Are you considering a business acquisition but unsure of how to express your interest? Crafting a compelling letter can open doors and set the stage for fruitful negotiations. By articulating your intentions clearly and professionally, you can effectively convey your enthusiasm for a potential partnership. Dive into our article to discover the essential elements of a successful acquisition letter!

Clear Subject Line

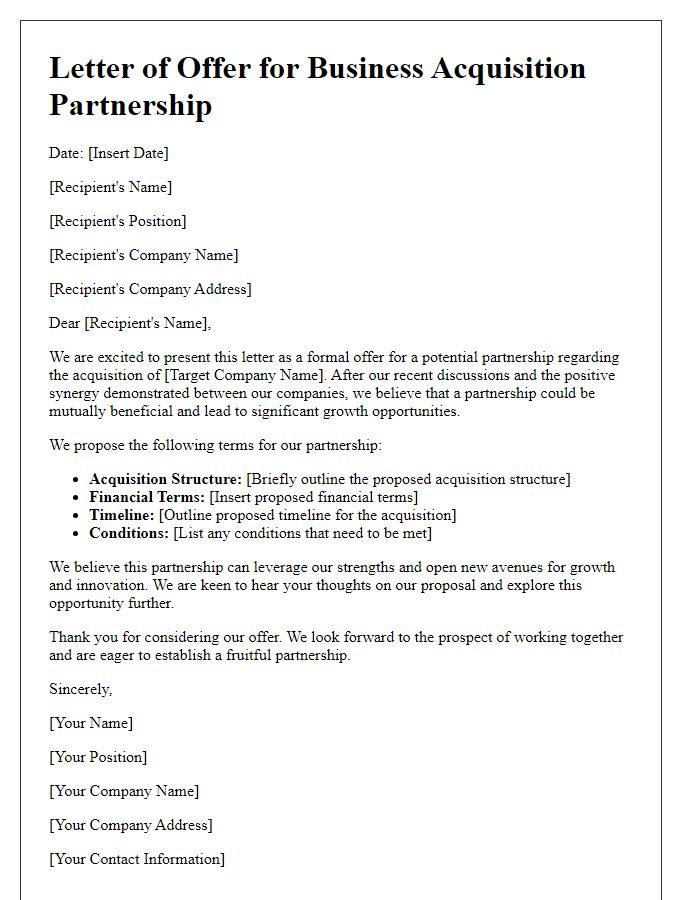

Business acquisition interest involves a strategic approach to corporate growth through the purchase of another company. Clear subject lines, such as "Proposal for Strategic Acquisition Discussion - [Company Name]" or "Inquiry Regarding Potential Acquisition of [Target Company Name]," are crucial for ensuring the recipient understands the email's intent immediately. A well-crafted subject line sets a professional tone for discussions regarding assets, operations, or market position. It allows potential sellers to assess the seriousness and legitimacy of the inquiry, resulting in more productive communication. Engaging in an acquisition can increase market share, enhance competitive advantages, and bring about significant growth opportunities in the industry.

Formal Salutation

A business acquisition interest reflects strategic growth intentions for mergers or purchases. Companies often seek to explore synergies in market share, technologies, or operational efficiencies. Due diligence is essential; reviewing financial records, employee structures, and customer bases ensures accurate assessments of potential value. Initial informal conversations typically set the framework for subsequent negotiations. Legal advisors may provide insights into compliance with regulations within specific industries. Ultimately, successful acquisitions can lead to significant revenue growth and competitive advantages in evolving marketplaces.

Introduction of Your Company

XYZ Corporation, established in 2005 in San Francisco, California, is a leading innovator in the renewable energy sector, focusing on solar technology solutions. With over 200 patented technologies and a dedicated workforce of 500 employees, XYZ has consistently achieved a revenue growth rate of 15% annually, surpassing industry averages. Our commitment to sustainability and efficiency has allowed us to serve over 1,000 commercial clients, including prominent organizations like ABC Foods and DEF Industries. Leveraging our strategic partnerships with research institutions such as the Stanford University Solar Energy Research Center, we aim to revolutionize energy consumption patterns across the nation while contributing to global environmental goals.

Statement of Interest in Acquisition

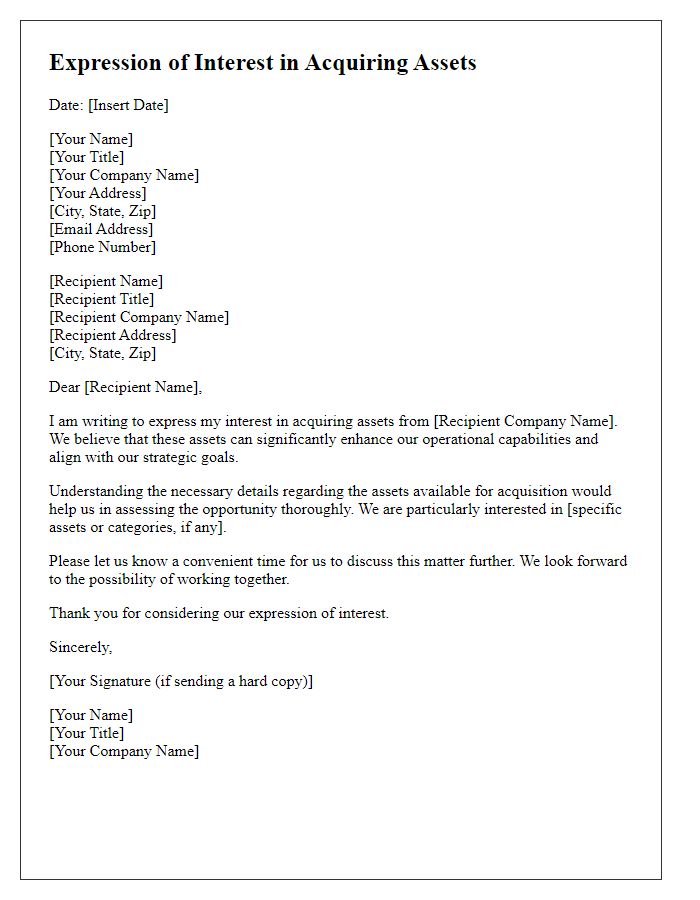

A Statement of Interest in Acquisition signifies a potential buyer's intent to explore purchasing a business entity. This document typically outlines the buyer's motivations, financial capacity, and preliminary terms of the acquisition. Stakeholders may include key executives from the acquiring company, financial advisors, and legal representatives. The letter establishes a framework for negotiation, highlighting strategic interests such as market expansion, resource acquisition, or synergies. Important details may encompass projected timelines, confidentiality agreements regarding sensitive information, and due diligence processes to ensure compliance with regulations and operational assessments.

Call to Action and Contact Information

A compelling call to action can drive potential business acquisition interests toward taking definitive steps. Key elements include a clear request for engagement, such as scheduling a meeting or phone call to discuss opportunities further, along with providing essential contact information. This should encompass a direct phone number, an email address, and possibly a physical address to facilitate communication. Clear instructions on next steps--such as specifying a preferred time for follow-up or encouraging them to respond by a certain date--can significantly enhance engagement. Emphasizing the benefits of this opportunity, such as increased market share or enhanced operational capabilities, can motivate a positive response and foster deeper business relationships.

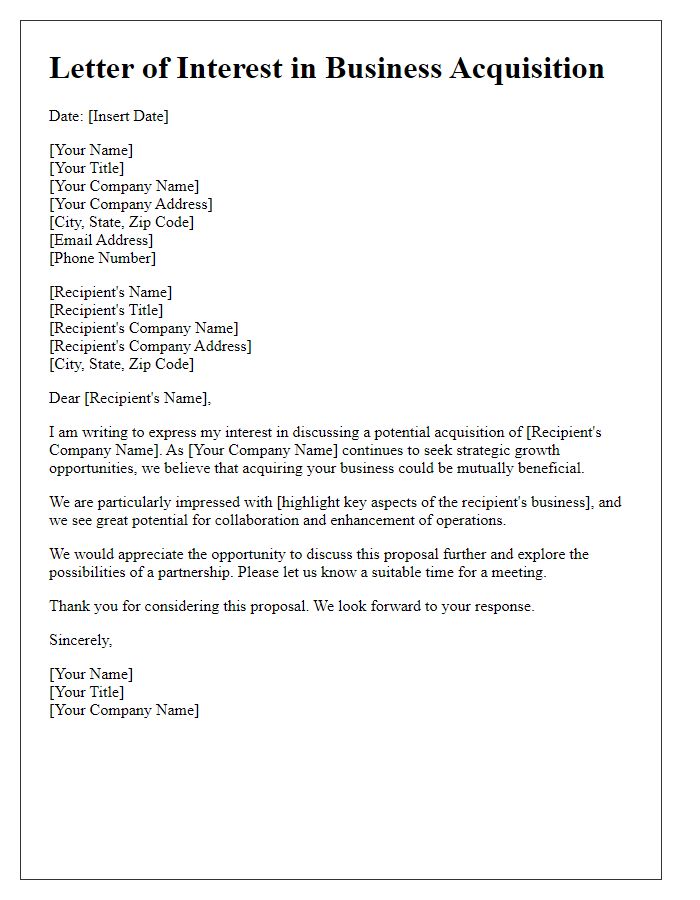

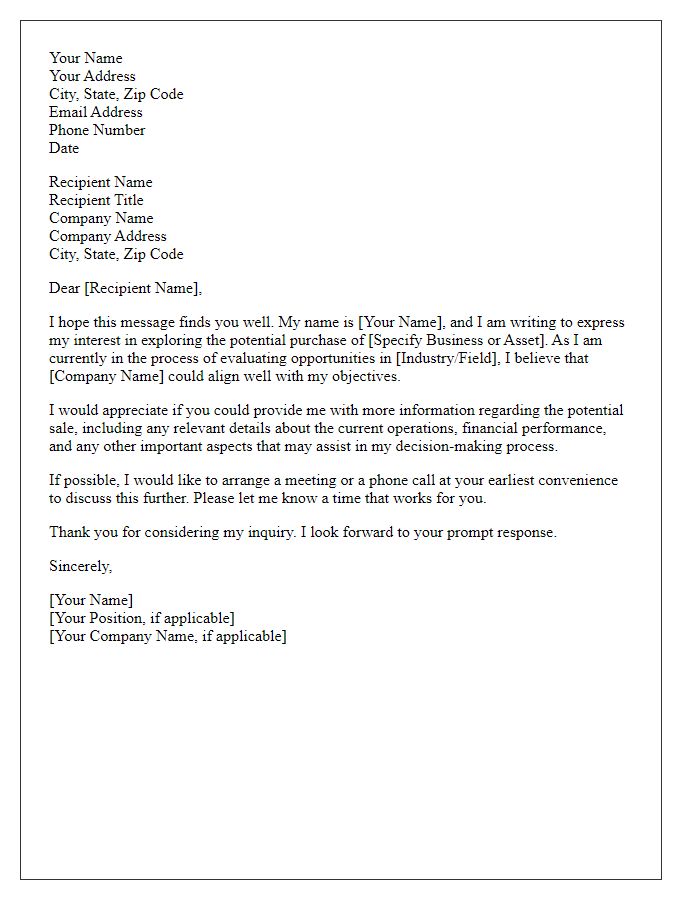

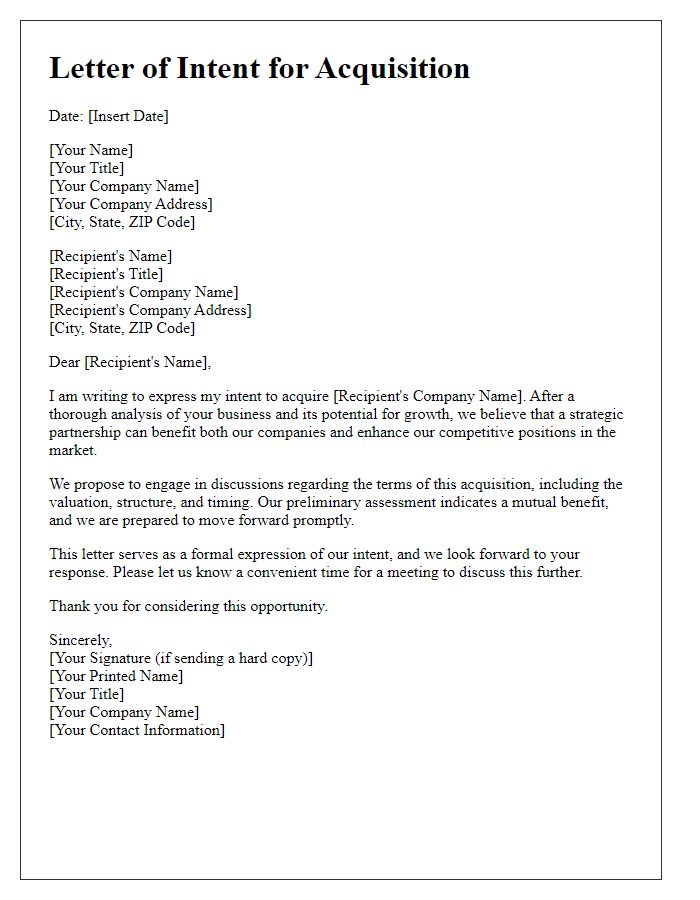

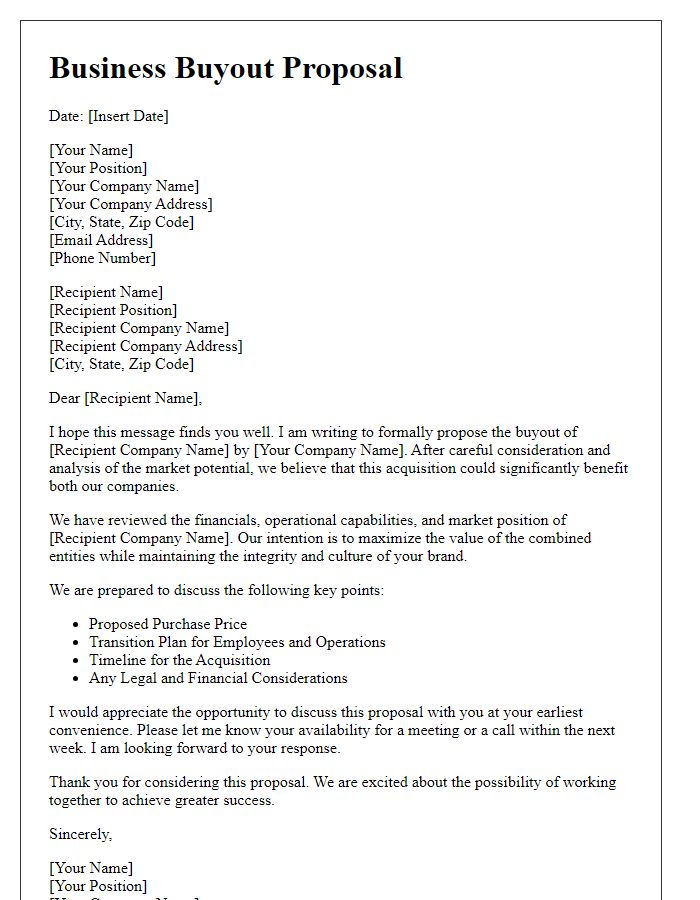

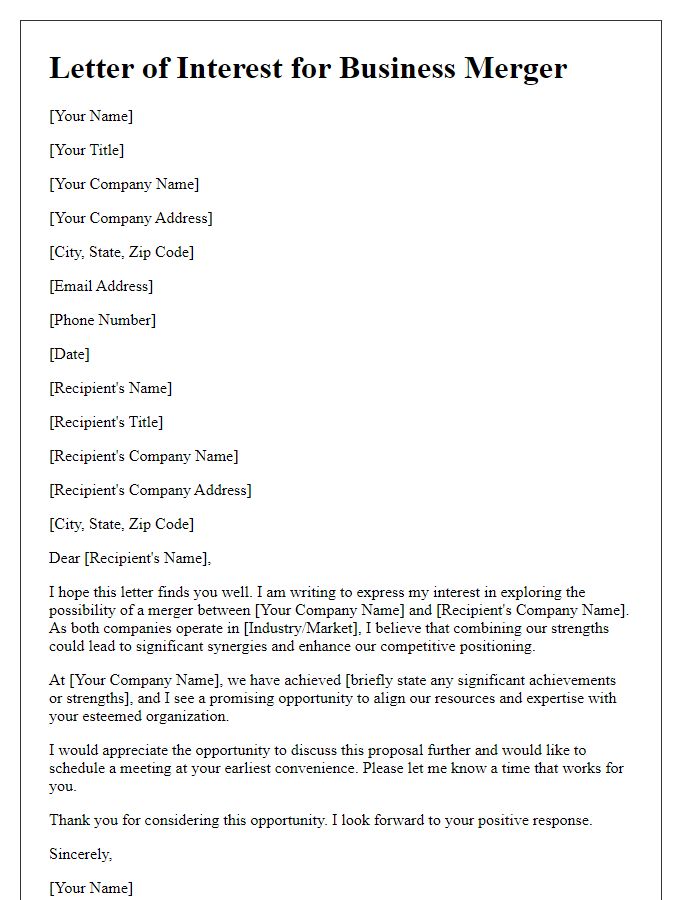

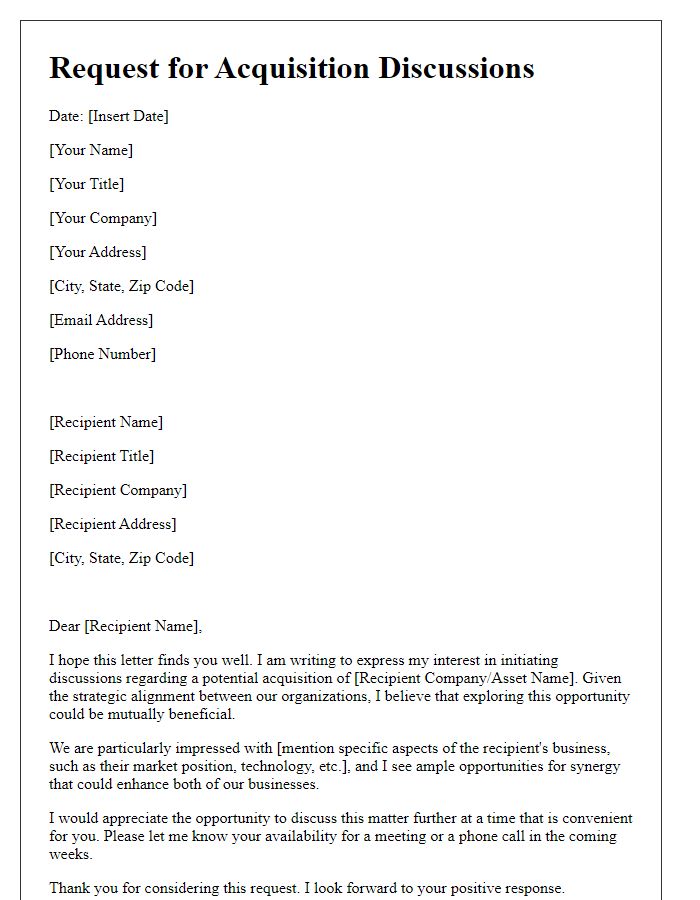

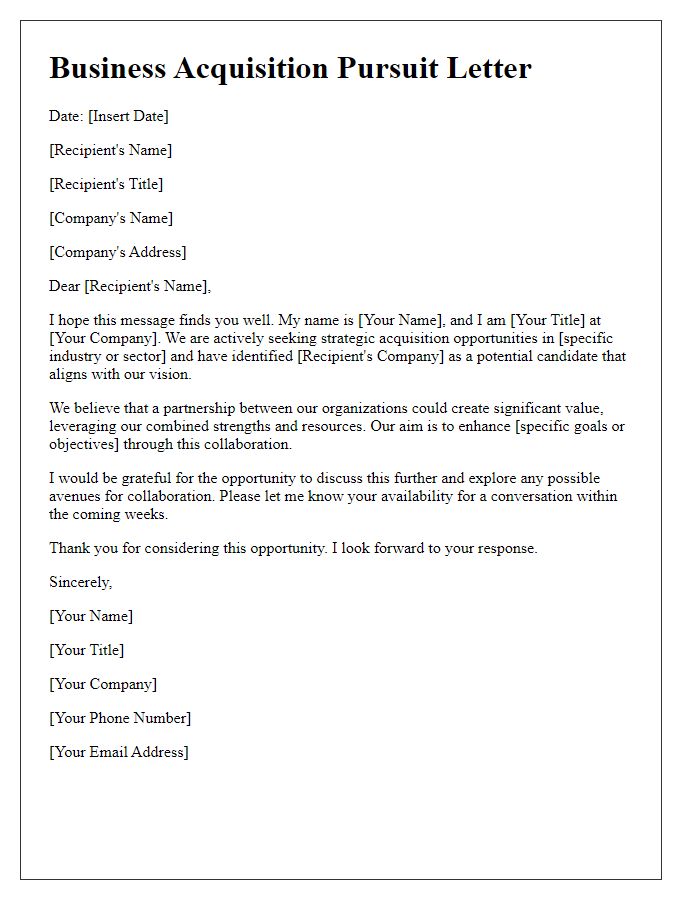

Letter Template For Business Acquisition Interest Samples

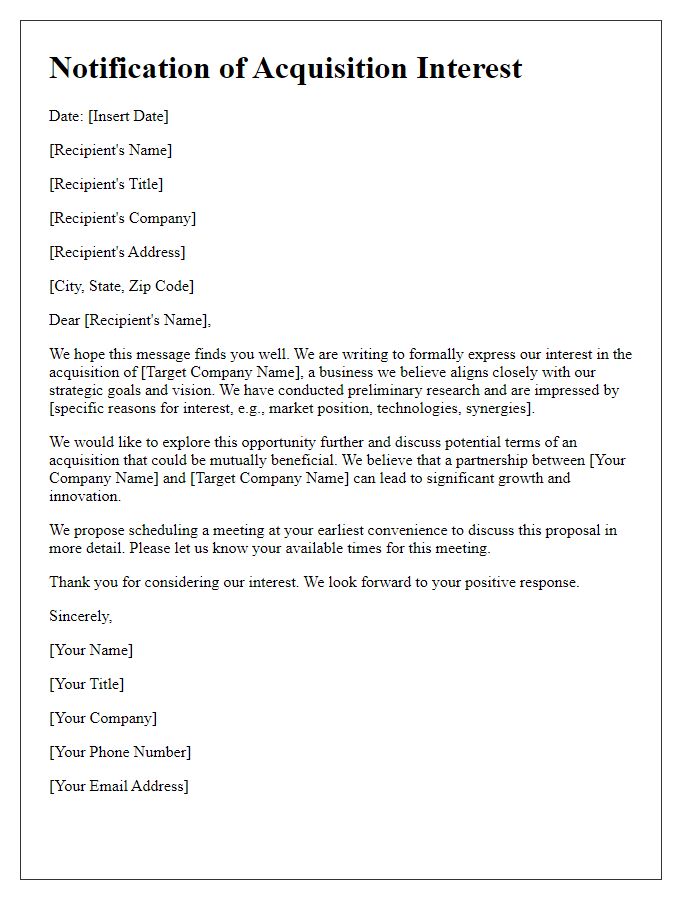

Letter template of notification for acquisition interest in specific business

Comments