Are you struggling to navigate the complexities of debt recovery? Whether you're a business owner looking to reclaim outstanding payments or an individual trying to settle financial disputes, a debt recovery agency can provide the support you need. These professionals bring a wealth of expertise and strategic methods to ensure that debts are addressed swiftly and effectively. Ready to learn how a debt recovery agency can help you regain control of your finances? Read on!

Professional Tone

The introduction of a debt recovery agency, established in 2023, signifies a critical development in the financial services industry. This agency specializes in the recovery of outstanding debts for businesses and individuals, employing a professional approach to ensure compliance with regulations, such as the Fair Debt Collection Practices Act in the United States. Located in New York City, the agency utilizes advanced technology and data analytics to track and manage accounts efficiently. Experienced professionals handle communication, maintaining a balance between assertiveness and professionalism to facilitate timely payments. Moreover, its comprehensive training programs for staff focus on effective negotiation techniques and understanding client needs, leading to higher recovery rates while preserving business relationships.

Clear Introduction

In the realm of financial management, debt recovery agencies play a crucial role in assisting businesses recover outstanding debts. These agencies specialize in locating debtors, negotiating payment plans, and implementing collection strategies to recover funds owed. With a collective experience exceeding 20 years, many agencies employ skilled negotiators trained in effective communication techniques and legal compliance to maximize recovery outcomes. Operational jurisdiction typically encompasses both local and national levels, allowing for the pursuit of debts across various regions. Utilizing advanced data analytics and strategic engagement methods, debt recovery agencies ensure that clients receive timely updates on the recovery process, reinforcing business relationships while maintaining professionalism.

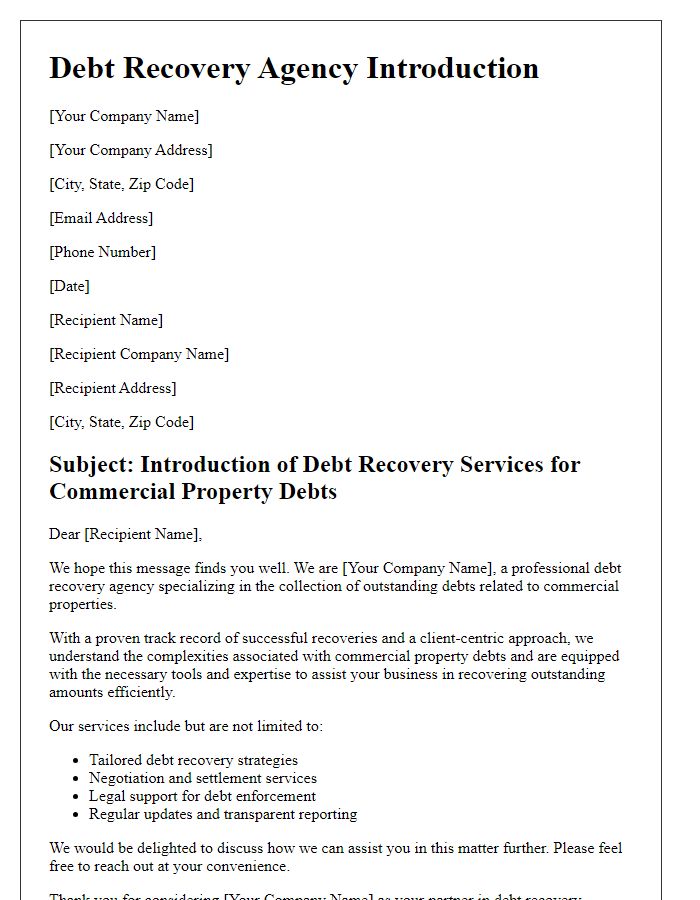

Contact Information

Debt recovery agencies play a crucial role in financial management by helping businesses recover unpaid debts. These agencies utilize various methods, including negotiation and legal proceedings, to ensure clients receive owed funds. Effective communication is essential in this field; agencies typically provide clear contact information, including phone numbers, email addresses, and physical addresses, to establish easy access for both creditors and debtors. Also, transparency in identifying themselves as licensed debt collectors enhances trustworthiness in the process, facilitating smoother interactions. Eventually, proper handling can lead to successful recoveries while maintaining professional relationships.

Compliance and Legal Adherence

Debt recovery agencies must prioritize compliance with relevant regulations and legal frameworks governing financial transactions and collections. Understanding the Fair Debt Collection Practices Act (FDCPA) is essential for ensuring that all collection efforts remain lawful and respectful to consumers. Agencies must implement adequate training programs for staff, highlighting key aspects of consumer rights while also maintaining accurate records of collection activities. Consistency with state-specific laws extends this compliance further, requiring familiarity with varying regulations such as those found in California's Rosenthal Fair Debt Collection Practices Act. Emphasizing transparency in communication with debtors fosters trust, hence helping to mitigate potential legal disputes while boosting recovery rates. Adhering to ethical standards reinforces the agency's reputation in the industry, which is paramount for long-term success and client retention.

Call to Action

Debt recovery agencies play a crucial role in financial management, assisting businesses in reclaiming overdue payments. Theses agencies often utilize professional approaches to contact debtors, enhancing the chance of repayment. The process typically involves sending formal notices that outline the outstanding amount, payment deadlines, and potential consequences. Engaging in this proactive measure can significantly improve cash flow for businesses experiencing delayed payments. Prompt action can lead to higher recovery rates, as early intervention is often key in debt collection cases. Establishing a firm yet respectful communication strategy is vital for building trust with clients while achieving financial objectives.

Letter Template For Debt Recovery Agency Introduction Samples

Letter template of debt recovery agency introduction for small businesses.

Letter template of debt recovery agency introduction for personal loans.

Letter template of debt recovery agency introduction for medical billing disputes.

Letter template of debt recovery agency introduction for unpaid invoices.

Letter template of debt recovery agency introduction for credit card debt.

Letter template of debt recovery agency introduction for utility bill collections.

Letter template of debt recovery agency introduction for tenant arrears.

Letter template of debt recovery agency introduction for student loan collections.

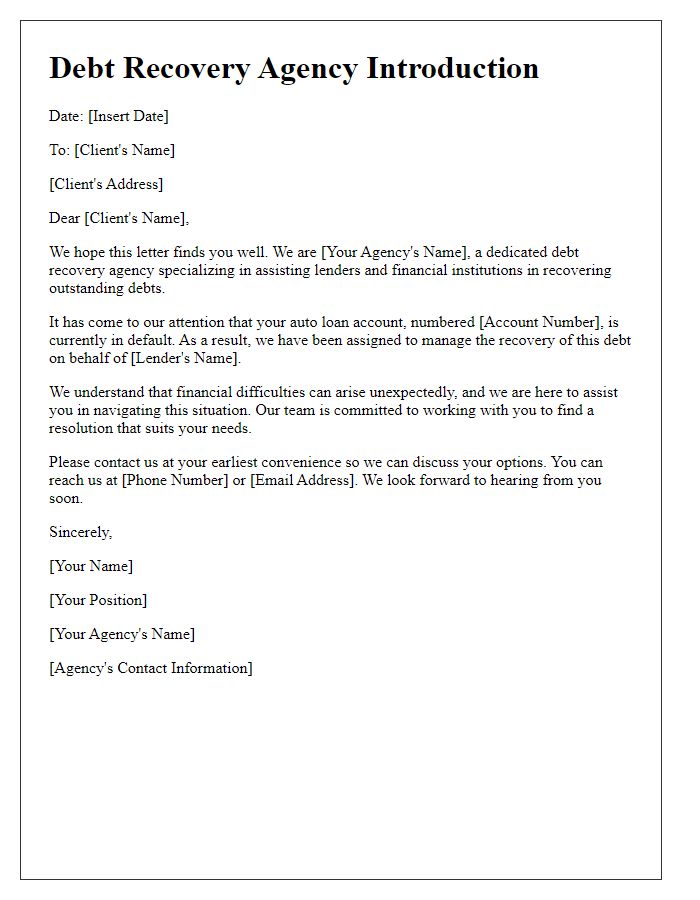

Letter template of debt recovery agency introduction for auto loan defaults.

Comments