Are you feeling overwhelmed by certain debts and unsure where to start? A debt validation request could be your first step toward regaining control and understanding your financial obligations better. In this article, we'll break down what a debt validation request is, why it's crucial for your financial health, and how to craft one effectively. So, let's dive into the process and empower you to take charge of your financial future!

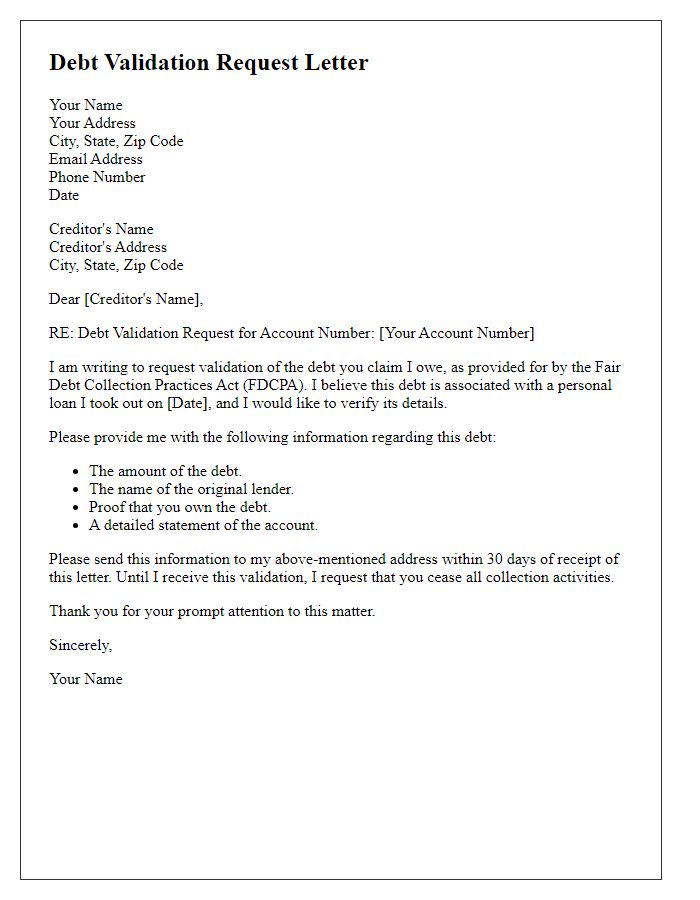

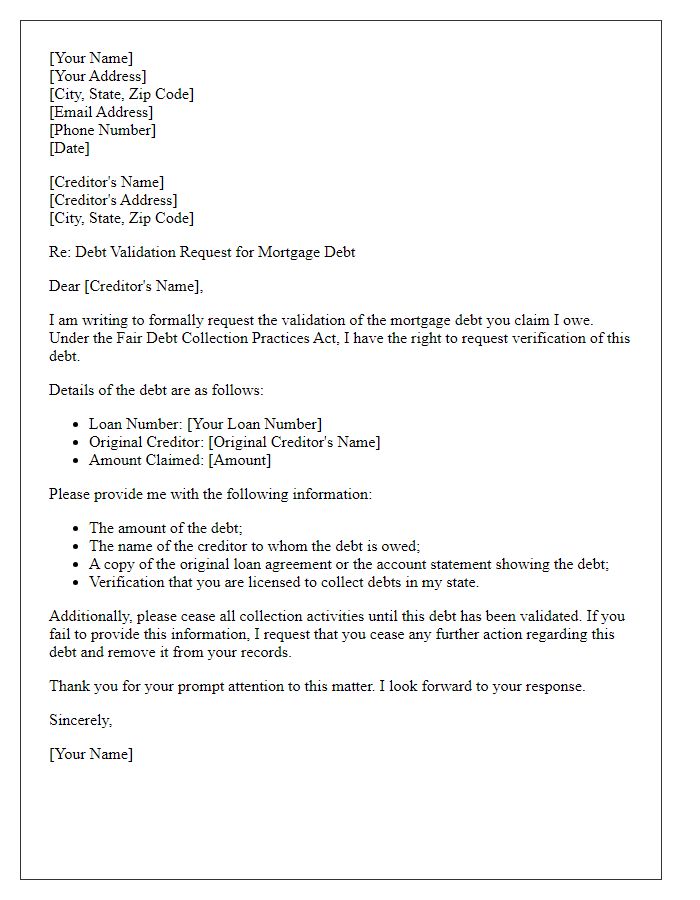

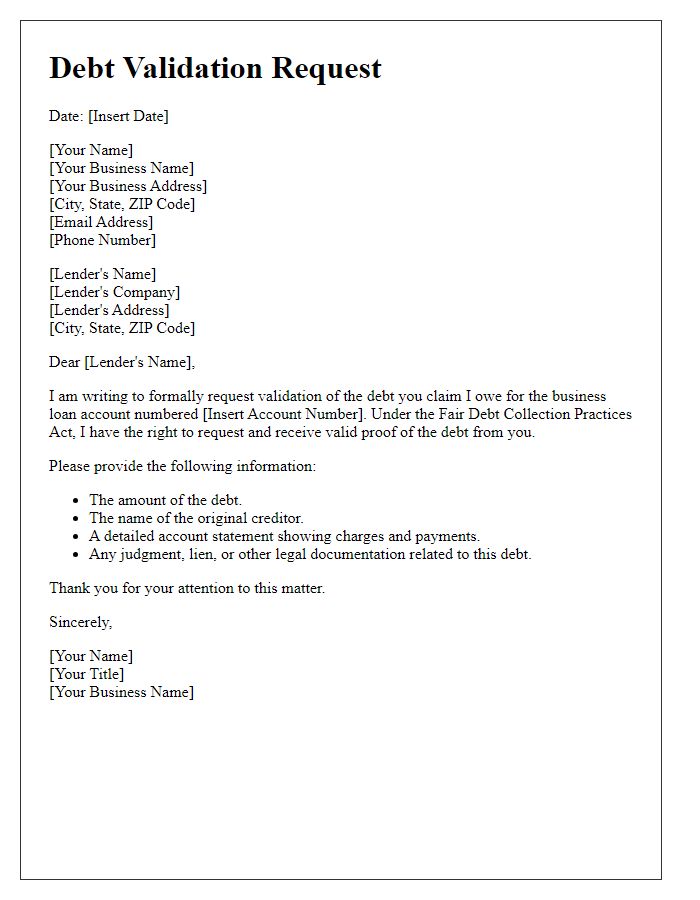

Creditor's Contact Details

When seeking validation of debt, it is essential to include the creditor's contact details clearly to facilitate communication. The creditor's full name, such as "XYZ Financial Services," should be mentioned alongside their physical address, like "123 Business Avenue, Suite 456, Cityville, ST, 78901." Additionally, including a dedicated phone number, such as "(555) 123-4567," and an email address, like "support@xyzfinancial.com," enhances the request's legitimacy. Also, mention the account number associated with the debt, like "Account #987654321," for easy reference. This comprehensive inclusion ensures that the creditor can promptly identify and respond to the validation request effectively.

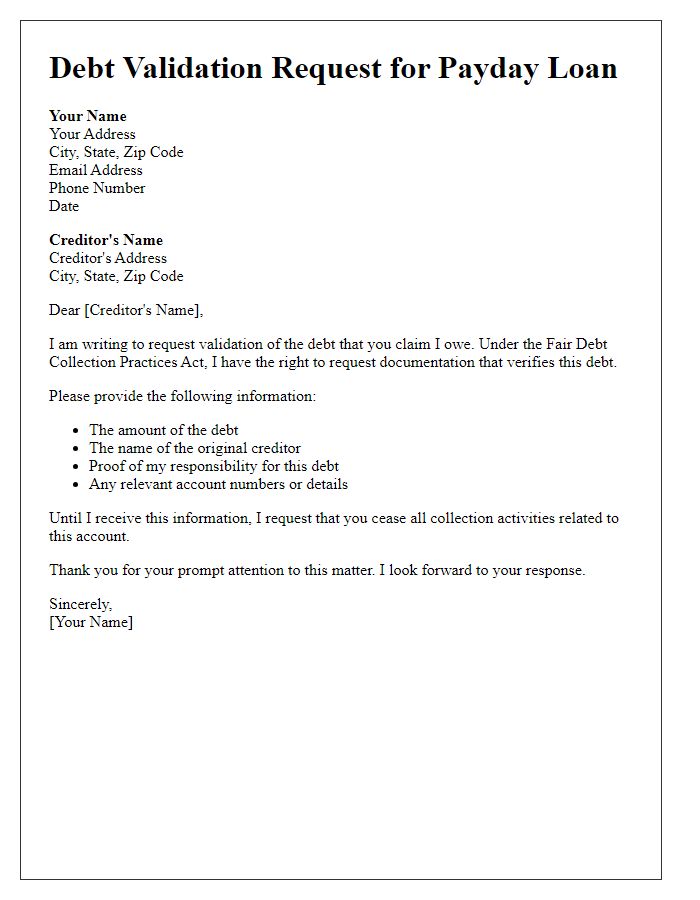

Debtor's Account Information

Valuation of debt validation requests requires the inclusion of specific debtor's account information, such as the debtor's full name, associated account number, and current balance. Providing documentation that specifies the original creditor's details is crucial, along with the date of the debt's origination and any relevant transaction history. Including proof of the debt's assignment from the original creditor to the current collector can substantiate legitimacy. A clear request for verification under section 809 of the Fair Debt Collection Practices Act should also be made, emphasizing the debtor's right to dispute the debt before proceeding with any payments. This structured approach enhances clarity and accountability in debt negotiation processes.

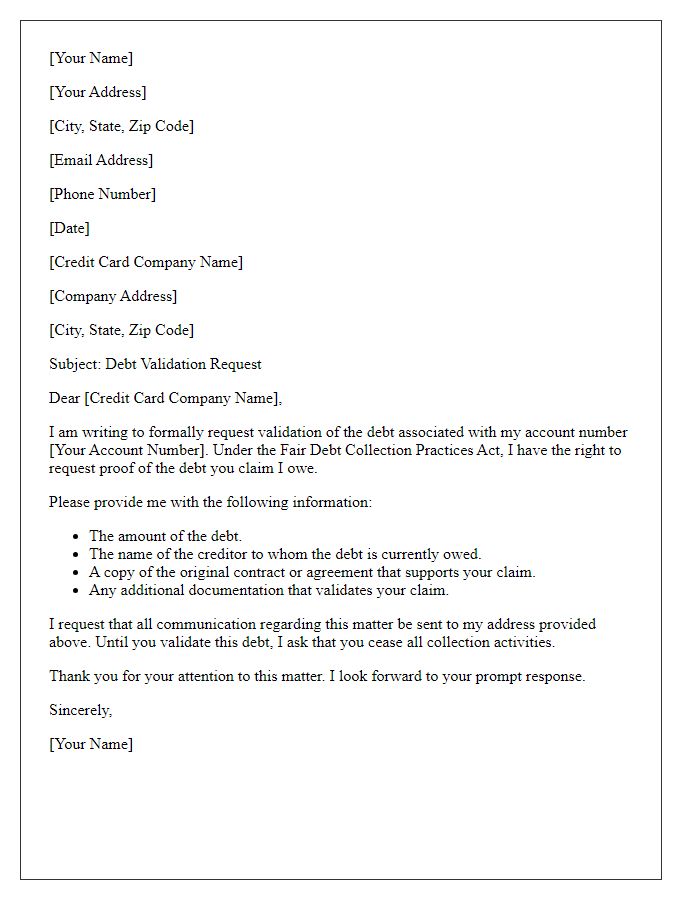

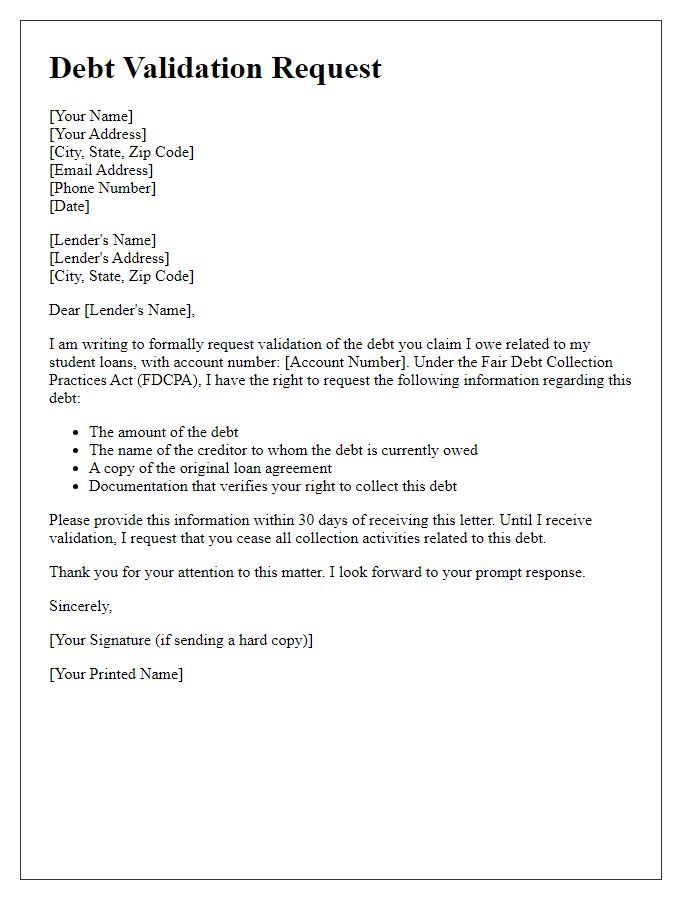

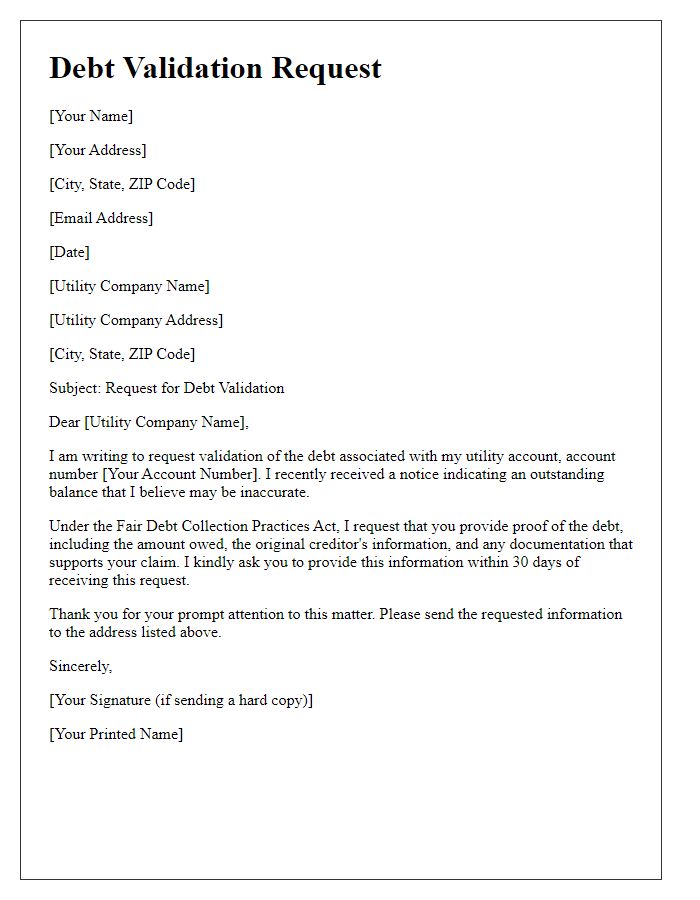

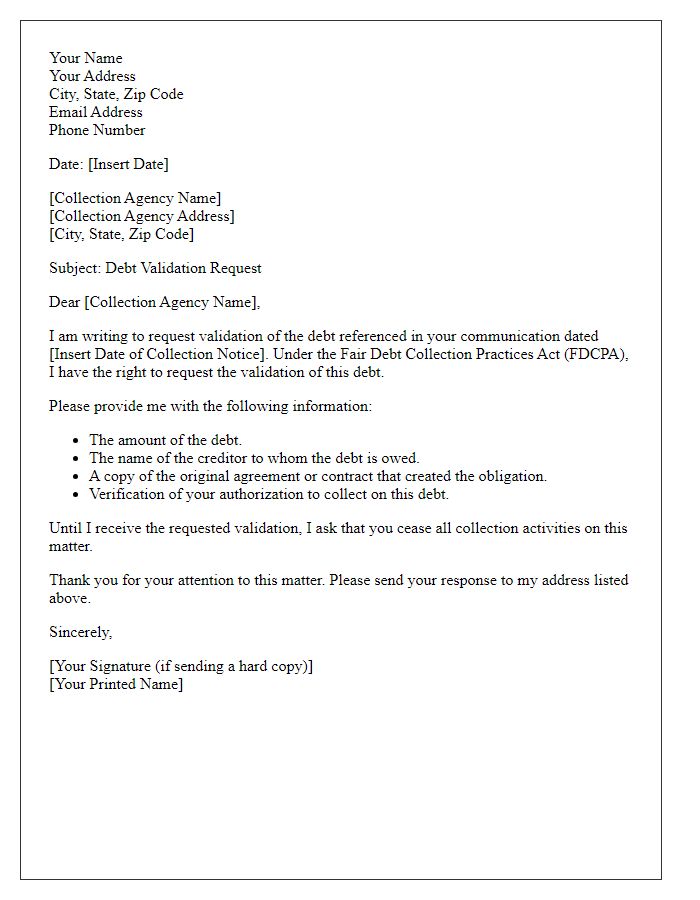

Formal Request Statement

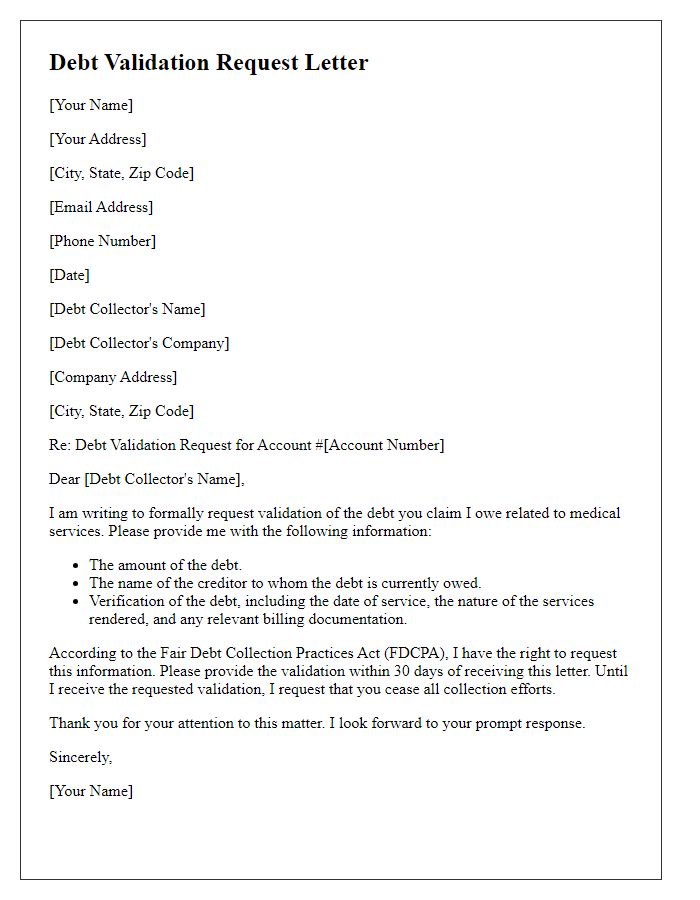

A formal request for debt validation involves an individual seeking confirmation regarding the legitimacy of a debt owed. Under the Fair Debt Collection Practices Act (FDCPA), consumers may request documentation to validate debts, especially if the outstanding amount is significant, such as over $1,000. This request typically involves providing personal identification details, the name of the creditor, and any account numbers associated with the debt. The consumer is entitled to receive proof, such as a statement of account, a copy of the original signed agreement, or any legal documents substantiating the debt. The timeframe for creditors to respond can be 30 days from the receipt of the request, which ensures consumers can verify accuracy before making any payments.

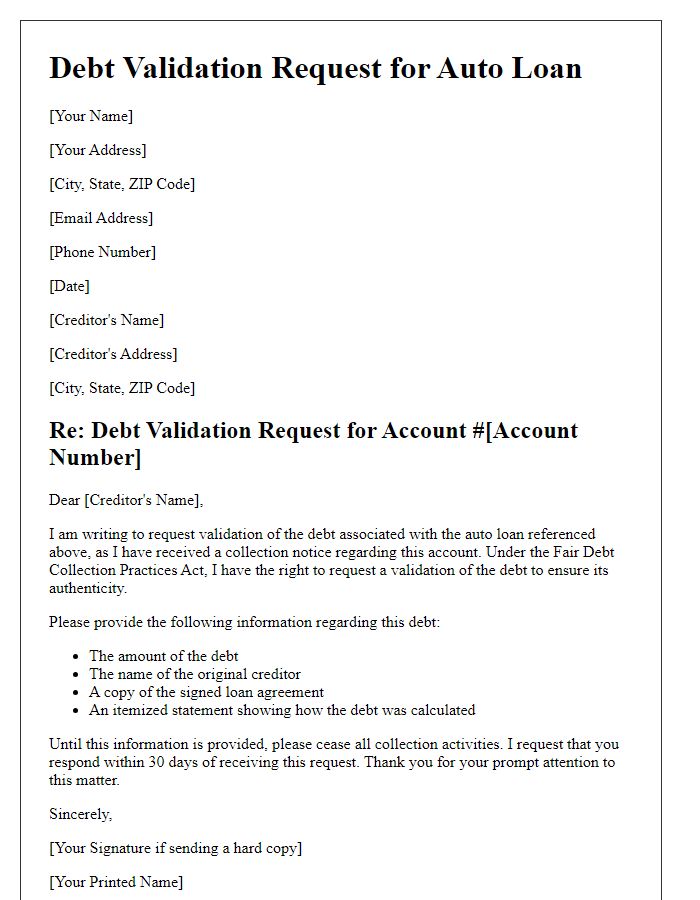

Debt Validation Regulations

Debt validation requests are governed by the Fair Debt Collection Practices Act (FDCPA), requiring debt collectors to provide validation upon request within five days of initial communication. This regulation mandates clear identification of the debt, including the amount owed, the name of the creditor, and relevant documentation supporting the claim. Failure to provide this information can result in changes to debt collection practices and potential legal repercussions for the collector. Individuals seeking validation must submit requests to the collector in writing, detailing the original debt agreement and any discrepancies noted in the account. Timely responses are critical, ensuring compliance with the law and protecting consumer rights successfully.

Response Deadline and Instructions

When addressing a validation of debt request, the response deadline is crucial. According to the Fair Debt Collection Practices Act (FDCPA), creditors must respond within thirty days of receiving the request. The letter should include specific instructions for the recipient. These instructions may encompass how to submit the response, acceptable formats (such as email or physical mail), and required documentation (like proof of the alleged debt). Additionally, references to jurisdictional rules (such as local consumer protection laws) can provide further context on the process. Ensuring clarity in communication enhances compliance and establishes an understanding of the rights and responsibilities of both parties involved in the debt validation process.

Comments