Are you feeling overwhelmed by your current student loan agreement? You're not aloneâmany graduates are finding themselves in need of a fresh look at their repayment options. Reassessing your student loan terms can save you money and stress in the long run. To explore how you can make the most of your financial future, keep reading for expert tips and actionable advice!

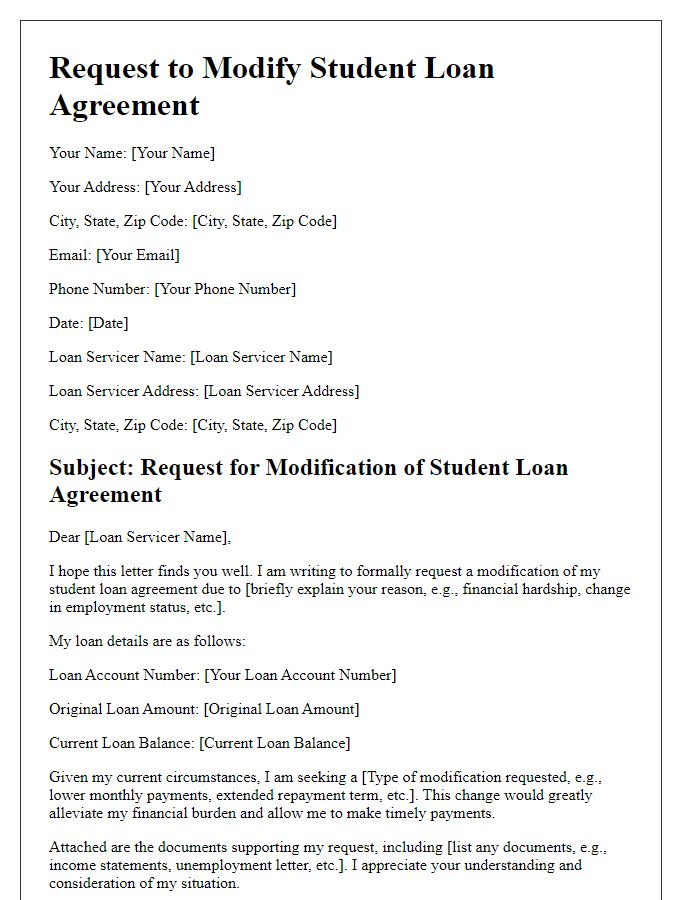

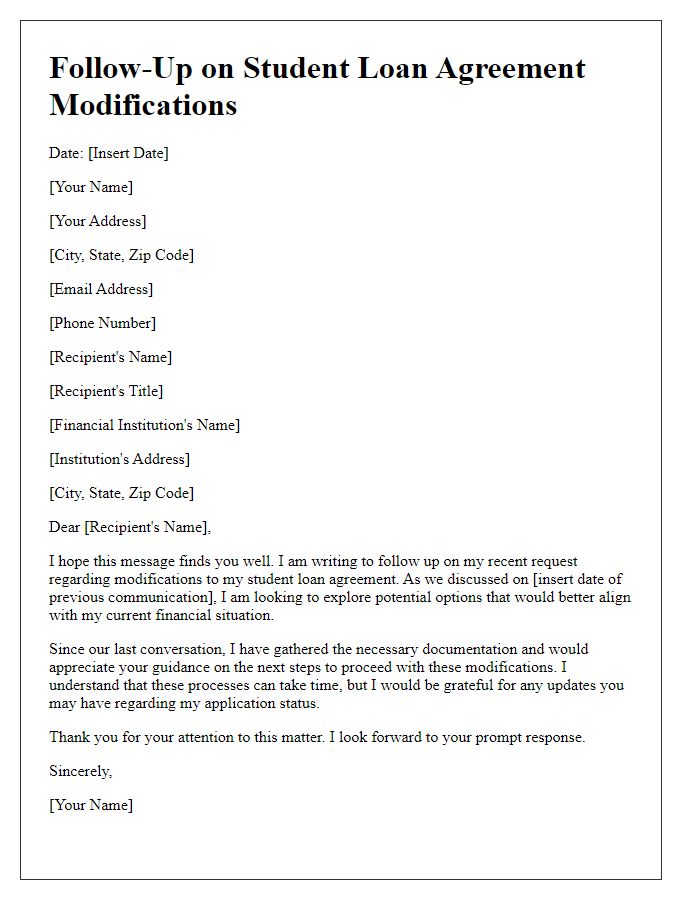

Personal Identification and Contact Information

Student loan agreements serve as critical financial documents outlining the terms and conditions of borrowed funds for educational purposes. Borrowers, typically students pursuing higher education degrees, must provide personal identification, like Social Security numbers, and detailed contact information, including current residential addresses and email communication, to facilitate accurate record-keeping and correspondence. Loan servicers rely on this information for billing statements, repayment notices, and other important communications throughout the loan lifecycle, ensuring that all parties remain informed and updated on payment schedules and outstanding balances. Accurate identification and contact details also help in avoiding potential delays in loan disbursement or billing issues that may arise during repayment.

Clear Reference to Original Loan Agreement

The original student loan agreement typically outlines key terms, interest rates, and repayment schedules associated with financial assistance for education, with specific amounts such as $30,000 (the principal loan amount) due to the lender, usually a federal or private institution. The agreement may state the interest rate, often variable around 5% to 10%, and specify the grace period lasting six months post-graduation, during which repayments are not required. Borrowers might refer to important sections: repayment plans, forbearance options (temporary postponement of payments), and default consequences (non-payment can affect credit scores significantly, dropping it by as much as 200 points). Additionally, the contact information for the lender, such as the servicing company's name, must be updated to ensure accurate communication during the revisiting process.

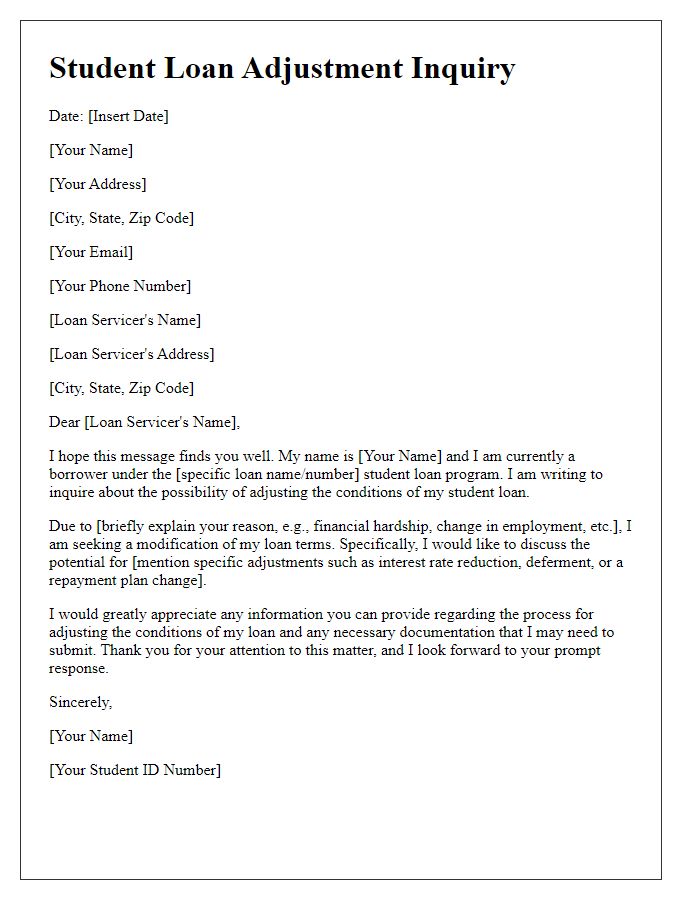

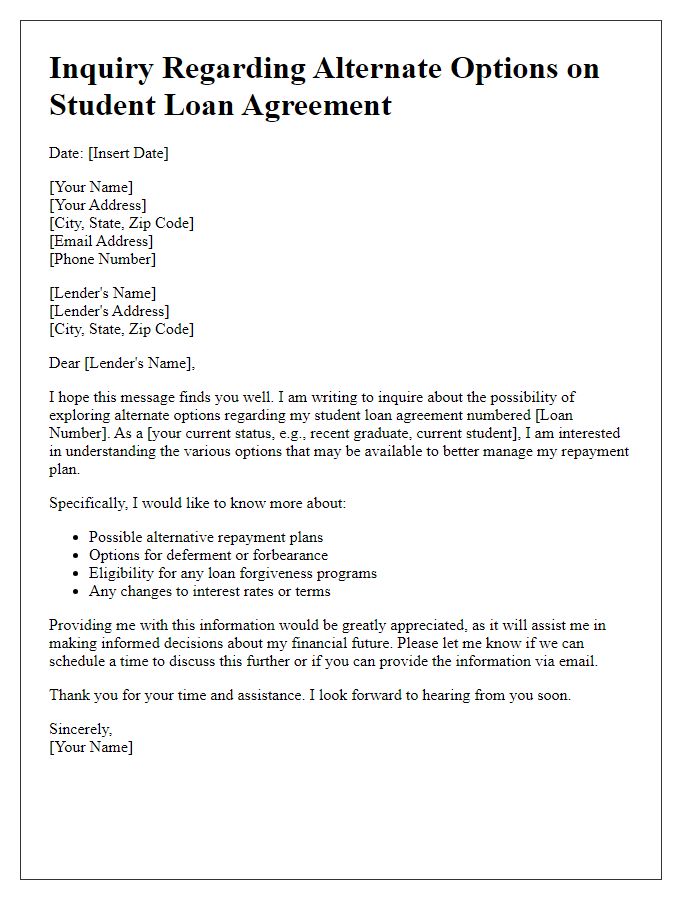

Specific Purpose for Revisiting the Agreement

Revisiting student loan agreements can provide essential opportunities for borrowers seeking financial relief or adjustments based on their changing circumstances. Factors such as changes in income levels, employment status, or unforeseen financial hardships may necessitate a reassessment of loan terms. For instance, borrowers enrolled in income-driven repayment plans may wish to revisit their agreements if their income fluctuates significantly or if they encounter lengthy unemployment periods, which can affect their eligibility for deferment or forbearance. Additionally, federal programs such as the Public Service Loan Forgiveness (PSLF) may prompt borrowers in public sectors like education or non-profits to re-evaluate their agreements to ensure they meet the necessary criteria for potential loan forgiveness after 120 qualifying payments. Reviewing agreements may also involve negotiating better interest rates or exploring consolidation options, which can enhance the flexibility and affordability of loan repayment.

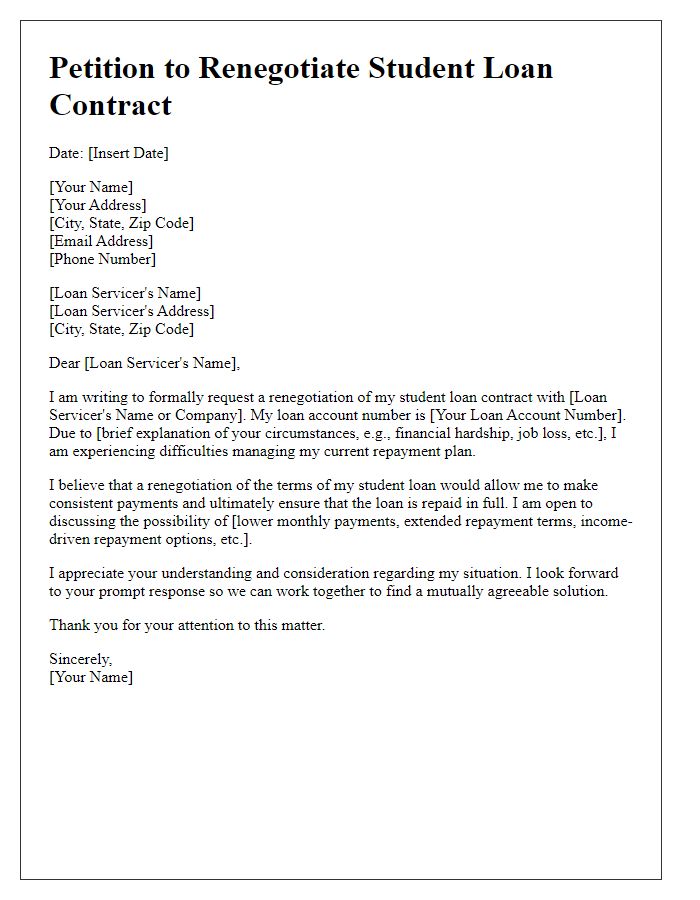

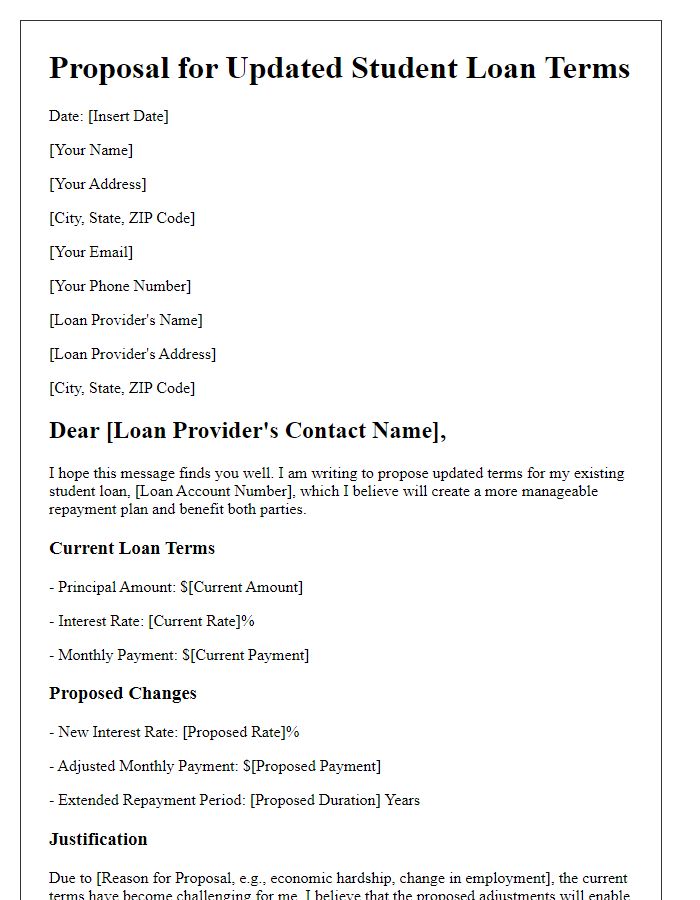

Proposed Changes or Terms for Discussion

The student loan agreement potentially impacts thousands of students attending universities across the United States. Proposed changes to the loan term structures may involve adjusting interest rates, currently averaging 4.53% for undergraduate subsidized loans or 6.08% for unsubsidized loans, and repayment periods which typically last between 10 to 30 years. Additionally, modifications could introduce income-driven repayment plans or potential loan forgiveness options, especially for borrowers in public service roles. Institutions like the Department of Education play a crucial role in these discussions, especially considering recent legislative measures focused on student debt relief initiatives in 2023. Reexamining these terms can lead to significant financial implications, affecting overall student debt levels, which surpassed $1.7 trillion nationally. Ensuring clear communication and supportive provisions during this negotiation process is essential for fostering financial well-being among students.

Request for Meeting or Response for Further Clarification

Revisiting a student loan agreement can evoke significant financial implications for borrowers. The United States Department of Education oversees federal student loans, with repayment options that include income-driven plans, which adjust monthly payments based on the borrower's income and family size. A face-to-face meeting or written response is often essential for borrowers seeking clarification on their repayment schedule, interest rates, or eligibility for loan forgiveness programs like Public Service Loan Forgiveness (PSLF). It is crucial to prepare specific questions regarding any recent changes in federal laws or educational policies that might impact the agreement. Furthermore, borrowers should review their loan servicer's contact details for efficient communication, ensuring they receive accurate information regarding potential deferment options or rehabilitation programs, which can help in managing default status.

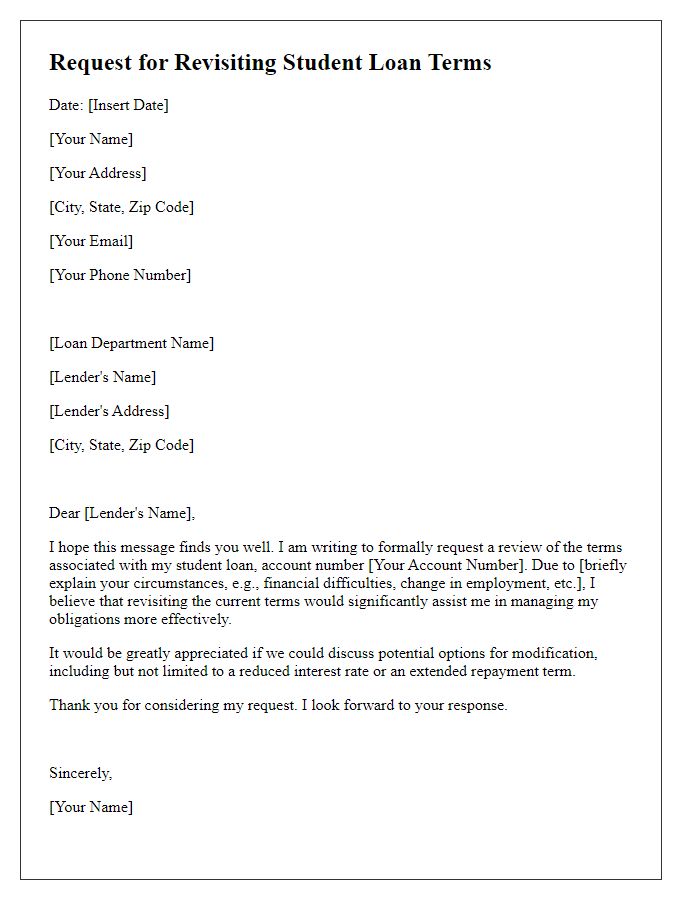

Letter Template For Revisiting Student Loan Agreement Samples

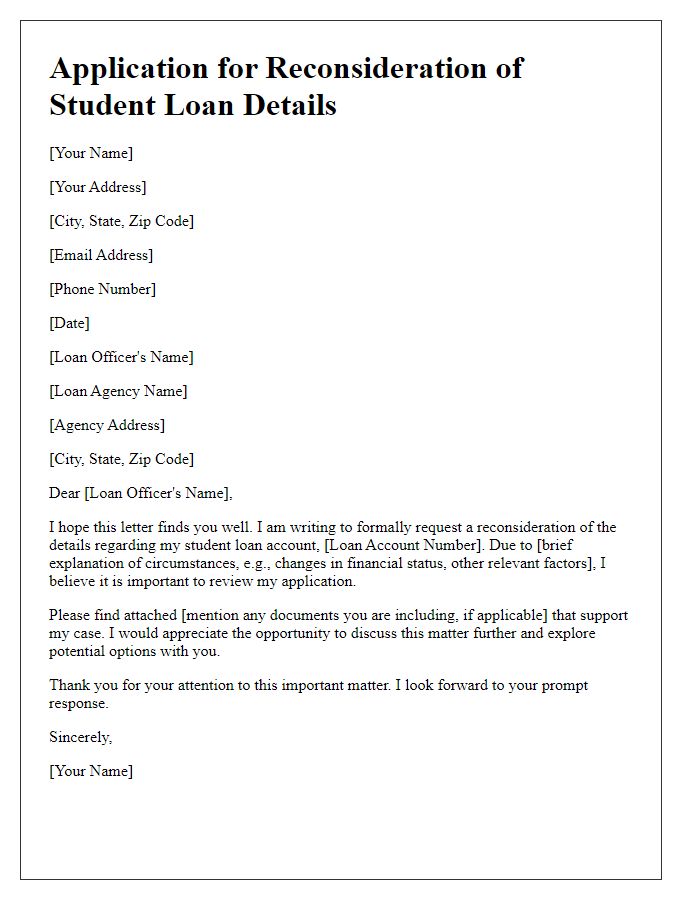

Letter template of application for reconsideration of student loan details

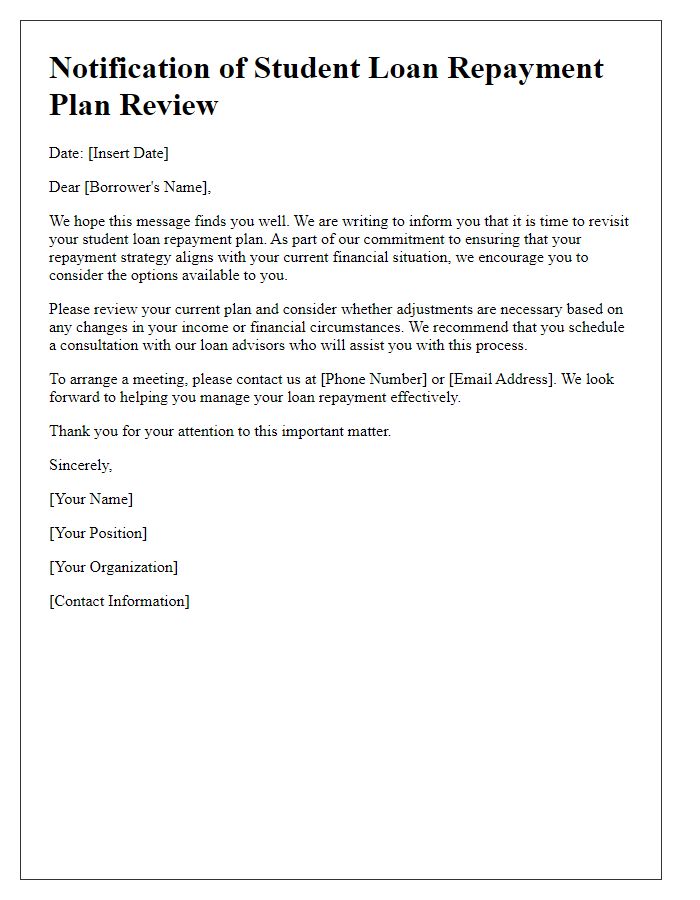

Letter template of notification for revisiting student loan repayment plan

Comments