Are you considering asking for a credit limit increase but unsure how to articulate your request? Writing a compelling letter doesn't have to be daunting; it's all about presenting your case clearly and confidently. In this article, we'll guide you through an effective letter template that highlights your financial responsibility and creditworthiness. Let's dive in and help you make that request with ease!

Personal Information

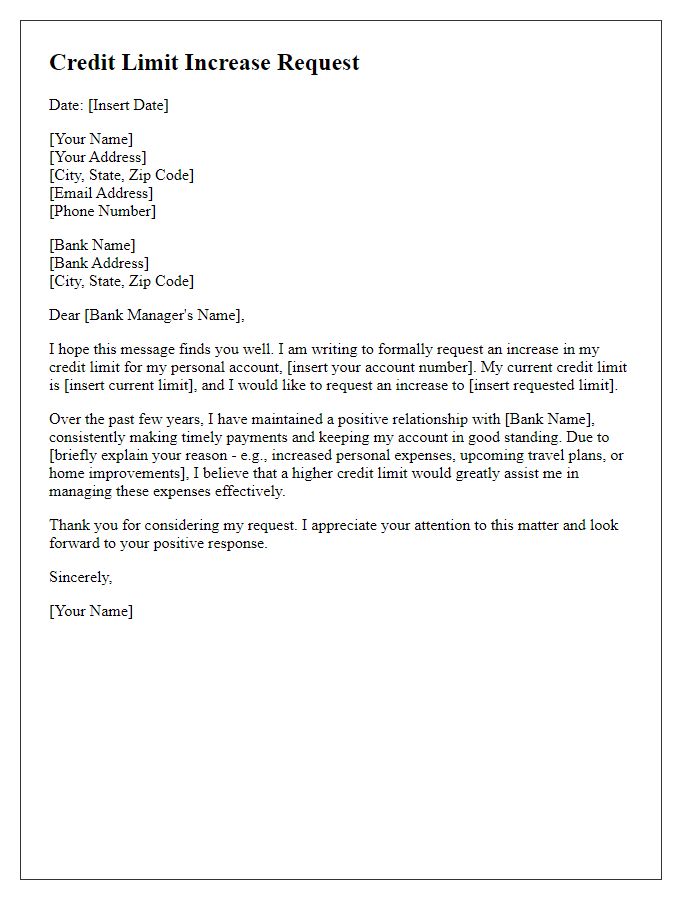

Many individuals seek a credit limit increase to enhance their purchasing power and improve their credit utilization ratio. Personal information plays a vital role in this request. Key details include full name (important for credit record matching), current address (for verification purposes), date of birth (to establish identity), Social Security Number (for credit assessment), and employment status (to gauge income stability). It is essential to provide accurate financial information, such as annual income (impacting creditworthiness), existing debts (affecting credit utilization), and any recent positive changes like promotions or additional income sources (which bolster the case for the increase). Banks and credit unions, such as Chase or Bank of America, often require this information for a thorough evaluation of the customer's financial situation before approving the credit limit increase.

Account Details

A credit limit increase request often relates to various factors, including financial changes and account performance. For instance, consumers with an account balance of $5,000 and a current credit limit of $10,000 may seek to increase their limit to $15,000 due to a recent salary raise or increased monthly expenses. Many financial institutions require a good payment history over the past 12 months, ideally with no late payments, which would enhance the chances of approval. Additionally, credit utilization rates below 30% are typically favorable; for example, using only $2,000 of a $10,000 limit demonstrates responsible financial management. Notably, certain institutions may also conduct a hard inquiry, examining the individual's credit score, which ideally should be over 700 for better chances of approval.

Reason for Increase

A credit limit increase can enhance financial flexibility for responsible consumers. Various reasons exist for requesting an increase, such as significant life events like a job promotion or a new role, which could lead to increased earnings. Additionally, major expenses like purchasing a car or funding education can necessitate higher credit availability. Consumers may also seek an increase to improve credit utilization ratio (the percentage of available credit being used), positively impacting credit scores. Furthermore, financial stability demonstrated by timely repayments over several months can serve as a solid basis for an increase request, showcasing trustworthiness to lenders, such as major banks or retail credit card companies.

Income and Financial Status

A credit limit increase request outlines changes in income and financial status, which can significantly impact creditworthiness. A strong increase in monthly income, such as a transition from $50,000 to $70,000 annually, demonstrates financial stability. Additionally, a decrease in monthly liabilities, such as reducing debt from $5,000 to $2,000, improves the debt-to-income ratio, enhancing credit application strength. Consistent payment histories on existing accounts, like a perfect payment track record over 24 months, also play a crucial role. Factors such as employment status (a recent promotion) and overall savings (increasing emergency funds to $10,000) further establish a financially sound case for requesting a credit limit increase from a financial institution.

Closing and Contact Information

A credit limit increase request may require specific closing and contact information details for efficient processing. Include the sender's full name (like John Doe), residential address (such as 123 Elm Street, Springfield), and contact number (e.g., 555-123-4567). Specify the date of the request (October 5, 2023) for reference. Include the email address (john.doe@email.com) for digital correspondence. Consider mentioning the account number (e.g., 987654321) for the credit account being referenced, ensuring all necessary details are clearly presented, facilitating a smoother communication process.

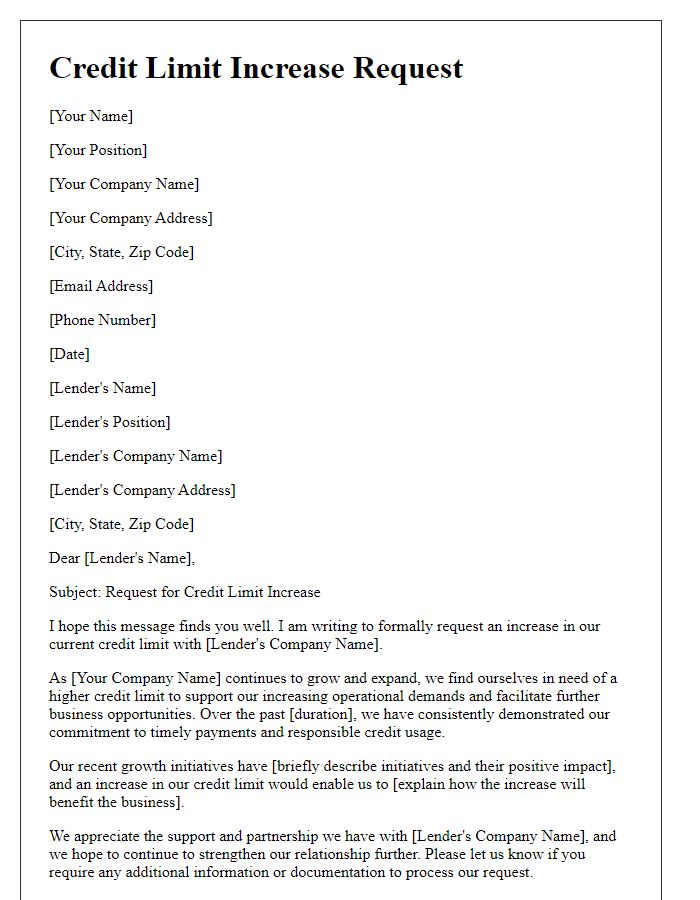

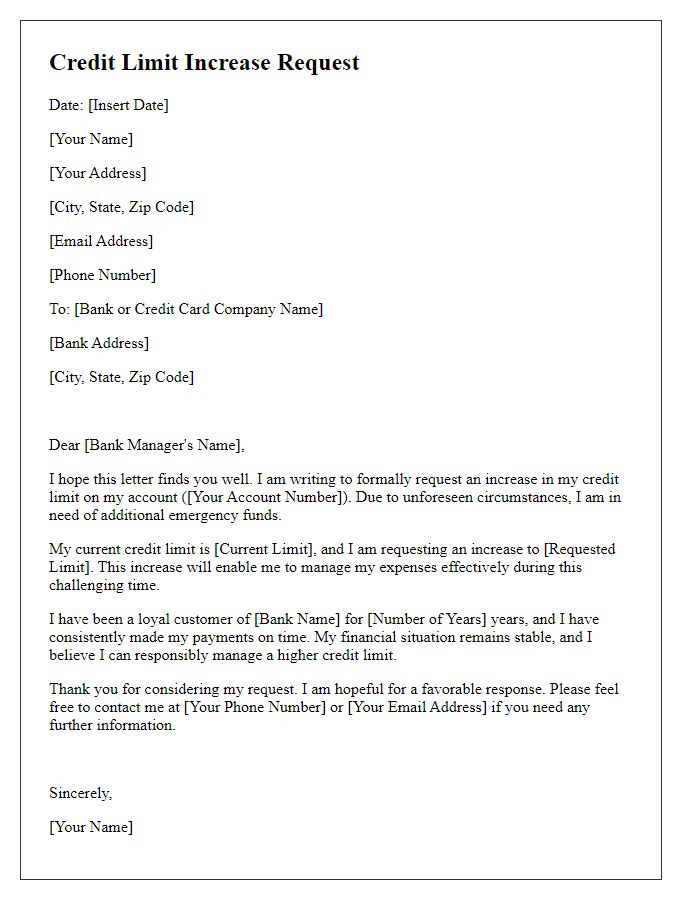

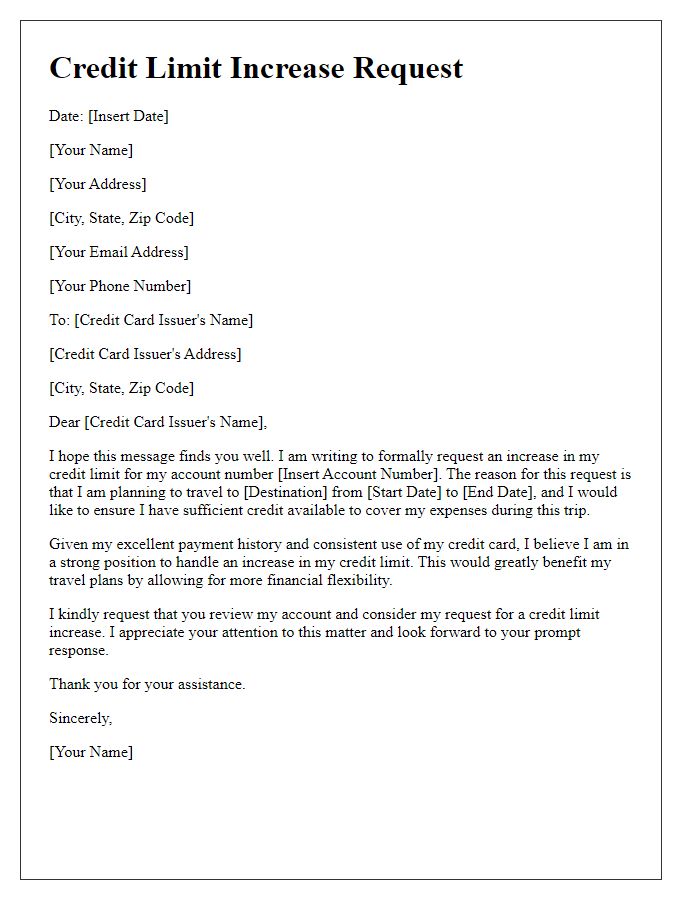

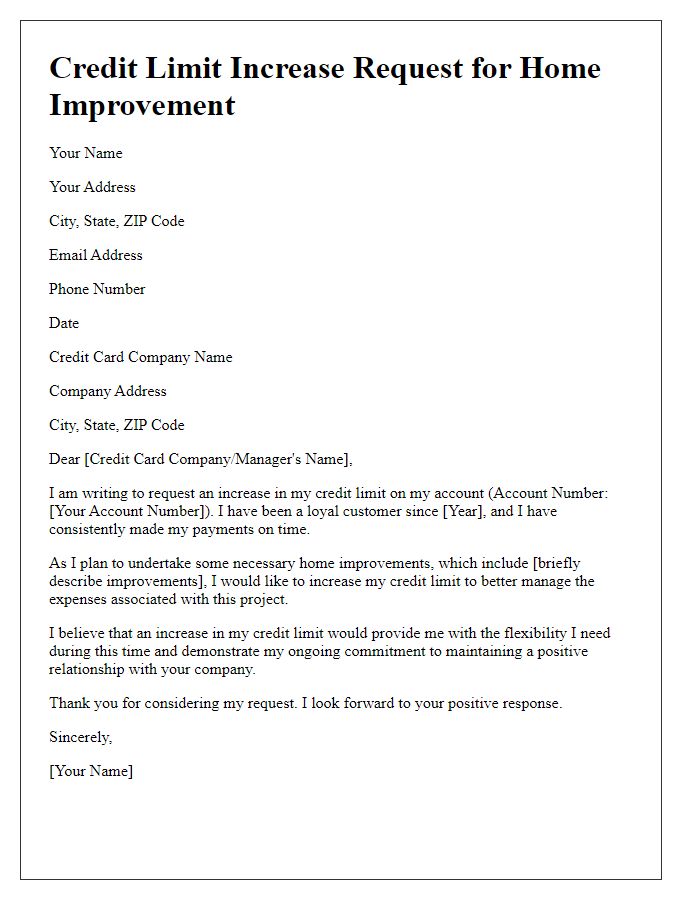

Letter Template For Credit Limit Increase Request Samples

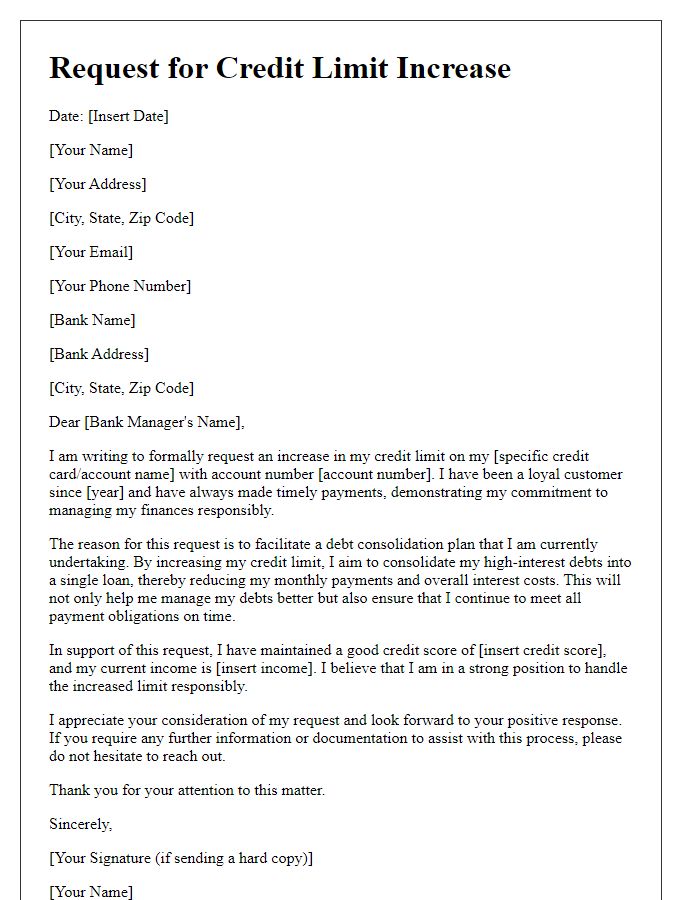

Letter template of credit limit increase request for debt consolidation.

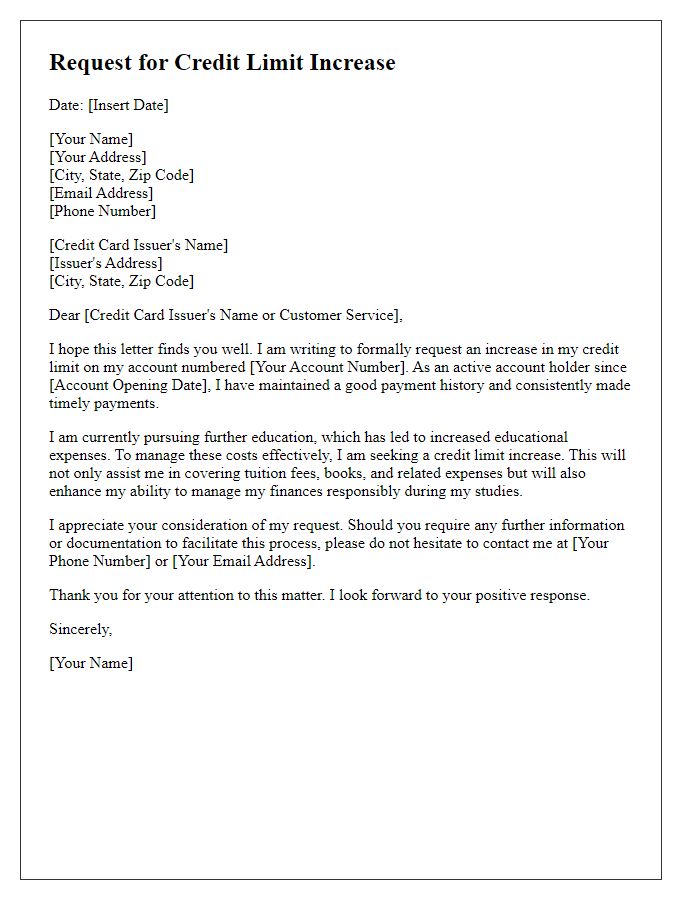

Letter template of credit limit increase request for educational expenses.

Comments