Are you feeling a bit puzzled about collection fees? You're not alone; many people find the details surrounding these fees a bit tricky to navigate. Understanding the reasons behind collection fees can help you handle your finances more effectively and avoid any unwanted surprises. So, let's dive in and decode what these charges really meanâcontinue reading to explore the ins and outs of collection fees!

Clear subject line

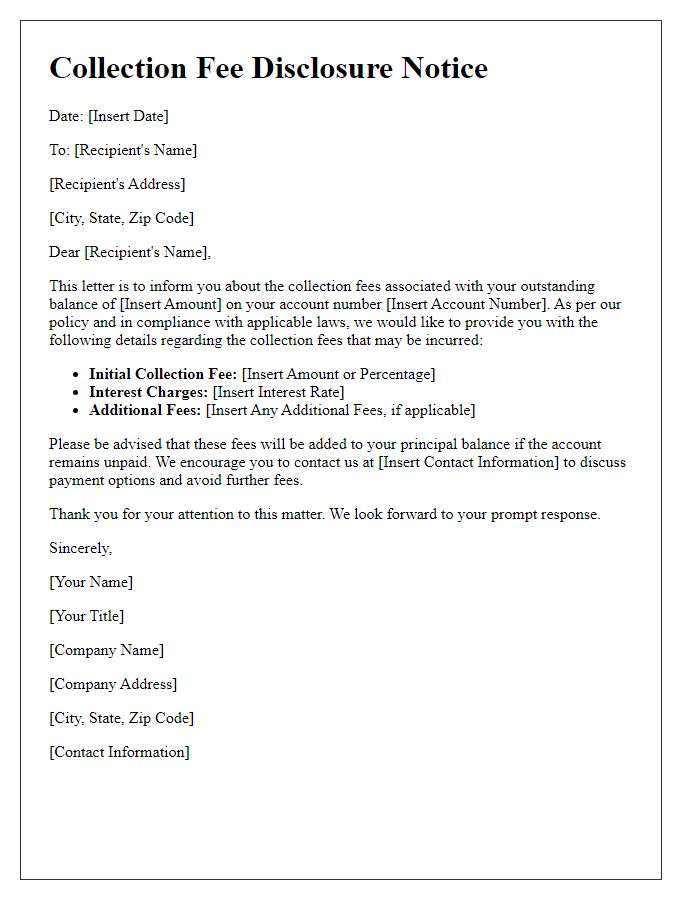

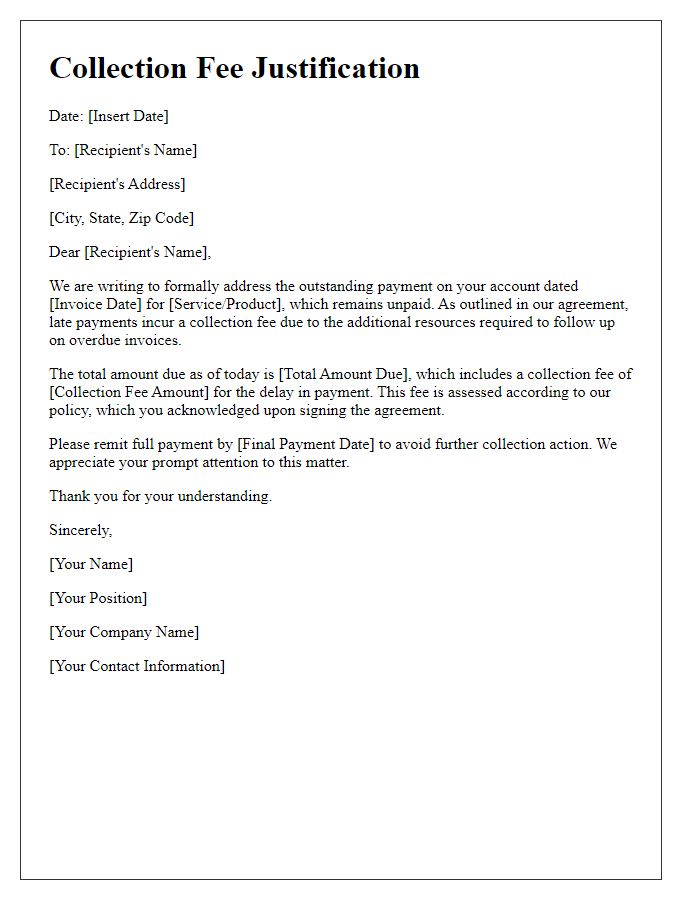

Subject line: Important Information Regarding Your Collection Fee Clear communication about collection fees is crucial for maintaining transparency. Collection fees, typically applied when accounts become overdue (often after 30 days), may include various charges such as late payment fees or service fees. For instance, a late payment fee might be set at $25 per violation, while service fees can vary based on the account size and duration of delinquency, sometimes reaching up to 1.5% of the owed amount. These fees are standard across many industries, including healthcare and utilities. Understanding collection processes and associated fees helps individuals manage their finances better and avoid further complications.

Recipient's details

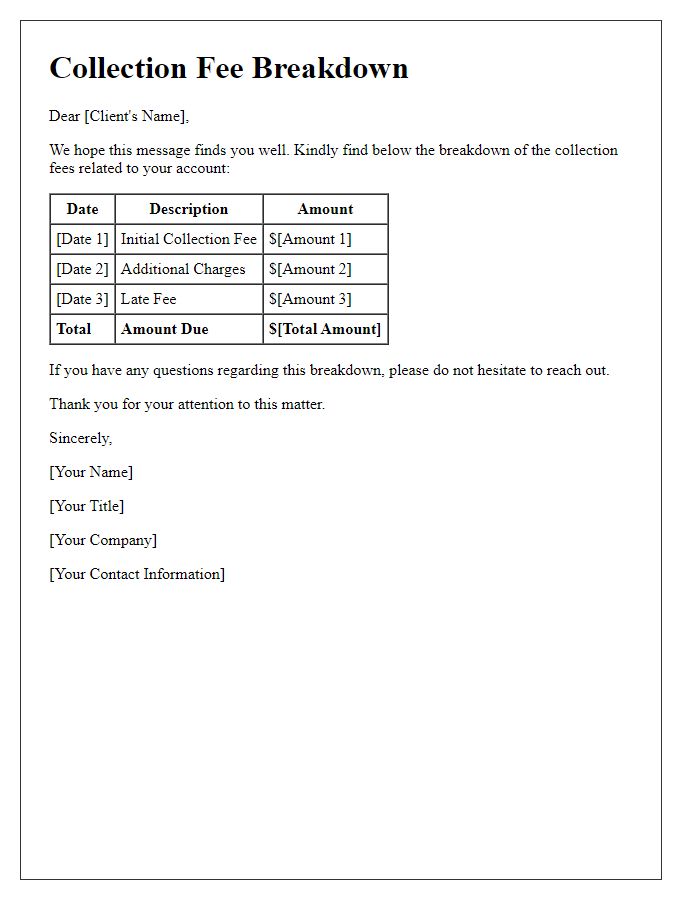

The collection fee for unpaid invoices, typically around 20% of the outstanding balance, can significantly impact the total amount owed. Invoices, issued for services rendered or products delivered, often have payment terms specifying a due date, commonly set at 30 days from the invoice date. The initial reminder for overdue payment, usually sent after the due date, serves to notify clients about their outstanding balance. If subsequent communication fails to elicit payment, the collection agency, a specialized firm that recovers debts, may intervene. Fees associated with collections often encompass service charges, administrative costs, and legal fees, thus necessitating prompt payment to avoid escalating costs. Each step in the process can be documented for clarity and legal purposes, ensuring transparency for both the service provider and the recipient involved.

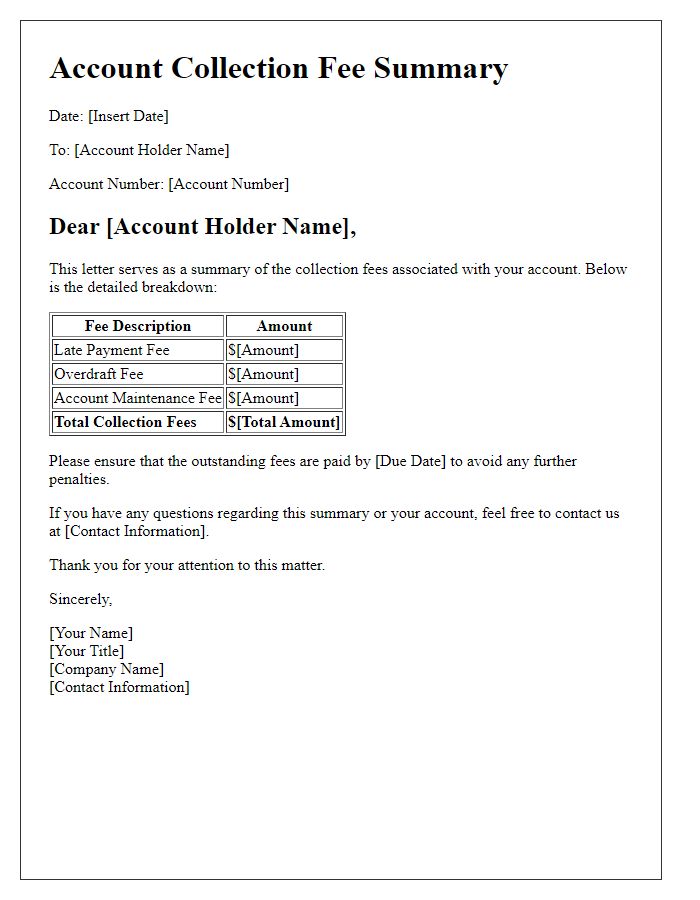

Explanation of debt amount

Outstanding debts can accrue collection fees, significantly increasing the total owed. In many instances, original amounts owed, such as $500 for past due invoices, can inflate due to late payment penalties and additional collection fees, often ranging from 15% to 30% of the original debt. Specific timelines, such as a 30-day notice period for payment before fees are applied, are outlined in the original contract. Jurisdictional laws also govern these fees; for example, states like California have regulations that limit the types of fees that can be charged. Overall, transparency in fee structures is crucial for debtors to fully understand their financial obligations and prevent further penalties.

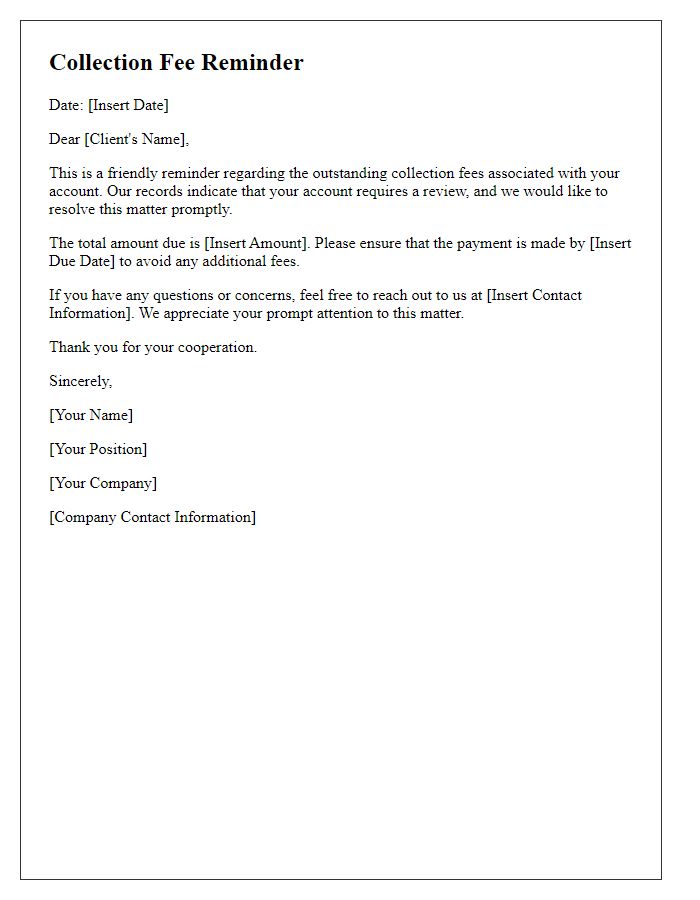

Payment options and deadline

The collection fee protocol pertains to unpaid bills, where additional charges are applied to the original amount owed. Fees can escalate rapidly, often reaching 1.5% monthly, depending on the jurisdiction's regulations. Payment options typically include credit card transactions, bank wire transfers, and payment plan arrangements, allowing flexibility for the debtor. Deadlines for payments usually fall within 30 days from the original invoice date or the date of notification, after which penalties may commence. Locations such as court houses or financial offices provide resources to clarify payment matters and potential repercussions of delays.

Contact information for questions and assistance

Unpaid debts often lead to collection fees, which can significantly increase the total amount owed. On average, collection fees can range from 25% to 50% of the outstanding balance, depending on the agreement and local regulations. For assistance with understanding these fees, as well as options for payment plans, consumers can reach out to collection agencies. Inquiry lines often operate during business hours, providing representatives who can clarify specific charges and discuss potential resolutions. It's advisable to keep personal records, such as invoices and correspondence, for reference during these discussions.

Comments