Are you feeling overwhelmed by your current loan terms? If so, you're not alone â many borrowers find themselves in situations where a loan modification can provide much-needed relief. In this article, we'll guide you through the essential steps on how to craft an effective loan modification request letter. So, keep reading to discover the best tips and strategies that can help you navigate this process with confidence!

Borrower's Personal Information

Submitting a loan modification request requires specific personal information from the borrower to facilitate assessment and processing. The borrower's full name, including middle initials, is crucial for identification. The primary address, including city, state, and ZIP code, helps locate the property tied to the mortgage. A contact phone number ensures direct communication for any follow-up questions. Additionally, including the borrower's email address provides an alternate communication method. It is also important to include loan details, such as the loan number, servicer name, and any relevant account information, to expedite the review process and maintain accurate records. Including any co-borrower's information, if applicable, ensures all parties are recognized in the application.

Loan Details

To successfully navigate the loan modification process, understanding key loan details is crucial. Loan Modification refers to a change in the original terms of the mortgage agreement, typically to achieve a more manageable monthly payment. Principal amount represents the total borrowed sum, often in the hundreds of thousands of dollars, requiring diligence in negotiation. Interest Rates, often expressed as an annual percentage, can significantly impact payment amounts; for example, a reduction from 6% to 4% can lead to substantial savings. Loan servicer is the financial institution handling the mortgage, while the loan number is a unique identifier that allows tracking of the loan's status and history. Default status indicates missed payments, which can lead to foreclosure if unresolved. Clarifying these details enables homeowners to present a compelling case for modification.

Hardship Explanation

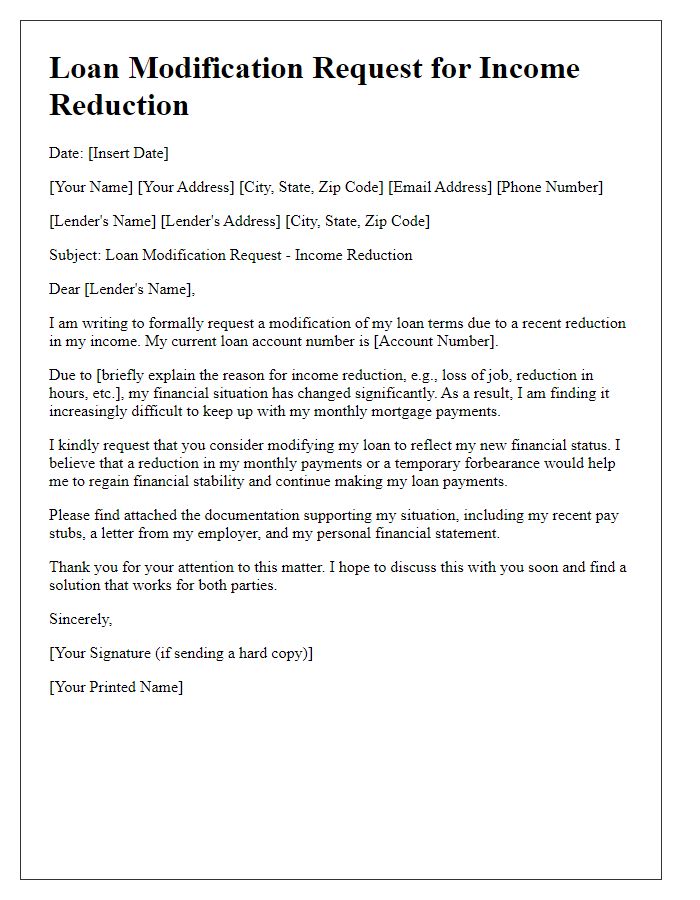

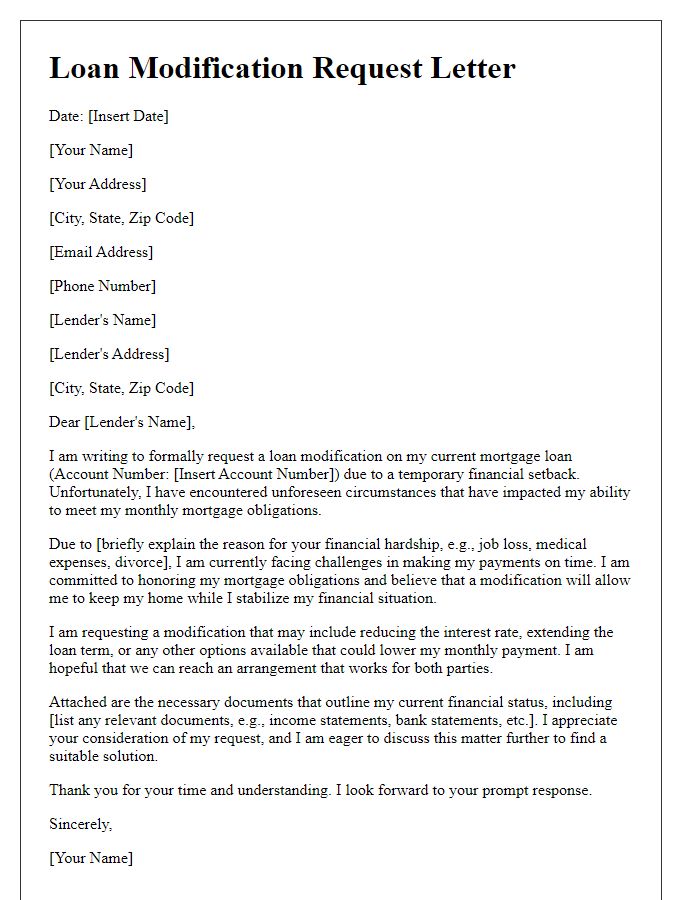

Homeowners facing financial difficulties may submit a loan modification request to their lender, detailing the specific circumstances leading to their hardship. Loss of income due to job termination, for instance, can drastically impact the ability to make monthly mortgage payments, especially if the individual is residing in high-cost areas such as San Francisco or New York City, where housing expenses exceed median income levels. Medical emergencies, unexpected repairs, or increases in living costs can amplify the strain on household budgets. The homeowner may outline these factors in a succinct format, explaining how each element contributes to their inability to meet current loan obligations while expressing a commitment to remain in the property and fulfill future payment responsibilities, potentially benefiting from reduced interest rates or extended repayment terms through the loan modification process.

Requested Modification Terms

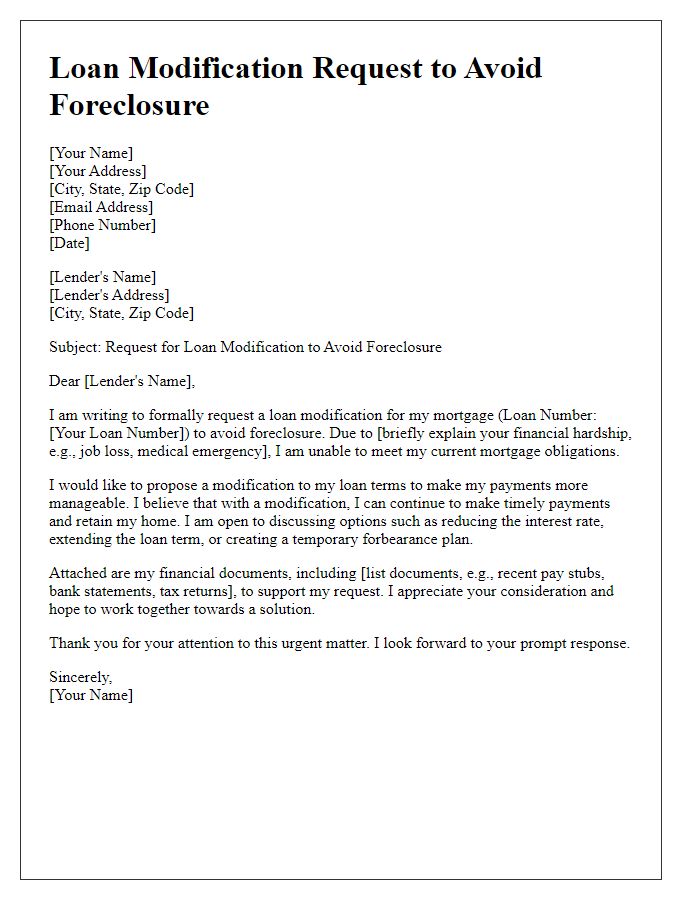

A loan modification request typically includes specific modifications aimed at adjusting loan terms to enhance affordability. Commonly requested modifications may consist of a reduction in interest rate (to as low as 2% in some cases), an extension of the loan term (up to 40 years for certain programs), or a temporary forbearance period (lasting 3 to 12 months), allowing a pause on payments. Homeowners may seek to capitalize late fees or missed payments into the new loan balance as part of the modification process, which could increase the principal but may prevent foreclosure. Documentation such as financial statements, income verification, and a hardship letter are often required to support these requests.

Supporting Documentation

Loan modification requests often require supporting documentation to ensure a thorough review by the lender. Key documents include recent pay stubs (showing current income levels), bank statements (detailing financial health over the past few months), tax returns (usually for the past two years), and a hardship letter (explaining specific reasons for financial difficulties). Additional information may include a current mortgage statement (indicating remaining balance and payment history) along with a budget analysis (showcasing monthly expenses and income). Providing a comprehensive collection of these documents can significantly impact the lender's evaluation process.

Letter Template For Loan Modification Request Samples

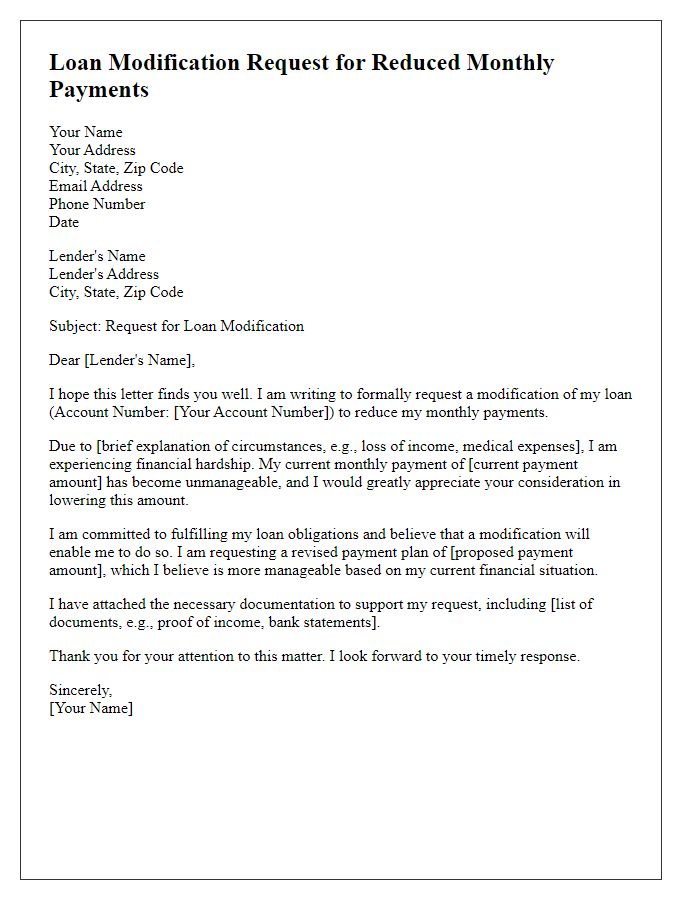

Letter template of Loan Modification Request for Reduced Monthly Payments

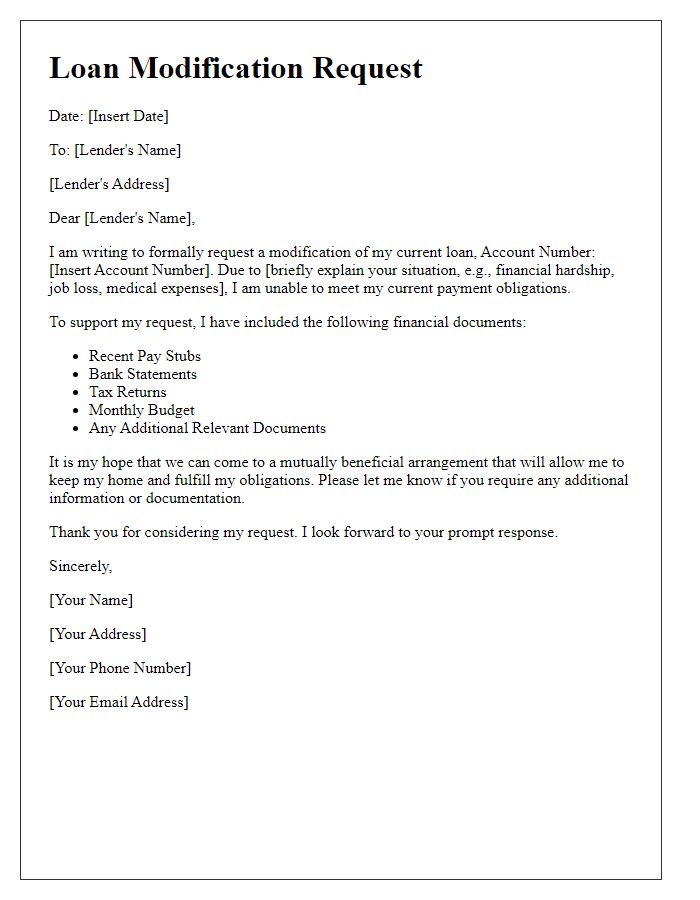

Letter template of Loan Modification Request with Supporting Financial Documents

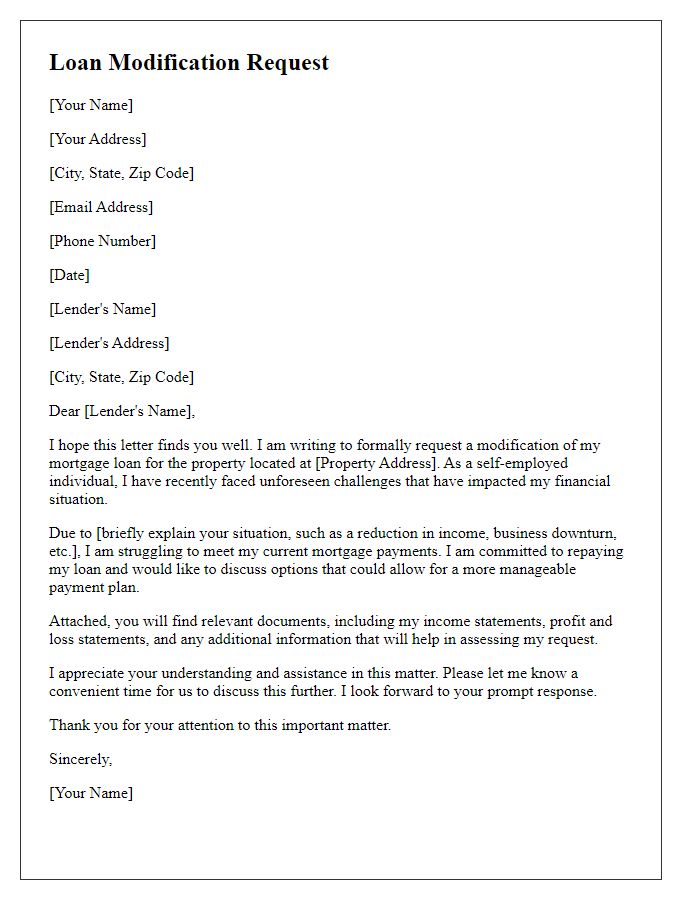

Letter template of Loan Modification Request for Self-Employed Individuals

Letter template of Loan Modification Request for Divorce-Related Financial Changes

Comments