Are you finding it challenging to manage your payment terms effectively? Reinstating payment terms can streamline your financial operations and enhance your cash flow. In this article, we'll walk you through the important steps and considerations needed to successfully reinstate those terms, ensuring clarity and consistency in your transactions. Read on to discover practical tips and templates that can make this process smoother!

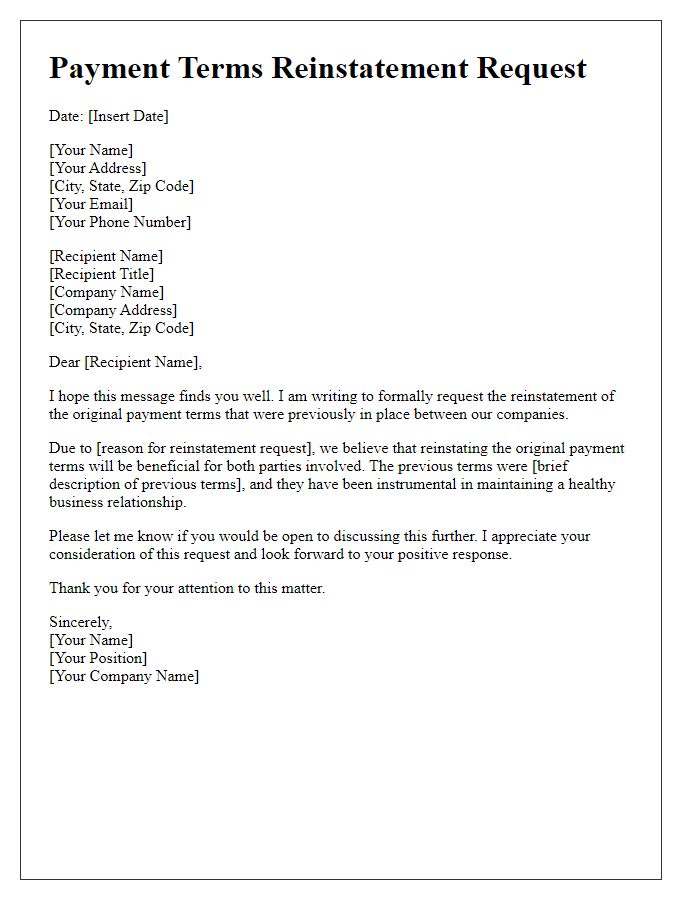

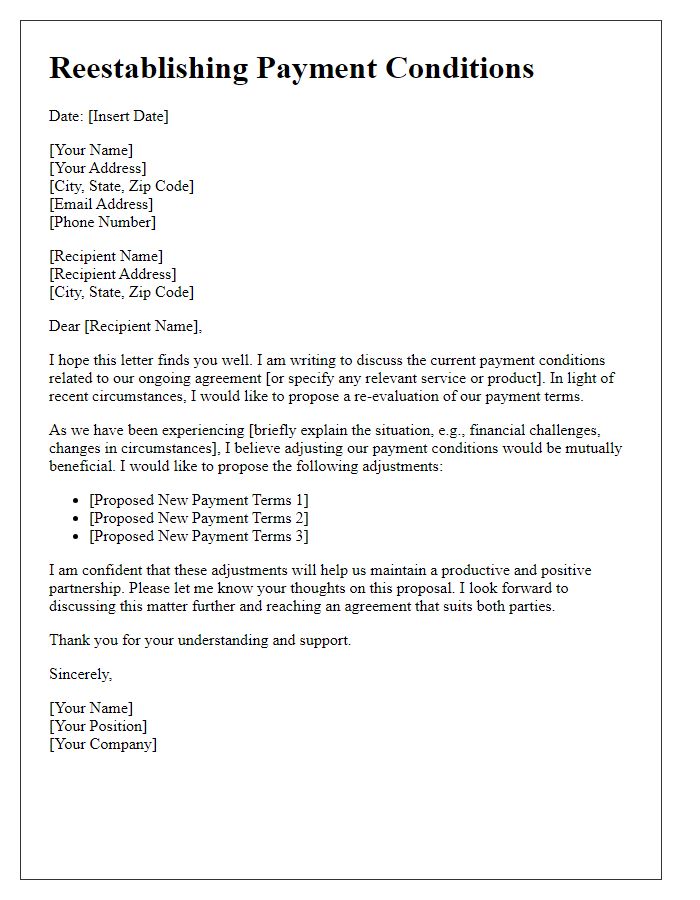

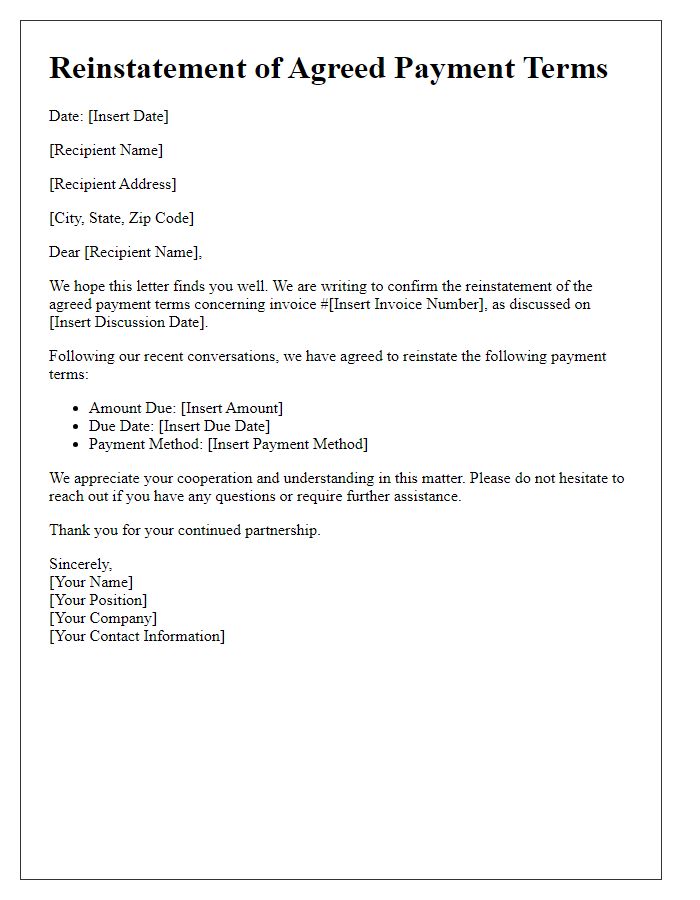

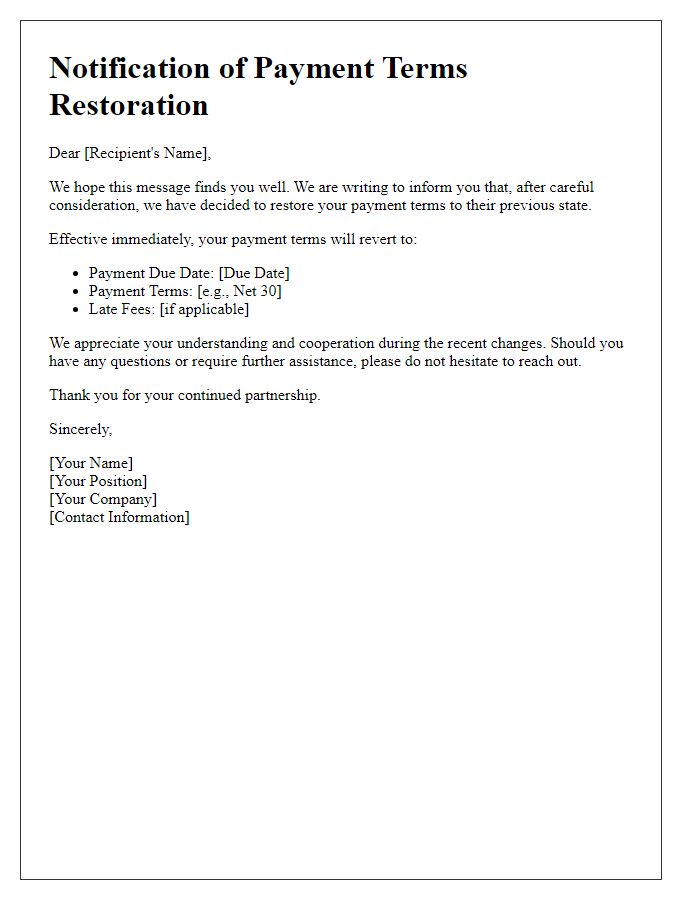

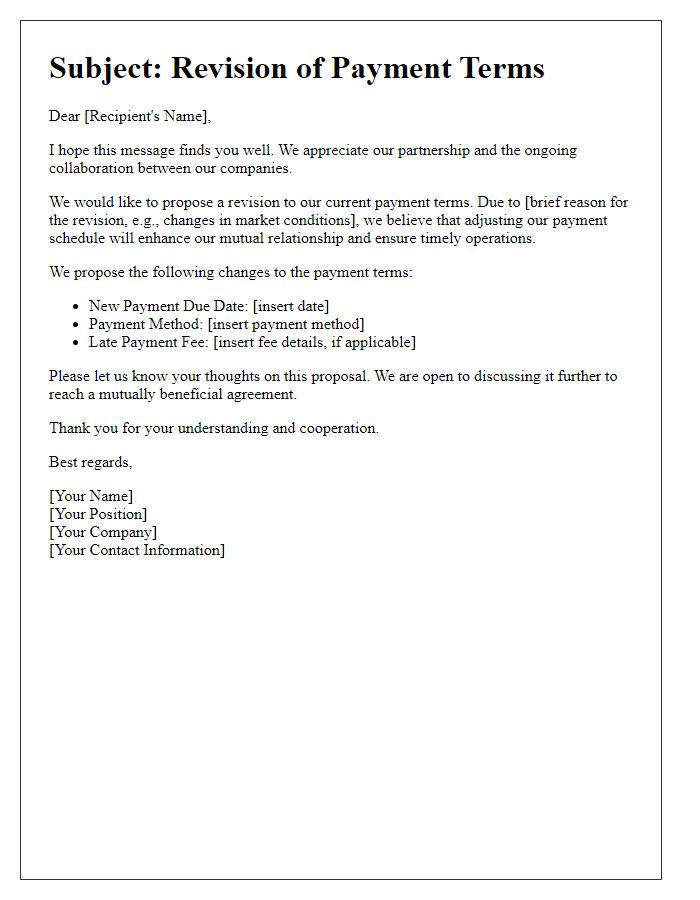

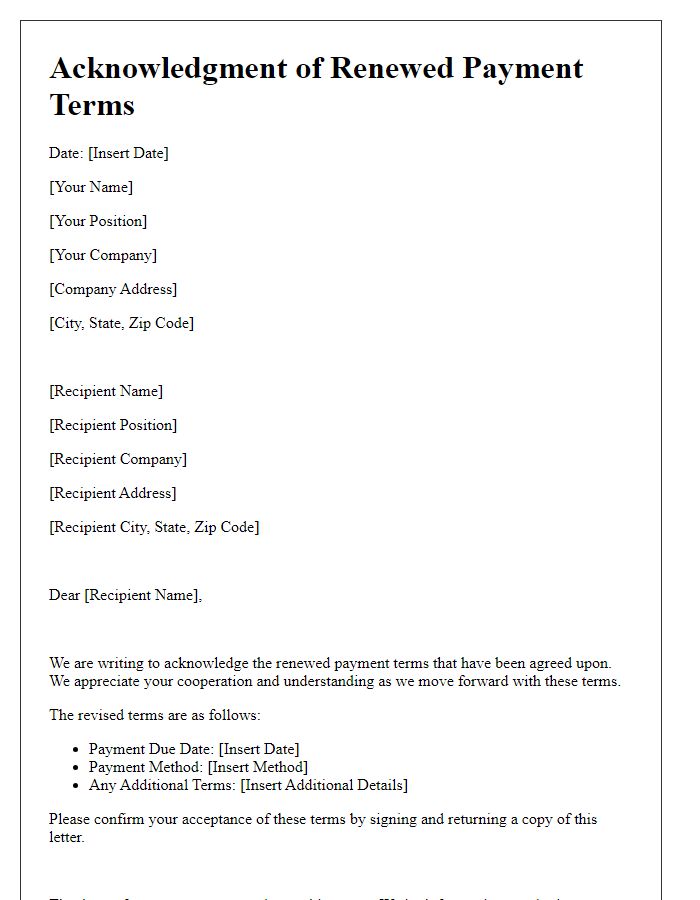

Clear Subject Line

Establishing streamlined payment terms is essential for maintaining financial health and positive client relationships. Clear communication regarding payment guidelines encourages prompt settlements. A detailed payment schedule may include due dates, acceptable payment methods (credit card, bank transfer, etc.), and penalties for overdue payments. For clarity, consider specifying terms such as "Net 30," meaning payment is due within 30 days. Additionally, outlining contact information for queries ensures clients can easily reach out for assistance. Improving awareness of payment expectations reduces misunderstandings and promotes timely financial transactions.

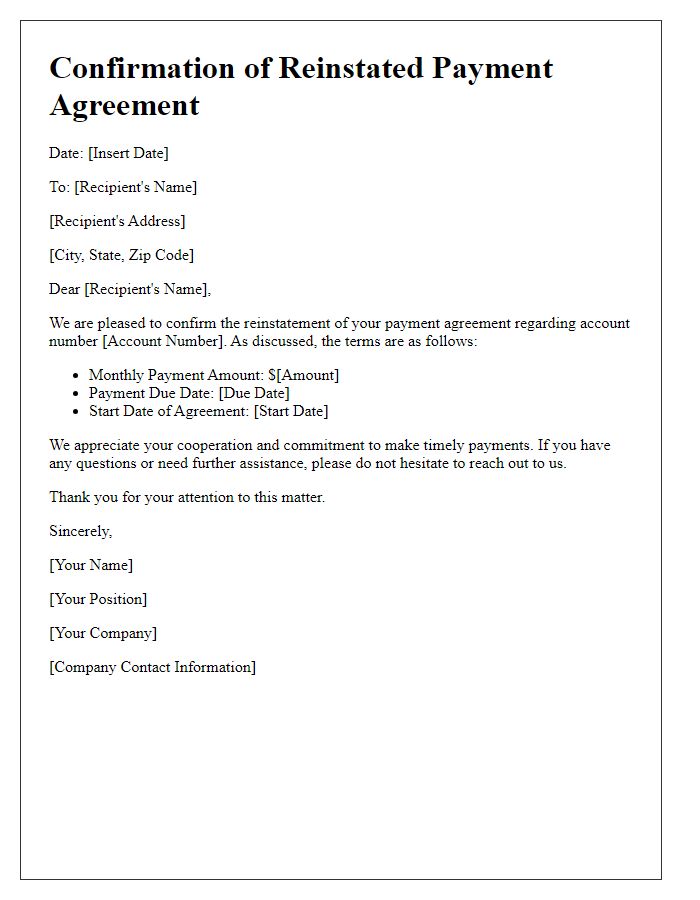

Professional Tone

Reinstating payment terms is essential for maintaining financial stability and ensuring timely cash flow in businesses. Specifically, clear guidelines on payment cycles (e.g., net 30 or net 60 days) provide consistency for both parties involved in a transaction. Establishing these terms benefits companies, such as suppliers or vendors, allowing them to manage their accounts receivable efficiently. Additionally, defining late payment penalties, such as a 1.5% monthly charge, incentivizes timely payments, fostering positive relationships between clients and service providers. Regular review of these terms can help adapt to economic changes or client needs, supporting sustainable business operations.

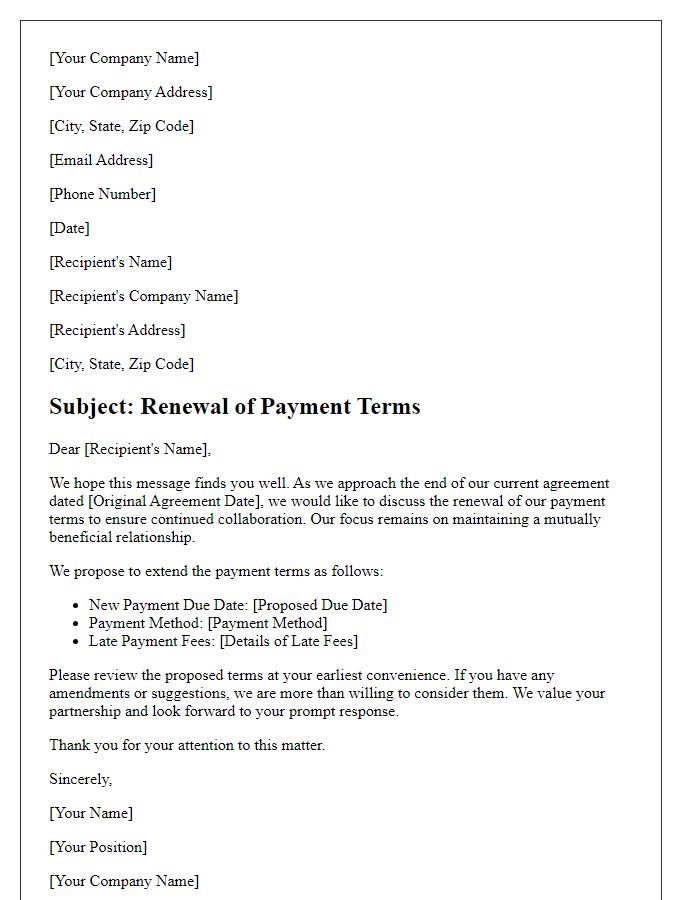

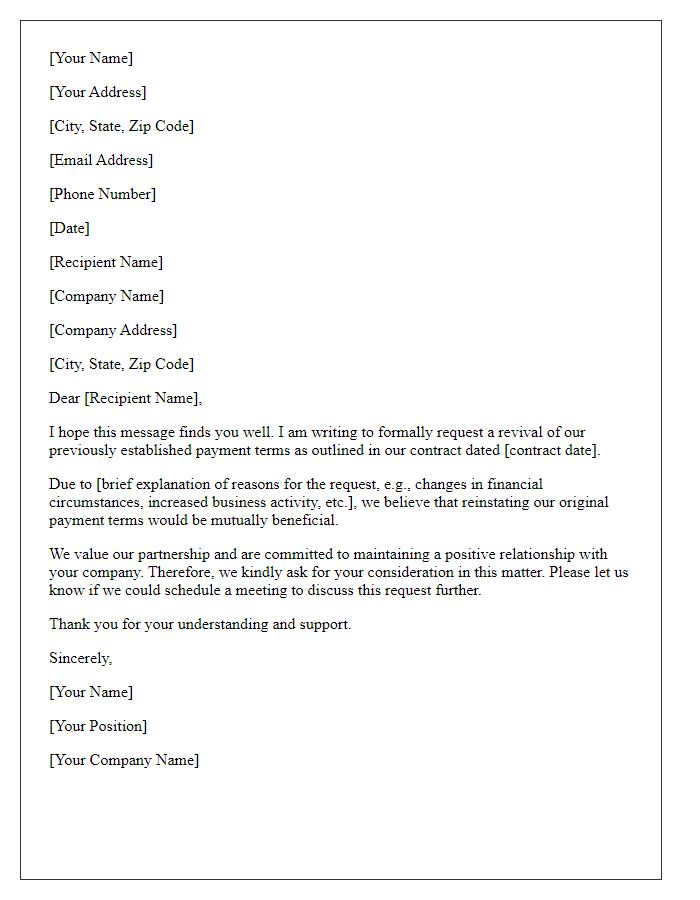

Detailed Explanation of Changes

Reinstating payment terms entails updating contractual agreements between businesses or payment structures for ongoing transactions to ensure clarity and compliance. Key elements include outlining the new payment schedule, which may specify whether payments are due weekly, bi-weekly, or monthly, and indicating any grace periods or late fees associated with non-compliance. Important dates must be highlighted, such as effective date, which marks when the new terms take effect. Documenting acceptable payment methods (credit cards, bank transfers, e-checks) is essential to facilitate smooth transactions. Additionally, noting any changes in interest rates or discounts can provide further motivation for timely payments, fostering better cash flow dynamics. Providing a clear rationale for changes enhances understanding, underscoring the importance of these terms for maintaining strong business relationships.

Justification for Reinstatement

Reinstating payment terms can significantly improve cash flow management for small businesses. A company's accounts receivable is critical, often comprising 30-60 days of payment waiting period. Delays in payments can lead to operational challenges, affecting payroll and supplier relations. Reinstating these terms can ensure timely revenue generation, promote better supplier negotiations, and foster financial stability. Implementing clear communication strategies, such as issuing reminders or establishing a dedicated payment team, can enhance compliance with payment timelines, thus reinforcing the importance of prompt transactions in maintaining healthy business operations.

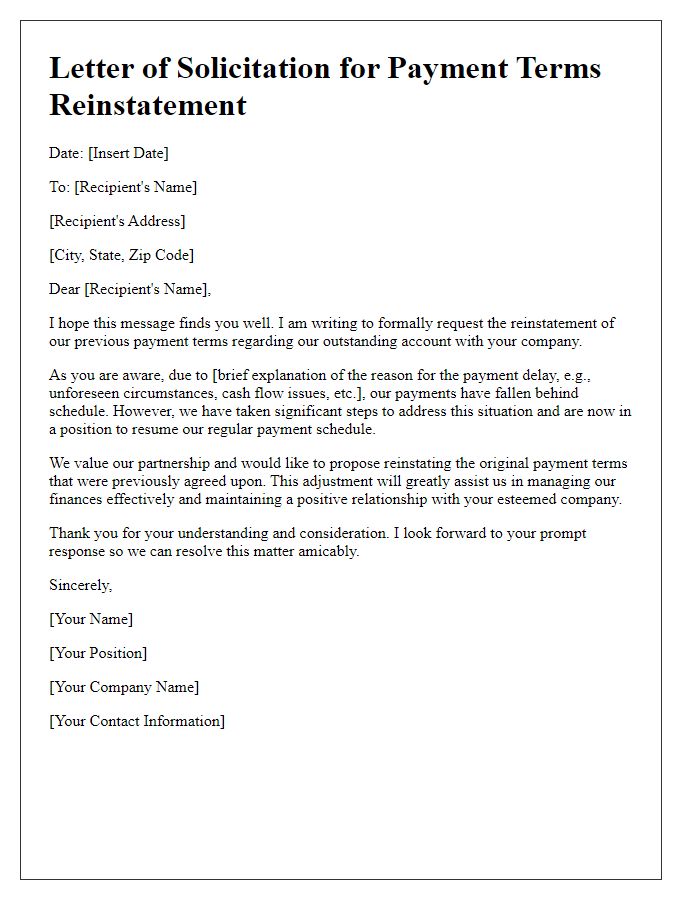

Call to Action

Reinstatement of payment terms can significantly impact business operations and financial stability. Companies that have adjusted to deferred payment plans due to economic constraints often seek to revert to original terms after improvement in cash flow conditions. Such adjustments are typically communicated formally, with emphasis on details such as the due date (often set 30 days post-invoice) and potential penalties for late payments (which may range from 1.5% to 5%). Clear expectations regarding the reinstatement process, including any necessary documentation or confirmations from clients, bolster transparency and foster positive relationships. Engaging clients with a structured call to action--such as "Please respond by [specific date]"--ensures timely acknowledgment and response to the changes, facilitating smoother financial transactions moving forward.

Comments