Are you facing challenges with your current payment plan? We understand that sometimes financial situations can change, and it's important to adapt accordingly. In this article, we'll explore how to craft an effective letter proposing an alternative payment arrangement that meets your needs while keeping communication open and respectful. Join us as we delve into the key components of this letter and provide helpful tips to ensure your proposal is well-received!

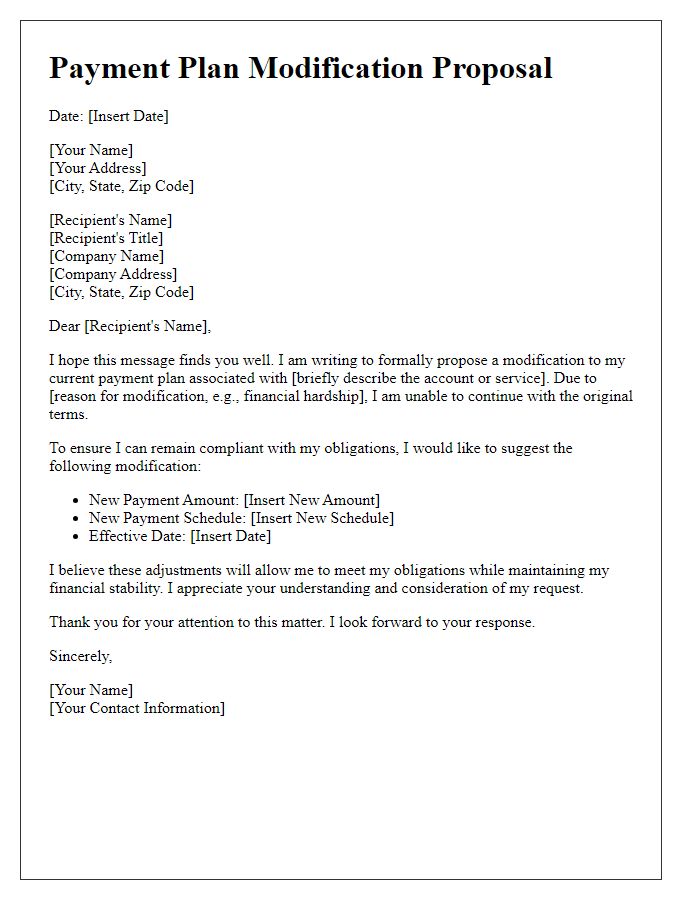

Clear subject line

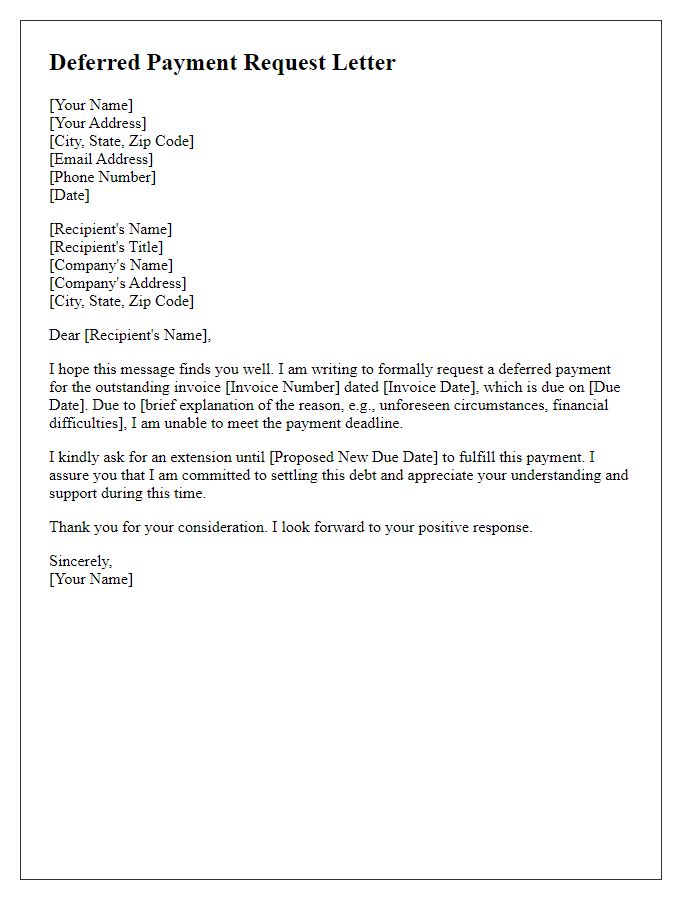

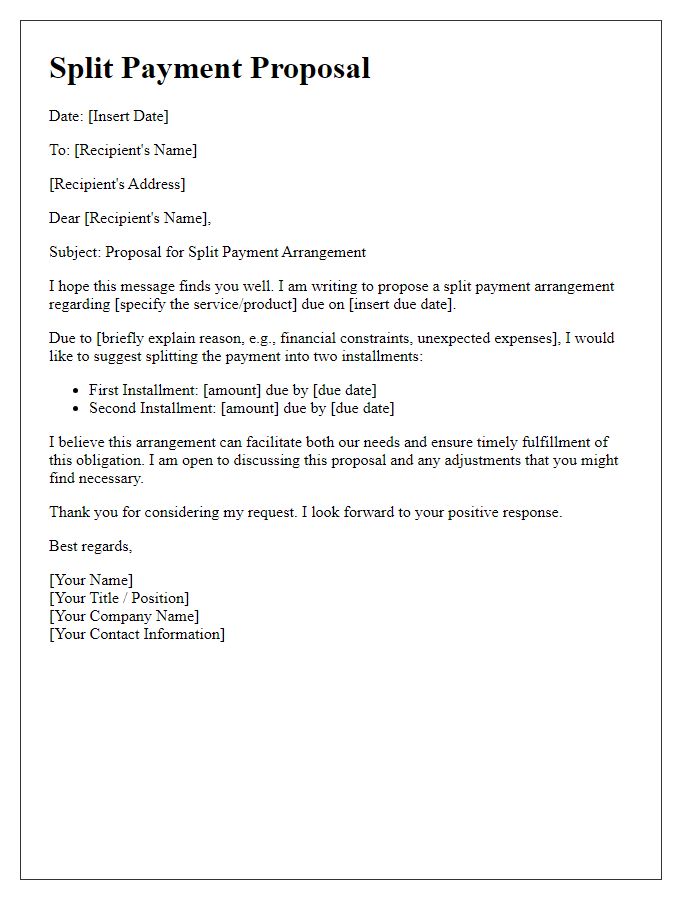

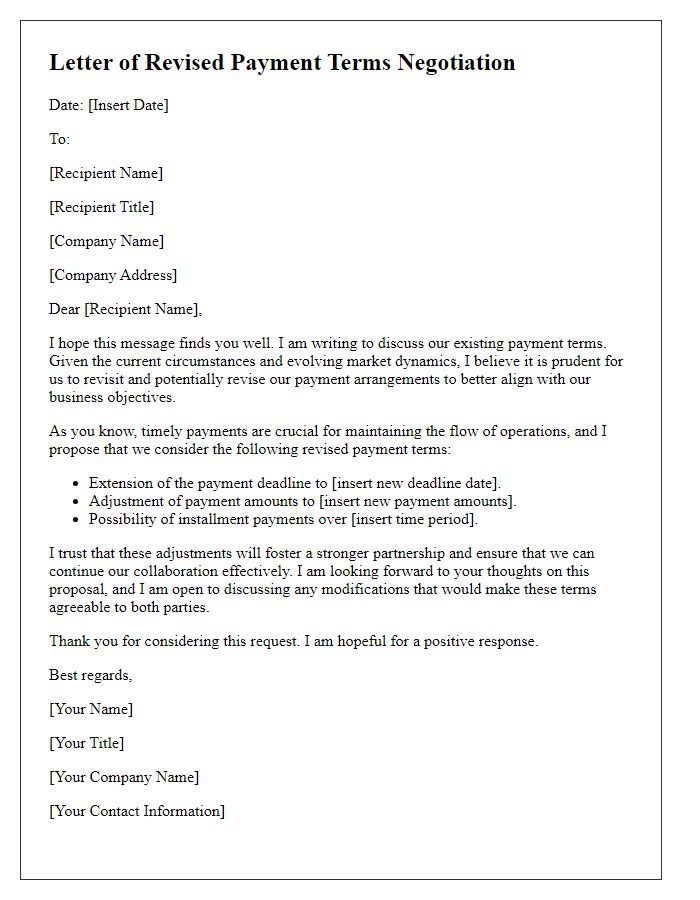

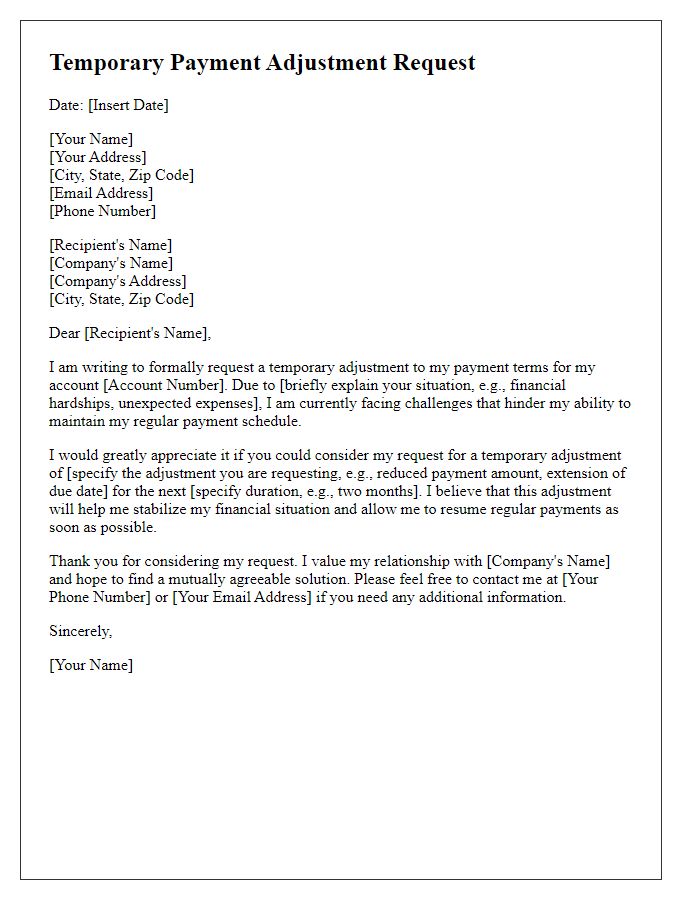

Subject: Proposal for Alternate Payment Arrangement Aiming to address financial flexibility, the proposed alternate payment arrangement allows for adjustments in payment terms for contractual obligations. This approach focuses on sustained engagement and mutual benefits between parties. New terms may include extended deadlines or installment plans tailored to income fluctuations. This proposal acknowledges existing financial challenges while ensuring continuity in obligations. Clear documentation and transparent communication are essential to establish trust and commitment throughout this process. This arrangement supports stability and promotes a long-term partnership.

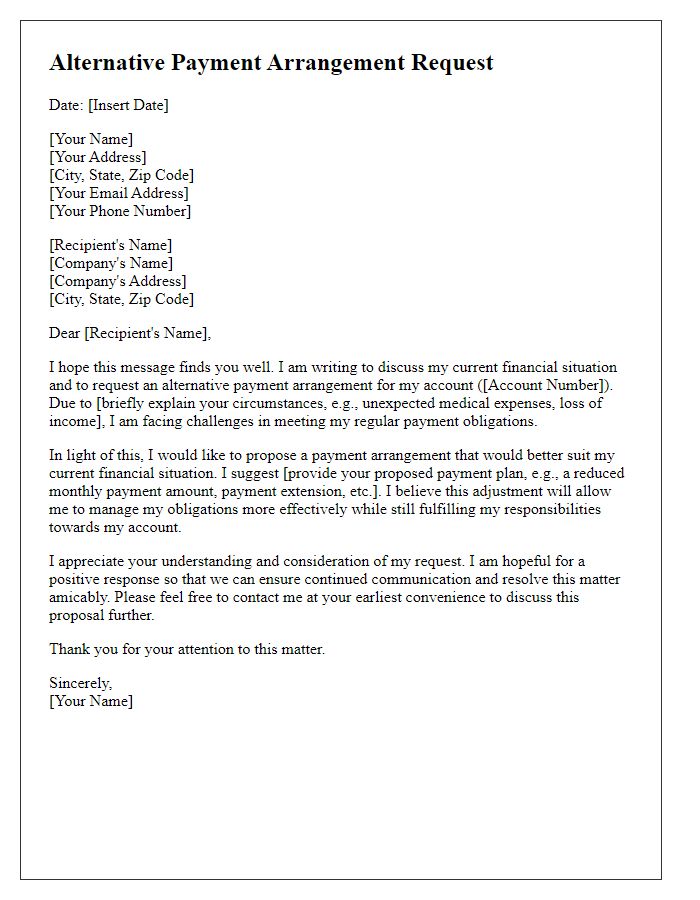

Professional greeting

In the realm of alternative payment proposals, establishing a professional greeting sets the tone for effective communication. A formal salutation such as "Dear [Recipient's Name and Title, e.g., Mr. Smith, Financial Manager]" signals respect and recognition of the individual's position. This approach is essential when addressing entities in organizations such as businesses, government bodies, or financial institutions. Using a courteous opening can foster a positive atmosphere for the discussion of proposals related to innovative payment plans or revised financial terms. Note: Include relevant details such as the organization's name, specific proposal types (e.g., installment payments, deferred payments), or deadlines to enhance the context of the greeting.

Concise explanation of current situation

In light of recent financial reviews, the current situation reflects a significant cash flow challenge impacting timely payments. Outstanding invoices totaling $15,000, primarily from Q2, have accumulated due to unexpected delays in receivables from key clients, including Client A and Client B. The need for an alternative payment proposal arises to ensure continuity of operations while maintaining healthy vendor relationships. Proposed adjustments aim to distribute payments over a revised schedule, alleviating immediate financial pressure and facilitating a gradual settlement of outstanding debts.

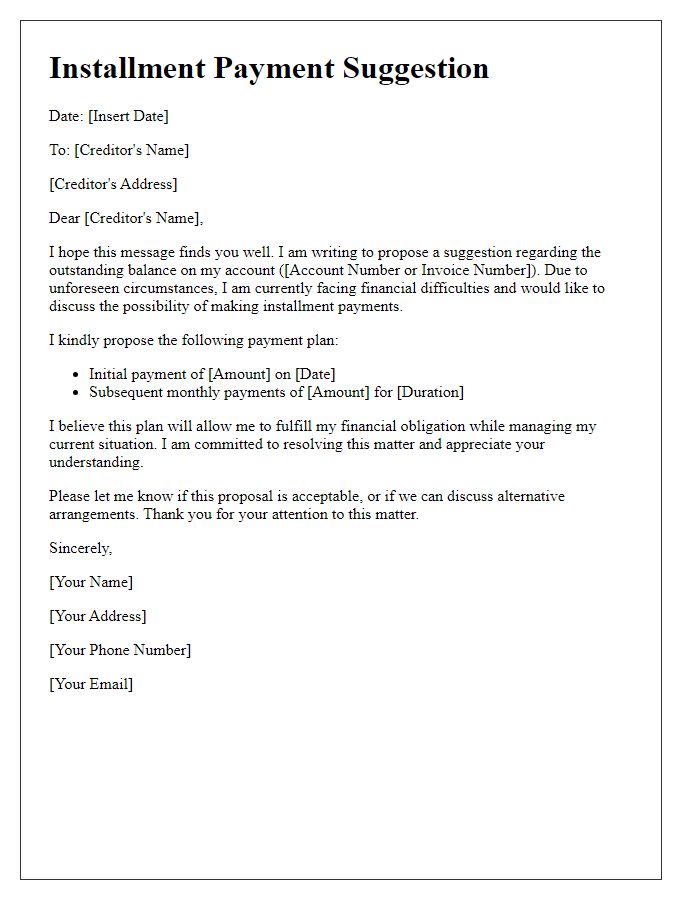

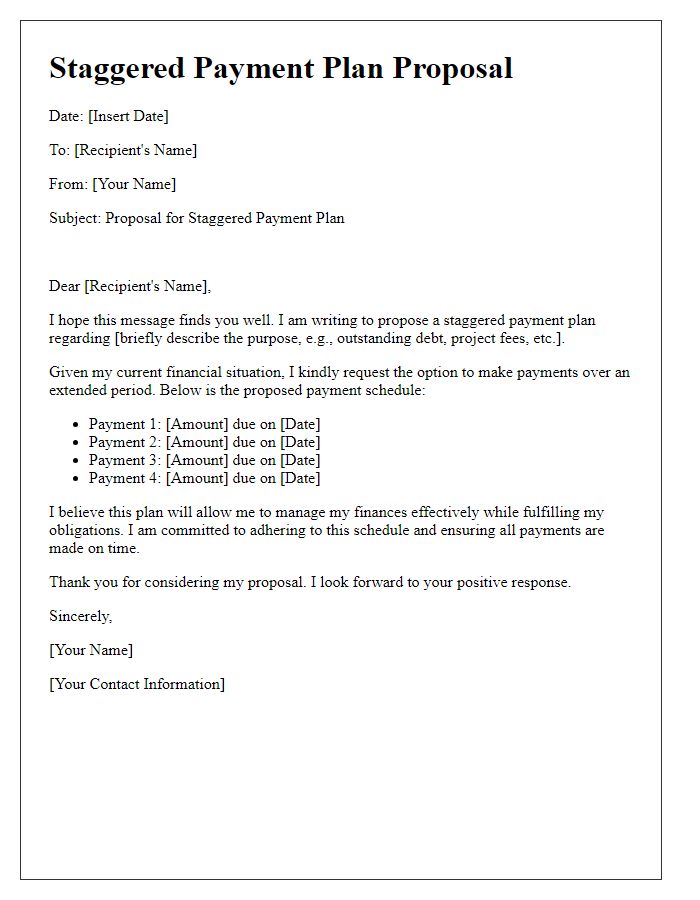

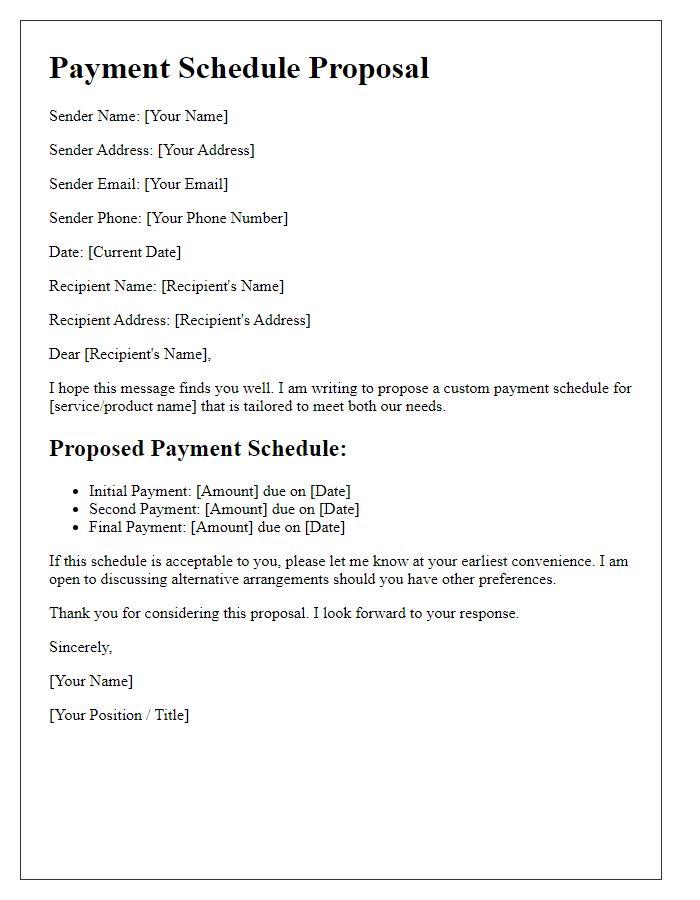

Detailed alternate payment plan

Creating a detailed alternate payment plan involves outlining specific payment amounts, due dates, and any associated fees. A structured payment agreement can aid in managing financial obligations more effectively. Monthly installments could be proposed, evenly distributed over a set period, such as 12 or 24 months. For example, if the total amount is $1,200, suggested payments might be $100 per month, due on the first of each month. A flexible grace period of five days for late payments can be included to accommodate unforeseen circumstances. Additionally, specifying payment methods (credit card, bank transfer, etc.) ensures clarity. A section dedicated to potential penalties for late payments or defaults will reinforce commitments. Finally, a clear understanding of communication channels for questions or adjustments strengthens the plan's reliability.

Polite closing and contact information

An alternate payment proposal can provide flexibility for settling financial obligations, especially in challenging situations that affect cash flow. Clear communication regarding alternative arrangements can help maintain positive relationships. In this context, the closing statement conveys appreciation for consideration and a willingness to discuss further arrangements. Providing accurate contact information, including phone number and email, ensures that communication remains open and efficient. Transparency is crucial in establishing trust and cooperation in these negotiations.

Comments