Are you feeling overwhelmed by the process of disputing inaccuracies on your credit report? You're not alone; many people find the task daunting, yet it's essential for maintaining a healthy financial profile. In this article, we'll break down a straightforward template you can use to effectively communicate your concerns to the credit bureau. Ready to take control of your credit report? Let's dive in!

Identification Information

The process of submitting a credit report dispute involves presenting accurate identification information to ensure proper handling. Essential details include the full name, such as John Doe, along with the current address, which should specify the city and state, for example, Springfield, IL 62701. Additionally, including the date of birth like January 1, 1980, and the Social Security Number (SSN) formatted correctly, e.g., 123-45-6789, is crucial for verifying identity. Supporting documents, such as a government-issued ID (e.g., driver's license) with identification number and expiration date, must also be attached to confirm authenticity and assist in the resolution of discrepancies found in credit reports from major bureaus like Experian, Equifax, and TransUnion.

Dispute Description

A credit report dispute arises when inaccuracies or errors appear in a consumer's credit history, which can negatively impact scores. Common issues involve incorrect personal information, outdated account statuses, or fraudulent accounts that do not belong to the individual. The Fair Credit Reporting Act (FCRA) allows consumers to challenge these discrepancies through a formal dispute process with credit bureaus like Experian, TransUnion, and Equifax. It is essential for consumers to gather supporting documentation, such as bank statements, correspondence with creditors, or identification verification, to substantiate their claims effectively. Timely resolution of disputes, often within 30 days, is crucial as it can influence loan approvals, interest rates, and overall financial health.

Supporting Documentation

Credit report disputes often require supporting documentation to validate claims. For instance, a credit report may contain inaccuracies related to personal information, such as an incorrect address or fraudulent account entries. Gather essential documents like a government-issued ID to verify identity, recent credit card statements to dispute erroneous charges, and any correspondence from creditors providing proof of errors. Include utilities bills showing the correct address to confirm residency details. Additionally, obtain police reports if identity theft is involved, ensuring a comprehensive approach to dispute resolution. Such documentation strengthens the case presented to credit bureaus, facilitating timely corrections in credit reports.

Formal Request

Disputing inaccuracies in a credit report can be crucial for maintaining financial health and ensuring fair access to loans and credit. Gather essential details such as the credit reporting agency name (e.g., Experian, TransUnion, Equifax), your personal information including full name and address, and the specific inaccuracies you wish to contest. Note relevant account details, such as account numbers and dates of reported discrepancies. Clearly state the desired outcome, whether it be correction or removal of false information. Additionally, include any supporting documentation, such as payment receipts or correspondence with creditors, to strengthen your case. Be sure to send the dispute request via certified mail for tracking purposes, ensuring a prompt response from the credit reporting agency.

Contact Details

Consumers often face issues with inaccuracies in their credit reports, leading to the need for a formal dispute. The Fair Credit Reporting Act (FCRA) establishes the necessity of providing personal information, such as full name, address, date of birth, and Social Security number when disputing errors. Specifically, consumers should include the name of the credit reporting agency, such as Equifax or TransUnion, alongside the address for correspondence. Properly identifying the disputed item includes details like account number or reference number, as well as a clear explanation of the inaccuracy. It's essential to attach supporting documents, such as recent statements or court rulings, to substantiate the claim. The timeframe allotted for a response is typically 30 days, mandated by regulations, ensuring timely resolution of disputes for consumers seeking credit integrity.

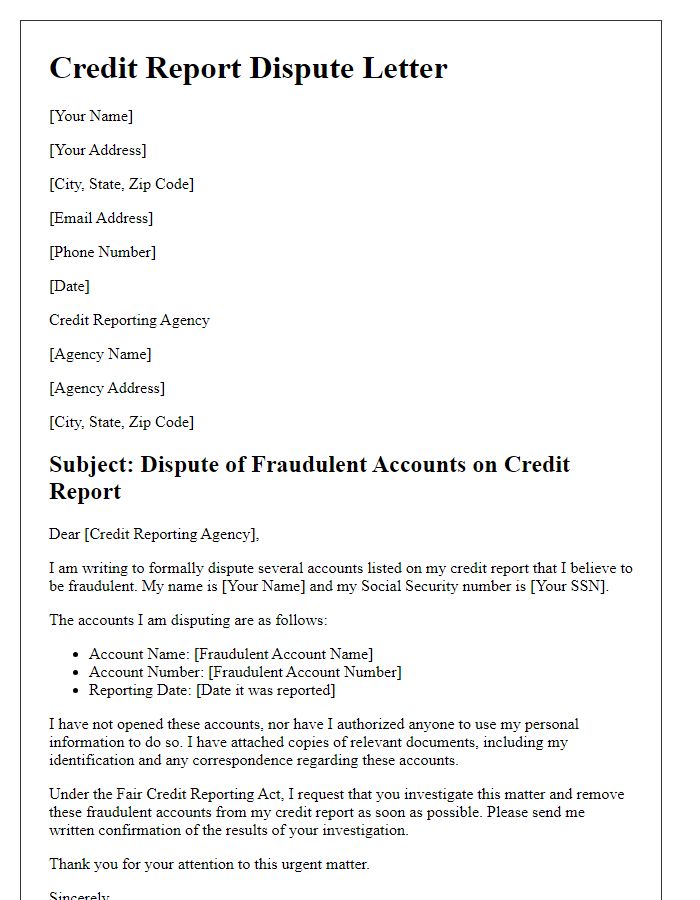

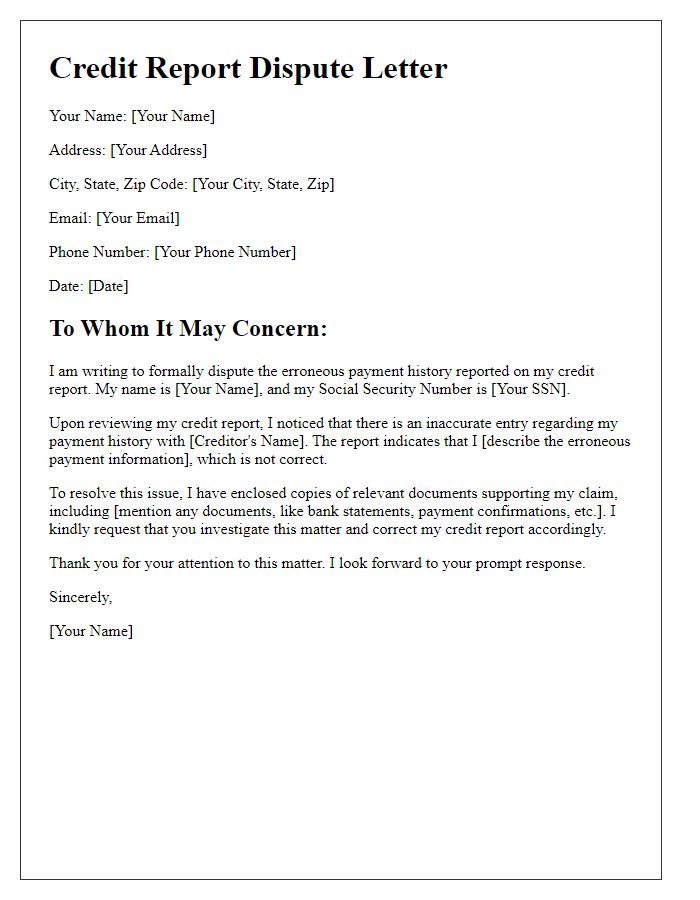

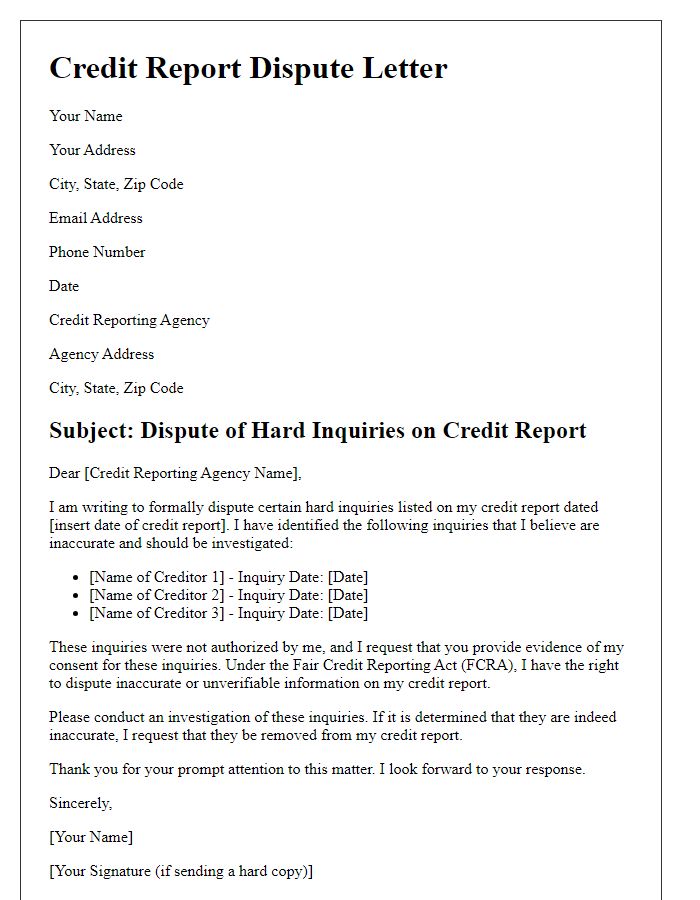

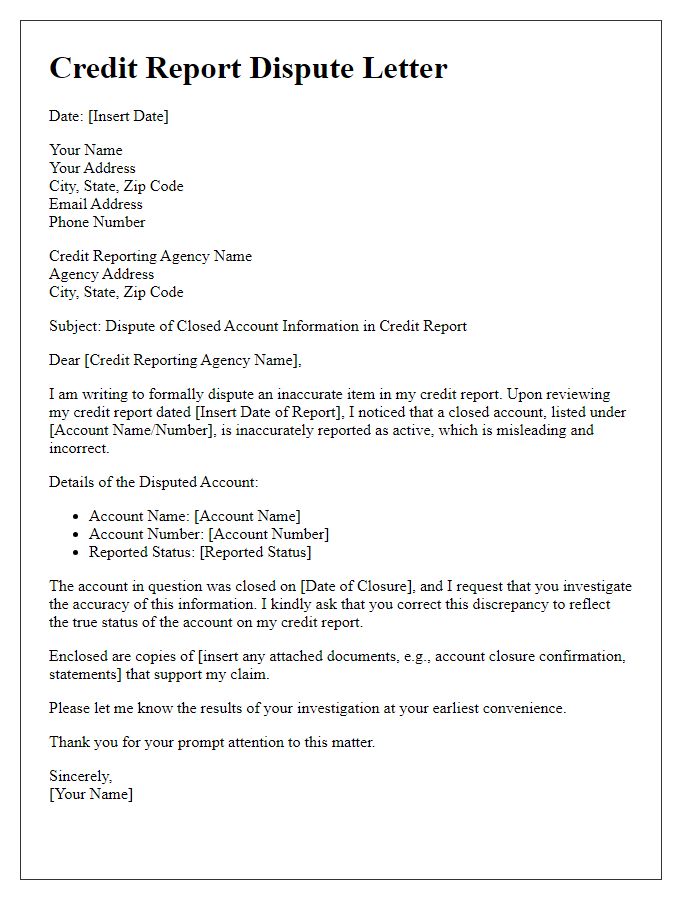

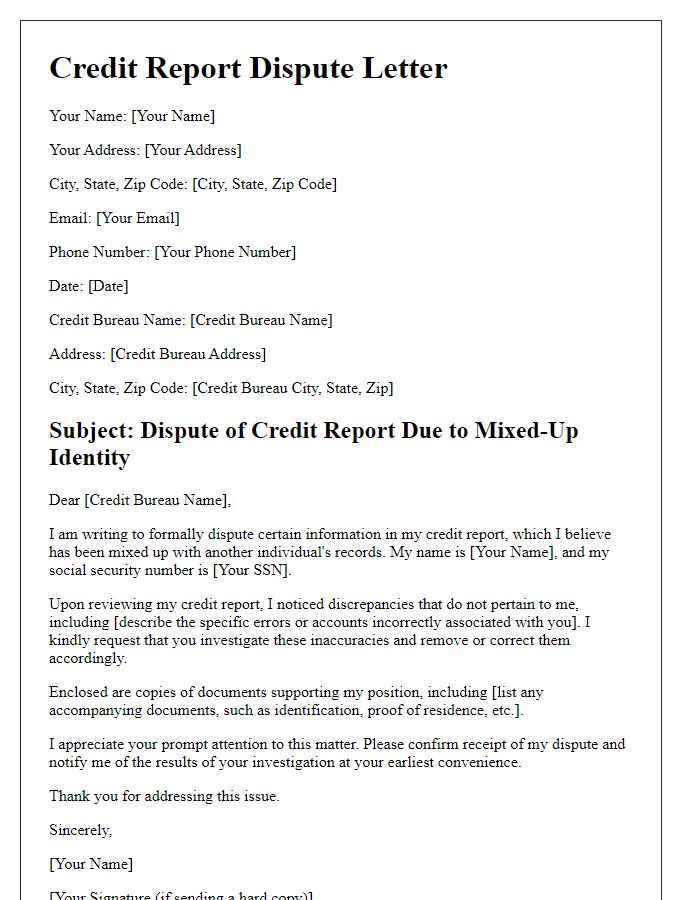

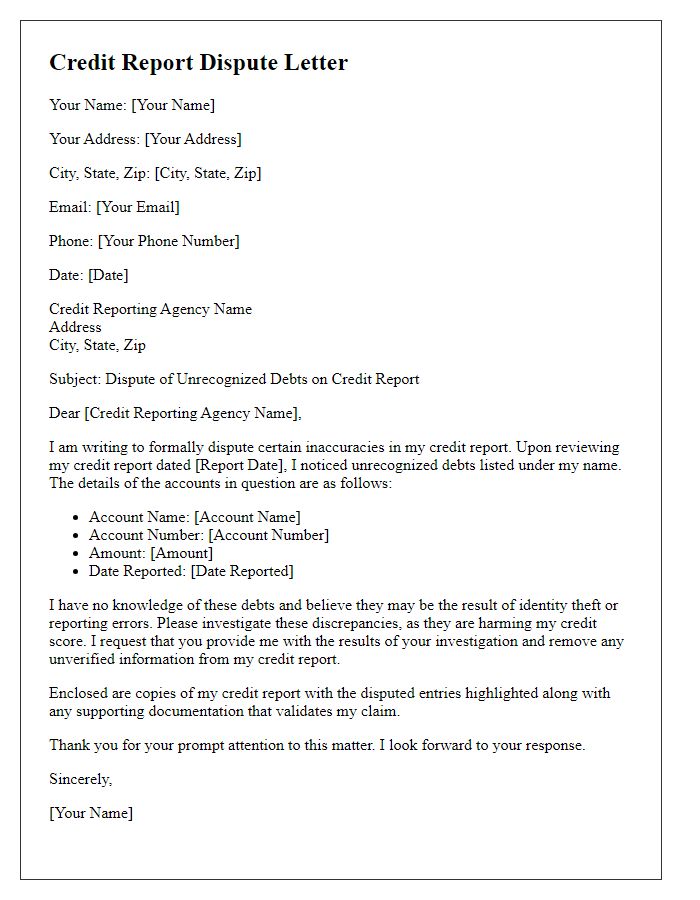

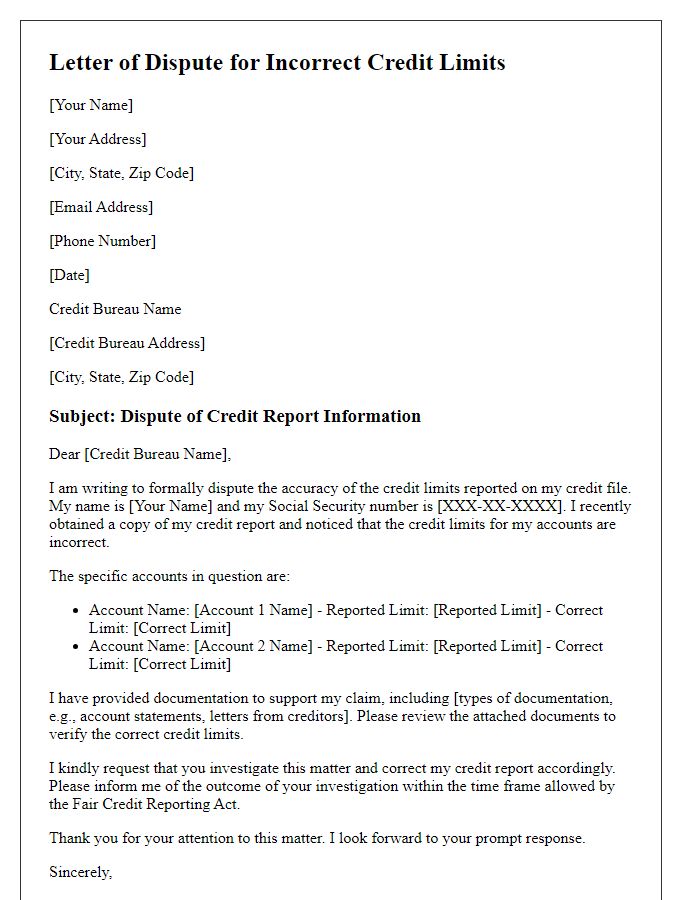

Letter Template For Credit Report Dispute Samples

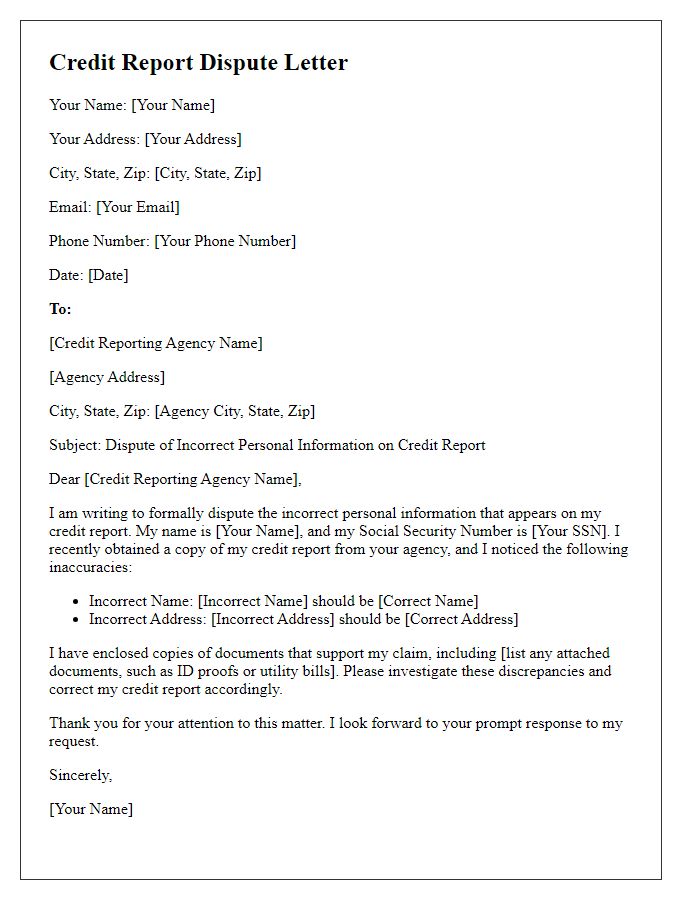

Letter template of credit report dispute for incorrect personal information

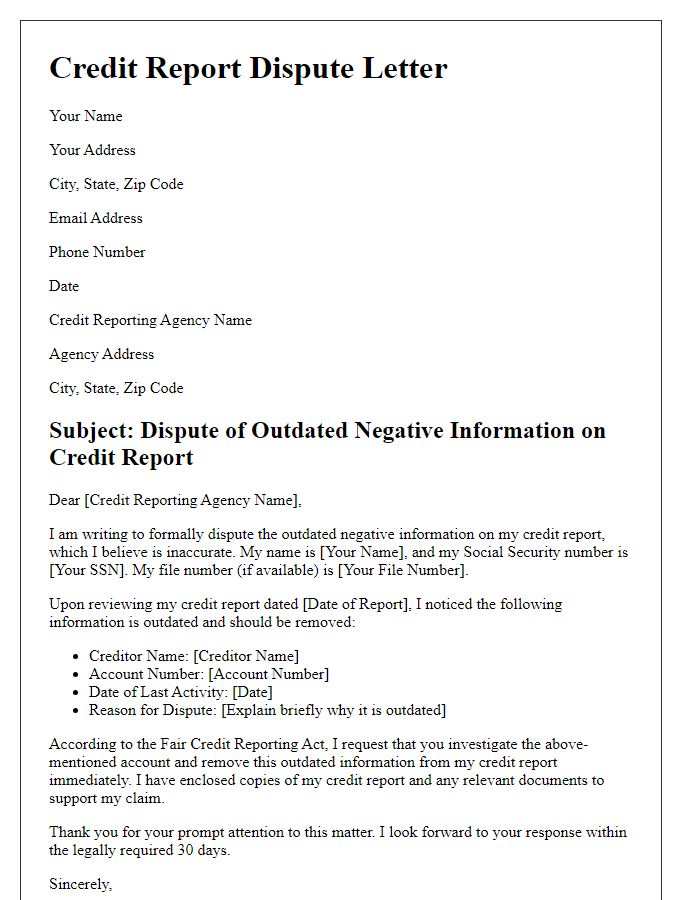

Letter template of credit report dispute for outdated negative information

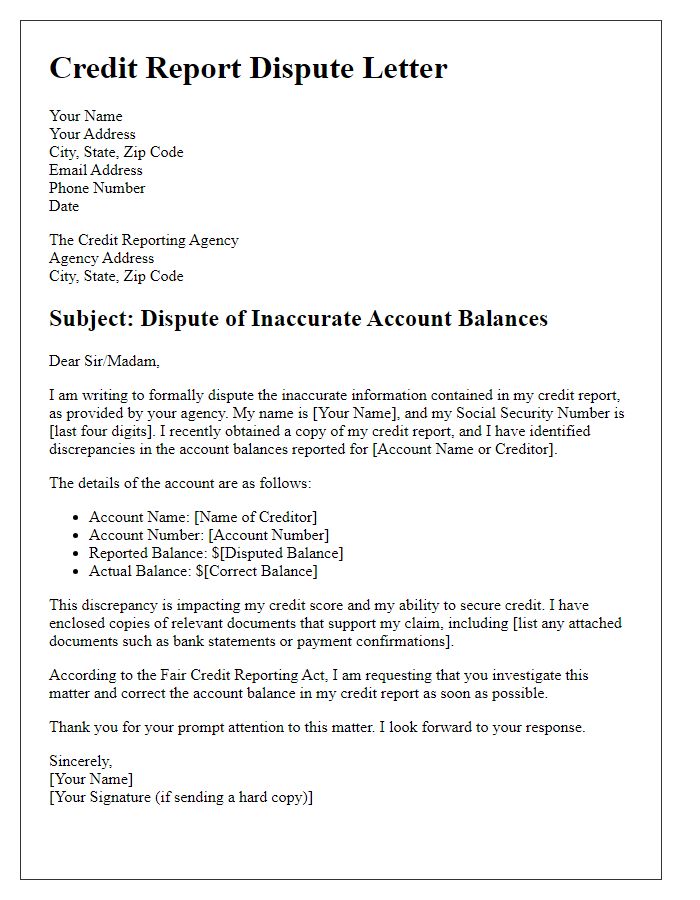

Letter template of credit report dispute for inaccurate account balances

Comments