Are you feeling overwhelmed by the prospect of requesting an account review? You're not aloneâmany people find themselves in need of assistance with their account but aren't sure how to articulate their concerns. In this article, we'll guide you through crafting a clear and concise letter template that will help you effectively communicate your request. Ready to take the next step? Let's dive in and explore the essentials of a successful account review request letter!

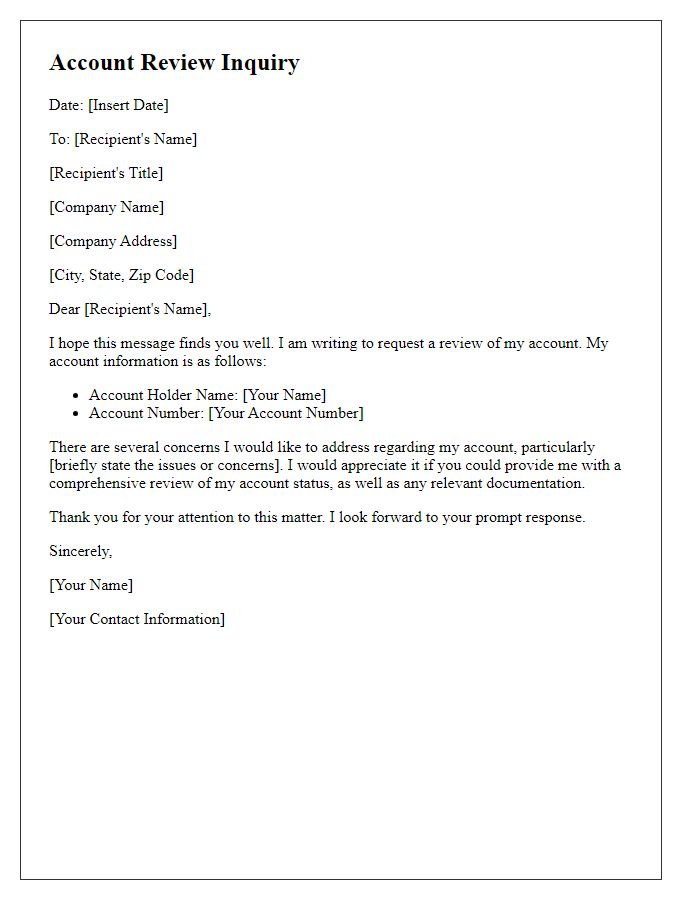

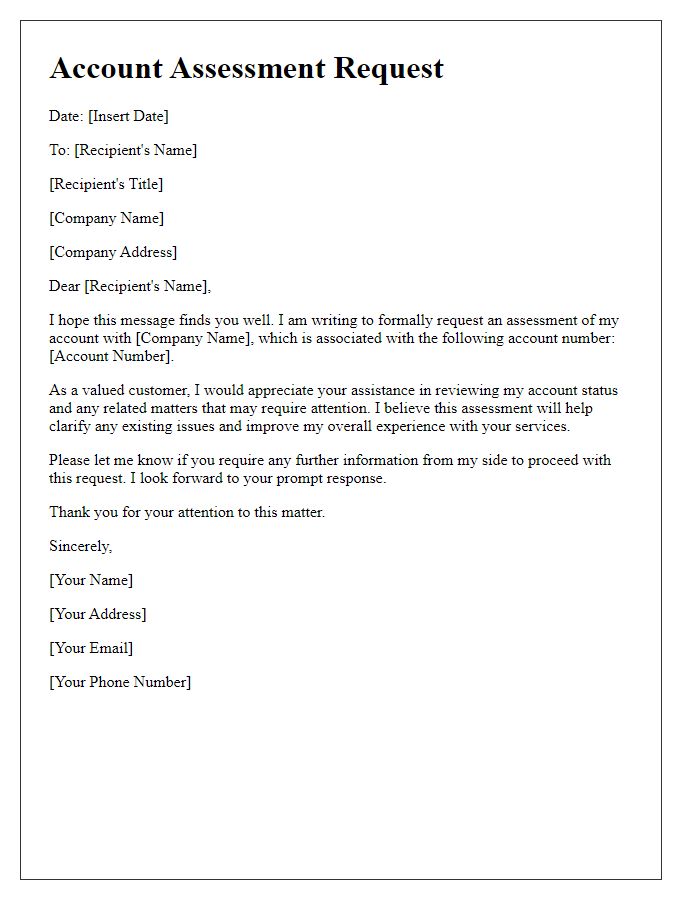

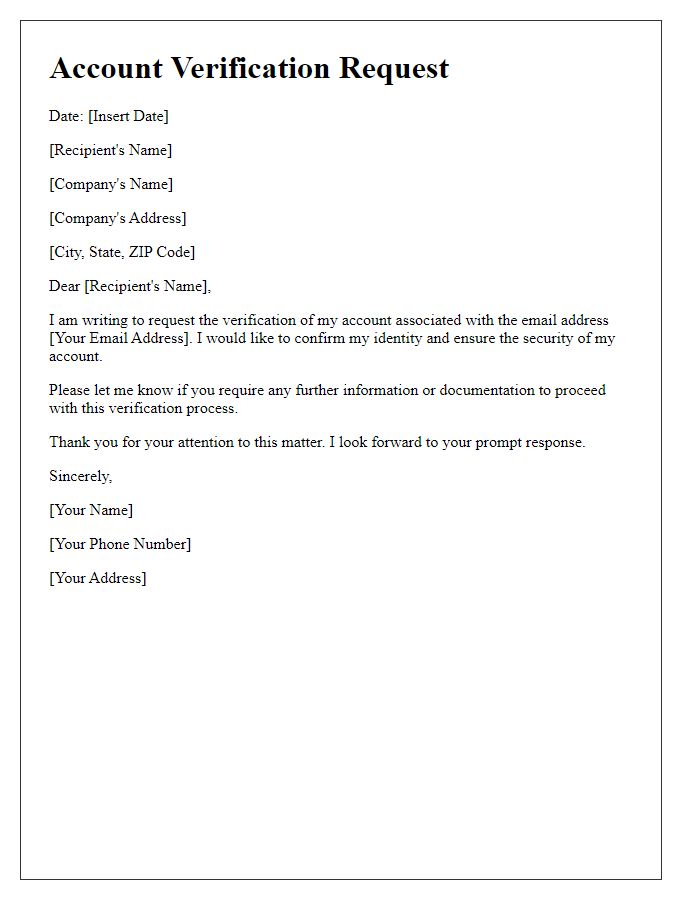

Personal information: Name, account number, and contact details.

A request for an account review often includes crucial personal information such as the individual's full name (for identification purposes), unique account number (which serves as a reference for the specific account in question), and contact details (such as email address and phone number) to facilitate communication regarding the review process. This information is essential for ensuring that the request is processed efficiently and that the individual can receive timely updates or necessary feedback regarding their account status.

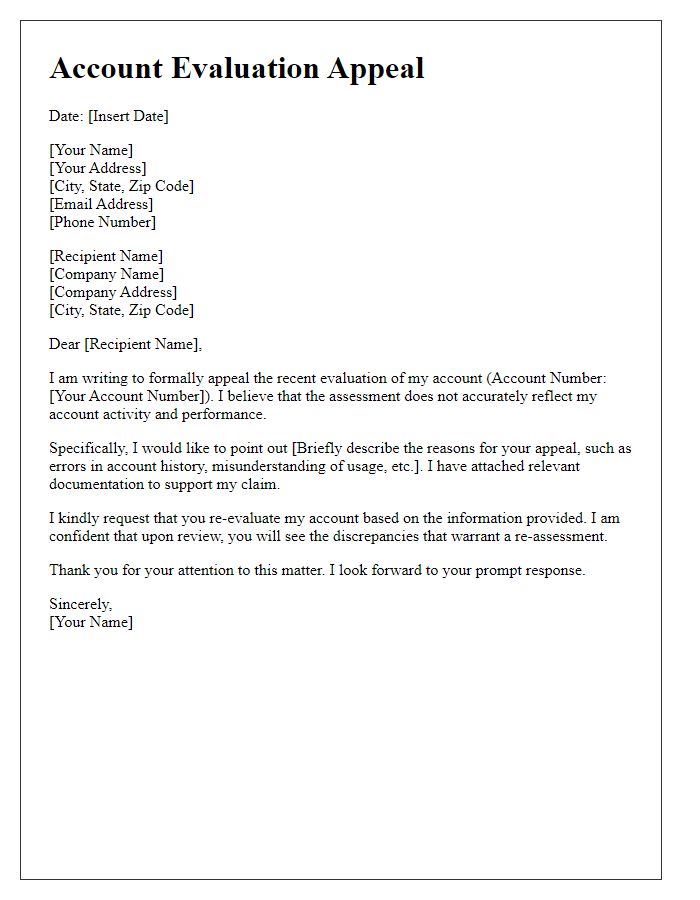

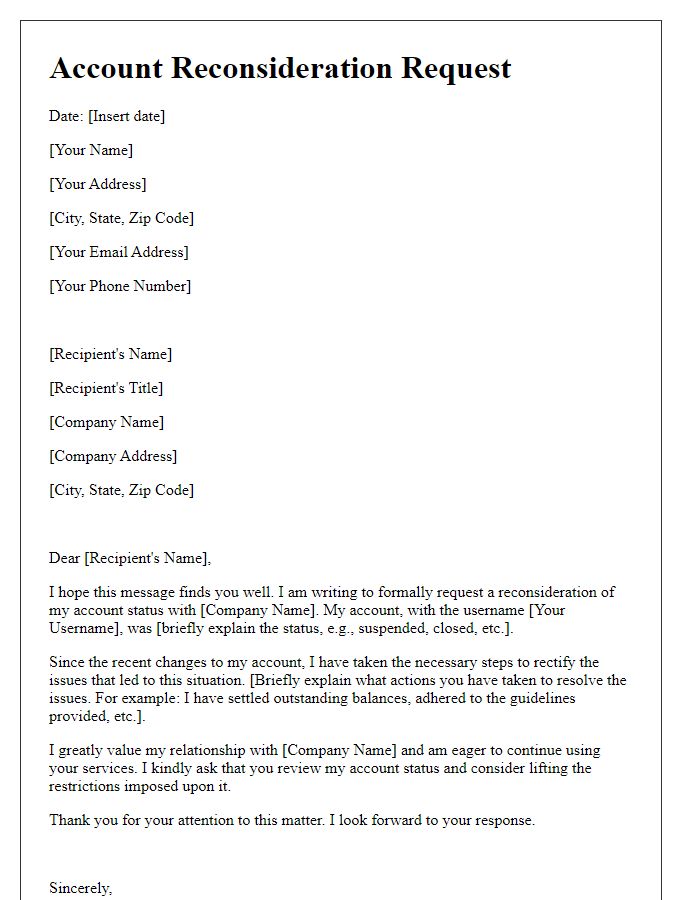

Specific request: State the purpose of the account review.

Requesting an account review is crucial for understanding financial standings and ensuring accurate information. This process allows individuals or businesses to assess account details, rectify discrepancies, and verify transaction histories. A comprehensive review may identify potential fraud or unauthorized transactions that could affect overall financial security. Account reviews facilitate improved budget planning, risk assessment, and compliance with financial regulations or company policies. Engaging with account managers or financial advisors during this review significantly enhances the ability to make informed decisions regarding future financial endeavors.

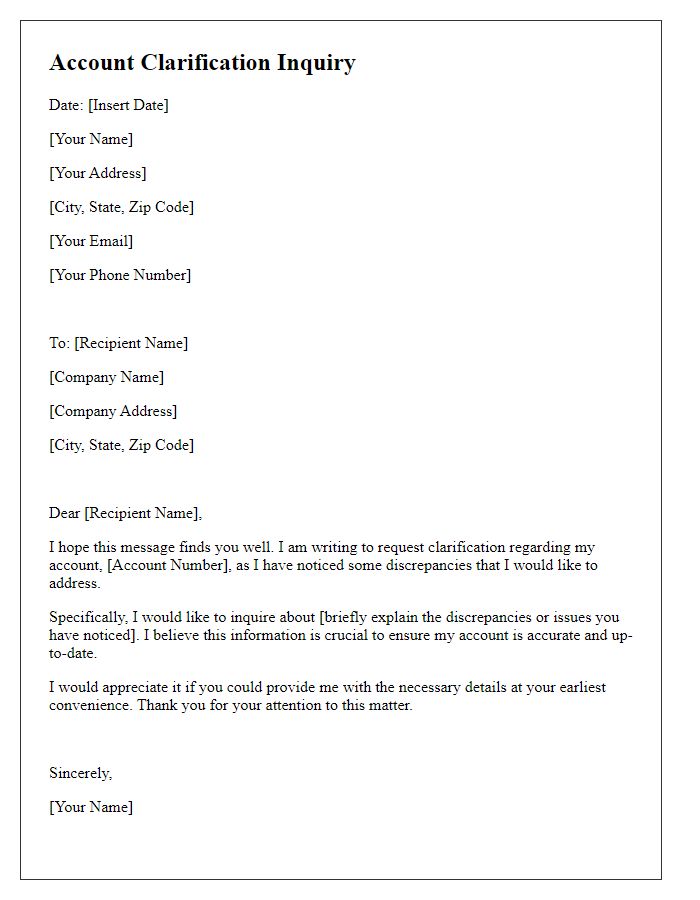

Supporting documents: Provide any required or helpful attachments.

An account review request typically requires a structured approach to ensure clarity and completeness. Supporting documents may include identification verification (such as a government-issued ID), financial statements (indicating the account's activity or anomalies over the last three months), correspondence copies (email exchanges related to the account issue), and any additional documentation (contracts, agreements relevant to the account). Each attachment should be clearly labeled and in commonly accepted formats (PDF or JPEG) to facilitate easy review by the recipient. Including a brief overview of each document's relevance can enhance understanding and expedite the evaluation process.

Timeframe: Desired response or review period.

For an account review request, a clear timeframe can significantly enhance the efficacy of the communication. Specify the desired response period, such as "within fourteen business days," to establish urgency. This timeframe allows sufficient time for processing while indicating the importance of a timely review. Moreover, including relevant account identifiers, like account number or user ID, can facilitate easier tracking and acknowledgment. Using timely follow-ups, such as reminders one week after the initial request, can help maintain momentum in securing the account review.

Polite closing: Thank the recipient and offer a follow-up method.

A request for account review typically involves appealing to customer service or administrative departments. This compares to instances where individuals might seek clarification on account status or seek a reinstatement due to specific reasons. Ensure clarity in your statements for effective communication. Following up with appropriate contact methods, like email or phone, enhances the likelihood of a timely response. Prompt and courteous interactions are vital in maintaining a positive rapport with the recipient.

Comments