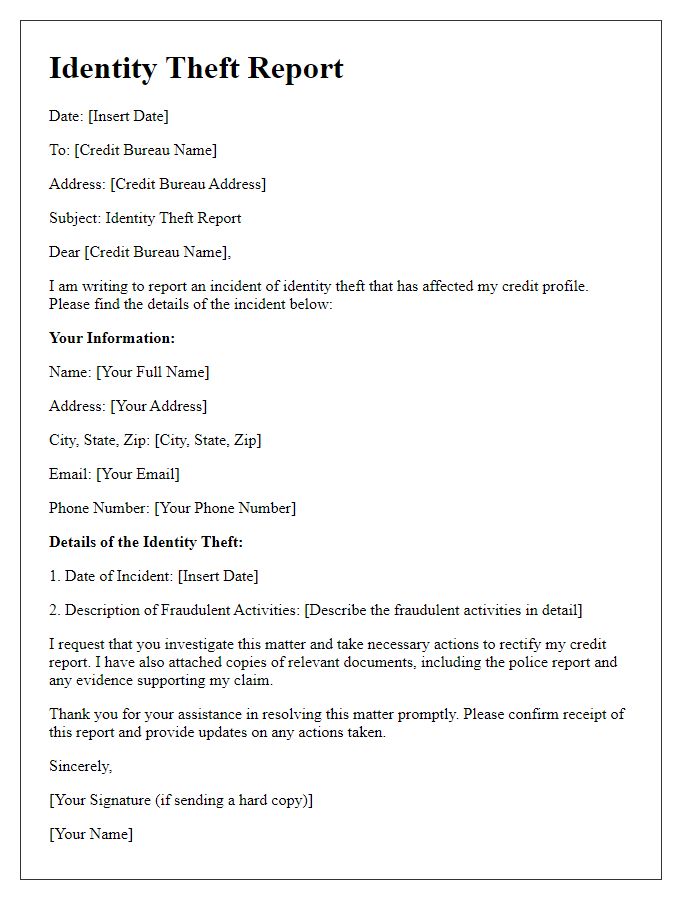

Detailed Dispute Explanation

Credit report inaccuracies can severely impact individual financial status, particularly credit scores. When disputing such inaccuracies, detailed documentation is essential for a thorough investigation. Credit bureaus, such as Experian, Equifax, and TransUnion, require specific information, including the nature of the error, relevant account numbers, and the date of the discrepancy. For instance, a late payment recorded on a mortgage account from January 2023 may need supporting evidence like bank statements or payment confirmation receipts. It is important to include a clear request for correction, emphasizing the urgency of resolving the issue to avoid potential impacts on loan applications or interest rates. Timely communication with the credit bureaus (typically within 30 days of discovering the error) initiates the formal dispute process, enabling consumers to protect their creditworthiness and overall financial health.

Supporting Documentation

Supporting documentation for credit bureau notifications often includes pertinent details critical to ensuring accurate reporting and updates to credit history. Key elements are recent credit reports from major agencies, such as Experian, TransUnion, and Equifax, which typically showcase an individual's credit score, outstanding debts, and payment history. Additional documents may consist of identification proofs, like a government-issued photo ID (driver's license or passport), and recent utility bills to verify the current address. For disputed items, relevant statements or correspondence with creditors can substantiate claims, including payment receipts and settlement letters. Accurate and organized presentation of these documents can expedite the resolution process, improving overall credit report accuracy.

Comments