Are you considering leaving a lasting legacy through a charitable bequest? This heartfelt decision not only reflects your values but also supports the causes you care deeply about. In our latest article, we provide a simple yet impactful letter template to notify organizations of your generous intentions. Join us as we explore how you can make a difference - read more to discover the steps involved!

Beneficiary details

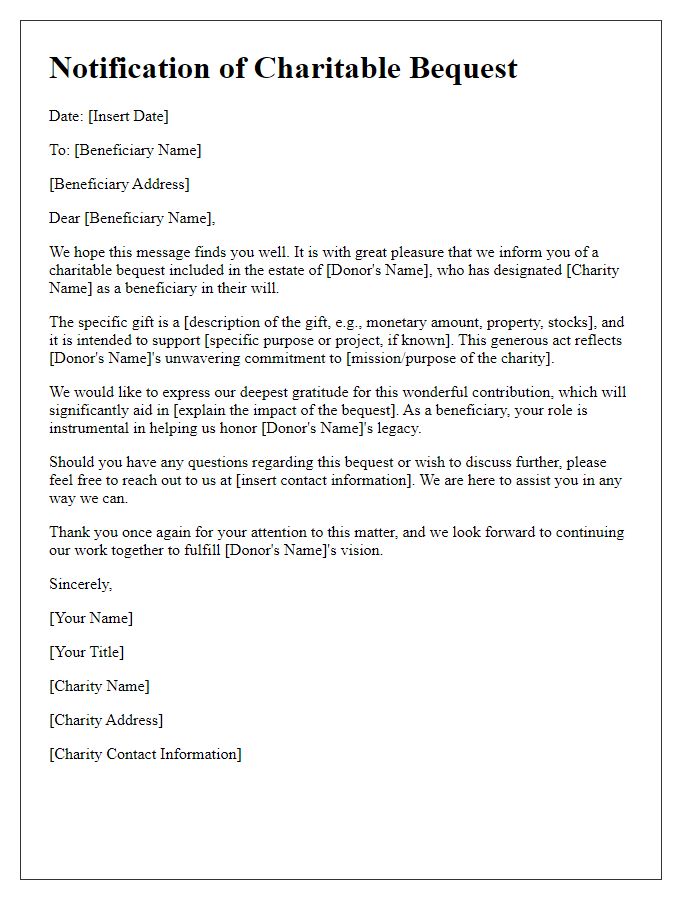

A charitable bequest notification provides essential details about the intended beneficiary organization. Such organizations like the American Red Cross or the World Wildlife Fund play critical roles in humanitarian efforts or environmental preservation. This notification should include the name of the organization, its registered charitable status (such as 501(c)(3) in the United States), and the specific purpose of the donation, whether for general support or a designated project like disaster relief or wildlife conservation efforts. Additionally, including the address of the organization ensures proper routing and allocation of the funds. This information not only clarifies the donor's intent but also emphasizes the impact of the charitable contribution on the chosen causes.

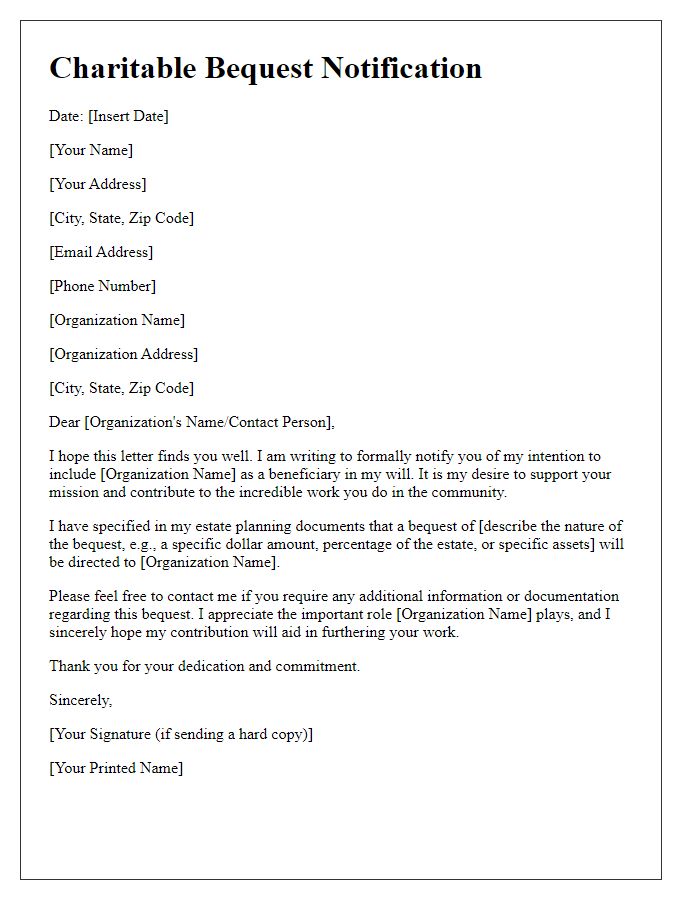

Charitable organization's name and address

Charitable organizations, such as the American Red Cross (located at 431 18th St NW, Washington, DC 20006), play a vital role in providing humanitarian aid and disaster relief. Many individuals consider leaving a bequest as a meaningful part of their legacy. A bequest notification informs the organization of the donor's intention to include it in their estate plan, potentially impacting future funding for essential programs and services. This notification can highlight specific funds or projects intended to benefit from the bequest, offering clarity on how the donation will enhance the organization's mission.

Personal message or reason for the bequest

A charitable bequest notification serves to inform a nonprofit organization of a planned gift made through an estate or will. Individuals often feel compelled to provide details about their motivation for this act, emphasizing values such as social impact or community welfare. This personal message may reflect a connection to specific programs or individuals associated with the organization, often highlighting past positive experiences. For many, the choice is driven by a deep-seated desire to leave a lasting legacy, ensuring that future generations benefit from the organization's mission. Such messages may include mention of significant events, financial figures, or personal stories that have inspired the decision to contribute, fostering a sense of purpose and shared vision for the organization's future goals.

Specific amount or percentage of estate

Charitable bequests significantly impact non-profit organizations. Designating a specific amount or percentage of an estate to a charitable organization provides financial stability and encourages future projects. A charitable bequest might involve allocating a set sum, for example, $10,000, to a local food bank, ensuring essential resources for community support services. Alternatively, designating 10% of an estate to a children's education fund can enable scholarships for underprivileged students. Communication of such intentions can be documented through a will or trust, outlining the donor's wishes for the benefit of future generations. This planned giving approach fosters a legacy of generosity and philanthropy.

Instructions for use of the bequest

Ensuring that charitable bequests are allocated effectively can significantly impact nonprofit organizations, like the American Red Cross or local animal shelters. A clear notification process outlines specific instructions for the intended use of the bequest, often based on the donor's wishes. For instance, a bequest of $100,000 might be designated for emergency relief services, while another of $50,000 could support community education programs. Documentation like the donor's letter should explicitly reference relevant events or campaigns, such as the annual fundraising gala or specific outreach initiatives, allowing the charity to honor the donor's legacy while maximizing the benefits of the contribution. Transparency and clarity in these directives enhance the organization's ability to fulfill its mission effectively.

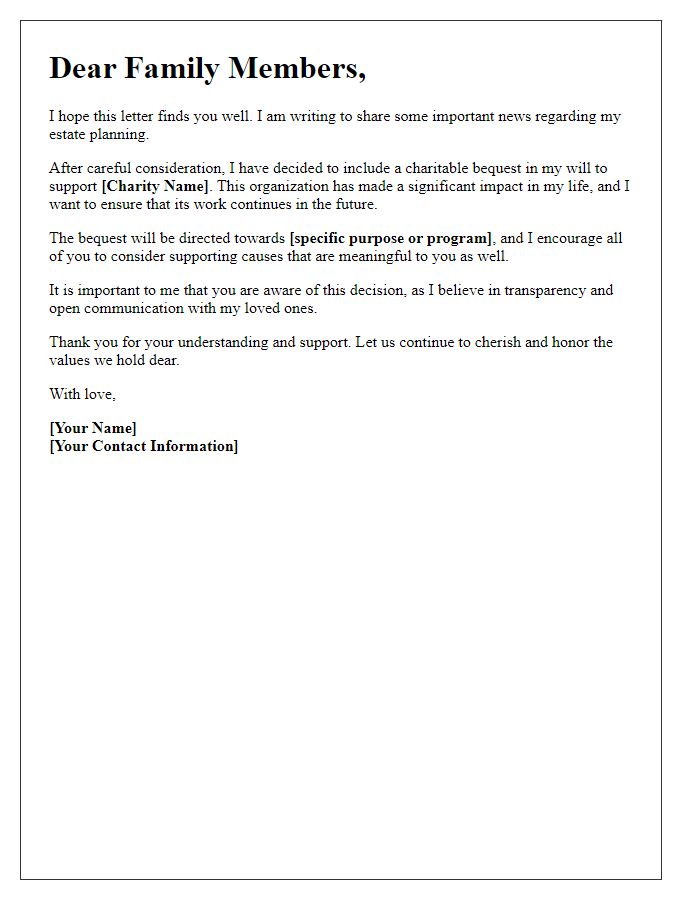

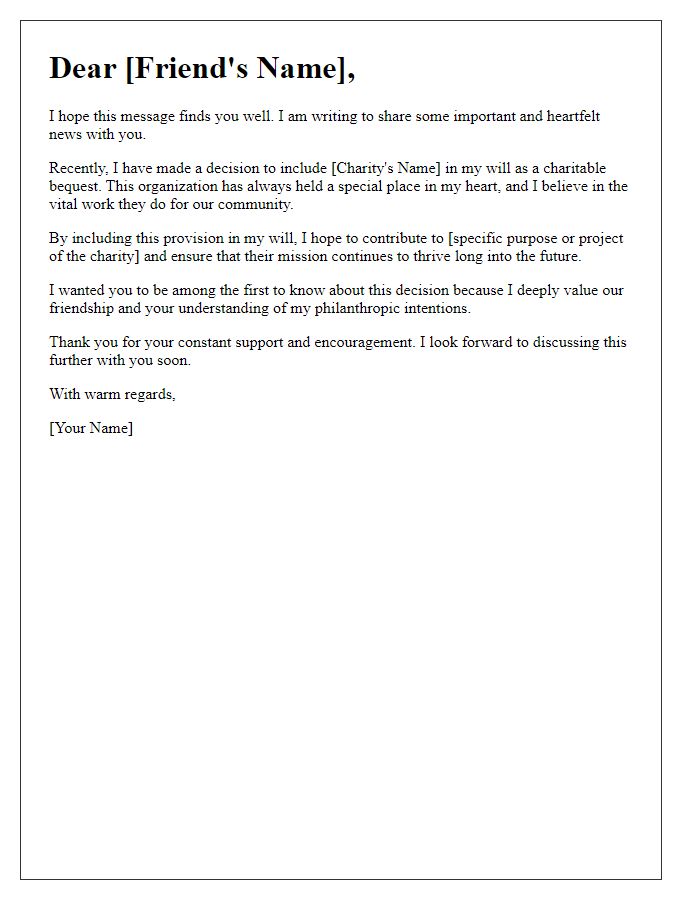

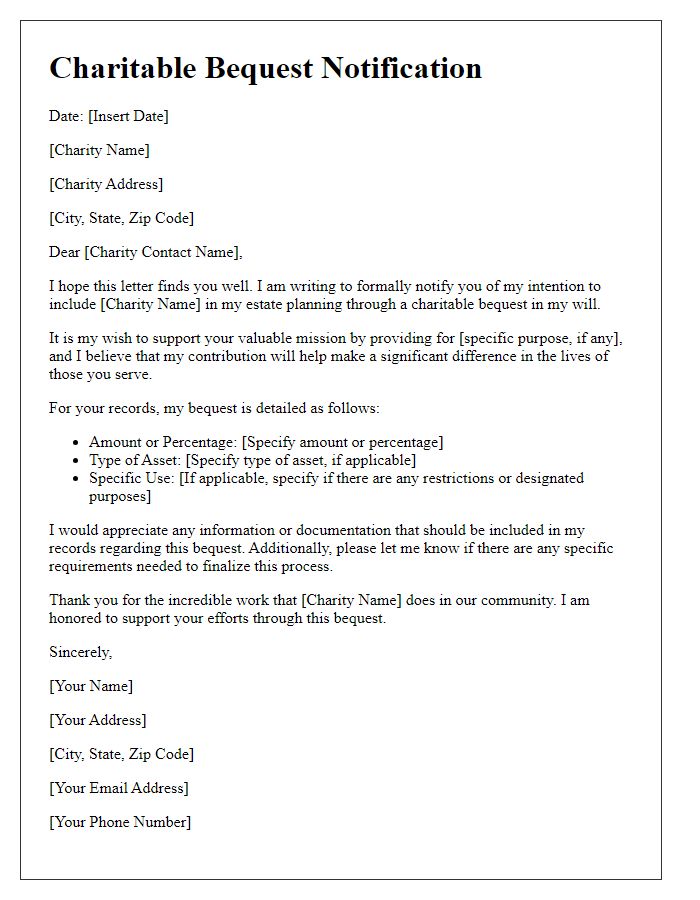

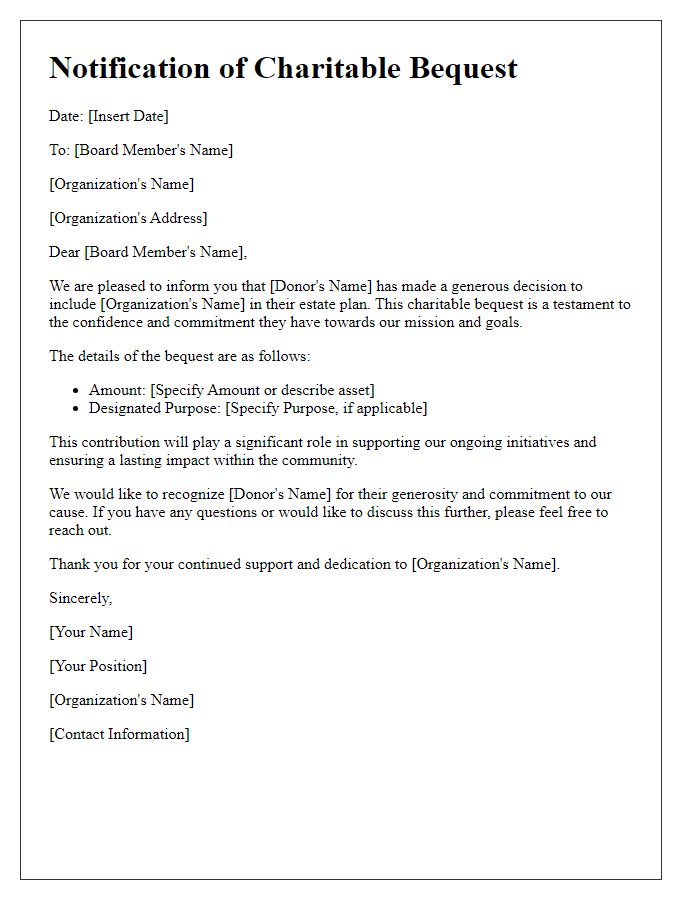

Letter Template For Charitable Bequest Notification Samples

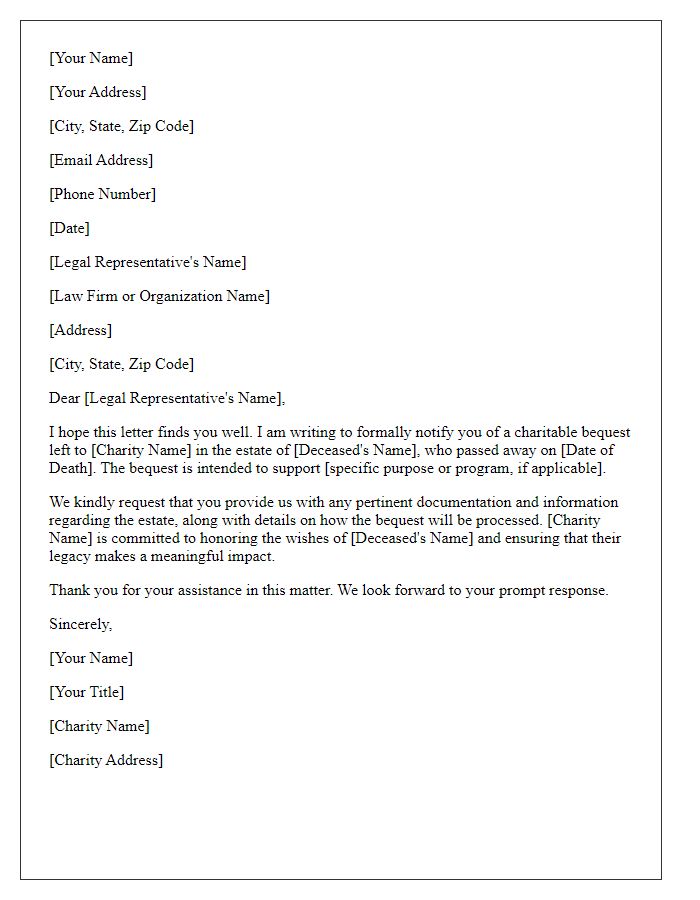

Letter template of charitable bequest notification for legal representatives.

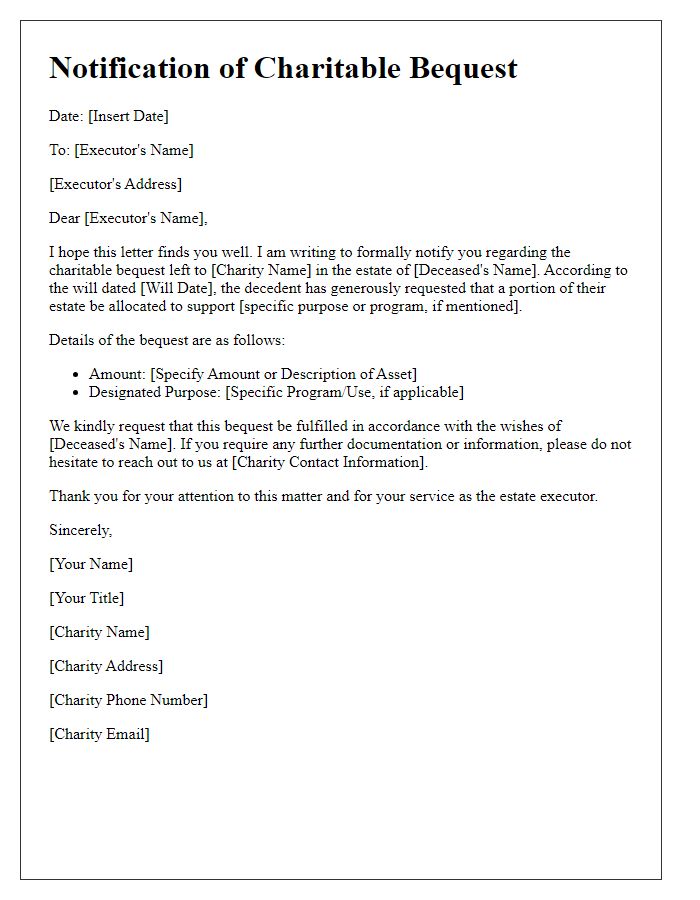

Letter template of charitable bequest notification for estate executors.

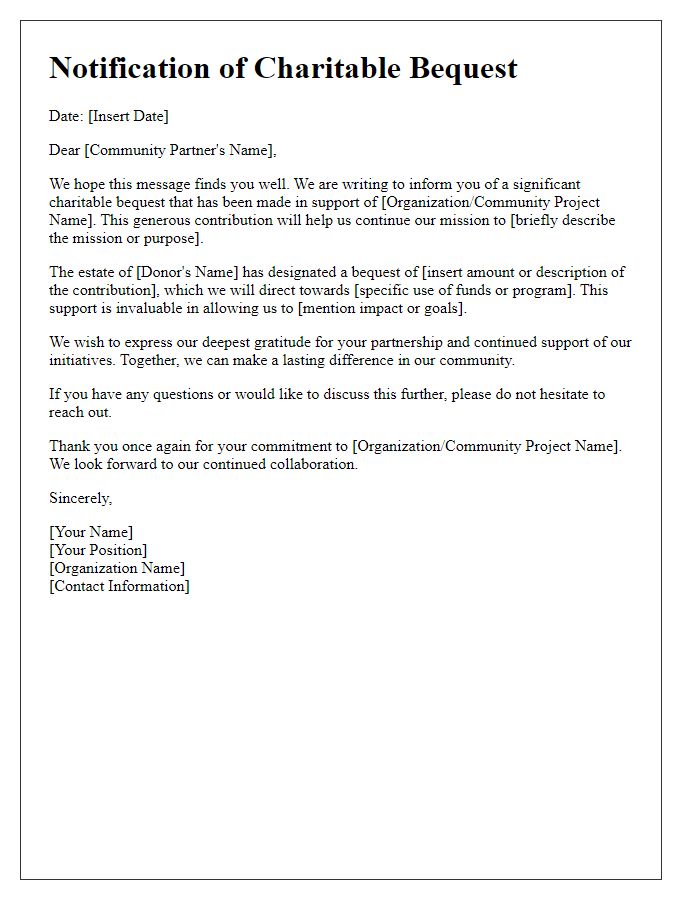

Letter template of charitable bequest notification for community partners.

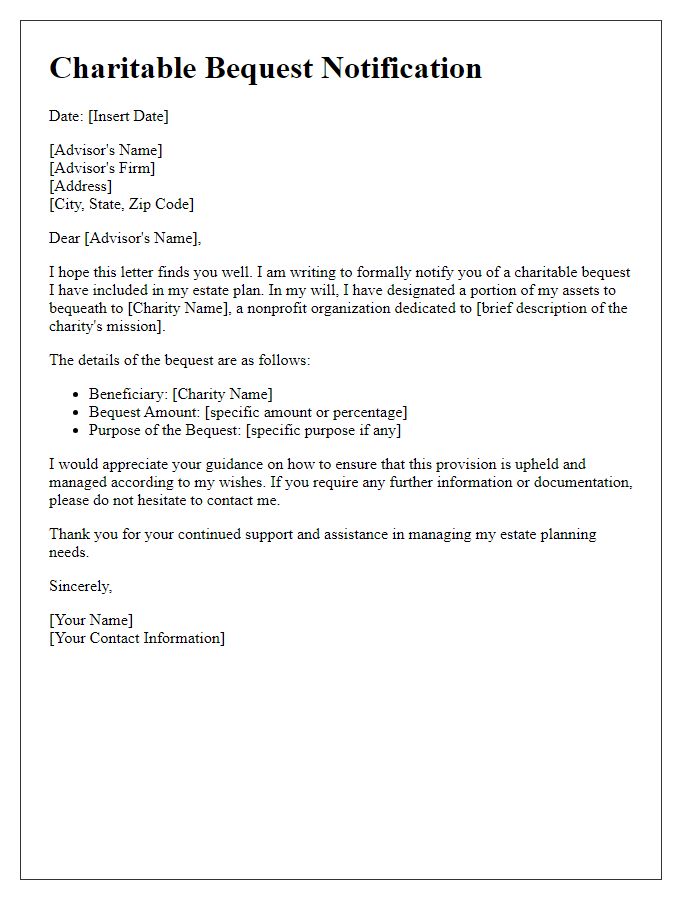

Letter template of charitable bequest notification for financial advisors.

Comments